2021年的美國(guó)房地產(chǎn)市場(chǎng),一方面是購(gòu)房人的競(jìng)購(gòu)潮,另一方面則是待售房產(chǎn)不足,成了許多潛在購(gòu)房人的噩夢(mèng)。

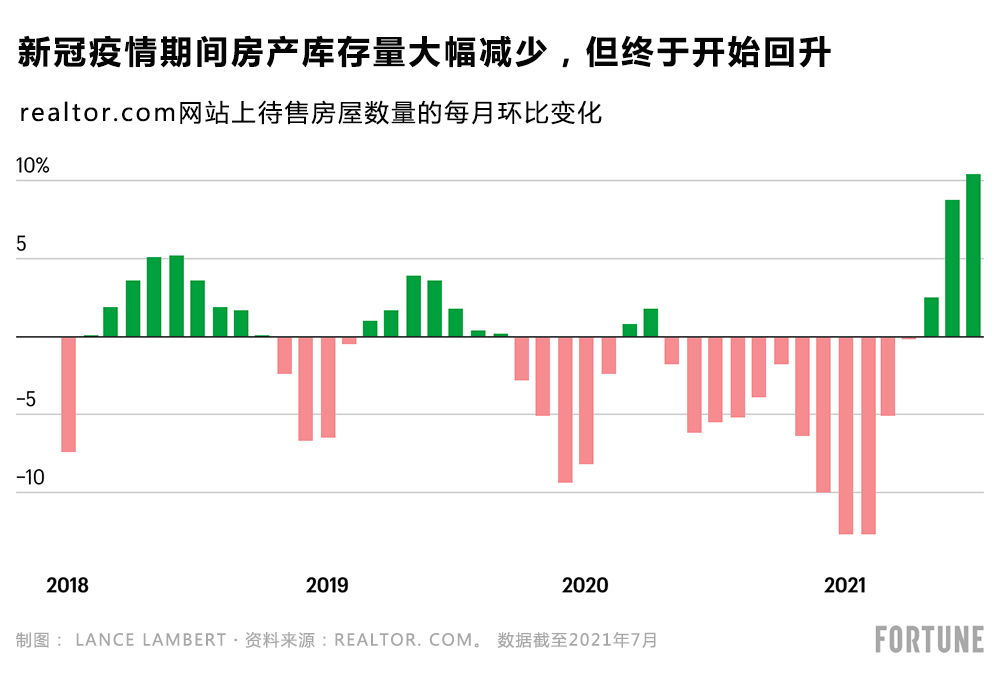

但火爆的房地產(chǎn)市場(chǎng)終于開(kāi)始小幅降溫。realtor.com網(wǎng)站在上周公布的數(shù)據(jù)顯示,7月,美國(guó)待售房產(chǎn)數(shù)量增加10%。自待售房產(chǎn)數(shù)量從今年春季走出低谷以來(lái),總漲幅達(dá)到23%。

房屋庫(kù)存量增多對(duì)購(gòu)房人而言是好消息。面對(duì)美國(guó)歷史上競(jìng)爭(zhēng)最激烈、最緊張的房地產(chǎn)市場(chǎng)之一,購(gòu)房人不得不相互競(jìng)價(jià)。事實(shí)上,在新冠疫情爆發(fā)后的前12個(gè)月,待售房屋庫(kù)存減少了超過(guò)50%。今年春季和夏季的房屋庫(kù)存水平處在40多年來(lái)的最低水平。

但房屋庫(kù)存量增多和市場(chǎng)降溫,并不意味著房?jī)r(jià)會(huì)下跌。業(yè)內(nèi)人士預(yù)測(cè)2008年的房市崩潰不會(huì)再次發(fā)生;相反他們認(rèn)為市場(chǎng)會(huì)恢復(fù)正常。據(jù)房地產(chǎn)調(diào)研公司CoreLogic統(tǒng)計(jì),去年,美國(guó)房?jī)r(jià)暴漲17.2%,令人瞠目結(jié)舌。該公司預(yù)測(cè)未來(lái)12個(gè)月,房?jī)r(jià)將相對(duì)小幅上漲3.2%。

