隨著各國(guó)央行紛紛利用加息應(yīng)對(duì)高通脹,CEO們都對(duì)經(jīng)濟(jì)前景感到擔(dān)憂。但奇怪的是,他們卻依舊在進(jìn)行招聘。Greenhouse最近調(diào)查發(fā)現(xiàn),約68%的首席執(zhí)行官今年計(jì)劃增加公司員工人數(shù)。在該數(shù)據(jù)發(fā)布之前,美國(guó)經(jīng)濟(jì)在1月份新增就業(yè)517,000個(gè),是經(jīng)濟(jì)學(xué)家預(yù)測(cè)的一倍以上,而失業(yè)率降至3.4%,為53年最低水平。

在最新就業(yè)報(bào)告公布之前,科技行業(yè)的大規(guī)模裁員,使勞動(dòng)力市場(chǎng)呈現(xiàn)出一片更加慘淡的景象。2022年,隨著曾經(jīng)高歌猛進(jìn)的科技股暴跌,有超過150,000名科技工作者失業(yè),在過去12個(gè)月,僅大型科技公司的裁員人數(shù)就超過了70,000人。

與此同時(shí),在安永(EY)1月份的調(diào)查中,約98%的首席執(zhí)行官表示“正在為經(jīng)濟(jì)下滑做準(zhǔn)備”,有55%的受訪者承認(rèn),他們正在準(zhǔn)備迎接“比全球金融危機(jī)更嚴(yán)重的”情況。盡管他們擔(dān)心經(jīng)濟(jì)衰退,而且科技行業(yè)哀鴻遍野,但大多數(shù)公司依舊沒有裁員計(jì)劃。

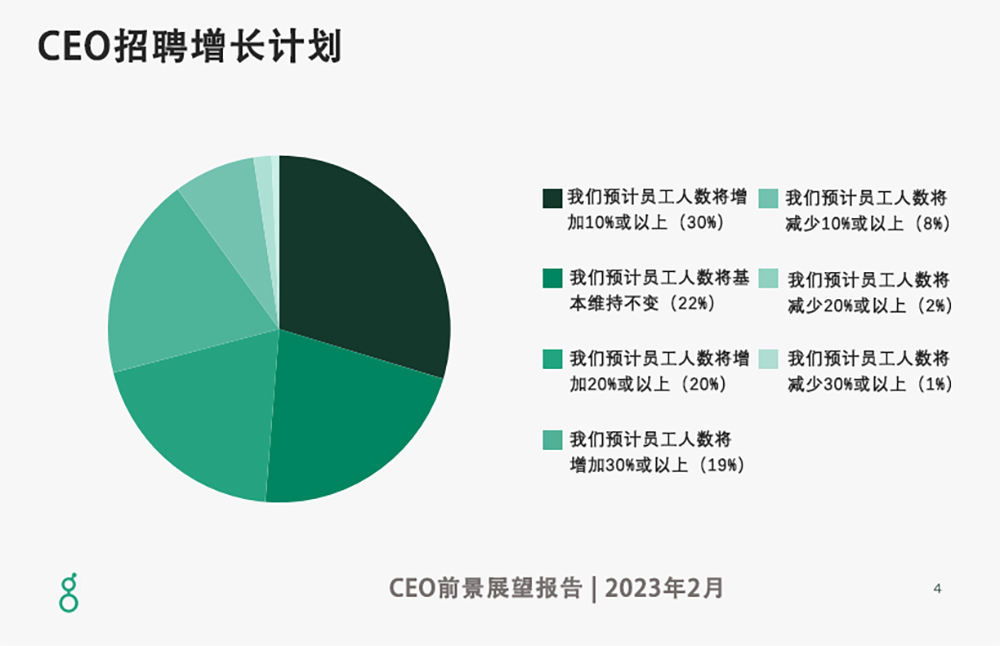

在Greenhouse的調(diào)查中,只有11%的CEO表示今年計(jì)劃裁員。約三分之一CEO計(jì)劃增加員工10%或以上,有19%的CEO計(jì)劃增加30%以上。

