近幾個月,盡管公眾對德爾塔變種毒株和縮減資產(chǎn)規(guī)模政策的擔憂加劇,標準普爾500指數(shù)(S&P 500)卻仍然在繼續(xù)攀升。但有一項指標可能預(yù)示著,未來股市或?qū)⒂瓉砥\浬踔列苁小?/p>

保證金借款是指投資者從經(jīng)紀商借入用于購買證券的資金。根據(jù)美國金融業(yè)監(jiān)管局(FINRA)的數(shù)據(jù),保證金借款總量在6月創(chuàng)下8820億美元的新高,此后出現(xiàn)下滑。7月是新冠肺炎疫情爆發(fā)以來保證金負債量首次下降,而此時的標準普爾500指數(shù)正創(chuàng)下歷史新高。換句話說,與今夏初期相比,盡管股市仍然在走高,投資者上個月用于購買股票的借款卻減少了。

這為什么是消極信號呢?嘉信理財(Charles Schwab)的交易和衍生品董事總經(jīng)理蘭迪?弗雷德里克解釋說,保證金借款“總體上反映了人們對市場的信心”。“如果有人愿意借錢買股票,說明他們相信這些股票的收益能夠超過自己為借款支付的利息。”

的確如此,正如美國銀行(Bank of America)的技術(shù)研究策略師斯蒂芬?薩特邁爾在8月23日的報告中所寫:“杠桿率上升往往和美國股市的上漲相呼應(yīng)。我們不擔心保證金借款量創(chuàng)下新高。”相反,“如果保證金借款量停止上漲,說明投資者已經(jīng)開始去杠桿,我們才會感到擔憂。”他指出,標準普爾500指數(shù)7月上漲了2.3%,但保證金借款量較上月高點下跌了4.3%。

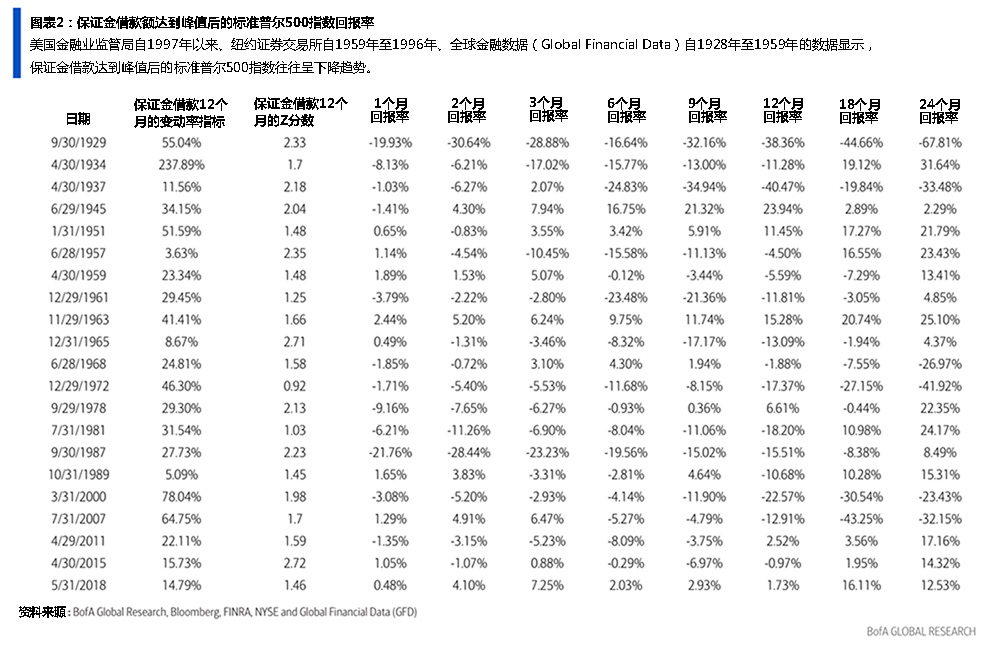

“盡管保證金借款的峰值并不總是與(標準普爾500指數(shù))的高點同時出現(xiàn),但出現(xiàn)峰值往往預(yù)示著股市將會疲軟。”薩特邁爾表示。他在報告中指出,自1997年以來(基于美國金融業(yè)監(jiān)管局的數(shù)據(jù)),有21次保證金借款在達到頂峰后變?nèi)踝儾睿S后標準普爾500指數(shù)也出現(xiàn)同樣趨勢(參見下面美國銀行的圖表)。

