大約兩年前,手工藝品零售商Michaels的董事會找到了阿什利?布坎南,并委以其重任。而今,當他首次到訪部分Michaels店面時,實體店并沒有給他留下多深的印象。很多產品都沒有貨,店面人手不足,顧客排著長隊等待結賬,定價令人感到疑惑。他覺得,店面自身對于手工藝品顧客來說也沒有什么吸引力,而且線上產品亦缺乏驚艷感。

于2020年初開始執掌Michaels的布坎南開玩笑說:“我覺得,這種狀態離關門大吉不遠了。”布坎南之前在沃爾瑪工作了13年,他在沃爾瑪最后擔任的職務是首席商戶官兼美國電商業務運營負責人。他對《財富》雜志說:“客戶一直對我說‘我喜歡這個地方’,但他們的言下之意是Michaels很難俘獲客戶的芳心。”

3月,Michaels同意以50億美元的價格出售給私募股權公司阿波羅全球管理公司(Apollo Global Management),這意味著布坎南可以以超越投資者通常對上市公司期許的速度開展行動,也讓公司俘獲忠誠客戶芳心的任務變得更加簡單。

誠然,Michaels還談不上是一個糟糕的零售商。然而,公司的表現明顯不在狀態。去年,即便Michaels股價增長了3倍,但依然成了這筆私有化交易的目標,其中一個原因在于,越來越多的居家美國人將目光投向了手工藝品,并通過自己動手來打發時間。

這一現象幫助Michaels創下了近些年來的增速記錄,并在這個規模高達450億美元的行業中鞏固了其領先地位。然而,Apollo執掌零售投資的高管安德魯?嘉瓦在3月發布的一份聲明中稱,該公司發現了“一個提升Michaels品牌的巨大機遇。”

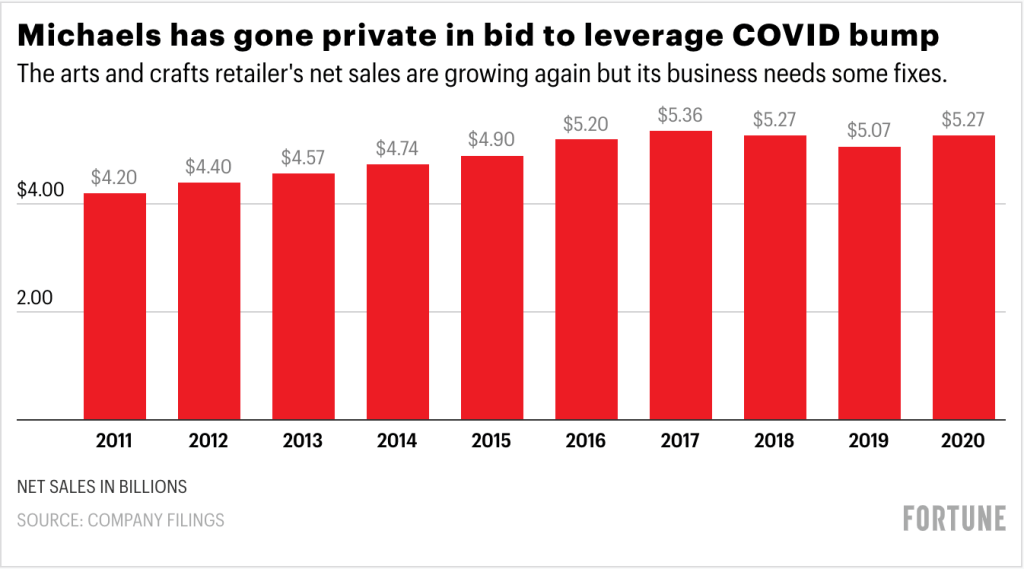

確實,Michael在2020年斬獲了53億美元的年銷售額,同比增長4%。然而,這個成績只是與其主要競爭對手霍比羅比(Hobby Lobby)打了個平手,而且僅達到了Michaels 2016年的凈銷售額水平,這也說明,公司有必要采取行動,從根本上扭轉多年來的停滯狀態,而且在從事這項工作時最好遠離華爾街的目光。

