一家名為Core Scientific的初創企業上周宣布,公司已籌集了2300萬美元,用于擴張其加密貨幣挖礦業務。這家北美比特幣采礦公司已在北卡羅萊納州、佐治亞州和肯塔基州建有加密礦場,并計劃在不久后開設更多的分支。

目前,一枚比特幣價值約2萬美元,數字礦山等同于天然金礦。開采一個比特幣區塊能夠挖出6.25枚比特幣,價值約12.5萬美元。因此,很容易理解為什么會有這一商業決策。

如果Core Scientific的挖礦業務獲得成功,那么公司不僅僅會大賺一筆,而且將幫助重振美國的加密貨幣行業,而美國也是比特幣的誕生地。

加密貨幣挖礦近期的東山再起聽起來像是個喜訊。像Core Scientific這樣的挖礦公司可借此賺錢并為農村地區創造就業機會,同時還能確保美國人手中能夠掌握更多即將成為一種戰略資產的比特幣。

然而,我們也有理由對此持謹慎態度。上一次加密貨幣挖礦熱也承諾了類似的福利,但結果是,很多不靠譜的企業爆出了一系列丑聞,并在隨后帶來了環境問題。這次的結果是否會有什么不一樣呢?

數字鎬鏟交易

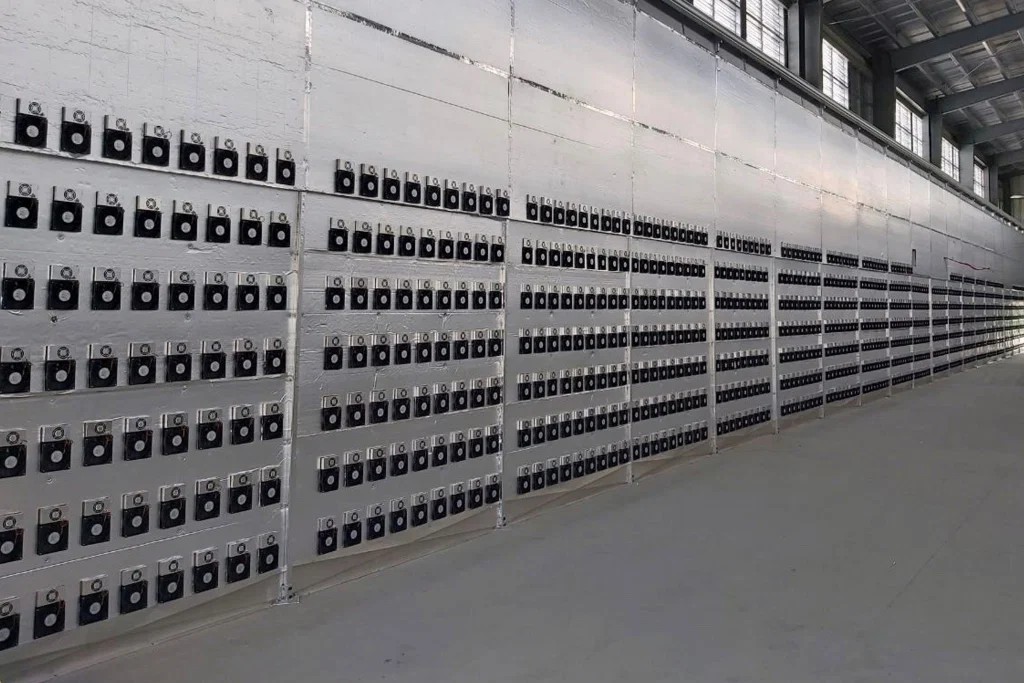

開采加密貨幣與傳統采礦業截然不同。這里沒有礦石挖掘,也無需搬運,所適用的工具也不是鎬和炸藥。加密貨幣挖礦者賴以謀生的行頭只有兩個:定制設計的計算機芯片和大量的電力。加密貨幣挖礦作業如下圖所示:

為了找到數字金礦,加密貨幣礦主會利用其計算機與全球其他礦主競爭,看誰先解決復雜的數學問題。解決問題的計算機會通過網絡向他人公布解決方案,并借此向區塊鏈增加一個區塊,一個防篡改分類賬戶將為交易提供公共記錄。麻煩的是,優勝計算機的所有者會獲得“區塊獎勵”,也就是6.25個比特幣(比特幣挖礦)外加交易費用。這個流程每10分鐘重復一次。

