10月13日收盤前,銀行業巨頭摩根大通公布的季度凈收入為94億美元,遠超預期,在該銀行的歷史上排在第二位。其第三季度的凈收入增長了4.4%,營業收入為291.5億美元,比去年同期僅有小幅下滑。

華爾街的分析師曾預測其銷售額會下降2%,利潤減少12%。分析師認為,摩根大通要針對可能出現的貸款減記撥備大量資金,為了維持這筆支出,摩根大通將產生28億美元信貸成本。而在前兩個季度,該公司都沒有預料到會出現這種情況。

事實上,摩根大通的準備金只有分析師預測金額的五分之一左右。這凸顯出摩根大通財報和其電話會議中傳達出的最重要的信息:隨著經濟超出預期的快速反彈,與幾個月前相比,無論消費者還是大部分企業借款人的信用情況都有顯著好轉。但未來道路上是否潛伏著未知的災難和風險,這還是一個巨大的未知數。

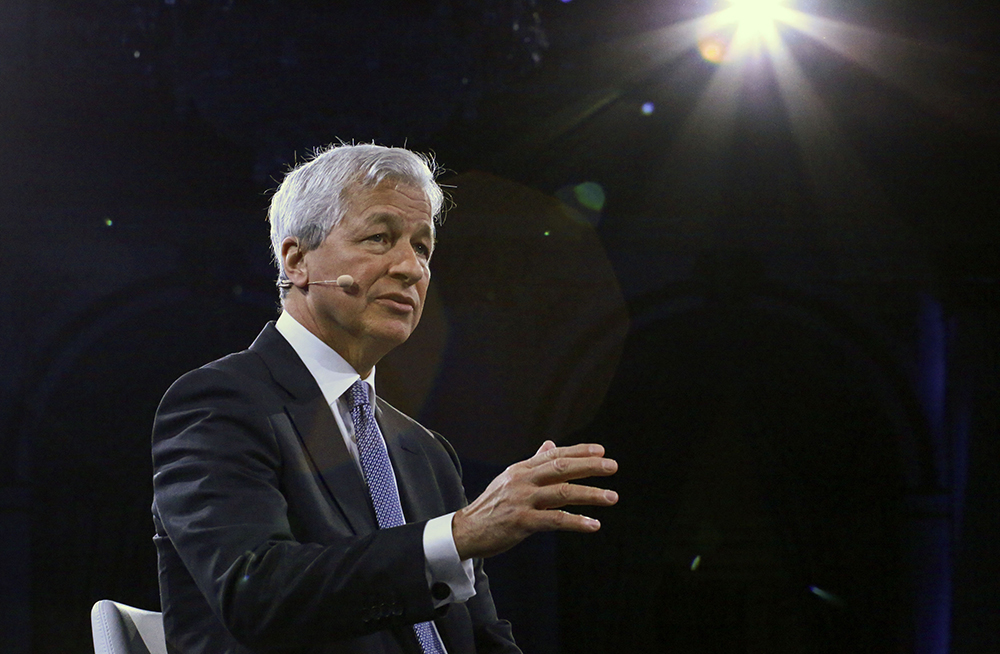

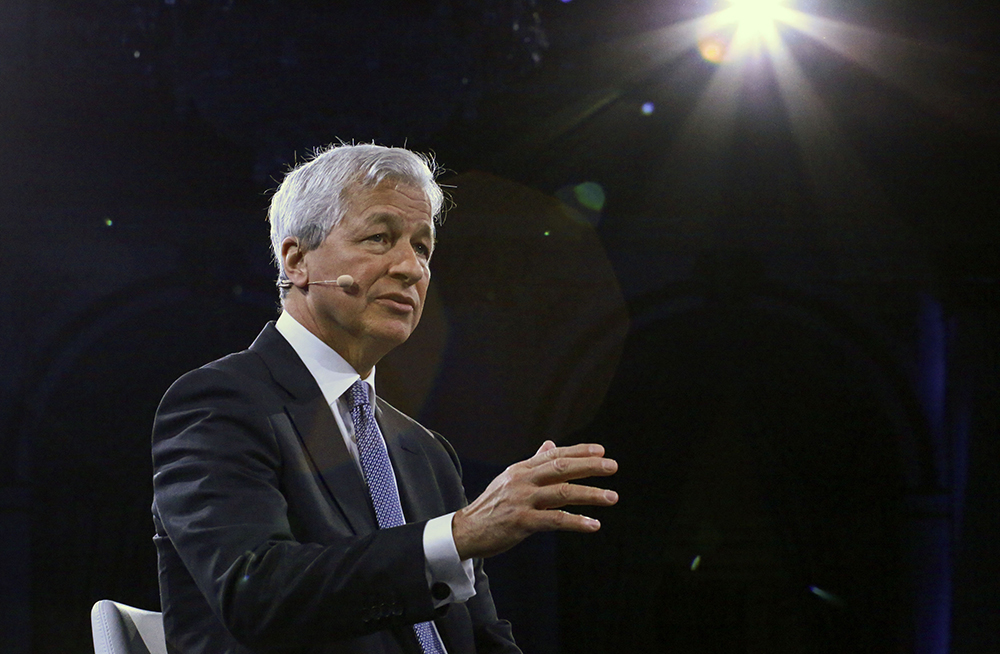

摩根大通CEO杰米·戴蒙在一份重磅聲明中表示,到明年年底之前,信貸損失并不嚴重。

他說這主要是因為政府為家庭和企業提供了前所未有的援助,銀行也推出了貸款延期還款計劃,使本可能更早到來的貸款違約拖延了幾個月。

摩根大通CFO詹妮弗·皮耶普扎克提供了一個粗略的時間線。她說:“2021年上半年,貸款拖欠率會有所上升,下半年會產生貸款沖銷額。”

在被問到貸款沖銷額的規模時,戴蒙和皮耶普扎克都拒絕就此進行預測。

戴蒙說,雖然更多財政刺激會“改善經濟狀況”,但到目前為止最大的影響因素是經濟復蘇的速度和持續時間,以及就業恢復速度。戴蒙表示,由于未來前景的不確定性,摩根大通在預估未來損失時所依據的情境,比美聯儲的“基準”數據更加消極。

美聯儲預測假設明年第四季度美國失業率依舊高居不下,達到7.7%,國民收入增長速度比去年低2.4%。

一個重要的積極因素是,摩根大通有充足的資本,即使在最糟糕的情境下,也能承受未來的損失并維持信貸流動。

事實上,摩根大通的狀況表明,與金融危機爆發前相比,現在的貸款機構做好了更加充足的準備。

