說起股神巴菲特,大家最熟悉的就是他的那句投資箴言:“別人貪婪我恐懼,別人恐懼我貪婪”——出自巴菲特1968年致股東的一封信。這句話時至今日仍有很強的指導性,因為現在美股又爬升到了新高度,大家似乎都動起來了——除了巴菲特自己。那么,“股神”是恐懼了,還是貪婪了呢?

雖然股市一路走高,但巴菲特從來沒有像現在這樣把大把現金捂在手里。據報表顯示,他的伯克希爾-哈撒韋公司目前大約持有3250億美元的現金和現金等價物,其中超過2880億美元是美國國債,也就是所謂的“無風險”利率投資產品。

與此同時,巴菲特還在市場上瘋狂拋售股票。據CNN報道,在過去8個季度中,伯克希爾-哈撒韋公司每個季度賣出的股票都超過了買入,最引人注目的就是拋售了最主要的三個倉位中的兩個——蘋果和美銀。

截至去年年底,伯克希爾-哈撒韋公司共持有價值1780億美元的蘋果公司股份,比第二大倉位高出五倍。雖然蘋果是伯克希爾-哈撒韋公司持倉最多的股票,但巴菲特今年已經減持了一大半。到今年9月30日,它持有的蘋果股份大約價值699億美元。

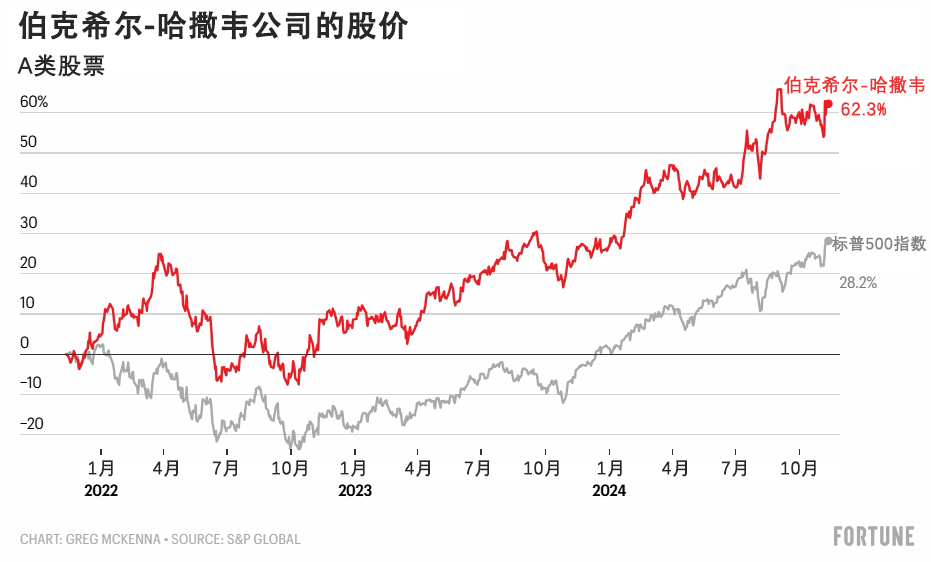

將這些股份變現后,伯克希爾-哈撒韋的季度凈利潤達到262.5億美元,相當于每一股A股變現18272美元。如下圖所示,伯克希爾-哈撒韋公司的股價已經輕松跑贏了大盤,過去三年的回報率是標普500指數的兩倍還多。

巴菲特會大舉入市嗎?

