1月,必然會被載入史冊。

2021年伊始,股市在經歷了不凡的2020年之后高調開局(股市于2020年3月份暴跌超過30%,隨后一路恢復,在12月底創下新高)。然而,就在進入1月數周之后,所謂的“Reddit股票”(那些被在線信息平臺Reddit的散戶炒起來的股票)著實讓股市狂野了一把:諸如GameStop等股票的漲幅達到了三位數,而基準指數則出現了大幅下跌。

大盤拋售的部分原因可能在于,軋空GameStop這類股票的對沖基金被迫通過籌集現金來軋平頭寸。然而,不管背后的罪魁禍首是誰,這一輪波動導致標普500在本月一度出現了1.1%的跌幅。

雖然這場華爾街大戲已隨著游戲驛站累計暴跌超80%的現狀而接近尾聲。但歷史告訴我們,1月份的拋售對于今年余下的時間來說不是個好兆頭。

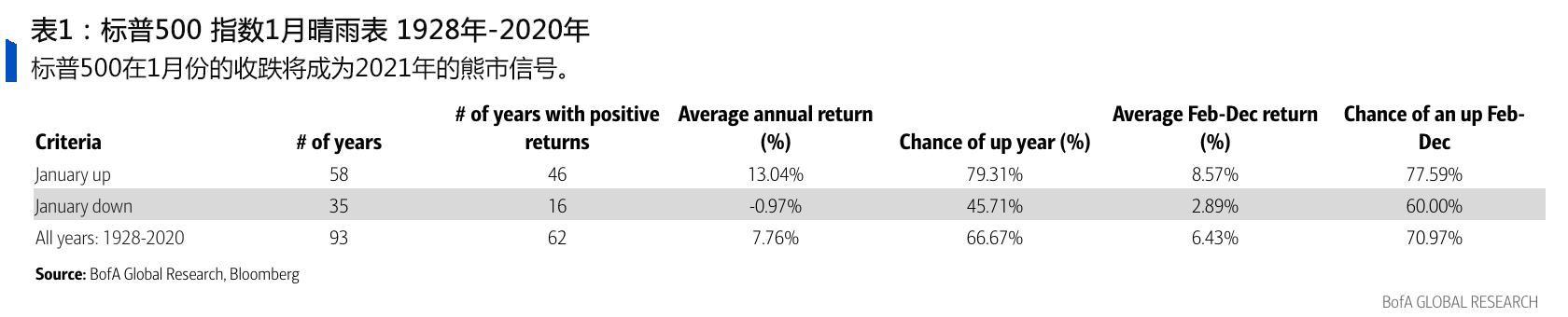

美國銀行技術研究策略師史蒂夫?薩特梅爾指出:“我們不禁想起了華爾街的一句老話:‘全年股市看1月’”。他在周二的報告中寫道:在1928年,“如果1月形勢不好,[標普500]往往也會走弱,而且這一時期1月出現上漲的年份僅占45.7%,平均回報率為-0.97%……這一時期剩余月份出現增長的年份占到了60%,平均回報率為2.89%。”(詳見美國銀行的圖表)

此外,讓我們來看看股市在新總統上任首年的歷史表現如何:“如果新總統上任第一年1月出現下滑,那么這一時期出現增長的年份僅占22.2%,平均回報率為-6.92%……而且2月-12月亦出現增長的年份占到了22.2%,平均回報率為-3.14%”,薩特梅爾寫道。

那好消息呢?美國銀行的薩特梅爾表示,1月晴雨表在最近幾年的“可靠性一直在降低”。LPL Financial的分析師在周一寫道,事實上,自21世紀00年代初開始,在過去1月股市下滑的9個年份中,有8個年份的股市出現了上漲,平均回報率為11.5%。

近些年的1月晴雨表并不怎么準確,近些年1月回報的負增長也并不代表熊市。

到目前為止,股市在2月迎來了開門紅。周二,標普500上漲了1.4%,而道瓊斯收漲近1.6%。確實,Ally的貝爾認為,“很明顯,市場正在應對那些[投機]股票的行動,而且目前人們對此的解讀似乎是‘不錯,這些投機型交易正在減少,而自然的市場力量正在回歸。’”

她說,就1月晴雨表而言,“回顧歷史并不是壞事,但這里存在著大量能夠從根本上推動股市上漲的各類因素。”

確實,瑞士聯合銀行稱,他們并不認為“標普500出現的溫和拋售就意味著經濟和企業利潤前景出現了根本性的轉變。”瑞士聯合銀行全球財富管理首席信息官索利塔?馬瑟利與瑞士聯合銀行美國股票業務負責人大衛?勒夫科維茨在周一的紀要中寫道。“在經歷了最近的拋售之后,美國股票的風險/回報看起來多了一點吸引力。”他們認為疫苗的推出、強勁的企業利潤以及持續的美聯儲和預算開支支持最終會推高股價。

然而,我們在過去幾周看到,這可能是一個跌宕起伏的旅程。Ally的貝爾說:“最終,我們可能依然會繼續看到股市在短期內(未來一兩個月內)會呈現出忽高忽低的狀態,但我期待今年后半年股市回報會有所回升。”(財富中文網)

譯者:馮豐

審校:夏林

1月,必然會被載入史冊。

2021年伊始,股市在經歷了不凡的2020年之后高調開局(股市于2020年3月份暴跌超過30%,隨后一路恢復,在12月底創下新高)。然而,就在進入1月數周之后,所謂的“Reddit股票”(那些被在線信息平臺Reddit的散戶炒起來的股票)著實讓股市狂野了一把:諸如GameStop等股票的漲幅達到了三位數,而基準指數則出現了大幅下跌。

