人們經(jīng)常說,房屋裝修需要付出的時(shí)間和成本往往會(huì)超出預(yù)算一倍。但這種說法現(xiàn)在可能有些樂觀,原因是最近木材價(jià)格暴漲。

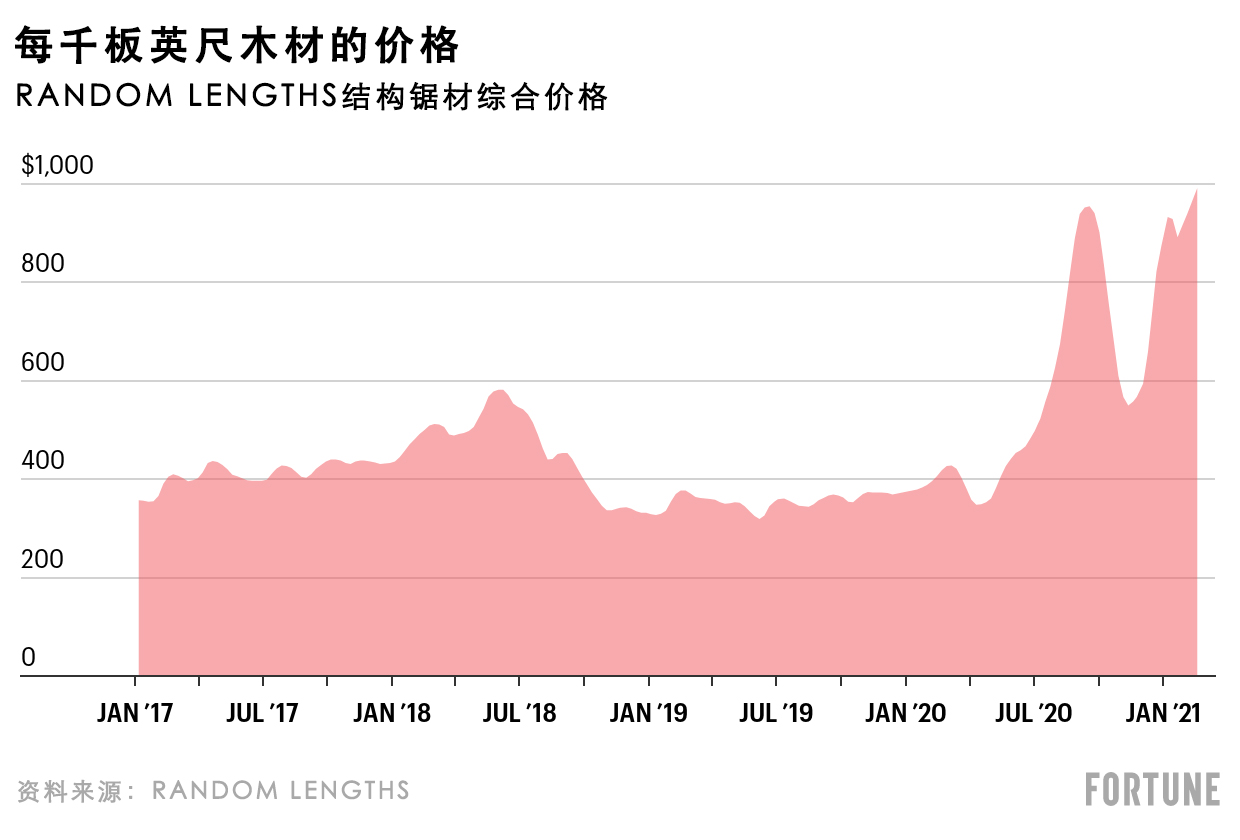

早在2020年8月,《財(cái)富》雜志就發(fā)表過一篇文章,分析了新冠疫情導(dǎo)致木材需求激增和供應(yīng)量下降的情況。疫情帶來的巨大沖擊使木材價(jià)格暴漲134%。美國房屋建筑商協(xié)會(huì)(National Association of Home Builders)表示,木材價(jià)格上漲將使一棟普通新建獨(dú)棟住宅的施工成本增加約14,000美元。

不過分析師曾經(jīng)認(rèn)為木材價(jià)格很快會(huì)有所回落,但他們的預(yù)測(cè)并未成真。

相反,木材價(jià)格進(jìn)一步上漲。據(jù)Random Lengths統(tǒng)計(jì),截至2月18日,每千板英尺木材的價(jià)格為992美元。木材價(jià)格自疫情爆發(fā)至今上漲了180%。根據(jù)美國房屋建筑商協(xié)會(huì)的計(jì)算,按照當(dāng)前的木材價(jià)格,一棟普通新建獨(dú)棟住宅的價(jià)格將上漲24,000美元。

