美聯(lián)儲(chǔ)主席杰羅姆·鮑威爾(Jerome Powell)在9月份的聯(lián)邦公開市場(chǎng)委員會(huì)新聞發(fā)布會(huì)上被要求澄清他在幾個(gè)月前說美國房地產(chǎn)市場(chǎng)將經(jīng)歷"重啟"的含義。他的回答是什么呢?我們已經(jīng)進(jìn)入了一個(gè)“艱難的[房產(chǎn)]修正時(shí)期”,將看到美國房地產(chǎn)市場(chǎng)過渡到供求都更“平衡”的時(shí)期。

然而,鮑威爾仍然沒有回應(yīng)這一棘手問題:美國房價(jià)會(huì)下跌嗎?

快進(jìn)到本周,我們終于更好地了解了美聯(lián)儲(chǔ)對(duì)房價(jià)的看法。周四,美聯(lián)儲(chǔ)理事克里斯托弗·沃勒(Christopher Waller)在肯塔基大學(xué)對(duì)聽眾表示,美國房價(jià)有可能出現(xiàn)“大幅”下跌。

沃勒對(duì)聽眾說:“雖然這次(房地產(chǎn))市場(chǎng)修正可能相當(dāng)溫和,但我不能排除在市場(chǎng)恢復(fù)正常之前,需求和房價(jià)出現(xiàn)更大幅度下跌的可能性。”

這是美聯(lián)儲(chǔ)官員首次承認(rèn),正在進(jìn)行的樓市修正可能導(dǎo)致全美房價(jià)下跌。沃勒還承認(rèn),房價(jià)修正最終可能不僅僅是小幅下跌。他說,這可能是一次“大幅[房價(jià)]修正”。

“盡管房價(jià)有大幅回調(diào)的風(fēng)險(xiǎn),但有幾個(gè)因素有助于減輕我對(duì)這種回調(diào)會(huì)引發(fā)一波抵押貸款違約潮并可能破壞金融體系穩(wěn)定的擔(dān)憂。”沃勒說。“一是由于21世紀(jì)10年代抵押貸款承銷相對(duì)緊縮,如今抵押貸款借款人的信用評(píng)分普遍高于上次住房修正之前的水平。此外,上一次修正的經(jīng)驗(yàn)告訴我們,大多數(shù)借款人只有在他們的收入受到負(fù)面沖擊,以及抵押貸款資不抵債時(shí)才會(huì)違約。”

就言外之意而言,沃勒的表述似乎有四層含義:1. 房地產(chǎn)市場(chǎng)的修正可能是“溫和的”;2. 有一種情況是,房地產(chǎn)市場(chǎng)的修正并不溫和;3. 房價(jià)大幅下跌是有可能出現(xiàn)的;4. 如果房價(jià)大幅下跌,也不會(huì)引發(fā)2008年那樣的止贖潮或金融崩潰。

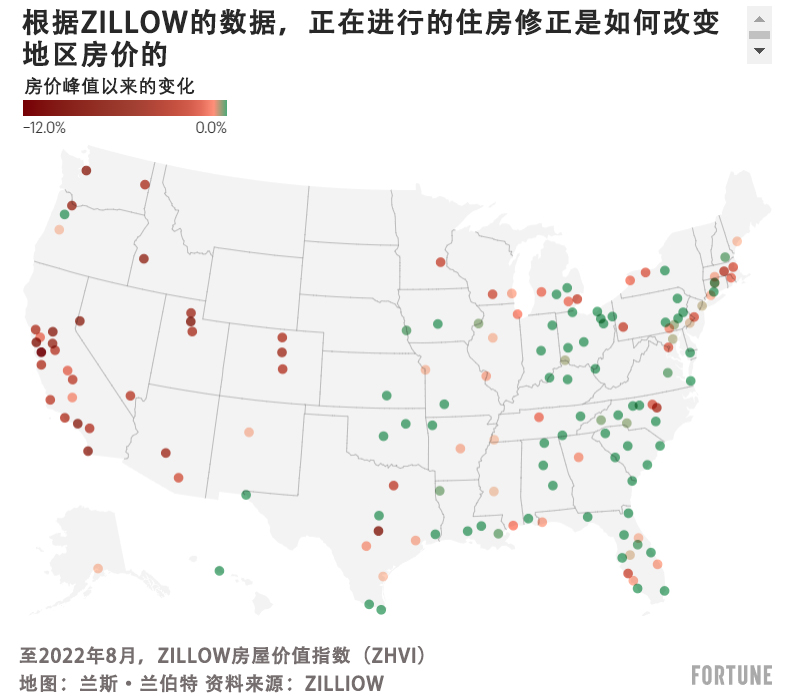

當(dāng)然,在美聯(lián)儲(chǔ)承認(rèn)房價(jià)可能下跌之前,很多市場(chǎng)的房價(jià)已經(jīng)開始下跌。在約翰伯恩斯房地產(chǎn)咨詢公司(John Burns Real Estate Consulting)追蹤的148個(gè)主要地區(qū)房地產(chǎn)市場(chǎng)中,98個(gè)市場(chǎng)的房屋價(jià)值已從2022年的峰值下跌。在11個(gè)市場(chǎng)中,伯恩斯房屋價(jià)值指數(shù)跌幅已經(jīng)超過5%。