穆迪投資者服務公司的金融機構部門高級副總裁戴維·范格表示:“現在與當初的情況有著天壤之別。大銀行在資本和流動性方面變得更加強大。他們的信貸儲備遠遠超過了2008年經濟周期中的水平。”

他補充說,美聯儲設定股息上限,并禁止股票回購,迫使銀行只能儲備現金,這進一步鞏固了他們的資產負債表。另外一重保障是:新會計規則規定,如果貸款機構通過經濟環境變化分析發現,其貸款未來可能變成壞賬,貸款機構就需要為貸款整個生命周期中的所有預期損失撥備資金,而不是等到借款人停止還款時再采取行動。

戴蒙在預測消費者業務的命運時非常謹慎,因為消費者業務將決定摩根大通的未來盈利能力,但他的兩段話證明他對未來持樂觀的態度。

首先,他希望美聯儲能盡快取消對股票回購的限制,使“我們可以在股價大幅上漲之前進行回購。”這番話表明,戴蒙認為沒有必要把以前積攢下來用于回購的收益,作為對未來損失的額外緩沖。

其次,他表示小心謹慎地度過疫情并不意味著會排除收購。戴蒙稱摩根大通正在積極物色一家資產管理公司。他說:“我們的大門始終是敞開的。我們非常感興趣。我們確信你們會看到,本行將進行業務整合。”

以下是摩根大通第三季度財報中的五個趨勢。

交易和投資銀行業務

摩根大通的盈利業務從消費者信貸這個最大的傳統收入來源,轉變到交易和資本市場,這令人非常震驚。

戴蒙一直主張,銀行要整合那些會在不同時期興起和衰落的業務,實行多樣化經營。這成為摩根大通的一大優勢,避免其陷入備受詬病的全能銀行模式。在消費者業務出現萎縮的時候,這些華爾街主要業務的日益強大,正在支撐著摩根大通度過此次危機。

摩根大通的四大盈利業務之一企業和投資銀行,凈收入達到43億美元,是2019年第三季度的三倍。最亮眼的當屬交易業務,或者所謂的“市場業務”。債券、大宗商品和股權交易為摩根大通帶來了近70億美元收入,年比增長27%。在新IPO交易大幅增長的刺激下,投資銀行業務的收入同樣表現搶眼。

總體上而言,企業與投資銀行業務為摩根大通貢獻了46%的利潤,較去年同期增長31%。

消費者貸款

消費者和社區銀行業務的收入與利潤均下滑了9%,收益減少42.5億美元,只有38.7億美元。該部門在摩根大通的利潤占比從去年的一半左右下降至41%。該業務收入下滑有兩個原因。

