隨著加密貨幣交易所運(yùn)營(yíng)商競(jìng)相履行韓國(guó)金融監(jiān)管機(jī)構(gòu)的新法規(guī),該國(guó)的大多數(shù)加密貨幣交易所有可能將于9月24日之前關(guān)閉。

在9月24日之前,所有在韓國(guó)運(yùn)營(yíng)的交易所必須獲得金融和互聯(lián)網(wǎng)監(jiān)管機(jī)構(gòu)的牌照。截至9月13日,僅有28家交易所(該國(guó)正在運(yùn)營(yíng)的共有63家)已經(jīng)收到了來(lái)自于韓國(guó)互聯(lián)網(wǎng)振興院(Korea Internet and Security Agency)的認(rèn)證,而該認(rèn)證只是獲得韓國(guó)金融服務(wù)委員會(huì)(Financial Services Commission)批準(zhǔn)的第一步。該委員會(huì)稱,有鑒于截止日期的臨近,剩余的35家交易所拿到這一牌照的可能性不大。

位于中國(guó)香港的普華永道(PwC)的合伙人兼全球加密貨幣領(lǐng)導(dǎo)人亨利·阿爾斯拉尼安指出,多年來(lái),全球加密貨幣行業(yè)一直在“呼吁出臺(tái)明晰的監(jiān)管框架。”阿爾斯拉尼安表示,很多加密貨幣領(lǐng)導(dǎo)人對(duì)直截了當(dāng)?shù)姆ㄒ?guī)表示歡迎,因?yàn)椤霸诨疑珔^(qū)域運(yùn)營(yíng)為業(yè)務(wù)操作帶來(lái)了挑戰(zhàn),例如資金籌集和開(kāi)設(shè)銀行賬戶等等,同時(shí)也不符合公眾的利益。”

然而,韓國(guó)超過(guò)半數(shù)加密貨幣交易所的火速關(guān)停可能會(huì)給加密貨幣寡頭的崛起掃清障礙,有人稱此舉可能會(huì)傷害普通的投資者。

適者生存

韓國(guó)加密貨幣市場(chǎng)于2017年年底首次一飛沖天,當(dāng)時(shí)比特幣(Bitcoin)交易受到了各年齡段市民的瘋狂追捧,他們希望通過(guò)這款數(shù)字貨幣價(jià)格的上漲大賺一筆。當(dāng)時(shí),韓國(guó)成為了全球第三大交易市場(chǎng),僅次于美國(guó)和日本。加密貨幣市場(chǎng)自此之后與比特幣的價(jià)格一樣一直起起伏伏,然而在過(guò)去18個(gè)月中,新冠疫情導(dǎo)致全球出現(xiàn)了數(shù)字貨幣熱,而韓國(guó)加密貨幣市場(chǎng)亦重新升溫。韓國(guó)加密貨幣數(shù)據(jù)提供商 Coinhills公司稱,在加密貨幣交易方面,韓元如今成為了全球第三大最常使用的貨幣,僅次于美元和歐元。

這段期間,年輕的散戶幫助推動(dòng)了韓國(guó)加密貨幣的狂熱,因?yàn)榉康禺a(chǎn)價(jià)格一直在上漲,但在競(jìng)爭(zhēng)激烈的工作市場(chǎng),其薪資卻一直停滯不前。韓國(guó)國(guó)民議會(huì)政治事務(wù)委員會(huì)(South Korea National Assembly’s Political Affairs Committee)的成員尹斗賢(音譯)在8月發(fā)布的數(shù)據(jù)顯示,韓國(guó)約60%的新加密貨幣投資者都集中在20多歲和30多歲的年齡段。

首爾在最近幾個(gè)月中也啟動(dòng)了對(duì)加密貨幣行業(yè)的管控,以打擊非法活動(dòng),比如洗錢(qián)和逃稅,以及監(jiān)管方眼中年輕散戶開(kāi)展的高風(fēng)險(xiǎn)金融活動(dòng)。2022年,政府還將征收加密貨幣資本利得稅,在交易中盈利超過(guò)2135美元的投資者需上繳20%的稅。

