美國月光族的人數幾乎達到了疫情初期、封控、停業和大眾恐慌期間的最高水平。

PYMNTS的最新版《新現實調查:月光族報告》(New Reality Check: The Paycheck-to-Paycheck Report)顯示,2022年12月,約64.4%(1.66億)的美國成年人表示,每到月底就會分文不剩,略低于2020年3月65.7%的月光族比例。

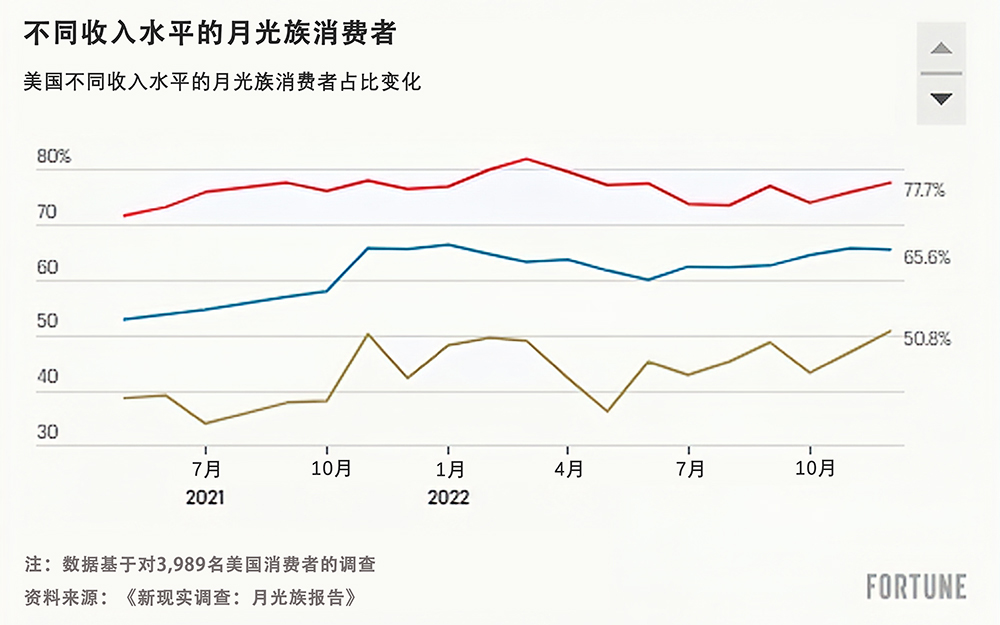

2021年底也有約930萬月光族。但這一次,高收入者也未能幸免:新增的約800萬勉強維持生計的美國人來自高收入階層。PYMNTS的調查顯示,12月,約50.8%收入超過10萬美元的美國人表示自己是月光族。

去年12月,美國高收入月光族的數量,較2021年12月的42%增長了9個百分點。相比之下,去年,美國中低收入月光族的比例相對穩定。

報告發現:“然而,隨著物價持續上漲削弱人們的購買力,越來越多消費者發現更難償還每個月的債務。高收入消費者也感到捉襟見肘,去年有越來越多收入者變成了月光族。”

為什么現在美國高收入群體處境更艱難?持續高通脹肯定是原因之一,但近在眼前的經濟衰退、高利率、金融市場波動和白領裁員,也對高收入者產生了影響。

在通脹方面,據蓋洛普(Gallup)9月發布的調查報告顯示,大部分美國人(56%)表示,物價上漲加劇了家庭的財務困難。在經濟周期早期,通脹上漲問題主要集中在燃料和二手車價格方面。這對于黑人、拉丁裔和中產家庭的影響更大。

例如,紐約聯邦儲備銀行(Federal Reserve Bank of New York)的研究顯示,2021年,美國中產階層面臨的通脹率最高,主要是因為交通成本上漲。但隨著通貨膨脹向其他行業蔓延并產生更大影響,包括食品和消費品等,通脹對中產家庭產生的過大影響也有所減少。

PYMNTS研究發現,盡管美國勉強維持生計的人數眾多,但消費者對今年的財務前景持相當樂觀的態度。約40%的美國月光族預計2023年,其收入能夠追上通脹,原因包括加薪和額外收入來源等。

同樣有約40%的美國人預計今年個人財務狀況會有所好轉,比2022年7月33%的樂觀者占比提高了7個百分點。(財富中文網)

