從新冠疫情封鎖的第一天起,富人就在紛紛逃離他們的城市,搬到阿斯彭、漢普頓等地的大豪宅。這讓全美各地的二手房市場掀起了搶購狂潮和競價戰。

在漢普頓,二手房的價格平均上漲了15.3%。這漲幅顯然不小了。但事實上,漲幅最讓人瞠目結舌的并不是知名的豪宅飛地。真正的飆漲反而發生在不那么為人知曉的豪宅市場和新興的豪宅社區。這就是《財富》雜志在查閱房地產信息網站realtor.com的價格數據,了解疫情期間漲得最兇的豪宅市場時發現的情況。

除了發現這些蓬勃發展的豪宅市場,《財富》雜志還調查了這些市場是否能夠保持增長態勢。畢竟,對于投資,買入時機與賣出時機一樣重要。

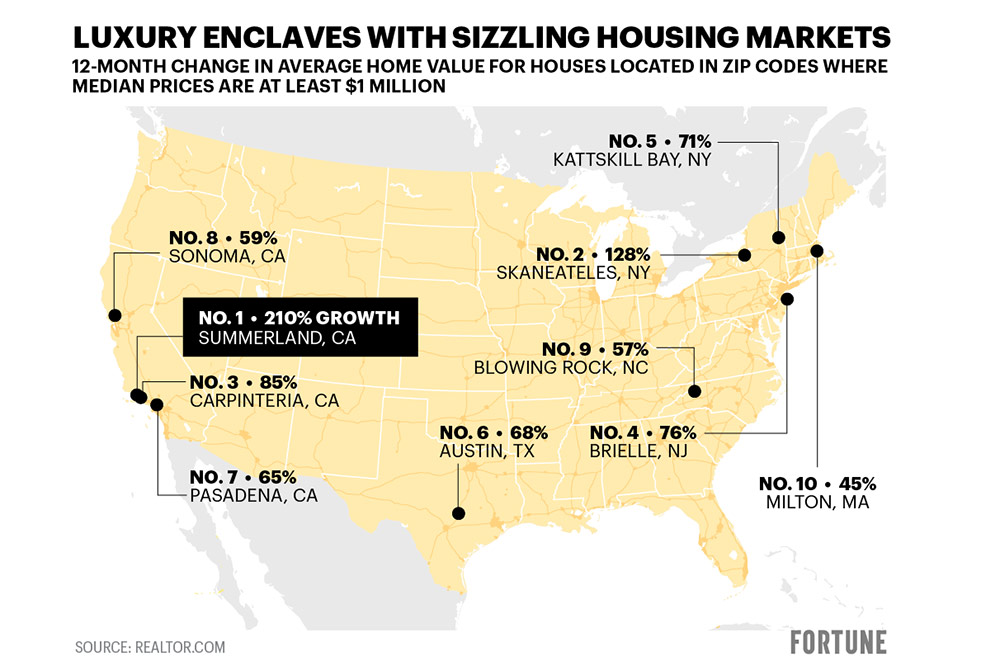

疫情期間美國漲得最兇的十大豪宅市場(按房屋中位價至少達100萬美元的地區12個月均價漲幅排名)

1. 加州薩默蘭,漲210%

2. 紐約州斯卡尼阿特勒斯,漲128%

3. 加州卡平特里亞,漲85%

4. 新澤西州布里勒,漲76%

5. 紐約州卡茨基爾灣,漲71%

6. 得州奧斯汀,漲68%

7. 加州帕薩迪納,漲65%

8. 加州索諾瑪,漲59%

9. 北卡羅來納州布洛英羅克,漲57%

10. 馬薩諸塞州密爾頓,漲45%

洛杉磯可能是美國住房最短缺的一個地方。即便是該市的富裕階層,也很難找到心儀的住宅。這就解釋了為什么在疫情爆發后,會有那么多的居民逃離城市——引爆了周邊的豪宅市場。

其中,最瘋狂的是加州的薩默蘭。該沿海社區的豪宅中位價已經飆升210%,達到1980萬美元,在《財富》雜志的排行榜上高居榜首。它位于圣巴巴拉以西5英里處——圣巴巴拉市場也出現飆漲——距離洛杉磯89英里。隨著那些富人紛紛搬來,原本的富人居民瞬間相形見絀。從薩莫蘭目前在售的最價格不菲的一處房屋便可見一斑,那是一座地中海風格的豪宅,占地4.3萬平方英尺(約合4000平方米),標價高達5500萬美元。

“薩默蘭豪宅的中位價漲幅是全美最高,主要原因包括庫存少、占地面積大(包含大牧場)、靠近海灘以及給人一種小城鎮般的感覺。”頂級房屋中介機構Engel & V?lkers圣巴巴拉的許可合伙人保羅·本森向《財富》雜志說道,“這似乎不是人們返回城市后會發生改變的事情。一旦你體驗過這種生活質量,你會舍不得離開,很難想象會有許多買家想要離開。”

