在新冠疫情爆發的第二年,美國大學生及其家人繼續為大學支付的費用減少了。

根據Sallie Mae和Ipsos的最新報告,在2021-22學年,美國家庭支付的大學平均費用連續第二年下降。這份年度報告是基于益普索(Ipsos)最近對952名本科生和953名大學生家長的調查得出的。

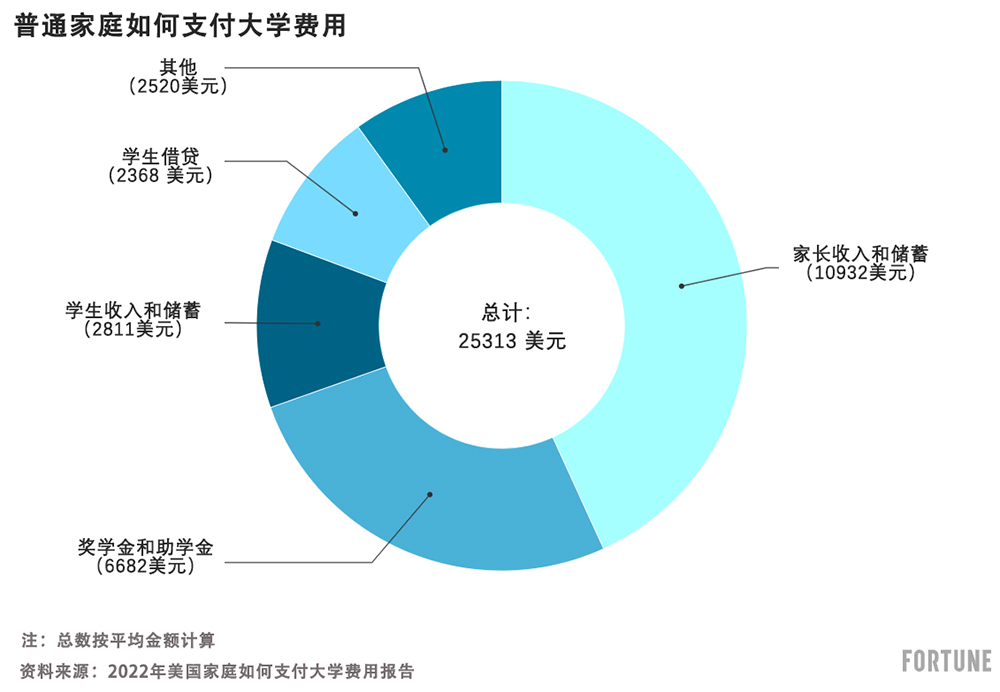

去年,家長和大學生平均支付大學費用25,313美元,包括學費、雜費、食宿費、交通費和技術費用。該報告稱,這比2020-21學年家庭支付的費用下降了約4%,與2017年的平均支出相比下降了4%。

然而,盡管在過去的兩年中,美國家庭支付的大學費用略有下降,但平均而言,上一學年美國家庭支付的大學費用比十年前增加了20%。

總體而言,大多數學院和大學的學費持續上漲——今年秋天還將繼續上漲。根據美國大學理事會(College Board)的數據,在2021-22學年,四年制公立大學的州內住校學生平均總費用為每年27,330美元,州外學生為44,150美元。四年制私立大學平均總費用為每年55,800美元。但有幾所學校已經提高了2022-23學年的學費,這讓許多家庭感到擔憂。

盡管近年來的聯邦學生資助免費申請(Free Application for Federal Student Aid)流程發生了變化,但家庭繼續通過自掏腰包(儲蓄和收入)的方式來支付大部分大學費用。事實上,只有68%的家庭在上一學年提交了聯邦學生資助免費申請表格。