首先,疫情導致消費者的貸款需求大幅下降。過去一年,住房貸款、汽車貸款和信用卡業務的規模從3,840億美元減少到3,320億美元。

其次,普通貸款的利息收入減少,因為為了應對新冠疫情,美聯儲向市場中注入大量流動性,導致各類貸款的利率下降。第三季度的利息收入與去年同期相比減少了11億美元,降幅高達13%。

但小企業貸款業務實現了增長,這主要得益于聯邦政府的薪資保護計劃。該計劃為保留就業崗位的雇主提供貸款擔保。在該計劃的推動下,過去幾個月,摩根大通向連鎖餐廳和承包商等發放的貸款達到440億美元。

信貸成本

摩根大通的財報中最令人意外的一點是,信貸成本在疫情期間一度達到歷史高點,但后來卻出人意料的下降,甚至低于經濟形勢良好時的水平。

信貸成本的大幅上漲和快速下降,部分原因是會計準則的根本性調整,改變了銀行處理信貸支出的規則。在今年之前,貸款機構基本上需要根據貸款逾期的時間長度,記錄信貸成本或“撥備資金”。所以當經濟形勢不佳時,隨著越來越多客戶停止還款,信貸成本每個季度都在增加。

但在2020年初,財務會計準則委員會推翻了舊的制度。該委員會規定,如果銀行的模型預測其資產組合中的貸款在未來任何時間可能成為壞賬,銀行要為這些貸款撥備準備金,盡管房主或企業主仍在按時償還貸款。當前預期信貸損失(CECL)的出臺,恰逢疫情剛剛爆發的時候。

結果:在第一季度和第二季度,銀行前期遭到嚴重影響,損失慘重。在以往的危機中,這些損失可能會被分散到多個季度。

摩根大通也不例外。

2019年,摩根大通的信貸損失約為每個季度15億美元。汽車貸款、信用卡或小企業貸款違約的情況相對較少,這種溫和的氛圍令整個行業受益,這可以抵消低利率的影響,使銀行業進入史上最好的一段時期。

在第一季度,全世界遭遇巨變,摩根大通根據CECL規則,為其認為可能出現的所有損失撥備了83億美元。第二季度的前景更加暗淡,因此摩根大通再次撥備105億美元。

在短短兩個季度內,摩根大通承受的損失比2019年全年增多了六倍,其中三分之二來自消費者業務。受影響最大的是1,400億美元的信用卡業務。

摩根大通在疫情最嚴重的時候,對未來損失的估算似乎非常準確。

第三季度,摩根大通記錄的信貸損失是6.11億美元,僅有第三季度的6%。消費者銀行業務的信貸損失從58億美元減少到7.94億美元。摩根大通第二季度看起來一切正常但現在似乎會變成壞賬的貸款,總損失約為12億美元。該銀行還“沖銷”了到期的和借款人償還的住房抵押貸款和企業信貸,這些資金變成了銀行的收益。所以6.11億美元的信貸成本實際上是CECL規則下的新撥備資金,以及銀行認為會變成壞賬,但客戶已經償還的貸款的凈值,為銀行帶來了一筆意外之財。

未來

CECL規則旨在強制貸款機構評估未來的潛在損失。新規則為銀行應對新冠疫情的沖擊增加了一重保護。值得注意的是,摩根大通只有一小部分貸款逾期。

在4,380億美元消費者貸款業務中,只有1.62%的住房貸款逾期30天以上,與去年同期相同,而信用卡業務的拒絕還款率為1.57%,遠低于2019年9月的水平。出現這種情況的原因是到目前為止,更多人選擇現金支付,或者還清了信用卡債務,而不是拖欠賬單。

摩根大通根據CECL規則,在三個季度內計提了200億美元信貸支出,它這樣做有充分的理由。這些撥備資金表明,摩根大通的模型預測,該銀行未來會減記同等規模的貸款。當然,撥備200億美元所依據的假設是,在美聯儲的情境下,經濟會進一步惡化。

戴蒙和皮耶普扎克在電話會議中表示,雖然汽車貸款和信用卡貸款的延期還款計劃已經結束,但該銀行仍允許280億美元住房抵押貸款的客戶延期還款。隨著所有延期還款計劃和財政援助計劃到期,除非政府通過新的刺激計劃,否則在2021年初,違約率必定會上升。

正如皮耶普扎克所說,這會導致明年下半年銀行的貸款減記大幅增加。她還預測,受到新冠疫情的影響,航空公司、零售商、餐旅業和其他服務業會給銀行帶來麻煩。

但請記住,摩根大通已經提前撥備了200億美元。除非在未來一兩年,其消費者業務面臨的壓力,超過其對未來經濟狀況的保守預測,銀行的貸款損失才有可能超過200億美元。

一個重要的問題是,形勢是否會繼續惡化。

雄厚的準備金

值得注意的是,現在摩根大通已經有足夠多的準備金,作為應對未來損失的緩沖,而且這家銀行仍有源源不斷的收入,遠高于它預留的準備金。

但這種趨勢能否延續下去?

