隨著世界各國央行繼續對抗不斷上升的通脹率,美元對大多數主要貨幣升值,其在整個2022年的走勢令人難以置信。

僅今年一年,美元兌日元匯率就上漲了15%,兌英鎊匯率上漲了10%,兌人民幣匯率上漲了5%。衡量美元兌其他16種主要貨幣匯率的《華爾街日報》美元指數(Dollar Index)今年上半年的表現是2010年以來最好的,年初至今漲幅超過10%。

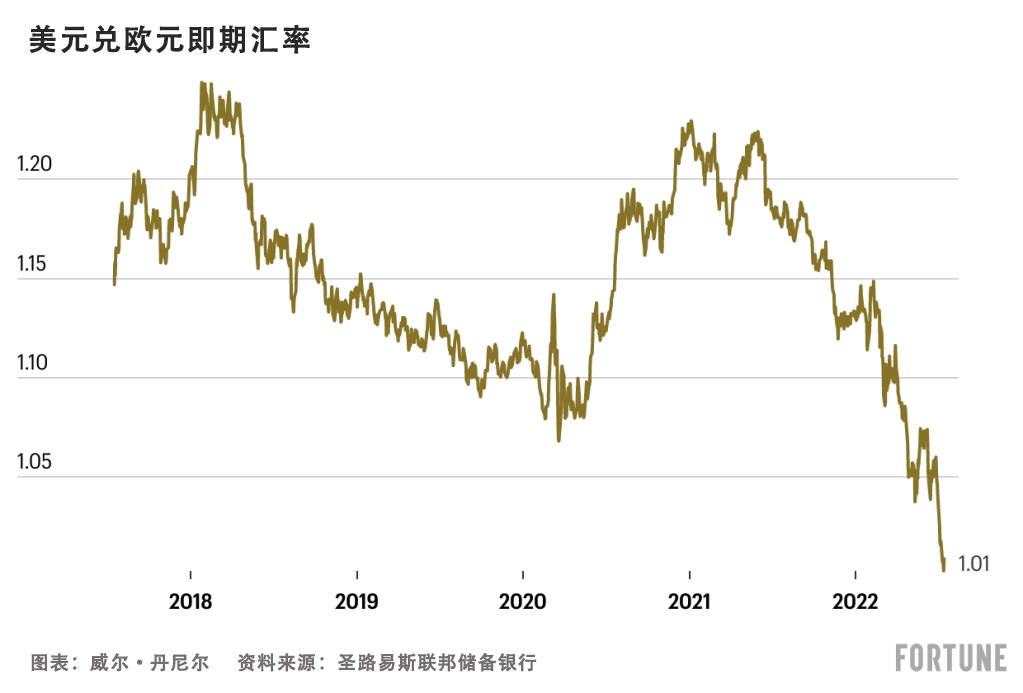

對于那些能夠買到廉價機票(帶著所有的行李通關)去歐洲的幸運的美國人來說,本月初,美元甚至在20年來第一次與歐元平起平坐。

美元升值意味著美國人可以享受特價國際旅行。雖然消費者價格繼續上漲,但美元走強可能有助于減少美國通脹率飆升帶來的影響。

但美元走強也給世界各國帶來一些毀滅性的影響,對今年剩余時間在海外開展業務的美國公司來說,這可能是一大阻力。

對許多投資者和消費者來說,仍有兩個亟待解決的問題:美元今年為何如此強勢,以及美元將何去何從?

多位華爾街首席投資官和策略師告訴《財富》雜志,一種推動美元走強的新趨勢已經出現,但大多數人認為,美元將在年底前開始下跌。以下是他們的看法。

美元為何如此強勢?

