美國(guó)一直自認(rèn)為是山巔閃光之城,是不必遵循舊規(guī)則的特例。自20世紀(jì)90年代中期現(xiàn)代互聯(lián)網(wǎng)誕生以來(lái),科技巨頭例外論已經(jīng)使硅谷成為經(jīng)濟(jì)界的山巔之城——一個(gè)正常規(guī)則不適用的地方。

Facebook、亞馬遜(Amazon)和谷歌(Google)等巨頭已經(jīng)成為歷史上市值最高的公司之一,被許多人視為堅(jiān)不可摧的賺錢(qián)機(jī)器。即使美國(guó)在2008年經(jīng)濟(jì)大衰退(Great Recession)后艱難度過(guò)“失業(yè)式復(fù)蘇”期,大型科技行業(yè)仍然是安·蘭德式般的存在,證明美國(guó)的科技行業(yè)在所有的資本主義國(guó)家中依舊鶴立雞群。技術(shù)一直被詬病為損害美國(guó)民主和青少年心理健康,甚至導(dǎo)致經(jīng)濟(jì)陷入長(zhǎng)期停滯。但該行業(yè)辯稱(chēng),創(chuàng)新使其成為例外,它可以在自己的準(zhǔn)自由主義黃金國(guó)度里運(yùn)作——監(jiān)管負(fù)擔(dān)不應(yīng)該適用,該行業(yè)的天才應(yīng)該不受任何障礙地自由工作。他們指出,F(xiàn)AANGs(美國(guó)市場(chǎng)上最受歡迎和表現(xiàn)最佳的五大科技股的首字母縮寫(xiě))的表現(xiàn)優(yōu)于標(biāo)準(zhǔn)普爾500指數(shù)(S&P 500)就是證明。

有一段時(shí)間,這似乎很奏效。在十多年近零利率的支持下,資本似乎全部涌向科技行業(yè)。隨后,新冠疫情爆發(fā)早期推動(dòng)科技股進(jìn)一步飆升。但這種狂歡在一年前就結(jié)束了,馬克·扎克伯格的Meta帝國(guó)遭遇了美國(guó)歷史上上市公司中最大的單日跌幅。從那以后,大型科技公司在所有糟糕的方面都變得異常突出:其他輝煌一時(shí)的FAANG公司市值跌幅創(chuàng)下新高;科技巨頭解雇了成千上萬(wàn)的員工,而其他經(jīng)濟(jì)領(lǐng)域卻實(shí)現(xiàn)了增長(zhǎng)。與此同時(shí),作為終極風(fēng)險(xiǎn)和創(chuàng)新資產(chǎn)的加密貨幣已經(jīng)損失了大約三分之二的價(jià)值,因?yàn)榧用茇泿诺摹笆兄怠痹谝荒陜?nèi)從3萬(wàn)億美元縮水到約1萬(wàn)億美元。

今年3月,當(dāng)風(fēng)險(xiǎn)投資行業(yè)的“思想領(lǐng)袖”淪為最老套的金融恐慌的受害者,那么認(rèn)為創(chuàng)業(yè)經(jīng)濟(jì)中的創(chuàng)新領(lǐng)導(dǎo)者卓爾不群的觀(guān)點(diǎn)就站不住腳了。硅谷銀行(Silicon Valley Bank)的倒閉被歸咎于美聯(lián)儲(chǔ)(Federal Reserve)監(jiān)管松懈、美國(guó)前總統(tǒng)唐納德·特朗普時(shí)代無(wú)能的國(guó)會(huì)削弱了規(guī)則、銀行高管管理不善,甚至更令人不可思議的是,還歸咎于“(對(duì)種族主義、不公等社會(huì)問(wèn)題的)覺(jué)醒”或者遠(yuǎn)程工作太多。諾貝爾獎(jiǎng)得主道格拉斯·戴蒙德最近對(duì)《財(cái)富》雜志的記者肖恩·塔利表示,硅谷銀行不是一家普通的銀行,該銀行相對(duì)不穩(wěn)定的儲(chǔ)戶(hù)群導(dǎo)致其異常脆弱。但事實(shí)是:在這個(gè)閃光的山谷里,驚慌失措的居民試圖在一天內(nèi)提取420億美元。正如今年3月流傳的一個(gè)笑話(huà)(套用了扎克伯格的話(huà)):科技行業(yè)行動(dòng)太過(guò)迅速,以至于為其提供服務(wù)的銀行都破產(chǎn)了。