摩根大通目前應對未來貸款損失的準備金有340億美元,比今年年初增加了200億美元,增幅高達142%。

戴蒙在電話會議中表示,如果經濟復蘇符合基準情景,摩根大通的準備金將有100億美元過剩。收回準備金能大幅提高未來利潤。

摩根大通有雄厚的準備金和強大的盈利能力,一旦形勢惡化,它可以增加準備金,并且依舊可以有豐厚的利潤。

戴蒙在電話會議上指出,在第三季度發放25億美元股息和支付貸款損失撥備之后,摩根大通仍有70億美元額外收入。這些收入充實了資本,為應對未來的信貸損失提供了更強有力的保障。

摩根大通不會像金融危機時一樣,遭遇當時銀行所面臨的困境。但如果美國陷入長期失業的泥潭,摩根大通需要根據CECL規則增加撥備,而且貸款增長會日趨放慢,這會使其利潤低于去年的黃金時期,甚至不及上個季度。

華爾街當然沒有被摩根大通的業績說服。摩根大通公布第二季度強勁的財報之后,股價下跌了1.6%,其市盈率倍數只有13。

惠譽評級分析師克里斯·沃爾夫提醒投資者要小心謹慎。

他說:“現在銀行的狀況比全球金融危機的時候要好的多。他們應該有足夠的準備金,可以順利進入2021年。但現在要預測銀行的準備金在本輪經濟周期中是否充足,仍為時尚早。我們必須看到新冠疫情防控工作能否取得進展,以及就業數據的具體表現。”

到目前為止,摩根大通依舊非常小心翼翼,并且仍有強大的盈利能力。(財富中文網)

翻譯:劉進龍

審校:汪皓

編輯:徐曉彤

10月13日收盤前,銀行業巨頭摩根大通公布的季度凈收入為94億美元,遠超預期,在該銀行的歷史上排在第二位。其第三季度的凈收入增長了4.4%,營業收入為291.5億美元,比去年同期僅有小幅下滑。

華爾街的分析師曾預測其銷售額會下降2%,利潤減少12%。分析師認為,摩根大通要針對可能出現的貸款減記撥備大量資金,為了維持這筆支出,摩根大通將產生28億美元信貸成本。而在前兩個季度,該公司都沒有預料到會出現這種情況。

事實上,摩根大通的準備金只有分析師預測金額的五分之一左右。這凸顯出摩根大通財報和其電話會議中傳達出的最重要的信息:隨著經濟超出預期的快速反彈,與幾個月前相比,無論消費者還是大部分企業借款人的信用情況都有顯著好轉。但未來道路上是否潛伏著未知的災難和風險,這還是一個巨大的未知數。

摩根大通CEO杰米·戴蒙在一份重磅聲明中表示,到明年年底之前,信貸損失并不嚴重。

他說這主要是因為政府為家庭和企業提供了前所未有的援助,銀行也推出了貸款延期還款計劃,使本可能更早到來的貸款違約拖延了幾個月。

摩根大通CFO詹妮弗·皮耶普扎克提供了一個粗略的時間線。她說:“2021年上半年,貸款拖欠率會有所上升,下半年會產生貸款沖銷額。”

在被問到貸款沖銷額的規模時,戴蒙和皮耶普扎克都拒絕就此進行預測。

戴蒙說,雖然更多財政刺激會“改善經濟狀況”,但到目前為止最大的影響因素是經濟復蘇的速度和持續時間,以及就業恢復速度。戴蒙表示,由于未來前景的不確定性,摩根大通在預估未來損失時所依據的情境,比美聯儲的“基準”數據更加消極。

美聯儲預測假設明年第四季度美國失業率依舊高居不下,達到7.7%,國民收入增長速度比去年低2.4%。

一個重要的積極因素是,摩根大通有充足的資本,即使在最糟糕的情境下,也能承受未來的損失并維持信貸流動。

事實上,摩根大通的狀況表明,與金融危機爆發前相比,現在的貸款機構做好了更加充足的準備。

穆迪投資者服務公司的金融機構部門高級副總裁戴維·范格表示:“現在與當初的情況有著天壤之別。大銀行在資本和流動性方面變得更加強大。他們的信貸儲備遠遠超過了2008年經濟周期中的水平。”

他補充說,美聯儲設定股息上限,并禁止股票回購,迫使銀行只能儲備現金,這進一步鞏固了他們的資產負債表。另外一重保障是:新會計規則規定,如果貸款機構通過經濟環境變化分析發現,其貸款未來可能變成壞賬,貸款機構就需要為貸款整個生命周期中的所有預期損失撥備資金,而不是等到借款人停止還款時再采取行動。