“美國一些地區(qū)的房價(jià)甚至已經(jīng)出現(xiàn)了下跌,尤其是那些在過去兩年中房價(jià)漲幅最大的地區(qū)。據(jù)報(bào)道,許多建筑商正在降低標(biāo)價(jià),并提供更大的優(yōu)惠力度。”沃勒告訴聽眾。

到目前為止,由抵押貸款利率飆升推動(dòng)的房地產(chǎn)市場(chǎng)修正對(duì)以下兩組市場(chǎng)中的一組打擊最為嚴(yán)重。

第一組是高成本的科技中心。其中包括舊金山(較2022年的峰值下跌7.8%)、圣何塞(較2022年的峰值下跌9%)和西雅圖(較2022年的峰值下跌6.2%)等市場(chǎng)。不僅高端房地產(chǎn)市場(chǎng)對(duì)利率更加敏感,科技領(lǐng)域亦是如此。

另一組是奧斯汀(較2022年的峰值下跌6.2%)、博伊西(較2022年的峰值下跌5.3%)和鳳凰城(較2022年的峰值下跌4.4%)等泡沫市場(chǎng)。在疫情期間的房地產(chǎn)熱潮中,這些泡沫市場(chǎng)的房價(jià)遠(yuǎn)超歷史上當(dāng)?shù)鼐用袷杖肟梢猿惺艿姆秶8鶕?jù)穆迪分析公司的數(shù)據(jù),奧斯汀和鳳凰城的房價(jià)分別被“高估”了61%和57%。從歷史上看,嚴(yán)重“高估”的房地產(chǎn)市場(chǎng)在房地產(chǎn)市場(chǎng)修正期間最易受到房價(jià)下跌的影響。(財(cái)富中文網(wǎng))

譯者:中慧言-王芳

美聯(lián)儲(chǔ)主席杰羅姆·鮑威爾(Jerome Powell)在9月份的聯(lián)邦公開市場(chǎng)委員會(huì)新聞發(fā)布會(huì)上被要求澄清他在幾個(gè)月前說美國房地產(chǎn)市場(chǎng)將經(jīng)歷"重啟"的含義。他的回答是什么呢?我們已經(jīng)進(jìn)入了一個(gè)“艱難的[房產(chǎn)]修正時(shí)期”,將看到美國房地產(chǎn)市場(chǎng)過渡到供求都更“平衡”的時(shí)期。

然而,鮑威爾仍然沒有回應(yīng)這一棘手問題:美國房價(jià)會(huì)下跌嗎?

快進(jìn)到本周,我們終于更好地了解了美聯(lián)儲(chǔ)對(duì)房價(jià)的看法。周四,美聯(lián)儲(chǔ)理事克里斯托弗·沃勒(Christopher Waller)在肯塔基大學(xué)對(duì)聽眾表示,美國房價(jià)有可能出現(xiàn)“大幅”下跌。

沃勒對(duì)聽眾說:“雖然這次(房地產(chǎn))市場(chǎng)修正可能相當(dāng)溫和,但我不能排除在市場(chǎng)恢復(fù)正常之前,需求和房價(jià)出現(xiàn)更大幅度下跌的可能性。”

這是美聯(lián)儲(chǔ)官員首次承認(rèn),正在進(jìn)行的樓市修正可能導(dǎo)致全美房價(jià)下跌。沃勒還承認(rèn),房價(jià)修正最終可能不僅僅是小幅下跌。他說,這可能是一次“大幅[房價(jià)]修正”。

“盡管房價(jià)有大幅回調(diào)的風(fēng)險(xiǎn),但有幾個(gè)因素有助于減輕我對(duì)這種回調(diào)會(huì)引發(fā)一波抵押貸款違約潮并可能破壞金融體系穩(wěn)定的擔(dān)憂。”沃勒說。“一是由于21世紀(jì)10年代抵押貸款承銷相對(duì)緊縮,如今抵押貸款借款人的信用評(píng)分普遍高于上次住房修正之前的水平。此外,上一次修正的經(jīng)驗(yàn)告訴我們,大多數(shù)借款人只有在他們的收入受到負(fù)面沖擊,以及抵押貸款資不抵債時(shí)才會(huì)違約。”

就言外之意而言,沃勒的表述似乎有四層含義:1. 房地產(chǎn)市場(chǎng)的修正可能是“溫和的”;2. 有一種情況是,房地產(chǎn)市場(chǎng)的修正并不溫和;3. 房價(jià)大幅下跌是有可能出現(xiàn)的;4. 如果房價(jià)大幅下跌,也不會(huì)引發(fā)2008年那樣的止贖潮或金融崩潰。