薩特邁爾說:“按照美國金融業(yè)監(jiān)管局的數(shù)據(jù),如果2021年6月是保證金負債量的又一個周期高點,那么在保證金見頂后的1個月到24個月里,(標準普爾500指數(shù))存在回報變低、甚至在大多數(shù)情況下為負收益的風險。”他引用數(shù)據(jù)指出,“在保證金債務(wù)達到峰值一年后,(標準普爾500指數(shù))下跌了71%,平均回報率為-7.8%(中位數(shù)為-10.7%)。”

弗雷德里克認為,7月保證金負債量的下降“不同尋常”,因為從歷史上看,保證金負債量在市場上漲時上升,在股市下跌時下降。“自2020年3月以來,我們還沒有真正看到市場出現(xiàn)大幅下滑,保證金負債量也沒有大幅下降。”他向《財富》雜志表示,“所以7月的數(shù)據(jù)非常不尋常,因為市場基本上處于歷史高點,而我們的保證金負債量卻出現(xiàn)了相當大幅度的下降。這很奇怪。”

一方面,弗雷德里克在最近發(fā)布的推特(Twitter)中指出,保證金債務(wù)下降“降低了回調(diào)變成全面修正的可能”(事實上,最近我們看到,每當市場出現(xiàn)拋售時,就會有買家入場,市場因此不會進入全面修正),但“也意味著投資者趨于謹慎”。

保證金負債量往往與市場表現(xiàn)掛鉤。但本月,盡管標準普爾500指數(shù)創(chuàng)下新高,但保證金負債量仍然出現(xiàn)了新冠肺炎疫情以來的首次下跌。這降低了回調(diào)變成全面修正的風險,但也意味著投資者變得更加謹慎。https://t.co/wyfH3UcCAS pic.twitter.com/2i7wMaKrlQ

——蘭迪?弗雷德里克(@RandyAFrederick),2021年8月16日

肯定還有其他因素會影響投資者對股市的預(yù)判,影響標準普爾500指數(shù)的短期走勢,比如季節(jié)性(8月和9月往往是股市淡季),即將到來的杰克遜霍爾全球央行年會、美聯(lián)儲會議(可能會透露關(guān)于縮減資產(chǎn)規(guī)模政策的信息),以及新冠病毒的持續(xù)傳播。

弗雷德里克也提醒道,“一個月并不代表趨勢”,如果8月的保證金負債量數(shù)據(jù)出現(xiàn)回升,7月就可能會被認為是一個無關(guān)緊要的“異常”。然而,如果8月的數(shù)據(jù)在股市保持強勁的情況下繼續(xù)下滑,就可能有“更重要”的意義。(弗雷德里克說,總體而言,如果近期出現(xiàn)5%至7%的回調(diào),他不會感到意外。)

不管怎樣,繼續(xù)關(guān)注下個月的數(shù)據(jù)才是上策。(財富中文網(wǎng))

譯者:Agatha

近幾個月,盡管公眾對德爾塔變種毒株和縮減資產(chǎn)規(guī)模政策的擔憂加劇,標準普爾500指數(shù)(S&P 500)卻仍然在繼續(xù)攀升。但有一項指標可能預(yù)示著,未來股市或?qū)⒂瓉砥\浬踔列苁小?/p>

保證金借款是指投資者從經(jīng)紀商借入用于購買證券的資金。根據(jù)美國金融業(yè)監(jiān)管局(FINRA)的數(shù)據(jù),保證金借款總量在6月創(chuàng)下8820億美元的新高,此后出現(xiàn)下滑。7月是新冠肺炎疫情爆發(fā)以來保證金負債量首次下降,而此時的標準普爾500指數(shù)正創(chuàng)下歷史新高。換句話說,與今夏初期相比,盡管股市仍然在走高,投資者上個月用于購買股票的借款卻減少了。