顯然,早在硅谷銀行破產(chǎn)之前,金融體制就已經(jīng)發(fā)生了變化——從寬松貨幣時(shí)代的“萬(wàn)物皆泡沫”,到前所未有的全球貨幣政策收緊。也許現(xiàn)在,在這種冷靜的重新評(píng)估中,是時(shí)候質(zhì)疑對(duì)風(fēng)險(xiǎn)的認(rèn)知(在科技例外論時(shí)代,風(fēng)險(xiǎn)不斷蔓延),并將其從美國(guó)創(chuàng)新的主流中拎出來(lái)。

創(chuàng)新要走向何方?

科技例外論的理念是基于作者塞巴斯蒂安·馬拉比的“冪次定律”(the power law)的,即投資者和發(fā)明家可能在前100次冒險(xiǎn)中慘敗,但只要堅(jiān)持下去,就有可能在第101次冒險(xiǎn)時(shí)取得成功——或者正如Meta的首席執(zhí)行官馬克·扎克伯格在2016年所說(shuō)的那樣,要愿意“選擇希望而不是恐懼”。

這種理念助長(zhǎng)了許多對(duì)無(wú)利可圖的科技股、誤入歧途的初創(chuàng)公司和發(fā)展方向不明朗的加密貨幣的高風(fēng)險(xiǎn)押注,因?yàn)榈拖⒔杩顣r(shí)代意味著投資者能夠安心地押注于那些越來(lái)越荒謬的公司,從Theranos到Juicero再到WeWork。這個(gè)非理性時(shí)代的碎片包括成千上萬(wàn)的“僵尸”公司和加密貨幣公司,這些公司在經(jīng)濟(jì)上已經(jīng)維持不下去了,但卻以某種方式通過(guò)大規(guī)模舉債來(lái)維持生存。這個(gè)時(shí)代給我們留下了其他各種需要計(jì)算的成本,包括肖珊娜·祖博夫所說(shuō)的“監(jiān)控型資本主義”,因?yàn)橹悄苁謾C(jī)和社交媒體占用了人們?cè)絹?lái)越多的時(shí)間。

斯坦福大學(xué)商學(xué)院(Stanford Graduate School of Business)的管理學(xué)講師、風(fēng)險(xiǎn)投資家羅伯特·E·西格爾告訴《財(cái)富》雜志:“不惜一切代價(jià)的創(chuàng)新從來(lái)不是一項(xiàng)長(zhǎng)期戰(zhàn)略。這是在資本廉價(jià)、市場(chǎng)存在泡沫的時(shí)候采取的一種策略……硅谷銀行的破產(chǎn)為低利率超級(jí)周期畫(huà)上了句點(diǎn),在這個(gè)周期中,資本追逐回報(bào),大量資金涌入風(fēng)險(xiǎn)投資和初創(chuàng)公司等高風(fēng)險(xiǎn)高回報(bào)資產(chǎn)。”

