英特爾從昔日無可匹敵的行業(yè)領(lǐng)導者跌落至現(xiàn)今每況愈下、方向迷失的境地,其中的失誤與誤判不勝枚舉。然而,在本周首席執(zhí)行官突然離職之后,英特爾正在探尋前行的方向,它亟需解決的根本問題是明確自身的定位,以及作為芯片制造商的真正優(yōu)勢所在。

這家擁有56年歷史的半導體公司是同行業(yè)中最后一家既能自行設計芯片又能自行生產(chǎn)芯片的公司——多年來,這一強大的組合為英特爾帶來了技術(shù)和財務上的雙重優(yōu)勢。然而,隨著市場的變化,這種模式已不再奏效,英特爾一直在努力調(diào)整以適應新變化。據(jù)業(yè)內(nèi)專家稱,首席執(zhí)行官帕特·格爾辛格發(fā)現(xiàn)自己陷入了利益沖突的困境,難以推銷公司的重組計劃。

本周一格爾辛格突然“退休”后,多家媒體報道稱,董事會對公司扭轉(zhuǎn)虧損的進展感到不滿,迫使他離職。

分析師認為,這一決定可能會對英特爾造成困擾,因為英特爾面臨的核心挑戰(zhàn)——身份認同危機仍未得到解決,并將繼續(xù)對公司的業(yè)務運營和戰(zhàn)略部署產(chǎn)生深遠影響。

華爾街可能也持類似觀點——英特爾的股價最初可能會因格爾辛格離職的消息而上漲,但隨著這一變動所帶來的連鎖反應逐漸顯現(xiàn),周二股價下跌逾6%。

丹麥咨詢公司Semiconductor Business Intelligence的分析師克勞斯·阿斯霍爾姆(Claus Aasholm)說:“解雇帕特·格爾辛格將帶來巨大損失,可能會讓英特爾一蹶不振。”

代工廠的雄心

英特爾在很多方面都出現(xiàn)了問題,比如在智能手機市場錯失良機,在由英偉達(Nvidia)主導的人工智能芯片市場也處于落后地位。但核心問題在于英特爾的制造部門——英特爾晶圓代工廠。

2021年,當格爾辛格重返英特爾擔任首席執(zhí)行官時——他曾在英特爾工作了30年,后于2009年離開英特爾,先后在EMC(總裁兼首席運營官)和VMware(首席執(zhí)行官)任職——這家美國芯片行業(yè)的標志性企業(yè)已經(jīng)陷入困境。

英特爾的營業(yè)利潤正在下滑;競爭對手AMD正從其個人電腦和數(shù)據(jù)中心業(yè)務中搶奪市場份額;就Mac產(chǎn)品線而言,蘋果公司(Apple)最近決定從英特爾的x86架構(gòu)處理器轉(zhuǎn)向自研的基于ARM架構(gòu)的芯片;英特爾也在努力升級其制造工藝,以趕上臺積電(TSMC)和三星(Samsung)等公司的步伐。離任的首席執(zhí)行官司睿博(Bob Swan)是一名財務出身的高管,而格爾辛格是一名深受歡迎的工程師。他的回歸在英特爾內(nèi)外都獲得了積極反響。

格爾辛格為英特爾提出的扭虧為盈的宏偉藍圖包括在美國和歐洲新建更多工廠,力圖使其轉(zhuǎn)型為一家成功的合約芯片制造商,同時保持自行設計與制造處理器的業(yè)務模式。

出于以下幾個原因,這是極具野心的想法。首先,英特爾在推進先進制造工藝方面的滯后已是業(yè)界周知的事實;臺積電無論過去還是現(xiàn)在,都是備受推崇的合作伙伴。其次,英特爾合約制造業(yè)務需要的大客戶對將知識產(chǎn)權(quán)交由英特爾的芯片設計業(yè)務運用持審慎態(tài)度(合乎情理)——這也是在先進芯片制造領(lǐng)域唯一能與臺積電匹敵的三星經(jīng)歷過的信任問題。

因此,格爾辛格及其團隊不得不對公司進行反復重組,以確保設計與制造業(yè)務的分離更具戰(zhàn)略意義。重組在9月份畫上句號,當時英特爾宣布,其代工廠將成為母公司旗下的獨立子公司。