布坎南說:“原本人們不大會投資那些需要再次投資進行翻修的店面群,何況還是一家上市公司。”如今,布坎南可以按照自己的意愿和計劃來迅速開展工作,其中包括在未來數年內對所有約1250家店面進行翻修。

與Apollo的交易讓Michaels在其返回股市7年之后重新變成了一家私營公司。Michaels曾在2006年私有化,而且其所有者當時在改善盈利能力方面進行了大刀闊斧的改革,然而卻并沒有實現Michaels店面的現代化和電商化,這依然是該公司面臨的問題。

GlobalData董事總經理內爾?桑德斯稱:“Michaels的店面彌漫著一種懶惰元素。”他指出,很多店面看起來十分老舊,而且在產品更新方面也是異常緩慢。47歲的布坎南如今正在實施自己的計劃,為店面注入新的活力。

再次成為一家特種商品零售商

與新冠疫情封鎖類似的是,隨著美國民眾將注意力投向新的消遣活動,尤其是那些能夠讓自己的眼睛脫離屏幕、需要動手的活動,家居改善、戶外體育和烘焙、工藝品呈現出欣欣向榮的景象。Michaels的財務業績在2020年得到了持續改善,第四季度可比銷售額增長了12.9%。

因此,疫情為Michaels提供了一次重新改造自己的機會,這類機會對于Michaels這種規模的零售商來說十分難得,有助于讓其擺脫老舊、膩煩、雜亂的店面形象,以及經常打折、一成不變的商品。這位首席執行官說:“我們一直在改造整個公司,而新冠疫情加速了這一進程。”

這意味著要解決缺貨這一Michaels的歷史問題,不能因此而白白損失銷售額;借助合力,通過削減老舊品牌或銷售業績不佳的產品來精簡其臃腫的產品種類;以及加快新產品的推出速度。Michaels已經削減了約10%的產品種類,其中包括不少家居裝飾產品(布坎南認為這個門類會分散公司精力,因為與Hobby Lobby出現了重疊,后者的家居裝飾業務規模更大),以更好地管控其最基本的產品門類:手工藝品。(家居裝飾和季節性商品占到了Michaels凈銷售額的22%。Hobby Lobby是一家私營公司,并不公布財務業績。)

GlobalData的桑德斯稱,此舉將非常有助于解決眾多Michaels店面的雜亂問題。

布坎南的孩子是發光飾物的鐵桿粉絲,布坎南稱,這種產品充分說明了Michaels商品存在的問題。公司多年來一直在銷售同種類型的發光飾物,但從來沒有做任何更換。他說:“就同一種藍色而言,我們擁有13個版本的產品。然而我們卻沒有其他顏色,例如彩虹色,問題其實就是這么簡單。”

這并非是Michaels依然在努力攻克的唯一問題。Michaels年復一年的優惠券和打折活動導致了品牌的廉價化,并讓購物者對于商品具有的價值感到困惑。

與眾多零售商一樣,Michaels正嘗試讓購物者告別布坎南所謂的“一大堆”六折優惠券,并在這一方面取得了一些進展。公司稱當前發的基本上都是八折券。

Michaels今年年初在這一領域得到一些助力,當時,與Michaels營收幾乎相當的勁敵Hobby Lobby取消了其標志性的全價商品單品6折優惠。

如果說有一個領域適用于所謂的“體驗式零售”(行業術語,意指能夠讓到店體驗變得有趣的特色),那么該領域便是手工藝品。然而多年來,令布坎南感到懊惱的是,眾多Michaels的店面看起來更像是倉庫而不是尋寶之地。不過,新冠疫情封鎖令為其帶來了積極的影響。Michaels舉辦了眾多的Zoom活動,例如手工藝品課程,由于疫情限制令的逐漸解除,這類活動如今正轉變為店內活動。

