更多的美國人現在能夠負擔1000美元的應急開支,但對于大多數美國家庭來說,這一目標仍然遙不可及。

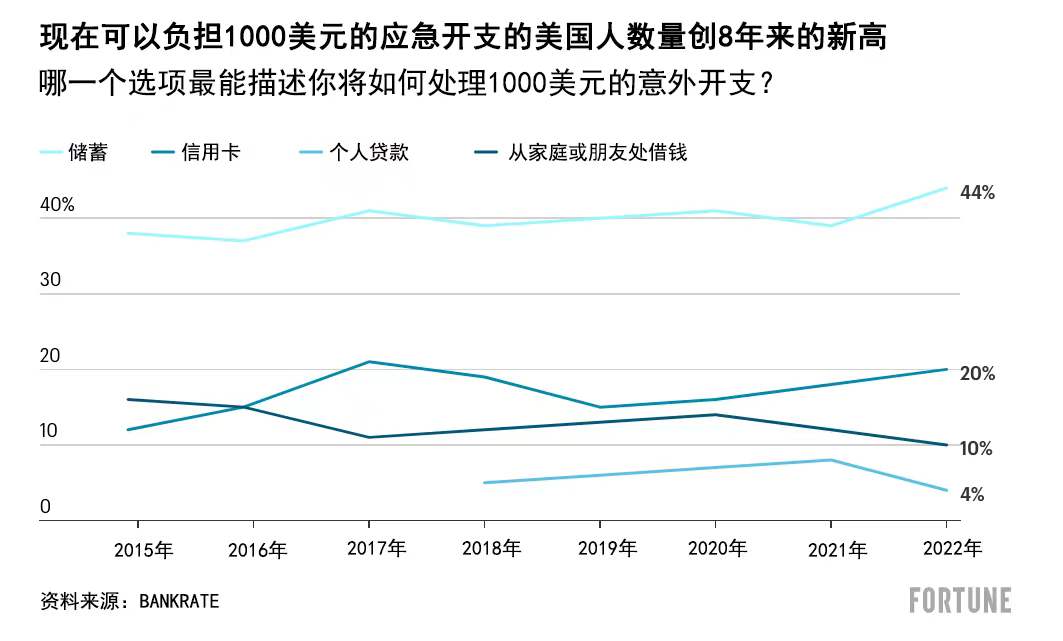

根據消費金融服務公司Bankrate在1月19日發布的一份針對1000多名美國成年人的調查,約44%的人表示,他們可以在不使用信用卡或借錢的情況下負擔這一水平的應急開支。

這是Bankrate開展這項調查的8年來,自稱有能力處理意外賬單的美國人所占比例最高的一次,甚至超過2020年和2021年,刺激支票、失業津貼和兒童稅收抵免付款等一系列聯邦資助相繼到賬時的水平。

美國人支付1000美元應急開支的能力有所增強,可能是拜以下幾個因素所賜:來自2021年聯邦資助項目的剩余儲蓄、美國經濟反彈,以及失業率下降。Bankrate的首席金融分析師格雷格·麥克布萊德對《財富》雜志表示,人們正在重返工作崗位,工資也在持續上漲。

但并不全是經濟因素在發揮作用。這場新冠疫情改變了美國人對儲蓄的重視程度,尤其是考慮到2020年的高失業率。“新冠疫情也凸顯了應急儲蓄的重要性。因此,人們更加專注地重建他們在疫情期間失去的東西,就連那些此前沒有儲蓄的人也開始攢錢了。”他說。

并非每個人的儲蓄都足以緩沖意外開支

盡管更多的美國人能夠用自己的儲蓄來應對重大的計劃外支出,但仍然有超過三分之一的人需要借錢。約35%的受訪者表示,他們將不得不通過信用卡、個人貸款或從親朋好友那里借錢來支付這筆費用。

在所有的年齡段中,26歲至32歲的千禧一代是最有可能用信用卡支付1000美元意外支出的。麥克布萊德指出,在新冠疫情期間,年輕工人備受收入中斷和失業的沖擊。他們開始積累儲蓄的時間也比年長的工人更短。

然而,即使對更年長的美國人而言,目前的儲蓄緩沖也不太可能持續下去,因為高通脹讓人們更加難以存錢。麥克布萊德告訴《財富》雜志:“對于我們能否在未來12個月復制過去12個月的成功,我并沒有那么樂觀。”

