如果你在美國,而且你恰好有套房,那么在過去兩年中,你八成沒少受到炒房客的電子郵件、電話和短信轟炸。他們的中心思想就一句:你的房賣嗎?

自新冠疫情爆發(fā)以來,美國的住房市場迎來了一波神奇的熱潮,大量投資者被吸引到了房市上。這其中既有家庭剛需者,也有買房做民宿者。還有的人專買舊房,翻修后出手賺差價(jià)。就連黑石集團(tuán)(Blackstone)這樣的華爾街巨頭和Opendoor Technologies這樣的科技公司也在大肆炒房。低按揭、貸款容易、房價(jià)升值快這幾個(gè)因素結(jié)合在一起,讓投資者很難抗拒房市的誘惑。

雖然在過去兩年里,美國投資者紛紛涌入房市,但很多房地產(chǎn)業(yè)者卻不愿意把房市的繁榮歸功于炒房。在他們看來,造成這一輪房市繁榮的原因有很多。首先是歷史性的低按揭利率,這是美聯(lián)儲(chǔ)(Federal Reserve)為了應(yīng)對新冠疫情導(dǎo)致的經(jīng)濟(jì)衰退而采取的救市之舉,不過它確實(shí)對各種買家都是有吸引力的。比如在新冠疫情期間,很多白領(lǐng)工作者進(jìn)入居家辦公模式,他們很有意愿放棄舊金山和波士頓等大城市貴得嚇人的“老破小”,搬到博伊西和坦帕等城市買房安家。另外,2019年至2023年這五年,恰好也是90后集體“奔三”、進(jìn)入買房高峰期的窗口期。因此需求的上漲完全蓋了供給端。在新冠疫情爆發(fā)前,美國住房市場庫存就已經(jīng)呈下降趨勢,新冠疫情以來更是降低至近40年來的最低水平。

盡管業(yè)界有人不愿意承認(rèn),但現(xiàn)在我們可以明顯看出,投資性購房確實(shí)加速了美國房地產(chǎn)市場的繁榮,并且推高了美國房價(jià)。至少這是《財(cái)富》雜志在研究了Redfin、房地美(Freddie Mac)和哈佛大學(xué)住宅聯(lián)合研究中心(Harvard Joint Center for Housing Studies)近期發(fā)布的數(shù)據(jù)后所得出的結(jié)論。

哈佛大學(xué)住宅聯(lián)合研究中心于上周發(fā)布的一份報(bào)告顯示,2022年第一季度,投資性購房占了全美獨(dú)房住宅銷量的28%,創(chuàng)下歷史紀(jì)錄,這一比例遠(yuǎn)高于2021年第一季度的19%,也遠(yuǎn)高于2017年至2019年16%的平均水平。(為了進(jìn)行分析,哈佛大學(xué)的研究人員使用了CoreLogic公司的房屋銷售數(shù)據(jù)。)