從歷史上看,匯率變動在很大程度上與相對利率和經濟實力有關。要想了解美元,專家們告訴《財富》雜志,只要看看美聯儲就知道了。美聯儲目前正以上世紀90年代以來前所未有的速度加息。

財富和投資管理公司Bailard的首席投資官埃里克·萊夫(Eric Leve)告訴《財富》雜志:“美元走強是因為美聯儲實施的貨幣緊縮政策是全球主要央行中最激進的。”

萊夫指出,美聯儲的加息已將政府債券的實際收益率(或債券投資者扣除通脹因素后的利息收益)推高至正值區域,這是多年來的首次。這使得美國債券對全球投資者更具吸引力,從而提高了美元的相對價值。

萊夫還認為,在通脹和衰退風險方面,美聯儲的加息使美國的經濟狀況比許多其他國家更好。

由于美聯儲,美國在很多方面都是“最干凈的臟襯衫”。

——BAILARD首席信息官埃里克·萊夫

美聯儲的舉措還有助于降低通脹預期(消費者和投資者的通脹預期),這使得美國對擔心消費者價格上漲的全球投資者來說更具吸引力。

投資研究公司CFRA research的首席投資策略師薩姆·斯托瓦爾(Sam Stovall)告訴《財富》雜志,美元的強勢得益于這種相對吸引力。他說,在擔憂全球經濟衰退的情況下,這對外國投資者來說是一種“避險”。

但在新冠肺炎疫情和俄烏沖突之后,也出現了一種影響全球貨幣相對強勢的新動態——自給自足。

當新冠肺炎疫情在2020年肆虐時,它引發了一場全球供應鏈的噩夢,加劇了從半導體到衛生紙等所有產品的短缺,并將大宗商品價格推至新高。標準普爾高盛綜合商品指數(S&P GSCI Index)是衡量全球原材料價格的廣泛指標,疫情以來,該指數已飆升了180%以上。

因此,世界上許多國家對其商品供應的保護力度加大,新一輪逆全球化浪潮已經大行其道。由于美國在能源和其他大宗商品供應方面相對自給自足,這種大宗商品保護主義導致美元升值。

俄烏沖突加劇了這一趨勢,因為歐洲的天然氣供應立即受到嚴重影響,導致天然氣價格在過去一年飆升了400%以上。這使得歐盟各國爭相滿足其能源需求,但迄今為止,計劃未能奏效。國際能源署(IEA)本周甚至警告說,歐盟需要立即削減天然氣需求,否則將面臨“漫長而艱難的冬天”。

歐洲能源危機和缺乏自給自足的最終結果是,在大宗商品價格居高不下的情況下,出口下降,進口增加。

宏觀數據分析公司Quant Insight的分析主管休?羅伯茨(Huw Roberts)告訴《財富》雜志,這相當于“貿易比率沖擊”,即進口價格相對于出口價格飆升。

他說:“如果你是能源進口國,那么這將造成嚴重的損害。但如果你是能源出口國,那么實際上你會受益。”

美國等能源出口較多、大宗商品供應更能實現自給自足的國家本幣升值,而歐盟等大宗商品無法實現自給自足的國家和地區本幣貶值。

強勢美元會帶來什么影響?

對于美國消費者而言,強勢美元不僅讓國際旅行更便宜;它還有助于降低通貨膨脹。

“在邊際上,美元走強在一定程度上限制了 [美國] 通脹,”Bailard的萊夫說。“由于美元走強,從國外購買商品,就像美國消費者傾向于做的那樣,變得便宜得多。所以我們實際上是在引入通貨緊縮。”

一些美國企業也受益于強勢美元,強勢美元降低了大宗商品價格。

Quant Insights的羅伯茨說:“因此,如果就制造業企業而言,他們購買的原材料以美元計價,而大宗商品價格正在下跌,那么強勢美元實際上對他們有利。”

然而,這些企業是例外。對大多數美國公司來說,美元走強是一種不受歡迎的逆風。

萊夫指出:“如果你想在海外銷售商品,那么強勢美元會讓你的商品更加昂貴,從而給美國企業的營收帶來負擔。”

此外,Northwestern Mutual Wealth Management Company的首席投資策略師布倫特·舒特(Brent Schutte)告訴《財富》雜志,當美國公司試圖將其海外收益匯回國內時,強勢美元意味著他們的收益比往年要少。

“當然,如果你在海外有很多以其他貨幣計值的獲利,當你將它們轉換回來時,可能會造成獲利虧損。”舒特說。國際商用機器公司(IBM)、強生公司(Johnson and Johnson)和奈飛公司(Netflix)等公司的季度財務業績在本財報季已經受到沖擊。

eToro全球市場策略師本·萊德勒(Ben Laidler)上周對《紐約時報》表示,美元升值可能會使擁有大型國際業務的標準普爾500指數成份股公司今年收益減少多達1000億美元。不過,舒特指出,這些“損失”更像是一種“會計慣例”。

