就像之前的加密貨幣一樣,非同質化代幣(NFT)已經發展到一個臨界點,如果投資者仍然對其視而不見,那就是不負責任的表現。

根據CoinDesk的數據,2020年上半年,NFT的銷售總額為1370萬美元。到2021年上半年,其銷售額達到24.7億美元,而且這些銷售數字絲毫沒有放緩的跡象。NFT有各種形狀和大小,其范圍包括籃球動圖、數字賽馬和獨特生成的社交媒體形象。

隨著越來越多的機構資金投入到NFT中,在這個價值數十億美元的行業中,一些可能被小眾行業忽視的問題突然變得重要起來。在NFT領域,一個此前被忽視的問題是知識產權法。是的,即使在非中心化的NFT世界中,版權法也同樣適用,投資者在投資前應該了解其重要性。

美國版權局發布了一份基本規則概要,值得任何潛在的NFT投資者認真閱讀。一般來說,任何原創作品,無論是音樂、繪畫、書籍,還是任何其他最低限度的創造性有形作品,都受到法律的保護。盡管藝術作品的版權在藝術品被“固定下來”后就自動存在,但該藝術品需要在美國版權局注冊,才能受到法律保護(即知識產權持有人能夠起訴侵權行為)。版權和所有相關的知識產權屬于創作者,但其中的部分或全部權利可以分配或轉讓給作品的任何后續購買者。

購買NFT的一個好處是,所有的鑒定都是在區塊鏈上完成的。就以某人購買了一件Ghxst作品為例:只要買家能確認原始銷售賬戶與藝術家有關聯(這通常由市場 “驗證”),那么買家就能確定其所購作品是真實的,無論它轉手多少次。不過,區塊鏈沒有告訴買家的是,這件作品是否僅僅是別人受版權保護作品的復制品——這使得其所購作品變得一文不值,而且如果它被轉賣的話,買家將承擔實質性的法律責任。

無情的版權規則

這一點之所以重要,是因為版權法是極其無情的。根據《版權法》第504條,出售侵權作品,即使是完全無辜的行為人在不知情的情況下侵犯了他人的版權,也會使賣方自動承擔實際損害賠償和/或每次侵權750至3萬美元的法定賠償。如果發現侵權行為是故意的(也就是說,賣家知道這是侵權行為,但仍將其出售),那么每次侵權的法定賠償就會上升到15萬美元。

就以最近發生的一樁在NFT領域掀起一股旋風的事件為例。年僅12歲的程序員本亞明·艾哈邁德在推特上發帖描述他是如何啟動自己的NFT項目的。在這個暖心故事的感召下,3350只由計算機生成的“怪異鯨魚(Weird Whales) ”幾乎瞬間售罄。突然之間,這些像素化鯨魚圖像的售價就從最初的0.033 ETH(當時約合66美元)上漲到幾個小時后的3 ETH(約合6000美元)。隨著越來越多的人加入進來,NFT領域的有影響力人士很快就將“怪異鯨魚”追捧成下一個值得擁有的大項目。

然而,就在這番炒作進行得如火如荼之際,一位用戶花了點時間在谷歌上搜索“像素鯨魚”,結果發現該項目的藝術創意似乎是直接從另一項目復制的,所有這些“怪異鯨魚”圖像都是基于一張四年前的像素圖片改編而成。目前還不清楚怪異鯨魚項目是否構成知識產權盜竊。那張基礎圖片可能已被原作者置于公共領域,或者本亞明·艾哈邁德可能已獲得使用許可。但在這一潛在的知識產權盜竊事件曝光后不久,人們便開始虧本出售他們的鯨魚,該項目的發展勢頭隨即減弱。無論制作圖像的人是一位12歲的孩子,還是出于無心,這都無關緊要,因為根本就不存在無辜的版權侵犯行為這種事情。

假設“怪異鯨魚”確實構成版權侵犯(我并不是說它們侵犯了版權),而你碰巧在所有這些信息出來之前,以每張6000美元的價格買了10張。再假設你在所有這些信息出來之前,以每張7000美元的價格賣掉它們,從而迅速獲得了1萬美元的總利潤。版權所有者可以起訴你,要求你支付通過這些銷售獲得的總收入,即7萬美元,以及高達30萬美元的法定賠償。倘若你明明知道“怪異鯨魚” 可能侵犯版權,但你還是出售了這些圖像,以減少你的損失?版權所有者可能會說你是故意侵權,你現在就將承擔高達150萬美元的賠償。最好的情況是:你不得不將這些NFT返還給版權所有者,而你的6萬美元初始投資也就打了水漂。

