在過去十年里,多年來的低息借款推動了美國投機(jī)性投資和無利可圖的商業(yè)模式的興起,頑固的通貨膨脹迫使美聯(lián)儲在2022年以前所未有的速度大舉加息。如今,在這個借貸成本上升、放貸機(jī)構(gòu)更加謹(jǐn)慎的新時代——再加上經(jīng)濟(jì)增長放緩和對經(jīng)濟(jì)衰退的擔(dān)憂——美國經(jīng)濟(jì)中曾經(jīng)炙手可熱的細(xì)分領(lǐng)域出現(xiàn)凍結(jié)。

首次公開募股(IPO)市場基本上已經(jīng)關(guān)閉;科技公司正在裁員并暫停招聘;房地產(chǎn)市場在經(jīng)歷了多年的迅猛增長后正在經(jīng)歷“重置”;隨著私募市場估值暴跌,風(fēng)險投資領(lǐng)域已大幅放緩。

不過,盡管關(guān)鍵領(lǐng)域出現(xiàn)了凍結(jié),而且華爾街一直在預(yù)測末日的到來,但隨著勞動力市場的恢復(fù),整體經(jīng)濟(jì)仍在繼續(xù)增長。去年第四季度,美國國內(nèi)生產(chǎn)總值(GDP)年增長率為2.9%,超過了分析師的預(yù)期。12月,失業(yè)率降至3.5%,接近疫情前的低點(diǎn)。

然而,許多經(jīng)濟(jì)學(xué)家預(yù)測,這種情況今年將發(fā)生變化。摩根士丹利(Morgan Stanley)首席經(jīng)濟(jì)學(xué)家埃倫·森特納(Ellen Zentner)本周表示,第一季度美國國內(nèi)生產(chǎn)總值年增長率將降至0.2%,富國銀行(Wells Fargo)則預(yù)計美國國內(nèi)生產(chǎn)總值年增長率將降至0.4%。一些首席執(zhí)行官、億萬富翁投資者和投資銀行認(rèn)為,全面經(jīng)濟(jì)衰退即將到來。

目前還不清楚,在利率上升的重壓下,關(guān)鍵領(lǐng)域凍結(jié)是最終會走向破裂——引發(fā)經(jīng)濟(jì)衰退——還是會從深度凍結(jié)狀態(tài)解凍——實(shí)現(xiàn)緩慢的正增長。但信貸市場可能會給出答案。

財富管理公司W(wǎng)ealth Enhancement Group的首席投資和業(yè)務(wù)發(fā)展官吉姆?卡恩(Jim Cahn)在接受《財富》雜志采訪時表示:“當(dāng)信貸市場出現(xiàn)回撤,你無法為交易或投資獲得融資時,就是經(jīng)濟(jì)陷入凍結(jié)狀態(tài)的時候。信貸作為秘密武器,可以推動經(jīng)濟(jì)增長。自400年前工業(yè)革命初期信貸市場形成以來,它一直是經(jīng)濟(jì)增長的動力。”

經(jīng)濟(jì)中正在凍結(jié)和已經(jīng)凍結(jié)的細(xì)分領(lǐng)域

新時代的高利率、通貨膨脹和對經(jīng)濟(jì)衰退的擔(dān)憂,導(dǎo)致美國經(jīng)濟(jì)各領(lǐng)域在過去一年里急劇放緩。

風(fēng)險投資

例如,風(fēng)險投資領(lǐng)域,在整個疫情期間實(shí)現(xiàn)強(qiáng)勁發(fā)展。2021年,全球風(fēng)險投資籌資量達(dá)到創(chuàng)紀(jì)錄的6810億美元,是2019年的兩倍多。

PitchBook分析師亞歷克斯·沃菲爾(Alex Warfel)在上周五的一份說明中解釋說:“2020年和2021年,廉價資本助長了不惜一切代價追求增長的心態(tài),害怕錯失良機(jī)(FOMO)也造成投資者興趣激增,導(dǎo)致人們大規(guī)模投資處于各個融資階段的初創(chuàng)公司。”

但根據(jù)Crunchbase的數(shù)據(jù),2022年,隨著利率上升,風(fēng)險投資下降了35%,至4450億美元。沃菲爾表示,“初創(chuàng)公司能夠獲得天價估值和有利融資機(jī)會”的日子已經(jīng)一去不復(fù)返了,風(fēng)險投資領(lǐng)域的情緒已經(jīng)“崩潰”,資本已經(jīng)枯竭。在他看來,根據(jù)PitchBook的數(shù)據(jù),第四季度,美國初創(chuàng)公司所需的資金估計超過了已提供的428億美元。