他說:“我通常認為,投資者,尤其是長期投資者,會識破這一點。”

強勢美元在美國以外帶來嚴重影響,這使得低收入國家(國債以美元計價)幾乎不可能償還債權人或購買足夠的基本商品。斯里蘭卡已經上演了這樣痛苦的現實,今年5月,由于貨幣貶值,該國被迫拖欠債務。

這個東南亞國家現在已經沒有美元可以用來支付關鍵的進口商品,由于民眾面臨饑餓和排長隊等待燃料,導致了大規模抗議活動,

世界銀行宏觀經濟、貿易和投資全球主任馬塞洛·埃斯特萬(Marcello Estev?o)本周對《華爾街日報》表示:“每個以美元計價的國家都需要承擔巨額債務,這都令人擔憂。”

美元將何去何從?

盡管到目前為止,美元在2022年經歷了歷史上最好的年份之一,但大多數專家認為,它正接近峰值。

"美元很昂貴,相對于其他貨幣被高估了。" Northwestern Mutual的舒特稱。“如果回顧2001年發生的情況,你會發現,相對于其他貨幣,美元被高估的程度與2001年類似。這確實引發了美元在國際市場上長達10年的優異表現,而這在很大程度上是由美元實際下跌推動的。”

舒特指出,購買力平價——或者說從長遠來看,一籃子商品在全球范圍內應該恢復到大致相同的價格——是美元可能“被高估”的一個關鍵指標。

Bailard的埃里克·萊夫說:“最好的衡量標準之一是《經濟學人》的巨無霸指數,你可以查看面包、特制醬料、餡餅和其他所有東西的價格,并在全球范圍內對其進行評估。考慮到巨無霸的所有組成部分基本上都是全球性的,這是我們可以說一種貨幣對美元來說太便宜的方式之一。”

最新的巨無霸指數于周四發布,它顯示“幾乎所有貨幣兌美元的匯率都被低估了”。

《財富》雜志采訪的大多數專家認為,這表明美元可能會在今年年底前貶值。

Northwestern Mutual的舒特指出,其他央行正在“追趕”美聯儲的加息步伐,并且有一些跡象表明美國通脹可能正在悄然回落,包括近期大宗商品價格回落和華爾街通脹預期下降。這可能導致美聯儲未來加息力度減弱,從而減緩美元的升值步伐。

對投資者來說,這意味著非美股市可能會在年底前開始變得有吸引力。

“最近,強勢美元使得非美股票投資變得相當痛苦。”萊夫說。“但我認為,展望未來……我們將看到美元從對非美股票投資的不利因素,變成有利因素。”

然而,并非所有專家都認為美元正接近峰值。CFRA Research的薩姆·斯托瓦爾表示,其研究機構的經濟學家預測,美元將在今年全年和2023年持續走強。

他說:“隨著美聯儲繼續以與其他央行行長相同或更快的速度加息,那么我認為這可能會繼續吸引外國投資者到美國來。此外,由于經濟衰退的威脅仍然非常嚴重。我認為這將導致投資者希望繼續將美元作為避風港。”(財富中文網)

譯者:中慧言-王芳

隨著世界各國央行繼續對抗不斷上升的通脹率,美元對大多數主要貨幣升值,其在整個2022年的走勢令人難以置信。

僅今年一年,美元兌日元匯率就上漲了15%,兌英鎊匯率上漲了10%,兌人民幣匯率上漲了5%。衡量美元兌其他16種主要貨幣匯率的《華爾街日報》美元指數(Dollar Index)今年上半年的表現是2010年以來最好的,年初至今漲幅超過10%。

對于那些能夠買到廉價機票(帶著所有的行李通關)去歐洲的幸運的美國人來說,本月初,美元甚至在20年來第一次與歐元平起平坐。

美元升值意味著美國人可以享受特價國際旅行。雖然消費者價格繼續上漲,但美元走強可能有助于減少美國通脹率飆升帶來的影響。

但美元走強也給世界各國帶來一些毀滅性的影響,對今年剩余時間在海外開展業務的美國公司來說,這可能是一大阻力。

對許多投資者和消費者來說,仍有兩個亟待解決的問題:美元今年為何如此強勢,以及美元將何去何從?