大盤拋售的部分原因可能在于,軋空GameStop這類股票的對沖基金被迫通過籌集現金來軋平頭寸。然而,不管背后的罪魁禍首是誰,這一輪波動導致標普500在本月一度出現了1.1%的跌幅。

雖然這場華爾街大戲已隨著游戲驛站累計暴跌超80%的現狀而接近尾聲。但歷史告訴我們,1月份的拋售對于今年余下的時間來說不是個好兆頭。

美國銀行技術研究策略師史蒂夫?薩特梅爾指出:“我們不禁想起了華爾街的一句老話:‘全年股市看1月’”。他在周二的報告中寫道:在1928年,“如果1月形勢不好,[標普500]往往也會走弱,而且這一時期1月出現上漲的年份僅占45.7%,平均回報率為-0.97%……這一時期剩余月份出現增長的年份占到了60%,平均回報率為2.89%。”(詳見美國銀行的圖表)

此外,讓我們來看看股市在新總統上任首年的歷史表現如何:“如果新總統上任第一年1月出現下滑,那么這一時期出現增長的年份僅占22.2%,平均回報率為-6.92%……而且2月-12月亦出現增長的年份占到了22.2%,平均回報率為-3.14%”,薩特梅爾寫道。

那好消息呢?美國銀行的薩特梅爾表示,1月晴雨表在最近幾年的“可靠性一直在降低”。LPL Financial的分析師在周一寫道,事實上,自21世紀00年代初開始,在過去1月股市下滑的9個年份中,有8個年份的股市出現了上漲,平均回報率為11.5%。

近些年的1月晴雨表并不怎么準確,近些年1月回報的負增長也并不代表熊市。

到目前為止,股市在2月迎來了開門紅。周二,標普500上漲了1.4%,而道瓊斯收漲近1.6%。確實,Ally的貝爾認為,“很明顯,市場正在應對那些[投機]股票的行動,而且目前人們對此的解讀似乎是‘不錯,這些投機型交易正在減少,而自然的市場力量正在回歸。’”

她說,就1月晴雨表而言,“回顧歷史并不是壞事,但這里存在著大量能夠從根本上推動股市上漲的各類因素。”

確實,瑞士聯合銀行稱,他們并不認為“標普500出現的溫和拋售就意味著經濟和企業利潤前景出現了根本性的轉變。”瑞士聯合銀行全球財富管理首席信息官索利塔?馬瑟利與瑞士聯合銀行美國股票業務負責人大衛?勒夫科維茨在周一的紀要中寫道。“在經歷了最近的拋售之后,美國股票的風險/回報看起來多了一點吸引力。”他們認為疫苗的推出、強勁的企業利潤以及持續的美聯儲和預算開支支持最終會推高股價。

然而,我們在過去幾周看到,這可能是一個跌宕起伏的旅程。Ally的貝爾說:“最終,我們可能依然會繼續看到股市在短期內(未來一兩個月內)會呈現出忽高忽低的狀態,但我期待今年后半年股市回報會有所回升。”(財富中文網)

譯者:馮豐

審校:夏林

January was certainly a month for the history books.

Markets started 2021 on a high note on the back of a sensational year (after stocks plunged over 30% in March they recovered to new highs by December). But just a few weeks into January, so-called "Reddit stocks," those pumped up by retail traders on online message board Reddit, took the markets on a wild ride: Names like GameStop soared triple digits, while benchmark indexes slumped.

Part of that broader selloff may have been due to hedge funds who were short (squeezing?)names like GameStop being forced to raise cash and cover their positions. But whatever the culprit, the bout of volatility sunk the S&P 500 1.1% lower for the month.

And according to history, the January selloff doesn't bode well for the rest of the year.

"The old Wall Street adage of 'as goes January, so goes the year' comes to mind," notes Bank of America technical research strategist Stephen Suttmeier. Going back to 1928, "When January is down, the [S&P 500] tends to be weaker and the year is up only 45.7% of the time with an average return of -0.97% ... and the rest of the year is up 60% of the time with an average return of 2.89%," he wrote in a Tuesday report (see BofA's chart).

Add to that how stocks historically perform during the first year of a new presidency: "When January is down in a Presidential Cycle Year 1, the year is up only 22.2% of the time with an average return of -6.92% ... and February-December is also up 22.2% of the time with an average return of -3.14%," Suttmeier wrote.

But the good news? That January barometer has "become less reliable in recent years," BofA's Suttmeier notes. In fact, since the early 2000s, stocks have been up eight out of the past nine times stocks were lower in January, with an average return of 11.5%, analysts at LPL Financial wrote Monday (see chart).

So far markets have seen a boost to kick off February. The S&P 500 rose 1.4% while the Dow closed up nearly 1.6% on Tuesday. Indeed, Ally's Bell suggests "Clearly the market is reacting to the action in those [speculative] stocks overall, and it seems like right now, the read-through is that, 'Okay, these speculative trades are winding down and the natural market forces are returning'," she suggests to Fortune.

In terms of that January barometer, "It’s good to look at history, but there are a lot of different things fundamentally that can drive the market higher," she says.

Indeed, strategists at UBS note they "don’t think the modest selloff in the S&P 500 is indicative of a fundamental shift in the outlook for the economy and corporate profits," Solita Marcelli, CIO of Americas at UBS Global Wealth Management and David Lefkowitz, head of Americas equities, wrote in a Monday note. "After the recent sell-off, the risk/reward for US equities is looking a bit more appealing." They believe stocks will ultimately trade higher due to the vaccine rollout, strong corporate profits, and continued Fed and fiscal spending support.

But as the past few weeks have shown us, it may be a bumpy ride. "Ultimately, we could still continue to see choppiness here in the near term for the next month or two," Ally's Bell says. "But I look forward to the latter part of the year to drive market returns."