與時間賽跑

英特爾代工廠今年即將推出(但卻遲遲未推出)的18A芯片制造工藝贏得了兩大知名客戶——微軟(Microsoft)和亞馬遜(Amazon)都已簽約,將由該公司為其生產(chǎn)定制芯片,——但這兩筆交易的規(guī)模遠不足以維持這項業(yè)務的可持續(xù)發(fā)展。該部門今年第三季度的運營虧損高達58億美元,收入下降了8%。

然而,阿斯霍爾姆認為格爾辛格在管理代工廠計劃時表現(xiàn)出了“高超的政治和財務駕馭能力”,即使“英特爾的制造能力過去和現(xiàn)在都未能達到預期”。

這位前首席執(zhí)行官在這方面最突出的成就是根據(jù)《芯片和科學法案》(CHIPS Act)為英特爾爭取到了高達78.6億美元的美國政府資金支持,該法案是拜登政府為避免過度依賴臺灣而大力推動的重建美國芯片制造能力的法案。(英特爾公司本應再獲得6億美元的資助,但由于英特爾還贏得了一份價值30億美元的美國軍方合同,并將其在美國的中期投資計劃縮減了10%,因此資助金額有所減少。)

格爾辛格還達成了兩項巨額交易,外部資產(chǎn)管理公司為關(guān)鍵工廠擴展投入了大量現(xiàn)金。在第一個例子中,英特爾和布魯克菲爾德資產(chǎn)管理公司(Brookfield Asset Management)于2022年達成協(xié)議,共同投資高達300億美元,用于英特爾在亞利桑那州錢德勒新建工廠。今年,阿波羅全球管理公司(Apollo Global Management)也與英特爾達成了類似的協(xié)議,向其位于愛爾蘭萊克斯利普的新Fab 34晶圓廠投資110億美元。在這兩個案例中,資產(chǎn)管理公司均獲得了合資企業(yè)49%的股份,而英特爾則保留了51%的控股權(quán)。

阿斯霍爾姆告訴《財富》雜志,格爾辛格“雖然還沒有籌集到全部資金,但已將一大筆資金收入囊中。”

花旗(Citi)分析師克里斯托弗·丹利(Christopher Danely)在格爾辛格離職后的周一報告中寫道:“我們……相信格爾辛格已經(jīng)開始扭轉(zhuǎn)公司局面。在他加入時,英特爾在技術(shù)上比臺積電/AMD落后了近兩年,現(xiàn)在有望在2025年底追平——在我們看來,這無疑是一項非凡的成就。”

隨著18A制造工藝將于明年投入使用——英特爾第三季度的虧損達到創(chuàng)紀錄的166億美元,同時今年有1.5萬名員工遭到解雇——這位首席執(zhí)行官似乎正在奮力駛過一座快速倒塌的橋梁。

他未能做到。現(xiàn)在的問題是英特爾能否做到。

未來之路

徹底擺脫代工廠顯然是大勢所趨。

就在格爾辛格被解職的幾周前,四位英特爾前董事在《財富》雜志的專欄文章中提出了這一主張。他們認為,“在英特爾現(xiàn)有的公司架構(gòu)下,其代工業(yè)務幾乎沒有成功的可能”,因為英特爾“未能證明其能夠有效運營代工業(yè)務”,而且前面提及的英偉達和博通(Broadcom)等潛在客戶也對英特爾缺乏信任。

花旗的丹利在報告中稱:“我們認為,英特爾若能放棄轉(zhuǎn)型為商業(yè)晶圓代工廠,將更符合股東的最大利益。鑒于代工廠計劃的擁護者格爾辛格離職,我們認為放棄轉(zhuǎn)型的可能性更大。”他補充道:“在理想情況下,格爾辛格會留下來,公司將逐步退出晶圓代工廠業(yè)務。”美國銀行(Bank of America)的分析師也表示,目前拆分業(yè)務的可能性更大了。

然而,這一轉(zhuǎn)型之路存在重大障礙。根據(jù)《芯片和科學法案》,美國政府對英特爾的資助條款明確了一項條件:如果代工廠被拆分,導致英特爾喪失對其的控制權(quán),那么除非美國商務部改變立場,否則資金將無法到位。(實際上,若第三方獲得了英特爾的全面控制權(quán),同樣的情況也會發(fā)生。盡管高通最近曾表現(xiàn)出收購英特爾的意向,但據(jù)報道,鑒于收購的復雜性,高通已不再對收購抱有興趣。)

