現(xiàn)金為王的情況再次出現(xiàn)。

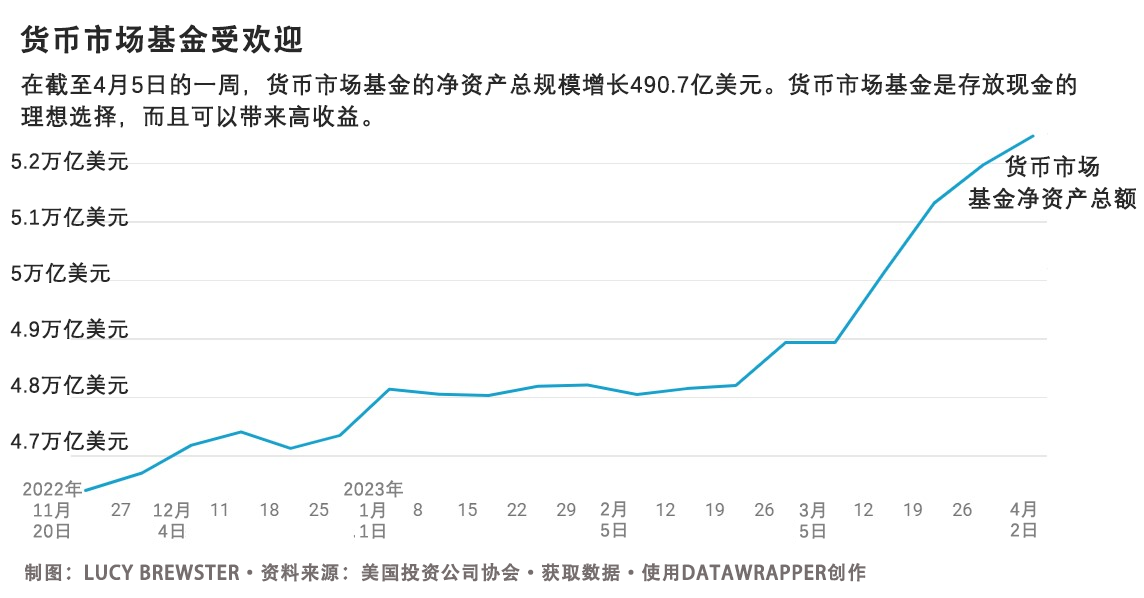

標(biāo)準(zhǔn)普爾500指數(shù)(S&P 500)近期收益低迷,而利率卻使儲(chǔ)蓄賬戶的收益率達(dá)到驚人的5%,因此有投資者開始思考,他們是否應(yīng)該徹底逃離不穩(wěn)定的股票市場(chǎng),選擇投資可靠但可能有些乏味的另外一類產(chǎn)品:現(xiàn)金。美國(guó)銀行(Bank of America)的分析師在一份客戶研究報(bào)告中預(yù)測(cè)標(biāo)準(zhǔn)普爾500指數(shù)近期的收益率會(huì)令人失望。他們表示,現(xiàn)金是“具有吸引力的標(biāo)準(zhǔn)普爾500指數(shù)替代選擇”。安聯(lián)(Allianz)最近的一份研究報(bào)告顯示,62%的美國(guó)受訪者稱寧愿持有現(xiàn)金,也不愿意承受股市風(fēng)暴的沖擊。最近發(fā)生的銀行倒閉也促使投資者,將資金轉(zhuǎn)移到更保守但低風(fēng)險(xiǎn)的賬戶和基金。美國(guó)銀行最近的全球研究報(bào)告稱,僅2023年第一季度,投資者將5,080億美元投入貨幣市場(chǎng)基金。貨幣市場(chǎng)基金是存放現(xiàn)金的理想選擇,而且能夠帶來高收益。