1月普華永道(PwC)對(duì)全球4,410位CEO的調(diào)查,在招聘計(jì)劃方面也發(fā)現(xiàn)了類似的現(xiàn)象。CEO們對(duì)經(jīng)濟(jì)狀況表示謹(jǐn)慎,有52%的CEO表示今年計(jì)劃削減成本。但與此同時(shí),留住人才依舊是他們的首要任務(wù)。

在普華永道的調(diào)查中,只有19%的CEO表示將停止招聘,只有16%的CEO計(jì)劃裁員。

普華永道研究人員表示:“這與我們?cè)?008年10月和11月對(duì)CEO們的調(diào)查結(jié)果形成鮮明對(duì)比。當(dāng)時(shí),預(yù)計(jì)近期裁員的CEO比例約是本次調(diào)查結(jié)果的兩倍之多。”

世界大型企業(yè)聯(lián)合會(huì)(Conference Board)的研究人員在1月的“企業(yè)高管前景展望”中,根據(jù)全球1,131名高管的回復(fù)發(fā)現(xiàn),雖然經(jīng)濟(jì)衰退是CEO們最擔(dān)心的“外部”問題,但在緊張的勞動(dòng)力市場(chǎng)吸引和留住人才,卻是最緊迫的“內(nèi)部”問題。

世界大型企業(yè)聯(lián)合會(huì)首席經(jīng)濟(jì)學(xué)家達(dá)納·皮特森在一份聲明中表示:“雖然全球CEO都計(jì)劃削減成本和減少非必要支出,這些都是在經(jīng)濟(jì)下滑時(shí)期通常采取的措施,但員工可以長(zhǎng)舒一口氣,因?yàn)楹苌儆蠧EO計(jì)劃裁員。相反,他們降低風(fēng)險(xiǎn)的計(jì)劃是,加快創(chuàng)新和數(shù)字化轉(zhuǎn)型,挖掘更高增長(zhǎng)市場(chǎng)中的機(jī)會(huì),以及調(diào)整公司的經(jīng)營(yíng)模式,這是被提及最多的三項(xiàng)措施。”(財(cái)富中文網(wǎng))

譯者:劉進(jìn)龍

審校:汪皓

隨著各國(guó)央行紛紛利用加息應(yīng)對(duì)高通脹,CEO們都對(duì)經(jīng)濟(jì)前景感到擔(dān)憂。但奇怪的是,他們卻依舊在進(jìn)行招聘。Greenhouse最近調(diào)查發(fā)現(xiàn),約68%的首席執(zhí)行官今年計(jì)劃增加公司員工人數(shù)。在該數(shù)據(jù)發(fā)布之前,美國(guó)經(jīng)濟(jì)在1月份新增就業(yè)517,000個(gè),是經(jīng)濟(jì)學(xué)家預(yù)測(cè)的一倍以上,而失業(yè)率降至3.4%,為53年最低水平。

在最新就業(yè)報(bào)告公布之前,科技行業(yè)的大規(guī)模裁員,使勞動(dòng)力市場(chǎng)呈現(xiàn)出一片更加慘淡的景象。2022年,隨著曾經(jīng)高歌猛進(jìn)的科技股暴跌,有超過150,000名科技工作者失業(yè),在過去12個(gè)月,僅大型科技公司的裁員人數(shù)就超過了70,000人。

與此同時(shí),在安永(EY)1月份的調(diào)查中,約98%的首席執(zhí)行官表示“正在為經(jīng)濟(jì)下滑做準(zhǔn)備”,有55%的受訪者承認(rèn),他們正在準(zhǔn)備迎接“比全球金融危機(jī)更嚴(yán)重的”情況。盡管他們擔(dān)心經(jīng)濟(jì)衰退,而且科技行業(yè)哀鴻遍野,但大多數(shù)公司依舊沒有裁員計(jì)劃。

在Greenhouse的調(diào)查中,只有11%的CEO表示今年計(jì)劃裁員。約三分之一CEO計(jì)劃增加員工10%或以上,有19%的CEO計(jì)劃增加30%以上。

1月普華永道(PwC)對(duì)全球4,410位CEO的調(diào)查,在招聘計(jì)劃方面也發(fā)現(xiàn)了類似的現(xiàn)象。CEO們對(duì)經(jīng)濟(jì)狀況表示謹(jǐn)慎,有52%的CEO表示今年計(jì)劃削減成本。但與此同時(shí),留住人才依舊是他們的首要任務(wù)。

