高盛集團(Goldman Sachs)周一表示,人工智能芯片股英偉達的暴跌為投資者提供了一個極具吸引力的切入點。

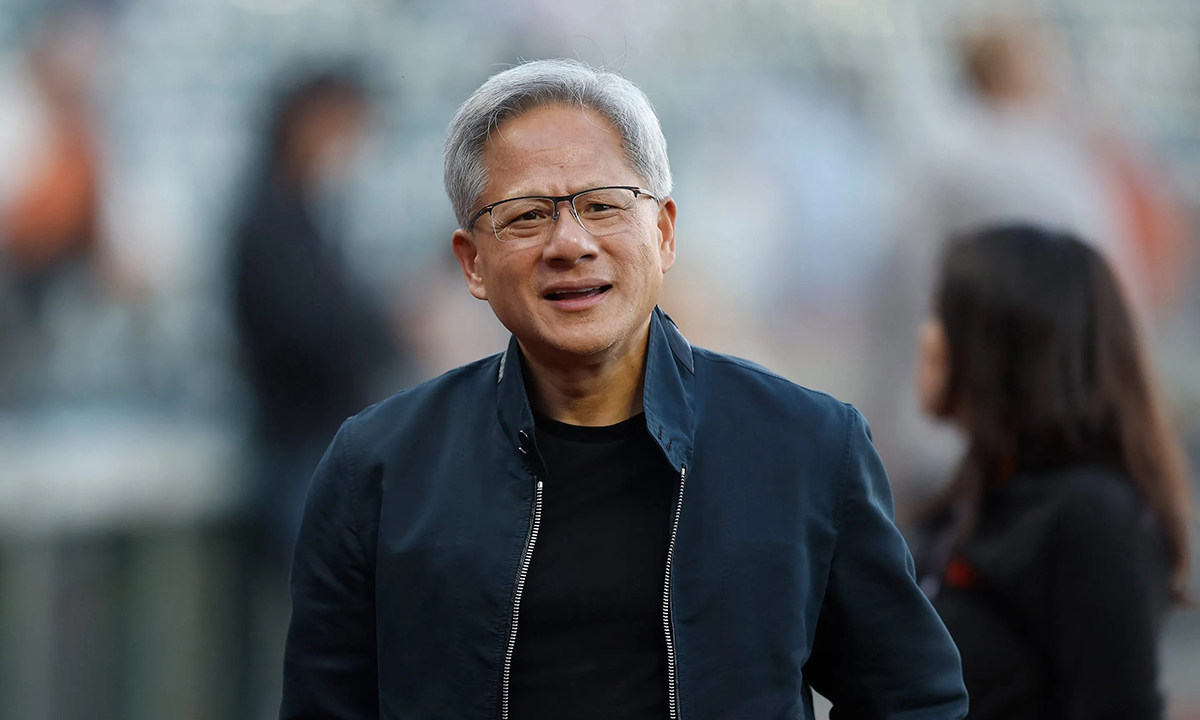

公司創始人兼首席執行官黃仁勛(Jensen Huang)發布了低調的第三季度業績指引,引發了人們對其快速增長的盈利可能無法持續的擔憂,自那以來,該公司的市值蒸發了17%。目前只有少數幾家公司在推動其人工智能芯片業務的蓬勃發展,其中僅四家客戶就占了英偉達全部營收的近一半。

高盛集團半導體分析師哈里俊也(Toshiya Hari)在該行主辦的科技會議的非正式會議期間接受雅虎財經采訪時表示,隨著亞馬遜(Amazon)、微軟(Microsoft)和谷歌(Google)這三大云計算超級巨頭以外的客戶開始投資自己的人工智能計算集群,他相信銷售額將會回升。

“對加速計算的需求仍然非常強勁。”他周一表示,重申了對該股的“買入”建議,并認為該股處于超賣狀態。“你會看到,需求組合正擴大到企業,甚至主權國家。”

根據哈里俊也對英偉達2025年利潤的估計,由于過去幾周的大幅回調,英偉達的市盈率僅為20出頭。相比之下,根據雅虎財經的數據,特斯拉(Tesla)明年的市盈率一致預期為77倍。

定制硅片成為亟需芯片的英偉達客戶的最新趨勢

英偉達今年推動了標準普爾500指數的上漲,但最近它成了自身成功的犧牲品。

生產瓶頸加上缺乏有意義的競爭,意味著客戶正在等待英偉達的Hopper人工智能訓練芯片的供應分配。那些能夠真正獲得這一寶貴資源的客戶則要付出高昂的代價,導致英偉達的利潤率大幅上升。

由于對缺乏選擇感到不滿,包括亞馬遜和特斯拉在內的科技公司正在自研定制芯片,而不是完全依賴英偉達。這些專有芯片可以在臺積電(TSMC)等專業代工廠制造,完全繞過英偉達。