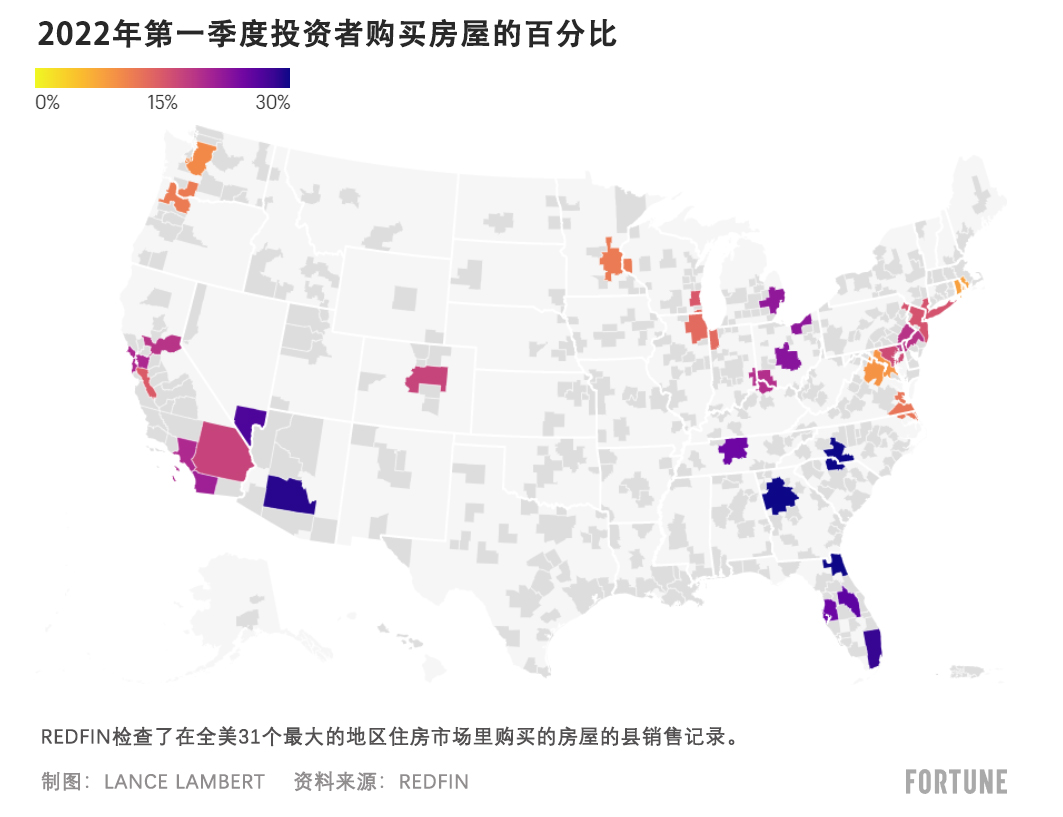

哈佛大學(xué)的研究人員指出,投資性購房在美國南部和西部增長最為迅猛。這一發(fā)現(xiàn)也得到了Redfin公司的一項(xiàng)獨(dú)立分析的支持。該分析是基于所有房型的銷量數(shù)據(jù)進(jìn)行的(而不像哈佛大學(xué)的分析只著眼于獨(dú)戶住宅),研究顯示,2022年第一季度,投資性購房占到了亞特蘭大房市銷量的33.1%。緊隨其后的是杰克森維爾(32.3%)、夏洛特(32.3%)、菲尼克斯(29.0%)和邁阿密(28.2%)。穆迪分析(Moody's Analytics)指出,這些城市也是全美房價(jià)“最被高估”的城市,也最有可能出現(xiàn)房價(jià)下跌。

雖然美國南部和西部地區(qū)的投資性購房活動(dòng)最多,不過幾乎每個(gè)美國主要城市的投資性購房活動(dòng)都在增多。例如在Redfin追蹤的31個(gè)大城市中,有29個(gè)城市的投資性購房活動(dòng)都有所增加。光是在俄亥俄州,就有辛辛那提(+2.9%)、克利夫蘭(+3.1%)和哥倫布(+7%)等城市的出現(xiàn)了投資性購房增多的情況。從2021年第一季度到2022年第一季度,只有西雅圖(-0.5%)和密爾沃基(-0.1%)的投資性購房有所下降。

房地美的研究人員也在公開數(shù)據(jù)基礎(chǔ)上進(jìn)行了分析,不過從他們的研究結(jié)果看,投資性住房的增長幅度并沒有哈佛大學(xué)和Redfin描繪的那么大。房地美發(fā)現(xiàn),從2019年12月至2021年12月,美國的投資性購房從26.7%提高到了27.6%。不過房地美也承認(rèn),他們的分析并未充分覆蓋投資者的“全現(xiàn)金”購房。

需要指出的是,在美國,參與投資性購房的絕大多數(shù)是中小投資者,比如民宿經(jīng)營者,或者靠收租度日的富二代等等。根據(jù)哈佛大學(xué)的研究,2021年9月,有74%的投資性購房,是由名下房產(chǎn)少于100套的投資者購買的。其余26%則被名下房產(chǎn)多于100套的大買家拿下。

而這些大投資者的入局,也是導(dǎo)致炒房行為增多的重要原因之一。

哈佛大學(xué)的研究人員指出:“擁有大量房產(chǎn)(至少100套)的投資者在相當(dāng)程度上推動(dòng)了這一波增長。從2020年9月到2021年9月,這些大投資者的購房比例從14%增長至26%,幾乎翻了一番。他們進(jìn)軍獨(dú)戶住宅市場后,潛在剛需群體,特別是首次購房者和收入有限者的可選擇范圍被進(jìn)一步擠壓了。”