到底發(fā)生了什么?2020年春季,在各州發(fā)布封鎖命令之后,美國各地的鋸木廠紛紛停工,導(dǎo)致木材供應(yīng)量銳減。與此同時(shí),居家隔離的美國民眾意識(shí)到,這是進(jìn)行房屋裝修或做手工項(xiàng)目的絕佳機(jī)會(huì)。于是,木材需求激增。

2020年秋季,木材價(jià)格開始下跌,在11月初降至每千板英尺550美元。似乎木材價(jià)格已經(jīng)開始回落。然而,美國在2020年最后幾周新冠肺炎確診病例激增,降低了鋸木廠的生產(chǎn)速度,尤其是在備受追捧的加州紅木產(chǎn)區(qū)。這種狀況再次導(dǎo)致木材價(jià)格飆升。

不要把問題只歸咎于勞氏公司(Lowe's)和家得寶(Home Depot)的顧客:在疫情期間,新房建設(shè)行業(yè)異常繁榮,也加劇了木材短缺問題。事實(shí)上,2020年12月,美國新住宅開工量創(chuàng)下14年新高。

眾所周知,在2008年金融危機(jī)及隨后幾年,住宅市場(chǎng)崩潰,房屋建筑量直線下降。那么,此輪繁榮的原因何在?首先,住宅并非本次危機(jī)的驅(qū)動(dòng)因素。其次,利率接近歷史最低水平。第三,1989年至1993年出生的大量千禧一代,將在2019年至2023年期間步入30歲,這五年被認(rèn)為會(huì)出現(xiàn)購房高峰。

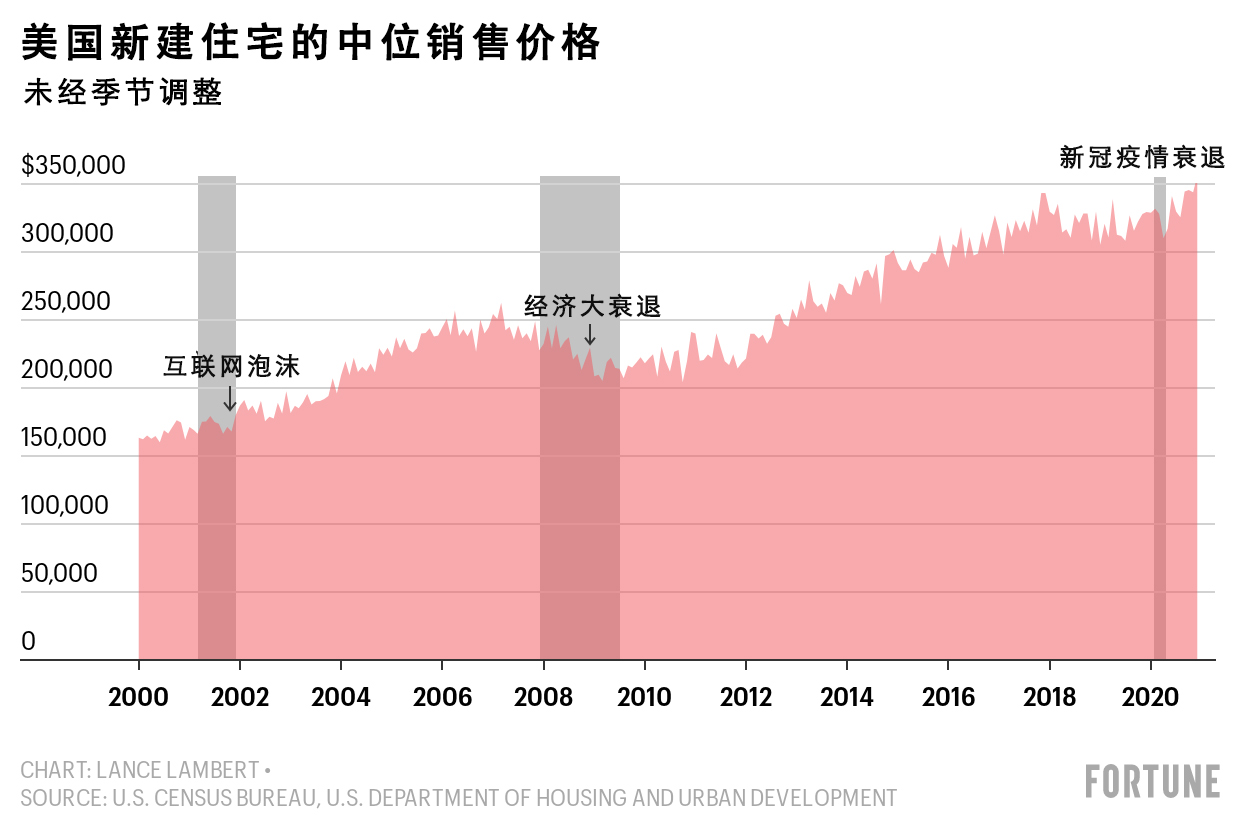

另外一個(gè)限制供應(yīng)量的因素是,許多美國老年人選擇等到疫情結(jié)束之后賣房,導(dǎo)致現(xiàn)有房屋存量下降,因此更多購房人選擇了新建住宅。房?jī)r(jià)也隨之出現(xiàn)波動(dòng):自疫情爆發(fā)以來,美國新建住宅的中位銷售價(jià)格已經(jīng)上漲了27,700美元,達(dá)到355,900美元。

