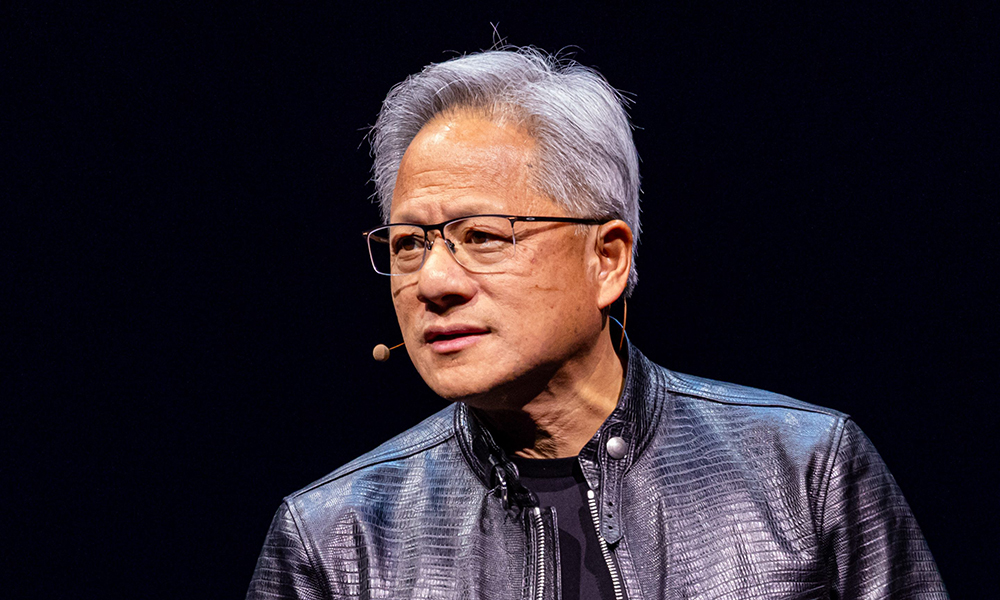

英偉達CEO黃仁勛聲稱,英偉達的人工智能芯片業務是多樣化的,但公司的申報文件卻顯示,幾家大客戶為其貢獻了近一半營收。圖片來源:ANNABELLE CHIH—BLOOMBERG/GETTY IMAGES

微芯片設計公司英偉達(Nvidia)第二季度的營收翻了一番以上,這主要得益于幾家大客戶的貢獻。公司接近一半的銷售額來自這幾家公司。

四家大客戶直接采購的商品和服務,合計占英偉達300億美元營業額的46%。出于競爭原因,對四家客戶的身份進行匿名處理。在英偉達公布備受期待的季度投資者報告時提交的10-Q監管申報文件顯示,四家客戶貢獻的營業額約為138億美元。

每家公司的采購額占公司總營收的十分之一以上,而且它們所采購的產品,都與英偉達蓬勃發展的數據中心芯片業務有關。在人工智能淘金熱中,埃隆·馬斯克等企業家都在爭相建設數據中心。

全面來看,這四家客戶所貢獻的銷售額,超過了英偉達上一年度公布的全年銷售額。

雖然這四家神秘的人工智能巨頭的名字不得而知,但它們可能就在亞馬遜(Amazon)、Meta、微軟(Microsoft)、Alphabet、OpenAI或特斯拉(Tesla)當中。

英偉達最熱門的產品是人工智能芯片,例如H200。OpenAI的GPT-4等大語言模型需要使用這些芯片進行訓練。這些芯片還被用于驅動推論過程,即ChatGPT或Sora等根據文本提示生成答案的過程。

英偉達對少數幾家大客戶的依賴,也引發了市場對于其單一業務突然的、指數級增長能否持久的擔憂。艾略特管理公司(Elliott Management)和城堡投資公司(Citadel)等投資者,也對這種增長能持續多長時間存在質疑。

歷史證明這種擔憂是有道理的。半導體行業的繁榮和衰落周期是眾所周知的。

有一家客戶為英偉達帶來的收入,超過了英偉達第二大業務的營收

事實上,英偉達的業務與這些大客戶之間的關系非常重要,以至于公司在季度報告中有一個章節的名稱就是“營收集中”,專門分析了這種集群風險。

英偉達在其10-Q監管申報文件中表示:“我們經歷了大量營收來自少數客戶的階段,而且這種趨勢可能會持續下去。”