這些大投資者都是誰?他們有的是大型租賃公司,例如全美最大的獨(dú)戶住宅租賃商Invitation Homes。在新冠疫情期間,它出手買了不少房子。創(chuàng)辦該公司的黑石集團(tuán)也在新冠疫情期間重返獨(dú)戶住宅市場。(2019年,黑石集團(tuán)在出售了Invitation Homes的剩余股份后,退出了這項(xiàng)業(yè)務(wù)。)

新冠疫情以來的這一波房地產(chǎn)繁榮,也促進(jìn)了線上購房市場的崛起。很多線上大買家——比如Opendoor、Offerpad、RedfinNow和Zillow Offers等,都會(huì)在全美各地四處詢價(jià),然后很快將吃下的房產(chǎn)重新投放到市場上。這種做法不像傳統(tǒng)的舊房翻新重售模式,而更像是一種“走量”銷售。在每筆交易中,這些公司都會(huì)向買家收取一定的“服務(wù)費(fèi)”,作為迅速鎖定交易的報(bào)酬。

隨著住房市場的繁榮,房地產(chǎn)網(wǎng)站Zillow的營收也出現(xiàn)了飆升。2021年第一季度,它的利潤達(dá)到了創(chuàng)紀(jì)錄的5200萬美元。信心大增的Zillow迅速進(jìn)軍“線上購房”市場,購房支出迅速占到其總收入的四分之三以上。只不過,Zillow的炒房神話最終在2021年秋天以爆雷告終。有分析師告訴《財(cái)富》雜志,Zillow的炒房爆雷與它的算法問題有關(guān)系。這個(gè)被吹爆的算法至少讓Zillow給幾千套房子多掏了不少錢。

不過,美國房市上的大多數(shù)投資者,都是一些你可能從未聽說過的群體。像Opendoor和黑石集團(tuán)這樣的大玩家,實(shí)際上只吃掉了投資性購房市場上的一小塊蛋糕。

房地美的研究人員本月早些時(shí)候曾經(jīng)指出:“盡管大型機(jī)構(gòu)投資者在市場上所占的份額正在迅速上升,而且很可能繼續(xù)擴(kuò)大,但它們的份額仍然很小,而且對整個(gè)市場的影響也并不大。”房地美的數(shù)據(jù)顯示,在新冠疫情期間,“線上買房”和機(jī)構(gòu)買家的交易份額大概只從1.5%提高到了4.5%左右。

在短短兩年時(shí)間里,美國房價(jià)上漲了37%。這么大幅度的房價(jià)上漲,當(dāng)然不可能歸咎于任何一家公司。不過考慮到投資需求的上升,你會(huì)發(fā)現(xiàn),投資性需求至少在某種程度上要為房價(jià)上漲負(fù)責(zé)。新冠疫情期間,大大小小的投資者的確搶占了更多的市場份額。而且炒房行為影響的不僅僅是房子本身。即便炒房者在競價(jià)中處于劣勢,他們的參與也給房價(jià)造成了上漲壓力。

隨著按揭利率加息已成定局,新冠疫情帶來的房市過熱也必將退燒。那么我們不禁要問:投資者大舉涌入住房市場,這究竟只是新冠疫情期間的短期行為,還是預(yù)兆著一個(gè)長期趨勢的開始?

現(xiàn)在,抵押貸款利率的飆升已經(jīng)勸退了很多首次購房者。與此同時(shí),一些炒房客也在退出市場。一旦炒房客要還的月供超過了租金,炒房就會(huì)變得不再劃算。

Redfin的高級經(jīng)濟(jì)學(xué)家謝哈里·博哈里在本月發(fā)表的一份報(bào)告中寫道:“投資性購房趨軟的原因與市場整體趨軟的原因相同,那就是利率飆升和房價(jià)高企導(dǎo)致按揭購房的成本變得過高。雖然將近四分之三的投資性購房都是用現(xiàn)金進(jìn)行的,但投資者也會(huì)受到利率影響,因?yàn)樗麄兺ǔJ峭ㄟ^貸款獲得現(xiàn)金的。”(財(cái)富中文網(wǎng))

譯者:樸成奎

如果你在美國,而且你恰好有套房,那么在過去兩年中,你八成沒少受到炒房客的電子郵件、電話和短信轟炸。他們的中心思想就一句:你的房賣嗎?