在早期,當人們還可以用家中筆記本挖掘比特幣的時候,很大一部分加密貨幣挖礦業務都集中在美國。然而,隨著解決數學問題的計算機算力的提升,中國成為了挖礦作業的主導國。

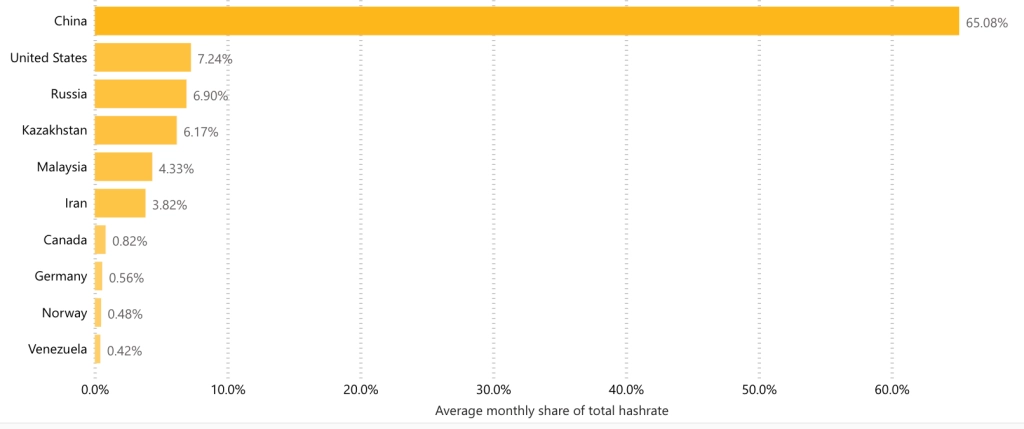

中國礦主擁有兩個優勢:容易獲得便宜的電力,包括像蒙古這樣的地區,以及能夠制作所謂礦機(也就是僅用于挖礦用的定制芯片計算機)的本土制造基地。盡管全球也存在著其他挖礦作業,但中國在這一領域依然遙遙領先,以下來自于劍橋另類金融中心的圖表便說明了這一點:

如今,一些美國公司認為,他們可以將一部分挖礦業務從中國搶回來。就Core Scientific而言,它已經拿下了5個城市的廉價電力,項目總占地面積超過了600多畝,其中包括佐治亞州的達爾頓市,北卡州的馬博市以及肯塔基州的卡爾弗特市。該公司還與中國制造商達成了協議,將最先拿到最新的礦機,并計劃開采比特幣之外的加密貨幣,例如萊特幣、比特現金、Zcash和以太幣。

Core Scientific如今是美國最大的礦主之一,但挖礦業務只是其更宏大計劃的一部分。該計劃的操控者是一家名為Foundry的機構,Core Scientific剛剛宣布的2300萬美元進資便來自于這家機構。Foundry是數字貨幣集團 (DCG)的子公司,后者是一家不斷擴張的企業巨頭,其最近宣布將在挖礦領域注資1億美元。

Foundry首席執行官邁克?科利爾稱,提升美國加密貨幣的產能可實現挖礦礦主的多元化,并借此提振比特幣網絡。

科利爾說:“只有當比特幣遍布全世界而且去中心化時,它才能發揮作用。”科利爾預測美國產比特幣的生產份額有望在未來幾年內增至25%。

換句話說,美國挖礦公司將幫助確保沒有任何礦主財團能夠共謀操縱區塊鏈網絡。說到共謀,這要求單一實體控制超過50%的區塊鏈網絡,這個概率對于比特幣來說非常之低,但在小型數字貨幣領域出現過這種現象。

Foundry的挖礦動議為提振比特幣網絡帶來了希望,當然,也給公司提供了賺錢的機會。同時,它可能也反映了另一個戰略必要性:隨著市場對比特幣需求的增長,更多的公司可能會希望自家也能供應比特幣,以促進交易業務。就數字貨幣集團而言,它擁有一個巨大的消費者比特幣業務,而Foundry在這一行業的舉措可能會有助于推動垂直整合。

此前在投行巨頭富達負責挖礦業務的阿曼達?法比亞諾說:“挖礦是積累比特幣的絕佳方式。借助正確的設置,開采比特幣可以比購買比特幣更省錢。” 阿曼達?法比亞諾如今在加密貨幣交易公司Galaxy Digital從事同樣的業務。

“碳挑戰世界”中電力的最佳用途?