還有那些與資產(chǎn)管理公司的交易。阿斯霍爾姆表示:"按照目前的運營利潤分配模式,[英特爾代工服務]難以吸引買家,甚至無法出售。與布魯克菲爾德和阿波羅的兩項交易都依賴英特爾利用其代工業(yè)務生產(chǎn)產(chǎn)品。英特爾必須在出售代工業(yè)務之前使其實現(xiàn)盈利。”

阿斯霍爾姆對格爾辛格被解職的解釋是——他并未聲稱了解內(nèi)幕,英特爾也拒絕置評——這位首席執(zhí)行官是公司內(nèi)部長期權(quán)力斗爭的犧牲品。這場斗爭的一方是負責英特爾傳統(tǒng)x86個人電腦處理器業(yè)務的客戶端計算事業(yè)部,而另一方是其他所有人。

他說:“縱觀歷史,英特爾雖創(chuàng)新頗多,卻鮮有耐心走完最后一英里。”他指的是英特爾在2019年將其移動設備業(yè)務出售給蘋果,并于翌年將存儲芯片業(yè)務轉(zhuǎn)讓給海力士(SK Hynix)。“問題的癥結(jié)在于,與英特爾的客戶端計算事業(yè)部相比,這些新計劃似乎總是黯然失色,且無一例外地遭到了遺棄。”

英特爾新任臨時聯(lián)席首席執(zhí)行官之一是米歇爾·約翰斯頓·霍爾特豪斯(Michelle Johnston Holthaus),她在過去幾年中一直負責客戶端計算事業(yè)部業(yè)務。(另一位是首席財務官大衛(wèi)·津斯納(David Zinsner)。)阿斯霍爾姆說:"在英特爾近期歷史中,客戶端計算事業(yè)部管理層相較于公司高層擁有更大的實權(quán)。客戶端計算事業(yè)部再次取得了勝利。”

至于格爾辛格的永久繼任者,美國全國廣播公司財經(jīng)頻道(CNBC)和路透社都報道稱,英特爾正在尋找外部候選人。

美滿科技集團(Marvell)首席執(zhí)行官馬特·墨菲(Matt Murphy)和數(shù)月前離開英特爾董事會的Cadence Design Systems執(zhí)行董事長陳立武(Lip-Bu tan)均被列入潛在候選人之列。陳立武離開董事會導致英特爾缺乏在芯片制造領(lǐng)域具有豐富技術(shù)經(jīng)驗的人才。據(jù)路透社當時報道,陳立武對格爾辛格執(zhí)行代工戰(zhàn)略的方式、內(nèi)部官僚主義和英特爾滯后的人工智能戰(zhàn)略感到失望。

丹利在報告中稱:“我們認為帕特是解決英特爾芯片制造問題的最佳首席執(zhí)行官,同時希望公司退出晶圓代工業(yè)務,保留格爾辛格。隨著帕特離職,如果新任首席執(zhí)行官不像帕特那樣精通先進半導體制造技術(shù),英特爾持續(xù)落后于臺積電/AMD的風險可能會進一步加大。”(財富中文網(wǎng))

譯者:中慧言-王芳

英特爾從昔日無可匹敵的行業(yè)領(lǐng)導者跌落至現(xiàn)今每況愈下、方向迷失的境地,其中的失誤與誤判不勝枚舉。然而,在本周首席執(zhí)行官突然離職之后,英特爾正在探尋前行的方向,它亟需解決的根本問題是明確自身的定位,以及作為芯片制造商的真正優(yōu)勢所在。

這家擁有56年歷史的半導體公司是同行業(yè)中最后一家既能自行設計芯片又能自行生產(chǎn)芯片的公司——多年來,這一強大的組合為英特爾帶來了技術(shù)和財務上的雙重優(yōu)勢。然而,隨著市場的變化,這種模式已不再奏效,英特爾一直在努力調(diào)整以適應新變化。據(jù)業(yè)內(nèi)專家稱,首席執(zhí)行官帕特·格爾辛格發(fā)現(xiàn)自己陷入了利益沖突的困境,難以推銷公司的重組計劃。

