房地產經濟學家們宣稱,目前發展繁榮的房地產業將面臨與2008年類似的衰退,這番言論可能讓你覺得膽戰心驚。事實上,許多人持相反觀點,理由是大批千禧一代首次購房人、工資上漲和有限供應,將繼續推高房價。包括CoreLogic和房利美(Fannie Mae)在內發布公開預測的多家大型房地產公司都表示,明年房價將繼續上漲。

盡管如此,美國火爆的房地產市場即將發展到自上一次出現房地產泡沫以來前所未見的水平。

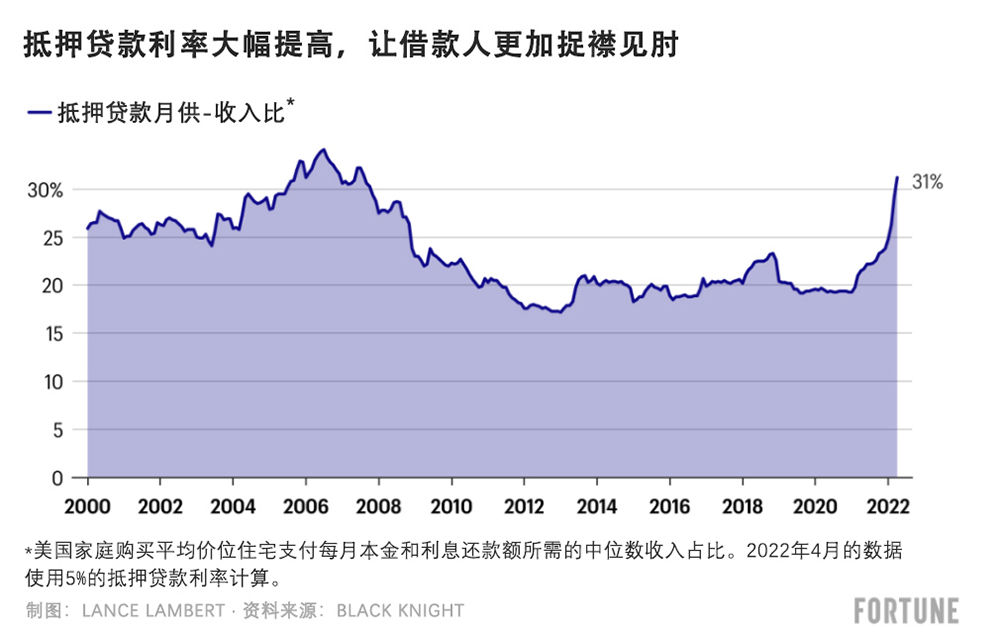

上周五,抵押抵款技術與數據提供商Black Knight向《財富》雜志展示的一項分析發現,普通美國家庭現在購買一般價位的美國住房,需要花費31%的月收入償還抵押貸款。一周前這個比例只有29%,去年12月為24%。Black Knight’抵押貸款月供-收入比自2007年9月以來從未達到過31%,在2010年代期間平均水平為19.9%。

到底發生了什么?過去幾周抵押貸款利率大幅上漲所帶來的經濟沖擊,顯著增加了新購房人的抵押貸款還款額。

早在12月,平均30年固定抵押貸款利率為3.11%。借款人按該利率抵押抵款500,000美元,月供為2,138美元。現在的平均利率為5%,申請同樣一筆貸款的月供高達2,684美元。30年貸款的總還款額額外增加了196,700美元。

3月,達拉斯聯邦儲備銀行(Federal Reserve Bank of Dallas)的一個研究員團隊發表了一篇標題為《實時市場監測發現美國房地產泡沫正在醞釀的跡象》的論文,引起了房地產業的關注。研究人員發現,美國最近的房價上漲再次“脫離了”經濟基本面。過去12個月,美國房價上漲了19.2%。