高居不下的木材價(jià)格是否會(huì)成為新常態(tài)?Fastmarkets RISI公司的高級(jí)經(jīng)濟(jì)學(xué)家達(dá)斯汀·賈爾伯特并不這樣認(rèn)為。他對(duì)《財(cái)富》雜志表示,木材價(jià)格必定會(huì)回落。在得克薩斯和北卡羅萊納等南部各州,伐木業(yè)務(wù)已經(jīng)開始恢復(fù)。賈爾伯特指出,只要木材供應(yīng)量增加,并且有成功的疫苗可以防止未來木材生產(chǎn)陷入停滯,就能夠降低木材價(jià)格。更不必說,疫情之后的手工DIY熱會(huì)出現(xiàn)降溫。

賈爾伯特說:“關(guān)于手工DIY和房屋裝修,隨著服務(wù)業(yè)復(fù)工,這些領(lǐng)域的需求和消費(fèi)會(huì)隨之下降:人們會(huì)增加出行,外出用餐,這意味著他們居家的時(shí)間會(huì)減少……這在某種程度上可以讓裝修熱降溫。”

但賈爾伯特預(yù)測(cè),木材價(jià)格回落可能要等到2021年下半年。(財(cái)富中文網(wǎng))

翻譯:劉進(jìn)龍

審校:汪皓

人們經(jīng)常說,房屋裝修需要付出的時(shí)間和成本往往會(huì)超出預(yù)算一倍。但這種說法現(xiàn)在可能有些樂觀,原因是最近木材價(jià)格暴漲。

早在2020年8月,《財(cái)富》雜志就發(fā)表過一篇文章,分析了新冠疫情導(dǎo)致木材需求激增和供應(yīng)量下降的情況。疫情帶來的巨大沖擊使木材價(jià)格暴漲134%。美國房屋建筑商協(xié)會(huì)(National Association of Home Builders)表示,木材價(jià)格上漲將使一棟普通新建獨(dú)棟住宅的施工成本增加約14,000美元。

不過分析師曾經(jīng)認(rèn)為木材價(jià)格很快會(huì)有所回落,但他們的預(yù)測(cè)并未成真。

相反,木材價(jià)格進(jìn)一步上漲。據(jù)Random Lengths統(tǒng)計(jì),截至2月18日,每千板英尺木材的價(jià)格為992美元。木材價(jià)格自疫情爆發(fā)至今上漲了180%。根據(jù)美國房屋建筑商協(xié)會(huì)的計(jì)算,按照當(dāng)前的木材價(jià)格,一棟普通新建獨(dú)棟住宅的價(jià)格將上漲24,000美元。

到底發(fā)生了什么?2020年春季,在各州發(fā)布封鎖命令之后,美國各地的鋸木廠紛紛停工,導(dǎo)致木材供應(yīng)量銳減。與此同時(shí),居家隔離的美國民眾意識(shí)到,這是進(jìn)行房屋裝修或做手工項(xiàng)目的絕佳機(jī)會(huì)。于是,木材需求激增。

2020年秋季,木材價(jià)格開始下跌,在11月初降至每千板英尺550美元。似乎木材價(jià)格已經(jīng)開始回落。然而,美國在2020年最后幾周新冠肺炎確診病例激增,降低了鋸木廠的生產(chǎn)速度,尤其是在備受追捧的加州紅木產(chǎn)區(qū)。這種狀況再次導(dǎo)致木材價(jià)格飆升。

不要把問題只歸咎于勞氏公司(Lowe's)和家得寶(Home Depot)的顧客:在疫情期間,新房建設(shè)行業(yè)異常繁榮,也加劇了木材短缺問題。事實(shí)上,2020年12月,美國新住宅開工量創(chuàng)下14年新高。

眾所周知,在2008年金融危機(jī)及隨后幾年,住宅市場(chǎng)崩潰,房屋建筑量直線下降。那么,此輪繁榮的原因何在?首先,住宅并非本次危機(jī)的驅(qū)動(dòng)因素。其次,利率接近歷史最低水平。第三,1989年至1993年出生的大量千禧一代,將在2019年至2023年期間步入30歲,這五年被認(rèn)為會(huì)出現(xiàn)購房高峰。