戴蒙在預測消費者業務的命運時非常謹慎,因為消費者業務將決定摩根大通的未來盈利能力,但他的兩段話證明他對未來持樂觀的態度。

首先,他希望美聯儲能盡快取消對股票回購的限制,使“我們可以在股價大幅上漲之前進行回購。”這番話表明,戴蒙認為沒有必要把以前積攢下來用于回購的收益,作為對未來損失的額外緩沖。

其次,他表示小心謹慎地度過疫情并不意味著會排除收購。戴蒙稱摩根大通正在積極物色一家資產管理公司。他說:“我們的大門始終是敞開的。我們非常感興趣。我們確信你們會看到,本行將進行業務整合。”

以下是摩根大通第三季度財報中的五個趨勢。

交易和投資銀行業務

摩根大通的盈利業務從消費者信貸這個最大的傳統收入來源,轉變到交易和資本市場,這令人非常震驚。

戴蒙一直主張,銀行要整合那些會在不同時期興起和衰落的業務,實行多樣化經營。這成為摩根大通的一大優勢,避免其陷入備受詬病的全能銀行模式。在消費者業務出現萎縮的時候,這些華爾街主要業務的日益強大,正在支撐著摩根大通度過此次危機。

摩根大通的四大盈利業務之一企業和投資銀行,凈收入達到43億美元,是2019年第三季度的三倍。最亮眼的當屬交易業務,或者所謂的“市場業務”。債券、大宗商品和股權交易為摩根大通帶來了近70億美元收入,年比增長27%。在新IPO交易大幅增長的刺激下,投資銀行業務的收入同樣表現搶眼。

總體上而言,企業與投資銀行業務為摩根大通貢獻了46%的利潤,較去年同期增長31%。

消費者貸款

消費者和社區銀行業務的收入與利潤均下滑了9%,收益減少42.5億美元,只有38.7億美元。該部門在摩根大通的利潤占比從去年的一半左右下降至41%。該業務收入下滑有兩個原因。

首先,疫情導致消費者的貸款需求大幅下降。過去一年,住房貸款、汽車貸款和信用卡業務的規模從3,840億美元減少到3,320億美元。

其次,普通貸款的利息收入減少,因為為了應對新冠疫情,美聯儲向市場中注入大量流動性,導致各類貸款的利率下降。第三季度的利息收入與去年同期相比減少了11億美元,降幅高達13%。

但小企業貸款業務實現了增長,這主要得益于聯邦政府的薪資保護計劃。該計劃為保留就業崗位的雇主提供貸款擔保。在該計劃的推動下,過去幾個月,摩根大通向連鎖餐廳和承包商等發放的貸款達到440億美元。

信貸成本

摩根大通的財報中最令人意外的一點是,信貸成本在疫情期間一度達到歷史高點,但后來卻出人意料的下降,甚至低于經濟形勢良好時的水平。

信貸成本的大幅上漲和快速下降,部分原因是會計準則的根本性調整,改變了銀行處理信貸支出的規則。在今年之前,貸款機構基本上需要根據貸款逾期的時間長度,記錄信貸成本或“撥備資金”。所以當經濟形勢不佳時,隨著越來越多客戶停止還款,信貸成本每個季度都在增加。

但在2020年初,財務會計準則委員會推翻了舊的制度。該委員會規定,如果銀行的模型預測其資產組合中的貸款在未來任何時間可能成為壞賬,銀行要為這些貸款撥備準備金,盡管房主或企業主仍在按時償還貸款。當前預期信貸損失(CECL)的出臺,恰逢疫情剛剛爆發的時候。

結果:在第一季度和第二季度,銀行前期遭到嚴重影響,損失慘重。在以往的危機中,這些損失可能會被分散到多個季度。

摩根大通也不例外。

2019年,摩根大通的信貸損失約為每個季度15億美元。汽車貸款、信用卡或小企業貸款違約的情況相對較少,這種溫和的氛圍令整個行業受益,這可以抵消低利率的影響,使銀行業進入史上最好的一段時期。

在第一季度,全世界遭遇巨變,摩根大通根據CECL規則,為其認為可能出現的所有損失撥備了83億美元。第二季度的前景更加暗淡,因此摩根大通再次撥備105億美元。

在短短兩個季度內,摩根大通承受的損失比2019年全年增多了六倍,其中三分之二來自消費者業務。受影響最大的是1,400億美元的信用卡業務。

摩根大通在疫情最嚴重的時候,對未來損失的估算似乎非常準確。

第三季度,摩根大通記錄的信貸損失是6.11億美元,僅有第二季度的6%。消費者銀行業務的信貸損失從58億美元減少到7.94億美元。摩根大通第二季度看起來一切正常但現在似乎會變成壞賬的貸款,總損失約為12億美元。該銀行還“沖銷”了到期的和借款人償還的住房抵押貸款和企業信貸,這些資金變成了銀行的收益。所以6.11億美元的信貸成本實際上是CECL規則下的新撥備資金,以及銀行認為會變成壞賬,但客戶已經償還的貸款的凈值,為銀行帶來了一筆意外之財。