這種趨勢能帶來驚人的利潤。今年上半年,英偉達每10美元營收中,就有5.60美元是凈收入——這是大多數公司求而不得的毛利潤率。

這也解釋了為什么今年上半年英偉達的稅后利潤比去年同期增長了近四倍,達到315億美元。英偉達的營收和利潤能否繼續以如此迅猛的速度增長,對于公司的投資至關重要。

以申報文件中提到的“客戶B”為例:其直接采購額占英偉達300億美元營收的11%。這意味著僅僅這一家公司為英偉達一項業務貢獻的收入,就超過了其第二大業務游戲業務的總營收(29億美元)。

但在整個上半年,客戶B貢獻的營收比例始終低于10%,這意味著它在上個季度似乎突然增加了支出。“客戶C”也是同樣的情況;英偉達提供的數據完全相同。

英偉達CEO黃仁勛在上周三接受彭博電視臺采訪時回答了一個問題:除了微軟、谷歌和亞馬遜等行業巨頭以外,其需求還來自哪些方面?

他表示:“目前我們的客戶已經相對多元化。”他列舉了一批不同的客戶群體。

但英偉達公布的數據似乎反駁了這個結論。例如,在去年同期,無論是第一季度還是第二季度,英偉達沒有任何一家直接客戶的業務,占總營收的比例達到或超過10%。

英偉達并未立即回復《財富》雜志的置評請求。(財富中文網)

譯者:劉進龍

審校:汪皓

微芯片設計公司英偉達(Nvidia)第二季度的營收翻了一番以上,這主要得益于幾家大客戶的貢獻。公司接近一半的銷售額來自這幾家公司。

四家大客戶直接采購的商品和服務,合計占英偉達300億美元營業額的46%。出于競爭原因,對四家客戶的身份進行匿名處理。在英偉達公布備受期待的季度投資者報告時提交的10-Q監管申報文件顯示,四家客戶貢獻的營業額約為138億美元。

每家公司的采購額占公司總營收的十分之一以上,而且它們所采購的產品,都與英偉達蓬勃發展的數據中心芯片業務有關。在人工智能淘金熱中,埃隆·馬斯克等企業家都在爭相建設數據中心。

全面來看,這四家客戶所貢獻的銷售額,超過了英偉達上一年度公布的全年銷售額。

雖然這四家神秘的人工智能巨頭的名字不得而知,但它們可能就在亞馬遜(Amazon)、Meta、微軟(Microsoft)、Alphabet、OpenAI或特斯拉(Tesla)當中。

英偉達最熱門的產品是人工智能芯片,例如H200。OpenAI的GPT-4等大語言模型需要使用這些芯片進行訓練。這些芯片還被用于驅動推論過程,即ChatGPT或Sora等根據文本提示生成答案的過程。

英偉達對少數幾家大客戶的依賴,也引發了市場對于其單一業務突然的、指數級增長能否持久的擔憂。艾略特管理公司(Elliott Management)和城堡投資公司(Citadel)等投資者,也對這種增長能持續多長時間存在質疑。

歷史證明這種擔憂是有道理的。半導體行業的繁榮和衰落周期是眾所周知的。

有一家客戶為英偉達帶來的收入,超過了英偉達第二大業務的營收

事實上,英偉達的業務與這些大客戶之間的關系非常重要,以至于公司在季度報告中有一個章節的名稱就是“營收集中”,專門分析了這種集群風險。

英偉達在其10-Q監管申報文件中表示:“我們經歷了大量營收來自少數客戶的階段,而且這種趨勢可能會持續下去。”

這種趨勢能帶來驚人的利潤。今年上半年,英偉達每10美元營收中,就有5.60美元是凈收入——這是大多數公司求而不得的毛利潤率。

這也解釋了為什么今年上半年英偉達的稅后利潤比去年同期增長了近四倍,達到315億美元。英偉達的營收和利潤能否繼續以如此迅猛的速度增長,對于公司的投資至關重要。

以申報文件中提到的“客戶B”為例:其直接采購額占英偉達300億美元營收的11%。這意味著僅僅這一家公司為英偉達一項業務貢獻的收入,就超過了其第二大業務游戲業務的總營收(29億美元)。

但在整個上半年,客戶B貢獻的營收比例始終低于10%,這意味著它在上個季度似乎突然增加了支出。“客戶C”也是同樣的情況;英偉達提供的數據完全相同。

英偉達CEO黃仁勛在上周三接受彭博電視臺采訪時回答了一個問題:除了微軟、谷歌和亞馬遜等行業巨頭以外,其需求還來自哪些方面?