本周一格爾辛格突然“退休”后,多家媒體報道稱,董事會對公司扭轉(zhuǎn)虧損的進展感到不滿,迫使他離職。

分析師認為,這一決定可能會對英特爾造成困擾,因為英特爾面臨的核心挑戰(zhàn)——身份認同危機仍未得到解決,并將繼續(xù)對公司的業(yè)務運營和戰(zhàn)略部署產(chǎn)生深遠影響。

華爾街可能也持類似觀點——英特爾的股價最初可能會因格爾辛格離職的消息而上漲,但隨著這一變動所帶來的連鎖反應逐漸顯現(xiàn),周二股價下跌逾6%。

丹麥咨詢公司Semiconductor Business Intelligence的分析師克勞斯·阿斯霍爾姆(Claus Aasholm)說:“解雇帕特·格爾辛格將帶來巨大損失,可能會讓英特爾一蹶不振。”

代工廠的雄心

英特爾在很多方面都出現(xiàn)了問題,比如在智能手機市場錯失良機,在由英偉達(Nvidia)主導的人工智能芯片市場也處于落后地位。但核心問題在于英特爾的制造部門——英特爾晶圓代工廠。

2021年,當格爾辛格重返英特爾擔任首席執(zhí)行官時——他曾在英特爾工作了30年,后于2009年離開英特爾,先后在EMC(總裁兼首席運營官)和VMware(首席執(zhí)行官)任職——這家美國芯片行業(yè)的標志性企業(yè)已經(jīng)陷入困境。

英特爾的營業(yè)利潤正在下滑;競爭對手AMD正從其個人電腦和數(shù)據(jù)中心業(yè)務中搶奪市場份額;就Mac產(chǎn)品線而言,蘋果公司(Apple)最近決定從英特爾的x86架構(gòu)處理器轉(zhuǎn)向自研的基于ARM架構(gòu)的芯片;英特爾也在努力升級其制造工藝,以趕上臺積電(TSMC)和三星(Samsung)等公司的步伐。離任的首席執(zhí)行官司睿博(Bob Swan)是一名財務出身的高管,而格爾辛格是一名深受歡迎的工程師。他的回歸在英特爾內(nèi)外都獲得了積極反響。

格爾辛格為英特爾提出的扭虧為盈的宏偉藍圖包括在美國和歐洲新建更多工廠,力圖使其轉(zhuǎn)型為一家成功的合約芯片制造商,同時保持自行設計與制造處理器的業(yè)務模式。

出于以下幾個原因,這是極具野心的想法。首先,英特爾在推進先進制造工藝方面的滯后已是業(yè)界周知的事實;臺積電無論過去還是現(xiàn)在,都是備受推崇的合作伙伴。其次,英特爾合約制造業(yè)務需要的大客戶對將知識產(chǎn)權(quán)交由英特爾的芯片設計業(yè)務運用持審慎態(tài)度(合乎情理)——這也是在先進芯片制造領(lǐng)域唯一能與臺積電匹敵的三星經(jīng)歷過的信任問題。

因此,格爾辛格及其團隊不得不對公司進行反復重組,以確保設計與制造業(yè)務的分離更具戰(zhàn)略意義。重組在9月份畫上句號,當時英特爾宣布,其代工廠將成為母公司旗下的獨立子公司。

與時間賽跑

英特爾代工廠今年即將推出(但卻遲遲未推出)的18A芯片制造工藝贏得了兩大知名客戶——微軟(Microsoft)和亞馬遜(Amazon)都已簽約,將由該公司為其生產(chǎn)定制芯片,——但這兩筆交易的規(guī)模遠不足以維持這項業(yè)務的可持續(xù)發(fā)展。該部門今年第三季度的運營虧損高達58億美元,收入下降了8%。

然而,阿斯霍爾姆認為格爾辛格在管理代工廠計劃時表現(xiàn)出了“高超的政治和財務駕馭能力”,即使“英特爾的制造能力過去和現(xiàn)在都未能達到預期”。

這位前首席執(zhí)行官在這方面最突出的成就是根據(jù)《芯片和科學法案》(CHIPS Act)為英特爾爭取到了高達78.6億美元的美國政府資金支持,該法案是拜登政府為避免過度依賴臺灣而大力推動的重建美國芯片制造能力的法案。(英特爾公司本應再獲得6億美元的資助,但由于英特爾還贏得了一份價值30億美元的美國軍方合同,并將其在美國的中期投資計劃縮減了10%,因此資助金額有所減少。)