布坎南說:“我們為客戶提供的不僅僅是高額折扣,同時還包括一些更實際的內容。”

布坎南的一位前任在數年前的季度電話會議上說,Michaels能夠免疫來自于亞馬遜的壓力,因為人們喜歡到店觸摸手工藝品,此話讓華爾街著實震驚了一把。布坎南說:“他的觀點并不正確。”如今,我們明顯意識到,打造某種類型的藝術家(Michaels將其稱為“制造者”)圈子至關重要 ,因為眾多Michaels的客戶如今都在Etsy上銷售物品,而且銷量十分可觀。

為了實現這一目標,Michaels在去年8月為更加專業的“工藝品制作者”設立了一個“專業”網站,該網站的銷售額立刻便占到了其線上銷售額的10%。Michaels還將創建一個市場平臺,為其制作者打造一站式的商店。

布坎南為Michaels開辟了一條明晰的發展道路,它不僅可以讓公司規避工藝品價格戰,還可以讓公司獲得相對于Hobby Lobby的電商優勢,此外,來自于塔吉特和布坎南前任雇主沃爾瑪的威脅亦十分有限,因為這兩家公司提供的產品雖然頗具吸引力,但其品種卻不多。(不過,大型零售商沃爾瑪剛剛宣布攜手Todd Oldham發布了一系列工藝品,相信布坎南對此已是早有耳聞。)

因此,布坎南策略的基本指導方針是:打造更好的電商(新網站將于明年上線)和更有吸引力的店面,推出充滿活力、令人耳目一新的商品,同時使用其店面和網站來確立Michaels在所有工藝品粉絲心目中的中心地位。

布坎南說:“我們為客戶提供的不僅僅是高額折扣,同時還包括一些更實際的內容。我的意思是說,我們并非是一家大型手工藝品零售商。”(財富中文網)

譯者:馮豐

審校:夏林

大約兩年前,手工藝品零售商Michaels的董事會找到了阿什利?布坎南,并委以其重任。而今,當他首次到訪部分Michaels店面時,實體店并沒有給他留下多深的印象。很多產品都沒有貨,店面人手不足,顧客排著長隊等待結賬,定價令人感到疑惑。他覺得,店面自身對于手工藝品顧客來說也沒有什么吸引力,而且線上產品亦缺乏驚艷感。

于2020年初開始執掌Michaels的布坎南開玩笑說:“我覺得,這種狀態離關門大吉不遠了。”布坎南之前在沃爾瑪工作了13年,他在沃爾瑪最后擔任的職務是首席商戶官兼美國電商業務運營負責人。他對《財富》雜志說:“客戶一直對我說‘我喜歡這個地方’,但他們的言下之意是Michaels很難俘獲客戶的芳心。”

3月,Michaels同意以50億美元的價格出售給私募股權公司阿波羅全球管理公司(Apollo Global Management),這意味著布坎南可以以超越投資者通常對上市公司期許的速度開展行動,也讓公司俘獲忠誠客戶芳心的任務變得更加簡單。

誠然,Michaels還談不上是一個糟糕的零售商。然而,公司的表現明顯不在狀態。去年,即便Michaels股價增長了3倍,但依然成了這筆私有化交易的目標,其中一個原因在于,越來越多的居家美國人將目光投向了手工藝品,并通過自己動手來打發時間。

這一現象幫助Michaels創下了近些年來的增速記錄,并在這個規模高達450億美元的行業中鞏固了其領先地位。然而,Apollo執掌零售投資的高管安德魯?嘉瓦在3月發布的一份聲明中稱,該公司發現了“一個提升Michaels品牌的巨大機遇。”

確實,Michael在2020年斬獲了53億美元的年銷售額,同比增長4%。然而,這個成績只是與其主要競爭對手霍比羅比(Hobby Lobby)打了個平手,而且僅達到了Michaels 2016年的凈銷售額水平,這也說明,公司有必要采取行動,從根本上扭轉多年來的停滯狀態,而且在從事這項工作時最好遠離華爾街的目光。

