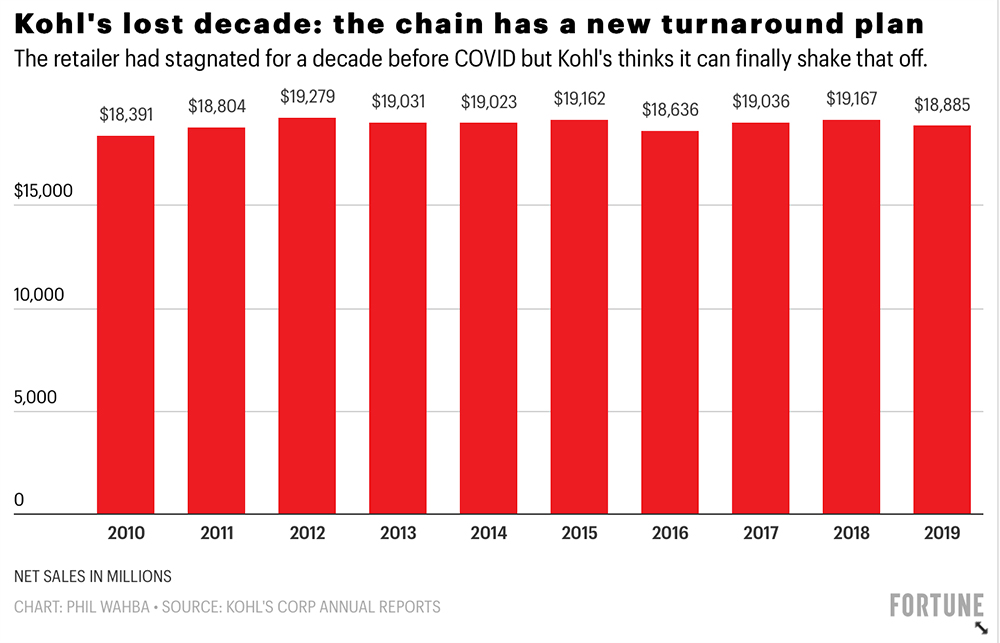

多年來,科爾氏百貨(Kohl’s)的業(yè)務(wù)成長一直停滯不前,為了解決這一問題,該公司重新準(zhǔn)備了一份面向華爾街的重整方案,孰料不久之后就碰上了新冠肺炎疫情大爆發(fā)。

受3月中旬爆發(fā)的疫情影響,科爾氏百貨門店被迫停業(yè)數(shù)周之久,不但令其增長提振方案化為泡影,上半財(cái)年銷售額更是下降了33%,瞬間陷入經(jīng)營危機(jī)之中。

當(dāng)前,雖然該公司的業(yè)務(wù)遠(yuǎn)未恢復(fù)到疫情爆發(fā)前的水平,不過也已經(jīng)逐漸企穩(wěn),科爾氏百貨也隨之公布了自己的重整方案,即將業(yè)務(wù)重心從發(fā)展不利的時(shí)尚領(lǐng)域轉(zhuǎn)向運(yùn)動(dòng)服裝。根據(jù)該方案,科爾氏百貨將加大耐克、TOMS等國民品牌及Lands’ End、Cole Hann等新進(jìn)合作伙伴在其業(yè)務(wù)矩陣中的分量,并剝離多個(gè)自有品牌。

科爾氏百貨的首席執(zhí)行官米歇爾?加斯在接受《財(cái)富》雜志采訪時(shí)說:“科爾氏百貨的門店及品牌將煥然一新,運(yùn)動(dòng)休閑將成為我們的核心業(yè)務(wù)。”

服裝零售是本次疫情中受影響最大的行業(yè)之一。而在其它百貨公司、服裝專賣店飽受沖擊之時(shí),耐克、安德瑪、阿迪達(dá)斯等運(yùn)動(dòng)品牌讓科爾氏百貨的業(yè)績得到了一定保障。2013年加斯加入科爾氏之后,十分明智地加大了對(duì)運(yùn)動(dòng)品牌的投入。目前,科爾氏百貨有20%的收入來自運(yùn)動(dòng)服飾,加斯認(rèn)為這一比例可能還會(huì)進(jìn)一步提高到30%。