格爾辛格還達成了兩項巨額交易,外部資產(chǎn)管理公司為關(guān)鍵工廠擴展投入了大量現(xiàn)金。在第一個例子中,英特爾和布魯克菲爾德資產(chǎn)管理公司(Brookfield Asset Management)于2022年達成協(xié)議,共同投資高達300億美元,用于英特爾在亞利桑那州錢德勒新建工廠。今年,阿波羅全球管理公司(Apollo Global Management)也與英特爾達成了類似的協(xié)議,向其位于愛爾蘭萊克斯利普的新Fab 34晶圓廠投資110億美元。在這兩個案例中,資產(chǎn)管理公司均獲得了合資企業(yè)49%的股份,而英特爾則保留了51%的控股權(quán)。

阿斯霍爾姆告訴《財富》雜志,格爾辛格“雖然還沒有籌集到全部資金,但已將一大筆資金收入囊中。”

花旗(Citi)分析師克里斯托弗·丹利(Christopher Danely)在格爾辛格離職后的周一報告中寫道:“我們……相信格爾辛格已經(jīng)開始扭轉(zhuǎn)公司局面。在他加入時,英特爾在技術(shù)上比臺積電/AMD落后了近兩年,現(xiàn)在有望在2025年底追平——在我們看來,這無疑是一項非凡的成就。”

隨著18A制造工藝將于明年投入使用——英特爾第三季度的虧損達到創(chuàng)紀錄的166億美元,同時今年有1.5萬名員工遭到解雇——這位首席執(zhí)行官似乎正在奮力駛過一座快速倒塌的橋梁。

他未能做到。現(xiàn)在的問題是英特爾能否做到。

未來之路

徹底擺脫代工廠顯然是大勢所趨。

就在格爾辛格被解職的幾周前,四位英特爾前董事在《財富》雜志的專欄文章中提出了這一主張。他們認為,“在英特爾現(xiàn)有的公司架構(gòu)下,其代工業(yè)務幾乎沒有成功的可能”,因為英特爾“未能證明其能夠有效運營代工業(yè)務”,而且前面提及的英偉達和博通(Broadcom)等潛在客戶也對英特爾缺乏信任。

花旗的丹利在報告中稱:“我們認為,英特爾若能放棄轉(zhuǎn)型為商業(yè)晶圓代工廠,將更符合股東的最大利益。鑒于代工廠計劃的擁護者格爾辛格離職,我們認為放棄轉(zhuǎn)型的可能性更大。”他補充道:“在理想情況下,格爾辛格會留下來,公司將逐步退出晶圓代工廠業(yè)務。”美國銀行(Bank of America)的分析師也表示,目前拆分業(yè)務的可能性更大了。

然而,這一轉(zhuǎn)型之路存在重大障礙。根據(jù)《芯片和科學法案》,美國政府對英特爾的資助條款明確了一項條件:如果代工廠被拆分,導致英特爾喪失對其的控制權(quán),那么除非美國商務部改變立場,否則資金將無法到位。(實際上,若第三方獲得了英特爾的全面控制權(quán),同樣的情況也會發(fā)生。盡管高通最近曾表現(xiàn)出收購英特爾的意向,但據(jù)報道,鑒于收購的復雜性,高通已不再對收購抱有興趣。)

還有那些與資產(chǎn)管理公司的交易。阿斯霍爾姆表示:"按照目前的運營利潤分配模式,[英特爾代工服務]難以吸引買家,甚至無法出售。與布魯克菲爾德和阿波羅的兩項交易都依賴英特爾利用其代工業(yè)務生產(chǎn)產(chǎn)品。英特爾必須在出售代工業(yè)務之前使其實現(xiàn)盈利。”

阿斯霍爾姆對格爾辛格被解職的解釋是——他并未聲稱了解內(nèi)幕,英特爾也拒絕置評——這位首席執(zhí)行官是公司內(nèi)部長期權(quán)力斗爭的犧牲品。這場斗爭的一方是負責英特爾傳統(tǒng)x86個人電腦處理器業(yè)務的客戶端計算事業(yè)部,而另一方是其他所有人。