去年9月,韓國(guó)當(dāng)局以欺詐指控為由,突襲檢查了Bithumb與Coinbit的辦公室,而這兩家是韓國(guó)第二大和第三大交易所。Coinbit隨后向CoinDesk透露,當(dāng)前面臨欺詐指控的公司前雇員實(shí)施了“洗白交易”,即通過(guò)創(chuàng)建虛假用戶賬戶來(lái)進(jìn)行交易,以推高交易所的交易量。在9月的突襲之后,韓國(guó)警察還調(diào)查了Bithumb的前任董事長(zhǎng)李正勛,并收繳了其公司股份。當(dāng)?shù)孛襟w報(bào)道稱,警察還對(duì)李正勛展開(kāi)了第二次欺詐調(diào)查,原因在于此前有14名投資者在7月提交了另一份訴狀。

監(jiān)管方稱,受加密貨幣行業(yè)快速增長(zhǎng)的刺激,韓國(guó)加密貨幣丑聞的規(guī)模和發(fā)生頻率都在不斷提升。監(jiān)管方稱,加密貨幣欺詐報(bào)告在2020年增長(zhǎng)了42%,而且除了Bithumb和Coinbit之外的多家加密貨幣交易所都遭到了欺詐指控。例如6月,警察以欺詐指控為由,逮捕了新近關(guān)停的交易所V Global的四位高管。當(dāng)局稱,該案涉及5.2萬(wàn)名受害者,損失超過(guò)了19億美元。

除了新規(guī)定之外,政府將于9月新設(shè)加密貨幣管理局,隸屬于韓國(guó)金融服務(wù)委員會(huì),旨在監(jiān)控韓國(guó)的數(shù)字資產(chǎn)。在整頓加密貨幣行業(yè)方面,韓國(guó)的監(jiān)管方并非是在孤軍作戰(zhàn):全球的監(jiān)管方,從中國(guó)到美國(guó),都因?yàn)橐恍┩瑯拥脑蚣訌?qiáng)了管控,目的是為了阻止金融犯罪,并改善對(duì)投資者的保護(hù)。

于8月離任的韓國(guó)金融服務(wù)委員會(huì)前主席恩成洙一直都在公開(kāi)地批評(píng)韓國(guó)的加密貨幣行業(yè)。恩成洙在4月稱,加密貨幣“沒(méi)有內(nèi)在價(jià)值[而且]不是真實(shí)的貨幣。我會(huì)建議人們不要投資加密貨幣。考慮其較高的價(jià)格波動(dòng)性,[加密貨幣]交易風(fēng)險(xiǎn)太高。”恩成洙的繼任者高承范對(duì)加密貨幣行業(yè)持有同樣的看法;高承范在8月拒絕了將加密貨幣作為合法金融資產(chǎn)的理念。

3月,在恩成洙的領(lǐng)導(dǎo)下,韓國(guó)金融服務(wù)委員會(huì)推出了新的規(guī)定,要求本國(guó)和國(guó)外加密貨幣交易所在向該委員會(huì)遞交其申請(qǐng)之前,必須通過(guò)金融情報(bào)部門(mén)(Financial Intelligence Unit)的審核。為了獲得韓國(guó)金融服務(wù)委員會(huì)的批準(zhǔn),加密貨幣平臺(tái)必須要求用戶注冊(cè)其真實(shí)姓名和銀行賬戶。為了符合反洗錢(qián)規(guī)定,各大平臺(tái)還需要讓其信息安全系統(tǒng)獲得政府互聯(lián)網(wǎng)監(jiān)管機(jī)構(gòu)的認(rèn)證。

該規(guī)定迫使交易所與傳統(tǒng)銀行合作,而是否合作則由銀行說(shuō)了算。如果這些資金被用于金融犯罪,那么各大銀行將承擔(dān)這些風(fēng)險(xiǎn),因此它們一直不愿意與規(guī)模較小的交易所合作,因?yàn)樗鼈內(nèi)狈?shí)施審慎反洗錢(qián)系統(tǒng)所需的資源。9月17日,第六大交易所火幣韓國(guó)(Huobi Korea)宣布,因?yàn)闊o(wú)法與銀行開(kāi)展合作,它已經(jīng)暫停了韓元交易。