自新冠疫情爆發(fā)以來,美國的住房市場迎來了一波神奇的熱潮,大量投資者被吸引到了房市上。這其中既有家庭剛需者,也有買房做民宿者。還有的人專買舊房,翻修后出手賺差價(jià)。就連黑石集團(tuán)(Blackstone)這樣的華爾街巨頭和Opendoor Technologies這樣的科技公司也在大肆炒房。低按揭、貸款容易、房價(jià)升值快這幾個(gè)因素結(jié)合在一起,讓投資者很難抗拒房市的誘惑。

雖然在過去兩年里,美國投資者紛紛涌入房市,但很多房地產(chǎn)業(yè)者卻不愿意把房市的繁榮歸功于炒房。在他們看來,造成這一輪房市繁榮的原因有很多。首先是歷史性的低按揭利率,這是美聯(lián)儲(chǔ)(Federal Reserve)為了應(yīng)對新冠疫情導(dǎo)致的經(jīng)濟(jì)衰退而采取的救市之舉,不過它確實(shí)對各種買家都是有吸引力的。比如在新冠疫情期間,很多白領(lǐng)工作者進(jìn)入居家辦公模式,他們很有意愿放棄舊金山和波士頓等大城市貴得嚇人的“老破小”,搬到博伊西和坦帕等城市買房安家。另外,2019年至2023年這五年,恰好也是90后集體“奔三”、進(jìn)入買房高峰期的窗口期。因此需求的上漲完全蓋了供給端。在新冠疫情爆發(fā)前,美國住房市場庫存就已經(jīng)呈下降趨勢,新冠疫情以來更是降低至近40年來的最低水平。

盡管業(yè)界有人不愿意承認(rèn),但現(xiàn)在我們可以明顯看出,投資性購房確實(shí)加速了美國房地產(chǎn)市場的繁榮,并且推高了美國房價(jià)。至少這是《財(cái)富》雜志在研究了Redfin、房地美(Freddie Mac)和哈佛大學(xué)住宅聯(lián)合研究中心(Harvard Joint Center for Housing Studies)近期發(fā)布的數(shù)據(jù)后所得出的結(jié)論。

哈佛大學(xué)住宅聯(lián)合研究中心于上周發(fā)布的一份報(bào)告顯示,2022年第一季度,投資性購房占了全美獨(dú)房住宅銷量的28%,創(chuàng)下歷史紀(jì)錄,這一比例遠(yuǎn)高于2021年第一季度的19%,也遠(yuǎn)高于2017年至2019年16%的平均水平。(為了進(jìn)行分析,哈佛大學(xué)的研究人員使用了CoreLogic公司的房屋銷售數(shù)據(jù)。)

哈佛大學(xué)的研究人員指出,投資性購房在美國南部和西部增長最為迅猛。這一發(fā)現(xiàn)也得到了Redfin公司的一項(xiàng)獨(dú)立分析的支持。該分析是基于所有房型的銷量數(shù)據(jù)進(jìn)行的(而不像哈佛大學(xué)的分析只著眼于獨(dú)戶住宅),研究顯示,2022年第一季度,投資性購房占到了亞特蘭大房市銷量的33.1%。緊隨其后的是杰克森維爾(32.3%)、夏洛特(32.3%)、菲尼克斯(29.0%)和邁阿密(28.2%)。穆迪分析(Moody's Analytics)指出,這些城市也是全美房價(jià)“最被高估”的城市,也最有可能出現(xiàn)房價(jià)下跌。

雖然美國南部和西部地區(qū)的投資性購房活動(dòng)最多,不過幾乎每個(gè)美國主要城市的投資性購房活動(dòng)都在增多。例如在Redfin追蹤的31個(gè)大城市中,有29個(gè)城市的投資性購房活動(dòng)都有所增加。光是在俄亥俄州,就有辛辛那提(+2.9%)、克利夫蘭(+3.1%)和哥倫布(+7%)等城市的出現(xiàn)了投資性購房增多的情況。從2021年第一季度到2022年第一季度,只有西雅圖(-0.5%)和密爾沃基(-0.1%)的投資性購房有所下降。