大多數美國人也不太可能像新冠疫情早期那樣,繼續享受遠程工作帶來的好處——新冠疫情早期階段的封鎖措施,大幅減少了人們在交通和餐飲方面的支出。在許多情況下,這意味著美國人有了更多的預算資金,從而更容易增加儲蓄。

“我們原以為這場疫情是短期的,所以人們沒有消費,而是把更多的錢存下來。”麥克布萊德說,“兩年過去了,很多家庭正在把沒有花在旅游、外出就餐或去聽音樂會上的錢花在其他地方,比如家居裝修,購買其他必需品,而這方面的成本正在增長。”

美國經濟分析局(Bureau of Economic Analysis)的最新數據顯示,自2020年4月達到33.8%的歷史高點以來,美國的個人儲蓄占其可支配收入的比例已經大幅下降,在2021年11月降至6.9%。

半數美國人表示,通貨膨脹正在侵蝕其儲蓄能力

專家建議,通常情況下,大多數美國人最好存下三到六個月的生活費。

盡管一些美國人或許有一筆充足的應急儲蓄,但事實可能會證明,一旦被花掉,再存下這樣一筆錢就更難了。這是因為通貨膨脹開始侵蝕儲蓄率。

在Bankrate的調查報告中,約49%的受訪者表示,通貨膨脹導致他們的儲蓄減少,三分之一的人表示沒有受到影響。約2%的受訪者坦言,他們一開始就沒有能力儲蓄。

“通貨膨脹正在使家庭預算變得越來越緊張。”麥克布萊德說。

“這次通脹的涉及面非常廣泛。”他補充說,通脹對食品和房租等非自由裁量支出的影響很大。2021年12月的消費者價格指數(Consumer Price Index)顯示,在過去12個月,食品價格上漲了6.5%,租金上漲約3.3%。

麥克布萊德表示,只有到家庭收入的增長跑贏通脹,并且通脹確實回落的時候,家庭儲蓄或許才會真正取得進展。但這很難預測;許多專家認為,高通脹將持續到2022年年底。

如何在通脹飆升的情況下存錢

對于那些想存錢的人,麥克布萊德建議利用商家的忠誠計劃,充分利用折扣、優惠券和返利來降低日常開支。甚至用完信用卡公司提供的現金回饋,或者收藏起來的禮品卡,也是有所助益的。

麥克布萊德指出,有可能的話,現在或許是專注于增加收入的好機會。要求加薪,或者找一份新工作。精力夠的話,不妨找一份兼職,做一些零工,哪怕只是做很短時間。

“勞動力市場目前有數百萬個空缺職位,你可以充分利用這一點。這能夠給你留出時間來重建應急儲蓄,或者一勞永逸地還清信用卡債務。”他說。

然而,最好的存錢方式仍然是將薪水直接存入一個專門的儲蓄賬戶。“這可以確保你存一點錢,并且迫使你圍繞實得工資制定預算。”但他隨即指出,考慮到生活成本持續攀升,很多人或許很難做到這一點。

“今時不同往日,你不能等到月底時,看看還剩下多少再試著存一點錢了。”麥克布萊德說,“在生活成本持續攀升的當下,根本就沒有‘余糧’可言。即使有,也是缺乏穩定性的。”(財富中文網)

譯者:任文科

更多的美國人現在能夠負擔1000美元的應急開支,但對于大多數美國家庭來說,這一目標仍然遙不可及。

根據消費金融服務公司Bankrate在1月19日發布的一份針對1000多名美國成年人的調查,約44%的人表示,他們可以在不使用信用卡或借錢的情況下負擔這一水平的應急開支。

這是Bankrate開展這項調查的8年來,自稱有能力處理意外賬單的美國人所占比例最高的一次,甚至超過2020年和2021年,刺激支票、失業津貼和兒童稅收抵免付款等一系列聯邦資助相繼到賬時的水平。

美國人支付1000美元應急開支的能力有所增強,可能是拜以下幾個因素所賜:來自2021年聯邦資助項目的剩余儲蓄、美國經濟反彈,以及失業率下降。Bankrate的首席金融分析師格雷格·麥克布萊德對《財富》雜志表示,人們正在重返工作崗位,工資也在持續上漲。

但并不全是經濟因素在發揮作用。這場新冠疫情改變了美國人對儲蓄的重視程度,尤其是考慮到2020年的高失業率。“新冠疫情也凸顯了應急儲蓄的重要性。因此,人們更加專注地重建他們在疫情期間失去的東西,就連那些此前沒有儲蓄的人也開始攢錢了。”他說。