約翰?伯恩斯房地產(chǎn)咨詢公司(John Burns Real Estate Consulting)的副研究主管德韋恩?巴赫曼告訴《財(cái)富》雜志:“房?jī)r(jià)上漲就像開(kāi)車(chē)。我們以前的行駛速度是120英里/小時(shí),現(xiàn)在降到100英里/小時(shí),而正常的速度是75英里/小時(shí)。我們需要房產(chǎn)庫(kù)存水平保持穩(wěn)定。這將穩(wěn)定定價(jià)環(huán)境。我認(rèn)為我們正在朝著這個(gè)方向發(fā)展。”

到底發(fā)生了什么?

對(duì)新手來(lái)說(shuō),房地產(chǎn)市場(chǎng)恢復(fù)了季節(jié)性變化。除了去年以外,每年這個(gè)時(shí)候,度假和返校等活動(dòng)都會(huì)轉(zhuǎn)移購(gòu)房人的注意力,房地產(chǎn)市場(chǎng)隨之有所降溫。

Home. LLC的首席執(zhí)行官尼克?沙告訴《財(cái)富》雜志:“2020年,房地產(chǎn)市場(chǎng)沒(méi)有出現(xiàn)季節(jié)性變化。但我們的研究預(yù)測(cè),2021年,房產(chǎn)庫(kù)存會(huì)恢復(fù)季節(jié)性變化,開(kāi)始降溫……待售房產(chǎn)庫(kù)存將增加,但距離恢復(fù)到正常庫(kù)存水平仍有很長(zhǎng)的路要走。”與CoreLogic的觀點(diǎn)類(lèi)似,他的預(yù)測(cè)表明,未來(lái)幾個(gè)月房?jī)r(jià)上漲速度會(huì)有所放緩,但依舊會(huì)維持上漲的趨勢(shì)。

然而,這并非都是由于季節(jié)性原因。巴赫曼表示,購(gòu)房人開(kāi)始反感過(guò)高的房?jī)r(jià),因此市場(chǎng)才開(kāi)始降溫。當(dāng)然,這是不可避免的:房?jī)r(jià)上漲速度永遠(yuǎn)不能超過(guò)收入增長(zhǎng)的速度。

巴赫曼說(shuō):“去年房?jī)r(jià)瘋漲,但這是不可持續(xù)的……如果房?jī)r(jià)漲幅過(guò)高,人們會(huì)停止購(gòu)買(mǎi),他們會(huì)這樣想:‘我得觀望一段時(shí)間,等到市場(chǎng)降溫。’”

房屋庫(kù)存增多不止受到購(gòu)房人的歡迎。許多賣(mài)房人也將從中受益。美國(guó)待售房產(chǎn)數(shù)量不足導(dǎo)致許多潛在賣(mài)房人放棄將房產(chǎn)掛牌出售。畢竟,如果把房子賣(mài)掉,他們就很難在庫(kù)存緊張的市場(chǎng)中找到其他房產(chǎn)。隨著庫(kù)存量反彈,潛在賣(mài)房人最終可能會(huì)出售現(xiàn)有的房產(chǎn)。這將進(jìn)一步增加房屋庫(kù)存量。

盡管最近待售房屋數(shù)量增加,但庫(kù)存水平與新冠疫情之前相比依舊減少了42%。庫(kù)存緊張的房地產(chǎn)市場(chǎng)不可能在一夜之間恢復(fù)正常。至少在史上最低的住房抵押貸款利率和大批千禧一代開(kāi)始購(gòu)房這一趨勢(shì)的推動(dòng)下,房地產(chǎn)市場(chǎng)會(huì)繼續(xù)上漲。(財(cái)富中文網(wǎng))

翻譯:劉進(jìn)龍

審校:汪皓

2021年的美國(guó)房地產(chǎn)市場(chǎng),一方面是購(gòu)房人的競(jìng)購(gòu)潮,另一方面則是待售房產(chǎn)不足,成了許多潛在購(gòu)房人的噩夢(mèng)。