他說:“縱觀歷史,英特爾雖創(chuàng)新頗多,卻鮮有耐心走完最后一英里。”他指的是英特爾在2019年將其移動設備業(yè)務出售給蘋果,并于翌年將存儲芯片業(yè)務轉(zhuǎn)讓給海力士(SK Hynix)。“問題的癥結(jié)在于,與英特爾的客戶端計算事業(yè)部相比,這些新計劃似乎總是黯然失色,且無一例外地遭到了遺棄。”

英特爾新任臨時聯(lián)席首席執(zhí)行官之一是米歇爾·約翰斯頓·霍爾特豪斯(Michelle Johnston Holthaus),她在過去幾年中一直負責客戶端計算事業(yè)部業(yè)務。(另一位是首席財務官大衛(wèi)·津斯納(David Zinsner)。)阿斯霍爾姆說:"在英特爾近期歷史中,客戶端計算事業(yè)部管理層相較于公司高層擁有更大的實權(quán)。客戶端計算事業(yè)部再次取得了勝利。”

至于格爾辛格的永久繼任者,美國全國廣播公司財經(jīng)頻道(CNBC)和路透社都報道稱,英特爾正在尋找外部候選人。

美滿科技集團(Marvell)首席執(zhí)行官馬特·墨菲(Matt Murphy)和數(shù)月前離開英特爾董事會的Cadence Design Systems執(zhí)行董事長陳立武(Lip-Bu tan)均被列入潛在候選人之列。陳立武離開董事會導致英特爾缺乏在芯片制造領(lǐng)域具有豐富技術(shù)經(jīng)驗的人才。據(jù)路透社當時報道,陳立武對格爾辛格執(zhí)行代工戰(zhàn)略的方式、內(nèi)部官僚主義和英特爾滯后的人工智能戰(zhàn)略感到失望。

丹利在報告中稱:“我們認為帕特是解決英特爾芯片制造問題的最佳首席執(zhí)行官,同時希望公司退出晶圓代工業(yè)務,保留格爾辛格。隨著帕特離職,如果新任首席執(zhí)行官不像帕特那樣精通先進半導體制造技術(shù),英特爾持續(xù)落后于臺積電/AMD的風險可能會進一步加大。”(財富中文網(wǎng))

譯者:中慧言-王芳

The list of mistakes and miscalculations that turned Intel from an unbeatable industry titan into its current ailing and rudderless state is a long one. But as the company seeks a path forward following the abrupt exit of its CEO this week, the fundamental problem Intel needs to resolve comes down to its very identity, and to questions about where its true strengths lie, as a chip company.

The 56-year-old semiconductor company is among the last of its kind to both design its own chips and manufacture them—a powerful combination that for years gave Intel a technological and financial edge. With changes in the market making that model less viable though, Intel has struggled to adapt. And CEO Pat Gelsinger, according to industry experts, found himself caught between competing interests, unable to sell his plan for remaking the company.

After Gelsinger abruptly “retired” on Monday, multiple outlets reported that the board had become impatient with the company’s turnaround progress and forced him out.

That decision could come to haunt Intel, analysts suggest, since the identity crisis at the heart of Intel’s challenges remains unresolved and will continue to have a big impact on the company’s business and whatever strategy it chooses to pursue.

Wall Street may have the same idea—Intel’s share price may have initially jumped on news of Gelsinger’s exit, but it fell by more than 6% on Tuesday as the implications sunk in.

“Axing Pat Gelsinger is a massive loss and could cost Intel its life,” said Claus Aasholm, an analyst at Denmark’s Semiconductor Business Intelligence consultancy.

Foundry ambitions

Plenty has gone wrong at Intel, which missed the boat on smartphones and is an also-ran in the Nvidia-dominated AI chip space. But the core issue in this affair is Intel Foundry, the company’s manufacturing arm.

When Gelsinger returned to Intel as CEO in 2021—he had served 30 years at the company before leaving in 2009 for stints at EMC (president and chief operating officer) and VMware (CEO)—the U.S. chip icon was already in trouble.