然而,達拉斯聯儲的研究人員認為2008年的危機不會重演。當然,許多新購房者在經濟上變得捉襟見肘,這與上一次房地產泡沫時購房者的狀況類似。但這只是新購房者。從整體上看,購房者的經濟狀況良好。

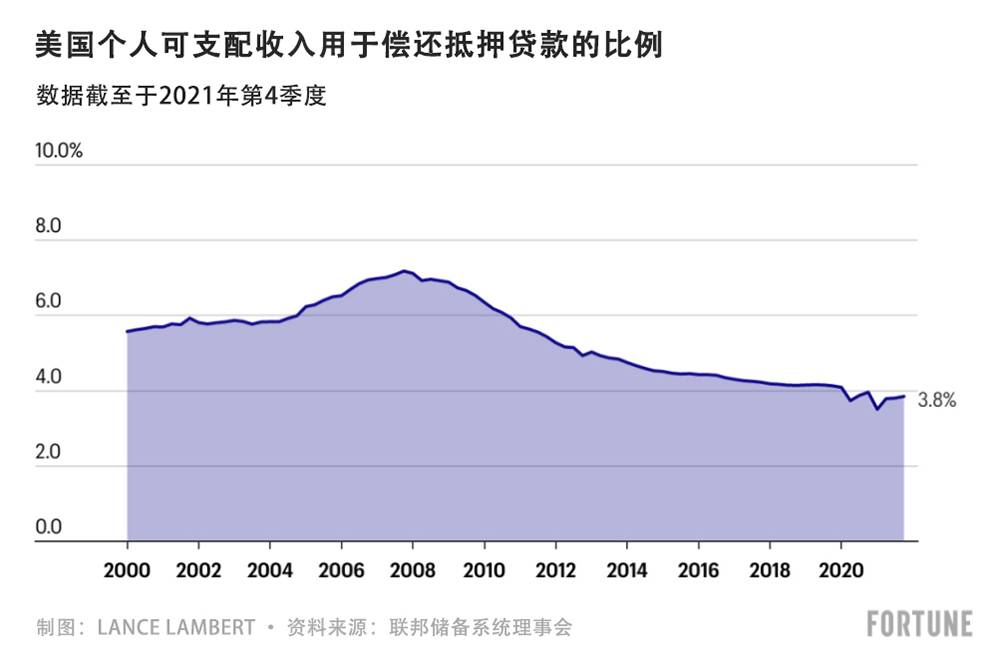

截至2021年第4季度,只有3.8%的美國個人可支配收入被用于償還抵押貸款。在2000年代房地產泡沫最嚴重的時候,這個數字幾乎翻了一番,達到7.2%。這一次,美國家庭的財務狀況似乎更健康,而且更多購房者已經還清了貸款。此外,2010年的《多德-弗蘭克法案》(Dodd-Frank Act)已經從市場中清理了之前那些違法貸款行為。簡而言之:如果發生危機,理論上購房者更容易克服困難。

達拉斯聯儲的研究人員寫道:“根據目前的證據,房價下跌的影響,無論從嚴重程度還是宏觀經濟重心來看,都不可能與2007-2009年的全球金融危機相提并論。除此之外,人們家庭財務狀況似乎更好,而且過度借貸似乎并沒有助長房地產市場的繁榮。”

抵押貸款利率上漲導致住房負擔能力下降,這或許是好事。HousingWire首席分析師羅根·莫塔沙米這樣認為。他表示,抵押貸款利率上漲可能給市場降溫,有機會增加庫存。庫存增加會放慢房價上漲的速度,降低火爆的房地產市場達到過熱甚至崩盤的可能性。

他對《財富》雜志表示:“抵押貸款利率上漲對于房地產市場而言是好消息,因為目前的房地產市場嚴重不健康,我們需要結束這種房屋庫存量極低的狀況。現在不是有太多貸款或不良信貸流入房地產市場。而是有太多人搶購過少的住房。我們迫切需要一個喘息的機會。”