他表示:“目前我們的客戶已經相對多元化。”他列舉了一批不同的客戶群體。

但英偉達公布的數據似乎反駁了這個結論。例如,在去年同期,無論是第一季度還是第二季度,英偉達沒有任何一家直接客戶的業務,占總營收的比例達到或超過10%。

英偉達并未立即回復《財富》雜志的置評請求。(財富中文網)

譯者:劉進龍

審校:汪皓

Microchip designer Nvidia more than doubled its second-quarter revenue thanks to just a handful of whales that accounted for nearly one out of every two dollars in sales the company booked.

Four customers, whose identities were kept anonymous for competitive reasons, directly purchased goods and services collectively worth 46% of Nvidia’s $30 billion in turnover. That amounts to roughly $13.8 billion, according to the company’s 10-Q regulatory filing published alongside its hotly anticipated quarterly investor update.

Each was responsible for more than a tenth of overall top line, and their purchases were all related to its booming business selling chips to data centers, the likes of which entrepreneurs such as Elon Musk are in a rush to build amid the gold rush in artificial intelligence.

To put that into perspective, this quartet of customers contributed more in sales than Nvidia reported for the prior year’s period as a whole.

Although the names of the mystery AI whales are not known, they are likely to include Amazon, Meta, Microsoft, Alphabet, OpenAI, or Tesla.

Nvidia’s hottest products are AI chips like the H200. These are needed to train large language models like OpenAI’s GPT-4. They are also used to power inference, the process that ChatGPT or Sora uses to generate answers to text-based prompts.

This dependency on a handful of major customers also highlights a rising concern in the market over just how sustainable this abrupt, exponential growth from just one corner of its business can be. Some investors like Elliott Management and Citadel have voiced skepticism over how long this can be maintained.

History does give reason for concern. The semiconductor industry is known for its boom-and-bust cycles.

One customer provided revenue greater than Nvidia’s second-largest business

In fact Nvidia’s business ties with these whales are so significant the company flags them in a section of its quarterly reports titled “concentration of revenue,” which is dedicated to cluster risks.

“We have experienced periods where we receive a significant amount of our revenue from a limited number of customers,” it stated in its 10-Q regulatory filing, “and this trend may continue.”

It’s a trend that is staggeringly profitable. Nvidia pocketed $5.60 out of every $10 of revenue it made over the entire first half as net income—margins most companies can only dream of.

That explains why profit after tax nearly quadrupled to $31.5 billion during this six-month period over the previous year. Whether revenue, and therefore earnings, can continue to grow at this blistering pace is crucial to its investment story.

Take “Customer B” cited in the filing, for example: Its direct purchases represented 11% of Nvidia’s $30 billion in revenue. That means a single company contributed more in business than the group’s second largest division—gaming, with $2.9 billion—did as a whole.

Customer B, however, remained below the 10% threshold for the entire first half, which suggests it significantly ramped up spending during the past quarter seemingly out of the blue. The exact same could be said about “Customer C”; the numbers provided by Nvidia are identical.

$NVDA pic.twitter.com/Lym4uHBCXs

Speaking to Bloomberg TV on Wednesday, CEO Jensen Huang answered a question on where demand is coming from, beyond the handful of hyperscalers like Microsoft, Google, and Amazon.

“We’re relatively diversified today,” he claimed, citing a range of different customer groups.

Yet his own company’s numbers appear to dispute that conclusion. This time last year, for example, there were no direct customers whose business made up 10% or more of total revenue—neither for the first nor the second quarter.

Nvidia didn’t immediately respond to a request from Fortune for comment.