有許多積極的信號表明,美國女性的財務狀況有顯著改善,投資和收入增加,開始退休儲蓄的年齡也早于前輩。但一份最新報告發現,女性對財務管理的信心依舊低于男性,而且她們的信心高度依賴于婚姻狀況。

理財服務公司Equitable對美國1,200多名18至77歲的女性和500名男性展開了調查,以研究婚姻狀況會對女性與個人財務的關系,以及她們的個人理財方式,產生哪些影響。

調查發現,無論處于年齡段、收入水平或資產水平,女性對個人財務管理能力和實現長期目標的信心,總體上均低于男性。與男性相比,有更大比例的女性表示,她們每天至少會有一次主動擔心財務問題,而且女性也更有可能對自己的財務狀況感到壓力。

這種觀點并不新鮮。但Equitable還發現,女性對財務的信心明顯會隨著婚姻狀況的變化而變化:42%的已婚女性表示對實現財務目標的能力有信心,而單身女性的比例為37%,離異女性為35%,喪偶女性為29%。

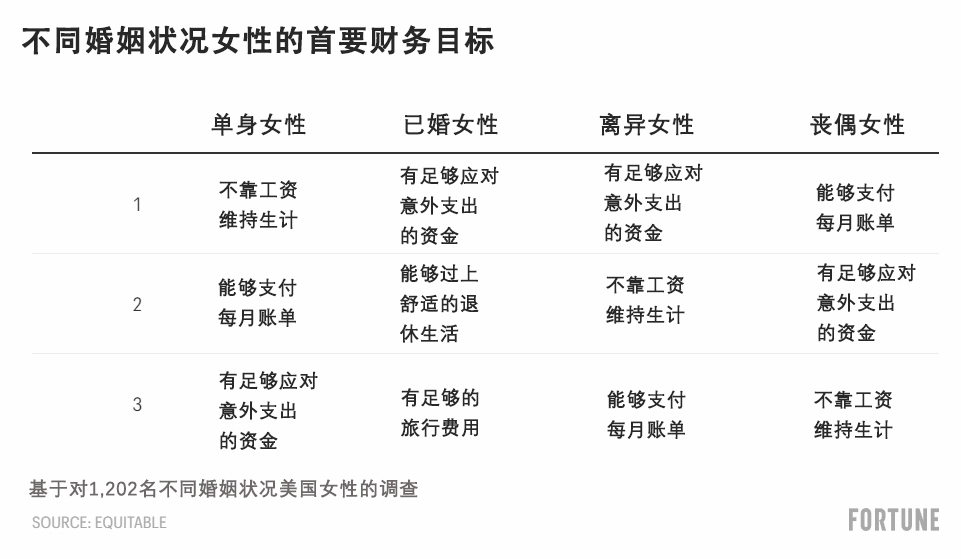

事實上,與單身、離異或喪偶的女性相比,已婚女性(在Equitable的調查中,包括處于長期伴侶關系的女性)表示,她們更有能力專注于長期財務目標,如退休等。只有已婚女性將舒適的退休生活和旅行等長期目標,作為前三大財務目標。

有多個原因導致這種結果的出現。但其中一個重要的原因是,在當前的經濟環境下,與潛在的雙收入家庭的人相比,無論男女,單身者的生活都更加艱難。

離異和喪偶女性可能以前不需要工作,或者要在家照顧孩子,這限制了她們的收入能力。而且在異性戀關系中,她們普遍不太可能參與長期財務策略,這讓她們對未來缺乏信心。約一半(46%)離異女性和61%的喪偶女性,因為婚姻狀況的變化,感覺不太可能實現自己的財務目標。

當然,也有一些例外。有些女性在單身狀態下的財務狀況更好,而且許多女性很享受自己的財務自由。單身女性對財務的信心低于男性,這并不意味著她們管理財務的能力更差。事實上,研究發現,女性的財務管理能力勝過男性投資者。

更早參與財務管理

雖然已婚女性對財務的信心最高,但Equitable表示,情況可能很快發生變化。例如,喪偶和離異女性的信心低于從未有過伴侶的單身女性。

為什么?因為許多離異和喪偶女性在伴侶關系中,會放棄從整體上管理她們的財務狀況。雖然大多數女性會積極參與預算制定等日常活動,但超過一半女性表示,后悔在結婚后沒有更多參與財務管理,尤其是在投資和退休規劃方面。