為了從不同角度了解北美的比特幣挖礦業務,我采訪了華盛頓州切蘭郡某公用設施總經理史蒂夫?懷特。2017年,也就是上一次比特幣熱期間,大量挖礦公司都希望利用該郡充足的水電資源,令懷特應接不暇。

懷特回憶說:“有很多公司過來對我們說,‘我們準備干大事。’然后他們就消失了。人們會說,‘我在這里會呆很長一段時間’,結果是連電話都沒人接。”

問題還在于,一些魯莽的運營商會讓變壓器超負荷運行,引發火災。與此同時,希望設廠的加密貨幣礦主要求獲得與當地企業一樣低的電價。對于懷特來說,如果同意這些,那么公用設施通過向外部市場高價出售其水電資源所賺取的利潤就有可能會減少。

懷特還面臨著來自于郡居民的反對意見,他們對于在比特幣挖礦這類項目上耗費更多的能源是否道德存在疑問。

懷特說:“當你在這個受到碳挑戰的世界中擁有綠色能源供應時,人們會問比特幣行業是否是能源利用的最佳方式。”懷特的工作職責就包括監管哥倫比亞河上的大壩(如下圖所示)。

有關于加密貨幣挖礦對環保影響的爭論不僅限于切蘭郡。支付巨頭Square最近購買了5000萬美元的比特幣作為公司資產,它于上周宣布投資1000萬美元來支持“比特幣清潔能源”動議,并將其作為2030年前碳中和宏偉計劃的一部分。

與此同時,其他美國公司正在尋求創新的方式來減少比特幣的環境影響。Galaxy Digital的法比亞諾提到了油氣行業的三家公司——Crusoe Energy、Great American Mining和Upstream Data,這些公司通過捕捉通常在燃除(頁巖鉆探井架會燒掉過多的天然氣)過程中浪費的能源來為加密貨幣挖礦提供電力。

所有這一切可能有助于安撫那些將比特幣挖礦視為環保災難的批評人士。然而,像 Core Scientific這樣的公司還不得不克服另一個公共關系問題:經營挖礦作業的都是一些詭詐的投機分子,沒誰會把當地社區的困境當回事。

這種看法是2017年比特幣熱所遺留的另一個問題,當時,數字礦主們心里都裝著更加宏偉的加密貨幣社區,秉承其自由、無國界的世界觀,而且讓全美的很多城鎮都加入了這一陣營。最為知名的案例莫過于德州的洛克戴爾。這個小鎮成為了《連線》雜志專題報道的主題,該報道講述了一家中國公司比特大陸曾吹噓新成立的比特幣公司將幫助彌補因美國鋁業公司工廠關閉所造成的工作崗位和收入損失。洛克戴爾鎮官員以豪華的晚宴來討好這家挖礦公司的高管,然而,就像切蘭郡和其他地方發生的情況一樣,這家公司消失的無影無蹤。

對于工作崗位來說,加密貨幣挖礦業務可能會為當地居民提供少量新崗位。然而懷特稱,就業機會與最近關閉的鋁廠曾經提供的就業機會差不多,這意味著該郡歡迎加密貨幣公司來此建廠的理由又少了一分。

Foundry首席執行官科利爾認為,加密貨幣采礦業必須克服深層次的不信任問題。然而他堅持認為,像Core Scientific這樣的公司不同于過去那些不靠譜的企業。

他說:“2017年,有很多人都夸下了海口,不把公司當回事,然后恐嚇當地政府。其中有很多人都消失了,但留下來的都是合法的。”

然而,即便北美挖礦公司可以克服公眾疑慮,但他們仍不得不證明自己能夠獲得成功,因為這個行業的大多數企業都以失敗告終。

對中國芯片的依賴

成功的加密貨幣挖礦作業要求使用整合特定用途集成電路芯片的新礦機,這種定制的計算機芯片都是用于某種特定用途。就比特幣礦機而言,這類芯片是專門針對解決構建區塊鏈的數學問題而設計。

人們不禁會問:如果一家公司可以制造最好的礦機,那么它們為什么不組建自己的比特幣挖礦業務,而是出售機器呢?