加州卡平特里亞和帕薩迪納市場也因為洛杉磯人的逃離而出現豪宅搶購熱潮。這些市場的豪宅掛牌價中位數漲幅分別達到85%和65%,在《財富》雜志的排行榜上分列第三和第七。當然,類似的現象也發生在紐約人經常光顧的二手房市場。比如排在榜單第五位的紐約州卡茨基爾灣,當地的房價上漲了71%。

二手房市場相當火爆,尤其是海灘或湖泊小鎮。但也有其他贏家:高速發展城市的高檔郊區。最明顯不過的例子是,排在榜單第六位的得州奧斯汀斯坦納牧場。當地以頂尖學校林立而聞名,在過去的一年里其豪宅中位價飛漲了68%。自疫情爆發以來,多家公司從灣區遷移到奧斯汀。其中規模最大的是甲骨文公司(Oracle),它在去年12月宣布遷往奧斯汀。隨這些公司而來的是腰纏萬貫的新居民,他們在物色得州的大房子。斯坦納牧場正好符合他們的需求。

“我們從來沒有見過當前的火爆行情,如此盛況遠遠甚于過往任何時候。從未見過如此緊張的庫存和如此高漲的需求同時出現。”AustinRealEstate.com的房地產經紀人杰森·伯恩克諾夫指出。

但是,這些豪宅市場能夠保持火箭般的飆漲嗎?美國備受青睞的豪宅經紀人多莉·倫茲告訴《財富》雜志,情況即將發生翻轉:郊區豪宅價格將呈現增長放緩或下降,而城市豪宅市場——包括目前“折價”的曼哈頓——則將迎來大幅反彈。有例外的地方嗎?她說,像漢普頓這樣的海濱城鎮,即將迎來大批國外購房者的涌入——這部分購房者在疫情出現以后一直難以進入市場。

倫茲說:“豪宅市場整體上已經顯示出反轉和回撤的跡象……人們的生活正在開始逐漸恢復到以前的正常狀態。”(財富中文網)

譯者:萬志文

一從新冠疫情封鎖的第一天起,富人就在紛紛逃離他們的城市,搬到阿斯彭、漢普頓等地的大豪宅。這讓全美各地的二手房市場掀起了搶購狂潮和競價戰。

在漢普頓,二手房的價格平均上漲了15.3%。這漲幅顯然不小了。但事實上,漲幅最讓人瞠目結舌的并不是知名的豪宅飛地。真正的飆漲反而發生在不那么為人知曉的豪宅市場和新興的豪宅社區。這就是《財富》雜志在查閱房地產信息網站realtor.com的價格數據,了解疫情期間漲得最兇的豪宅市場時發現的情況。

除了發現這些蓬勃發展的豪宅市場,《財富》雜志還調查了這些市場是否能夠保持增長態勢。畢竟,對于投資,買入時機與賣出時機一樣重要。

疫情期間美國漲得最兇的十大豪宅市場(按房屋中位價至少達100萬美元的地區12個月均價漲幅排名)

1. 加州薩默蘭,漲210%

2. 紐約州斯卡尼阿特勒斯,漲128%

3. 加州卡平特里亞,漲85%

4. 新澤西州布里勒,漲76%

5. 紐約州卡茨基爾灣,漲71%

6. 得州奧斯汀,漲68%

7. 加州帕薩迪納,漲65%

8. 加州索諾瑪,漲59%

9. 北卡羅來納州布洛英羅克,漲57%

10. 馬薩諸塞州密爾頓,漲45%

洛杉磯可能是美國住房最短缺的一個地方。即便是該市的富裕階層,也很難找到心儀的住宅。這就解釋了為什么在疫情爆發后,會有那么多的居民逃離城市——引爆了周邊的豪宅市場。

其中,最瘋狂的是加州的薩默蘭。該沿海社區的豪宅中位價已經飆升210%,達到1980萬美元,在《財富》雜志的排行榜上高居榜首。它位于圣巴巴拉以西5英里處——圣巴巴拉市場也出現飆漲——距離洛杉磯89英里。隨著那些富人紛紛搬來,原本的富人居民瞬間相形見絀。從薩莫蘭目前在售的最價格不菲的一處房屋便可見一斑,那是一座地中海風格的豪宅,占地4.3萬平方英尺(約合4000平方米),標價高達5500萬美元。

“薩默蘭豪宅的中位價漲幅是全美最高,主要原因包括庫存少、占地面積大(包含大牧場)、靠近海灘以及給人一種小城鎮般的感覺。”頂級房屋中介機構Engel & V?lkers圣巴巴拉的許可合伙人保羅·本森向《財富》雜志說道,“這似乎不是人們返回城市后會發生改變的事情。一旦你體驗過這種生活質量,你會舍不得離開,很難想象會有許多買家想要離開。”

加州卡平特里亞和帕薩迪納市場也因為洛杉磯人的逃離而出現豪宅搶購熱潮。這些市場的豪宅掛牌價中位數漲幅分別達到85%和65%,在《財富》雜志的排行榜上分列第三和第七。當然,類似的現象也發生在紐約人經常光顧的二手房市場。比如排在榜單第五位的紐約州卡茨基爾灣,當地的房價上漲了71%。