這為什么是消極信號呢?嘉信理財(Charles Schwab)的交易和衍生品董事總經(jīng)理蘭迪?弗雷德里克解釋說,保證金借款“總體上反映了人們對市場的信心”。“如果有人愿意借錢買股票,說明他們相信這些股票的收益能夠超過自己為借款支付的利息。”

的確如此,正如美國銀行(Bank of America)的技術(shù)研究策略師斯蒂芬?薩特邁爾在8月23日的報告中所寫:“杠桿率上升往往和美國股市的上漲相呼應(yīng)。我們不擔心保證金借款量創(chuàng)下新高。”相反,“如果保證金借款量停止上漲,說明投資者已經(jīng)開始去杠桿,我們才會感到擔憂。”他指出,標準普爾500指數(shù)7月上漲了2.3%,但保證金借款量較上月高點下跌了4.3%。

“盡管保證金借款的峰值并不總是與(標準普爾500指數(shù))的高點同時出現(xiàn),但出現(xiàn)峰值往往預(yù)示著股市將會疲軟。”薩特邁爾表示。他在報告中指出,自1997年以來(基于美國金融業(yè)監(jiān)管局的數(shù)據(jù)),有21次保證金借款在達到頂峰后變?nèi)踝儾睿S后標準普爾500指數(shù)也出現(xiàn)同樣趨勢(參見下面美國銀行的圖表)。

薩特邁爾說:“按照美國金融業(yè)監(jiān)管局的數(shù)據(jù),如果2021年6月是保證金負債量的又一個周期高點,那么在保證金見頂后的1個月到24個月里,(標準普爾500指數(shù))存在回報變低、甚至在大多數(shù)情況下為負收益的風險。”他引用數(shù)據(jù)指出,“在保證金債務(wù)達到峰值一年后,(標準普爾500指數(shù))下跌了71%,平均回報率為-7.8%(中位數(shù)為-10.7%)。”

弗雷德里克認為,7月保證金負債量的下降“不同尋常”,因為從歷史上看,保證金負債量在市場上漲時上升,在股市下跌時下降。“自2020年3月以來,我們還沒有真正看到市場出現(xiàn)大幅下滑,保證金負債量也沒有大幅下降。”他向《財富》雜志表示,“所以7月的數(shù)據(jù)非常不尋常,因為市場基本上處于歷史高點,而我們的保證金負債量卻出現(xiàn)了相當大幅度的下降。這很奇怪。”

一方面,弗雷德里克在最近發(fā)布的推特(Twitter)中指出,保證金債務(wù)下降“降低了回調(diào)變成全面修正的可能”(事實上,最近我們看到,每當市場出現(xiàn)拋售時,就會有買家入場,市場因此不會進入全面修正),但“也意味著投資者趨于謹慎”。

保證金負債量往往與市場表現(xiàn)掛鉤。但本月,盡管標準普爾500指數(shù)創(chuàng)下新高,但保證金負債量仍然出現(xiàn)了新冠肺炎疫情以來的首次下跌。這降低了回調(diào)變成全面修正的風險,但也意味著投資者變得更加謹慎。https://t.co/wyfH3UcCAS pic.twitter.com/2i7wMaKrlQ

——蘭迪?弗雷德里克(@RandyAFrederick),2021年8月16日

肯定還有其他因素會影響投資者對股市的預(yù)判,影響標準普爾500指數(shù)的短期走勢,比如季節(jié)性(8月和9月往往是股市淡季),即將到來的杰克遜霍爾全球央行年會、美聯(lián)儲會議(可能會透露關(guān)于縮減資產(chǎn)規(guī)模政策的信息),以及新冠病毒的持續(xù)傳播。

