英偉達成功平息了投資者對產(chǎn)品延期和長期增長前景的擔憂,股價開始反彈。

該股本月累計上漲近14%,其中周一上漲2.4%,創(chuàng)下自6月以來的首個收盤紀錄,但仍低于盤中峰值。該股是今年標準普爾500指數(shù)中表現(xiàn)第二好的股票。

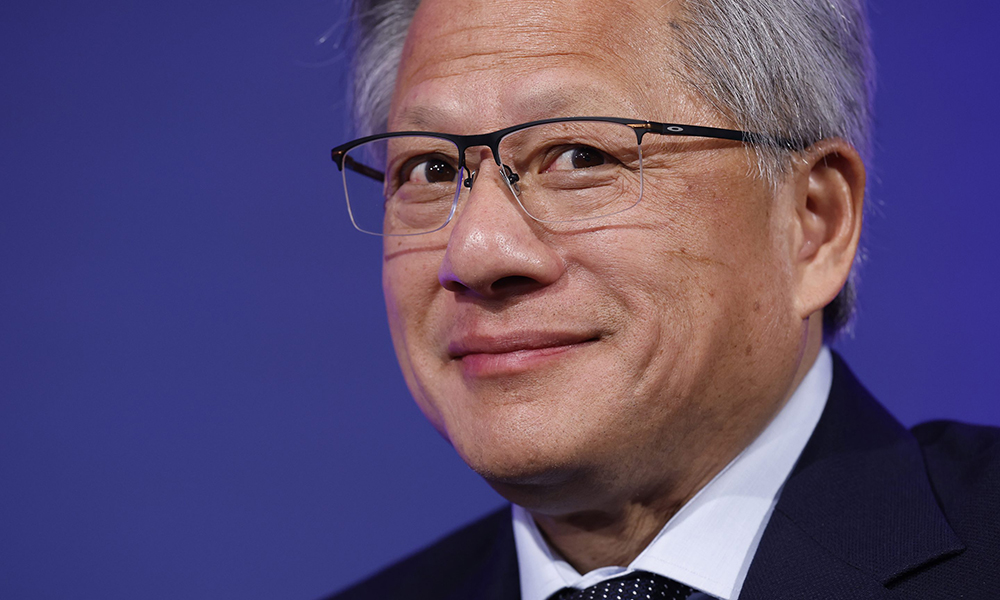

最近股價上漲是因為首席執(zhí)行官黃仁勛表示,該公司的Blackwell芯片“已全面投產(chǎn)”,市場需求“非常瘋狂”。此前,由于工程問題,Blackwell芯片推遲上市,眾多評論引發(fā)了投資者對英偉達股票的拋售,但這部分跌幅目前已被抹去。此外,摩根士丹利(Morgan Stanley)分析師上周與管理層會面后發(fā)布的報告稱,“未來一年左右的”Blackwell訂單“已全部售罄”,“各種跡象表明,該公司的業(yè)務(wù)仍然強勁,未來前景向好”。

這些評論強化了這樣一種觀點,即英偉達仍是投資人工智能領(lǐng)域的首選股票,尤其是在大型科技公司仍致力于其人工智能計劃的情況下。例如,根據(jù)彭博社匯總的分析師預(yù)測平均值,,微軟(Microsoft Corp.)預(yù)計將在2025財年增加近三分之一的資本支出,達到約580億美元。

馬丁可利投資管理有限公司(Martin Currie Investment Management)的投資組合經(jīng)理澤赫里德·奧斯馬尼(Zehrid Osmani)表示:"一直有人質(zhì)疑Blackwell生產(chǎn)延遲可能產(chǎn)生的影響,因此這些最新消息令人欣慰。”

除了對Blackwell的樂觀情緒之外,臺積電(Taiwan Semiconductor Manufacturing Co.)最近的銷售額也顯示出人工智能的強勁需求,而OpenAI在新一輪融資中的估值也達到了1570億美元,該公司近期還發(fā)布了一個具有推理能力的人工智能模型,Alphabet Inc.也在研發(fā)這一模型。

Gabelli Funds的投資組合經(jīng)理約翰·貝爾頓(John Belton)表示:"這些事件重新激發(fā)了人們對這一領(lǐng)域的興趣,人們對基于推理的人工智能的用例感到非常興奮。對于英偉達而言,推理是一個全新的領(lǐng)域,如果考慮到它的計算密集程度,這可能會成為巨大的新產(chǎn)品類別。”

貝爾頓將英偉達視為核心持股,并認為人工智能將為該公司帶來“持續(xù)不斷的穩(wěn)定需求”。“這不是一只未被發(fā)現(xiàn)的股票,但如果它能實現(xiàn)預(yù)期的業(yè)績,其估值仍然合理。”