房地美的研究人員也在公開數(shù)據(jù)基礎(chǔ)上進(jìn)行了分析,不過從他們的研究結(jié)果看,投資性住房的增長幅度并沒有哈佛大學(xué)和Redfin描繪的那么大。房地美發(fā)現(xiàn),從2019年12月至2021年12月,美國的投資性購房從26.7%提高到了27.6%。不過房地美也承認(rèn),他們的分析并未充分覆蓋投資者的“全現(xiàn)金”購房。

需要指出的是,在美國,參與投資性購房的絕大多數(shù)是中小投資者,比如民宿經(jīng)營者,或者靠收租度日的富二代等等。根據(jù)哈佛大學(xué)的研究,2021年9月,有74%的投資性購房,是由名下房產(chǎn)少于100套的投資者購買的。其余26%則被名下房產(chǎn)多于100套的大買家拿下。

而這些大投資者的入局,也是導(dǎo)致炒房行為增多的重要原因之一。

哈佛大學(xué)的研究人員指出:“擁有大量房產(chǎn)(至少100套)的投資者在相當(dāng)程度上推動(dòng)了這一波增長。從2020年9月到2021年9月,這些大投資者的購房比例從14%增長至26%,幾乎翻了一番。他們進(jìn)軍獨(dú)戶住宅市場后,潛在剛需群體,特別是首次購房者和收入有限者的可選擇范圍被進(jìn)一步擠壓了。”

這些大投資者都是誰?他們有的是大型租賃公司,例如全美最大的獨(dú)戶住宅租賃商Invitation Homes。在新冠疫情期間,它出手買了不少房子。創(chuàng)辦該公司的黑石集團(tuán)也在新冠疫情期間重返獨(dú)戶住宅市場。(2019年,黑石集團(tuán)在出售了Invitation Homes的剩余股份后,退出了這項(xiàng)業(yè)務(wù)。)

新冠疫情以來的這一波房地產(chǎn)繁榮,也促進(jìn)了線上購房市場的崛起。很多線上大買家——比如Opendoor、Offerpad、RedfinNow和Zillow Offers等,都會(huì)在全美各地四處詢價(jià),然后很快將吃下的房產(chǎn)重新投放到市場上。這種做法不像傳統(tǒng)的舊房翻新重售模式,而更像是一種“走量”銷售。在每筆交易中,這些公司都會(huì)向買家收取一定的“服務(wù)費(fèi)”,作為迅速鎖定交易的報(bào)酬。

隨著住房市場的繁榮,房地產(chǎn)網(wǎng)站Zillow的營收也出現(xiàn)了飆升。2021年第一季度,它的利潤達(dá)到了創(chuàng)紀(jì)錄的5200萬美元。信心大增的Zillow迅速進(jìn)軍“線上購房”市場,購房支出迅速占到其總收入的四分之三以上。只不過,Zillow的炒房神話最終在2021年秋天以爆雷告終。有分析師告訴《財(cái)富》雜志,Zillow的炒房爆雷與它的算法問題有關(guān)系。這個(gè)被吹爆的算法至少讓Zillow給幾千套房子多掏了不少錢。

不過,美國房市上的大多數(shù)投資者,都是一些你可能從未聽說過的群體。像Opendoor和黑石集團(tuán)這樣的大玩家,實(shí)際上只吃掉了投資性購房市場上的一小塊蛋糕。

房地美的研究人員本月早些時(shí)候曾經(jīng)指出:“盡管大型機(jī)構(gòu)投資者在市場上所占的份額正在迅速上升,而且很可能繼續(xù)擴(kuò)大,但它們的份額仍然很小,而且對整個(gè)市場的影響也并不大。”房地美的數(shù)據(jù)顯示,在新冠疫情期間,“線上買房”和機(jī)構(gòu)買家的交易份額大概只從1.5%提高到了4.5%左右。

在短短兩年時(shí)間里,美國房價(jià)上漲了37%。這么大幅度的房價(jià)上漲,當(dāng)然不可能歸咎于任何一家公司。不過考慮到投資需求的上升,你會(huì)發(fā)現(xiàn),投資性需求至少在某種程度上要為房價(jià)上漲負(fù)責(zé)。新冠疫情期間,大大小小的投資者的確搶占了更多的市場份額。而且炒房行為影響的不僅僅是房子本身。即便炒房者在競價(jià)中處于劣勢,他們的參與也給房價(jià)造成了上漲壓力。

隨著按揭利率加息已成定局,新冠疫情帶來的房市過熱也必將退燒。那么我們不禁要問:投資者大舉涌入住房市場,這究竟只是新冠疫情期間的短期行為,還是預(yù)兆著一個(gè)長期趨勢的開始?