多位華爾街首席投資官和策略師告訴《財富》雜志,一種推動美元走強的新趨勢已經出現,但大多數人認為,美元將在年底前開始下跌。以下是他們的看法。

美元為何如此強勢?

從歷史上看,匯率變動在很大程度上與相對利率和經濟實力有關。要想了解美元,專家們告訴《財富》雜志,只要看看美聯儲就知道了。美聯儲目前正以上世紀90年代以來前所未有的速度加息。

財富和投資管理公司Bailard的首席投資官埃里克·萊夫(Eric Leve)告訴《財富》雜志:“美元走強是因為美聯儲實施的貨幣緊縮政策是全球主要央行中最激進的。”

萊夫指出,美聯儲的加息已將政府債券的實際收益率(或債券投資者扣除通脹因素后的利息收益)推高至正值區域,這是多年來的首次。這使得美國債券對全球投資者更具吸引力,從而提高了美元的相對價值。

萊夫還認為,在通脹和衰退風險方面,美聯儲的加息使美國的經濟狀況比許多其他國家更好。

由于美聯儲,美國在很多方面都是“最干凈的臟襯衫”。

——BAILARD首席信息官埃里克·萊夫

美聯儲的舉措還有助于降低通脹預期(消費者和投資者的通脹預期),這使得美國對擔心消費者價格上漲的全球投資者來說更具吸引力。

投資研究公司CFRA research的首席投資策略師薩姆·斯托瓦爾(Sam Stovall)告訴《財富》雜志,美元的強勢得益于這種相對吸引力。他說,在擔憂全球經濟衰退的情況下,這對外國投資者來說是一種“避險”。

但在新冠肺炎疫情和俄烏沖突之后,也出現了一種影響全球貨幣相對強勢的新動態——自給自足。

當新冠肺炎疫情在2020年肆虐時,它引發了一場全球供應鏈的噩夢,加劇了從半導體到衛生紙等所有產品的短缺,并將大宗商品價格推至新高。標準普爾高盛綜合商品指數(S&P GSCI Index)是衡量全球原材料價格的廣泛指標,疫情以來,該指數已飆升了180%以上。

因此,世界上許多國家對其商品供應的保護力度加大,新一輪逆全球化浪潮已經大行其道。由于美國在能源和其他大宗商品供應方面相對自給自足,這種大宗商品保護主義導致美元升值。

俄烏沖突加劇了這一趨勢,因為歐洲的天然氣供應立即受到嚴重影響,導致天然氣價格在過去一年飆升了400%以上。這使得歐盟各國爭相滿足其能源需求,但迄今為止,計劃未能奏效。國際能源署(IEA)本周甚至警告說,歐盟需要立即削減天然氣需求,否則將面臨“漫長而艱難的冬天”。

歐洲能源危機和缺乏自給自足的最終結果是,在大宗商品價格居高不下的情況下,出口下降,進口增加。

宏觀數據分析公司Quant Insight的分析主管休?羅伯茨(Huw Roberts)告訴《財富》雜志,這相當于“貿易比率沖擊”,即進口價格相對于出口價格飆升。

他說:“如果你是能源進口國,那么這將造成嚴重的損害。但如果你是能源出口國,那么實際上你會受益。”

美國等能源出口較多、大宗商品供應更能實現自給自足的國家本幣升值,而歐盟等大宗商品無法實現自給自足的國家和地區本幣貶值。

強勢美元會帶來什么影響?

對于美國消費者而言,強勢美元不僅讓國際旅行更便宜;它還有助于降低通貨膨脹。

“在邊際上,美元走強在一定程度上限制了 [美國] 通脹,”Bailard的萊夫說。“由于美元走強,從國外購買商品,就像美國消費者傾向于做的那樣,變得便宜得多。所以我們實際上是在引入通貨緊縮。”

一些美國企業也受益于強勢美元,強勢美元降低了大宗商品價格。

Quant Insights的羅伯茨說:“因此,如果就制造業企業而言,他們購買的原材料以美元計價,而大宗商品價格正在下跌,那么強勢美元實際上對他們有利。”