未來

CECL規則旨在強制貸款機構評估未來的潛在損失。新規則為銀行應對新冠疫情的沖擊增加了一重保護。值得注意的是,摩根大通只有一小部分貸款逾期。

在4,380億美元消費者貸款業務中,只有1.62%的住房貸款逾期30天以上,與去年同期相同,而信用卡業務的拒絕還款率為1.57%,遠低于2019年9月的水平。出現這種情況的原因是到目前為止,更多人選擇現金支付,或者還清了信用卡債務,而不是拖欠賬單。

摩根大通根據CECL規則,在三個季度內計提了200億美元信貸支出,它這樣做有充分的理由。這些撥備資金表明,摩根大通的模型預測,該銀行未來會減記同等規模的貸款。當然,撥備200億美元所依據的假設是,在美聯儲的情境下,經濟會進一步惡化。

戴蒙和皮耶普扎克在電話會議中表示,雖然汽車貸款和信用卡貸款的延期還款計劃已經結束,但該銀行仍允許280億美元住房抵押貸款的客戶延期還款。隨著所有延期還款計劃和財政援助計劃到期,除非政府通過新的刺激計劃,否則在2021年初,違約率必定會上升。

正如皮耶普扎克所說,這會導致明年下半年銀行的貸款減記大幅增加。她還預測,受到新冠疫情的影響,航空公司、零售商、餐旅業和其他服務業會給銀行帶來麻煩。

但請記住,摩根大通已經提前撥備了200億美元。除非在未來一兩年,其消費者業務面臨的壓力,超過其對未來經濟狀況的保守預測,銀行的貸款損失才有可能超過200億美元。

一個重要的問題是,形勢是否會繼續惡化。

雄厚的準備金

值得注意的是,現在摩根大通已經有足夠多的準備金,作為應對未來損失的緩沖,而且這家銀行仍有源源不斷的收入,遠高于它預留的準備金。

但這種趨勢能否延續下去?

摩根大通目前應對未來貸款損失的準備金有340億美元,比今年年初增加了200億美元,增幅高達142%。

戴蒙在電話會議中表示,如果經濟復蘇符合基準情景,摩根大通的準備金將有100億美元過剩。收回準備金能大幅提高未來利潤。

摩根大通有雄厚的準備金和強大的盈利能力,一旦形勢惡化,它可以增加準備金,并且依舊可以有豐厚的利潤。

戴蒙在電話會議上指出,在第三季度發放25億美元股息和支付貸款損失撥備之后,摩根大通仍有70億美元額外收入。這些收入充實了資本,為應對未來的信貸損失提供了更強有力的保障。

摩根大通不會像金融危機時一樣,遭遇當時銀行所面臨的困境。但如果美國陷入長期失業的泥潭,摩根大通需要根據CECL規則增加撥備,而且貸款增長會日趨放慢,這會使其利潤低于去年的黃金時期,甚至不及上個季度。

華爾街當然沒有被摩根大通的業績說服。摩根大通公布第二季度強勁的財報之后,股價下跌了1.6%,其市盈率倍數只有13。

惠譽評級分析師克里斯·沃爾夫提醒投資者要小心謹慎。

他說:“現在銀行的狀況比全球金融危機的時候要好的多。他們應該有足夠的準備金,可以順利進入2021年。但現在要預測銀行的準備金在本輪經濟周期中是否充足,仍為時尚早。我們必須看到新冠疫情防控工作能否取得進展,以及就業數據的具體表現。”

到目前為止,摩根大通依舊非常小心翼翼,并且仍有強大的盈利能力。(財富中文網)

翻譯:劉進龍

審校:汪皓

編輯:徐曉彤

Before the market close on Oct. 13, the banking colossus smashed expectations by announcing $9.4 billion in net income, the second-highest quarterly number in its history. That's a 4.4% gain over Q3 on $29.15 billion in revenues that slipped just a hair from last year. Wall Street analysts were forecasting a 2% fall in sales and 12% drop in profits, the latter driven by another big slug of provisions to cover future loan losses. The analysts reckoned that JPMorgan would book $2.8 billion in credit costs to bolster its reserves for looming write-downs that it hadn't seen coming in the previous two quarters.