專注于金融科技的風(fēng)險投資和私募股權(quán)公司Fin Capital的創(chuàng)始人洛根?阿林(Logan Allin)在接受《財富》雜志采訪時表示,他認(rèn)為風(fēng)險投資領(lǐng)域要到2024年才能完全復(fù)蘇,部分原因是信貸緊縮。他認(rèn)為對于科技初創(chuàng)公司來說,2023年可能是極具挑戰(zhàn)性的一年。

他說:“我們的觀點(diǎn)是,2023年將繼續(xù)是極度痛苦的一年,實(shí)際上從科技領(lǐng)域的私募市場和公共股權(quán)的角度來看,2023年將比2022年更痛苦。”

阿林補(bǔ)充說,市場的急劇下滑應(yīng)該給那些在疫情期間養(yǎng)成不負(fù)責(zé)任的習(xí)慣、未能對投資進(jìn)行適當(dāng)盡職調(diào)查的風(fēng)險投資人“敲響了警鐘”。他舉了現(xiàn)已倒閉的加密貨幣交易所FTX的例子,薩姆·班克曼-弗里德對盡職調(diào)查“不予理會”,是因?yàn)樗麄儫o法通過根據(jù)基本的“檢查清單”進(jìn)行的盡職調(diào)查,他們還不允許獨(dú)立審計員查看他們的財務(wù)狀況。但其他風(fēng)險投資家甚至沒有查看他們的賬目就向該公司投資了數(shù)百萬美元。

他說:“他們要求提供財務(wù)數(shù)據(jù),而FTX的團(tuán)隊卻給他們發(fā)送Excel電子表格。這實(shí)在是太荒謬了。”

但現(xiàn)在,隨著利率上升和許多規(guī)模較小的風(fēng)投公司退出市場,阿林認(rèn)為市場將回歸到更為嚴(yán)格的投資方式。

他說:“我認(rèn)為風(fēng)險投資環(huán)境將變得更健康、更可持續(xù),因?yàn)槲覀兺顿Y的估值和市盈率更合理,能夠讓公司以更好的方式實(shí)現(xiàn)估值并獲得利潤。這是真正的回歸基本面的過程,并重新聚焦盡職調(diào)查。”

首次公開募股

當(dāng)美國的利率接近零,消費(fèi)者在疫情期間從刺激計劃中獲得大量現(xiàn)金時,首次公開募股市場經(jīng)歷了與風(fēng)險投資領(lǐng)域類似的激增。

僅在2021年,美國就有創(chuàng)紀(jì)錄的1033家新上市公司。但根據(jù)安永的《2022年全球首次公開募股市場趨勢報告》,在利率上升、標(biāo)準(zhǔn)普爾500指數(shù)下跌約20%的情況下,2022年的首次公開募股數(shù)量減少了50%。在美洲,這種下降更為明顯,去年首次公開募股數(shù)量較2021年下降了86%,同期總?cè)谫Y額下降了96%。

“整個2022年,交易活動和交易量急劇下降。首次公開募股市場完全關(guān)閉。”阿林說。“公共市場對任何公司都毫無興趣,即使是那些可能盈利的公司。”

阿林說,他認(rèn)為今年“首次公開募股市場”只有“一線機(jī)會”,而且只有那些能夠證明自己賺錢能力的公司才有機(jī)會上市。

他說:“否則,這些公司的估值將大幅下降,就像去年或2021年上市的任何一家公司一樣。我們?nèi)匀幻媾R通貨膨脹、高利率、地緣政治不確定性和巨大的波動性,無法為首次公開募股創(chuàng)造一個溫暖的市場環(huán)境。”

房地產(chǎn)

由于低利率和居家辦公趨勢推動了房地產(chǎn)市場的繁榮,從2020年第二季度到去年第三季度,美國房價飆升了45%以上。但利率上升已將30年期固定抵押貸款利率(美國最常見的抵押貸款類型)從2020年2月的3.45%推高至今天的6.1%出頭。