并非每個人的儲蓄都足以緩沖意外開支

盡管更多的美國人能夠用自己的儲蓄來應對重大的計劃外支出,但仍然有超過三分之一的人需要借錢。約35%的受訪者表示,他們將不得不通過信用卡、個人貸款或從親朋好友那里借錢來支付這筆費用。

在所有的年齡段中,26歲至32歲的千禧一代是最有可能用信用卡支付1000美元意外支出的。麥克布萊德指出,在新冠疫情期間,年輕工人備受收入中斷和失業的沖擊。他們開始積累儲蓄的時間也比年長的工人更短。

然而,即使對更年長的美國人而言,目前的儲蓄緩沖也不太可能持續下去,因為高通脹讓人們更加難以存錢。麥克布萊德告訴《財富》雜志:“對于我們能否在未來12個月復制過去12個月的成功,我并沒有那么樂觀。”

大多數美國人也不太可能像新冠疫情早期那樣,繼續享受遠程工作帶來的好處——新冠疫情早期階段的封鎖措施,大幅減少了人們在交通和餐飲方面的支出。在許多情況下,這意味著美國人有了更多的預算資金,從而更容易增加儲蓄。

“我們原以為這場疫情是短期的,所以人們沒有消費,而是把更多的錢存下來。”麥克布萊德說,“兩年過去了,很多家庭正在把沒有花在旅游、外出就餐或去聽音樂會上的錢花在其他地方,比如家居裝修,購買其他必需品,而這方面的成本正在增長。”

美國經濟分析局(Bureau of Economic Analysis)的最新數據顯示,自2020年4月達到33.8%的歷史高點以來,美國的個人儲蓄占其可支配收入的比例已經大幅下降,在2021年11月降至6.9%。

半數美國人表示,通貨膨脹正在侵蝕其儲蓄能力

專家建議,通常情況下,大多數美國人最好存下三到六個月的生活費。

盡管一些美國人或許有一筆充足的應急儲蓄,但事實可能會證明,一旦被花掉,再存下這樣一筆錢就更難了。這是因為通貨膨脹開始侵蝕儲蓄率。

在Bankrate的調查報告中,約49%的受訪者表示,通貨膨脹導致他們的儲蓄減少,三分之一的人表示沒有受到影響。約2%的受訪者坦言,他們一開始就沒有能力儲蓄。

“通貨膨脹正在使家庭預算變得越來越緊張。”麥克布萊德說。

“這次通脹的涉及面非常廣泛。”他補充說,通脹對食品和房租等非自由裁量支出的影響很大。2021年12月的消費者價格指數(Consumer Price Index)顯示,在過去12個月,食品價格上漲了6.5%,租金上漲約3.3%。

麥克布萊德表示,只有到家庭收入的增長跑贏通脹,并且通脹確實回落的時候,家庭儲蓄或許才會真正取得進展。但這很難預測;許多專家認為,高通脹將持續到2022年年底。

如何在通脹飆升的情況下存錢

對于那些想存錢的人,麥克布萊德建議利用商家的忠誠計劃,充分利用折扣、優惠券和返利來降低日常開支。甚至用完信用卡公司提供的現金回饋,或者收藏起來的禮品卡,也是有所助益的。

麥克布萊德指出,有可能的話,現在或許是專注于增加收入的好機會。要求加薪,或者找一份新工作。精力夠的話,不妨找一份兼職,做一些零工,哪怕只是做很短時間。

“勞動力市場目前有數百萬個空缺職位,你可以充分利用這一點。這能夠給你留出時間來重建應急儲蓄,或者一勞永逸地還清信用卡債務。”他說。

然而,最好的存錢方式仍然是將薪水直接存入一個專門的儲蓄賬戶。“這可以確保你存一點錢,并且迫使你圍繞實得工資制定預算。”但他隨即指出,考慮到生活成本持續攀升,很多人或許很難做到這一點。

“今時不同往日,你不能等到月底時,看看還剩下多少再試著存一點錢了。”麥克布萊德說,“在生活成本持續攀升的當下,根本就沒有‘余糧’可言。即使有,也是缺乏穩定性的。”(財富中文網)

譯者:任文科

More Americans can now afford a $1,000 emergency expense, but that goal still remains out of reach to the majority of U.S. households.