布坎南說:“原本人們不大會投資那些需要再次投資進行翻修的店面群,何況還是一家上市公司。”如今,布坎南可以按照自己的意愿和計劃來迅速開展工作,其中包括在未來數年內對所有約1250家店面進行翻修。

與Apollo的交易讓Michaels在其返回股市7年之后重新變成了一家私營公司。Michaels曾在2006年私有化,而且其所有者當時在改善盈利能力方面進行了大刀闊斧的改革,然而卻并沒有實現Michaels店面的現代化和電商化,這依然是該公司面臨的問題。

GlobalData董事總經理內爾?桑德斯稱:“Michaels的店面彌漫著一種懶惰元素。”他指出,很多店面看起來十分老舊,而且在產品更新方面也是異常緩慢。47歲的布坎南如今正在實施自己的計劃,為店面注入新的活力。

再次成為一家特種商品零售商

與新冠疫情封鎖類似的是,隨著美國民眾將注意力投向新的消遣活動,尤其是那些能夠讓自己的眼睛脫離屏幕、需要動手的活動,家居改善、戶外體育和烘焙、工藝品呈現出欣欣向榮的景象。Michaels的財務業績在2020年得到了持續改善,第四季度可比銷售額增長了12.9%。

因此,疫情為Michaels提供了一次重新改造自己的機會,這類機會對于Michaels這種規模的零售商來說十分難得,有助于讓其擺脫老舊、膩煩、雜亂的店面形象,以及經常打折、一成不變的商品。這位首席執行官說:“我們一直在改造整個公司,而新冠疫情加速了這一進程。”

這意味著要解決缺貨這一Michaels的歷史問題,不能因此而白白損失銷售額;借助合力,通過削減老舊品牌或銷售業績不佳的產品來精簡其臃腫的產品種類;以及加快新產品的推出速度。Michaels已經削減了約10%的產品種類,其中包括不少家居裝飾產品(布坎南認為這個門類會分散公司精力,因為與Hobby Lobby出現了重疊,后者的家居裝飾業務規模更大),以更好地管控其最基本的產品門類:手工藝品。(家居裝飾和季節性商品占到了Michaels凈銷售額的22%。Hobby Lobby是一家私營公司,并不公布財務業績。)

GlobalData的桑德斯稱,此舉將非常有助于解決眾多Michaels店面的雜亂問題。

布坎南的孩子是發光飾物的鐵桿粉絲,布坎南稱,這種產品充分說明了Michaels商品存在的問題。公司多年來一直在銷售同種類型的發光飾物,但從來沒有做任何更換。他說:“就同一種藍色而言,我們擁有13個版本的產品。然而我們卻沒有其他顏色,例如彩虹色,問題其實就是這么簡單。”

這并非是Michaels依然在努力攻克的唯一問題。Michaels年復一年的優惠券和打折活動導致了品牌的廉價化,并讓購物者對于商品具有的價值感到困惑。

與眾多零售商一樣,Michaels正嘗試讓購物者告別布坎南所謂的“一大堆”六折優惠券,并在這一方面取得了一些進展。公司稱當前發的基本上都是八折券。

Michaels今年年初在這一領域得到一些助力,當時,與Michaels營收幾乎相當的勁敵Hobby Lobby取消了其標志性的全價商品單品6折優惠。

如果說有一個領域適用于所謂的“體驗式零售”(行業術語,意指能夠讓到店體驗變得有趣的特色),那么該領域便是手工藝品。然而多年來,令布坎南感到懊惱的是,眾多Michaels的店面看起來更像是倉庫而不是尋寶之地。不過,新冠疫情封鎖令為其帶來了積極的影響。Michaels舉辦了眾多的Zoom活動,例如手工藝品課程,由于疫情限制令的逐漸解除,這類活動如今正轉變為店內活動。

布坎南說:“我們為客戶提供的不僅僅是高額折扣,同時還包括一些更實際的內容。”