As it turned out, JPMorgan took around one-fifth of the predicted provisions. That underscores the most important takeaway from the release and conference call: The consumer and even most corporate borrowers are looking like much better credits than a few months ago as the economy rebounds faster than expected. The big unknown is whether the meltdown that appeared to be around the corner is lurking down the road.

In one of his most noteworthy statements, CEO Jamie Dimon declared that credit losses will remain mild until late next year. He says that's mostly because the government's unprecedented aid to families and businesses, and the banks' forbearance programs, have delayed defaults for months that would have come far earlier. CFO Jennifer Piepszak provided a rough timeline. "We'll see delinquencies pick up in the early part of 2021, and charge-offs will come in the back half," she said.

Asked to put a number on how big those charge-offs could be a year hence, Dimon and Piepszak declined to even venture a guess. Dimon said that although more rounds of stimulus would "improve the picture," by far the biggest factor is the pace and durability of the recovery and how fast lost jobs return. Because the outlook is so uncertain, Dimon said, JPMorgan is basing its estimates of future losses on a scenario that's lot more negative than the Federal Reserve's "base case" numbers that forecast positing an stubbornly high unemployment rate of 7.7% in Q4 of next year, and national income running 2.4% below last year's levels.

The big positive is that JPMorgan has plenty of capital to withstand future losses and keep credit flowing, even in the direst of scenarios. In fact, its position epitomizes how much better fortified lenders are today than at the dawn of the financial crisis. "It's night and day," says David Fanger, SVP of the financial institutions group at Moody's Investors Service. "The big banks are far stronger in capital and liquidity. They're holding much bigger credit reserves than at this point in the cycle in 2008." He adds that the Fed-imposed cap on dividends and prohibition on share buybacks is forcing them to hoard cash that further buttresses their balance sheets. Another safeguard: New accounting rules requiring lenders to take all anticipated losses, over the entire life of their loans, not when they stop paying, but when analysis of shifts in the economic climate show they're likely to go bad in the future.

Despite his caution on forecasting the fate of the consumer who will determine the bank's future profitability, Dimon made two observations that showed optimism. First, he hopes that the Fed will lift restrictions on stock buybacks soon so that "we're allowed to do it before the stock is much higher." That comment suggests Dimon sees no need to keep accumulating earnings previously spent on repurchases as an additional buffer for future losses. Second, he revealed that prudently navigating the pandemic doesn't rule out acquisitions. Dimon revealed that JPMorgan is in the market for an asset manager. "Our doors and telephone lines are wide open," he said. "We'd be very interested. We do think you will see consolidation in the business."

Here are five trends that stood out in the Q3 report.

Trading and investment banking

The shift in JPMorgan’s profitability from the biggest traditional source, the consumer, to trading and capital markets, is nothing short of astounding. The much-criticized universal bank model is demonstrating what Dimon always claimed was a big plus, that it offers broad diversification by uniting businesses that rise and fall at different times. The waxing in those Wall Street staples as the results in consumer wane is what's supporting JPMorgan in the crisis.

The corporate & investment bank, one of the four major profit centers, posted net income of $4.3 billion, triple the figure in Q3 of 2019. The star was trading, or what's called "markets." Bond, commodity, and equity trading combined garnered nearly $7 billion in revenue, up 27% year over year. Investment banking revenues, propelled by the surge in new IPOs, were also extremely strong. All told, the C&I segment accounted for 46% of JPMorgan’s profits, up 31% in the year-ago period.

Consumer lending

In consumer & community banking, revenues and profits both retreated by 9%, with earnings falling $4.25 billion to $3.87 billion. That shrank the segment's share of total profits from around half through all of last year to 41%. The reason for the pullback is twofold. First, the pandemic has pummeled demand for consumer loans. In the past year, the combined portfolio for home, auto, and credit cards has fallen from $384 billion to $332 billion. Second, the interest collected on the average loan shrank as the Fed flooded the markets with liquidity to counter the COVID crisis, shrinking rates across the entire spectrum of lending. Interest income dropped by $1.1 billion or 13% in Q3, versus Q3 of last year.

An exception to the retreat was a jump in lending to small businesses driven by the federal Payroll Protection Program that guaranteed loans to employers that kept their workers employed. The initiative doubled JPMorgan's portfolio to the likes of restaurant chains and contractors to $44 billion in the past several months.

Credit costs

The report's most astounding feature is the unexpected drop in credit costs from crisis heights to below where they stand even in good periods. The shift from a sharp spike and steep fall are partly explained by a radical change in the accounting standards that dictate how banks must treat credit expense. Until this year, lenders booked credit costs, called "provisions," mostly based on the length of time loans were delinquent. So in a bad economy, as more and more customers stopped paying, the credit costs would keep mounting quarter after quarter.