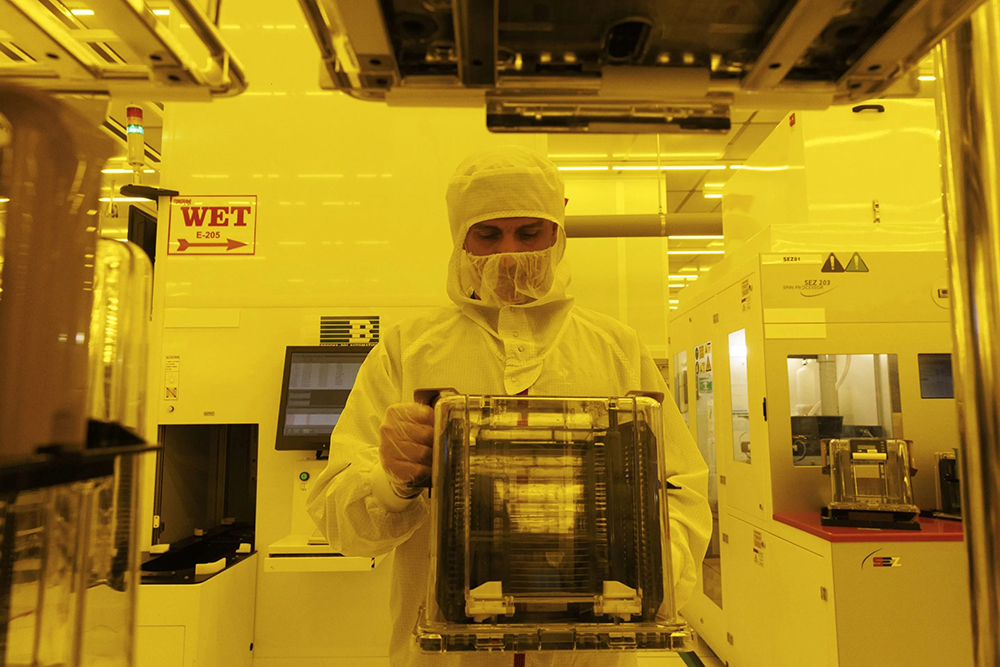

Chip manufacturing facilities have been one of Intel’s long-term advantages—and are at the heart of its current identity crisis.

Kobi Wolf—Bloomberg/Getty Images

Its operating profits were slipping; rival AMD was taking market share from its PC and data center businesses; Apple had recently decided to switch from Intel’s x86-architecture processors to its own ARM-based chips for its Mac line; and Intel was struggling to upgrade its manufacturing processes to keep up with the likes of Taiwan Semiconductor Manufacturing Co. (TSMC) and Samsung. Outgoing CEO Bob Swan was a finance guy, but Gelsinger was an engineer and a much liked one at that. His return was well received inside and outside Intel.

Gelsinger’s big idea for the Intel turnaround was to build out more factories in the U.S. and Europe and to finally become a successful contract chip manufacturer, as well as designer and maker of its own processors.

This was a hugely ambitious idea for a couple of reasons. Firstly, Intel’s delays in switching to more advanced manufacturing processes were very well publicized; TSMC remained and remains the premium option. Secondly, the big clients that Intel’s contract-manufacturing business needed were understandably wary about letting their intellectual property anywhere near Intel’s own chip-design business—a trust problem that Samsung, the only big rival to TSMC in advanced chip manufacturing, has also experienced.

As a result, Gelsinger and his team had to repeatedly reorganize the company to make the separation of its two sides ever more meaningful. This culminated in September’s announcement that Intel Foundry would become an independent subsidiary business within the mothership.

Race against time

Intel this year won two notable customers for Foundry’s upcoming (and much delayed) 18A chipmaking process—both Microsoft and Amazon have signed up to have the company produce custom chips for them—but neither deal is anywhere near the scale that’s needed to make the business sustainable. The division had an operating loss of $5.8 billion in the third quarter of this year, with revenues down 8%.

However, Aasholm argues that Gelsinger displayed “masterful navigation of the political and financial landscape” in his handling of the Foundry plans, even if “Intel’s manufacturing was and is subpar.”

The erstwhile CEO’s most prominent achievement on this front was the securing of up to $7.86 billion in U.S. government funding under the CHIPS Act, the Biden administration’s big push to rebuild America’s chip-manufacturing prowess as a hedge against overreliance on Taiwan. (It was to have been $600 million more, but the sum was reduced because Intel also won a $3 billion U.S. military contract and scaled back its medium-term U.S. investment plans by 10%.)