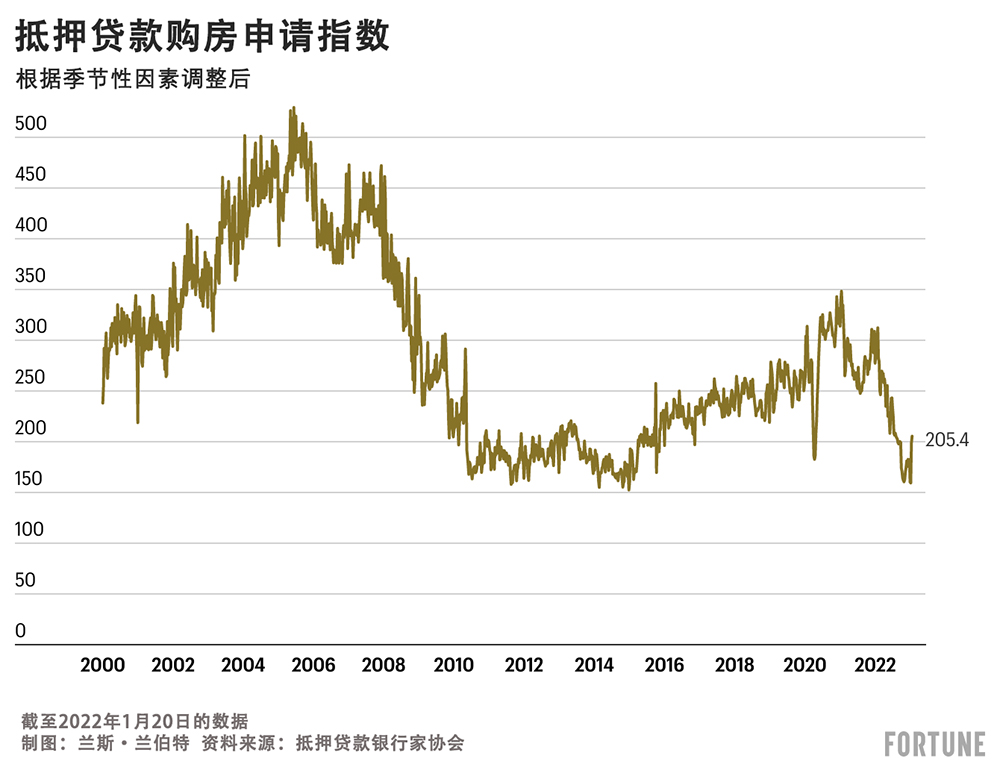

更高的借貸成本和高房價導(dǎo)致負(fù)擔(dān)能力下降,房地產(chǎn)市場出現(xiàn)重大“重置”。上周,抵押貸款購房申請較上年同期下降39%。

投資管理公司Infrastructure Capital Advisors創(chuàng)始人兼首席執(zhí)行官杰伊?哈特菲爾德(Jay Hatfield)表示,不僅僅是潛在的房主被拒之門外,機(jī)構(gòu)房地產(chǎn)投資者也感受到了利率上升帶來的痛苦。他在接受《財富》雜志采訪時表示,高利率和對經(jīng)濟(jì)衰退的擔(dān)憂導(dǎo)致銀行貸款“枯竭”,這使得收購新房產(chǎn)和/或房地產(chǎn)行業(yè)的公司面臨嚴(yán)峻挑戰(zhàn)。

他說:“現(xiàn)在有一小部分私人貸款仍在進(jìn)行,但貸款條件太苛刻了,無法再進(jìn)行杠桿收購(LBO)。杠桿收購指的是一家公司試圖用借來的錢收購另一家公司。還有像黑石集團(tuán)(Blackstone)這樣曾是買家的公司。他們現(xiàn)在更可能成為賣家而不是買家。因此,并購活動已經(jīng)終結(jié)了。”

Wealth Enhancement Group的卡恩說,放貸機(jī)構(gòu)不僅提出了更高的利率,而且他們在放貸前也進(jìn)行了更多的核保——或者說研究和風(fēng)險評估——以避免違約風(fēng)險。他指出,這是另一個例子,表明目前某些經(jīng)濟(jì)領(lǐng)域的凍結(jié)完全是對“信貸市場狀況的反映”。

他強(qiáng)調(diào)說:“在2021年以及18個月之前,人們以最快的速度地向任何領(lǐng)域大肆投資,因?yàn)楝F(xiàn)金太多了,但在2022年,信貸市場基本上凍結(jié)了。這就是為什么你會看到這些行業(yè)陷入凍結(jié)狀態(tài)。”

凍結(jié)的經(jīng)濟(jì)即將崩潰?