哈里俊也承認,在“自制或外購”的問題上,障礙正在減少,但他認為這種威脅被夸大了。

首先,與AMD的MI300系列等競爭對手相比,英偉達的H100占據了人工智能芯片市場90%的份額,因此沒有公司能與其技術相提并論。哈里俊也解釋說,那些正在研發定制芯片的客戶主要是為了解決其業務特有的計算任務。

雖然這將意味著英偉達本應獲得的銷售損失,但這些專有芯片并不適合在公開市場上與英偉達直接競爭。

哈里俊也以谷歌為例,稱該公司正在自研人工智能芯片,以幫助改進谷歌搜索。相比之下,該集團的超大規模平臺谷歌云平臺對黃仁勛的芯片的需求并沒有減弱的跡象。

高盛集團分析師表示:“他們仍在大量購買英偉達的圖形處理器(GPU),亞馬遜也是如此。在商用芯片領域,英偉達是首選供應商。即使與定制芯片相比,它們在創新速度方面有優勢。”

高盛集團看跌英特爾(Intel),敦促芯片制造商最終達到其指導目標

與此同時,哈里俊也仍然看跌英特爾,認為首席執行官帕特·基辛格(Pat Gelsinger)面臨著一場艱苦的戰斗。

英特爾不僅在產品方面輸掉了與英偉達、AMD和高通(Qualcomm)的競爭,而且其代工業務在生產技術方面也沒有超越臺積電的明確途徑。

哈里俊也認為,尋求外包芯片制造業務的公司不會冒險將這家臺灣巨頭換成技術較差的英特爾。

他對英特爾的評級為“賣出”,但就如何在短期內至少為該股提供支撐,他向基辛格提出了一些建議:

他說:“首先,該公司最好能開始實現其既定的指導目標。它們經常讓市場失望,這對股價絕非好事。”

《財富》雜志未能立即聯系到英偉達或英特爾置評。(財富中文網)

譯者:中慧言-王芳

高盛集團(Goldman Sachs)周一表示,人工智能芯片股英偉達的暴跌為投資者提供了一個極具吸引力的切入點。

公司創始人兼首席執行官黃仁勛(Jensen Huang)發布了低調的第三季度業績指引,引發了人們對其快速增長的盈利可能無法持續的擔憂,自那以來,該公司的市值蒸發了17%。目前只有少數幾家公司在推動其人工智能芯片業務的蓬勃發展,其中僅四家客戶就占了英偉達全部營收的近一半。

高盛集團半導體分析師哈里俊也(Toshiya Hari)在該行主辦的科技會議的非正式會議期間接受雅虎財經采訪時表示,隨著亞馬遜(Amazon)、微軟(Microsoft)和谷歌(Google)這三大云計算超級巨頭以外的客戶開始投資自己的人工智能計算集群,他相信銷售額將會回升。

“對加速計算的需求仍然非常強勁。”他周一表示,重申了對該股的“買入”建議,并認為該股處于超賣狀態。“你會看到,需求組合正擴大到企業,甚至主權國家。”

根據哈里俊也對英偉達2025年利潤的估計,由于過去幾周的大幅回調,英偉達的市盈率僅為20出頭。相比之下,根據雅虎財經的數據,特斯拉(Tesla)明年的市盈率一致預期為77倍。

定制硅片成為亟需芯片的英偉達客戶的最新趨勢

英偉達今年推動了標準普爾500指數的上漲,但最近它成了自身成功的犧牲品。

生產瓶頸加上缺乏有意義的競爭,意味著客戶正在等待英偉達的Hopper人工智能訓練芯片的供應分配。那些能夠真正獲得這一寶貴資源的客戶則要付出高昂的代價,導致英偉達的利潤率大幅上升。

由于對缺乏選擇感到不滿,包括亞馬遜和特斯拉在內的科技公司正在自研定制芯片,而不是完全依賴英偉達。這些專有芯片可以在臺積電(TSMC)等專業代工廠制造,完全繞過英偉達。

哈里俊也承認,在“自制或外購”的問題上,障礙正在減少,但他認為這種威脅被夸大了。

首先,與AMD的MI300系列等競爭對手相比,英偉達的H100占據了人工智能芯片市場90%的份額,因此沒有公司能與其技術相提并論。哈里俊也解釋說,那些正在研發定制芯片的客戶主要是為了解決其業務特有的計算任務。

雖然這將意味著英偉達本應獲得的銷售損失,但這些專有芯片并不適合在公開市場上與英偉達直接競爭。

哈里俊也以谷歌為例,稱該公司正在自研人工智能芯片,以幫助改進谷歌搜索。相比之下,該集團的超大規模平臺谷歌云平臺對黃仁勛的芯片的需求并沒有減弱的跡象。

高盛集團分析師表示:“他們仍在大量購買英偉達的圖形處理器(GPU),亞馬遜也是如此。在商用芯片領域,英偉達是首選供應商。即使與定制芯片相比,它們在創新速度方面有優勢。”