新冠疫情對(duì)科爾氏百貨的部分競爭對(duì)手造成了沉重打擊,比如門店主要集中在購物中心中的彭尼百貨(J.C. Penney)已經(jīng)申請(qǐng)破產(chǎn)保護(hù),梅西百貨(Macy’s)也同樣損失慘重,不過其它競爭對(duì)手的情況要好得多,這也增加了科爾氏百貨恢復(fù)增長的壓力。

由于95%的門店都開在購物中心之外,科爾氏百貨的損失不像彭尼和梅西百貨那么大,不過作為一家主要布局商業(yè)街區(qū)的連鎖百貨,科爾氏百貨也面臨著來自塔吉特(Target)、Ulta Beauty、Dick’s Sporting Goods和T.J. Maxx等強(qiáng)大對(duì)手的激烈競爭。

以Gap Inc旗下的Old Navy為例,該服裝品牌在美國年輕母親及其它消費(fèi)群體中與科爾氏有直接競爭關(guān)系,其銷售額下降幅度便遠(yuǎn)小于科爾氏百貨,塔吉特的服飾及家居用品銷售額甚至還有所增長。

面對(duì)這種局面,科爾氏百貨不得不重新思考自己的商品策略,想辦法吸引消費(fèi)者。雖然科爾氏并非唯一一家銷售運(yùn)動(dòng)休閑產(chǎn)品的企業(yè),但其所提供的產(chǎn)品除著眼于女性消費(fèi)者,還能夠滿足全家人的需要,這也讓其開辟出了一個(gè)新的細(xì)分市場(chǎng)。加斯表示:“我們有能力占領(lǐng)這個(gè)市場(chǎng)。”科爾氏百貨也在嘗試一些新思路,比如在50家門店銷售個(gè)人護(hù)理產(chǎn)品。加斯補(bǔ)充道:“新的思路可能行得通,也可能行不通,我們?cè)谕ㄟ^推廣運(yùn)動(dòng)休閑的生活方式來拓展自己的業(yè)務(wù)邊界。”

多年以來,科爾氏百貨一直大力發(fā)展自有品牌,原因是自有品牌更容易控制,利潤率更高,理想情況下也能夠滿足顧客的需求,不過缺點(diǎn)則是無法推向更多的銷售渠道。科爾氏百貨的問題在于有太多的自有品牌已經(jīng)過時(shí),尤其是在服裝領(lǐng)域。與其形成鮮明對(duì)比的塔吉特,總能迅速推出對(duì)消費(fèi)者充滿吸引力的全新品牌。

截至目前,科爾氏百貨已經(jīng)放棄了JLO、Rock&Republic、Dana Buchman等8個(gè)自有品牌,雖然該公司還在引入更多像Lands’ End、Cole Haan這樣國民品牌,但未來還會(huì)有更多的自有品牌退出市場(chǎng)。現(xiàn)在,科爾氏百貨有37%的銷售額來自服裝等品類的自有品牌,而就在幾年之前,這一數(shù)字甚至超過了50%。在談到品牌線收縮時(shí),加斯說:“我們將會(huì)把更多的精力集中到更少的品牌上去。”

美妝行業(yè)的呼喚

自從將美妝市場(chǎng)拱手讓給梅西百貨和彭尼百貨(絲芙蘭專賣店的所在地)之后,科爾氏百貨多年以來一直試圖重新成為該領(lǐng)域的重要參與者。實(shí)際上,早在2014年的“偉大議程”之中,科爾氏百貨就將打造規(guī)模化的美妝業(yè)務(wù)作為自己的核心,希望能借助所謂“美妝看門人”計(jì)劃在短期內(nèi)將美妝業(yè)務(wù)在總銷售額中的占比從當(dāng)時(shí)的2%提高到5%。雖然科爾氏百貨的香水業(yè)務(wù)表現(xiàn)不俗,但由于同在購物街區(qū)開展業(yè)務(wù)的塔吉特、Ulta Beauty、CVS、沃爾格林(Walgreens)等公司或激烈或溫和的競爭,其美妝業(yè)務(wù)始終未能達(dá)到預(yù)期的高度。

現(xiàn)在,科爾氏百貨計(jì)劃將其美妝門店的規(guī)模擴(kuò)大兩倍,并為門店配備專業(yè)的美妝顧問。多年來,科爾氏百貨一直探索著如何讓匆匆而過的顧客增加在店逗留時(shí)間,而美妝品類恰是解決這一問題的關(guān)鍵。