Around 44% of people in the U.S. say they would be able to cover that level of emergency expense without putting it on a credit card or borrowing money, according to a?survey released on January 19 by Bankrate of just over 1,000 U.S. adults.

That’s the highest proportion of Americans who said they could handle unexpected bills in the eight years that Bankrate has been conducting the survey, topping even 2020 and 2021 levels when federal programs like stimulus checks, enhanced unemployment benefits and child tax credit payments were in place.

The increased ability to cover that $1,000 expense could be due to a few things: remaining savings from federal programs from last year, a rebounding U.S. economy, and a fall in unemployment. People are getting back to work and wage growth has been on the rise, Greg McBride, chief financial analyst for Bankrate, tells Fortune.

But it’s not all economic factors at play. The pandemic changed Americans’ priorities around saving, especially in light of the high unemployment seen in 2020. “The pandemic also underscored the importance of emergency savings, so there's a greater focus on rebuilding what was lost during the pandemic, but also accumulating savings for those that previously hadn't done so,” he says.

Not everyone has a robust savings cushion

Despite a higher number of Americans able to pay for a major unplanned expense using their savings, more than a third would still have to borrow the money. About 35% of those surveyed said they’d have to finance the expense using a credit card, personal loan, or by taking money from family and friends.

Younger millennials, ages 26 to 32, were the most likely of all age groups to finance an unplanned $1,000 expense with a credit card. Younger workers were predominantly hit by income disruptions and joblessness during the pandemic, McBride says. They’ve also had less time than older workers to even begin to build up their savings.

Even among older Americans, however, the current savings cushion is unlikely to last because high inflation is making it harder to save. “I'm not as optimistic that we're going to replicate the success of the last 12 months over the next 12 months,” McBride tells Fortune.

It’s also unlikely that most Americans are still reaping the rewards of working remotely like they were when lockdowns were in place during the early days of the pandemic, which led to less spending on transportation costs and restaurants. In many cases, this meant Americans had more money in their budgets and found it easier to put more away in savings.

“We were expecting [the pandemic] to be short term, so people weren't spending, they were saving more,” McBride says. “Two years in, for a lot of households, the money that doesn't get spent on travel, dining out or going to a concert is just getting spent someplace else—whether it’s on home improvements, or just other necessities that are increasing in cost.”

Americans’ personal saving rates as a percentage of their disposable personal income have already dropped since the?all-time high of 33.8% in April 2020, hitting 6.9% in November, according to the?latest data available from the Bureau of Economic Analysis.

Half of Americans say inflation is eating into their ability to save

Typically?experts recommend most Americans have between three to six months of living expenses saved up.

And while some Americans may have a fully-funded emergency savings cushion, it may now prove harder to build it back up once it’s been spent. That’s because inflation is starting to eat into savings rates.

About 49% of those surveyed by Bankrate report that inflation is causing them to save less, while a third say it’s having no impact. About 2% of respondents say they were never able to save to begin with.

“Inflation is stretching the household budget further and further,” McBride says.

“This inflation is very broad based,” he adds, saying that it’s affecting non-discretionary spending such as food and rent in big ways. Grocery food prices rose 6.5% over the last 12 months while rents increased by about 3.3%, according to the?December Consumer Price Index.

If household income growth outpaces inflation—and if inflation does come back down, McBride says maybe then households could truly make headway with their savings. But that’s difficult to predict and many?experts are predicting that high inflation will stick around through 2022.

How to save with soaring inflation

For those who are looking to save, McBride recommends utilizing loyalty programs and taking full advantage of discounts, coupons and rebates to help keep spending costs down. Even using up your cash back rewards or that stash of gift cards tucked away helps.

If possible, McBride says now might be a good opportunity to focus on increasing your income. Ask for raise or perhaps seek out a new job. Or, if you've got the bandwidth to take on a second job, do some gig work even just for a brief period of time.

“You can capitalize on this labor market where there are millions of open unfilled jobs and that can give you this window of time to rebuild your emergency savings or pay off that credit card debt once and for all,” he says.

The best step toward building savings, however, is still to set up a direct deposit from your paycheck into a dedicated savings account. “It makes sure that the savings happens—it forces you to build a budget around your take home pay,” he says, but adds that may be difficult for many in light of rising costs.

“Now more than ever, you can't try to save by waiting until the end of the month to see what's left over,” McBride says. “At a time when costs are going up the way they are, there just isn't money left over. And even when there is, there's no consistency to that.”