謹慎行事

那么,你能做些什么來保護自己不受這種情況影響呢?首先,在購買任何NFT項目之前,務必要做一番功課。調查一下開發者和藝術家,并搜索類似的項目。如果該項目有網站,調查你購買的到底是什么知識產權。如果你打算花一大筆錢,可能值得聘請律師來確定是否存在與該項目相匹配的注冊版權。

其次,如果該項目似乎是打擦邊球,游蕩在知識產權盜竊和模仿之間(就像我最近在博客上談論的 CryptoPhunks與CryptoPunks爭端),那么你就應該理解其中蘊含的風險,并進行相應的投資。在NFT世界中,你難免碰到山寨項目。這意味著其潛在收益也會帶來潛在風險。

本文無意傳播對任何特定NFT項目或NFT世界的恐懼、不確定性或懷疑。我本人就是一位NFT投資者,并且非常看好這個行業的前景。然而,隨著NFT成為一種更加嚴肅的投資工具,我們必須更加認真地關注這個領域蘊含的法律問題。(財富中文網)

本文作者喬納森·施馬爾菲德是一名知識產權和商業訴訟律師,供職于Chilton Yambert Porter LLP。他也是博客The NFTtorney的作者。

譯者:任文科

就像之前的加密貨幣一樣,非同質化代幣(NFT)已經發展到一個臨界點,如果投資者仍然對其視而不見,那就是不負責任的表現。

根據CoinDesk的數據,2020年上半年,NFT的銷售總額為1370萬美元。到2021年上半年,其銷售額達到24.7億美元,而且這些銷售數字絲毫沒有放緩的跡象。NFT有各種形狀和大小,其范圍包括籃球動圖、數字賽馬和獨特生成的社交媒體形象。

隨著越來越多的機構資金投入到NFT中,在這個價值數十億美元的行業中,一些可能被小眾行業忽視的問題突然變得重要起來。在NFT領域,一個此前被忽視的問題是知識產權法。是的,即使在非中心化的NFT世界中,版權法也同樣適用,投資者在投資前應該了解其重要性。

美國版權局發布了一份基本規則概要,值得任何潛在的NFT投資者認真閱讀。一般來說,任何原創作品,無論是音樂、繪畫、書籍,還是任何其他最低限度的創造性有形作品,都受到法律的保護。盡管藝術作品的版權在藝術品被“固定下來”后就自動存在,但該藝術品需要在美國版權局注冊,才能受到法律保護(即知識產權持有人能夠起訴侵權行為)。版權和所有相關的知識產權屬于創作者,但其中的部分或全部權利可以分配或轉讓給作品的任何后續購買者。

購買NFT的一個好處是,所有的鑒定都是在區塊鏈上完成的。就以某人購買了一件Ghxst作品為例:只要買家能確認原始銷售賬戶與藝術家有關聯(這通常由市場 “驗證”),那么買家就能確定其所購作品是真實的,無論它轉手多少次。不過,區塊鏈沒有告訴買家的是,這件作品是否僅僅是別人受版權保護作品的復制品——這使得其所購作品變得一文不值,而且如果它被轉賣的話,買家將承擔實質性的法律責任。

無情的版權規則

這一點之所以重要,是因為版權法是極其無情的。根據《版權法》第504條,出售侵權作品,即使是完全無辜的行為人在不知情的情況下侵犯了他人的版權,也會使賣方自動承擔實際損害賠償和/或每次侵權750至3萬美元的法定賠償。如果發現侵權行為是故意的(也就是說,賣家知道這是侵權行為,但仍將其出售),那么每次侵權的法定賠償就會上升到15萬美元。

就以最近發生的一樁在NFT領域掀起一股旋風的事件為例。年僅12歲的程序員本亞明·艾哈邁德在推特上發帖描述他是如何啟動自己的NFT項目的。在這個暖心故事的感召下,3350只由計算機生成的“怪異鯨魚(Weird Whales) ”幾乎瞬間售罄。突然之間,這些像素化鯨魚圖像的售價就從最初的0.033 ETH(當時約合66美元)上漲到幾個小時后的3 ETH(約合6000美元)。隨著越來越多的人加入進來,NFT領域的有影響力人士很快就將“怪異鯨魚”追捧成下一個值得擁有的大項目。

然而,就在這番炒作進行得如火如荼之際,一位用戶花了點時間在谷歌上搜索“像素鯨魚”,結果發現該項目的藝術創意似乎是直接從另一項目復制的,所有這些“怪異鯨魚”圖像都是基于一張四年前的像素圖片改編而成。目前還不清楚怪異鯨魚項目是否構成知識產權盜竊。那張基礎圖片可能已被原作者置于公共領域,或者本亞明·艾哈邁德可能已獲得使用許可。但在這一潛在的知識產權盜竊事件曝光后不久,人們便開始虧本出售他們的鯨魚,該項目的發展勢頭隨即減弱。無論制作圖像的人是一位12歲的孩子,還是出于無心,這都無關緊要,因為根本就不存在無辜的版權侵犯行為這種事情。