持續(xù)發(fā)展電商業(yè)務(wù)也是該公司計(jì)劃的重要一環(huán)。疫情爆發(fā)前,線上購物在總銷售額中的占比還不到四分之一,而在疫情高峰期,這一數(shù)字達(dá)到了40%之多。預(yù)計(jì),最終電商業(yè)務(wù)在銷售總額中的占比將會(huì)回落到25%至40%之間的某個(gè)位置。

店內(nèi)方面,科爾氏百貨將會(huì)大幅減少某些品牌的商品品種,幅度可達(dá)40%。該公司將會(huì)減少手提包、高級(jí)珠寶、男士西裝等銷售下滑的產(chǎn)品,為銷量更好的產(chǎn)品騰出庫存空間。

加斯說:“這樣可以提升我們的靈活性,讓我們能夠?qū)⒏噘Y源投入那些持續(xù)成長的品類之中,嘗試、學(xué)習(xí)、迭代,優(yōu)勝劣汰。”也希望公司可以借此實(shí)現(xiàn)長期以來渴望的增長。(財(cái)富中文網(wǎng))

譯者:梁宇

審校:夏林

多年來,科爾氏百貨(Kohl’s)的業(yè)務(wù)成長一直停滯不前,為了解決這一問題,該公司重新準(zhǔn)備了一份面向華爾街的重整方案,孰料不久之后就碰上了新冠肺炎疫情大爆發(fā)。

受3月中旬爆發(fā)的疫情影響,科爾氏百貨門店被迫停業(yè)數(shù)周之久,不但令其增長提振方案化為泡影,上半財(cái)年銷售額更是下降了33%,瞬間陷入經(jīng)營危機(jī)之中。

當(dāng)前,雖然該公司的業(yè)務(wù)遠(yuǎn)未恢復(fù)到疫情爆發(fā)前的水平,不過也已經(jīng)逐漸企穩(wěn),科爾氏百貨也隨之公布了自己的重整方案,即將業(yè)務(wù)重心從發(fā)展不利的時(shí)尚領(lǐng)域轉(zhuǎn)向運(yùn)動(dòng)服裝。根據(jù)該方案,科爾氏百貨將加大耐克、TOMS等國民品牌及Lands’ End、Cole Hann等新進(jìn)合作伙伴在其業(yè)務(wù)矩陣中的分量,并剝離多個(gè)自有品牌。

科爾氏百貨的首席執(zhí)行官米歇爾?加斯在接受《財(cái)富》雜志采訪時(shí)說:“科爾氏百貨的門店及品牌將煥然一新,運(yùn)動(dòng)休閑將成為我們的核心業(yè)務(wù)。”

服裝零售是本次疫情中受影響最大的行業(yè)之一。而在其它百貨公司、服裝專賣店飽受沖擊之時(shí),耐克、安德瑪、阿迪達(dá)斯等運(yùn)動(dòng)品牌讓科爾氏百貨的業(yè)績得到了一定保障。2013年加斯加入科爾氏之后,十分明智地加大了對(duì)運(yùn)動(dòng)品牌的投入。目前,科爾氏百貨有20%的收入來自運(yùn)動(dòng)服飾,加斯認(rèn)為這一比例可能還會(huì)進(jìn)一步提高到30%。

新冠疫情對(duì)科爾氏百貨的部分競爭對(duì)手造成了沉重打擊,比如門店主要集中在購物中心中的彭尼百貨(J.C. Penney)已經(jīng)申請(qǐng)破產(chǎn)保護(hù),梅西百貨(Macy’s)也同樣損失慘重,不過其它競爭對(duì)手的情況要好得多,這也增加了科爾氏百貨恢復(fù)增長的壓力。

由于95%的門店都開在購物中心之外,科爾氏百貨的損失不像彭尼和梅西百貨那么大,不過作為一家主要布局商業(yè)街區(qū)的連鎖百貨,科爾氏百貨也面臨著來自塔吉特(Target)、Ulta Beauty、Dick’s Sporting Goods和T.J. Maxx等強(qiáng)大對(duì)手的激烈競爭。

以Gap Inc旗下的Old Navy為例,該服裝品牌在美國年輕母親及其它消費(fèi)群體中與科爾氏有直接競爭關(guān)系,其銷售額下降幅度便遠(yuǎn)小于科爾氏百貨,塔吉特的服飾及家居用品銷售額甚至還有所增長。