另外一個(gè)限制供應(yīng)量的因素是,許多美國老年人選擇等到疫情結(jié)束之后賣房,導(dǎo)致現(xiàn)有房屋存量下降,因此更多購房人選擇了新建住宅。房?jī)r(jià)也隨之出現(xiàn)波動(dòng):自疫情爆發(fā)以來,美國新建住宅的中位銷售價(jià)格已經(jīng)上漲了27,700美元,達(dá)到355,900美元。

高居不下的木材價(jià)格是否會(huì)成為新常態(tài)?Fastmarkets RISI公司的高級(jí)經(jīng)濟(jì)學(xué)家達(dá)斯汀·賈爾伯特并不這樣認(rèn)為。他對(duì)《財(cái)富》雜志表示,木材價(jià)格必定會(huì)回落。在得克薩斯和北卡羅萊納等南部各州,伐木業(yè)務(wù)已經(jīng)開始恢復(fù)。賈爾伯特指出,只要木材供應(yīng)量增加,并且有成功的疫苗可以防止未來木材生產(chǎn)陷入停滯,就能夠降低木材價(jià)格。更不必說,疫情之后的手工DIY熱會(huì)出現(xiàn)降溫。

賈爾伯特說:“關(guān)于手工DIY和房屋裝修,隨著服務(wù)業(yè)復(fù)工,這些領(lǐng)域的需求和消費(fèi)會(huì)隨之下降:人們會(huì)增加出行,外出用餐,這意味著他們居家的時(shí)間會(huì)減少……這在某種程度上可以讓裝修熱降溫。”

但賈爾伯特預(yù)測(cè),木材價(jià)格回落可能要等到2021年下半年。(財(cái)富中文網(wǎng))

翻譯:劉進(jìn)龍

審校:汪皓

It’s often said renovations take twice as long and cost twice as much as you’ve budgeted for. But even that might be optimistic now, given the recent surge in lumber prices.

Back in August 2020, Fortune published an article looking at how the pandemic was both causing lumber demand to spike and lumber supply to fall. The perfect storm caused lumber prices to skyrocket 134%. That added about $14,000 to the cost of the average new single-family home construction, according to the National Association of Home Builders (NAHB).

Analysts assumed prices would quickly fall back to earth. It didn’t happen.

Instead, they have risen further. As of the week of Feb. 18, the price of lumber per thousand board feet is at $992, according to Random Lengths. Prices are up 180% since the onset of the pandemic. The NAHB calculates current lumber prices are adding $24,000 to the price tag of a typical new single-family home.

What exactly is going on? Well, when states issued lockdowns in the spring of 2020, sawmills across the nation closed. Cue a falling lumber supply. At the same time Americans quarantining at home realized it was a great time to undergo home renovations or do-it-yourself projects. Cue a rising demand for timber.

Prices started to drop in the fall of 2020, hitting $550 per thousand board feet in early November. It looked like the correction was starting. However, the U.S. explosion in COVID-19 cases in the final weeks of 2020 saw sawmill production slow down, particularly in areas cutting much sought-after California redwood. That helped push prices sky-high again.

Don’t blame Lowe’s and Home Depot patrons alone: Homebuilding is booming during the pandemic, which is also worsening the lumber shortage. Indeed, in December 2020 we hit a 14-year high in new housing starts.

The 2008 financial crisis and subsequent years notoriously saw housing crash and home construction plummet. So how come we’re seeing a boom this time around? For starters, housing was never a driver of this crisis. Second, near-record low interest rates. Third, the biggest cohort of millennials, those born between 1989 and 1993, are amid the five-year stretch, 2019 to 2023, when they will all hit their thirties, which are considered the peak homebuying years.

Another factor limiting supply: Many older Americans are opting to wait until the pandemic is over to sell their home, which is causing existing home inventory to fall and more buyers to turn to new construction. Prices are following suit: Since the onset of the pandemic, the median sales price of new U.S. homes has increased $27,700 to $355,900.

Are these sky-high lumber prices the new normal? Dustin Jalbert, senior economist at Fastmarkets RISI, doesn’t believe so. He told Fortune a correction will come. Already, more harvesting operations are sprouting up in southern states like Texas and North Carolina. Increased supply paired with a successful vaccine that prevents future halts in production, Jalbert says, should bring prices down. Not to mention, the DIY fad should slow down post-pandemic.

“When you think about DIY and home renovations, some of the demand and spending in that channel could cool as the service side of the economy reopens: People traveling more, going to restaurants, means they’re spending less time at home…To some degree, it should cool the renovation boom,” Jalbert says.

But, predicts Jalbert, the lumber correction might not arrive until the second half of 2021.