假設“怪異鯨魚”確實構成版權侵犯(我并不是說它們侵犯了版權),而你碰巧在所有這些信息出來之前,以每張6000美元的價格買了10張。再假設你在所有這些信息出來之前,以每張7000美元的價格賣掉它們,從而迅速獲得了1萬美元的總利潤。版權所有者可以起訴你,要求你支付通過這些銷售獲得的總收入,即7萬美元,以及高達30萬美元的法定賠償。倘若你明明知道“怪異鯨魚” 可能侵犯版權,但你還是出售了這些圖像,以減少你的損失?版權所有者可能會說你是故意侵權,你現在就將承擔高達150萬美元的賠償。最好的情況是:你不得不將這些NFT返還給版權所有者,而你的6萬美元初始投資也就打了水漂。

謹慎行事

那么,你能做些什么來保護自己不受這種情況影響呢?首先,在購買任何NFT項目之前,務必要做一番功課。調查一下開發者和藝術家,并搜索類似的項目。如果該項目有網站,調查你購買的到底是什么知識產權。如果你打算花一大筆錢,可能值得聘請律師來確定是否存在與該項目相匹配的注冊版權。

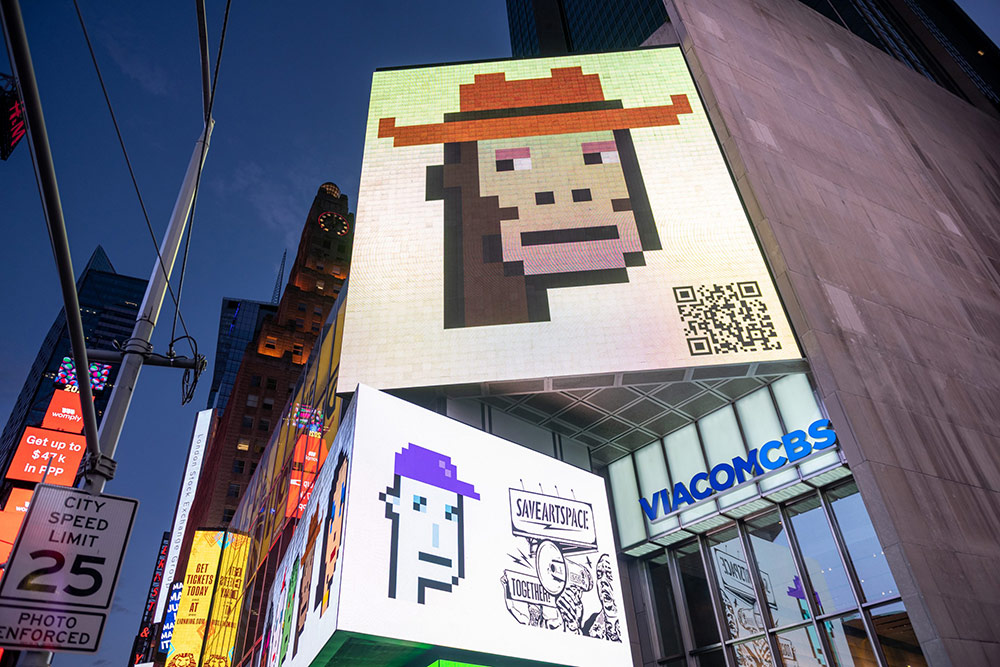

其次,如果該項目似乎是打擦邊球,游蕩在知識產權盜竊和模仿之間(就像我最近在博客上談論的 CryptoPhunks與CryptoPunks爭端),那么你就應該理解其中蘊含的風險,并進行相應的投資。在NFT世界中,你難免碰到山寨項目。這意味著其潛在收益也會帶來潛在風險。

本文無意傳播對任何特定NFT項目或NFT世界的恐懼、不確定性或懷疑。我本人就是一位NFT投資者,并且非常看好這個行業的前景。然而,隨著NFT成為一種更加嚴肅的投資工具,我們必須更加認真地關注這個領域蘊含的法律問題。(財富中文網)

本文作者喬納森·施馬爾菲德是一名知識產權和商業訴訟律師,供職于Chilton Yambert Porter LLP。他也是博客The NFTtorney的作者。

譯者:任文科

NFTs, just like cryptocurrencies before them, have reached a point where it has become irresponsible for investors to just ignore them. In the first half of 2020, NFT sales totaled $13.7 million, according to CoinDesk. In the first half of 2021, those sales reached $2.47 billion, and those sales figures show no signs of slowing down. NFTs come in all shapes and sizes, with a range that spans basketball GIFs, digital racehorses, and uniquely generated social media avatars.