確實,比特大陸在過去曾面臨將二手礦機當新機賣的指控,這類礦機大多由中國的兩家公司制造,比特大陸是其中之一。與此同時,公司還是正在進行的集體訴訟的被告。該訴訟稱公司不正當地挖掘其客戶購買的比特幣。

這一指控還未得到證實,而且比特大陸亦對此表示否認。然而,這一局面為Foundry和Core Scientific這樣的公司帶來了風險,這些公司不僅有自己的挖礦業務,同時還計劃向其他公司提供礦機。

Foundry的科利爾稱,這類顧慮在過去是有根據的,但加密貨幣采礦業的日漸發展已經杜絕了中國制造商內部交易的情形。他說,其中一個原因在于制造商意識到,挖礦能力的全球擴散將造福更廣泛的比特幣經濟。

Galaxy Digital的挖礦專家法比亞諾稱,該行業在過去已經變得更值得信賴,部分原因在于比特大陸和另一家大型制造商MicroBT之間的激烈競爭。

然而,法比亞諾還表示,供應鏈問題導致公司難以得到最先進的礦機,這些礦機的價格每臺在2600-2800美元之間。她指出,各大公司都從臺灣臺積電和三星那里購買芯片,而這些公司又有其他數千家客戶,其中包括像蘋果這樣的公司,因此比特幣挖礦公司可能就難以成為其優先供貨對象。法比亞諾稱,結果就成了,新機器可能要到明年7月份才能交付。

從長遠來看,Core Scientific預測像臺積電這樣的芯片制造商可能會在美國設立生產線,從而在美國本土提供挖礦設備所需芯片。然而法比亞諾認為,中國將始終擁有制造方面的優勢,而且他對科利爾預測美國挖礦能力將占到全球總能力25%持樂觀態度。

總之,就像比特幣本身一樣,美國加密貨幣采礦業的發展壯大存在風險而且充滿了不確定性。(財富中文網)

譯者:馮豐

審校:夏林

一家名為Core Scientific的初創企業上周宣布,公司已籌集了2300萬美元,用于擴張其加密貨幣挖礦業務。這家北美比特幣采礦公司已在北卡羅萊納州、佐治亞州和肯塔基州建有加密礦場,并計劃在不久后開設更多的分支。

目前,一枚比特幣價值約2萬美元,數字礦山等同于天然金礦。開采一個比特幣區塊能夠挖出6.25枚比特幣,價值約12.5萬美元。因此,很容易理解為什么會有這一商業決策。

如果Core Scientific的挖礦業務獲得成功,那么公司不僅僅會大賺一筆,而且將幫助重振美國的加密貨幣行業,而美國也是比特幣的誕生地。

加密貨幣挖礦近期的東山再起聽起來像是個喜訊。像Core Scientific這樣的挖礦公司可借此賺錢并為農村地區創造就業機會,同時還能確保美國人手中能夠掌握更多即將成為一種戰略資產的比特幣。

然而,我們也有理由對此持謹慎態度。上一次加密貨幣挖礦熱也承諾了類似的福利,但結果是,很多不靠譜的企業爆出了一系列丑聞,并在隨后帶來了環境問題。這次的結果是否會有什么不一樣呢?

數字鎬鏟交易

開采加密貨幣與傳統采礦業截然不同。這里沒有礦石挖掘,也無需搬運,所適用的工具也不是鎬和炸藥。加密貨幣挖礦者賴以謀生的行頭只有兩個:定制設計的計算機芯片和大量的電力。加密貨幣挖礦作業如下圖所示:

為了找到數字金礦,加密貨幣礦主會利用其計算機與全球其他礦主競爭,看誰先解決復雜的數學問題。解決問題的計算機會通過網絡向他人公布解決方案,并借此向區塊鏈增加一個區塊,一個防篡改分類賬戶將為交易提供公共記錄。麻煩的是,優勝計算機的所有者會獲得“區塊獎勵”,也就是6.25個比特幣(比特幣挖礦)外加交易費用。這個流程每10分鐘重復一次。

在早期,當人們還可以用家中筆記本挖掘比特幣的時候,很大一部分加密貨幣挖礦業務都集中在美國。然而,隨著解決數學問題的計算機算力的提升,中國成為了挖礦作業的主導國。

中國礦主擁有兩個優勢:容易獲得便宜的電力,包括像蒙古這樣的地區,以及能夠制作所謂礦機(也就是僅用于挖礦用的定制芯片計算機)的本土制造基地。盡管全球也存在著其他挖礦作業,但中國在這一領域依然遙遙領先,以下來自于劍橋另類金融中心的圖表便說明了這一點:

