A國(guó)有全球歷史最悠久的股票交易所,有可靠的法治基礎(chǔ),為投資者提供了嚴(yán)格的保護(hù)。

B國(guó)實(shí)質(zhì)上是一個(gè)石油國(guó)家,各項(xiàng)金融自由指數(shù)都很低。該國(guó)近期向市場(chǎng)化經(jīng)濟(jì)轉(zhuǎn)型的過程并不順利,推動(dòng)民主進(jìn)程和準(zhǔn)則的過程也備受人權(quán)組織批評(píng)。例如,B國(guó)總統(tǒng)最近修改了憲法,將任期延長(zhǎng)了數(shù)十年,并且外界普遍懷疑他經(jīng)常毒害政治對(duì)手。

但對(duì)投資者來說,這兩個(gè)國(guó)家很難區(qū)分。它們都是會(huì)把你的閑錢套牢的可怕的地方。

你或許已經(jīng)猜到了,B國(guó)就是俄羅斯。那么A國(guó)呢?A國(guó)是英國(guó)。

今年3月,看漲英國(guó)股票的投資者,難以置信地看著自己投資的股票突然暴跌,同樣讓他們大跌眼鏡的是,英國(guó)股市竟然沒有恢復(fù)到其他歐洲市場(chǎng)的水平。

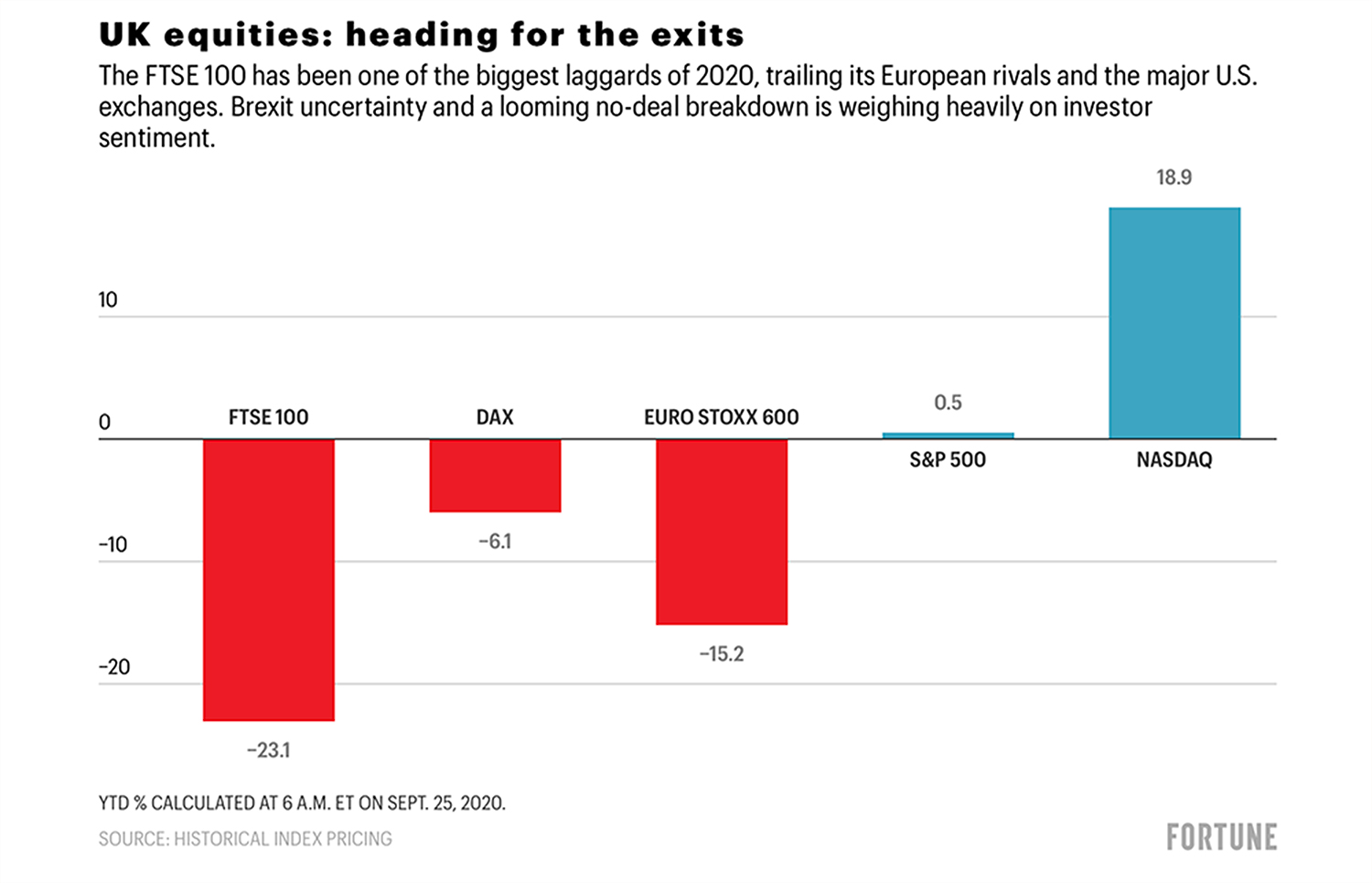

盛極一時(shí)的富時(shí)100指數(shù),從年初至今下跌了約23%,其表現(xiàn)幾乎落后于所有歐洲主要交易所,更無(wú)法與主要的美股指數(shù)相提并論。