Redfin認為,抵押貸款利率大幅上漲已經讓房地產市場略有降溫。該房屋中介平臺發現房屋掛牌數量小幅增加,價格下降,而且預約看房的數量減少。然而,我們需要再等幾周或者幾個月,才能確定房地產市場確實正在降溫。(財富中文網)

翻譯:劉進龍

審校:汪皓

房地產經濟學家們宣稱,目前發展繁榮的房地產業將面臨與2008年類似的衰退,這番言論可能讓你覺得膽戰心驚。事實上,許多人持相反觀點,理由是大批千禧一代首次購房人、工資上漲和有限供應,將繼續推高房價。包括CoreLogic和房利美(Fannie Mae)在內發布公開預測的多家大型房地產公司都表示,明年房價將繼續上漲。

盡管如此,美國火爆的房地產市場即將發展到自上一次出現房地產泡沫以來前所未見的水平。

上周五,抵押抵款技術與數據提供商Black Knight向《財富》雜志展示的一項分析發現,普通美國家庭現在購買一般價位的美國住房,需要花費31%的月收入償還抵押貸款。一周前這個比例只有29%,去年12月為24%。Black Knight’抵押貸款月供-收入比自2007年9月以來從未達到過31%,在2010年代期間平均水平為19.9%。

到底發生了什么?過去幾周抵押貸款利率大幅上漲所帶來的經濟沖擊,顯著增加了新購房人的抵押貸款還款額。

早在12月,平均30年固定抵押貸款利率為3.11%。借款人按該利率抵押抵款500,000美元,月供為2,138美元。現在的平均利率為5%,申請同樣一筆貸款的月供高達2,684美元。30年貸款的總還款額額外增加了196,700美元。

3月,達拉斯聯邦儲備銀行(Federal Reserve Bank of Dallas)的一個研究員團隊發表了一篇標題為《實時市場監測發現美國房地產泡沫正在醞釀的跡象》的論文,引起了房地產業的關注。研究人員發現,美國最近的房價上漲再次“脫離了”經濟基本面。過去12個月,美國房價上漲了19.2%。

然而,達拉斯聯儲的研究人員認為2008年的危機不會重演。當然,許多新購房者在經濟上變得捉襟見肘,這與上一次房地產泡沫時購房者的狀況類似。但這只是新購房者。從整體上看,購房者的經濟狀況良好。

截至2021年第4季度,只有3.8%的美國個人可支配收入被用于償還抵押貸款。在2000年代房地產泡沫最嚴重的時候,這個數字幾乎翻了一番,達到7.2%。這一次,美國家庭的財務狀況似乎更健康,而且更多購房者已經還清了貸款。此外,2010年的《多德-弗蘭克法案》(Dodd-Frank Act)已經從市場中清理了之前那些違法貸款行為。簡而言之:如果發生危機,理論上購房者更容易克服困難。

達拉斯聯儲的研究人員寫道:“根據目前的證據,房價下跌的影響,無論從嚴重程度還是宏觀經濟重心來看,都不可能與2007-2009年的全球金融危機相提并論。除此之外,人們家庭財務狀況似乎更好,而且過度借貸似乎并沒有助長房地產市場的繁榮。”

抵押貸款利率上漲導致住房負擔能力下降,這或許是好事。HousingWire首席分析師羅根·莫塔沙米這樣認為。他表示,抵押貸款利率上漲可能給市場降溫,有機會增加庫存。庫存增加會放慢房價上漲的速度,降低火爆的房地產市場達到過熱甚至崩盤的可能性。

他對《財富》雜志表示:“抵押貸款利率上漲對于房地產市場而言是好消息,因為目前的房地產市場嚴重不健康,我們需要結束這種房屋庫存量極低的狀況。現在不是有太多貸款或不良信貸流入房地產市場。而是有太多人搶購過少的住房。我們迫切需要一個喘息的機會。”