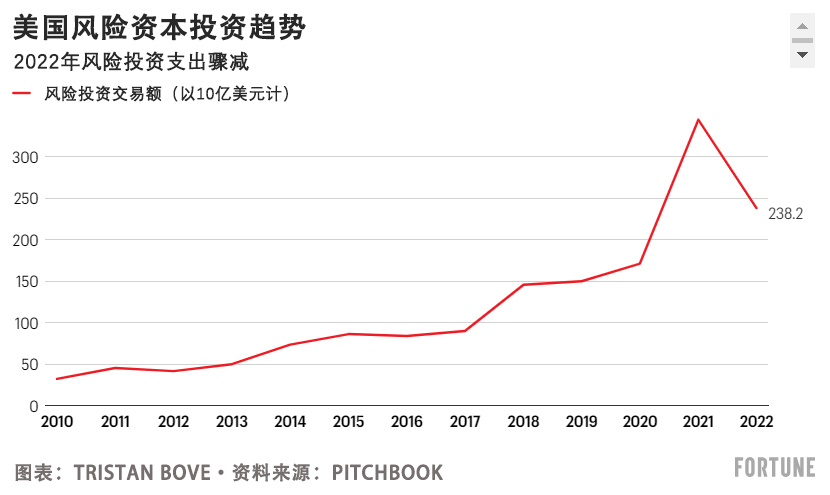

這張支票于2022年到期,當(dāng)時(shí)美聯(lián)儲(chǔ)為了對(duì)抗通貨膨脹而大舉加息,這就像一把錘子砸向了科技行業(yè)。包括Meta、亞馬遜和蘋(píng)果(Apple)在內(nèi)的大公司去年的市值都損失了數(shù)千億美元,而風(fēng)險(xiǎn)投資支出下降了31%。

“冒進(jìn)的風(fēng)險(xiǎn)投資項(xiàng)目會(huì)越來(lái)越少”

盡管過(guò)去幾年科技行業(yè)進(jìn)行著自殘式的揮霍,但創(chuàng)新在美國(guó)不一定會(huì)消亡。但是,如果科技行業(yè)想要生存下去,那么就必須改變目前的創(chuàng)新運(yùn)作方式。這可能意味著徹底拋棄科技例外論的想法。

Meta公司的馬克·扎克伯格將2023年定為“效率年”,而亞馬遜、谷歌和其他科技公司正在瘋狂地削減不再關(guān)鍵的部門(mén)和項(xiàng)目——包括員工曾經(jīng)爭(zhēng)先恐后地參與的、幾乎不考慮投資回報(bào)的“堂吉訶德式登月計(jì)劃”。

為應(yīng)對(duì)可能到來(lái)的經(jīng)濟(jì)衰退,那么轉(zhuǎn)而注重提高效率是有意義的。斯坦福大學(xué)的西格爾說(shuō),美國(guó)的創(chuàng)新部門(mén)要想保持活力,可能也需要進(jìn)行精簡(jiǎn)。他對(duì)《財(cái)富》雜志表示:“你將會(huì)看到這一點(diǎn):冒進(jìn)的風(fēng)險(xiǎn)投資項(xiàng)目會(huì)越來(lái)越少,因?yàn)榱魍ǖ馁Y金將越來(lái)越少。糟得一塌糊涂的想法獲得投資的幾率會(huì)越來(lái)越小,過(guò)剩資金出現(xiàn)的幾率也會(huì)越來(lái)越小。”

科技公司可能也不必獨(dú)自思考如何更有效地實(shí)現(xiàn)創(chuàng)新,因?yàn)樗瓉?lái)了美國(guó)政府來(lái)解決這個(gè)爛攤子。美國(guó)國(guó)會(huì)或者美聯(lián)儲(chǔ)是否可以承擔(dān)起進(jìn)行全面改革,從而實(shí)現(xiàn)有效監(jiān)管的重任,仍然有待觀(guān)察。

“我持謹(jǐn)慎樂(lè)觀(guān)態(tài)度。”總部位于紐約的風(fēng)險(xiǎn)投資公司Brooklyn Bridge Ventures的合伙人查理·奧唐奈告訴《財(cái)富》雜志。在奧唐奈投資的大約70家公司里,約有三分之一的公司受到硅谷銀行破產(chǎn)的影響。他說(shuō),他歡迎對(duì)風(fēng)投界進(jìn)行有效監(jiān)管:“歸根結(jié)底,你只想知道規(guī)則是什么。你只想要穩(wěn)定。”

這一切都意味著,科技行業(yè)不可能很快回到自由散漫的狀態(tài),但該行業(yè)能夠從2022年的創(chuàng)傷中吸取教訓(xùn)。盡管面臨諸多挑戰(zhàn),但美國(guó)的創(chuàng)新遠(yuǎn)未消亡。現(xiàn)在是時(shí)候適應(yīng)這一變化了。(財(cái)富中文網(wǎng))

譯者:中慧言-王芳

美國(guó)一直自認(rèn)為是山巔閃光之城,是不必遵循舊規(guī)則的特例。自20世紀(jì)90年代中期現(xiàn)代互聯(lián)網(wǎng)誕生以來(lái),科技巨頭例外論已經(jīng)使硅谷成為經(jīng)濟(jì)界的山巔之城——一個(gè)正常規(guī)則不適用的地方。