經(jīng)濟(jì)會慢慢解凍并避免衰退,還是利率上升和高通脹造成的裂縫即將破裂?這取決于你問誰。

卡恩說,他的“預(yù)感”是,我們將在“2023年下半年的某個時候”陷入經(jīng)濟(jì)衰退。“我認(rèn)為也許要到2024年,我們才能恢復(fù)正常。”他說。

他并不是唯一一個對前景持悲觀態(tài)度的人。許多頂級投資銀行預(yù)測,今年將出現(xiàn)“溫和的經(jīng)濟(jì)衰退”,一些預(yù)測者認(rèn)為,“嚴(yán)重的經(jīng)濟(jì)衰退”甚至“另一種類型的大蕭條”可能即將到來。

“從經(jīng)濟(jì)和宏觀角度來看,我們肯定會進(jìn)入一個越來越艱難的時期,那可能是大寫‘R’型衰退或小寫‘R’型衰退,但無論是哪種衰退,情況都會很糟糕。”阿林說。

雖然許多專家認(rèn)為經(jīng)濟(jì)衰退即將到來,但也有人認(rèn)為,這次衰退不會像過去的經(jīng)濟(jì)衰退那樣具有毀滅性,到2023年底和2024年,凍結(jié)的經(jīng)濟(jì)領(lǐng)域?qū)㈤_始解凍。Infrastructure Capital Advisors的哈特菲爾德表示,到今年下半年,“首次公開募股市場將恢復(fù)正常狀態(tài),并購和股市也將復(fù)蘇。”

他認(rèn)為,“后疫情的順風(fēng)”使勞動力市場保持健康狀態(tài)——特別是服務(wù)行業(yè),在疫情期間,許多企業(yè)難以招聘到員工——如果沒有大規(guī)模裁員使得消費(fèi)者支出大幅下滑,經(jīng)濟(jì)不太可能出現(xiàn)嚴(yán)重衰退。他還指出,盡管去年利率飆升,但住房庫存接近歷史最低點(diǎn),他認(rèn)為這將使房地產(chǎn)領(lǐng)域全年都實(shí)現(xiàn)解凍。

他表示:“不過,我們需要美聯(lián)儲暫停[加息],美國的國內(nèi)生產(chǎn)總值可能會出現(xiàn)一兩個季度的負(fù)增長,但不會陷入嚴(yán)重的經(jīng)濟(jì)衰退。”(財富中文網(wǎng))

譯者:中慧言-王芳

在過去十年里,多年來的低息借款推動了美國投機(jī)性投資和無利可圖的商業(yè)模式的興起,頑固的通貨膨脹迫使美聯(lián)儲在2022年以前所未有的速度大舉加息。如今,在這個借貸成本上升、放貸機(jī)構(gòu)更加謹(jǐn)慎的新時代——再加上經(jīng)濟(jì)增長放緩和對經(jīng)濟(jì)衰退的擔(dān)憂——美國經(jīng)濟(jì)中曾經(jīng)炙手可熱的細(xì)分領(lǐng)域出現(xiàn)凍結(jié)。

首次公開募股(IPO)市場基本上已經(jīng)關(guān)閉;科技公司正在裁員并暫停招聘;房地產(chǎn)市場在經(jīng)歷了多年的迅猛增長后正在經(jīng)歷“重置”;隨著私募市場估值暴跌,風(fēng)險投資領(lǐng)域已大幅放緩。

不過,盡管關(guān)鍵領(lǐng)域出現(xiàn)了凍結(jié),而且華爾街一直在預(yù)測末日的到來,但隨著勞動力市場的恢復(fù),整體經(jīng)濟(jì)仍在繼續(xù)增長。去年第四季度,美國國內(nèi)生產(chǎn)總值(GDP)年增長率為2.9%,超過了分析師的預(yù)期。12月,失業(yè)率降至3.5%,接近疫情前的低點(diǎn)。

然而,許多經(jīng)濟(jì)學(xué)家預(yù)測,這種情況今年將發(fā)生變化。摩根士丹利(Morgan Stanley)首席經(jīng)濟(jì)學(xué)家埃倫·森特納(Ellen Zentner)本周表示,第一季度美國國內(nèi)生產(chǎn)總值年增長率將降至0.2%,富國銀行(Wells Fargo)則預(yù)計美國國內(nèi)生產(chǎn)總值年增長率將降至0.4%。一些首席執(zhí)行官、億萬富翁投資者和投資銀行認(rèn)為,全面經(jīng)濟(jì)衰退即將到來。

目前還不清楚,在利率上升的重壓下,關(guān)鍵領(lǐng)域凍結(jié)是最終會走向破裂——引發(fā)經(jīng)濟(jì)衰退——還是會從深度凍結(jié)狀態(tài)解凍——實(shí)現(xiàn)緩慢的正增長。但信貸市場可能會給出答案。

財富管理公司W(wǎng)ealth Enhancement Group的首席投資和業(yè)務(wù)發(fā)展官吉姆?卡恩(Jim Cahn)在接受《財富》雜志采訪時表示:“當(dāng)信貸市場出現(xiàn)回撤,你無法為交易或投資獲得融資時,就是經(jīng)濟(jì)陷入凍結(jié)狀態(tài)的時候。信貸作為秘密武器,可以推動經(jīng)濟(jì)增長。自400年前工業(yè)革命初期信貸市場形成以來,它一直是經(jīng)濟(jì)增長的動力。”