As more and more institutional money is invested into NFTs, issues that may have been ignored in a niche industry are suddenly becoming important in a multibillion-dollar industry. In the NFT sphere, one previously ignored issue is intellectual property (“IP”) law. Even in the decentralized world of NFTs, copyright laws apply, and investors should understand their importance prior to investing.

The United States Copyright Office put out a summary of its basic rules, which is worth a read for any would-be NFT investor. Generally, any original work of authorship, be it music, paintings, books, or any other even minimally creative tangible work, is protected under federal law. While the copyright on art exists automatically as soon as that art is “fixed,” that art needs to be registered with the U.S. Copyright Office to be legally protected (i.e., for the IP rights holder to be able to sue for infringement damages). The copyright and all associated IP rights belong to the creator of the work, but some or all of those rights can be assigned or transferred to any subsequent purchaser of the work.

One advantage to purchasing an NFT is that all authentication is done on the blockchain. Let’s take the example of somebody who buys a Ghxsts piece: As long as the buyer can confirm the original selling account is linked to the artist (which is often “verified” by the marketplace) then the buyer knows for a fact that purchased piece is authentic, no matter how many times it changes hands. What the blockchain doesn’t tell the buyer, though, is whether that piece was merely a copy of somebody else’s copyrighted work—rendering that purchase worthless and subjecting the buyer to substantial legal liability if it is resold.

Unforgiving copyright rules

The reason this is important is that copyright law is exceedingly unforgiving. Under section 504 of the Copyright Act, the sale of an infringing work, even if done by a completely innocent actor who unknowingly violated somebody else’s copyright, makes the seller automatically liable for actual damages and/or statutory damages of $750 to $30,000 per infringement. If that infringement is found to be willful (i.e., the seller knew this was a copyright infringement but sold it anyway) that number bumps up to $150,000 per infringement.

Take, for example, a recent story which took the NFT world by storm. There was a Twitter thread in which a 12-year-old programmer named Benyamin Ahmed described how he was able to launch his own NFT project. The 3,350 computer-generated “Weird Whales” almost instantly sold out based on the heartwarming story. Suddenly, these pixelated whale images, which were originally sold for 0.033 ETH (about $66 at the time), were being sold hours later for 3 ETH ($6,000). As more people jumped in, NFT influencers pumped this project as the next big NFT to own.

However, while this hype was going on, one user took the time to google “pixel whale” and found that the art for the project appeared to be directly copied from another project, using a four-year-old pixel image as the base for all the Weird Whale images. It’s still not currently clear whether the Weird Whale project constitutes IP theft. That base image may have been placed in the public domain by the original artist, or Benyamin Ahmed may have had permission to use it. But shortly after this potential IP theft was revealed, people began selling their whales at a loss, and momentum for the project instantly faltered. It doesn’t matter whether the person who took the image was 12 years old and did so innocently, because there is no such thing as innocent copyright violation.

Let’s say hypothetically that the Weird Whales do constitute copyright infringement (and I’m not saying they do), and you happened to buy 10 of them at $6,000 each before all this information came out. Let’s say, also before all this news came out, you sold them for $7,000 each for a quick $10,000 total profit. The owner of the copyright could sue you for all $70,000 of gross revenue from those sales, and for up to $300,000 in statutory damages. Say you knew the Weird Whales were potentially copyright infringement, but you sold them anyway to limit your losses? The owner of the copyright could argue you were a willful infringer, and now you would be on the hook for up to $1.5 million. Best-case scenario: You would have to return the NFTs to the copyright owner, and you are out your $60,000 initial investment.

Play it safe

So what can you do to protect yourself from this situation? First, before buying any NFT project, do your own research. Look into the developer(s) and artist(s) and search for similar projects. If the project has a website, investigate exactly what IP rights you are buying. If you are expending large sums of money, it may be worth hiring an attorney to determine if there is a registered copyright matching the project.

Second, if the project seems to toe the fine line between intellectual property theft and parody (like the recent CryptoPhunks vs. CryptoPunks dispute, which I wrote about for my blog) go into it understanding your risks and invest accordingly. Copycat projects are unavoidable in the NFT world, which means that with their potential gains also come potential risks.

This article is not intended to FUD (meaning to spread fear, uncertainty, or doubt about) any particular NFT project or NFTs in general. I am an NFT investor myself and am bullish on the industry. However, as NFTs become a more serious investment vehicle, more serious attention must be paid to the legal issues they represent.

Jonathan Schmalfeld is an intellectual property and complex commercial litigation attorney for Chilton Yambert Porter LLP, and author of the blog The NFTtorney.