問題是:在市場(chǎng)風(fēng)暴結(jié)束之前,你是否應(yīng)該將大量或大部分投資轉(zhuǎn)移到現(xiàn)金投資?理財(cái)顧問和投資分析師給出了否定回答。申克曼財(cái)富管理公司(Shenkman Wealth Management)的喬納森·申克曼解釋稱:“向高收益率的大額存單、貨幣市場(chǎng)基金或國(guó)債等配置更多資金,看起來是謹(jǐn)慎的做法;然而,這是一種市場(chǎng)擇機(jī)行為,應(yīng)該避免。”Univest Wealth下屬部門Girard的理財(cái)顧問兼投資總監(jiān)馬克·N·巴爾塞指出:“從長(zhǎng)遠(yuǎn)來看,現(xiàn)金并非沒有風(fēng)險(xiǎn)。”他解釋道,現(xiàn)金投資無法跑贏通脹的風(fēng)險(xiǎn)極高,就像在錯(cuò)誤的時(shí)機(jī)進(jìn)行再投資的風(fēng)險(xiǎn)一樣。巴爾塞表示:“投資者說:‘當(dāng)情況很糟糕的時(shí)候,我會(huì)把現(xiàn)金投入高收益的貨幣市場(chǎng),在一切風(fēng)平浪靜之后,我們會(huì)重新回到股票市場(chǎng)。’問題是,等到一切風(fēng)平浪靜的時(shí)候,市場(chǎng)已經(jīng)發(fā)生了變化。”

美國(guó)銀行依舊預(yù)測(cè)未來十年,標(biāo)準(zhǔn)普爾500指數(shù)有7%的年收益率。在設(shè)計(jì)投資策略以充分利用現(xiàn)金時(shí),關(guān)鍵是要考慮自己的投資期限和長(zhǎng)期財(cái)務(wù)目標(biāo)。Facet Wealth的理財(cái)顧問布倫特·韋斯說:“不要追逐利率,要堅(jiān)持自己的計(jì)劃。”申克曼表示:“從長(zhǎng)遠(yuǎn)來看,股市將跑贏債市,而債市將跑贏貨幣市場(chǎng)。”

然而,如果你在近期內(nèi)有消費(fèi)需求,或者只想將部分儲(chǔ)蓄投入到較為安全的產(chǎn)品,個(gè)人理財(cái)專家支持以下投資策略。

尋找高收益產(chǎn)品

理財(cái)顧問強(qiáng)調(diào),最簡(jiǎn)單、最有效的利用高利率的途徑之一是,保證將應(yīng)急資金存入高收益儲(chǔ)蓄賬戶。網(wǎng)站Bankrate的理財(cái)顧問格雷戈·麥克布賴德說:“彈性增貸確實(shí)擴(kuò)大了許多銀行的存款收益率和大銀行存款收益率之間的差異,作為儲(chǔ)戶,你可以將其作為優(yōu)勢(shì)加以利用。”雖然許多大型傳統(tǒng)金融機(jī)構(gòu)依舊為儲(chǔ)戶提供約1%的年化收益率,但一些在線銀行為高收益賬戶提供的收益率高達(dá)4%。韋斯解釋稱,一些在線經(jīng)紀(jì)機(jī)構(gòu),例如Ally和UFB銀行等,提供最有競(jìng)爭(zhēng)力的年化收益率。

如果最近的銀行倒閉令你感到焦慮,只要你存款的銀行有聯(lián)邦保險(xiǎn),你的存款最高達(dá)到25萬美元就是安全的。如果你的存款金額超過25萬美元,理財(cái)顧問就建議在不同銀行開立賬戶,讓存款金額低于該限額,或者在同一個(gè)銀行不同所有權(quán)類型下開立賬戶。韋斯還解釋稱,他通常建議客戶在至少兩家不同銀行開立賬戶,尤其是存款金額超過美國(guó)聯(lián)邦存款保險(xiǎn)公司(FDIC)25萬美元保險(xiǎn)限額的客戶。韋斯解釋稱:“如果一家銀行出現(xiàn)一些問題,你在另外一家銀行就還有資金可用。”

考慮建立大額存單階梯

大額存單(CD)是在指定期限內(nèi)獲得利息的定期存款。大額存單階梯是一種儲(chǔ)蓄策略,即按照不同到期時(shí)間購(gòu)買多份大額存單,形成可以帶來交錯(cuò)收益的“階梯”。

麥克布賴德說:“如果你在未來的確定時(shí)間點(diǎn)有特定現(xiàn)金需求,大額存單就是很好的選擇。如果你期待獲得能夠預(yù)測(cè)的利息收入流,或者希望將投資組合多樣化,通過現(xiàn)金配置獲得最高收益同時(shí)避免承擔(dān)任何風(fēng)險(xiǎn),[這就是最好的選擇]。”大額存單階梯適合在退休期間想要獲得穩(wěn)定收入的投資者。如果你知道未來會(huì)有固定支出,比如支付學(xué)費(fèi)或買車,大額存單階梯就能夠幫助你充分利用利率。與高收益儲(chǔ)蓄賬戶一樣,不同金融機(jī)構(gòu)提供不同的利率,你可以通過對(duì)比找到最適合你的一家。