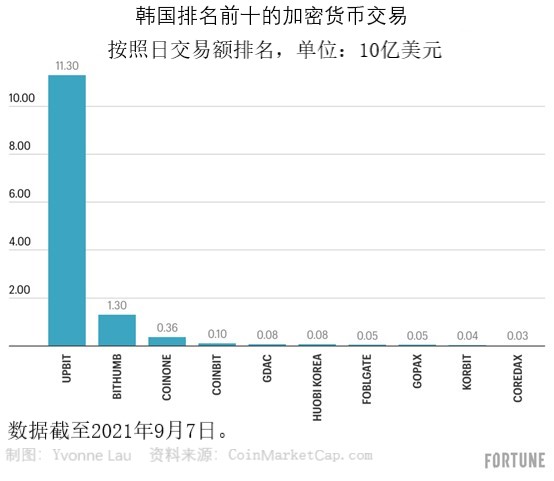

僅有Upbit、Bithumb、Coinone和Korbit這四家韓國(guó)平臺(tái)向韓國(guó)金融情報(bào)部門(mén)提交了注冊(cè)材料,意味著它們已經(jīng)獲得了與銀行的合作,以及來(lái)自于互聯(lián)網(wǎng)監(jiān)管方的認(rèn)證。

一些人稱,交易所的大規(guī)模關(guān)閉將給普通投資者帶來(lái)傷害。高麗大學(xué)加密貨幣研究中心(Korea University’s Cryptocurrency Research Center)的一名教授兼負(fù)責(zé)人金炯中(音譯)估計(jì),大多數(shù)韓國(guó)的代幣(除比特幣外的其他加密貨幣)會(huì)因?yàn)榻灰姿年P(guān)閉而消失,將導(dǎo)致投資者損失25億美元的資產(chǎn)。韓國(guó)金融服務(wù)委員會(huì)敦促投資者在9月24日之前取出資產(chǎn),并警告說(shuō)這些資產(chǎn)在交易所關(guān)閉之后將無(wú)法恢復(fù)。

上周,一批中小規(guī)模交易所舉辦了聯(lián)合新聞發(fā)布會(huì),稱這些規(guī)定將“催生不平衡的壟斷現(xiàn)象”。當(dāng)?shù)孛襟w報(bào)道稱,國(guó)會(huì)民主黨議員盧雄來(lái)還警告說(shuō):“如果壟斷市場(chǎng)出現(xiàn),任何交易所就都可能會(huì)隨意上市或下市代幣,或提升交易費(fèi)。”

其他人稱,對(duì)交易所壟斷的恐懼已經(jīng)到了無(wú)以復(fù)加的地步。Eqonex銷(xiāo)售負(fù)責(zé)人賈斯汀·德·安納森指出,“海外所采用的集中式交易所模式,以及去中心化交易所的大幅增長(zhǎng)意味著交易者手中的選擇權(quán)正在不斷增加,而不是減少。”他說(shuō),不斷收緊的規(guī)定意味著僅有“在合規(guī)和準(zhǔn)備方面有所欠缺”的平臺(tái)將出局。

德·安納森稱:“這些規(guī)定將使加密貨幣空間合法化,并明確了參與者能夠應(yīng)付的行業(yè)實(shí)踐。從長(zhǎng)期來(lái)看,監(jiān)管方的舉措將對(duì)行業(yè)帶來(lái)有利的影響。”(財(cái)富中文網(wǎng))

譯者:馮豐

審校:夏林

隨著加密貨幣交易所運(yùn)營(yíng)商競(jìng)相履行韓國(guó)金融監(jiān)管機(jī)構(gòu)的新法規(guī),該國(guó)的大多數(shù)加密貨幣交易所有可能將于9月24日之前關(guān)閉。

在9月24日之前,所有在韓國(guó)運(yùn)營(yíng)的交易所必須獲得金融和互聯(lián)網(wǎng)監(jiān)管機(jī)構(gòu)的牌照。截至9月13日,僅有28家交易所(該國(guó)正在運(yùn)營(yíng)的共有63家)已經(jīng)收到了來(lái)自于韓國(guó)互聯(lián)網(wǎng)振興院(Korea Internet and Security Agency)的認(rèn)證,而該認(rèn)證只是獲得韓國(guó)金融服務(wù)委員會(huì)(Financial Services Commission)批準(zhǔn)的第一步。該委員會(huì)稱,有鑒于截止日期的臨近,剩余的35家交易所拿到這一牌照的可能性不大。