然而,這些企業是例外。對大多數美國公司來說,美元走強是一種不受歡迎的逆風。

萊夫指出:“如果你想在海外銷售商品,那么強勢美元會讓你的商品更加昂貴,從而給美國企業的營收帶來負擔。”

此外,Northwestern Mutual Wealth Management Company的首席投資策略師布倫特·舒特(Brent Schutte)告訴《財富》雜志,當美國公司試圖將其海外收益匯回國內時,強勢美元意味著他們的收益比往年要少。

“當然,如果你在海外有很多以其他貨幣計值的獲利,當你將它們轉換回來時,可能會造成獲利虧損。”舒特說。國際商用機器公司(IBM)、強生公司(Johnson and Johnson)和奈飛公司(Netflix)等公司的季度財務業績在本財報季已經受到沖擊。

eToro全球市場策略師本·萊德勒(Ben Laidler)上周對《紐約時報》表示,美元升值可能會使擁有大型國際業務的標準普爾500指數成份股公司今年收益減少多達1000億美元。不過,舒特指出,這些“損失”更像是一種“會計慣例”。

他說:“我通常認為,投資者,尤其是長期投資者,會識破這一點。”

強勢美元在美國以外帶來嚴重影響,這使得低收入國家(國債以美元計價)幾乎不可能償還債權人或購買足夠的基本商品。斯里蘭卡已經上演了這樣痛苦的現實,今年5月,由于貨幣貶值,該國被迫拖欠債務。

這個東南亞國家現在已經沒有美元可以用來支付關鍵的進口商品,由于民眾面臨饑餓和排長隊等待燃料,導致了大規模抗議活動,

世界銀行宏觀經濟、貿易和投資全球主任馬塞洛·埃斯特萬(Marcello Estev?o)本周對《華爾街日報》表示:“每個以美元計價的國家都需要承擔巨額債務,這都令人擔憂。”

美元將何去何從?

盡管到目前為止,美元在2022年經歷了歷史上最好的年份之一,但大多數專家認為,它正接近峰值。

"美元很昂貴,相對于其他貨幣被高估了。" Northwestern Mutual的舒特稱。“如果回顧2001年發生的情況,你會發現,相對于其他貨幣,美元被高估的程度與2001年類似。這確實引發了美元在國際市場上長達10年的優異表現,而這在很大程度上是由美元實際下跌推動的。”

舒特指出,購買力平價——或者說從長遠來看,一籃子商品在全球范圍內應該恢復到大致相同的價格——是美元可能“被高估”的一個關鍵指標。

Bailard的埃里克·萊夫說:“最好的衡量標準之一是《經濟學人》的巨無霸指數,你可以查看面包、特制醬料、餡餅和其他所有東西的價格,并在全球范圍內對其進行評估。考慮到巨無霸的所有組成部分基本上都是全球性的,這是我們可以說一種貨幣對美元來說太便宜的方式之一。”

最新的巨無霸指數于周四發布,它顯示“幾乎所有貨幣兌美元的匯率都被低估了”。

《財富》雜志采訪的大多數專家認為,這表明美元可能會在今年年底前貶值。

Northwestern Mutual的舒特指出,其他央行正在“追趕”美聯儲的加息步伐,并且有一些跡象表明美國通脹可能正在悄然回落,包括近期大宗商品價格回落和華爾街通脹預期下降。這可能導致美聯儲未來加息力度減弱,從而減緩美元的升值步伐。

對投資者來說,這意味著非美股市可能會在年底前開始變得有吸引力。

“最近,強勢美元使得非美股票投資變得相當痛苦。”萊夫說。“但我認為,展望未來……我們將看到美元從對非美股票投資的不利因素,變成有利因素。”

然而,并非所有專家都認為美元正接近峰值。CFRA Research的薩姆·斯托瓦爾表示,其研究機構的經濟學家預測,美元將在今年全年和2023年持續走強。

他說:“隨著美聯儲繼續以與其他央行行長相同或更快的速度加息,那么我認為這可能會繼續吸引外國投資者到美國來。此外,由于經濟衰退的威脅仍然非常嚴重。我認為這將導致投資者希望繼續將美元作為避風港。”(財富中文網)

譯者:中慧言-王芳

The U.S. dollar has had an incredible run throughout 2022, appreciating against most major currencies as the world’s central banks continue to combat rising inflation.