但火爆的房地產(chǎn)市場(chǎng)終于開(kāi)始小幅降溫。realtor.com網(wǎng)站在上周公布的數(shù)據(jù)顯示,7月,美國(guó)待售房產(chǎn)數(shù)量增加10%。自待售房產(chǎn)數(shù)量從今年春季走出低谷以來(lái),總漲幅達(dá)到23%。

房屋庫(kù)存量增多對(duì)購(gòu)房人而言是好消息。面對(duì)美國(guó)歷史上競(jìng)爭(zhēng)最激烈、最緊張的房地產(chǎn)市場(chǎng)之一,購(gòu)房人不得不相互競(jìng)價(jià)。事實(shí)上,在新冠疫情爆發(fā)后的前12個(gè)月,待售房屋庫(kù)存減少了超過(guò)50%。今年春季和夏季的房屋庫(kù)存水平處在40多年來(lái)的最低水平。

但房屋庫(kù)存量增多和市場(chǎng)降溫,并不意味著房?jī)r(jià)會(huì)下跌。業(yè)內(nèi)人士預(yù)測(cè)2008年的房市崩潰不會(huì)再次發(fā)生;相反他們認(rèn)為市場(chǎng)會(huì)恢復(fù)正常。據(jù)房地產(chǎn)調(diào)研公司CoreLogic統(tǒng)計(jì),去年,美國(guó)房?jī)r(jià)暴漲17.2%,令人瞠目結(jié)舌。該公司預(yù)測(cè)未來(lái)12個(gè)月,房?jī)r(jià)將相對(duì)小幅上漲3.2%。

約翰?伯恩斯房地產(chǎn)咨詢公司(John Burns Real Estate Consulting)的副研究主管德韋恩?巴赫曼告訴《財(cái)富》雜志:“房?jī)r(jià)上漲就像開(kāi)車(chē)。我們以前的行駛速度是120英里/小時(shí),現(xiàn)在降到100英里/小時(shí),而正常的速度是75英里/小時(shí)。我們需要房產(chǎn)庫(kù)存水平保持穩(wěn)定。這將穩(wěn)定定價(jià)環(huán)境。我認(rèn)為我們正在朝著這個(gè)方向發(fā)展。”

到底發(fā)生了什么?

對(duì)新手來(lái)說(shuō),房地產(chǎn)市場(chǎng)恢復(fù)了季節(jié)性變化。除了去年以外,每年這個(gè)時(shí)候,度假和返校等活動(dòng)都會(huì)轉(zhuǎn)移購(gòu)房人的注意力,房地產(chǎn)市場(chǎng)隨之有所降溫。

Home. LLC的首席執(zhí)行官尼克?沙告訴《財(cái)富》雜志:“2020年,房地產(chǎn)市場(chǎng)沒(méi)有出現(xiàn)季節(jié)性變化。但我們的研究預(yù)測(cè),2021年,房產(chǎn)庫(kù)存會(huì)恢復(fù)季節(jié)性變化,開(kāi)始降溫……待售房產(chǎn)庫(kù)存將增加,但距離恢復(fù)到正常庫(kù)存水平仍有很長(zhǎng)的路要走。”與CoreLogic的觀點(diǎn)類(lèi)似,他的預(yù)測(cè)表明,未來(lái)幾個(gè)月房?jī)r(jià)上漲速度會(huì)有所放緩,但依舊會(huì)維持上漲的趨勢(shì)。

然而,這并非都是由于季節(jié)性原因。巴赫曼表示,購(gòu)房人開(kāi)始反感過(guò)高的房?jī)r(jià),因此市場(chǎng)才開(kāi)始降溫。當(dāng)然,這是不可避免的:房?jī)r(jià)上漲速度永遠(yuǎn)不能超過(guò)收入增長(zhǎng)的速度。

巴赫曼說(shuō):“去年房?jī)r(jià)瘋漲,但這是不可持續(xù)的……如果房?jī)r(jià)漲幅過(guò)高,人們會(huì)停止購(gòu)買(mǎi),他們會(huì)這樣想:‘我得觀望一段時(shí)間,等到市場(chǎng)降溫。’”