Facebook、亞馬遜(Amazon)和谷歌(Google)等巨頭已經(jīng)成為歷史上市值最高的公司之一,被許多人視為堅(jiān)不可摧的賺錢(qián)機(jī)器。即使美國(guó)在2008年經(jīng)濟(jì)大衰退(Great Recession)后艱難度過(guò)“失業(yè)式復(fù)蘇”期,大型科技行業(yè)仍然是安·蘭德式般的存在,證明美國(guó)的科技行業(yè)在所有的資本主義國(guó)家中依舊鶴立雞群。技術(shù)一直被詬病為損害美國(guó)民主和青少年心理健康,甚至導(dǎo)致經(jīng)濟(jì)陷入長(zhǎng)期停滯。但該行業(yè)辯稱(chēng),創(chuàng)新使其成為例外,它可以在自己的準(zhǔn)自由主義黃金國(guó)度里運(yùn)作——監(jiān)管負(fù)擔(dān)不應(yīng)該適用,該行業(yè)的天才應(yīng)該不受任何障礙地自由工作。他們指出,F(xiàn)AANGs(美國(guó)市場(chǎng)上最受歡迎和表現(xiàn)最佳的五大科技股的首字母縮寫(xiě))的表現(xiàn)優(yōu)于標(biāo)準(zhǔn)普爾500指數(shù)(S&P 500)就是證明。

有一段時(shí)間,這似乎很奏效。在十多年近零利率的支持下,資本似乎全部涌向科技行業(yè)。隨后,新冠疫情爆發(fā)早期推動(dòng)科技股進(jìn)一步飆升。但這種狂歡在一年前就結(jié)束了,馬克·扎克伯格的Meta帝國(guó)遭遇了美國(guó)歷史上上市公司中最大的單日跌幅。從那以后,大型科技公司在所有糟糕的方面都變得異常突出:其他輝煌一時(shí)的FAANG公司市值跌幅創(chuàng)下新高;科技巨頭解雇了成千上萬(wàn)的員工,而其他經(jīng)濟(jì)領(lǐng)域卻實(shí)現(xiàn)了增長(zhǎng)。與此同時(shí),作為終極風(fēng)險(xiǎn)和創(chuàng)新資產(chǎn)的加密貨幣已經(jīng)損失了大約三分之二的價(jià)值,因?yàn)榧用茇泿诺摹笆兄怠痹谝荒陜?nèi)從3萬(wàn)億美元縮水到約1萬(wàn)億美元。

今年3月,當(dāng)風(fēng)險(xiǎn)投資行業(yè)的“思想領(lǐng)袖”淪為最老套的金融恐慌的受害者,那么認(rèn)為創(chuàng)業(yè)經(jīng)濟(jì)中的創(chuàng)新領(lǐng)導(dǎo)者卓爾不群的觀(guān)點(diǎn)就站不住腳了。硅谷銀行(Silicon Valley Bank)的倒閉被歸咎于美聯(lián)儲(chǔ)(Federal Reserve)監(jiān)管松懈、美國(guó)前總統(tǒng)唐納德·特朗普時(shí)代無(wú)能的國(guó)會(huì)削弱了規(guī)則、銀行高管管理不善,甚至更令人不可思議的是,還歸咎于“(對(duì)種族主義、不公等社會(huì)問(wèn)題的)覺(jué)醒”或者遠(yuǎn)程工作太多。諾貝爾獎(jiǎng)得主道格拉斯·戴蒙德最近對(duì)《財(cái)富》雜志的記者肖恩·塔利表示,硅谷銀行不是一家普通的銀行,該銀行相對(duì)不穩(wěn)定的儲(chǔ)戶(hù)群導(dǎo)致其異常脆弱。但事實(shí)是:在這個(gè)閃光的山谷里,驚慌失措的居民試圖在一天內(nèi)提取420億美元。正如今年3月流傳的一個(gè)笑話(huà)(套用了扎克伯格的話(huà)):科技行業(yè)行動(dòng)太過(guò)迅速,以至于為其提供服務(wù)的銀行都破產(chǎn)了。

