在兩種相互沖突的力量影響下,美國房地產市場卷入了一場激烈的斗爭。一方面,在新冠疫情期間的房地產熱潮(Pandemic Housing Boom)中,全美房價暴漲超過40%,隨后不久,在2022年,抵押貸款利率從3%飆升至超過6%,導致可負擔性下降,從而帶來了房價下行壓力。另一方面,所謂的“鎖定效應”加劇了現有房屋庫存短缺,許多業主不愿意賣房和買新房,因為他們擔心2%或3%的抵押貸款利率將變成6%至7%,這帶來了房價上行壓力。

房地產經濟學家表示,這兩種力量都不容忽視。

2022年抵押貸款利率上漲令許多潛在購房人措手不及,降低了購房人的購買力和房屋的可負擔性。隨著抵押貸款利率在短期內提高了一倍,亞特蘭大聯邦儲備銀行(Federal Reserve Bank of Atlanta)跟蹤的住宅可負擔性(或者更貼切地說是可負擔性不足)達到了自2006年房地產泡沫最嚴重時期以來的最高水平。可負擔性不足導致去年秋天房價回調,對過熱的西南部和西海岸房地產市場造成了最大影響。可負擔性危機讓許多潛在購房人選擇繼續觀望,這導致需求下降,房屋銷售增速放緩。

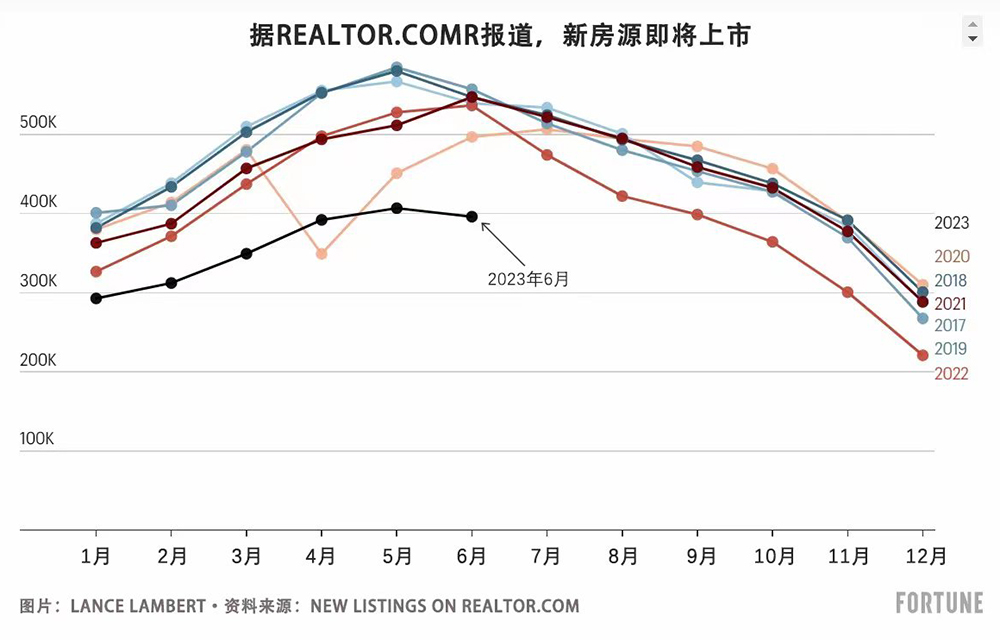

與此同時,房地產市場還面臨可售房屋庫存不足的問題。鎖定效應,即業主因為擔心要承擔更高的抵押貸款利率而不愿意賣房的現象,導致市場上現有住宅存量不足。一直享受低利率的業主不愿意放棄有利的融資條款,導致房地產供應出現了瓶頸。Realtor.com的數據顯示,2023年6月掛牌待售房源數量比2022年6月減少了26.2%,比2019年6月減少了28.9%。房源有限加劇了購房人的競爭,導致今年上半年大多數市場房價上漲。通常來說,上半年是房產銷售旺季。