翻譯:劉進龍

審校:汪皓

美國月光族的人數幾乎達到了疫情初期、封控、停業和大眾恐慌期間的最高水平。

PYMNTS的最新版《新現實調查:月光族報告》(New Reality Check: The Paycheck-to-Paycheck Report)顯示,2022年12月,約64.4%(1.66億)的美國成年人表示,每到月底就會分文不剩,略低于2020年3月65.7%的月光族比例。

2021年底也有約930萬月光族。但這一次,高收入者也未能幸免:新增的約800萬勉強維持生計的美國人來自高收入階層。PYMNTS的調查顯示,12月,約50.8%收入超過10萬美元的美國人表示自己是月光族。

去年12月,美國高收入月光族的數量,較2021年12月的42%增長了9個百分點。相比之下,去年,美國中低收入月光族的比例相對穩定。

報告發現:“然而,隨著物價持續上漲削弱人們的購買力,越來越多消費者發現更難償還每個月的債務。高收入消費者也感到捉襟見肘,去年有越來越多收入者變成了月光族。”

為什么現在美國高收入群體處境更艱難?持續高通脹肯定是原因之一,但近在眼前的經濟衰退、高利率、金融市場波動和白領裁員,也對高收入者產生了影響。

在通脹方面,據蓋洛普(Gallup)9月發布的調查報告顯示,大部分美國人(56%)表示,物價上漲加劇了家庭的財務困難。在經濟周期早期,通脹上漲問題主要集中在燃料和二手車價格方面。這對于黑人、拉丁裔和中產家庭的影響更大。

例如,紐約聯邦儲備銀行(Federal Reserve Bank of New York)的研究顯示,2021年,美國中產階層面臨的通脹率最高,主要是因為交通成本上漲。但隨著通貨膨脹向其他行業蔓延并產生更大影響,包括食品和消費品等,通脹對中產家庭產生的過大影響也有所減少。

PYMNTS研究發現,盡管美國勉強維持生計的人數眾多,但消費者對今年的財務前景持相當樂觀的態度。約40%的美國月光族預計2023年,其收入能夠追上通脹,原因包括加薪和額外收入來源等。

同樣有約40%的美國人預計今年個人財務狀況會有所好轉,比2022年7月33%的樂觀者占比提高了7個百分點。(財富中文網)

翻譯:劉進龍

審校:汪皓

The number of Americans living paycheck to paycheck has almost reached the high levels seen during the onset of the COVID-19 pandemic, during the days of lockdowns, business closings, and mass panic.

About 64.4%, or 166 million, of U.S. adults reported having no money left over at the end of the month in December 2022—just shy of the 65.7% who reported living paycheck to paycheck in March 2020, according to the latest edition of PYMNTS’?New Reality Check: The Paycheck-to-Paycheck Report.

That’s also about 9.3 million more people who ended 2021 living paycheck to paycheck. But this time, high-income Americans are not immune: Approximately 8 million of those newly scraping-by Americans are from higher income brackets. About 50.8% of those earning over $100,000 reported living paycheck to paycheck in December, according to the PYMNTS’ research.

The number of high-income Americans living paycheck to paycheck last December was up nine percentage points from the 42% who reported similar struggles in December 2021. In contrast, the share of middle- and lower-income Americans who reported living paycheck to paycheck remained relatively stable over the past year.

“As rising prices continue to weaken their spending power, however, a growing number of consumers will find it harder to meet their monthly obligations,” the report finds. “High-income consumers are also feeling the financial strain, increasingly joining the ranks of those living paycheck to paycheck in the past year.”

But why are higher-income Americans struggling more now? Persistent high inflation is certainly part of the equation, but a looming recession, high interest rates, volatile financial markets, and white-collar layoffs are also hitting higher-income earners.

When it comes to inflation, a majority of Americans, 56%, reported price increases were causing financial hardship for their household, according to a Gallup survey published in September. Earlier in the cycle, much of the inflation spikes were concentrated in fuel and used-car prices. And that had more of an effect on Blacks, Hispanics, and middle-class households.

It was middle-income Americans,?for example, who experienced the highest rates of inflation in 2021, particularly because of the spike in transportation costs, according to research by the Federal Reserve Bank of New York. But as inflation has permeated into other sectors more heavily—including food and consumer goods—the disproportionate effect on middle-class households has also narrowed.

Despite the high number of Americans struggling to cover their living expenses, consumers are fairly optimistic about their financial futures this year, the PYMNTS’ research finds. About 40% of Americans living paycheck to paycheck expect their incomes to keep up with inflation in 2023, citing raises and additional sources of income.

Similarly, about four in 10 Americans expect their personal finances to improve this year, up seven percentage points from 33% who reported such optimism in July 2022.