Redfin認為,抵押貸款利率大幅上漲已經讓房地產市場略有降溫。該房屋中介平臺發現房屋掛牌數量小幅增加,價格下降,而且預約看房的數量減少。然而,我們需要再等幾周或者幾個月,才能確定房地產市場確實正在降溫。(財富中文網)

翻譯:劉進龍

審校:汪皓

You’d be hard-pressed to find housing economists proclaiming that the ongoing housing boom is nearing a 2008-type bust. In fact, many say the opposite, based on the belief that the demographic wave of millennial first-time homebuyers, elevated wage growth, and limited supply will all continue pushing the market upwards. Every major real estate firm with a publicly available forecast, including CoreLogic and Fannie Mae, predicts that home prices will go even higher over the coming year.

That said, the red-hot U.S. housing market is beginning to hit levels not seen since our last housing bubble.

Black Knight, a mortgage technology and data provider, showed Fortune an analysis on Friday that finds the typical American household would now have to spend 31% of their monthly income to make a mortgage payment on the average-priced U.S. home. That’s up from 29% just one week earlier, and up from 24% in December. Black Knight’s mortgage-payment-to-income ratio—which averaged 19.9% during the 2010s decade—hasn’t topped 31% since September 2007.

What’s going on? The economic shock caused by soaring mortgage rates over the past few weeks has dramatically increased mortgage payments for new homebuyers.

Back in December, the average 30-year fixed mortgage rate stood at 3.11%. A borrower taking on a $500,000 mortgage at that rate would owe $2,138 per month. Now that the average rate is at 5%, that loan if issued today would cost $2,684 per month. Over the course of the 30-year loan, that’s an additional $196,700.

In March, a team of researchers at the Federal Reserve Bank of Dallas got the attention of the real estate industry after publishing a paper titled Real-time market monitoring finds signs of brewing U.S. housing bubble. They found that recent U.S. home-price growth—which is up 19.2% over the past 12 months—is once again becoming “unhinged” from economic fundamentals.

However, the Dallas Fed researchers don’t see this as a 2008 repeat. Sure, many new homebuyers are getting stretched financially in a way that resembles buyers during the last bubble. But that’s just new homebuyers. If you look broadly at homeowners, they’re doing quite well.

As of the fourth quarter of 2021, only 3.8% of U.S. disposable personal income was going toward mortgage debt payments. At the height of the 2000s housing bubble, that figure was nearly double at 7.2%. This time around, households’ balance sheets look healthier, and more homeowners have paid off their mortgage altogether. In addition, the shady lending practices of the aughts were regulated out of the market by the 2010 Dodd-Frank Act. Simply put: If a storm does come, homeowners, in theory, should be better positioned to ride it out.

“Based on present evidence, there is no expectation that fallout from a housing correction would be comparable to the 2007–09 global financial crisis in terms of magnitude or macroeconomic gravity. Among other things, household balance sheets appear in better shape, and excessive borrowing doesn’t appear to be fueling the housing market boom,” write the Dallas Fed researchers.

It’s possible the affordability crunch created by soaring mortgage rates could be a good thing. That’s according to Logan Mohtashami, lead analyst at HousingWire. Spiking mortgage rates, he says, could take some steam out of the market and give inventory a chance to rise a bit. If that happens, it could slow down the rate of home price appreciation and reduce the likelihood of the red-hot housing market culminating in an overheated market—or even worse, a housing bust.

“Higher mortgage rates are the best thing for housing because we are in a savagely unhealthy housing market, and we need to get off these extreme low levels of inventory,” Mohtashami told Fortune. “It isn’t too much or bad credit chasing homes this time around. It’s too many people chasing too few homes. We desperately need a breather.”

According to Redfin, spiking mortgage rates are already softening the housing market a bit. The brokerage platform is seeing slightly more home listings with price cuts and fewer bookings for home showings. However, we’ll need to wait a few weeks—or months—before we can be sure that the housing market is actually softening.