高盛集團看跌英特爾(Intel),敦促芯片制造商最終達到其指導目標

與此同時,哈里俊也仍然看跌英特爾,認為首席執行官帕特·基辛格(Pat Gelsinger)面臨著一場艱苦的戰斗。

英特爾不僅在產品方面輸掉了與英偉達、AMD和高通(Qualcomm)的競爭,而且其代工業務在生產技術方面也沒有超越臺積電的明確途徑。

哈里俊也認為,尋求外包芯片制造業務的公司不會冒險將這家臺灣巨頭換成技術較差的英特爾。

他對英特爾的評級為“賣出”,但就如何在短期內至少為該股提供支撐,他向基辛格提出了一些建議:

他說:“首先,該公司最好能開始實現其既定的指導目標。它們經常讓市場失望,這對股價絕非好事。”

《財富》雜志未能立即聯系到英偉達或英特爾置評。(財富中文網)

譯者:中慧言-王芳

The brutal selloff in AI-chip stock Nvidia offers investors an attractive entry point, Goldman Sachs argued on Monday.

Founder and CEO Jensen Huang has seen his company lose 17% of its market cap since issuing muted third-quarter guidance that sparked concerns its rapid earnings growth may not be sustainable. Only a handful of companies are currently fueling its booming AI chip business, with just four customers constituting nearly half of all Nvidia’s revenue.

Speaking with Yahoo Finance on the sidelines of a tech conference hosted by his bank, Goldman Sachs semiconductor analyst Toshiya Hari remained confident sales will pick up as customers outside of the three cloud hyperscalers—Amazon, Microsoft, and Google—start to invest in their own AI compute clusters.

“Demand for accelerated computing continues to be really strong,” he said on Monday, reaffirming his “buy” recommendation on the stock and arguing the stock was oversold. “You are seeing a broadening in the demand portfolio into enterprise, even into sovereign states.”

Based on Hari’s estimates for Nvidia’s 2025 profits, Nvidia’s price-to-earnings multiple is in the low 20s thanks to the sharp pullback over the past couple of weeks. By comparison, Tesla trades at 77 times next year’s consensus earnings estimates, according to Yahoo Finance.

Custom silicon the latest trend among chip-starved Nvidia customers

Nvidia has driven this year’s gains in the S&P 500 index, but lately it has become a victim of its own success.

A combination of production bottlenecks and a lack of meaningful competition means customers are waiting to be allocated supply of Nvidia’s Hopper AI training chips. Those that are able to actually get their hands on this prized resource are paying through the nose, causing profit margins at Nvidia to balloon.

Unhappy with the lack of choice, tech companies—including Amazon and Tesla—are developing their own custom silicon rather than depending entirely on Nvidia. These proprietary chips can be fabricated at specialized foundries like Taiwan Semiconductor Manufacturing Co. (TSMC), bypassing Nvidia entirely.

Hari acknowledged barriers are dropping when it comes to the make-or-buy question, but argued the threat is overblown.

For one, Nvidia H100s command a 90% share of the AI chip market versus rivals like AMD’s MI300 series, so no one comes close to its technology. Those customers that are in the process of developing custom silicon are primarily interested in solving compute tasks unique to their businesses, Hari explained.

While these would represent lost sales that would have otherwise gone to Nvidia, the proprietary chips would not be suited for competing with Nvidia directly on the open market.

Hari cited Google as an example, saying the company is working on its own AI chips to help improve Google Search. By comparison, the group’s hyperscaler, Google Cloud Platform, showed no signs of a diminished appetite for Huang’s chips.

“They’re still buying a boatload of Nvidia GPUs, and you can make the same case for Amazon,” the Goldman Sachs analyst said. “Within merchant silicon, Nvidia is the go-to. And even versus custom silicon, they’ve got the edge in terms of pace of innovation.”

Goldman bearish on Intel, urging chipmaker to finally hit its guidance

At the same time, Hari remained bearish on Intel, arguing CEO Pat Gelsinger has an uphill battle.

Not only is Intel is losing the race with Nvidia, AMD, and Qualcomm on the product side, but its foundry business has no clear path to surpassing TSMC in terms of production technology.

Companies looking to outsource fabrication of their chips would not risk swapping out the Taiwanese giant for the inferior technology of Intel, argued Hari.

He rates Intel a “sell,” but offered some advice to Gelsinger on how to at least put a floor under the stock in the near term:

“For starters it would help for the company to start hitting what they guide to,” he said. “They’ve disappointed the market quite frequently, and that’s never good for a stock price.”

Neither Nvidia nor Intel could immediately be reached by Fortune for comment.