為了建立大額存單階梯,你可以購(gòu)買一系列在不同時(shí)間連續(xù)到期的大額存單。如果你有2,500美元,就能夠投資五份大額存單,期限從一年到五年不等。第一份大額存單到期后,如果你想延續(xù)大額存單階梯,你就能夠取現(xiàn),并按照你預(yù)期的期限再投資新的大額存單。

貨幣市場(chǎng)基金是一種很受歡迎的選擇

另外一種引起大量投資者關(guān)注的選擇是貨幣市場(chǎng)共同基金。這些共同基金的特殊性在于,他們投資具有流動(dòng)性的短期資產(chǎn),包括現(xiàn)金、基于債務(wù)的短期證券等。美國(guó)投資公司協(xié)會(huì)(Investment Company Institute)的數(shù)據(jù)顯示,截至4月5日的一周,貨幣市場(chǎng)基金的總資產(chǎn)增長(zhǎng)了400.7億美元,使貨幣市場(chǎng)基金的資產(chǎn)總額達(dá)到5.25萬億美元。

申克曼表示:“這些基金的利率通常高于支票或儲(chǔ)蓄賬戶。”他補(bǔ)充道:“雖然許多貨幣市場(chǎng)基金沒有美國(guó)聯(lián)邦存款保險(xiǎn)公司的保險(xiǎn),但投資者遭受損失的風(fēng)險(xiǎn)微乎其微,因?yàn)檫@些基金投資最高質(zhì)量的債券,這些債券的期限非常短。”

麥克布賴德稱,他建議客戶將計(jì)劃投資的基金投入這些基金。他說:“如果你想開立經(jīng)紀(jì)賬戶,并且你想立刻投資手頭的資金,貨幣基金就是理想選擇,你可以將貨幣市場(chǎng)基金作為出售一項(xiàng)投資和買入另外一項(xiàng)投資期間的臨時(shí)選擇。”

投資短期債券基金

短期債券基金是相對(duì)低風(fēng)險(xiǎn)的投資選擇,適合希望從更高收益率中獲利的投資者。短期債券基金以投資企業(yè)債券和其他投資級(jí)證券為主。申克曼解釋稱:“如果投資者的投資期限相對(duì)更長(zhǎng),而且愿意忍受投資項(xiàng)目的小幅波動(dòng),那么短期債券基金就是最佳選擇。”

然而,即使相對(duì)低風(fēng)險(xiǎn)的投資,其風(fēng)險(xiǎn)也高于將錢存入現(xiàn)金賬戶的風(fēng)險(xiǎn)。投資者不應(yīng)該將他們可能隨時(shí)需要?jiǎng)佑玫馁Y金,投入任何類型的股票或債券基金。申克曼補(bǔ)充道:“雖然這些基金依舊安全,但重要的是,投資者需要牢記它們不是貨幣市場(chǎng)賬戶的替代品,因?yàn)楝F(xiàn)金價(jià)值會(huì)出現(xiàn)波動(dòng),尤其是在利率上浮時(shí)期。”

風(fēng)險(xiǎn)越高,回報(bào)越高

重要的是,雖然在當(dāng)前的市場(chǎng)環(huán)境下,精明地進(jìn)行投資可以帶來高收益,但這些賬戶依舊無法跑贏通脹。如果你要針對(duì)退休等長(zhǎng)期目標(biāo)進(jìn)行投資,就永遠(yuǎn)不要用現(xiàn)金賬戶取代一種投資策略。

韋斯說:“有些人很膽小,他們會(huì)想‘你知道嗎,或許我該等等再進(jìn)行投資’,因此我要再次重申這一點(diǎn):大額存單階梯[或其他現(xiàn)金賬戶]不應(yīng)該成為長(zhǎng)期投資或財(cái)富累積策略的替代品。因此,如果你對(duì)投資感到緊張,就一定保證用于投資的資金在未來5年至10年不會(huì)動(dòng)用。”

雖然目前股票市場(chǎng)動(dòng)蕩,但經(jīng)驗(yàn)豐富的投資者有一種理念很有道理:不要因?yàn)楹ε聞?dòng)蕩的市場(chǎng)環(huán)境,而看不到長(zhǎng)期收益。(財(cái)富中文網(wǎng))