Equitable首席營銷官康妮·韋弗對此深有體會。韋弗表示,盡管她現在“更精通財務管理”,但丈夫去世后,她感覺自己很脆弱,而且處在一種尷尬的境地,因為她對自己的財務狀況知之甚少。再婚之后,她不打算放棄這方面的主導權。

韋弗說道:“雖然我在財務方面見多識廣,但還是有許多我不了解的情況。我當時不得不面對非常可怕的狀況。令我羞愧的是,我一直沒有積極參與我的財務管理。”

事實上,調查發現,生活中的重大變故,如換工作、加薪、離婚和喪偶等,通常會促使女性更積極地參與自己的財務管理。但韋弗和Equitable Advisors的認證理財規劃師喬迪·德阿古斯蒂尼鼓勵所有人更主動地管理自己的財務。這兩位女性鼓勵其他女性不要把財務規劃權交給伴侶或配偶,或者期待對方制定長期計劃。

Equitable的報告用很大的篇幅鼓勵女性更早參與財務管理,并向專業顧問尋求幫助。但德阿古斯蒂尼表示,不要隨隨便便找理財顧問。如果你有任何不明白的問題,不必害怕讓對方進一步說明。如果理財顧問不準備幫助你,或者不愿意根據你的情況提供建議,那就換新的顧問。

韋弗表示:“我看到的統計數據顯示,年輕人更關心財務狀況,這令我備受鼓舞。我們越早讓人們學會財務管理方面的基礎知識,就能讓她們有更好的財務狀況。”(財富中文網)

翻譯:劉進龍

審校:汪皓

有許多積極的信號表明,美國女性的財務狀況有顯著改善,投資和收入增加,開始退休儲蓄的年齡也早于前輩。但一份最新報告發現,女性對財務管理的信心依舊低于男性,而且她們的信心高度依賴于婚姻狀況。

理財服務公司Equitable對美國1,200多名18至77歲的女性和500名男性展開了調查,以研究婚姻狀況會對女性與個人財務的關系,以及她們的個人理財方式,產生哪些影響。

調查發現,無論處于年齡段、收入水平或資產水平,女性對個人財務管理能力和實現長期目標的信心,總體上均低于男性。與男性相比,有更大比例的女性表示,她們每天至少會有一次主動擔心財務問題,而且女性也更有可能對自己的財務狀況感到壓力。

這種觀點并不新鮮。但Equitable還發現,女性對財務的信心明顯會隨著婚姻狀況的變化而變化:42%的已婚女性表示對實現財務目標的能力有信心,而單身女性的比例為37%,離異女性為35%,喪偶女性為29%。

事實上,與單身、離異或喪偶的女性相比,已婚女性(在Equitable的調查中,包括處于長期伴侶關系的女性)表示,她們更有能力專注于長期財務目標,如退休等。只有已婚女性將舒適的退休生活和旅行等長期目標,作為前三大財務目標。

有多個原因導致這種結果的出現。但其中一個重要的原因是,在當前的經濟環境下,與潛在的雙收入家庭的人相比,無論男女,單身者的生活都更加艱難。

離異和喪偶女性可能以前不需要工作,或者要在家照顧孩子,這限制了她們的收入能力。而且在異性戀關系中,她們普遍不太可能參與長期財務策略,這讓她們對未來缺乏信心。約一半(46%)離異女性和61%的喪偶女性,因為婚姻狀況的變化,感覺不太可能實現自己的財務目標。

當然,也有一些例外。有些女性在單身狀態下的財務狀況更好,而且許多女性很享受自己的財務自由。單身女性對財務的信心低于男性,這并不意味著她們管理財務的能力更差。事實上,研究發現,女性的財務管理能力勝過男性投資者。

更早參與財務管理

雖然已婚女性對財務的信心最高,但Equitable表示,情況可能很快發生變化。例如,喪偶和離異女性的信心低于從未有過伴侶的單身女性。

為什么?因為許多離異和喪偶女性在伴侶關系中,會放棄從整體上管理她們的財務狀況。雖然大多數女性會積極參與預算制定等日常活動,但超過一半女性表示,后悔在結婚后沒有更多參與財務管理,尤其是在投資和退休規劃方面。

Equitable首席營銷官康妮·韋弗對此深有體會。韋弗表示,盡管她現在“更精通財務管理”,但丈夫去世后,她感覺自己很脆弱,而且處在一種尷尬的境地,因為她對自己的財務狀況知之甚少。再婚之后,她不打算放棄這方面的主導權。

韋弗說道:“雖然我在財務方面見多識廣,但還是有許多我不了解的情況。我當時不得不面對非常可怕的狀況。令我羞愧的是,我一直沒有積極參與我的財務管理。”