位于中國(guó)香港的普華永道(PwC)的合伙人兼全球加密貨幣領(lǐng)導(dǎo)人亨利·阿爾斯拉尼安指出,多年來(lái),全球加密貨幣行業(yè)一直在“呼吁出臺(tái)明晰的監(jiān)管框架。”阿爾斯拉尼安表示,很多加密貨幣領(lǐng)導(dǎo)人對(duì)直截了當(dāng)?shù)姆ㄒ?guī)表示歡迎,因?yàn)椤霸诨疑珔^(qū)域運(yùn)營(yíng)為業(yè)務(wù)操作帶來(lái)了挑戰(zhàn),例如資金籌集和開(kāi)設(shè)銀行賬戶等等,同時(shí)也不符合公眾的利益。”

然而,韓國(guó)超過(guò)半數(shù)加密貨幣交易所的火速關(guān)停可能會(huì)給加密貨幣寡頭的崛起掃清障礙,有人稱此舉可能會(huì)傷害普通的投資者。

適者生存

韓國(guó)加密貨幣市場(chǎng)于2017年年底首次一飛沖天,當(dāng)時(shí)比特幣(Bitcoin)交易受到了各年齡段市民的瘋狂追捧,他們希望通過(guò)這款數(shù)字貨幣價(jià)格的上漲大賺一筆。當(dāng)時(shí),韓國(guó)成為了全球第三大交易市場(chǎng),僅次于美國(guó)和日本。加密貨幣市場(chǎng)自此之后與比特幣的價(jià)格一樣一直起起伏伏,然而在過(guò)去18個(gè)月中,新冠疫情導(dǎo)致全球出現(xiàn)了數(shù)字貨幣熱,而韓國(guó)加密貨幣市場(chǎng)亦重新升溫。韓國(guó)加密貨幣數(shù)據(jù)提供商 Coinhills公司稱,在加密貨幣交易方面,韓元如今成為了全球第三大最常使用的貨幣,僅次于美元和歐元。

這段期間,年輕的散戶幫助推動(dòng)了韓國(guó)加密貨幣的狂熱,因?yàn)榉康禺a(chǎn)價(jià)格一直在上漲,但在競(jìng)爭(zhēng)激烈的工作市場(chǎng),其薪資卻一直停滯不前。韓國(guó)國(guó)民議會(huì)政治事務(wù)委員會(huì)(South Korea National Assembly’s Political Affairs Committee)的成員尹斗賢(音譯)在8月發(fā)布的數(shù)據(jù)顯示,韓國(guó)約60%的新加密貨幣投資者都集中在20多歲和30多歲的年齡段。

首爾在最近幾個(gè)月中也啟動(dòng)了對(duì)加密貨幣行業(yè)的管控,以打擊非法活動(dòng),比如洗錢(qián)和逃稅,以及監(jiān)管方眼中年輕散戶開(kāi)展的高風(fēng)險(xiǎn)金融活動(dòng)。2022年,政府還將征收加密貨幣資本利得稅,在交易中盈利超過(guò)2135美元的投資者需上繳20%的稅。

去年9月,韓國(guó)當(dāng)局以欺詐指控為由,突襲檢查了Bithumb與Coinbit的辦公室,而這兩家是韓國(guó)第二大和第三大交易所。Coinbit隨后向CoinDesk透露,當(dāng)前面臨欺詐指控的公司前雇員實(shí)施了“洗白交易”,即通過(guò)創(chuàng)建虛假用戶賬戶來(lái)進(jìn)行交易,以推高交易所的交易量。在9月的突襲之后,韓國(guó)警察還調(diào)查了Bithumb的前任董事長(zhǎng)李正勛,并收繳了其公司股份。當(dāng)?shù)孛襟w報(bào)道稱,警察還對(duì)李正勛展開(kāi)了第二次欺詐調(diào)查,原因在于此前有14名投資者在7月提交了另一份訴狀。