二手房市場相當火爆,尤其是海灘或湖泊小鎮。但也有其他贏家:高速發展城市的高檔郊區。最明顯不過的例子是,排在榜單第六位的得州奧斯汀斯坦納牧場。當地以頂尖學校林立而聞名,在過去的一年里其豪宅中位價飛漲了68%。自疫情爆發以來,多家公司從灣區遷移到奧斯汀。其中規模最大的是甲骨文公司(Oracle),它在去年12月宣布遷往奧斯汀。隨這些公司而來的是腰纏萬貫的新居民,他們在物色得州的大房子。斯坦納牧場正好符合他們的需求。

“我們從來沒有見過當前的火爆行情,如此盛況遠遠甚于過往任何時候。從未見過如此緊張的庫存和如此高漲的需求同時出現。”AustinRealEstate.com的房地產經紀人杰森·伯恩克諾夫指出。

但是,這些豪宅市場能夠保持火箭般的飆漲嗎?美國備受青睞的豪宅經紀人多莉·倫茲告訴《財富》雜志,情況即將發生翻轉:郊區豪宅價格將呈現增長放緩或下降,而城市豪宅市場——包括目前“折價”的曼哈頓——則將迎來大幅反彈。有例外的地方嗎?她說,像漢普頓這樣的海濱城鎮,即將迎來大批國外購房者的涌入——這部分購房者在疫情出現以后一直難以進入市場。

倫茲說:“豪宅市場整體上已經顯示出反轉和回撤的跡象……人們的生活正在開始逐漸恢復到以前的正常狀態。”(財富中文網)

譯者:萬志文

From day one of the lockdowns, the rich were fleeing their city cribs for spacious abodes in places like Aspen and the Hamptons. That set off buying sprees and bidding wars in second-home markets across the nation.

In the Hamptons that translated into a 15.3% average price jump. Undoubtedly, a solid gain. But it turns out the most earth-shattering numbers weren't posted in big-name ritzy enclaves. The real run-ups were instead happening in less publicized high-end markets and up-and-coming luxury neighborhoods. That's what Fortune found when we looked at realtor.com price data to find the luxury markets with the most price appreciation during the pandemic.

In addition to finding these booming luxury markets, Fortune also looked into whether these markets can hold on to the gains. After all, investing is just as much about knowing when to buy as when to sell.

Arguably, Los Angeles has the worst housing shortage in America. Even the city's affluent and wealthy struggle to find what they want in the city. That explains why when the pandemic struck so many residents decamped—setting off a real estate explosion for outlying luxury markets.

The top benefactor is Summerland, Calif. (93067 zip code), a coastal community that has seen its median list price soar 210% to $19.8 million—putting it No. 1 on Fortune’s ranking. It's five miles west of Santa Barbara—which is seeing its own price boom—and 89 miles from Los Angeles. The rich people moving here make some other rich people look poor. Just look at the most expensive home currently for sale in Summerland: a 43,000-square-foot Mediterranean-style mansion listed at $55 million.

"Summerland has seen the highest median price growth in the nation, thanks to a combination of low inventory, large properties including ranches, proximity to the beach, and that small-town feel," Paul Benson, license partner of Engel & V?lkers Santa Barbara, told Fortune. "This does not seem to be something that will change when people return to cities. Once you get a taste of this quality of life it is hard to imagine that many of these buyers will want to leave."

The market in Carpinteria, Calif. (93013 zip code), and Pasadena (91103 zip code) have seen similar luxury booms from fleeing Angelenos. The median list price in those markets are up 85% and 65%, putting the zip codes as No. 3 and No. 7 on the list. Of course, a similar phenomenon is happening in the second-home markets frequented by New Yorkers. Look no farther than No. 5, Kattskill Bay, N.Y. (12844 zip code), where home prices are up 71%.

Second-home markets, especially beach or lake towns, dominate the list. There are other winners, too, however: high-end suburbs in fast-growing cities. The clearest example is No. 6, Steiner Ranch (78732 zip code) in Austin. The median list price in that zip code—known for its top-ranked schools—soared 68% over the past year. Since the onset of the pandemic, a wave of companies have relocated from the Bay Area to Austin. The biggest is Oracle, which announced the move to Austin in December. These companies bring with them deep-pocketed new arrivals who are looking for big Texas homes. Steiner Ranch fits the bill.

"We've never seen anything like this—nothing even comes close. Never seen this little inventory and this much demand all at once," says Jason Bernknopf, a real estate agent at AustinRealEstate.com.

But can these luxury markets hold on to their astronomic gains? Dolly Lenz, one of the most sought-after luxury real estate brokers in America, told Fortune that the script is about to flip: Suburban luxury markets will see prices slow or fall, while luxury urban markets—including currently "discounted" Manhattan—will see a big rebound. The one exception? Beach towns like the Hamptons, which are about to see an influx of international homebuyers—a segment of buyers that disappeared when the pandemic hit, she says.

"It is already showing signs of reversing and pulling back…They're starting to see their lives go back to the old normal," Lenz says.