顯然,早在硅谷銀行破產(chǎn)之前,金融體制就已經(jīng)發(fā)生了變化——從寬松貨幣時(shí)代的“萬(wàn)物皆泡沫”,到前所未有的全球貨幣政策收緊。也許現(xiàn)在,在這種冷靜的重新評(píng)估中,是時(shí)候質(zhì)疑對(duì)風(fēng)險(xiǎn)的認(rèn)知(在科技例外論時(shí)代,風(fēng)險(xiǎn)不斷蔓延),并將其從美國(guó)創(chuàng)新的主流中拎出來(lái)。

創(chuàng)新要走向何方?

科技例外論的理念是基于作者塞巴斯蒂安·馬拉比的“冪次定律”(the power law)的,即投資者和發(fā)明家可能在前100次冒險(xiǎn)中慘敗,但只要堅(jiān)持下去,就有可能在第101次冒險(xiǎn)時(shí)取得成功——或者正如Meta的首席執(zhí)行官馬克·扎克伯格在2016年所說(shuō)的那樣,要愿意“選擇希望而不是恐懼”。

這種理念助長(zhǎng)了許多對(duì)無(wú)利可圖的科技股、誤入歧途的初創(chuàng)公司和發(fā)展方向不明朗的加密貨幣的高風(fēng)險(xiǎn)押注,因?yàn)榈拖⒔杩顣r(shí)代意味著投資者能夠安心地押注于那些越來(lái)越荒謬的公司,從Theranos到Juicero再到WeWork。這個(gè)非理性時(shí)代的碎片包括成千上萬(wàn)的“僵尸”公司和加密貨幣公司,這些公司在經(jīng)濟(jì)上已經(jīng)維持不下去了,但卻以某種方式通過(guò)大規(guī)模舉債來(lái)維持生存。這個(gè)時(shí)代給我們留下了其他各種需要計(jì)算的成本,包括肖珊娜·祖博夫所說(shuō)的“監(jiān)控型資本主義”,因?yàn)橹悄苁謾C(jī)和社交媒體占用了人們?cè)絹?lái)越多的時(shí)間。

斯坦福大學(xué)商學(xué)院(Stanford Graduate School of Business)的管理學(xué)講師、風(fēng)險(xiǎn)投資家羅伯特·E·西格爾告訴《財(cái)富》雜志:“不惜一切代價(jià)的創(chuàng)新從來(lái)不是一項(xiàng)長(zhǎng)期戰(zhàn)略。這是在資本廉價(jià)、市場(chǎng)存在泡沫的時(shí)候采取的一種策略……硅谷銀行的破產(chǎn)為低利率超級(jí)周期畫(huà)上了句點(diǎn),在這個(gè)周期中,資本追逐回報(bào),大量資金涌入風(fēng)險(xiǎn)投資和初創(chuàng)公司等高風(fēng)險(xiǎn)高回報(bào)資產(chǎn)。”

這張支票于2022年到期,當(dāng)時(shí)美聯(lián)儲(chǔ)為了對(duì)抗通貨膨脹而大舉加息,這就像一把錘子砸向了科技行業(yè)。包括Meta、亞馬遜和蘋(píng)果(Apple)在內(nèi)的大公司去年的市值都損失了數(shù)千億美元,而風(fēng)險(xiǎn)投資支出下降了31%。

“冒進(jìn)的風(fēng)險(xiǎn)投資項(xiàng)目會(huì)越來(lái)越少”

盡管過(guò)去幾年科技行業(yè)進(jìn)行著自殘式的揮霍,但創(chuàng)新在美國(guó)不一定會(huì)消亡。但是,如果科技行業(yè)想要生存下去,那么就必須改變目前的創(chuàng)新運(yùn)作方式。這可能意味著徹底拋棄科技例外論的想法。

Meta公司的馬克·扎克伯格將2023年定為“效率年”,而亞馬遜、谷歌和其他科技公司正在瘋狂地削減不再關(guān)鍵的部門(mén)和項(xiàng)目——包括員工曾經(jīng)爭(zhēng)先恐后地參與的、幾乎不考慮投資回報(bào)的“堂吉訶德式登月計(jì)劃”。