But at the start of 2020, the Financial Accounting Standards Board overturned the old regime. FASB stipulated that banks take a hit on all loans on their portfolio that the bank's models forecast will go bad at any time in the future, even if the home or business owner was still paying right on time. The arrival of Current Expected Credit Loss provision, or CECL, coincided with the onset of the pandemic. The upshot: Banks took gigantic losses in Q1 and Q2 in a big, upfront wallop that, in past crises, they'd have parceled out over many quarters.

JPMorgan was no exception. In 2019, its credit losses were running at roughly $1.5 billion a quarter. The entire industry was benefiting from a balmy climate where relatively few car, credit card, or small-business loans were going into default, a benefit that countered the drag of low rates and brought one of the best runs in banking history. When the world changed in Q1, JPMorgan followed the CECL guidelines by taking a $8.3 billion blow for all the losses it saw coming. Then when the outlook turned darker in Q2, it took another $10.5 billion in provisions. In just two quarters, JPMorgan absorbed a blow that was six times bigger than the total damage for 2019, with two-thirds coming on the consumer side. Hardest hit was the $140 billion credit card portfolio.

It appears that JPMorgan did a good job estimating those future losses during the depths of the crisis. In Q3, the bank registered credit losses of just $611 million, 6% of the figure in Q2. In the consumer bank, the number dropped from $5.8 billion to $794 million. Overall, JPMorgan registered around $1.2 billion in losses on loans that looked all right in Q2 but that it now deemed would go bad. It also took "reversals" for mortgages and corporate credits that came due, and that borrowers paid back, money that flowed back into earnings. So the cost of $611 million is actually the net of the new hit from CECL, and the loans it reckoned were going bad, but that customers repaid, providing a kind of windfall.

The future

CECL is forcing lenders to assess potential losses far into the future. The new rules have provided added shelter against the COVID hurricane. What's remarkable is that so far, JPMorgan is seeing a tiny fraction of its loans go delinquent. In the $438 billion consumer portfolio, only 1.62% of home loans are 30 or more days past due, the same fraction as a year ago, and in cards, the nonpayment rate of 1.57% is well below the mark in September 2019. The reason: So far, more people have been paying down or retiring their card balances than are falling behind.

JPMorgan has followed CECL by taking $20 billion in upfront credit expense in just three quarters for good reason. Those provisions signal that its models predict that it will actually write off that dollar amount in loans in future quarters. Of course, that $20 billion hit assumes an economy much worse than under the Fed scenario. On the conference call, Dimon and Piepszak cited that although forbearance has ended for auto and card loans, it's still allowing customers with $28 billion in mortgages to defer payments. As all the deferrals programs run out, and aid from the stimulus fades—unless a new one is forthcoming—defaults will inevitably rise starting in 2021, and as Piepszak noted, lead to a surge in actual charge-offs late in the year. She's also expecting trouble from airlines, retailers, hospitality, and other service sectors roiled by the pandemic.

But keep in mind, JPMorgan has already taken the $20 billion hit upfront. For the bank to face more loan losses, the consumer will have to suffer far more stress over the next year or two than shown under its conservative projections for the economy's future. The big question is whether things will get that much worse.

Deep reserves

Right now, it's remarkable that JPMorgan has managed to build a thick cushion against future losses and still generate substantial earnings over and above what it's putting aside. But can that trend continue? JPMorgan now holds $34 billion in reserves for future loan losses, a $20 billion or 142% increase from the start of the year. On the call, Dimon said that if the recovery tracks the base case scenario, JPMorgan will have $10 billion in excess reserves that it won't need. Recouping reserves would provide a big lift to future profits.

What JPMorgan has going for it is a combination of gigantic reserves and big earnings power that would enables it to swell its reserves if things get much worse, and still have plenty of profit left over. On the call, Dimon pointed out that after paying the regular $2.5 billion dividend and covering loan loss provisions in Q3, JPMorgan booked $7 billion in extra earnings that it added to capital, providing a stronger bulwark for future credit losses.

JPMorgan's in no danger of getting in the same kind of trouble that crippled banks in the great financial crisis. Still, if the U.S. enters a period of grinding long-lasting unemployment, it could still take more CECL hits—as well as suffer from flagging loan growth—that could make it a lot less profitable than in last year's golden days, or even in the last quarter. Wall Street certainly isn't convinced. The bank's share price fell 1.6% following the strong Q2 report, and its price/earnings ratio is languishing at a paltry 13.

Chris Wolfe, an analyst for Fitch Ratings, sounds a note of caution. "The banks are significantly better off than in the global financial crisis," he says. "They should be well-reserved through into 2021. But it's too early to tell how adequate their reserves are over the cycle. We'll have to see the progress in containing the pandemic, and see how the employment data rolls in."

So far, JPMorgan is proceeding with extreme caution—and still making plenty of money.