布坎南的一位前任在數年前的季度電話會議上說,Michaels能夠免疫來自于亞馬遜的壓力,因為人們喜歡到店觸摸手工藝品,此話讓華爾街著實震驚了一把。布坎南說:“他的觀點并不正確。”如今,我們明顯意識到,打造某種類型的藝術家(Michaels將其稱為“制造者”)圈子至關重要 ,因為眾多Michaels的客戶如今都在Etsy上銷售物品,而且銷量十分可觀。

為了實現這一目標,Michaels在去年8月為更加專業的“工藝品制作者”設立了一個“專業”網站,該網站的銷售額立刻便占到了其線上銷售額的10%。Michaels還將創建一個市場平臺,為其制作者打造一站式的商店。

布坎南為Michaels開辟了一條明晰的發展道路,它不僅可以讓公司規避工藝品價格戰,還可以讓公司獲得相對于Hobby Lobby的電商優勢,此外,來自于塔吉特和布坎南前任雇主沃爾瑪的威脅亦十分有限,因為這兩家公司提供的產品雖然頗具吸引力,但其品種卻不多。(不過,大型零售商沃爾瑪剛剛宣布攜手Todd Oldham發布了一系列工藝品,相信布坎南對此已是早有耳聞。)

因此,布坎南策略的基本指導方針是:打造更好的電商(新網站將于明年上線)和更有吸引力的店面,推出充滿活力、令人耳目一新的商品,同時使用其店面和網站來確立Michaels在所有工藝品粉絲心目中的中心地位。

布坎南說:“我們為客戶提供的不僅僅是高額折扣,同時還包括一些更實際的內容。我的意思是說,我們并非是一家大型手工藝品零售商。”(財富中文網)

譯者:馮豐

審校:夏林

When Ashley Buchanan first visited some Michaels stores after the retailer's board approached him about the top job nearly two years ago, he was not impressed. Too many items were out of stock, there were slow moving lines at checkout in the understaffed stores, pricing was confusing, and the stores themselves were hardly palaces of wonder for its arts and crafts clientele, he thought. Things online were not stellar, either.

"I thought it was a rehearsal for the end of the world," jokes Buchanan, who took the reins of Michaels in early 2020, after 13 years at Walmart, including most recently, chief merchant and operations chief of the mass discounter's U.S. e-commerce business. "Customers kept telling me 'I love this place,'" he tells Fortune. "But they were also saying Michaels made it really hard to love it."

Making Michaels easier to love among its loyal shoppers became a simpler task in March when Michaels agreed to be bought by private equity firm Apollo Global Management in a $5 billion deal, meaning Buchanan could move faster than investors typically allow publicly listed companies to.

To be sure, Michaels hardly a disaster of a retailer. But it was clearly underachieving. The go-private deal came even as Michaels stock had quadrupled in the year before, helped by homebound Americans turning in greater numbers to arts and crafts and doing things with their hands to pass the time.

That helped Michaels score its best growth in years and strengthened its leading position in a $45 billion industry. Yet, the Apollo executive in charge of its retail investments, Andrew Jhawar, said in a statement in March that the firm sees "significant opportunity to enhance the Michaels brand."

Indeed in 2020, Michael brought in $5.3 billion in annual sales, up 4% over the previous year. But that's on par with arch-rival Hobby Lobby and roughly were Michaels net sales were in 2016, illustrating the work needed to finally shake years of stagnation, work better done far from the klieg lights of Wall Street.

"It would have been harder to invest the capital at the store base that we needed to invest again, to refresh the store base, as a public company," Buchanan says. And now Buchanan can proceed as quickly as he wants to and plans, among others thing, to remodel all 1,250 or so Michaels stores in the next couple of years.

The Apollo deal took Michaels private again seven years after it returned the stock markets. Michaels had been taken private in 2006, and its owners made big strides in improving profitability but without modernizing Michaels stores or e-commerce—problems that persist.