為應(yīng)對(duì)可能到來(lái)的經(jīng)濟(jì)衰退,那么轉(zhuǎn)而注重提高效率是有意義的。斯坦福大學(xué)的西格爾說(shuō),美國(guó)的創(chuàng)新部門(mén)要想保持活力,可能也需要進(jìn)行精簡(jiǎn)。他對(duì)《財(cái)富》雜志表示:“你將會(huì)看到這一點(diǎn):冒進(jìn)的風(fēng)險(xiǎn)投資項(xiàng)目會(huì)越來(lái)越少,因?yàn)榱魍ǖ馁Y金將越來(lái)越少。糟得一塌糊涂的想法獲得投資的幾率會(huì)越來(lái)越小,過(guò)剩資金出現(xiàn)的幾率也會(huì)越來(lái)越小。”

科技公司可能也不必獨(dú)自思考如何更有效地實(shí)現(xiàn)創(chuàng)新,因?yàn)樗瓉?lái)了美國(guó)政府來(lái)解決這個(gè)爛攤子。美國(guó)國(guó)會(huì)或者美聯(lián)儲(chǔ)是否可以承擔(dān)起進(jìn)行全面改革,從而實(shí)現(xiàn)有效監(jiān)管的重任,仍然有待觀(guān)察。

“我持謹(jǐn)慎樂(lè)觀(guān)態(tài)度。”總部位于紐約的風(fēng)險(xiǎn)投資公司Brooklyn Bridge Ventures的合伙人查理·奧唐奈告訴《財(cái)富》雜志。在奧唐奈投資的大約70家公司里,約有三分之一的公司受到硅谷銀行破產(chǎn)的影響。他說(shuō),他歡迎對(duì)風(fēng)投界進(jìn)行有效監(jiān)管:“歸根結(jié)底,你只想知道規(guī)則是什么。你只想要穩(wěn)定。”

這一切都意味著,科技行業(yè)不可能很快回到自由散漫的狀態(tài),但該行業(yè)能夠從2022年的創(chuàng)傷中吸取教訓(xùn)。盡管面臨諸多挑戰(zhàn),但美國(guó)的創(chuàng)新遠(yuǎn)未消亡。現(xiàn)在是時(shí)候適應(yīng)這一變化了。(財(cái)富中文網(wǎng))

譯者:中慧言-王芳

America has always seen itself as a shining city upon a hill, an exceptional country that doesn’t have to follow the old rules. And since the birth of the modern internet in the mid-1990s, tech exceptionalism has made Silicon Valley the economy’s city on a hill — a place where the normal rules didn’t apply.

Giants such as Facebook, Amazon, and Google have become some of the wealthiest corporations in history, seen by many as indestructible money-making machines. Even as the nation struggled through a “jobless recovery” after the Great Recession of 2008, Big Tech was the Ayn Randian sector proving America had the best of all capitalisms. Technology has been criticized for harming American democracy, youth mental health, and even contributing to long-term economic stagnation. But the sector argued that its innovation made it exceptional enough to operate in its own quasi-libertarian golden state — that regulatory burdens shouldn’t apply, and that its geniuses should be free to work without hurdles. They pointed to the FAANGs outperforming the S&P 500 as proof.

For a time, things seemed to work. Buoyed by over a decade of near-zero interest rates, capital was seemingly everywhere in tech. Then the early pandemic sent tech stocks soaring even higher. But that party ended a year ago, when Mark Zuckerberg’s Meta empire suffered the largest single-day drop of any publicly traded company in American history. Big tech firms have since become exceptional in all the bad ways: the rest of the once-mighty FAANG companies seeing record drops in market cap; and tech giants laying off thousands upon thousands of workers, even as the rest of the economy grows. Meanwhile the ultimate risk and innovation asset, cryptocurrencies, have lost roughly two-thirds of their value, as crypto’s “market cap” shrank from $3 trillion to roughly $1 trillion in a year marked by several huge meltdowns.