根據(jù)彭博社收集的數(shù)據(jù),分析師預(yù)計英偉達本財年的營收將增長一倍以上,并在下一財年再增長44%。過去一個季度,華爾街持續(xù)上調(diào)對英偉達收益和利潤的預(yù)期。

英偉達強勁的增長前景抑制了估值,這為多頭提供了持續(xù)買入的理由。該股市盈率高于37倍,較納斯達克100指數(shù)有一定溢價,但低于其五年平均水平,也低于6月達到的逾44倍的峰值。

馬丁可利投資管理有限公司的奧斯馬尼說:"英偉達依然顯得非常強大,它正處于一個非常有利的位置,能夠抓住人工智能領(lǐng)域的機遇。”

期權(quán)市場也出現(xiàn)了積極的跡象。周四出現(xiàn)了一波買入看漲期權(quán)的熱潮,這些期權(quán)允許持有者在3月份之前以每股150美元至189美元的價格買入逾3000萬股。英偉達的股票周一報收于138.07美元。

相對于看跌期權(quán),看漲期權(quán)的成本(稱為偏斜)有所下降,這使得投資者押注其進一步上漲的成本更低。這些期權(quán)合約將在英偉達預(yù)計于2月底發(fā)布第四季度財報后到期。

路博邁(Neuberger Berman)董事總經(jīng)理兼高級研究分析師丹·弗萊克斯(Dan Flax)說:“英偉達的股價將繼續(xù)波動,訂單情況也可能不穩(wěn)定。但只要英偉達能夠執(zhí)行其產(chǎn)品路線圖,就會推動健康增長,并保持股票的吸引力。”(財富中文網(wǎng))

譯者:中慧言-王芳

英偉達成功平息了投資者對產(chǎn)品延期和長期增長前景的擔憂,股價開始反彈。

該股本月累計上漲近14%,其中周一上漲2.4%,創(chuàng)下自6月以來的首個收盤紀錄,但仍低于盤中峰值。該股是今年標準普爾500指數(shù)中表現(xiàn)第二好的股票。

最近股價上漲是因為首席執(zhí)行官黃仁勛表示,該公司的Blackwell芯片“已全面投產(chǎn)”,市場需求“非常瘋狂”。此前,由于工程問題,Blackwell芯片推遲上市,眾多評論引發(fā)了投資者對英偉達股票的拋售,但這部分跌幅目前已被抹去。此外,摩根士丹利(Morgan Stanley)分析師上周與管理層會面后發(fā)布的報告稱,“未來一年左右的”Blackwell訂單“已全部售罄”,“各種跡象表明,該公司的業(yè)務(wù)仍然強勁,未來前景向好”。

這些評論強化了這樣一種觀點,即英偉達仍是投資人工智能領(lǐng)域的首選股票,尤其是在大型科技公司仍致力于其人工智能計劃的情況下。例如,根據(jù)彭博社匯總的分析師預(yù)測平均值,,微軟(Microsoft Corp.)預(yù)計將在2025財年增加近三分之一的資本支出,達到約580億美元。

馬丁可利投資管理有限公司(Martin Currie Investment Management)的投資組合經(jīng)理澤赫里德·奧斯馬尼(Zehrid Osmani)表示:"一直有人質(zhì)疑Blackwell生產(chǎn)延遲可能產(chǎn)生的影響,因此這些最新消息令人欣慰。”

除了對Blackwell的樂觀情緒之外,臺積電(Taiwan Semiconductor Manufacturing Co.)最近的銷售額也顯示出人工智能的強勁需求,而OpenAI在新一輪融資中的估值也達到了1570億美元,該公司近期還發(fā)布了一個具有推理能力的人工智能模型,Alphabet Inc.也在研發(fā)這一模型。

Gabelli Funds的投資組合經(jīng)理約翰·貝爾頓(John Belton)表示:"這些事件重新激發(fā)了人們對這一領(lǐng)域的興趣,人們對基于推理的人工智能的用例感到非常興奮。對于英偉達而言,推理是一個全新的領(lǐng)域,如果考慮到它的計算密集程度,這可能會成為巨大的新產(chǎn)品類別。”

貝爾頓將英偉達視為核心持股,并認為人工智能將為該公司帶來“持續(xù)不斷的穩(wěn)定需求”。“這不是一只未被發(fā)現(xiàn)的股票,但如果它能實現(xiàn)預(yù)期的業(yè)績,其估值仍然合理。”

根據(jù)彭博社收集的數(shù)據(jù),分析師預(yù)計英偉達本財年的營收將增長一倍以上,并在下一財年再增長44%。過去一個季度,華爾街持續(xù)上調(diào)對英偉達收益和利潤的預(yù)期。