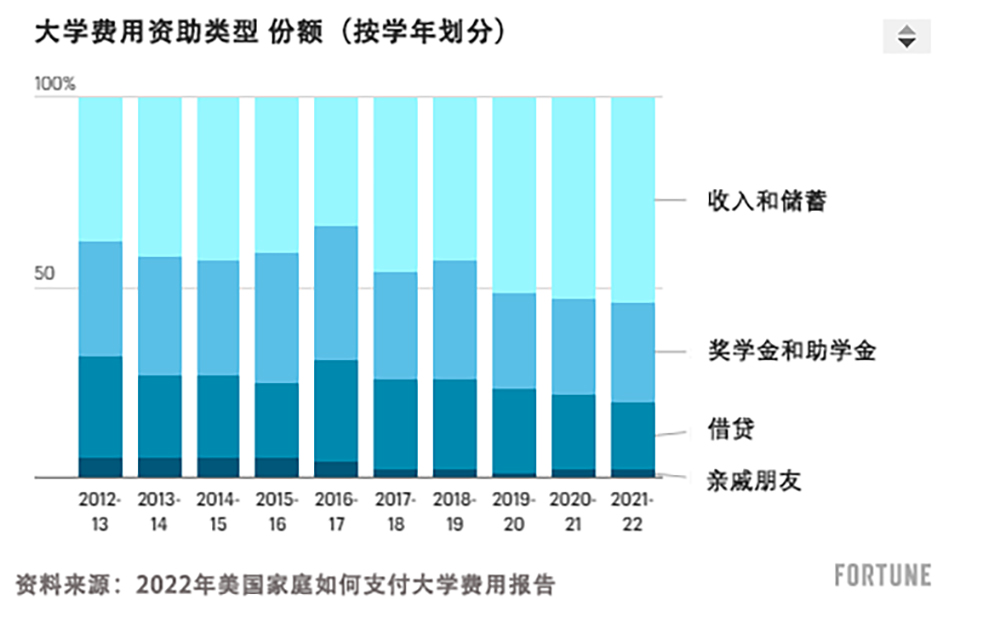

在過去的十年里,越來越多的家庭承擔了更多的大學費用,對獎學金和貸款的依賴越來越少。在2012-13學年,大約38%的大學費用來自家庭儲蓄,30%來自獎學金和助學金,27%來自貸款,5%來自親戚和朋友。

但在去年,家庭儲蓄和收入占典型大學總資金的一半以上(54%),而只有26%來自助學金和獎學金形式的“免費資金”。大約18%來自貸款,平均而言,親戚和朋友的資金占總資金的2%。

在許多情況下,家庭和學生都在采取措施降低大學費用。在Sallie Mae調查的家庭中,約有60%的家庭說他們有獎學金資助,這些獎學金通常來自學生就讀的大學。但許多人沒有最大化利用助學金。

雖然大多數家庭和學生提交了聯邦學生資助免費申請表格,但許多人沒有提交表格。最常見的原因是什么?他們認為他們的收入太高了。但專家表示,除非父母年收入超過35萬美元,并且只有一名學生就讀于州內公立大學,否則他們應該提交聯邦學生資助免費申請表格。

此外,許多家庭仍然沒有盡早提交聯邦學生資助免費申請表格。據報道,當被問及這個問題時,75%的家庭表示不知道從10月1日開始就可以提交聯邦學生資助免費申請表格。但提早申請,獲得資助的機會就更大。如果你等待了一段時間,能夠申請的助學金資金可能就會減少。

然而,報告稱,絕大多數接受調查的家庭(88%)仍然認為,獲得大學學位可以創造機會,是“對學生未來的投資”。此外,約有六成(61%)家庭表示,他們會送孩子去大學僅僅是為了社交和智力體驗——持這種觀點的人數達到了十年來的最高水平。(財富中文網)

譯者:中慧言-王芳

在新冠疫情爆發的第二年,美國大學生及其家人繼續為大學支付的費用減少了。

根據Sallie Mae和Ipsos的最新報告,在2021-22學年,美國家庭支付的大學平均費用連續第二年下降。這份年度報告是基于益普索(Ipsos)最近對952名本科生和953名大學生家長的調查得出的。

去年,家長和大學生平均支付大學費用25,313美元,包括學費、雜費、食宿費、交通費和技術費用。該報告稱,這比2020-21學年家庭支付的費用下降了約4%,與2017年的平均支出相比下降了4%。

然而,盡管在過去的兩年中,美國家庭支付的大學費用略有下降,但平均而言,上一學年美國家庭支付的大學費用比十年前增加了20%。

總體而言,大多數學院和大學的學費持續上漲——今年秋天還將繼續上漲。根據美國大學理事會(College Board)的數據,在2021-22學年,四年制公立大學的州內住校學生平均總費用為每年27,330美元,州外學生為44,150美元。四年制私立大學平均總費用為每年55,800美元。但有幾所學校已經提高了2022-23學年的學費,這讓許多家庭感到擔憂。

盡管近年來的聯邦學生資助免費申請(Free Application for Federal Student Aid)流程發生了變化,但家庭繼續通過自掏腰包(儲蓄和收入)的方式來支付大部分大學費用。事實上,只有68%的家庭在上一學年提交了聯邦學生資助免費申請表格。