譯者:劉進(jìn)龍

審校:汪皓

現(xiàn)金為王的情況再次出現(xiàn)。

標(biāo)準(zhǔn)普爾500指數(shù)(S&P 500)近期收益低迷,而利率卻使儲(chǔ)蓄賬戶的收益率達(dá)到驚人的5%,因此有投資者開始思考,他們是否應(yīng)該徹底逃離不穩(wěn)定的股票市場(chǎng),選擇投資可靠但可能有些乏味的另外一類產(chǎn)品:現(xiàn)金。美國(guó)銀行(Bank of America)的分析師在一份客戶研究報(bào)告中預(yù)測(cè)標(biāo)準(zhǔn)普爾500指數(shù)近期的收益率會(huì)令人失望。他們表示,現(xiàn)金是“具有吸引力的標(biāo)準(zhǔn)普爾500指數(shù)替代選擇”。安聯(lián)(Allianz)最近的一份研究報(bào)告顯示,62%的美國(guó)受訪者稱寧愿持有現(xiàn)金,也不愿意承受股市風(fēng)暴的沖擊。最近發(fā)生的銀行倒閉也促使投資者,將資金轉(zhuǎn)移到更保守但低風(fēng)險(xiǎn)的賬戶和基金。美國(guó)銀行最近的全球研究報(bào)告稱,僅2023年第一季度,投資者將5,080億美元投入貨幣市場(chǎng)基金。貨幣市場(chǎng)基金是存放現(xiàn)金的理想選擇,而且能夠帶來高收益。

問題是:在市場(chǎng)風(fēng)暴結(jié)束之前,你是否應(yīng)該將大量或大部分投資轉(zhuǎn)移到現(xiàn)金投資?理財(cái)顧問和投資分析師給出了否定回答。申克曼財(cái)富管理公司(Shenkman Wealth Management)的喬納森·申克曼解釋稱:“向高收益率的大額存單、貨幣市場(chǎng)基金或國(guó)債等配置更多資金,看起來是謹(jǐn)慎的做法;然而,這是一種市場(chǎng)擇機(jī)行為,應(yīng)該避免。”Univest Wealth下屬部門Girard的理財(cái)顧問兼投資總監(jiān)馬克·N·巴爾塞指出:“從長(zhǎng)遠(yuǎn)來看,現(xiàn)金并非沒有風(fēng)險(xiǎn)。”他解釋道,現(xiàn)金投資無法跑贏通脹的風(fēng)險(xiǎn)極高,就像在錯(cuò)誤的時(shí)機(jī)進(jìn)行再投資的風(fēng)險(xiǎn)一樣。巴爾塞表示:“投資者說:‘當(dāng)情況很糟糕的時(shí)候,我會(huì)把現(xiàn)金投入高收益的貨幣市場(chǎng),在一切風(fēng)平浪靜之后,我們會(huì)重新回到股票市場(chǎng)。’問題是,等到一切風(fēng)平浪靜的時(shí)候,市場(chǎng)已經(jīng)發(fā)生了變化。”

美國(guó)銀行依舊預(yù)測(cè)未來十年,標(biāo)準(zhǔn)普爾500指數(shù)有7%的年收益率。在設(shè)計(jì)投資策略以充分利用現(xiàn)金時(shí),關(guān)鍵是要考慮自己的投資期限和長(zhǎng)期財(cái)務(wù)目標(biāo)。Facet Wealth的理財(cái)顧問布倫特·韋斯說:“不要追逐利率,要堅(jiān)持自己的計(jì)劃。”申克曼表示:“從長(zhǎng)遠(yuǎn)來看,股市將跑贏債市,而債市將跑贏貨幣市場(chǎng)。”

然而,如果你在近期內(nèi)有消費(fèi)需求,或者只想將部分儲(chǔ)蓄投入到較為安全的產(chǎn)品,個(gè)人理財(cái)專家支持以下投資策略。