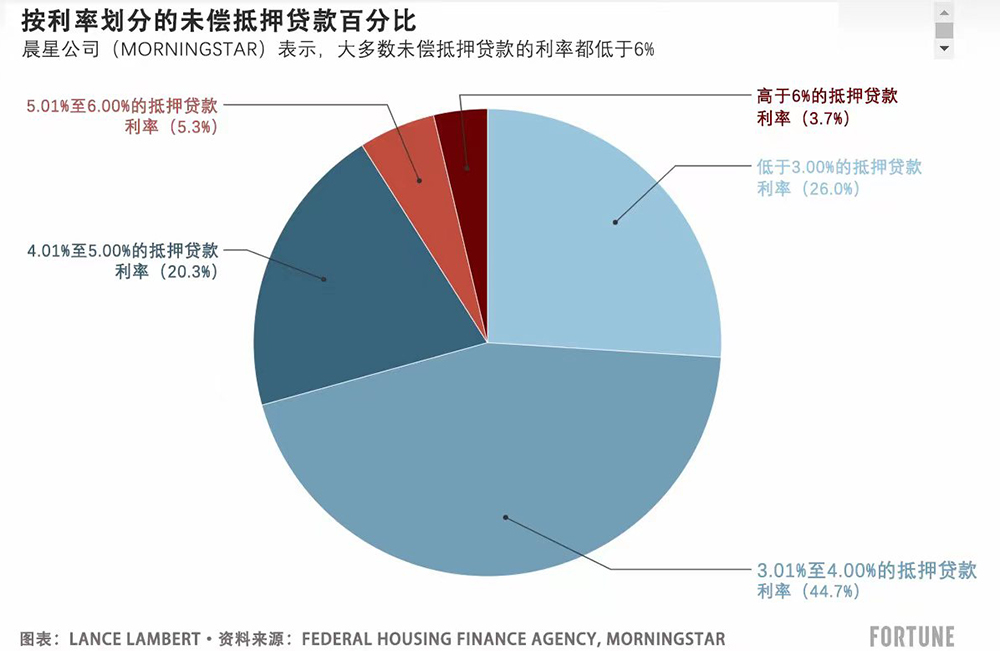

為了更好地了解“鎖定效應”,我們需要了解一個事實,那就是有91%的抵押貸款借款人利率低于5%,有70.7%的購房人利率低于4%。對這些業主而言,賣掉現有的房子,再以當前6%或7%的抵押貸款利率買一套房子,這顯然是不合理的。

不止潛在購房人和賣房人感受到了壓力,依靠房屋交易量維持生計的房地產從業者也受到了影響。隨著住宅可負擔性的持續惡化和可售房屋短缺,房產中介和經紀商只能努力利用有限的機會完成銷售和賺取傭金。成交量減少影響了他們的財務穩定性,使一些公司出現生存危機。

哪種力量將占據上風?緊張的可負擔性會導致全美房價進一步下跌,還是現有房屋庫存不足使全美房價上漲?

Zillow和CoreLogic等公司認為全美房價已經跌至最低點,它們預測未來12個月房價會繼續上漲。它們表示,現有房屋庫存不足使購房人別無選擇,這會導致房價上漲。

穆迪分析(Moody's Analytics)的首席經濟學家馬克·贊迪持不同觀點。他預測未來幾年,隨著抵押貸款利率緩慢從2023年的約6.5%下降到2025年的5.5%,以及全美房價從最高點到最低點最終下跌約8%,住宅可負擔性將有所改善。換言之,贊迪預計可負擔性不足會占據上風。

贊迪對《財富》雜志表示:“我們認為,未來三年房價會持續下跌,但不會發生暴跌,而是一個緩慢而漫長的過程。”

如果贊迪團隊的預測是錯誤的,并且“房價最終高于預期”,他認為原因將是當前的鎖定效應,即人們選擇觀望,而房屋庫存不足繼續推高全國房價。(財富中文網)

譯者:劉進龍

審校:汪皓

在兩種相互沖突的力量影響下,美國房地產市場卷入了一場激烈的斗爭。一方面,在新冠疫情期間的房地產熱潮(Pandemic Housing Boom)中,全美房價暴漲超過40%,隨后不久,在2022年,抵押貸款利率從3%飆升至超過6%,導致可負擔性下降,從而帶來了房價下行壓力。另一方面,所謂的“鎖定效應”加劇了現有房屋庫存短缺,許多業主不愿意賣房和買新房,因為他們擔心2%或3%的抵押貸款利率將變成6%至7%,這帶來了房價上行壓力。

房地產經濟學家表示,這兩種力量都不容忽視。

2022年抵押貸款利率上漲令許多潛在購房人措手不及,降低了購房人的購買力和房屋的可負擔性。隨著抵押貸款利率在短期內提高了一倍,亞特蘭大聯邦儲備銀行(Federal Reserve Bank of Atlanta)跟蹤的住宅可負擔性(或者更貼切地說是可負擔性不足)達到了自2006年房地產泡沫最嚴重時期以來的最高水平。可負擔性不足導致去年秋天房價回調,對過熱的西南部和西海岸房地產市場造成了最大影響。可負擔性危機讓許多潛在購房人選擇繼續觀望,這導致需求下降,房屋銷售增速放緩。

與此同時,房地產市場還面臨可售房屋庫存不足的問題。鎖定效應,即業主因為擔心要承擔更高的抵押貸款利率而不愿意賣房的現象,導致市場上現有住宅存量不足。一直享受低利率的業主不愿意放棄有利的融資條款,導致房地產供應出現了瓶頸。Realtor.com的數據顯示,2023年6月掛牌待售房源數量比2022年6月減少了26.2%,比2019年6月減少了28.9%。房源有限加劇了購房人的競爭,導致今年上半年大多數市場房價上漲。通常來說,上半年是房產銷售旺季。

為了更好地了解“鎖定效應”,我們需要了解一個事實,那就是有91%的抵押貸款借款人利率低于5%,有70.7%的購房人利率低于4%。對這些業主而言,賣掉現有的房子,再以當前6%或7%的抵押貸款利率買一套房子,這顯然是不合理的。

不止潛在購房人和賣房人感受到了壓力,依靠房屋交易量維持生計的房地產從業者也受到了影響。隨著住宅可負擔性的持續惡化和可售房屋短缺,房產中介和經紀商只能努力利用有限的機會完成銷售和賺取傭金。成交量減少影響了他們的財務穩定性,使一些公司出現生存危機。

哪種力量將占據上風?緊張的可負擔性會導致全美房價進一步下跌,還是現有房屋庫存不足使全美房價上漲?