當(dāng)然,在美聯(lián)儲(chǔ)承認(rèn)房價(jià)可能下跌之前,很多市場(chǎng)的房價(jià)已經(jīng)開始下跌。在約翰伯恩斯房地產(chǎn)咨詢公司(John Burns Real Estate Consulting)追蹤的148個(gè)主要地區(qū)房地產(chǎn)市場(chǎng)中,98個(gè)市場(chǎng)的房屋價(jià)值已從2022年的峰值下跌。在11個(gè)市場(chǎng)中,伯恩斯房屋價(jià)值指數(shù)跌幅已經(jīng)超過5%。

“美國一些地區(qū)的房價(jià)甚至已經(jīng)出現(xiàn)了下跌,尤其是那些在過去兩年中房價(jià)漲幅最大的地區(qū)。據(jù)報(bào)道,許多建筑商正在降低標(biāo)價(jià),并提供更大的優(yōu)惠力度。”沃勒告訴聽眾。

到目前為止,由抵押貸款利率飆升推動(dòng)的房地產(chǎn)市場(chǎng)修正對(duì)以下兩組市場(chǎng)中的一組打擊最為嚴(yán)重。

第一組是高成本的科技中心。其中包括舊金山(較2022年的峰值下跌7.8%)、圣何塞(較2022年的峰值下跌9%)和西雅圖(較2022年的峰值下跌6.2%)等市場(chǎng)。不僅高端房地產(chǎn)市場(chǎng)對(duì)利率更加敏感,科技領(lǐng)域亦是如此。

另一組是奧斯汀(較2022年的峰值下跌6.2%)、博伊西(較2022年的峰值下跌5.3%)和鳳凰城(較2022年的峰值下跌4.4%)等泡沫市場(chǎng)。在疫情期間的房地產(chǎn)熱潮中,這些泡沫市場(chǎng)的房價(jià)遠(yuǎn)超歷史上當(dāng)?shù)鼐用袷杖肟梢猿惺艿姆秶8鶕?jù)穆迪分析公司的數(shù)據(jù),奧斯汀和鳳凰城的房價(jià)分別被“高估”了61%和57%。從歷史上看,嚴(yán)重“高估”的房地產(chǎn)市場(chǎng)在房地產(chǎn)市場(chǎng)修正期間最易受到房價(jià)下跌的影響。(財(cái)富中文網(wǎng))

譯者:中慧言-王芳

Fed Chair Jerome Powell was asked at the FOMC press conference in September to clarify what he meant when he said a few months earlier the U.S. housing market would “reset.” His response? We’ve entered into a “difficult [housing] correction” that will see the U.S. housing market transition to a more “balanced” market for buyers and sellers alike.

However, Powell still hasn’t addressed the elephant in the room: Will U.S. home prices fall?

Fast forward to this week, and we finally got a better understanding of the central bank’s view on home prices: On Thursday, Fed Governor Christopher Waller told an audience at the University of Kentucky that it’s possible we could see a “material” drop in U.S. home prices.

“While this [housing] market correction could be fairly mild, I cannot dismiss the possibility of a much larger drop in demand and house prices before the market normalizes,” Waller told the crowd.

That’s the first time a Fed official has acknowledged that the ongoing housing correction could see home prices fall at a national level. Waller also admitted the home price correction might end up being more than a small tick down. It could, he says, be a “material [home price] correction.”

“Despite the risk of a material correction in house prices, several factors help reduce my concern that such a correction would trigger a wave of mortgage defaults and potentially destabilize the financial system,” Waller said. “One is that because of relatively tight mortgage underwriting in the 2010s, the credit scores of mortgage borrowers today are generally higher than they were prior to that last housing correction. Also, the experience of the last correction taught us that most borrowers only default when they experience a negative shock to their incomes in addition to being underwater on their mortgage.”

Reading between the lines, it looks like Waller is making four points. 1. The housing market correction could be “mild.” 2. There’s a scenario where the housing market correction isn’t mild 3. A sharp home price decline is possible. 4. If a sharp home price drop manifests, it wouldn’t trigger a 2008-type foreclosure wave or financial collapse.

Of course, the Fed acknowledging that home prices could fall comes after, well, home prices in many markets have already started to fall. Among the 148 major regional housing markets tracked by John Burns Real Estate Consulting, 98 markets have seen home values fall from their 2022 peaks. In 11 markets, the Burns Home Value Index has already dropped by more than 5%.

"Prices have even fallen in some areas of the country, especially those that saw the largest increases over the previous two years. And many builders are reportedly cutting their list prices and offering larger incentives," Waller told the crowd.

So far, the housing correction—which is driven by spiking mortgage rates—is hitting one of two markets the hardest.

The first group are high-cost tech hubs. That includes markets like San Francisco (down 7.8% from its 2022 peak), San Jose (down 9%), and Seattle (down 6.2%). Not only are their high-end real estate markets more rate sensitive, but so are their tech sectors.

The other group are bubbly markets like Austin (down 6.2%), Boise (down 5.3%), and Phoenix (down 4.4%). During the Pandemic Housing Boom, those bubbly markets saw home prices reach levels well beyond what local incomes would historically support. According to Moody's Analytics, Austin and Phoenix are "overvalued" by 61% and 57%, respectively. Historically speaking, significantly "overvalued" housing markets are the most vulnerable to home price cuts during a housing correction.