"Michaels has an element of laziness in its stores," says Neil Saunders, a managing director with GlobalData, pointing to how dated many stores look and how slow Michaels has been to refresh its assortment. And Buchanan, 47, is now implementing his plan to re-energize them.

Becoming a specialty retailer again

Much like the COVID-19 lockdowns were a boon for home improvement, outdoor sports, and baking, arts and crafts thrived as Americans gravitated toward new pastimes, preferably those that involved working with their hands to get a break from all that screen time. Michaels financial results kept improving throughout 2020, and comparable sales rose 12.9% in the fourth quarter.

So the pandemic has offered Michaels the chance at reinvention that a retailer its size rarely gets—an opportunity to stand for something other than old, tired cluttered stores, and discounting and the same-old same-old merchandise. "We had been revamping the entire company, and COVID accelerated that," the CEO says.

That has meant attacking Michaels' chronic problems with out-of-stocks that needlessly sap sales; a more concerted effort to cut its bloated assortment by ditching tired brands or products not selling well and speeding up the velocity of new products. Michaels has already cut about 10% of items. That has included a good chunk of Michaels' home décor—a category Buchanan feels can be a distraction given the overlap with Hobby Lobby, which does a bigger home furnishings business—to better dominate its bread-and-butter categories: arts and crafts supplies. (Home décor and seasonal items generate 22% of Michaels' net sales. Hobby Lobby is privately held and does not release financial results.)

GlobalData's Saunders says this will go a long way in addressing the clutter problem at many Michaels stores.

Buchanan, whose children are big glitter aficionados, says that product illustrates perfectly Michaels merchandise problems. The retailer had been selling the same variety of glitter for years without ever changing it up. "We had 13 versions of the same blue. But we did not have like, you know, rainbow; it's like just simple stuff like that," he says.

And that wasn't the only problem Michaels is still working on. Years of coupons and discounts at Michaels have led to a cheapening of the brand and confusion among shoppers on what value items have.

Like many retailers, Michaels is trying to wean shoppers off of what Buchanan calls "a dog's breakfast" of coupons offering discounts of 60%, and claims some success on that front, saying that 20% off coupons are more the norm now.

Michaels got some help earlier this year on this front when arch-rival Hobby Lobby, which is almost identical to Michaels in revenue, did away with its signature 40% off a single full-price item.

If there's an area that lends itself to so-called "experiential retail"—industry jargon for features that can make a store fun to visit—it's arts and crafts. And yet for years, to Buchanan's chagrin, many Michaels stores have seemed more like warehouses than places of discovery. But the COVID lockdowns have helped with that. Michaels held many Zoom events, such as arts and crafts lessons, a trend that is translating to more in-store events now that pandemic restrictions are easing.

"We're providing customers with something that's a little more tangible than just deep discounts," says Buchanan.

One of Buchanan's predecessors famously shocked Wall Street when he said a few years ago on an quarterly conference call that Michaels was insulated from Amazon's pressure since people like to come in and touch arts and crafts. "He was wrong," Buchanan says. Now it's clear that it is all the more essential to create some kind of community between artists—or as Michaels calls them, "makers"—given that so many Michaels customers are selling on Etsy now, and selling a lot.

To that end, Michaels in August recently launched a "pro" site for the more serious arts-and-crafters that has instantly generated 10% of its online sales. Michaels is also planning a marketplace to create a one-stop shop for its makers.

Buchanan sees a clear path for Michaels to run away with the arts-and-crafts prize, seeing an e-commerce advantage over Hobby Lobby and limited threat from the likes of Target and Buchanan's alma mater Walmart, which offer a limited though attractive selection. (He is undoubtedly well aware though that mass retailer Walmart just announced a line of crafts with Todd Oldham.)

And so better e-commerce (a new site is being launched next year), more attractive stores with dynamic refreshing of merchandise, and using its stores and web site to make Michaels central to all the arts-and-crafts aficionados out there, are the basics that guide his strategy.

"We're providing customers with something that's a little more tangible than just deep discounts," says Buchanan. "I mean, we are not a mass retailer of arts and crafts."