尋找高收益產(chǎn)品

理財(cái)顧問強(qiáng)調(diào),最簡(jiǎn)單、最有效的利用高利率的途徑之一是,保證將應(yīng)急資金存入高收益儲(chǔ)蓄賬戶。網(wǎng)站Bankrate的理財(cái)顧問格雷戈·麥克布賴德說:“彈性增貸確實(shí)擴(kuò)大了許多銀行的存款收益率和大銀行存款收益率之間的差異,作為儲(chǔ)戶,你可以將其作為優(yōu)勢(shì)加以利用。”雖然許多大型傳統(tǒng)金融機(jī)構(gòu)依舊為儲(chǔ)戶提供約1%的年化收益率,但一些在線銀行為高收益賬戶提供的收益率高達(dá)4%。韋斯解釋稱,一些在線經(jīng)紀(jì)機(jī)構(gòu),例如Ally和UFB銀行等,提供最有競(jìng)爭(zhēng)力的年化收益率。

如果最近的銀行倒閉令你感到焦慮,只要你存款的銀行有聯(lián)邦保險(xiǎn),你的存款最高達(dá)到25萬美元就是安全的。如果你的存款金額超過25萬美元,理財(cái)顧問就建議在不同銀行開立賬戶,讓存款金額低于該限額,或者在同一個(gè)銀行不同所有權(quán)類型下開立賬戶。韋斯還解釋稱,他通常建議客戶在至少兩家不同銀行開立賬戶,尤其是存款金額超過美國(guó)聯(lián)邦存款保險(xiǎn)公司(FDIC)25萬美元保險(xiǎn)限額的客戶。韋斯解釋稱:“如果一家銀行出現(xiàn)一些問題,你在另外一家銀行就還有資金可用。”

考慮建立大額存單階梯

大額存單(CD)是在指定期限內(nèi)獲得利息的定期存款。大額存單階梯是一種儲(chǔ)蓄策略,即按照不同到期時(shí)間購(gòu)買多份大額存單,形成可以帶來交錯(cuò)收益的“階梯”。

麥克布賴德說:“如果你在未來的確定時(shí)間點(diǎn)有特定現(xiàn)金需求,大額存單就是很好的選擇。如果你期待獲得能夠預(yù)測(cè)的利息收入流,或者希望將投資組合多樣化,通過現(xiàn)金配置獲得最高收益同時(shí)避免承擔(dān)任何風(fēng)險(xiǎn),[這就是最好的選擇]。”大額存單階梯適合在退休期間想要獲得穩(wěn)定收入的投資者。如果你知道未來會(huì)有固定支出,比如支付學(xué)費(fèi)或買車,大額存單階梯就能夠幫助你充分利用利率。與高收益儲(chǔ)蓄賬戶一樣,不同金融機(jī)構(gòu)提供不同的利率,你可以通過對(duì)比找到最適合你的一家。

為了建立大額存單階梯,你可以購(gòu)買一系列在不同時(shí)間連續(xù)到期的大額存單。如果你有2,500美元,就能夠投資五份大額存單,期限從一年到五年不等。第一份大額存單到期后,如果你想延續(xù)大額存單階梯,你就能夠取現(xiàn),并按照你預(yù)期的期限再投資新的大額存單。

貨幣市場(chǎng)基金是一種很受歡迎的選擇

另外一種引起大量投資者關(guān)注的選擇是貨幣市場(chǎng)共同基金。這些共同基金的特殊性在于,他們投資具有流動(dòng)性的短期資產(chǎn),包括現(xiàn)金、基于債務(wù)的短期證券等。美國(guó)投資公司協(xié)會(huì)(Investment Company Institute)的數(shù)據(jù)顯示,截至4月5日的一周,貨幣市場(chǎng)基金的總資產(chǎn)增長(zhǎng)了400.7億美元,使貨幣市場(chǎng)基金的資產(chǎn)總額達(dá)到5.25萬億美元。

申克曼表示:“這些基金的利率通常高于支票或儲(chǔ)蓄賬戶。”他補(bǔ)充道:“雖然許多貨幣市場(chǎng)基金沒有美國(guó)聯(lián)邦存款保險(xiǎn)公司的保險(xiǎn),但投資者遭受損失的風(fēng)險(xiǎn)微乎其微,因?yàn)檫@些基金投資最高質(zhì)量的債券,這些債券的期限非常短。”

麥克布賴德稱,他建議客戶將計(jì)劃投資的基金投入這些基金。他說:“如果你想開立經(jīng)紀(jì)賬戶,并且你想立刻投資手頭的資金,貨幣基金就是理想選擇,你可以將貨幣市場(chǎng)基金作為出售一項(xiàng)投資和買入另外一項(xiàng)投資期間的臨時(shí)選擇。”