總哈希率月均占比

如今,一些美國公司認為,他們可以將一部分挖礦業務從中國搶回來。就Core Scientific而言,它已經拿下了5個城市的廉價電力,項目總占地面積超過了600多畝,其中包括佐治亞州的達爾頓市,北卡州的馬博市以及肯塔基州的卡爾弗特市。該公司還與中國制造商達成了協議,將最先拿到最新的礦機,并計劃開采比特幣之外的加密貨幣,例如萊特幣、比特現金、Zcash和以太幣。

Core Scientific如今是美國最大的礦主之一,但挖礦業務只是其更宏大計劃的一部分。該計劃的操控者是一家名為Foundry的機構,Core Scientific剛剛宣布的2300萬美元進資便來自于這家機構。Foundry是數字貨幣集團 (DCG)的子公司,后者是一家不斷擴張的企業巨頭,其最近宣布將在挖礦領域注資1億美元。

Foundry首席執行官邁克?科利爾稱,提升美國加密貨幣的產能可實現挖礦礦主的多元化,并借此提振比特幣網絡。

科利爾說:“只有當比特幣遍布全世界而且去中心化時,它才能發揮作用。”科利爾預測美國產比特幣的生產份額有望在未來幾年內增至25%。

換句話說,美國挖礦公司將幫助確保沒有任何礦主財團能夠共謀操縱區塊鏈網絡。說到共謀,這要求單一實體控制超過50%的區塊鏈網絡,這個概率對于比特幣來說非常之低,但在小型數字貨幣領域出現過這種現象。

Foundry的挖礦動議為提振比特幣網絡帶來了希望,當然,也給公司提供了賺錢的機會。同時,它可能也反映了另一個戰略必要性:隨著市場對比特幣需求的增長,更多的公司可能會希望自家也能供應比特幣,以促進交易業務。就數字貨幣集團而言,它擁有一個巨大的消費者比特幣業務,而Foundry在這一行業的舉措可能會有助于推動垂直整合。

此前在投行巨頭富達負責挖礦業務的阿曼達?法比亞諾說:“挖礦是積累比特幣的絕佳方式。借助正確的設置,開采比特幣可以比購買比特幣更省錢。” 阿曼達?法比亞諾如今在加密貨幣交易公司Galaxy Digital從事同樣的業務。

“碳挑戰世界”中電力的最佳用途?

為了從不同角度了解北美的比特幣挖礦業務,我采訪了華盛頓州切蘭郡某公用設施總經理史蒂夫?懷特。2017年,也就是上一次比特幣熱期間,大量挖礦公司都希望利用該郡充足的水電資源,令懷特應接不暇。

懷特回憶說:“有很多公司過來對我們說,‘我們準備干大事。’然后他們就消失了。人們會說,‘我在這里會呆很長一段時間’,結果是連電話都沒人接。”

問題還在于,一些魯莽的運營商會讓變壓器超負荷運行,引發火災。與此同時,希望設廠的加密貨幣礦主要求獲得與當地企業一樣低的電價。對于懷特來說,如果同意這些,那么公用設施通過向外部市場高價出售其水電資源所賺取的利潤就有可能會減少。

懷特還面臨著來自于郡居民的反對意見,他們對于在比特幣挖礦這類項目上耗費更多的能源是否道德存在疑問。

懷特說:“當你在這個受到碳挑戰的世界中擁有綠色能源供應時,人們會問比特幣行業是否是能源利用的最佳方式。”懷特的工作職責就包括監管哥倫比亞河上的大壩(如下圖所示)。

有關于加密貨幣挖礦對環保影響的爭論不僅限于切蘭郡。支付巨頭Square最近購買了5000萬美元的比特幣作為公司資產,它于上周宣布投資1000萬美元來支持“比特幣清潔能源”動議,并將其作為2030年前碳中和宏偉計劃的一部分。

與此同時,其他美國公司正在尋求創新的方式來減少比特幣的環境影響。Galaxy Digital的法比亞諾提到了油氣行業的三家公司——Crusoe Energy、Great American Mining和Upstream Data,這些公司通過捕捉通常在燃除(頁巖鉆探井架會燒掉過多的天然氣)過程中浪費的能源來為加密貨幣挖礦提供電力。

所有這一切可能有助于安撫那些將比特幣挖礦視為環保災難的批評人士。然而,像 Core Scientific這樣的公司還不得不克服另一個公共關系問題:經營挖礦作業的都是一些詭詐的投機分子,沒誰會把當地社區的困境當回事。