經(jīng)濟(jì)中正在凍結(jié)和已經(jīng)凍結(jié)的細(xì)分領(lǐng)域

新時代的高利率、通貨膨脹和對經(jīng)濟(jì)衰退的擔(dān)憂,導(dǎo)致美國經(jīng)濟(jì)各領(lǐng)域在過去一年里急劇放緩。

風(fēng)險投資

例如,風(fēng)險投資領(lǐng)域,在整個疫情期間實(shí)現(xiàn)強(qiáng)勁發(fā)展。2021年,全球風(fēng)險投資籌資量達(dá)到創(chuàng)紀(jì)錄的6810億美元,是2019年的兩倍多。

PitchBook分析師亞歷克斯·沃菲爾(Alex Warfel)在上周五的一份說明中解釋說:“2020年和2021年,廉價資本助長了不惜一切代價追求增長的心態(tài),害怕錯失良機(jī)(FOMO)也造成投資者興趣激增,導(dǎo)致人們大規(guī)模投資處于各個融資階段的初創(chuàng)公司。”

但根據(jù)Crunchbase的數(shù)據(jù),2022年,隨著利率上升,風(fēng)險投資下降了35%,至4450億美元。沃菲爾表示,“初創(chuàng)公司能夠獲得天價估值和有利融資機(jī)會”的日子已經(jīng)一去不復(fù)返了,風(fēng)險投資領(lǐng)域的情緒已經(jīng)“崩潰”,資本已經(jīng)枯竭。在他看來,根據(jù)PitchBook的數(shù)據(jù),第四季度,美國初創(chuàng)公司所需的資金估計超過了已提供的428億美元。

專注于金融科技的風(fēng)險投資和私募股權(quán)公司Fin Capital的創(chuàng)始人洛根?阿林(Logan Allin)在接受《財富》雜志采訪時表示,他認(rèn)為風(fēng)險投資領(lǐng)域要到2024年才能完全復(fù)蘇,部分原因是信貸緊縮。他認(rèn)為對于科技初創(chuàng)公司來說,2023年可能是極具挑戰(zhàn)性的一年。

他說:“我們的觀點(diǎn)是,2023年將繼續(xù)是極度痛苦的一年,實(shí)際上從科技領(lǐng)域的私募市場和公共股權(quán)的角度來看,2023年將比2022年更痛苦。”

阿林補(bǔ)充說,市場的急劇下滑應(yīng)該給那些在疫情期間養(yǎng)成不負(fù)責(zé)任的習(xí)慣、未能對投資進(jìn)行適當(dāng)盡職調(diào)查的風(fēng)險投資人“敲響了警鐘”。他舉了現(xiàn)已倒閉的加密貨幣交易所FTX的例子,薩姆·班克曼-弗里德對盡職調(diào)查“不予理會”,是因?yàn)樗麄儫o法通過根據(jù)基本的“檢查清單”進(jìn)行的盡職調(diào)查,他們還不允許獨(dú)立審計員查看他們的財務(wù)狀況。但其他風(fēng)險投資家甚至沒有查看他們的賬目就向該公司投資了數(shù)百萬美元。

他說:“他們要求提供財務(wù)數(shù)據(jù),而FTX的團(tuán)隊卻給他們發(fā)送Excel電子表格。這實(shí)在是太荒謬了。”

但現(xiàn)在,隨著利率上升和許多規(guī)模較小的風(fēng)投公司退出市場,阿林認(rèn)為市場將回歸到更為嚴(yán)格的投資方式。

他說:“我認(rèn)為風(fēng)險投資環(huán)境將變得更健康、更可持續(xù),因?yàn)槲覀兺顿Y的估值和市盈率更合理,能夠讓公司以更好的方式實(shí)現(xiàn)估值并獲得利潤。這是真正的回歸基本面的過程,并重新聚焦盡職調(diào)查。”

首次公開募股

當(dāng)美國的利率接近零,消費(fèi)者在疫情期間從刺激計劃中獲得大量現(xiàn)金時,首次公開募股市場經(jīng)歷了與風(fēng)險投資領(lǐng)域類似的激增。

僅在2021年,美國就有創(chuàng)紀(jì)錄的1033家新上市公司。但根據(jù)安永的《2022年全球首次公開募股市場趨勢報告》,在利率上升、標(biāo)準(zhǔn)普爾500指數(shù)下跌約20%的情況下,2022年的首次公開募股數(shù)量減少了50%。在美洲,這種下降更為明顯,去年首次公開募股數(shù)量較2021年下降了86%,同期總?cè)谫Y額下降了96%。