在普華永道的調(diào)查中,只有19%的CEO表示將停止招聘,只有16%的CEO計(jì)劃裁員。

普華永道研究人員表示:“這與我們?cè)?008年10月和11月對(duì)CEO們的調(diào)查結(jié)果形成鮮明對(duì)比。當(dāng)時(shí),預(yù)計(jì)近期裁員的CEO比例約是本次調(diào)查結(jié)果的兩倍之多。”

世界大型企業(yè)聯(lián)合會(huì)(Conference Board)的研究人員在1月的“企業(yè)高管前景展望”中,根據(jù)全球1,131名高管的回復(fù)發(fā)現(xiàn),雖然經(jīng)濟(jì)衰退是CEO們最擔(dān)心的“外部”問題,但在緊張的勞動(dòng)力市場(chǎng)吸引和留住人才,卻是最緊迫的“內(nèi)部”問題。

世界大型企業(yè)聯(lián)合會(huì)首席經(jīng)濟(jì)學(xué)家達(dá)納·皮特森在一份聲明中表示:“雖然全球CEO都計(jì)劃削減成本和減少非必要支出,這些都是在經(jīng)濟(jì)下滑時(shí)期通常采取的措施,但員工可以長(zhǎng)舒一口氣,因?yàn)楹苌儆蠧EO計(jì)劃裁員。相反,他們降低風(fēng)險(xiǎn)的計(jì)劃是,加快創(chuàng)新和數(shù)字化轉(zhuǎn)型,挖掘更高增長(zhǎng)市場(chǎng)中的機(jī)會(huì),以及調(diào)整公司的經(jīng)營(yíng)模式,這是被提及最多的三項(xiàng)措施。”(財(cái)富中文網(wǎng))

譯者:劉進(jìn)龍

審校:汪皓

With central banks worldwide raising interest rates to fight high inflation, CEOs are worried about the economy. But oddly enough, they’re still hiring. Some 68% of chief executives plan to increase their company’s headcount this year, according to a new Greenhouse survey. The data comes after the U.S. economy added 517,000 jobs in January—more than double economists’ forecasts—and the unemployment rate fell to a 53-year low of 3.4%.

Before the latest jobs report, a drumbeat of tech industry layoffs painted a much darker picture of the labor market. Over 150,000 tech workers lost their jobs in 2022 as once-high-flying tech stocks tumbled, and Big Tech companies alone have now shed over 70,000 employees in the past 12 months.

At the same time, some 98% of chief executives said they are “bracing for an economic downturn” in a January EY survey—with 55% admitting they’re preparing for something “worse than the global financial crisis.” But despite the recession fears and tech industry woes, layoffs still aren’t in the cards for most companies.

In the Greenhouse survey, just 11% of CEOs said they expect to reduce their firm’s headcount this year. And roughly a third of chief execs plan to increase their headcount by 10% or more, while 19% plan a 30%-plus increase.

A January PwC survey of 4,410 CEOs from around the world found a similar phenomenon in hiring plans. CEOs are cautious about the economy, and 52% said they plan to cut costs this year. But at the same time, retaining talent remains a top priority.

Only 19% of CEOs said in PwC’s survey that they were implementing hiring freezes, and just 16% planned to reduce their company’s headcount.

“This stands in stark contrast to what we heard from CEOs back in October and November of 2008, when about twice as many told us they anticipated near-term headcount reductions,” the PwC researchers noted.

Conference Board researchers also found in their January C-Suite Outlook, based on responses from 1,131 executives worldwide, that although a recession was the top “external” concern among CEOs, attracting and retaining talent in a tight labor market was the most pressing “internal” concern.

“While CEOs globally are looking to contain costs and reduce discretionary spending—actions typically taken during a slowdown—employees may be able to breathe a sigh of relief, as few executives are turning to layoffs,” Dana Peterson, chief economist of the Conference Board, explained in a statement. “Instead, they plan to mitigate risk by accelerating innovation and digital transformation, pursuing new opportunities in higher-growth markets, and revising business models—the three most-cited actions.”