This year alone, the dollar is up 15% against the Japanese yen, 10% against the British pound, and 5% compared to China’s renminbi. The Wall Street Journal’s Dollar Index, which measures the dollar against 16 other major currencies, has also had its best first half performance since 2010 this year, rising more than 10% year-to-date.

And for the lucky Americans who could find cheap airfare to Europe (and made it through with all their luggage), the dollar even reached equal standing with the euro for the first time in two decades earlier this month.

The dollar’s gains mean international travel is on sale for Americans. And while consumer prices continue to rise, a stronger dollar could help reduce the impact of rising inflation in the U.S.

But the dollar’s strength has also led to some devastating outcomes for countries around the world, and it’s likely to be a major headwind for U.S. companies with operations overseas through the rest of the year.

For many investors and consumers, there are still two burning questions: why has the U.S. dollar been so strong this year, and where is it headed next?

Multiple top Wall Street chief investment officers and strategists told Fortune that a new trend has emerged and is driving the dollar’s strength, but most argue the greenback will begin to drop by the end of the year. Here’s what they had to say.

Why is the dollar so strong?

Historically, currency movements have largely been related to relative interest rates and economic strength. To understand the dollar, experts told Fortune to look no further than the Federal Reserve, which is currently jacking up interest rates at a pace unseen since the 1990s.

“The dollar is strong because the Fed is in the midst of the most aggressive monetary tightening policy among major central banks in the world,” Eric Leve, the chief investment officer at the wealth and investment management firm Bailard, told Fortune.

Leve noted that the Fed’s rate increases have pushed real yields on government bonds (or bond investors’ returns from interest payments after accounting for inflation) into positive territory for the first time in years. This makes U.S. bonds more attractive for investors around the world, thereby increasing the relative value of the dollar.

Leve also argued that the Fed’s rate increases have left the U.S. economy in a better place than many of its peers when it comes to inflation and recession risk.

The U.S., because of the Fed, is in many ways the cleanest dirty shirt.

—BAILARD'S CIO ERIC LEVE

The Fed’s actions also help to reduce inflation expectations (consumers' and investors' inflation outlook), which makes the U.S. more appealing to global investors that fear rising consumer prices.

Sam Stovall, the chief investment strategist at the investment research firm CFRA Research, told Fortune that the dollar’s strength has been helped by this relative attractiveness. It’s a “flight to safety” for foreign investors amid global recession fears, he said.

But after the COVID-19 pandemic and Russia’s invasion of Ukraine, a new dynamic has also emerged affecting the relative strength of currencies around the world—self-sufficiency.

When COVID-19 took hold in 2020, it led to a global supply chain nightmare, fueling shortages in everything from semiconductors to toilet paper, and pushing commodity prices to new heights. The S&P GSCI Index, a broad measure of the price of raw materials worldwide, has soared by more than 180% in the years since.

As a result, many nations around the world have become more protective of their commodity supplies, and a new wave of deglobalization has taken hold. Because of the U.S.’ relative self-sufficiency when it comes to energy and other commodity supplies, this commodity protectionism has led the dollar to appreciate.

The Ukraine war only exacerbated the trend as Europe’s natural gas supplies were immediately and dramatically affected, leading prices to soar more than 400% in the past year. This has left the bloc scrambling to meet its energy needs, and so far it’s failed. The International Energy Agency (IEA) even warned this week that the EU will need to cut its natural gas consumption immediately or face a "long, hard winter."

The end result of Europe’s energy crisis and lack of self-sufficiency is falling exports and rising imports at a time when commodity prices remain elevated.

Huw Roberts, the head of analytics at the macro data analytics firm Quant Insight, told Fortune that this amounts to a “terms of trade shock,” where import prices have soared relative to export prices.

“If you are an energy importer, then this is hugely hurtful,” he said. “But if you're an energy exporter, then actually you stand to benefit.”

Countries that export more energy and have more self-sufficiency in their commodity supply, like the U.S., have seen their currencies appreciate, while countries and regions without commodity self-sufficiency, like the E.U., have watched their currencies drop.

What are the effects of the strong dollar?

For U.S. consumers, the strong dollar not only makes international travel much cheaper; it also helps to reduce inflation.