現(xiàn)在,抵押貸款利率的飆升已經(jīng)勸退了很多首次購房者。與此同時(shí),一些炒房客也在退出市場。一旦炒房客要還的月供超過了租金,炒房就會(huì)變得不再劃算。

Redfin的高級經(jīng)濟(jì)學(xué)家謝哈里·博哈里在本月發(fā)表的一份報(bào)告中寫道:“投資性購房趨軟的原因與市場整體趨軟的原因相同,那就是利率飆升和房價(jià)高企導(dǎo)致按揭購房的成本變得過高。雖然將近四分之三的投資性購房都是用現(xiàn)金進(jìn)行的,但投資者也會(huì)受到利率影響,因?yàn)樗麄兺ǔJ峭ㄟ^貸款獲得現(xiàn)金的。”(財(cái)富中文網(wǎng))

譯者:樸成奎

Text messages. Mailers. Cold calls. Over the past two years, homeowners have been bombarded with inquiries from investors who want to know one thing: Are they open to selling their property?

Since the onset of the Pandemic Housing Boom, investors have flooded the U.S. housing market. There are small players, like mom-and-pop landlords and Airbnb hosts who are adding to their property portfolios. Home flippers returned with vengeance. There's also the Wall Street-types like Blackstone and iBuyer players like Opendoor Technologies that are gobbling up homes. The combination of low mortgage rates, easy access to capital, and record home appreciation was all too enticing for investors to pass up on.

However, even as investors piled into the housing market, many real estate insiders over the past two years hesitated to attribute much, if any, of the boom to investors. In their view, numerous factors drove the housing frenzy. Historically low mortgage rates, spurred by the Federal Reserve's response to the COVID-19 recession, attracted all types of buyers. That included white-collar professionals who saw their jobs transition to remote during the pandemic and were eager to ditch apartments in places like San Francisco and Boston for homes in markets like Boise and Tampa. The pandemic also coincided with the five-year window (between 2019 and 2023) when millennials born during the generation’s five largest birth years (between 1989 and 1993) would hit the peak first-time homebuying age of 30. That elevated demand simply overwhelmed the supply side: Housing inventory, which was already trending downward before the pandemic struck, fell to a 40-year low during the boom.

But that hesitation to name investors as one of the pillars of the Pandemic Housing Boom is no longer necessary. It's now abundantly clear that investors did indeed help accelerate the housing boom and drive up U.S. home prices. At least that's what Fortune concluded after looking over recent data published by Redfin, Freddie Mac, and the Harvard Joint Center for Housing Studies.

In the first quarter of 2022, investors made up a record 28% of single-family home sales, according to a report published last week by the Harvard Joint Center for Housing Studies. That's up from 19% in the first quarter of 2021. It's also far above the 16% that investors made up of single-family home sales between 2017 and 2019. (To conduct the analysis, the Harvard researchers analyzed home sale data collected by CoreLogic).

The investor bull rush into the housing market was the most pronounced in fast-growing markets in the U.S. South and West, according to the Harvard researchers. That finding is backed up by a separate Redfin analysis, which looked at all home sales (unlike Harvard's single-family homes analysis). In the first quarter of 2022, investors made up a staggering 33.1% of home sales in Atlanta. Not far behind was Jacksonville (32.3%), Charlotte (32.3%), Phoenix (29.0%), and Miami (28.2%). Those same markets are also among the nation's most "overvalued" housing markets that are at-risk of seeing a home price decline, according to Moody's Analytics.