這種看法是2017年比特幣熱所遺留的另一個問題,當時,數字礦主們心里都裝著更加宏偉的加密貨幣社區,秉承其自由、無國界的世界觀,而且讓全美的很多城鎮都加入了這一陣營。最為知名的案例莫過于德州的洛克戴爾。這個小鎮成為了《連線》雜志專題報道的主題,該報道講述了一家中國公司比特大陸曾吹噓新成立的比特幣公司將幫助彌補因美國鋁業公司工廠關閉所造成的工作崗位和收入損失。洛克戴爾鎮官員以豪華的晚宴來討好這家挖礦公司的高管,然而,就像切蘭郡和其他地方發生的情況一樣,這家公司消失的無影無蹤。

對于工作崗位來說,加密貨幣挖礦業務可能會為當地居民提供少量新崗位。然而懷特稱,就業機會與最近關閉的鋁廠曾經提供的就業機會差不多,這意味著該郡歡迎加密貨幣公司來此建廠的理由又少了一分。

Foundry首席執行官科利爾認為,加密貨幣采礦業必須克服深層次的不信任問題。然而他堅持認為,像Core Scientific這樣的公司不同于過去那些不靠譜的企業。

他說:“2017年,有很多人都夸下了海口,不把公司當回事,然后恐嚇當地政府。其中有很多人都消失了,但留下來的都是合法的。”

然而,即便北美挖礦公司可以克服公眾疑慮,但他們仍不得不證明自己能夠獲得成功,因為這個行業的大多數企業都以失敗告終。

對中國芯片的依賴

成功的加密貨幣挖礦作業要求使用整合特定用途集成電路芯片的新礦機,這種定制的計算機芯片都是用于某種特定用途。就比特幣礦機而言,這類芯片是專門針對解決構建區塊鏈的數學問題而設計。

人們不禁會問:如果一家公司可以制造最好的礦機,那么它們為什么不組建自己的比特幣挖礦業務,而是出售機器呢?

確實,比特大陸在過去曾面臨將二手礦機當新機賣的指控,這類礦機大多由中國的兩家公司制造,比特大陸是其中之一。與此同時,公司還是正在進行的集體訴訟的被告。該訴訟稱公司不正當地挖掘其客戶購買的比特幣。

這一指控還未得到證實,而且比特大陸亦對此表示否認。然而,這一局面為Foundry和Core Scientific這樣的公司帶來了風險,這些公司不僅有自己的挖礦業務,同時還計劃向其他公司提供礦機。

Foundry的科利爾稱,這類顧慮在過去是有根據的,但加密貨幣采礦業的日漸發展已經杜絕了中國制造商內部交易的情形。他說,其中一個原因在于制造商意識到,挖礦能力的全球擴散將造福更廣泛的比特幣經濟。

Galaxy Digital的挖礦專家法比亞諾稱,該行業在過去已經變得更值得信賴,部分原因在于比特大陸和另一家大型制造商MicroBT之間的激烈競爭。

然而,法比亞諾還表示,供應鏈問題導致公司難以得到最先進的礦機,這些礦機的價格每臺在2600-2800美元之間。她指出,各大公司都從臺灣臺積電和三星那里購買芯片,而這些公司又有其他數千家客戶,其中包括像蘋果這樣的公司,因此比特幣挖礦公司可能就難以成為其優先供貨對象。法比亞諾稱,結果就成了,新機器可能要到明年7月份才能交付。

從長遠來看,Core Scientific預測像臺積電這樣的芯片制造商可能會在美國設立生產線,從而在美國本土提供挖礦設備所需芯片。然而法比亞諾認為,中國將始終擁有制造方面的優勢,而且他對科利爾預測美國挖礦能力將占到全球總能力25%持樂觀態度。

總之,就像比特幣本身一樣,美國加密貨幣采礦業的發展壯大存在風險而且充滿了不確定性。(財富中文網)

譯者:馮豐

審校:夏林

A startup called Core Scientific announced this week that it has raised $23 million to expand its cryptocurrency mining operations. The company, based in Bellevue, Wash., is already running crypto mines in North Carolina, Georgia, and Kentucky, and plans to open more before long.

It’s not hard to understand why. Right now, a single Bitcoin—the digital mining equivalent of a gold nugget—is worth around $20,000. Mining a single Bitcoin block brings a reward of 6.25 of them, or about $125,000.

If Core Scientific’s mining ventures are successful, the company will not just make a lot of money. It will also help to repatriate crypto production to the United States, where Bitcoin got its start.