投資短期債券基金

短期債券基金是相對(duì)低風(fēng)險(xiǎn)的投資選擇,適合希望從更高收益率中獲利的投資者。短期債券基金以投資企業(yè)債券和其他投資級(jí)證券為主。申克曼解釋稱:“如果投資者的投資期限相對(duì)更長(zhǎng),而且愿意忍受投資項(xiàng)目的小幅波動(dòng),那么短期債券基金就是最佳選擇。”

然而,即使相對(duì)低風(fēng)險(xiǎn)的投資,其風(fēng)險(xiǎn)也高于將錢存入現(xiàn)金賬戶的風(fēng)險(xiǎn)。投資者不應(yīng)該將他們可能隨時(shí)需要?jiǎng)佑玫馁Y金,投入任何類型的股票或債券基金。申克曼補(bǔ)充道:“雖然這些基金依舊安全,但重要的是,投資者需要牢記它們不是貨幣市場(chǎng)賬戶的替代品,因?yàn)楝F(xiàn)金價(jià)值會(huì)出現(xiàn)波動(dòng),尤其是在利率上浮時(shí)期。”

風(fēng)險(xiǎn)越高,回報(bào)越高

重要的是,雖然在當(dāng)前的市場(chǎng)環(huán)境下,精明地進(jìn)行投資可以帶來高收益,但這些賬戶依舊無法跑贏通脹。如果你要針對(duì)退休等長(zhǎng)期目標(biāo)進(jìn)行投資,就永遠(yuǎn)不要用現(xiàn)金賬戶取代一種投資策略。

韋斯說:“有些人很膽小,他們會(huì)想‘你知道嗎,或許我該等等再進(jìn)行投資’,因此我要再次重申這一點(diǎn):大額存單階梯[或其他現(xiàn)金賬戶]不應(yīng)該成為長(zhǎng)期投資或財(cái)富累積策略的替代品。因此,如果你對(duì)投資感到緊張,就一定保證用于投資的資金在未來5年至10年不會(huì)動(dòng)用。”

雖然目前股票市場(chǎng)動(dòng)蕩,但經(jīng)驗(yàn)豐富的投資者有一種理念很有道理:不要因?yàn)楹ε聞?dòng)蕩的市場(chǎng)環(huán)境,而看不到長(zhǎng)期收益。(財(cái)富中文網(wǎng))

譯者:劉進(jìn)龍

審校:汪皓

Cash is king again.

When near-term returns for the S&P 500 look bleak and interest rates push yields from savings accounts up to an eye-popping 5%, some investors are asking themselves if they should ditch the erratic equities market altogether for its reliable, if not boring, cousin: cash. Cash is a “compelling alternative to the S&P 500,” Bank of America analysts wrote in a research note to clients, predicting disappointing near-term returns for the S&P 500. According to a recent Allianz research report, 62% of Americans surveyed said they would rather keep their money in cash than weather the market storm. Recent bank failures have also caused investors to move their money to more conservative, low-risk accounts and funds. In the first quarter of 2023 alone, investors moved $508 billion into money market funds, a high-yielding place to store cash, according to Bank of America’s most recent global research report.

So the question is: Should you move a significant amount, or the majority, of your investments into cash until the market storm is over? The answer is no, according to advisors and investment analysts. “Allocating more funds to high-yielding CDs, money market funds, or treasuries may seem prudent; however, this is a form of market timing and should be avoided,” explained Jonathan Shenkman of Shenkman Wealth Management. “Long term, cash is not risk-free,” explained Marc N. Balcer, financial advisor and investment director at Girard, a Univest Wealth Division. He explained that the risk of your cash being outpaced by inflation is significant, as is the risk of reinvesting at the wrong time. “Investors say, ‘I’ll put cash into this high-yield money market while things are scary and then when things calm down, I’ll move it back into the market,’ and the problem with that is that by the time things calm down, the market will have already moved,” said Balcer.

Bank of America still predicts a 7% annual return for the S&P 500 over the next decade. When designing a strategy to make the most of your cash, it’s important to take into account your time horizon and long-term financial goals. “Don’t just chase the rates, follow your plan,” explained Brent Weiss, a financial advisor at Facet Wealth. “Over the long term, stocks will outpace bonds and bonds will outpace cash,” added Shenkman.