The notion, too, that the big brains of the innovators in our startup economy are truly exceptional took a beating in March, when the “thought leaders” that populate the venture capital industry fell victim to the most old-fashioned kind of financial panic. The blow-up of Silicon Valley Bank has been blamed on lax regulation by the Federal Reserve, rules weakened by a feckless Trump-era Congress, mismanagement by bank executives, and even, bizarrely, on “wokeness” or too much remote working. SVB was not a normal bank, and its relatively unstable depositor base rendered it uniquely vulnerable, as Nobel laureate Douglas Diamond recently told Fortune’s Shawn Tully. But the fact remains: The panicked denizens of that shiny valley tried to withdraw $42 billion in one day. As a joke paraphrasing Zuckerberg that was going around March put it: The tech industry moved so fast it broke its own bank.

It was clear long before the collapse of SVB that there has been a financial regime change — from the “everything bubble” of the easy money era to an unprecedented global tightening of monetary policy. Perhaps now, amid this sober reappraisal, is the moment to question the magical thinking about risk that was rampant in the era of tech exceptionalism, and to extract it from the mainstream of American innovation.

W(h)ither innovation?

The idea of tech exceptionalism is grounded in what the author Sebastian Mallaby called “the power law,” the belief that investors and inventors could lose on 100 ventures as long as they succeed on the 101st — or as Meta CEO Mark Zuckerberg put it in 2016, the willingness to “choose hope over fear.”

That philosophy fueled many risky bets on unprofitable tech stocks, misguided startups, and directionless cryptocurrencies, as the era of cheap money meant investors were comfortable gambling on increasingly absurd ventures, from Theranos to the Juicero to WeWork. The detritus of this irrational era includes thousands of “zombie” companies and cryptocurrencies, companies that are no longer economically viable but have somehow managed to stay alive by taking on more and more debt. And this era left us with various other costs to calculate, including that of what Shosanna Zuboff has called “surveillance capitalism,” as smartphones and social media invade ever more of people’s time.

“Innovation at all costs is never a long-term strategy,” Robert E. Siegel, a lecturer in management at the Stanford Graduate School of Business and a venture capitalist himself, told Fortune. “That’s a strategy in a moment in time when capital is cheap and there’s frothiness in the market… SVB’s implosion is a punctuation mark at the end of a supercycle of low interest rates where capital was chasing returns, and where there was so much money flowed into high-risk high-return assets like venture and startups.”

The check came due last year with steep interest rate hikes to fight inflation which came down on tech like a hammer. Major companies including Meta, Amazon, and Apple all lost hundreds of billions in market cap last year, while venture capital spending dropped 31%.

“Fewer stupid ventures”

Despite tech’s self-harming lavishness of the past few years, innovation isn’t necessarily dead in the U.S. But the type of innovation practiced by the tech industry will have to operate very differently if it wants to survive. That will likely mean putting to bed once and for all the idea of tech exceptionalism.

Meta’s Mark Zuckerberg has called 2023 the “year of efficiency,” while Amazon, Google, and other tech companies are furiously chopping unnecessary departments and projects — including the Quixotic moonshot projects employees once clamored to work on, with little thought of return on investment.

This pivot to efficiency makes sense in preparation for a possible recession. It might also be the pruning that America’s innovation sector needs to stay alive, said Stanford University’s Siegel. “We’re going to see fewer stupid ventures,” he told Fortune. "You’re going to see this because there's going to be less money to go around. Fewer bad ideas will get funded and there will be less excess.”

Tech probably won’t have to figure out how to innovate more efficiently alone either, as it has invited DC to come in and sort out the mess. It remains to be seen whether Congress or the Federal Reserve are up to the task of overhauling regulation.

“I’m cautiously optimistic,” Charlie O’Donnell, a partner at the New York-based venture capital firm Brooklyn Bridge Ventures, told Fortune. Around a third of the approximately 70 companies in O’Donnell’s portfolio were exposed to SVB’s collapse, and he said he welcomes some thoughtful oversight of the VC world: “At the end of the day, you just want to know what the rules are,” he said. “You just want stability.”

This all means that tech cannot return to its freewheeling ways anytime soon, but the sector can learn from the past year’s trauma. Despite the challenges ahead, innovation in the U.S. is far from dead. It’s time to adapt.