The recent resurgence in crypto mining feels like a good-news story. Mining companies like Core Scientific are in a position to make money and create jobs in rural areas, while also ensuring more Bitcoin—which is becoming a strategic asset—ends up in American hands.

But there are also reasons for caution. The last crypto-mining boom promised similar benefits but resulted in fly-by-night companies leaving a trail of scams and environmental degradation in their wake. Will the outcome be any different this time?

Digital picks and shovels

Mining cryptocurrency is different from conventional mining in some obvious ways. There’s no excavating and hauling ore. And the tools of the trade are not pickaxes and dynamite. Instead, crypto miners rely on two things to make a living: custom-designed computer chips and a torrent of electricity. A crypto-mining operation looks like this:

In order to find a digital nugget, crypto miners pit their computers against others around the world in a race to solve complex math problems. The computer that solves the problem broadcasts the solution to others on the network and, in doing so, adds a block to the blockchain—a tamperproof ledger that serves as a public record of transactions. For their trouble, the owner of the winning computer pockets the “block reward,” which is 6.25 Bitcoins in the case of Bitcoin plus transaction fees. The process is repeated every 10 minutes or so.

In the early days, when it was still viable to mine Bitcoin with a home laptop, a large proportion of crypto mining took place in the U.S. But as the computer power needed to solve the math problems increased, Chinese mining operations came to dominate.

The Chinese miners enjoyed two advantages: easy access to cheap power, including in places like Mongolia, and a domestic manufacturing base capable of cranking out so-called mining rigs—computers with custom chips made just for mining. While there are other mining operations around the globe, China remains far and away the leader, as can be seen in this chart from the Cambridge Centre for Alternative Finance:

Now, some U.S. companies believe they can wrest some of the mining pie back from China. In the case of Core Scientific, it has struck arrangements for cheap power across five sites, spanning over 100 acres in total, in Dalton, Ga., Marble, N.C., and Calvert City, Ky. The firm has also cut deals with Chinese manufacturers to get first dibs on the newest mining rigs, and plans to mine not just Bitcoin but so-called alt coins like Litecoin, Bitcoin Cash, Zcash, and Ethereum.

Core Scientific is now one of the biggest U.S. miners, but its operations are part of a still larger plan. That plan is being steered by an outfit called Foundry, which is behind the just announced $23 million investment in Core Scientific. Foundry is a subsidiary of Digital Currency Group (DCG), a sprawling crypto conglomerate that recently announced it would spend $100 million on mining initiatives.

According to Foundry CEO Mike Colyer, boosting crypto production in the U.S. will serve to strengthen Bitcoin’s network by diversifying the miners who maintain it.

“The only way Bitcoin works is when it’s distributed through the world and when it’s decentralized,” says Colyer, who predicts the share of U.S.-produced Bitcoin could rise to 25% in the next few years.

Put another way, the U.S. mining ventures will help ensure that no consortium of miners can collude to manipulate the blockchain network. Such collusion requires a single entity to control over 50% of the network—a risk that is is remote in the case of Bitcoin, but which has transpired in the case of smaller digital currencies.

Foundry’s mining initiatives offer the promise of strengthening Bitcoin’s network—and, of course, giving the company a chance to make money—but may also reflect another strategic imperative. Namely, as demand for Bitcoin increases in the market, more companies may wish to have a private supply of it to facilitate trading operations. In the case of DCG, which has a giant consumer Bitcoin business, Foundry’s ventures may help facilitate vertical integration.

“Mining is a great way to accumulate Bitcoin. With the correct setup, you can mine it cheaper than you can buy it,” says Amanda Fabiano, who formerly oversaw mining operations at investment giant Fidelity and now does the same for crypto-trading firm Galaxy Digital.

The best use of power in a “carbon-challenged world”?

To get a different perspective on Bitcoin mining in North America, I spoke to Steve Wright, the general manager of a public utility in Chelan County, Wash. During the last big Bitcoin boom in 2017, Wright had to contend with a crush of mining companies asking to tap into the county’s ample hydroelectric resources.

“We had a lot of companies come in and say, ‘We’re going to do great things,’ and then they would be gone from the face of the earth,” Wright recalls. “People would say, ‘We’re here for long term,’ and then nobody would pick up the phone.”

Problems also came in the form of reckless operators who overloaded transformers, triggering fires. Meanwhile, the crypto miners who wanted to set up shop demanded the low electricity rates available to locals. For Wright, agreeing to those demands risked undercutting the profits the utility earned from selling its hydropower at higher rates to outside markets.