Zillow和CoreLogic等公司認為全美房價已經跌至最低點,它們預測未來12個月房價會繼續上漲。它們表示,現有房屋庫存不足使購房人別無選擇,這會導致房價上漲。

穆迪分析(Moody's Analytics)的首席經濟學家馬克·贊迪持不同觀點。他預測未來幾年,隨著抵押貸款利率緩慢從2023年的約6.5%下降到2025年的5.5%,以及全美房價從最高點到最低點最終下跌約8%,住宅可負擔性將有所改善。換言之,贊迪預計可負擔性不足會占據上風。

贊迪對《財富》雜志表示:“我們認為,未來三年房價會持續下跌,但不會發生暴跌,而是一個緩慢而漫長的過程。”

如果贊迪團隊的預測是錯誤的,并且“房價最終高于預期”,他認為原因將是當前的鎖定效應,即人們選擇觀望,而房屋庫存不足繼續推高全國房價。(財富中文網)

譯者:劉進龍

審校:汪皓

In a clash of opposing forces, the U.S. housing market finds itself embroiled in a fierce battle. On one side, deteriorated affordability resulting from a spike in mortgage rates from 3% to over 6% in 2022, just after national home prices surged by more than 40% during the Pandemic Housing Boom, is exerting downward pressure on home prices. On the other side, the scarcity of existing inventory, exacerbated by the so-called “lock-in effect,” as many homeowners are reluctant to sell and buy anew, fearing the trade-off from a 2% or 3% mortgage rate to one in the 6% to 7% range, is exerting upward pressure on home prices.

Housing economists say neither force should be ignored.

The surge in mortgage rates in 2022 caught many prospective buyers off guard, diminishing their purchasing power and making homeownership less affordable. With mortgage rates doubling in such a short period, housing affordability (or better put the lack of affordability) as tracked by the Federal Reserve Bank of Atlanta has reached levels unseen since the height of the bubble in 2006. That affordability crunch translated into a home price correction last fall, which packed its biggest punch in overheated Southwest and West Coast markets. That affordability crisis continues to leave many potential buyers on the sidelines, thwarting demand and leading to a slowdown in home sales.

Simultaneously, the housing market is being strained by a lack of available inventory. The lock-in effect, a term used to describe homeowners’ hesitance to sell their properties due to the fear of higher mortgage rates, has resulted in a dearth of existing homes on the market. Homeowners, enjoying historically low interest rates, are reluctant to relinquish their favorable financing terms, creating a bottleneck in the housing supply. According to Realtor.com, there were 26.2% fewer homes listed for sale in June 2023 than in June 2022, and 28.9% fewer than in June 2019. This limited inventory has fueled competition among buyers, and caused home prices to rise in the first half of the year—the seasonally strong part of the year—in most markets.

To better understand the "lock-in effect," consider the fact that 91% of mortgage borrowers have an interest rate below 5%, including 70.7% with an interest rate below 4%. For those homeowners, it simply doesn't make a lot of sense to sell and purchase a property right now at a 6% or 7% mortgage rate.

It is not just prospective buyers and sellers feeling the strain; the ramifications extend to the real estate professionals who depend on transaction volume to make a living. With the rapid deterioration of housing affordability and the scarcity of available homes, real estate agents and brokers are grappling with limited opportunities to facilitate sales and earn commissions. The dwindling transaction volumes have dealt a blow to their financial stability and jeopardized the viability of some businesses.

So who will win out? Will strained affordability see national home prices drift lower, or will a lack of existing inventory drive national prices higher?

According to firms like Zillow and CoreLogic, national house prices have already hit bottom and are projected to continue rising over the next 12 months. The scarcity of existing inventory, they say, leaves buyers with no choice but to drive prices higher.

Moody's Analytics chief economist Mark Zandi holds a different view. He anticipates housing affordability will improve over the next few years, as mortgage rates slowly drift from around 6.5% in 2023 to 5.5% in 2025, and as national house prices ultimately fall around 8% from peak-to-trough. In other words, Zandi expects strained affordability to overcome the lack of inventory.

"In our thinking this [price] weakness plays out over the next three years, there's no cliff event here, it's more of a slow grind lower," Zandi tells Fortune.

If, by any chance, Zandi's team is mistaken and "prices end up being stronger than anticipated," he asserts that it would be due to the prevailing lock-in effect, as individuals choose to hunker down and the shortage of inventory continues to drive national house prices upward.