英偉達強勁的增長前景抑制了估值,這為多頭提供了持續(xù)買入的理由。該股市盈率高于37倍,較納斯達克100指數(shù)有一定溢價,但低于其五年平均水平,也低于6月達到的逾44倍的峰值。

馬丁可利投資管理有限公司的奧斯馬尼說:"英偉達依然顯得非常強大,它正處于一個非常有利的位置,能夠抓住人工智能領(lǐng)域的機遇。”

期權(quán)市場也出現(xiàn)了積極的跡象。周四出現(xiàn)了一波買入看漲期權(quán)的熱潮,這些期權(quán)允許持有者在3月份之前以每股150美元至189美元的價格買入逾3000萬股。英偉達的股票周一報收于138.07美元。

相對于看跌期權(quán),看漲期權(quán)的成本(稱為偏斜)有所下降,這使得投資者押注其進一步上漲的成本更低。這些期權(quán)合約將在英偉達預(yù)計于2月底發(fā)布第四季度財報后到期。

路博邁(Neuberger Berman)董事總經(jīng)理兼高級研究分析師丹·弗萊克斯(Dan Flax)說:“英偉達的股價將繼續(xù)波動,訂單情況也可能不穩(wěn)定。但只要英偉達能夠執(zhí)行其產(chǎn)品路線圖,就會推動健康增長,并保持股票的吸引力。”(財富中文網(wǎng))

譯者:中慧言-王芳

Nvidia Corp.’s shares are roaring back after the company successfully calmed investor concerns about product delays and its long-term growth prospects.

The stock is up almost 14% this month, including a 2.4% gain on Monday that resulted in its first record close since June, though it remains below an intraday peak. It’s the second-best performer in the S&P 500 Index this year.

Recent strength came after CEO Jensen Huang said Nvidia’s Blackwell chip “is in full production,” and that demand for it “is insane,” comments that came after Blackwell was delayed due to engineering snags, prompting a selloff that has now been erased. In addition, a report last week from Morgan Stanley analysts who met management said that Blackwell orders “are booked out 12 months or so,” with “every indication that business remains robust with very high forward visibility.”

The comments cement the view that Nvidia is still a favored way to invest in artificial intelligence, especially as major companies remain committed to their AI initiatives. Microsoft Corp., for example, is projected to boost capex spending by nearly a third in fiscal 2025 to about $58 billion, according to the average of analyst estimates compiled by Bloomberg.

“There had been questions about the impact production delays could have, so these updates are reassuring,” said Zehrid Osmani, portfolio manager at Martin Currie Investment Management.

Beyond the Blackwell optimism, recent sales from Taiwan Semiconductor Manufacturing Co. showed strong AI demand, while a funding round for OpenAI resulted in a $157 billion valuation. OpenAI recently released an AI model with reasoning capabilities, something Alphabet Inc. is also working on.

These events “have driven a reinvigoration of interest in the space, and people are really getting excited about the use cases for reasoning-based AI,” said John Belton, a portfolio manager at Gabelli Funds. “Reasoning represents a new area for Nvidia, and when you consider how compute-intensive it is, this could be a huge new product category.”

Belton views Nvidia as a core holding and sees AI offering “a steady drumbeat of demand” for years. “It’s not an undiscovered stock, but the valuation is still reasonable if it can deliver the numbers that are expected.”

Analysts expect Nvidia’s revenue to more than double in its current fiscal year, and rise another 44% the following one, according to data compiled by Bloomberg. The Street has continually raised estimates for Nvidia’s earnings and profit over the past quarter.

Nvidia’s strong growth prospects have kept its valuation in check, helping bulls support their case to keep buying. It trades above 37 times estimated earnings, which represents a premium to the Nasdaq 100 Index, but is below its five-year average and under a June peak of more than 44 times.

“Nvidia still looks formidable,” said Osmani, of Martin Currie. “It remains really well positioned to harness the AI opportunity.”

Signs of optimism have also been flashing in the options market. On Thursday, there was a wave of purchases in calls that allow holders to buy more than 30 million shares at levels from $150 to $189 through March. Nvidia closed at $138.07 on Monday.

The cost of calls relative to bearish put options — known as the skew — has fallen, making it cheaper to bet on a further rally. The contracts won’t expire until after Nvidia’s fourth-quarter earnings release, expected in late February.

“The stock will remain volatile and orders will be lumpy,” said Dan Flax, managing director and senior research analyst at Neuberger Berman. “But so long as Nvidia executes on its product road map, that will drive the kind of healthy growth that keeps the stock attractive.”