除了及時收手變現以外,巴菲特如此大手筆拋售股份,是否也因為他認為市場已經過熱了?著名的“巴菲特指標”(即將所有上市股份的價值與美國經濟總規模進行比較)表明,巴菲特有可能的確是這樣想的。

據《華爾街日報》計,美國當前的威爾希爾5000指數已達200%左右,這表明美股積聚的壓力已經超過了科技泡沫探頂的那段時期。

一旦市場下行,伯克希爾-哈撒韋公司肯定會拿出資金抄底。《華爾街日報》指出,巴菲特的公司可能會瞄準25家左右美國最有價值的上市公司,包括迪士尼、高盛、輝瑞、通用電氣和AT&T等。

當然,巴菲特也有可能因為股市整體估值過高,而在此輪反彈中選擇不出手,又或者他只是在單純地等待機會。據《華爾街日報》報道,巴菲特曾在2023年的年會上表示:“我們要買入的是那些真正優秀的公司。如果我們能以500億、750億或者1000億美元買入一家真正優秀的公司,我們就會那樣做的。”但是能達到這種規模的公司并不多,所以這也可以解釋為什么巴菲特一直沒有出手。

《華爾街日報》指出,伯克希爾-哈撒韋公司目前的現金儲備情況,可能是為什么巴菲特沒有大舉入市的主要原因之一。目前,該公司要進行任何形式的收購,可能都要支付20%或以上的溢價。與此同時,伯克希爾-哈撒韋公司的規模已經太大了,因此它也越來越難復制其能利用利潤持續跑贏市場的那種可靠模式。

在去年年會上,巴菲特還表示,他將持有更多現金,好為更高的資本所得稅做準備。不過,雖然巴菲特認為這件事已經是迫在眉睫了,但美國的資本所得稅可能不會很快到來,畢竟特朗普馬上就要二次入主白宮了。(財富中文網)

譯者:樸成奎

說起股神巴菲特,大家最熟悉的就是他的那句投資箴言:“別人貪婪我恐懼,別人恐懼我貪婪”——出自巴菲特1968年致股東的一封信。這句話時至今日仍有很強的指導性,因為現在美股又爬升到了新高度,大家似乎都動起來了——除了巴菲特自己。那么,“股神”是恐懼了,還是貪婪了呢?

雖然股市一路走高,但巴菲特從來沒有像現在這樣把大把現金捂在手里。據報表顯示,他的伯克希爾-哈撒韋公司目前大約持有3250億美元的現金和現金等價物,其中超過2880億美元是美國國債,也就是所謂的“無風險”利率投資產品。

與此同時,巴菲特還在市場上瘋狂拋售股票。據CNN報道,在過去8個季度中,伯克希爾-哈撒韋公司每個季度賣出的股票都超過了買入,最引人注目的就是拋售了最主要的三個倉位中的兩個——蘋果和美銀。

截至去年年底,伯克希爾-哈撒韋公司共持有價值1780億美元的蘋果公司股份,比第二大倉位高出五倍。雖然蘋果是伯克希爾-哈撒韋公司持倉最多的股票,但巴菲特今年已經減持了一大半。到今年9月30日,它持有的蘋果股份大約價值699億美元。

將這些股份變現后,伯克希爾-哈撒韋的季度凈利潤達到262.5億美元,相當于每一股A股變現18272美元。如下圖所示,伯克希爾-哈撒韋公司的股價已經輕松跑贏了大盤,過去三年的回報率是標普500指數的兩倍還多。

巴菲特會大舉入市嗎?

除了及時收手變現以外,巴菲特如此大手筆拋售股份,是否也因為他認為市場已經過熱了?著名的“巴菲特指標”(即將所有上市股份的價值與美國經濟總規模進行比較)表明,巴菲特有可能的確是這樣想的。

據《華爾街日報》計,美國當前的威爾希爾5000指數已達200%左右,這表明美股積聚的壓力已經超過了科技泡沫探頂的那段時期。

一旦市場下行,伯克希爾-哈撒韋公司肯定會拿出資金抄底。《華爾街日報》指出,巴菲特的公司可能會瞄準25家左右美國最有價值的上市公司,包括迪士尼、高盛、輝瑞、通用電氣和AT&T等。

當然,巴菲特也有可能因為股市整體估值過高,而在此輪反彈中選擇不出手,又或者他只是在單純地等待機會。據《華爾街日報》報道,巴菲特曾在2023年的年會上表示:“我們要買入的是那些真正優秀的公司。如果我們能以500億、750億或者1000億美元買入一家真正優秀的公司,我們就會那樣做的。”但是能達到這種規模的公司并不多,所以這也可以解釋為什么巴菲特一直沒有出手。