事實(shí)上,這種表現(xiàn)只有在新興市場(chǎng)才能夠見到。富時(shí)100指數(shù)在2020年年初至今的表現(xiàn)(-23.1%),在巴西(-16%)和智利圣地亞哥IPSA指數(shù)(-26%)之間。

但路孚特理柏(Refinitiv Lipper)的英國(guó)與愛爾蘭市場(chǎng)研究負(fù)責(zé)人德維?約翰認(rèn)為,表現(xiàn)糟糕的富時(shí)100指數(shù)與摩根士丹利資本國(guó)際(MSCI)俄羅斯指數(shù)類似。

他表示:“與富時(shí)100指數(shù)的表現(xiàn)最接近的是MSCI俄羅斯指數(shù),兩者的相關(guān)系數(shù)達(dá)到0.83,非常接近。”

他分享的股票走勢(shì)圖顯示,從年初至今,倫敦和莫斯科的股票走勢(shì)非常接近。(注:富時(shí)100指數(shù)為橘色;MSCI俄羅斯指數(shù)為紫色。)

兩個(gè)指數(shù)的表現(xiàn)如此接近,讓約翰感到非常震驚。他補(bǔ)充說,這兩個(gè)國(guó)家作為投資選擇,是完全不同的。

他說,俄羅斯股票波動(dòng)性更大,莫斯科交易所“流動(dòng)性更差,股票種類更少。”在莫斯科上市的公司50%左右是能源公司。自新冠疫情爆發(fā)以來,全球能源類資產(chǎn)一直是表現(xiàn)最差的股票之一。

與此同時(shí),“英國(guó)卻有全球規(guī)模最大、流動(dòng)性最好的交易所。英國(guó)市場(chǎng)資產(chǎn)種類豐富,并且法治基礎(chǔ)牢固。英國(guó)對(duì)投資者提供全球最高水平的保護(hù)。俄羅斯在這方面無(wú)法與英國(guó)相提并論。”

莫斯科股市以能源股為主,倫敦則主要是金融股和醫(yī)療股。今年,金融股表現(xiàn)低迷,但醫(yī)療股在3月跌入低谷之后已經(jīng)反彈。

兩個(gè)交易所有一個(gè)驚人的相似之處:高增長(zhǎng)的科技股較少。

史上最低

投資新興市場(chǎng),比如金磚國(guó)家,如果選擇的時(shí)機(jī)恰當(dāng),就能帶來巨額回報(bào)。當(dāng)然,投資金磚國(guó)家的風(fēng)險(xiǎn)更高,但這也意味著潛在回報(bào)更高。

市場(chǎng)專家很少看到英國(guó)股市像新興市場(chǎng)一樣,高風(fēng)險(xiǎn)與高回報(bào)并存。事實(shí)恰恰相反。

從今年的表現(xiàn)來看,富時(shí)指數(shù)一直存在一種“避險(xiǎn)”的情緒。本月早些時(shí)候,根據(jù)MSCI全球指數(shù),富時(shí)指數(shù)跌至歷史新低,對(duì)于一個(gè)不久前還被認(rèn)為是歐洲經(jīng)濟(jì)發(fā)動(dòng)機(jī)的國(guó)家來說,如此糟糕的表現(xiàn)令其蒙羞。如今,歐洲經(jīng)濟(jì)的發(fā)動(dòng)機(jī)變成了德國(guó)。事實(shí)上,上個(gè)月,藍(lán)籌指數(shù)Dax的表現(xiàn)勝過了三大美股指數(shù)。

而倒霉的英國(guó)股票沒有吸引到太多外部投資者。據(jù)高盛(Goldman Sachs)統(tǒng)計(jì),截至9月16日,過去四周內(nèi),投資者從英國(guó)股市總共撤走資金6.45億美元。這些資金被投資到哪些領(lǐng)域?首先是歐洲大陸國(guó)家和美國(guó)的股票。

信安環(huán)球投資基金(Principal Global Investors)的首席投資策略師西瑪?沙告訴彭博社:“我們認(rèn)為英國(guó)是一個(gè)價(jià)值陷阱。股票的估值或許很有吸引力,但基本面很糟糕。”

與其他有投資價(jià)值的股票相比,英國(guó)股票顯然并不占優(yōu)勢(shì)。投資者認(rèn)為英國(guó)股票面臨三重風(fēng)險(xiǎn):疫情帶來的不確定性、經(jīng)濟(jì)二次探底,以及即將到來的脫歐帶來的災(zāi)難。