Wright also faced pushback from county residents who questioned whether it was ethical to expend energy on something like Bitcoin mining.

“When you have a green supply of power and you have a carbon-challenged world, people were asking if this is the best use of that power,” said Wright, whose job involves overseeing Columbia River dams like the one below.

The debate over the environmental impact of crypto mining is not restricted to Chelan County. The payment giant Square, which recently bought $50 million of Bitcoin for its corporate treasury, announced a $10 million pledge this week to support a “Bitcoin Clean Energy” initiative as part of a larger plan to become carbon neutral by 2030.

Meanwhile, other U.S. companies are finding creative ways to reduce Bitcoin’s environmental impact. Fabiano of Galaxy Digital pointed to three firms in the oil-and-gas field—Crusoe Energy, Great American Mining, and Upstream Data—that are capturing the energy typically wasted through flaring (when shale drilling rigs burn off excess natural gas) to power crypto mining.

All of this may help assuage critics who view Bitcoin mining as an environmental disaster. But firms like Core Scientific also have to overcome another public relations problem: that mining operations are run by shifty carpetbaggers who will leave local communities in the lurch.

This perception is another legacy of the 2017 Bitcoin boom when digital miners—who typically share the libertarian, borderless worldview of the larger crypto community—took towns across the country for a ride. The most famous example is Rockdale, Texas. The town became the subject of a Wired magazine feature about how a Chinese firm, Bitmain, touted a new Bitcoin venture that would help replace jobs and revenue that had been lost when an Alcoa plant closed. Rockdale town officials put on lavish dinners to make the mining executives feel welcome but, as happened in Chelan County and elsewhere, they vanished into the night.

As for jobs, cryptocurrency mining operations may provide a handful of new positions for local residents. But Wright says the employment opportunities are nothing like what a recently closed aluminum plant used to provide—meaning his county has less reason to roll out a welcome mat for crypto companies.

Colyer, the Foundry CEO, acknowledges the crypto-mining industry must overcome deep levels of mistrust. But he insists ventures like Core Scientific are a different breed from past fly-by-night operations.

“In 2017, there were lots of people making huge promises, running around the company, and scaring local governments. A lot of those people have disappeared, and the companies that are left are legitimate,” he says.

But even if the North American mining companies can overcome public skepticism, they will also have to prove they can succeed in a venture that has mostly been defined by failure.

Relying on Chinese chips

A successful crypto-mining operation requires the use of new machines built with ASIC chips—a type of computer chip custom-built for a specific purpose. In the case of Bitcoin mining rigs, the chips are specially designed to crunch the math problems that build the blockchain.

This raises an obvious question: If a company can manufacture the best mining rigs, why would it sell them rather than set up a Bitcoin-mining operation of its own?

And indeed Bitmain, one of the two Chinese companies that makes most of the machines, has faced past accusations of passing off used mining rigs as new. Meanwhile, the company is the subject of an ongoing class action lawsuit that claims it surreptitiously mined Bitcoins purchased by its customers.

The allegations are unproven, and Bitmain denies wrongdoing. But the situation appears to pose a risk for the likes of Foundry and Core Scientific, which are not only undertaking their own mining operations but plan to supply machines to other companies.

Colyer of Foundry says that such concerns were valid in the past but that the mining industry has evolved to eliminate self-dealing by the Chinese manufacturers. One reason, he says, is that the manufacturers have come to recognize that distributing mining power across the globe benefits the broader Bitcoin economy.

Fabiano, the mining expert with Galaxy Digital, says the industry has become more trustworthy in part because there is now intense competition between Bitmain and the other big manufacturer, MicroBT.

But Fabiano adds that accessing state-of-the-art mining rigs, which can cost between $2,600 and $2,800 apiece, has become difficult as a result of supply chain issues. She notes that the companies obtain their chips from Taiwan-based TSMC and Samsung, and that those companies have hundreds of other clients—including the likes of Apple—that may receive priority over Bitcoin companies. The upshot, says Fabiano, is that new machines may not be available until next July.

In the long term, Core Scientific executives predict that chipmakers like TSMC may set up production in the U.S. and provide a domestic source of mining equipment. But Fabiano suggests that China will always have the manufacturing edge and that Colyer’s prediction of the U.S. obtaining a 25% share of mining capacity is optimistic.

The bottom line is that aspirations for a booming crypto-mining industry in the U.S. is risky and fraught with uncertainty—much like Bitcoin itself.