監(jiān)管方稱,受加密貨幣行業(yè)快速增長(zhǎng)的刺激,韓國(guó)加密貨幣丑聞的規(guī)模和發(fā)生頻率都在不斷提升。監(jiān)管方稱,加密貨幣欺詐報(bào)告在2020年增長(zhǎng)了42%,而且除了Bithumb和Coinbit之外的多家加密貨幣交易所都遭到了欺詐指控。例如6月,警察以欺詐指控為由,逮捕了新近關(guān)停的交易所V Global的四位高管。當(dāng)局稱,該案涉及5.2萬(wàn)名受害者,損失超過(guò)了19億美元。

除了新規(guī)定之外,政府將于9月新設(shè)加密貨幣管理局,隸屬于韓國(guó)金融服務(wù)委員會(huì),旨在監(jiān)控韓國(guó)的數(shù)字資產(chǎn)。在整頓加密貨幣行業(yè)方面,韓國(guó)的監(jiān)管方并非是在孤軍作戰(zhàn):全球的監(jiān)管方,從中國(guó)到美國(guó),都因?yàn)橐恍┩瑯拥脑蚣訌?qiáng)了管控,目的是為了阻止金融犯罪,并改善對(duì)投資者的保護(hù)。

于8月離任的韓國(guó)金融服務(wù)委員會(huì)前主席恩成洙一直都在公開(kāi)地批評(píng)韓國(guó)的加密貨幣行業(yè)。恩成洙在4月稱,加密貨幣“沒(méi)有內(nèi)在價(jià)值[而且]不是真實(shí)的貨幣。我會(huì)建議人們不要投資加密貨幣。考慮其較高的價(jià)格波動(dòng)性,[加密貨幣]交易風(fēng)險(xiǎn)太高。”恩成洙的繼任者高承范對(duì)加密貨幣行業(yè)持有同樣的看法;高承范在8月拒絕了將加密貨幣作為合法金融資產(chǎn)的理念。

3月,在恩成洙的領(lǐng)導(dǎo)下,韓國(guó)金融服務(wù)委員會(huì)推出了新的規(guī)定,要求本國(guó)和國(guó)外加密貨幣交易所在向該委員會(huì)遞交其申請(qǐng)之前,必須通過(guò)金融情報(bào)部門(mén)(Financial Intelligence Unit)的審核。為了獲得韓國(guó)金融服務(wù)委員會(huì)的批準(zhǔn),加密貨幣平臺(tái)必須要求用戶注冊(cè)其真實(shí)姓名和銀行賬戶。為了符合反洗錢(qián)規(guī)定,各大平臺(tái)還需要讓其信息安全系統(tǒng)獲得政府互聯(lián)網(wǎng)監(jiān)管機(jī)構(gòu)的認(rèn)證。

該規(guī)定迫使交易所與傳統(tǒng)銀行合作,而是否合作則由銀行說(shuō)了算。如果這些資金被用于金融犯罪,那么各大銀行將承擔(dān)這些風(fēng)險(xiǎn),因此它們一直不愿意與規(guī)模較小的交易所合作,因?yàn)樗鼈內(nèi)狈?shí)施審慎反洗錢(qián)系統(tǒng)所需的資源。9月17日,第六大交易所火幣韓國(guó)(Huobi Korea)宣布,因?yàn)闊o(wú)法與銀行開(kāi)展合作,它已經(jīng)暫停了韓元交易。

僅有Upbit、Bithumb、Coinone和Korbit這四家韓國(guó)平臺(tái)向韓國(guó)金融情報(bào)部門(mén)提交了注冊(cè)材料,意味著它們已經(jīng)獲得了與銀行的合作,以及來(lái)自于互聯(lián)網(wǎng)監(jiān)管方的認(rèn)證。