While markets in the South and West saw the most investor activity, almost every major U.S. housing market saw an uptick. Among the 31 large markets analyzed by Redfin, 29 saw an uptick in investor activity. Look no further than Ohio, which saw the share of investor homes sales jump in Cincinnati (up 2.9 percentage points), Cleveland (up 3.1 percentage points), and Columbus (up 7 percentage points). Between the first quarter of 2021 and the first quarter of 2022, only Seattle (down 0.5 percentage points) and Milwaukee (down 0.1 percentage points) saw a decline in the share of home sales attributed to investors.

Researchers at Freddie Mac, who did their own analysis of public records, found a more modest jump in investor purchases than Harvard and Redfin researchers. Between December 2019 and December 2021, Freddie Mac found investor home purchases climbed from 26.7% to 27.6%. However, Freddie Mac acknowledges their analysis isn't fully capturing "all-cash" purchases by investors.

Let's be clear: The vast majority of investor home purchases in America are still made by small or midsized investors: everyone from average Joes owning an Airbnb rental to individuals who've spent years amassing a hefty portfolio of rentals. According to the Harvard study, 74% of investor purchases in September were made by investors with portfolios of less than 100 properties. The remaining 26% of investor purchases were made by groups with property portfolios of at least 100 units.

That said, it's clear that those big investors were among the biggest drivers of the uptick in investor purchases.

"Investors with large portfolios (at least 100 properties) drove much of this growth, nearly doubling their share of investor purchases from 14% in September 2020 to 26% in September 2021," wrote the Harvard researchers. "By buying up single-family homes, investors have reduced the already limited supply available to potential owner-occupants, particularly first-time and moderate-income buyers."

Who are these big investors? Some are massive rental companies like Invitation Homes—the nation's largest owner of single-family rental homes—which grew its portfolio during the pandemic. Blackstone, which founded Invitation Homes back in 2012, also got back into the single-family home business during the pandemic. (In 2019, Blackstone had backed away from the business after selling its remaining shares of Invitation Homes.)

The Pandemic Housing Boom also saw a surge on the iBuying side of the market. These iBuyers—including firms like Opendoor, Offerpad, RedfinNow, and Zillow Offers—went around the country making swift offers to home sellers. The companies would then quickly put the home back on the market. It's less of a traditional "home flip" and more of a volume play: On each sale, iBuyers net a "service fee" that the firm charges the buyer in exchange for the speedy transaction.

As the housing boom took hold, it saw Zillow's earnings initially soar—with the real estate site posting a record $52 million profit in the first quarter of 2021. That fed Zillow’s iBuyer confidence as it quickly grew its home buying business to over three-fourths of its total revenues. Of course, Zillow's home flipping business would go on to implode in epic fashion last fall. But only after Zillow’s much-lauded algorithm overpaid, analysts tell?Fortune, for thousands of U.S. homes.

But most housing investors are still groups you've likely never heard of. The Opendoor and Blackstones of the world, at least for now, are still a small piece of the investor pie.

"While large corporate investors are rapidly rising as a share of the market and are likely to expand, they remain so small that their market share only has a modest impact on the overall percentage of investors," wrote Freddie Mac researchers earlier this month. During the pandemic, iBuyer and institutional buyers have jumped from around a 1.5% market share of purchases to around 4.5%, according to Freddie Mac.

It's intellectually dishonest to pin soaring U.S. home prices—which are up 37% over the past two years—on any one company. However, when you step back and examine the elevated demand that has come from the investor side of the market, it's clear they've attributed, at least in some degree, to soaring home prices. Investors, both big and small, gobbled up a larger market share during the pandemic. The impact of elevated investor demand also goes beyond the homes they actually bought. Even when investors are on the losing side of a bidding war, from an economic lens at least, they are still putting upward pressure on prices.

As the Pandemic Housing boom implodes amid spiked mortgage rates, it raises the question: Is the investor rush into the housing market a temporary feature of the pandemic or the start of a lasting trend?

While spiked mortgage rates are pricing out many first-time buyers, it's also seeing investors pull back from the market. Surging mortgage rates change the math for investors: The added costs means many investors would take on mortgage payments that are greater than they can charge for rent.

“Investor home purchases are falling for the same reason overall home purchases are falling: Surging interest rates and high housing prices have made it more expensive to get a mortgage and buy a home,” wrote Sheharyar Bokhari, a senior economist at Redfin, in a report published this month. “While roughly three-quarters of investor purchases are made with cash, investors are still impacted by interest rates because they often take out loans to get that cash.”