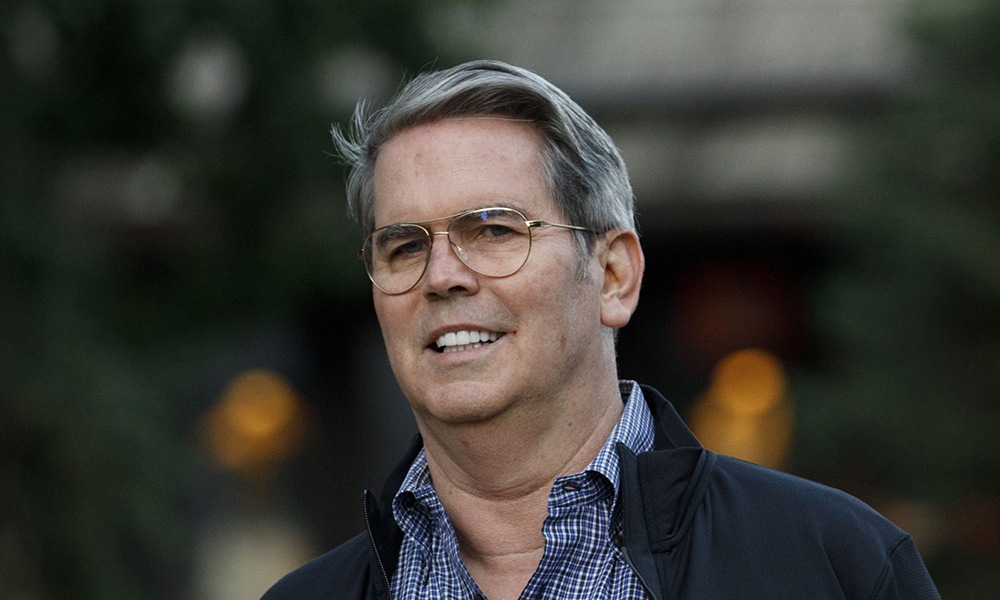

美國當選總統唐納德·特朗普(Donald Trump)提名斯科特·貝森特擔任美國財政部長,使得美元近期的漲勢有所降溫。

美元兌十國集團貨幣均呈走軟趨勢,歐元、英鎊和澳元兌美元漲幅尤為顯著。在新興市場貨幣中,墨西哥比索、泰銖和人民幣的表現也較為突出。

上周五,美元創下了一年多來最長周連漲紀錄,原因是交易員繼續對特朗普的財政政策進行定價,包括全面的貿易關稅和持續的經濟增長。這推動歐元兌美元匯率跌至兩年低點,而瑞士法郎則跌至7月以來最低水平。

在貝森特被提名為美國財政部長之后,彭博社調查的市場參與者普遍認為,這位對沖基金經理在關稅問題上采取了分階段推進的做法,并致力于控制預算赤字。這些政策立場被視為美國經濟和市場的積極信號。

德國聯合信貸銀行(UniCredit Bank GmbH)首席經濟顧問埃里克·尼爾森(Erik Nielsen)在給客戶的一份說明中寫道:“在特朗普宣布其他提名以及財政部職位競爭者之間的拉鋸戰之后,當貝森特被宣布為提名人選時,你無疑能聽到美國金融市場參與者松了一口氣。”

新西蘭銀行(Bank of New Zealand)駐惠靈頓的貨幣策略師杰森·黃(Jason Wong)說:“由于特朗普貿易和更為強勁的經濟數據流,美元在經歷了‘谷倉風暴’之后將迎來盤整期。即使未來數月美元能夠進一步上漲,它也需要稍作喘息。”(財富中文網)

譯者:中慧言-王芳

美國當選總統唐納德·特朗普(Donald Trump)提名斯科特·貝森特擔任美國財政部長,使得美元近期的漲勢有所降溫。

美元兌十國集團貨幣均呈走軟趨勢,歐元、英鎊和澳元兌美元漲幅尤為顯著。在新興市場貨幣中,墨西哥比索、泰銖和人民幣的表現也較為突出。

上周五,美元創下了一年多來最長周連漲紀錄,原因是交易員繼續對特朗普的財政政策進行定價,包括全面的貿易關稅和持續的經濟增長。這推動歐元兌美元匯率跌至兩年低點,而瑞士法郎則跌至7月以來最低水平。

在貝森特被提名為美國財政部長之后,彭博社調查的市場參與者普遍認為,這位對沖基金經理在關稅問題上采取了分階段推進的做法,并致力于控制預算赤字。這些政策立場被視為美國經濟和市場的積極信號。

德國聯合信貸銀行(UniCredit Bank GmbH)首席經濟顧問埃里克·尼爾森(Erik Nielsen)在給客戶的一份說明中寫道:“在特朗普宣布其他提名以及財政部職位競爭者之間的拉鋸戰之后,當貝森特被宣布為提名人選時,你無疑能聽到美國金融市場參與者松了一口氣。”

新西蘭銀行(Bank of New Zealand)駐惠靈頓的貨幣策略師杰森·黃(Jason Wong)說:“由于特朗普貿易和更為強勁的經濟數據流,美元在經歷了‘谷倉風暴’之后將迎來盤整期。即使未來數月美元能夠進一步上漲,它也需要稍作喘息。”(財富中文網)

譯者:中慧言-王芳

President-elect Donald Trump’s nomination of Scott Bessent to oversee the US Treasury is taking some heat out of the dollar’s recent rally.

The US currency weakened against all Group-of-10 peers with the euro, pound and Aussie leading the gains against the greenback. The Mexican peso, Thai baht and Chinese yuan outperformed among emerging market currencies.

The dollar notched its longest stretch of weekly advances in more than a year on Friday as traders continued to price in Trump’s fiscal policies including sweeping trade tariffs and persistent economic growth. This pushed the euro to a two-year low against the dollar while the Swiss franc slid to its weakest since July.

Market participants surveyed by Bloomberg following Bessent’s appointment see the hedge fund manager taking a more phased approach on tariffs and attempting to rein in the budget deficit, regarded as positive signs for the US economy and markets.

“Following his other nominations, and the drawn-out battle among the contenders for the Treasury job, you could literally hear the sigh of relief from financial markets participants in the US when Bessent was announced,” Erik Nielsen, chief economics advisor at UniCredit Bank GmbH wrote in a note to clients.

The greenback is due for some consolidation after its “barn-storming run of late due to the Trump trade and stronger economic data flow,” said Jason Wong, a Wellington-based currency strategist at the Bank of New Zealand. “Even if it can make further gains in the months ahead, it is due for a breather.”