在過去的十年里,越來越多的家庭承擔了更多的大學費用,對獎學金和貸款的依賴越來越少。在2012-13學年,大約38%的大學費用來自家庭儲蓄,30%來自獎學金和助學金,27%來自貸款,5%來自親戚和朋友。

但在去年,家庭儲蓄和收入占典型大學總資金的一半以上(54%),而只有26%來自助學金和獎學金形式的“免費資金”。大約18%來自貸款,平均而言,親戚和朋友的資金占總資金的2%。

在許多情況下,家庭和學生都在采取措施降低大學費用。在Sallie Mae調查的家庭中,約有60%的家庭說他們有獎學金資助,這些獎學金通常來自學生就讀的大學。但許多人沒有最大化利用助學金。

雖然大多數家庭和學生提交了聯邦學生資助免費申請表格,但許多人沒有提交表格。最常見的原因是什么?他們認為他們的收入太高了。但專家表示,除非父母年收入超過35萬美元,并且只有一名學生就讀于州內公立大學,否則他們應該提交聯邦學生資助免費申請表格。

此外,許多家庭仍然沒有盡早提交聯邦學生資助免費申請表格。據報道,當被問及這個問題時,75%的家庭表示不知道從10月1日開始就可以提交聯邦學生資助免費申請表格。但提早申請,獲得資助的機會就更大。如果你等待了一段時間,能夠申請的助學金資金可能就會減少。

然而,報告稱,絕大多數接受調查的家庭(88%)仍然認為,獲得大學學位可以創造機會,是“對學生未來的投資”。此外,約有六成(61%)家庭表示,他們會送孩子去大學僅僅是為了社交和智力體驗——持這種觀點的人數達到了十年來的最高水平。(財富中文網)

譯者:中慧言-王芳

During the second year of the pandemic, American college students and their families continued to pay less for the college experience.

The average cost families paid for college fell for the second year in a row during the 2021–22 academic school year, according to the latest How America Pays for College?report from Sallie Mae and Ipsos. The annual report is based on a recent survey of 952 undergraduate students and 953 parents of college students conducted by Ipsos.

Last year, parents and college students paid an average of $25,313 toward college costs, including tuition, fees, and room and board, as well as transportation costs and technology expenses. That’s down by about 4% from what families paid during the 2020–21 school year, and a 4% drop compared with the average spent in 2017, according to the report.

Yet despite the slight drop in college spending over the past two years, on average, families spent 20% more on college during the past school year than families did 10 years ago.

Overall, tuition costs have continued to tick up for most colleges and universities—and that’s set to continue this fall as well. The average total cost during the 2021–22 school year for a public four-year university for in-state students staying on campus was $27,330 a year and $44,150 for out-of-state students, according to the College Board. A year at a four-year private college cost an average of $55,800 for all expenses. But several schools have already increased prices for the 2022–23 school year, causing many families to worry.

Despite changes to the Free Application for Federal Student Aid (FAFSA) process in recent years, families continue to cover the bulk of college costs through out-of-pocket savings and income. In fact, only 68% of college families reported submitting a FAFSA form in the past school year.

Over the past decade, families have increasingly shouldered more college costs, depending less on scholarships and loans. During the 2012–13 school year, about 38% of funds came from savings, while 30% came from scholarships and grants, 27% from loans, and 5% from relatives and friends.

But last year, families’ savings and income accounted for over half (54%) of typical total college funding, while only 26% came from “free money” in the form of grants and scholarships. About 18% came from loans, and money from relatives and friends made up an average of 2% of funds.

In many cases, families and students are taking steps to reduce the cost of college. About 60% of families surveyed by Sallie Mae say they used scholarships, most commonly from the college the student attended. But many are leaving money on the table in the form of financial aid.

Although the majority of families and students submitted a FAFSA form, many did not. The most common reason? They believed their income was too high. But experts say that unless parents earn more than $350,000 a year and only have one student enrolled in an in-state public college, they should file a FAFSA form.

Additionally, many families are still not submitting their FAFSA form as early as possible. When asked, 75% of families are unaware the FAFSA is available beginning on Oct. 1, according to the report. But filing earlier gives families a better chance at getting aid. If you wait, there may be less financial aid money available.

Yet the vast majority of families surveyed (88%) still believe that earning a college degree creates opportunities and is an “investment in the student’s future,” according to the report. Further, roughly six in 10 families (61%) report they would send their student to college for the social and intellectual experiences alone—and that sentiment is at a 10-year high.