事實上,調查發現,生活中的重大變故,如換工作、加薪、離婚和喪偶等,通常會促使女性更積極地參與自己的財務管理。但韋弗和Equitable Advisors的認證理財規劃師喬迪·德阿古斯蒂尼鼓勵所有人更主動地管理自己的財務。這兩位女性鼓勵其他女性不要把財務規劃權交給伴侶或配偶,或者期待對方制定長期計劃。

Equitable的報告用很大的篇幅鼓勵女性更早參與財務管理,并向專業顧問尋求幫助。但德阿古斯蒂尼表示,不要隨隨便便找理財顧問。如果你有任何不明白的問題,不必害怕讓對方進一步說明。如果理財顧問不準備幫助你,或者不愿意根據你的情況提供建議,那就換新的顧問。

韋弗表示:“我看到的統計數據顯示,年輕人更關心財務狀況,這令我備受鼓舞。我們越早讓人們學會財務管理方面的基礎知識,就能讓她們有更好的財務狀況。”(財富中文網)

翻譯:劉進龍

審校:汪皓

Women in the U.S. have been making strides when it comes to finances, investing and earning more, and saving for retirement earlier than older generations, among other promising behaviors. Still, their confidence in money management lags men—and is highly dependent on their relationship status, a new report finds.

The survey, from financial services company Equitable, of over 1,200 U.S. women aged 18 to 77 and 500 men explores how personal relationship status can change women’s relationship with and management of her finances.

Overall, the survey found that women are less confident in their ability to manage their finances and reach their long-term goals than men are, regardless of age, income, or asset level. A greater share of women say they actively worry about money at least once a day compared to men, and women are also much more likely to feel stressed about their finances.

That’s not new insight. But Equitable also finds that that confidence changes dramatically based on a woman’s relationship status: 42% of married women report believing in their ability to reach their financial goals, compared to 37% of singles, 35% of divorced women, and 29% of widows.

In fact, married women (in Equitable’s survey, this included women in a long-term partnership) report being better able to focus on long-term financial goals, like retirement, than single, divorced, or widowed women. They are the only group to name long-term goals like a comfortable retirement and travel among their top three financial goals.

There are any number of reasons for this. But a big one is that it's generally harder to be a single person in today's economy, no matter your gender, than it is with a potential dual income.

And divorcées and widows may not have needed to work, or stayed home with children, limiting their earning power. They also were less likely, generally, to be involved with long-term financial strategy in heterosexual relationships, leaving them unsure of their futures. Almost half (46%) of divorced women and 61% of widows feel less likely to achieve their financial goals because of the change in their relationship status.

Of course, there are exceptions. Some women are better off financially when they are unpartnered, and many women revel in their financial freedom. And just because single women may report lower confidence than men, that doesn't mean they are actually worse at managing their finances. In fact, research has found that women outperform male investors.

Get involved sooner

While married women report the most confidence, Equitable notes that the circumstances can quickly change. Widowed and divorced women, for example, report much lower confidence than never-partnered single women.

One reason? Many divorced and widowed women took a step back from managing the larger picture when they were in partnerships. While most women are intimately involved in day-to-day activities like budgeting, more than half say they regret not being more involved in their finances during their marriages, especially when it comes to investing and retirement planning.

Connie Weaver, Equitable’s chief marketing officer, knows the feeling well. After her husband died, Weaver was left feeling vulnerable and embarrassed with her knowledge of her finances, despite "knowing better," she says. Now engaged to be married again, she doesn't plan to take the back seat again.

"I’m very financially sophisticated, but yet there was so much I didn’t know. What I was thrown into and what I had to cope with was pretty daunting," Weaver says. "Shame on me, I had not been as engaged as I should have been."

In fact, major life changes—including job switches, raises, divorce, and, yes, the death of the spouse—often serve as catalysts for women to get more involved in their finances, the report finds. But Weaver and Jody D’Agostini, a certified financial planner who works with Equitable Advisors, encourage everyone to be more proactive. The women encourage other women not to delegate planning to their partner or spouse, or wait to build a long-term plan.

Much of Equitable's report focuses on encouraging women to get involved sooner and seek out professional help from an advisor. But don't settle for just any advisor, says D'Agostini. If you don't understand something, don't be afraid to ask for more clarification. If the advisor isn't prepared to help you or won't meet you where you are, find a new one.

"I’m encouraged when I see statistics where young people are paying more attention," says Weaver. "The earlier we can get people to learn the basics, the better of they will be."