However, if you have money you’ll need to spend in the near term, or just want to park a portion of your savings in something safe, here are a few strategies that personal finance experts do endorse.

Search for high yields

Advisors emphasized that one of the simplest and most effective ways to take advantage of high interest rates is to make sure your emergency fund is in a high-yield savings account. “The accordion has certainly expanded the difference between what a lot of banks are paying and what the top banks are paying, and as a saver, you can exploit that to your advantage,” said Greg McBride, financial advisor at Bankrate. While many large traditional financial institutions still offer savers APYs of about 1%, some online banks offer yields of up to 4% for their high-yield accounts. Weiss explained that some online brokerages, such as Ally bank and UFB bank, offer the most competitive APYs.

If you feel anxious about the recent bank failures, know that as long as you are at a bank that is federally insured, your money is safe up to $250,000. If you have more than that amount in a bank account, advisors recommend opening accounts at different banks to stay under the limit or opening accounts under different ownership categories at the same bank. Weiss also explained that he usually recommends clients have accounts with at least two different banks, especially if they are saving more than the FDIC-insured $250,000. “If one bank has some issues, you have another bank with cash available,” Weiss explained.

Consider building a CD ladder

Certificates of deposit (CDs) are fixed deposits that earn interest over a designated period. A CD ladder is a savings strategy in which you stack multiple certificates of deposit (CDs) that all mature at different times to create a “l(fā)adder” of staggered returns.

“CDs are a great option if you have a specific cash need at a known point in the future,” explained McBride. “[They work best] if you are looking to generate a predictable stream of interest income or you’re looking to diversify your portfolio positioning cash allocation to get the best return without taking any risk,” McBride. CD ladders can be great for those who want a steady income during retirement. If you know you’re going to have a fixed expense in the future, like a tuition payment or car purchase, CD ladders can help you make the most of the rates. Similar to high-yield savings accounts, different financial institutions offer different rates and you can compare to find the one that makes the most sense for you.

To build your own CD ladder, you can buy a string of CDs that all expire at different times, but in succession. If you have $2,500 to invest, you could invest in five CDs that range from one-year to five-year CDs. When the first CD matures, you can cash it out and reinvest the money in a new CD that matures however many years away you want to continue the ladder.

Money market funds are a popular option

Another option that has gotten a lot of attention from investors is money market mutual funds. These mutual funds are unique in that they invest in liquid, short-term assets including cash, and debt-based securities with near-term maturities. According to data from the Investment Company Institute, total money market fund assets went up by $40.07 billion for the week of April 5, making the new total $5.25 trillion in money market fund assets.

“These funds typically earn a higher interest rate than a checking or savings account,” explained Shenkman. “While many money market funds are not FDIC-insured, the risk of investors losing money is minuscule since they invest in the highest-quality bonds with an extremely short duration,” he added.

McBride explained that he advises clients to use these funds for money that you may be planning to invest. “Money funds are a great option for your brokerage account and the money that you want to be able to invest at a moment’s notice, using the money market fund as your temporary parking between selling one investment and buying another,” said McBride.

Invest in short-duration bond funds

Short-term bond funds are relatively low-risk investment options for those who want to benefit from higher yields. Short-term bond funds invest in mostly corporate bonds and other investment-grade securities. “For investors who have a slightly longer time horizon and are willing to endure some slight fluctuation in their holdings, short-duration bond funds are a wonderful option,” explained Shenkman.

However, even relatively low-risk investments carry more risk than having your money in cash accounts. Investors should not put the cash that they might need readily available in any kind of equity or bond fund. “While these funds still provide safety, it’s important to keep in mind that they are not a substitute for money market accounts since cash will fluctuate in value, especially as interest rates increase,” added Shenkman.

With higher risk comes higher returns

It’s important to keep in mind that while being savvy with your cash can get you high returns given the current market environment, these accounts still don’t outpace inflation. You should never substitute a cash account for an investment strategy, especially for long-term goals such as retirement.

“Some people are skittish and say, 'You know what, maybe I'll just wait on investing,’ so I want to reiterate this point: What a CD ladder [or another cash account] shouldn't be is an alternative to a longer-term investment or wealth-building strategy,” explained Weiss. “So if you're nervous about investing, make sure you’re investing money you don’t need to touch for the next five to 10 years.”

While the equity market is rocky now, the sage wisdom of seasoned investors is true: Don't let tumultuous market conditions scare you away from seeing long-term returns.