弗雷德里克也提醒道,“一個月并不代表趨勢”,如果8月的保證金負債量數(shù)據(jù)出現(xiàn)回升,7月就可能會被認為是一個無關(guān)緊要的“異常”。然而,如果8月的數(shù)據(jù)在股市保持強勁的情況下繼續(xù)下滑,就可能有“更重要”的意義。(弗雷德里克說,總體而言,如果近期出現(xiàn)5%至7%的回調(diào),他不會感到意外。)

不管怎樣,繼續(xù)關(guān)注下個月的數(shù)據(jù)才是上策。(財富中文網(wǎng))

譯者:Agatha

The S&P 500 has continued its upward climb in recent months, despite rising fears about the Delta variant and tapering. But one indicator may be warning of a weaker—or even bearish—period ahead for stocks.

Margin debt, which is the money investors borrow from brokers to buy securities, hit a record high in June, at $882 billion per FINRA, and has since slumped. July marked the first time margin debt declined since the pre-COVID days, and that decline comes at a time when the S&P 500 is hitting all-time highs of its own. In other words, investors were borrowing less money to buy stocks last month than they were earlier this summer, even as stocks ticked higher.

So why would that be a bad thing? Think of margin debt as "basically just a statement of confidence in the market," explains Randy Frederick, managing director of trading and derivatives at Charles Schwab. "If someone's willing to borrow money in order to buy stocks, they believe that the return they get on those stocks is going to exceed the interest rate they pay on that borrowing."

Indeed, as Stephen Suttmeier, technical research strategist at Bank of America, wrote in a August 23 note, "Rising leverage tends to confirm U.S. equity rallies. It is not new record highs for margin debt that we worry about." Instead, "we get concerned when margin debt stops rising to suggest that investors have begun to reduce leverage." He points out that the S&P 500 rose 2.3% in July, but margin debt dropped by 4.3% from its high the month prior.

"Although peaks in margin debt don't always coincide with highs for the [S&P 500], they tend to be bearish for equities," Suttmeier argues. In his note, he points to 21 times since 1997 (based on FINRA data) when margin debt peaked and weaker, and even poor, S&P 500 performance ensued (see Bank of America's chart below).

"If June 2021 proves to be another cycle high for FINRA margin debt, the risk is for weaker, and in most cases negative, [S&P 500] returns from one month through 24 months after a margin peak," Suttmeier says. To put numbers on that, he notes that one year after "a peak in margin debt shows the [S&P 500] down 71% of the time with an average return of -7.8% (-10.7% median)."

Frederick suggests the July drop in margin debt is "unusual," since historically margin debt goes up when the market is going up, and goes down when stocks sell off. "We haven't really seen a big downturn in the market, and we really haven't seen a big drop in margin debt since March 2020," he tells Fortune. "That's why the July data is very unusual, because the market is essentially sitting at an all-time high and we had a pretty sizable downtick in margin debt. That's really weird."

On one hand, Frederick noted in a recent tweet that declining margin debt "reduces the risk that a pullback becomes a full correction" (indeed, lately we've seen dip buyers jumping in whenever the market sells off, preventing it from going into a full correction), but that "it also implies investors are getting more cautious."

Margin debt is mostly tied to market performance. But this month it declined for the first time post-COVID, despite new $SPX highs. This reduces the risk that a pullback becomes a full correction, but it also implies investors are getting more cautious.https://t.co/wyfH3UcCAS pic.twitter.com/2i7wMaKrlQ

— Randy Frederick (@RandyAFrederick) August 16, 2021

Certainly there are other factors at play in terms of how investors are feeling about stocks and how the S&P 500 may perform in the short term, including seasonality (August and September tend to be weak months for stocks), the upcoming Jackson Hole summit, and Fed meetings (which could offer clues about tapering), and the continued path of the coronavirus.

Frederick cautions that "one month doesn't make a trend" and that if margin debt data for August comes in higher, July may be considered a somewhat insignificant "anomaly." If August data continues the slump while stocks remain resilient, however, that may be "more significant." (In general, Frederick says, he wouldn't be surprised by a 5% to 7% pullback in the near term.)

Either way, it might be a good idea to keep your eye on the next month's worth of data.