面對(duì)這種局面,科爾氏百貨不得不重新思考自己的商品策略,想辦法吸引消費(fèi)者。雖然科爾氏并非唯一一家銷售運(yùn)動(dòng)休閑產(chǎn)品的企業(yè),但其所提供的產(chǎn)品除著眼于女性消費(fèi)者,還能夠滿足全家人的需要,這也讓其開辟出了一個(gè)新的細(xì)分市場(chǎng)。加斯表示:“我們有能力占領(lǐng)這個(gè)市場(chǎng)。”科爾氏百貨也在嘗試一些新思路,比如在50家門店銷售個(gè)人護(hù)理產(chǎn)品。加斯補(bǔ)充道:“新的思路可能行得通,也可能行不通,我們?cè)谕ㄟ^推廣運(yùn)動(dòng)休閑的生活方式來拓展自己的業(yè)務(wù)邊界。”

多年以來,科爾氏百貨一直大力發(fā)展自有品牌,原因是自有品牌更容易控制,利潤率更高,理想情況下也能夠滿足顧客的需求,不過缺點(diǎn)則是無法推向更多的銷售渠道。科爾氏百貨的問題在于有太多的自有品牌已經(jīng)過時(shí),尤其是在服裝領(lǐng)域。與其形成鮮明對(duì)比的塔吉特,總能迅速推出對(duì)消費(fèi)者充滿吸引力的全新品牌。

截至目前,科爾氏百貨已經(jīng)放棄了JLO、Rock&Republic、Dana Buchman等8個(gè)自有品牌,雖然該公司還在引入更多像Lands’ End、Cole Haan這樣國民品牌,但未來還會(huì)有更多的自有品牌退出市場(chǎng)。現(xiàn)在,科爾氏百貨有37%的銷售額來自服裝等品類的自有品牌,而就在幾年之前,這一數(shù)字甚至超過了50%。在談到品牌線收縮時(shí),加斯說:“我們將會(huì)把更多的精力集中到更少的品牌上去。”

科爾氏百貨“失去的十年”:零售巨頭推出全新重整方案

美妝行業(yè)的呼喚

自從將美妝市場(chǎng)拱手讓給梅西百貨和彭尼百貨(絲芙蘭專賣店的所在地)之后,科爾氏百貨多年以來一直試圖重新成為該領(lǐng)域的重要參與者。實(shí)際上,早在2014年的“偉大議程”之中,科爾氏百貨就將打造規(guī)模化的美妝業(yè)務(wù)作為自己的核心,希望能借助所謂“美妝看門人”計(jì)劃在短期內(nèi)將美妝業(yè)務(wù)在總銷售額中的占比從當(dāng)時(shí)的2%提高到5%。雖然科爾氏百貨的香水業(yè)務(wù)表現(xiàn)不俗,但由于同在購物街區(qū)開展業(yè)務(wù)的塔吉特、Ulta Beauty、CVS、沃爾格林(Walgreens)等公司或激烈或溫和的競爭,其美妝業(yè)務(wù)始終未能達(dá)到預(yù)期的高度。

現(xiàn)在,科爾氏百貨計(jì)劃將其美妝門店的規(guī)模擴(kuò)大兩倍,并為門店配備專業(yè)的美妝顧問。多年來,科爾氏百貨一直探索著如何讓匆匆而過的顧客增加在店逗留時(shí)間,而美妝品類恰是解決這一問題的關(guān)鍵。

持續(xù)發(fā)展電商業(yè)務(wù)也是該公司計(jì)劃的重要一環(huán)。疫情爆發(fā)前,線上購物在總銷售額中的占比還不到四分之一,而在疫情高峰期,這一數(shù)字達(dá)到了40%之多。預(yù)計(jì),最終電商業(yè)務(wù)在銷售總額中的占比將會(huì)回落到25%至40%之間的某個(gè)位置。

店內(nèi)方面,科爾氏百貨將會(huì)大幅減少某些品牌的商品品種,幅度可達(dá)40%。該公司將會(huì)減少手提包、高級(jí)珠寶、男士西裝等銷售下滑的產(chǎn)品,為銷量更好的產(chǎn)品騰出庫存空間。

加斯說:“這樣可以提升我們的靈活性,讓我們能夠?qū)⒏噘Y源投入那些持續(xù)成長的品類之中,嘗試、學(xué)習(xí)、迭代,優(yōu)勝劣汰。”也希望公司可以借此實(shí)現(xiàn)長期以來渴望的增長。(財(cái)富中文網(wǎng))

譯者:梁宇

審校:夏林

On the eve of the pandemic's outbreak in mid-March, Kohl's had a new turnaround plan it wanted to unveil to Wall Street that it hoped would finally shake years of stagnation.