“At the margin, the stronger dollar is putting a bit of a limiter on [U.S.] inflation,” Bailard’s Leve said. “By having a strong dollar, purchasing goods from abroad, as U.S. consumers tend to do, becomes much cheaper. And so we're essentially importing deflation.”

Some U.S. businesses also benefit from a strong dollar, which acts to lower commodity prices.

“So, if it's maybe more of a manufacturing company, and they're buying raw materials that are priced in dollars and commodities are coming lower, then a strong dollar actually helps them,” said Quant Insights’ Roberts.

Those businesses are the exception, however. For most U.S.-based corporations, the strong dollar is an unwelcome headwind.

“If you're trying to sell goods overseas, that strong dollar makes your goods all the more expensive, putting a burden on top line revenue for US companies,” Leve noted.

On top of that, Brent Schutte, the chief investment strategist at Northwestern Mutual Wealth Management Company, told Fortune that when U.S. companies attempt to repatriate their foreign earnings, the strong dollar means they are getting less back than they have in previous years.

“Certainly if you have a lot of earnings across the ocean, and in other currencies, when you convert them back, it could cause earnings misses,” Schutte said. IBM, Johnson and Johnson, and Netflix are among the companies whose quarterly financial results have already taken a hit this earnings season.

Ben Laidler, a global markets strategist for eToro, told the New York Times last week that the dollar's rise could cut the earnings of S&P 500 companies with large international operations by up to $100 billion this year. Still, Schutte noted that these “losses” are more of an “accounting convention.”

“I generally do think that investors, especially longer-term ones, would look through that,” he said.

The most harmful effects of a strong dollar occur outside the US, making it nearly impossible for lower-income countries—with national debts denominated in dollars—to pay back their creditors or buy enough basic goods. That painful reality has been on display in Sri Lanka, which was forced to default on its debts in May as its currency depreciated.

The South East Asian nation has now run out of U.S. dollars to pay for critical imports, leading to mass protests as citizens face starvation and wait in long lines for fuel.

“Every country that has large liability in dollars is a cause for concern,” Marcello Estev?o, the World Bank’s global director for macroeconomics, trade, and investment, told the Wall Street Journal this week.

Where is the dollar headed from here?

While the dollar has had one of its best years in history so far in 2022, most experts believe it is nearing its peak.

“The dollar is expensive, it's overvalued relative to its peers,” Northwestern Mutual’s Schutte said. “If you look back to 2001, you're at similar levels of the dollar being overvalued, relative to other currencies, which did launch a 10-year time period of international outperformance that was largely driven by the dollar actually falling.”

Schutte pointed to purchasing power parity—or the idea that a given basket of goods should revert to a somewhat equal price around the world over the long run—as a key indicator that the dollar may be “overvalued.”

“One of the best measures of that is the Economists’ Big Mac Index, where you look at the price of that bun, that special sauce, the patties and everything else, and evaluate it around the world,” Bailard’s Eric Leve said. “It’s one of those ways that we can state that a currency is too cheap versus the dollar, given that all the components of a Big Mac are essentially global.”

The latest Big Mac Index was released on Thursday, and it showed that “nearly all currencies are undervalued against the dollar.”

Most experts that Fortune interviewed argued this shows that the dollar will likely see its value wane by the end of the year.

Northwestern Mutual’s Schutte noted that other central banks are “catching up” to the Fed with interest rate hikes, and there are some signs that U.S. inflation may be quietly coming down, including a recent commodity price retreat and falling inflation expectations on Wall Street. That could lead the Fed to less aggressive interest rate increases moving forward, slowing the dollar’s rise.

For investors, that means that non-U.S. equities may begin to look attractive by the end of the year.

“The strong dollar has made investing in non-U.S. equities pretty painful recently,” Leve said. “But I think as we look forward…we will see the dollar move from being a headwind to non-US equity investing to a tailwind.”

Not every expert sees the dollar nearing its peak, however. CFRA Research’s Sam Stovall said his economists have forecasted a strengthening dollar throughout the year and into 2023.

“As the Fed continues to raise rates, and at a pace that is equal to or greater than other central bankers, then I would say that that could continue to attract foreign investors to the U.S,” he said. “And also, as the threat of recession remains paramount. I think that would cause investors to want to continue to search for the dollar as a safe haven.”