《華爾街日報》指出,伯克希爾-哈撒韋公司目前的現金儲備情況,可能是為什么巴菲特沒有大舉入市的主要原因之一。目前,該公司要進行任何形式的收購,可能都要支付20%或以上的溢價。與此同時,伯克希爾-哈撒韋公司的規模已經太大了,因此它也越來越難復制其能利用利潤持續跑贏市場的那種可靠模式。

在去年年會上,巴菲特還表示,他將持有更多現金,好為更高的資本所得稅做準備。不過,雖然巴菲特認為這件事已經是迫在眉睫了,但美國的資本所得稅可能不會很快到來,畢竟特朗普馬上就要二次入主白宮了。(財富中文網)

譯者:樸成奎

One of the famous pieces of investment advice is “be fearful when others are greedy and be greedy when others are fearful.” It’s fitting this advice comes from the world’s most famous investor, Warren Buffett, who first set out a version of it in a 1968 letter to shareholders. His words are more timely than ever as the stock market reaches new heights and as everyone appears to be getting in on the action—except Buffett himself. Has the Oracle of Omaha grown fearful?

Even as corporate valuations soar, Buffett has never sat on more dollar bills. His conglomerate, Berkshire Hathaway, currently holds $325 billion in cash and equivalents, according to the firm’s quarterly financial statements. Over $288 billion of that pile is in U.S. Treasury Bills, the textbook example of investing at the so-called “risk-free” rate.

At the same time, the Oracle has been active in the market—in the form of a selling spree. During each of the last eight quarters, CNN reports that Berkshire has offloaded more stock than it’s bought, most notably selling off two of its top-three largest holdings— Apple and Bank of America.

Apple made up $178 billion of Berkshire’s portfolio at the end of last year, roughly five times the size of the conglomerate’s next largest position. While the iPhone maker, which Buffett has long praised, remains Berkshire’s top holding, the conglomerate has trimmed its stake by over half. As of Sept. 30, it holds $69.9 billion worth of Apple shares.

Realizing gains on those investments drove Berkshires’ quarterly net earnings up to $26.25 billion, or $18,272 per Class A share. As the chart below shows, the conglomerate’s stock has easily outpaced the broader market, more than doubling the return of the S&P 500 over the last three years.

Will Buffett make a big acquisition?

Beyond immense profit taking, however, is the Oracle also getting out of the market because he believes it is overheating? The famed “Buffett indicator,” which compares the value of all listed stocks to the size of the U.S economy, suggests that’s possible.

Using the Wilshire 5000 Index as a proxy, The Wall Street Journal calculated that number to be roughly 200%, indicating the market is more stretched than at the peak of the tech bubble.

In the event of a market downturn, Berkshire would certainly have the funds to capitalize on opportunities. The Journal noted Buffett's company could fork over a check for all but 25 or so of America’s most-valuable listed corporations, including names like Walt Disney, Goldman Sachs, Pfizer, General Electric, and AT&T.

While Buffett may be sitting out the stock rally due to inflated valuations, it's also possible he is just waiting. As the Journal reported, at the 2023 annual meeting, he said “What we’d really like to do is buy great businesses. If we could buy a company for $50 billion or $75 billion, $100 billion, we could do it.” There are simply not many companies of that size in play, so that could also explain why Berkshire has not been spending.

The Journal noted the company's cash hoard is likely a reflection of how its current situation prevents it from making major moves. Berkshire would currently have to pay a premium of 20% or more in any sort of takeover. Meanwhile, the company’s immense size has made it increasingly difficult for Berkshire to replicate its tried-and-true model of deploying its profits to continuously beat the market.

At last year’s annual meeting, Buffett also suggested he would keep more cash on hand to prepare for higher capital gains taxes. The tax increases he believed were imminent, however, might not materialize anytime soon with Trump returning for a second term in the Oval Office.