But the COVID-19 outbreak, which forced Kohl's to close its stores for weeks, thwarted those plans, instead putting the retailer in survival mode as sales fell 33% in the first half of the fiscal year.

Now that business has stabilized—though far from returning to pre-pandemic levels—Kohl's is unveiling its plan, which shifts it away from fashion, where it has stumbled, and further into activewear. The plan also calls for Kohl's to lean more heavily on national brands like Nike and TOMS, as well as newer partners like Lands' End and Cole Haan, and shed many of its store brands.

"The Kohl’s store and brand is going to look and feel different," Kohl's CEO Michelle Gass tells Fortune. "Active and casual are going to be at the center of that."

Apparel spending has been one of the biggest victims of the pandemic. Shielding Kohl's from the worst of the clothing armageddon buffeting other department stores and specialty clothing chains is activewear from brands like Nike, Under Armour, and Adidas. Kohl's wisely placed a big bet on sporty apparel after Gass joined Kohl's in 2013. That category now generates 20% of Kohl's sales and Gass thinks that can hit 30%.

While COVID-19 took a hammer to the business of many Kohl's rivals— notably bankrupting mall-based J.C. Penney and decimating Macy's—other competitors have fared much better, adding to the pressure on Kohl's to finally get back to growth.

Having 95% of stores away from malls helped it avoid from much of the ravages felt by Penney and Macy's. Yet as a strip-mall based chain, Kohl's is going up against very strong competitors in Target, Ulta Beauty, Dick's Sporting Goods and T.J. Maxx.

Gap Inc's Old Navy chain, which competes directly with Kohl's for the business of young American mothers, among other demographics, saw a sales decline much smaller than Kohl's, while Target reported an increase in apparel and home goods sales.

And this has forced Kohl's to rethink its merchandise strategy and what makes it appealing to shoppers. While Kohl's isn't alone in selling athleisure, it has carved out a niche by focusing on such items for the whole family and not just women. "We can own that space," says Gass. Kohl's is also testing out new ideas, like personal care products, at 50 stores. "It may or may not work—we’re really stretching the boundaries of where we can go and take this active and casual lifestyle," Gass adds.

For years, Kohl's bet heavily on store brands, which offer higher profit margins, more control, and ideally, something customers want—but can't get elsewhere. Kohl's problem is that too many of its store brands grew stale, particularly in apparel. That weakness stands in stark contrast to Target's remarkable ability to quickly launch new brands that send consumers flocking.

Kohl's has so far ditched eight of its exclusive brands, including JLO, Rock & Republic and Dana Buchman, with more exits to come, even as it has lined up more national brands, like Lands' End and Cole Haan. The retailer now gets 37% of sales from its exclusive brands in apparel and other categories, down from more than half just a few years ago. "We will be more focused," Gass said of the paring of brands.

Beauty call

Kohl's has been trying for years to become a serious player in the beauty sector after having ceded it to Macy's and J.C. Penney, which houses Sephora shops. In fact, building a sizable beauty was a linchpin of Kohl's "Greatness Agenda" in 2014, with the company hoping beauty would grow from 2% of sales then to 5% in short order, helped by so-called "beauty concierges." While Kohl's has shown strength in fragrance, beauty has not yielded the upside the company planned on, as it has faced stiff competition from strip mall neighbors Target and Ulta Beauty, and to a lesser extent CVS and Walgreens.

Kohl's is now planning beauty shops three times the size of its current ones, staffed with beauty advisors. The category is crucial to solving a riddle that has bedeviled Kohl's for years: how to get more shoppers to come to store and indulge, rather than just popping into the store for a quick in-and-out trip.

A big part of its plan is to keep building its e-commerce business. Online shopping, which accounted for nearly a quarter of sales pre-pandemic, spiked to as much as 40% at the peak of the pandemic. Ultimately, it's expected to settle in somewhere in the middle of those two percentages.

In-store, Kohl's will reduce its assortment within some brands as much as 40%. It will shrink its offering of handbags, fine jewelry, and men's suits—areas that have seen sales decline—making space to increase inventory of healthier categories.

"That gives us the flexibility to lean into growth categories, test, learn, iterate—kill what’s not working, scale what is," says Gass. And hopefully finally yield that long elusive growth.