“整個2022年,交易活動和交易量急劇下降。首次公開募股市場完全關(guān)閉。”阿林說。“公共市場對任何公司都毫無興趣,即使是那些可能盈利的公司。”

阿林說,他認(rèn)為今年“首次公開募股市場”只有“一線機(jī)會”,而且只有那些能夠證明自己賺錢能力的公司才有機(jī)會上市。

他說:“否則,這些公司的估值將大幅下降,就像去年或2021年上市的任何一家公司一樣。我們?nèi)匀幻媾R通貨膨脹、高利率、地緣政治不確定性和巨大的波動性,無法為首次公開募股創(chuàng)造一個溫暖的市場環(huán)境。”

房地產(chǎn)

由于低利率和居家辦公趨勢推動了房地產(chǎn)市場的繁榮,從2020年第二季度到去年第三季度,美國房價飆升了45%以上。但利率上升已將30年期固定抵押貸款利率(美國最常見的抵押貸款類型)從2020年2月的3.45%推高至今天的6.1%出頭。

更高的借貸成本和高房價導(dǎo)致負(fù)擔(dān)能力下降,房地產(chǎn)市場出現(xiàn)重大“重置”。上周,抵押貸款購房申請較上年同期下降39%。

投資管理公司Infrastructure Capital Advisors創(chuàng)始人兼首席執(zhí)行官杰伊?哈特菲爾德(Jay Hatfield)表示,不僅僅是潛在的房主被拒之門外,機(jī)構(gòu)房地產(chǎn)投資者也感受到了利率上升帶來的痛苦。他在接受《財富》雜志采訪時表示,高利率和對經(jīng)濟(jì)衰退的擔(dān)憂導(dǎo)致銀行貸款“枯竭”,這使得收購新房產(chǎn)和/或房地產(chǎn)行業(yè)的公司面臨嚴(yán)峻挑戰(zhàn)。

他說:“現(xiàn)在有一小部分私人貸款仍在進(jìn)行,但貸款條件太苛刻了,無法再進(jìn)行杠桿收購(LBO)。杠桿收購指的是一家公司試圖用借來的錢收購另一家公司。還有像黑石集團(tuán)(Blackstone)這樣曾是買家的公司。他們現(xiàn)在更可能成為賣家而不是買家。因此,并購活動已經(jīng)終結(jié)了。”

Wealth Enhancement Group的卡恩說,放貸機(jī)構(gòu)不僅提出了更高的利率,而且他們在放貸前也進(jìn)行了更多的核保——或者說研究和風(fēng)險評估——以避免違約風(fēng)險。他指出,這是另一個例子,表明目前某些經(jīng)濟(jì)領(lǐng)域的凍結(jié)完全是對“信貸市場狀況的反映”。

他強(qiáng)調(diào)說:“在2021年以及18個月之前,人們以最快的速度地向任何領(lǐng)域大肆投資,因?yàn)楝F(xiàn)金太多了,但在2022年,信貸市場基本上凍結(jié)了。這就是為什么你會看到這些行業(yè)陷入凍結(jié)狀態(tài)。”

凍結(jié)的經(jīng)濟(jì)即將崩潰?

經(jīng)濟(jì)會慢慢解凍并避免衰退,還是利率上升和高通脹造成的裂縫即將破裂?這取決于你問誰。

卡恩說,他的“預(yù)感”是,我們將在“2023年下半年的某個時候”陷入經(jīng)濟(jì)衰退。“我認(rèn)為也許要到2024年,我們才能恢復(fù)正常。”他說。

他并不是唯一一個對前景持悲觀態(tài)度的人。許多頂級投資銀行預(yù)測,今年將出現(xiàn)“溫和的經(jīng)濟(jì)衰退”,一些預(yù)測者認(rèn)為,“嚴(yán)重的經(jīng)濟(jì)衰退”甚至“另一種類型的大蕭條”可能即將到來。

“從經(jīng)濟(jì)和宏觀角度來看,我們肯定會進(jìn)入一個越來越艱難的時期,那可能是大寫‘R’型衰退或小寫‘R’型衰退,但無論是哪種衰退,情況都會很糟糕。”阿林說。

雖然許多專家認(rèn)為經(jīng)濟(jì)衰退即將到來,但也有人認(rèn)為,這次衰退不會像過去的經(jīng)濟(jì)衰退那樣具有毀滅性,到2023年底和2024年,凍結(jié)的經(jīng)濟(jì)領(lǐng)域?qū)㈤_始解凍。Infrastructure Capital Advisors的哈特菲爾德表示,到今年下半年,“首次公開募股市場將恢復(fù)正常狀態(tài),并購和股市也將復(fù)蘇。”