一些人稱,交易所的大規(guī)模關(guān)閉將給普通投資者帶來(lái)傷害。高麗大學(xué)加密貨幣研究中心(Korea University’s Cryptocurrency Research Center)的一名教授兼負(fù)責(zé)人金炯中(音譯)估計(jì),大多數(shù)韓國(guó)的代幣(除比特幣外的其他加密貨幣)會(huì)因?yàn)榻灰姿年P(guān)閉而消失,將導(dǎo)致投資者損失25億美元的資產(chǎn)。韓國(guó)金融服務(wù)委員會(huì)敦促投資者在9月24日之前取出資產(chǎn),并警告說(shuō)這些資產(chǎn)在交易所關(guān)閉之后將無(wú)法恢復(fù)。

上周,一批中小規(guī)模交易所舉辦了聯(lián)合新聞發(fā)布會(huì),稱這些規(guī)定將“催生不平衡的壟斷現(xiàn)象”。當(dāng)?shù)孛襟w報(bào)道稱,國(guó)會(huì)民主黨議員盧雄來(lái)還警告說(shuō):“如果壟斷市場(chǎng)出現(xiàn),任何交易所就都可能會(huì)隨意上市或下市代幣,或提升交易費(fèi)。”

其他人稱,對(duì)交易所壟斷的恐懼已經(jīng)到了無(wú)以復(fù)加的地步。Eqonex銷(xiāo)售負(fù)責(zé)人賈斯汀·德·安納森指出,“海外所采用的集中式交易所模式,以及去中心化交易所的大幅增長(zhǎng)意味著交易者手中的選擇權(quán)正在不斷增加,而不是減少。”他說(shuō),不斷收緊的規(guī)定意味著僅有“在合規(guī)和準(zhǔn)備方面有所欠缺”的平臺(tái)將出局。

德·安納森稱:“這些規(guī)定將使加密貨幣空間合法化,并明確了參與者能夠應(yīng)付的行業(yè)實(shí)踐。從長(zhǎng)期來(lái)看,監(jiān)管方的舉措將對(duì)行業(yè)帶來(lái)有利的影響。”(財(cái)富中文網(wǎng))

譯者:馮豐

審校:夏林

The majority of South Korea’s cryptocurrency exchanges will likely shut down by September 24, as operators race to meet stringent new rules from the country’s financial watchdog.

By Sept. 24, all exchanges operating in South Korea must obtain licenses from financial and Internet regulators. As of September 13, only 28 exchanges—out of the 63 operating in-country—had received certification from the Korea Internet and Security Agency (KISA), the first step to obtaining final approval from the Financial Services Commission (FSC). The remaining 35 exchanges are unlikely to be able to comply given the looming deadline, says the FSC.

The crypto industry worldwide has for many years “l(fā)obbied to have clear regulatory frameworks,” says Henri Arslanian, partner and crypto leader at consultancy PwC based in Hong Kong. Many crypto leaders welcome straightforward rules because “operating in gray areas makes running the business challenging, from fundraising to opening bank accounts,” Arslanian notes. “It’s not in the best interest of the public, either.”

Still, the rapid-fire closure of over half of South Korea’s crypto exchanges could pave an easy path for crypto monopolies to emerge, which some say could harm ordinary investors.

Survival of the fittest

South Korea’s crypto market first surged in late 2017, when Bitcoin trading skyrocketed in popularity among ordinary citizens of all ages who looked to cash in on the digital currency’s rising price. The country became the world’s third-largest trading market behind the U.S. and Japan at the time. The market has fluctuated since then, alongside the price of Bitcoin, but in the past 18 months, South Korea’s crypto market has experienced a resurgence aligned with the pandemic-fueled global boom in digital currencies. The Korean won now ranks third worldwide behind the U.S. dollar and the euro as the most commonly used currency for trading Bitcoin, says Coinhills data.

Young retail traders, facing rising real estate prices and stagnating salaries in a competitive job market, helped fuel South Korea’s crypto frenzy this time around. For young investors, the crypto market provided easy access to trading and the prospect of quick gains. Around 60% of South Korea’s new crypto investors are in their twenties and thirties, according to data released in August from Yoon Doo-hyeon, a member of the South Korea National Assembly’s Political Affairs Committee.

Seoul in recent months has cranked up its control of the country’s cryptocurrency industry to rein in illicit activities such as money laundering and tax evasion, and what regulators view as risky financial activity among young retail traders. In 2022, the government will also introduce a crypto capital gains tax; investors who make over $2,135 in trading profit will face a 20% tariff.