房屋庫(kù)存增多不止受到購(gòu)房人的歡迎。許多賣(mài)房人也將從中受益。美國(guó)待售房產(chǎn)數(shù)量不足導(dǎo)致許多潛在賣(mài)房人放棄將房產(chǎn)掛牌出售。畢竟,如果把房子賣(mài)掉,他們就很難在庫(kù)存緊張的市場(chǎng)中找到其他房產(chǎn)。隨著庫(kù)存量反彈,潛在賣(mài)房人最終可能會(huì)出售現(xiàn)有的房產(chǎn)。這將進(jìn)一步增加房屋庫(kù)存量。

盡管最近待售房屋數(shù)量增加,但庫(kù)存水平與新冠疫情之前相比依舊減少了42%。庫(kù)存緊張的房地產(chǎn)市場(chǎng)不可能在一夜之間恢復(fù)正常。至少在史上最低的住房抵押貸款利率和大批千禧一代開(kāi)始購(gòu)房這一趨勢(shì)的推動(dòng)下,房地產(chǎn)市場(chǎng)會(huì)繼續(xù)上漲。(財(cái)富中文網(wǎng))

翻譯:劉進(jìn)龍

審校:汪皓

Between the bidding wars and lack of homes for sale, the 2021 housing market has been nothing short of a nightmare for many would-be buyers.

But the red-hot market is finally starting to cool down a bit. The number of homes for sale in the country rose 10% in July, according to data released last week by realtor.com. In all, the figure is up 23% since bottoming out this spring.

Increasing levels of inventory is a good sign for buyers who've been pitted against one another in one of the most competitive—and tight—housing markets in the nation's history. Indeed, during the first 12 months of the pandemic, inventory for sale fell by more than 50%. Inventory levels this spring and summer were at their lowest in more than 40 years.

But rising inventory and a cooling market don’t mean home shoppers should expect prices to fall. Industry insiders don't foresee a 2008-style housing crash; instead, they see a market returning to normal. Over the past year, home prices soared a mind-boggling 17.2%, according to real estate research firm CoreLogic. That company forecasts a more modest 3.2% appreciation in the next 12-month window.

"We were going 120 mph; now we're going 100 mph. A normal year is 75 mph," Devyn Bachman, vice of research at John Burns Real Estate Consulting, told Fortune. "We need inventory levels to stabilize. That will stabilize the pricing environment as well. And I think we're heading in that direction."

What’s going on?

For starters, seasonality is coming back to the market. Around this time every year—with the exception of last year—housing cools a bit as shoppers get distracted by vacations and the restart of school.

"After skipping seasonal trends in 2020, our research projects that housing inventory will follow seasonal patterns in 2021, and begin cooling down…Housing inventory for sale will trend upward, but we are still a long way off from normal inventory levels," Nik Shah, CEO of Home.LLC, told Fortune. Similar to CoreLogic, his forecast shows home appreciation decelerating in the coming months but still moving upward.

This isn't all driven by seasonality, however. Bachman said the market is cooling as homebuyers start to push back at sky-high home prices. Of course, this was always inevitable: Prices can't outpace income growth forever.

“You’ve had crazy-strong home price appreciation over the last year, that is unsustainable…When you have that much appreciation, people pause and say, ‘I need to step back and let things cool down,’” Bachman said.

This uptick in housing inventory is welcomed by more than just home shoppers. Many sellers will benefit too. The lack of homes for sale in the U.S. has persuaded some would-be home sellers to not put their home up for sale. After all, if they sold, the tight market would make it hard for them to find something else. As inventory levels begin to go back up, these potential sellers might finally make the plunge. And that would help to further increase inventory levels.

Even with the recent uptick in homes for sale, inventory levels are still down 42% from pre-pandemic levels. That tight market won't go back to normal overnight. Not when historically low mortgage rates and a wave of millennials looking to buy are still driving the market forward.