他認(rèn)為,“后疫情的順風(fēng)”使勞動力市場保持健康狀態(tài)——特別是服務(wù)行業(yè),在疫情期間,許多企業(yè)難以招聘到員工——如果沒有大規(guī)模裁員使得消費(fèi)者支出大幅下滑,經(jīng)濟(jì)不太可能出現(xiàn)嚴(yán)重衰退。他還指出,盡管去年利率飆升,但住房庫存接近歷史最低點(diǎn),他認(rèn)為這將使房地產(chǎn)領(lǐng)域全年都實(shí)現(xiàn)解凍。

他表示:“不過,我們需要美聯(lián)儲暫停[加息],美國的國內(nèi)生產(chǎn)總值可能會出現(xiàn)一兩個季度的負(fù)增長,但不會陷入嚴(yán)重的經(jīng)濟(jì)衰退。”(財富中文網(wǎng))

譯者:中慧言-王芳

After years of cheap money helped fuel the rise of speculative investing and profitless business models in the U.S. over the past decade, stubborn inflation has forced the Federal Reserve to increase interest rates faster than ever before in 2022. Now, a new era of higher borrowing costs and more cautious lenders—coupled with slowing growth and recession fears—has frozen once-red hot segments of the U.S. economy.

The initial public offering (IPO) market is essentially shut; tech companies are laying off workers and pausing hiring; the housing market is experiencing a “reset” after years of booming growth; and the venture capital (VC) space has slowed dramatically, with private market valuations tumbling.

But despite the freeze in key sectors—and consistent doomsday predictions from Wall Street—the economy as a whole has continued to grow alongside the resilient labor market. In the fourth quarter of last year, U.S. gross domestic product (GDP) rose at a 2.9% annualized rate, topping analysts’ forecasts. And the unemployment rate came in near pre-pandemic lows at 3.5% in December.

Many economists are predicting that will change this year, however. Morgan Stanley’s chief U.S. economist Ellen Zentner said this week that annualized GDP growth will fall to just 0.2% in the first quarter, while Wells Fargo expects a drop to 0.4%. And some CEOs, billionaire investors, and investment banks believe an outright recession is on the way.

It’s still unclear whether key frozen aspects of the economy will eventually crack under the weight of rising interest rates—sparking a recession—or if the deep freeze will thaw—enabling slow, but positive growth. But credit markets could hold the answer.

“When credit markets pull back, and you’re unable to get financing for transactions or for investment, that’s when things freeze,” Jim Cahn, chief investments and business development officer at Wealth Enhancement Group, a wealth management firm, told Fortune. “Credit is the secret. It’s the fuel of growth. And it’s always been the fuel of growth, since the credit markets evolved 400 years ago at the beginning of the industrial revolution.”

The freezing and frozen segments of the economy

A new era of higher interest rates, inflation, and recession fears have led various segments of the U.S. economy to slow dramatically over the past year.

Venture Capital

The VC space, for example, was supercharged throughout the pandemic. In 2021, global VC funding volume reached a record $681 billion, more than double 2019’s figures.

“[A] growth-at-all-cost mindset fueled by cheap capital in 2020 and 2021 and exploding investor interest caused by a fear of missing out (FOMO) led to large investments into startups across all stages,” Alex Warfel, a PitchBook analyst, explained in a Friday note.

But in 2022, with interest rates rising, there was a 35% decline in VC investment to $445 billion, according to Crunchbase. Warfel said the days of “sky-high valuations for startups and easy fundraising opportunities” are gone, sentiment in the VC space has been “crushed,” and capital has dried up. To his point, the estimated amount of capital demanded by U.S. startups outpaced the amount supplied by $42.8 billion in the fourth quarter, according to PitchBook data.

Logan Allin, founder of Fin Capital, a fintech-focused VC and private equity firm, told Fortune that he doesn’t see the VC space recovering fully until 2024 due in part to the credit crunch, and he argued that for tech startups, 2023 could be a particularly challenging year.

“Our view is that 2023 is going to continue to be a year of extremely acute pain, and actually more painful than 2022 from both a private markets and public equity perspective in tech,” he said.

Allin added the sharp downturn in the market should be a “bit of a wake up call” for VC investors who developed irresponsible habits during the pandemic, failing to do proper due diligence for their investments. He gave the example of the now-defunct crypto exchange, FTX, which he “passed on” because they didn’t get past basic “checklist items” in the due diligence process, including not allowing an independent auditor to look at their financials. But other venture capitalists invested millions in the firm without even looking at their books.

“They were asking for financials and the team at FTX was sending them excel spreadsheets,” he said. “It was just absurd.”