But Gelsinger also struck two megadeals that saw external asset managers throw vast amounts of cash at key plant buildouts. In the first example, Intel and Brookfield Asset Management agreed in 2022 to jointly invest up to $30 billion in Intel’s new factories in Chandler, Ariz. A similar deal followed this year, in which Apollo Global Management put $11 billion into Intel’s new Fab 34 plant in Leixlip, Ireland. In each case, the asset manager got 49% of the joint venture and Intel retained a controlling interest of 51%.

Gelsinger “still did not have all the money, but a big chunk was in the bag,” Aasholm told Fortune.

As CEO of Intel, Pat Gelsinger worked to get billions in funding from the Biden administration to manufacture chips in the U.S.

BRENDAN SMIALOWSKI—AFP/Getty Images

“We … believe Gelsinger has begun to right the manufacturing ship,” Citi analyst Christopher Danely wrote in a Monday note following Gelsinger’s ouster. “Intel was almost two years behind TSMC/AMD when he joined and is now poised to draw even … by the end of 2025—a remarkable feat in our opinion.”

With the 18A manufacturing process due to finally come online next year—but with Intel posting a record quarterly loss of $16.6 billion in Q3 and 15,000 workers being shown the door this year—it was as though the CEO was racing to make it over a fast-crumbling bridge.

He didn’t make it. The question now is whether Intel will.

The road ahead

There is clearly momentum behind the idea of getting rid of Foundry altogether.

Four former Intel directors advocated this route in a Fortune op-ed just weeks before Gelsinger’s defenestration. They argued that “an Intel foundry operation, inside Intel’s corporate structure, has little chance of success” because Intel has “failed to prove that it can effectively run a foundry,” and because of the aforementioned lack of trust on the part of potential clients like Nvidia and Broadcom.

“We believe it is in the best interest of Intel shareholders if the company stops trying to be a merchant foundry, and we believe the chance is higher now given Gelsinger was a champion of it,” said Citi’s Danely in his note, adding: “In our ideal world, Gelsinger would stay and foundry goes.” Bank of America’s analysts also said a breakup was now more likely.

But there are significant potential roadblocks in the way. The U.S. government erected one of them in the terms that were attached to Intel’s CHIPS Act funding: If Foundry gets spun off, and Intel loses control of it, bang goes the cash, unless the Department of Commerce has a change of heart. (Indeed, the same result would follow if a third party gained control of Intel as a whole. Qualcomm was sniffing around Intel recently but reportedly lost interest owing to the complexity of a takeover.)

Then there are those deals with the asset management companies. “With the current operating profit split, [Intel Foundry Services] is unsellable,” said Aasholm. “It cannot even be given away. The two deals with Brookfield and Apollo depend on Intel products using IFS. Intel will have to get IFS to profitability before selling it.”

Aasholm’s interpretation of Gelsinger’s ouster—he does not claim insider knowledge, and Intel declined to comment—is that the CEO fell victim to a long-running power struggle within the company. On the one side: the Client Computing Group (CCG), which handles Intel’s traditional x86 PC processor business. On the other: everyone else.

“Historically, Intel has innovated a lot but has never had the patience to go the last mile,” he said, pointing to Intel’s sale of its mobile model business to Apple in 2019, and that of its memory chip business to SK Hynix the following year. “The problem is that these initiatives always look small compared to CCG, and each was abandoned.”

One of Intel’s new interim co-CEOs is Michelle Johnston Holthaus, who has run CCG for the past couple of years. (The other is CFO David Zinsner.) “In Intel’s most recent history, CCG management has been more powerful than senior management itself. And once again, CCG won,” said Aasholm.

As for Gelsinger’s permanent replacement, both CNBC and Reuters report that Intel is looking at external candidates.

Marvell CEO Matt Murphy’s name is in the frame, as is that of Cadence Design Systems executive chair Lip-Bu Tan—who departed Intel’s board just a few months ago, leaving it without anyone with deep technical experience in chip manufacturing. Reuters reported at the time that Tan had been frustrated with the way Gelsinger’s Foundry strategy was being executed, and with internal bureaucracy and Intel’s lagging AI strategy.

“We believe Pat was the best CEO for fixing Intel’s manufacturing and prefer the company exit Foundry and keep Gelsinger,” said Danely in his note. “Now that Pat is gone, the risk increases that Intel could remain behind TSMC/AMD if the new CEO is not as well-versed in advanced semiconductor manufacturing as Pat.”