Last September, state authorities raided the offices of Bithumb and Coinbit, the second- and third-largest exchanges in the country by trading volume, over fraud allegations. Coinbit later told CoinDesk that its former employees, now facing fraud charges, carried out “wash trading” by creating fake user accounts that made trades to inflate the exchange’s trading volumes. After the September raids, South Korean police also investigated Bithumb’s former chairman Lee Jung-hoon and seized his company shares. Police have opened a second fraud investigation into Lee after a group of 14 investors filed another complaint in July, according to local media reports.

Regulators say crypto scams in South Korea are becoming bigger and more frequent, aided by the industry’s rapid growth. Crypto fraud reports increased 42% in 2020, regulators say, and several crypto exchanges in addition to Bithumb and Coinbit have been accused of fraud. In June, for instance, police arrested four executives of now-defunct exchange V Global on fraud charges; authorities say the case involves 52,000 victims and losses in excess of $1.9 billion.

In addition to the new rules, the government is setting up a new crypto bureau in September that will operate under the FSC to supervise、 the country’s digital assets. South Korea’s regulators aren’t alone in their clampdown on the crypto industry: Regulators worldwide from China to the U.S. are seeking tighter control for some of the same reasons; to stop financial crimes and improve investor protection.

Former FSC chairman Eun Sung-soo, who stepped down in August, has been an outspoken critic of the South Korean crypto industry. Eun said in April that cryptocurrencies “have no intrinsic value…[and] are not a real currency. I would advise people not to invest in cryptocurrencies. It’s too risky to trade [cryptocurrencies] considering their high price volatility.” Eun’s successor, Koh Seung-beom, holds the same hawkish stance toward the crypto industry; Koh in August rejected the idea of cryptocurrencies as a legitimate financial asset.

In March the FSC, under Eun’s direction, introduced new rules stipulating that domestic and foreign crypto exchanges must be vetted by the Financial Intelligence Unit (FIU) before their applications are passed on to the FSC. To win FSC approval, crypto platforms must require users to register using their real names and bank accounts. Platforms also need to meet anti–money laundering standards by having their information security systems certified by the government’s Internet watchdog.

The rules force the exchanges to partner with traditional banks, which have the final say in confirming the partnership. Banks bear the risk if the funds are used for financial crimes so they have been unwilling to partner with smaller exchanges that lack the resources to implement stringent anti–money laundering systems. On September 17, the sixth-largest exchange, Huobi Korea, announced that it had suspended Korean won trading owing to its inability to obtain a bank partnership.

Only four of South Korea’s platforms, Upbit, Bithumb, Coinone, and Korbit, have submitted their registrations to the FIU, meaning that they have secured both bank partnerships and certification from the Internet regulator.

Some say that the mass closure of exchanges penalizes ordinary investors. Most of South Korea’s alt-coins—cryptocurrencies other than Bitcoin—will be lost via exchange closures, jeopardizing $2.5 billion of investor assets, according to estimates from Kim Hyoung-joong, a professor and head of Korea University’s Cryptocurrency Research Center. The FSC urged investors to withdraw assets ahead of the Sept. 24 deadline, warning that those assets could be irretrievable if an exchange shuts down. The FSC didn’t reply to Fortune’s request for comment.

Last week, a group of small and midsize exchanges held a joint press conference saying that the rules will “allow for a lopsided monopoly to emerge.” Noh Woong-rae, a Democratic Party member of parliament, also warned that “if a monopoly market emerges, any exchange could list or delist coins, or raise transaction fees at will,” according to local media reports.

Others say that fears of exchange monopolies are overblown. The abundance of “overseas options for centralized exchanges, and the massive growth of decentralized exchanges shows that the options offered to traders are increasing, not decreasing,” says Justin d’Anethan, head of sales at Eqonex. Tightened rules mean that only the “l(fā)ess compliant and less prepared” platforms will be killed off, he says.

“These regulations legitimize the crypto space and clarify industry practices for the participants that can cope,” says d’Anethan. “Long-term, the regulator’s efforts will be positive for the industry.”