But now, with interest rates rising and many lesser VCs going out of business, Allin believes the market will return to a more rigorous investing approach.

“I think it will be a much healthier, more sustainable venture capital environment now, because we’re investing in valuations and multiples that make sense and that allow the company to grow into them in a much better way,” he said. “It’s a true return to fundamentals. It is a refocusing on real diligence.”

IPOs

When U.S. interest rates were near zero and consumers were flush with cash from stimulus checks during the pandemic, the IPO market experienced a similar surge to the VC space.

In 2021 alone there were a record 1,033 new public listings in the U.S. But in 2022—with interest rates rising and the S&P 500 sinking roughly 20%—there was a 50% reduction in the number of IPOs compared, according to EY’s 2022 Global IPO Trends Report. And in the Americas, the drop was even more pronounced, with the number of IPOs falling 86% last year versus 2021, while total proceeds sank 96% over the same period.

“Deal activity and volume came down precipitously throughout 2022. IPOs were completely shuttered,” Allin said. “There was very little public market appetite for anything, even those companies that were potentially profitable.”

This year, Allin said he sees just a “sliver of an IPO window,” and only for firms that can prove their ability to make money.

“Otherwise, they’re going to trade significantly down, as any of the companies that went public last year or in 2021 did,” he said. “We still have inflation, high interest rates, geopolitical uncertainty, and significant volatility, and that does not create a warm market for IPOs.”

Housing

U.S. home prices soared over 45% between the second quarter of 2020 and the third quarter of last year, as low interest rates and work-from-home trends fueled a housing market boom. But rising interest rates have pushed the averaged 30-year fixed mortgage rate—the most common type in the U.S.—from 3.45% in February of 2020 to just over 6.1% today.

The higher borrowing costs and high home prices have led to an affordability crunch and a major “reset” in the housing market. Mortgage purchase applications were down 39% from a year ago last week.

It’s not just prospective homeowners who are feeling shut out—institutional real estate investors are feeling the pain from rising interest rates as well, according to Jay Hatfield, founder and CEO of the investment management firm Infrastructure Capital Advisors. Higher rates and recession fears have caused lending from banks to “dry up,” he told Fortune, making acquiring new properties—and/or companies in the real estate sector—a challenge.

“There’s a little bit of private lending going on, but it’s at terms that are too onerous to do LBOs [leveraged buyouts] anymore,” he said, referring to when one company tries to buy another company using borrowed money. “And then also, the companies that were buyers like Blackstone. They’re more likely to be sellers than buyers now. So M&A activity has dried up.”

Cahn of Wealth Enhancement Group says that lenders are not only offering much higher interest rates, but they’re also doing a lot more underwriting—or research and risk assessment—before lending money to avoid default risk. He noted that it’s another example that the current freeze in some sectors of the economy is all a “reflection of what’s going on in the credit markets.”

“In 2021, and 18 months before, people were just throwing money at anything as fast as they could because there was so much cash, but in 2022, the credit markets basically froze up,” he emphasized. “And that’s why you’re seeing these industries freeze.”

The frozen economy that’s about to crack?

Will the economy slowly thaw out and avoid a recession, or are the cracks caused by rising interest rates and high inflation about to rupture? That depends on who you ask.

Cahn said his “hunch” is that we’ll have a recession “sometime in the back half of 2023. “I think it’s really, you know, maybe 2024, before we’re back in business as usual,” he said.

He’s not the only one with a pessimistic outlook. Many top investment banks are forecasting a “mild recession” this year, and some forecasters have argued that “severe recession” or even “another variant of a Great Depression” could be on the way.

“We’re definitely going to enter into a harder and harder period from an economic and macro standpoint, that may be a capital “R” recession or lowercase “r” recession, but it’s going to be bad,” Allin said.

While many experts believe a recession is on the way, some argue it won’t be as devastating as past downturns, and the frozen sectors of the economy will begin to unfreeze by the end of 2023 and into 2024. Infrastructure Capital Advisors’ Hatfield said that by the second half of this year “we’ll have a more normal IPO market and a recovery M&A and stock market.”

He argued that “post pandemic tailwinds” have kept the labor market healthy—particularly in the services sector where so many businesses struggled to find workers during the pandemic—and without wide-spread layoffs that crush consumer spending, it’s unlikely there will be a serious downturn in the economy. He also noted that despite the rapid rise in interest rates last year, housing inventories are near an all-time low which he believes will allow that sector to unfreeze throughout the year.

“We need the Fed to pause [interest rate hikes] though,” he said. “And we might get a negative quarter or two [of GDP], but we don’t think we’re gonna have a significant recession.”