這些都預(yù)示著英國(guó)經(jīng)濟(jì)和英國(guó)股票面臨著大麻煩。貝倫貝格銀行(Berenberg Bank)的高級(jí)經(jīng)濟(jì)學(xué)家卡魯姆?皮克林在9月26日發(fā)布的一篇投資者報(bào)告中寫道:“與疫情相關(guān)的不確定性,以及英國(guó)與歐盟之間艱難的貿(mào)易談判和在2020年12月31日硬脫歐,直接退出歐盟單一市場(chǎng)帶來的混亂,預(yù)示著英國(guó)今年將面臨嚴(yán)峻的挑戰(zhàn)。在最糟糕的情況下,第二輪全國(guó)封鎖和毫無(wú)秩序地退出單一市場(chǎng),會(huì)使英國(guó)經(jīng)濟(jì)第二次陷入衰退。我們將其視為尾部風(fēng)險(xiǎn),而不是基準(zhǔn)情景。”

經(jīng)濟(jì)學(xué)家和分析師都認(rèn)為英國(guó)在無(wú)貿(mào)易協(xié)定的情況下脫歐的可能性大幅提高,在這種背景下,英國(guó)資產(chǎn)出現(xiàn)了史上最差的行情。隨著新冠疫情愈演愈烈和對(duì)英國(guó)脫歐的擔(dān)憂加劇,本月,英鎊兌美元貶值超過5%。英鎊也代表了投資者的需求。

與此同時(shí),唐寧街的政客們依舊在宣揚(yáng)“不計(jì)后果完成脫歐”的承諾。

但投資者們卻已經(jīng)主動(dòng)開始與英國(guó)脫鉤。

路孚特理柏的約翰說:“英國(guó)政府信心滿滿。但市場(chǎng)似乎并不認(rèn)同他們的觀點(diǎn)。”(財(cái)富中文網(wǎng))

翻譯:劉進(jìn)龍

審校:汪皓

A國(guó)有全球歷史最悠久的股票交易所,有可靠的法治基礎(chǔ),為投資者提供了嚴(yán)格的保護(hù)。

B國(guó)實(shí)質(zhì)上是一個(gè)石油國(guó)家,各項(xiàng)金融自由指數(shù)都很低。該國(guó)近期向市場(chǎng)化經(jīng)濟(jì)轉(zhuǎn)型的過程并不順利,推動(dòng)民主進(jìn)程和準(zhǔn)則的過程也備受人權(quán)組織批評(píng)。例如,B國(guó)總統(tǒng)最近修改了憲法,將任期延長(zhǎng)了數(shù)十年,并且外界普遍懷疑他經(jīng)常毒害政治對(duì)手。

但對(duì)投資者來說,這兩個(gè)國(guó)家很難區(qū)分。它們都是會(huì)把你的閑錢套牢的可怕的地方。

你或許已經(jīng)猜到了,B國(guó)就是俄羅斯。那么A國(guó)呢?A國(guó)是英國(guó)。

今年3月,看漲英國(guó)股票的投資者,難以置信地看著自己投資的股票突然暴跌,同樣讓他們大跌眼鏡的是,英國(guó)股市竟然沒有恢復(fù)到其他歐洲市場(chǎng)的水平。

盛極一時(shí)的富時(shí)100指數(shù),從年初至今下跌了約23%,其表現(xiàn)幾乎落后于所有歐洲主要交易所,更無(wú)法與主要的美股指數(shù)相提并論。

事實(shí)上,這種表現(xiàn)只有在新興市場(chǎng)才能夠見到。富時(shí)100指數(shù)在2020年年初至今的表現(xiàn)(-23.1%),在巴西(-16%)和智利圣地亞哥IPSA指數(shù)(-26%)之間。

但路孚特理柏(Refinitiv Lipper)的英國(guó)與愛爾蘭市場(chǎng)研究負(fù)責(zé)人德維?約翰認(rèn)為,表現(xiàn)糟糕的富時(shí)100指數(shù)與摩根士丹利資本國(guó)際(MSCI)俄羅斯指數(shù)類似。

他表示:“與富時(shí)100指數(shù)的表現(xiàn)最接近的是MSCI俄羅斯指數(shù),兩者的相關(guān)系數(shù)達(dá)到0.83,非常接近。”

他分享的股票走勢(shì)圖顯示,從年初至今,倫敦和莫斯科的股票走勢(shì)非常接近。(注:富時(shí)100指數(shù)為橘色;MSCI俄羅斯指數(shù)為紫色。)

兩個(gè)指數(shù)的表現(xiàn)如此接近,讓約翰感到非常震驚。他補(bǔ)充說,這兩個(gè)國(guó)家作為投資選擇,是完全不同的。

他說,俄羅斯股票波動(dòng)性更大,莫斯科交易所“流動(dòng)性更差,股票種類更少。”在莫斯科上市的公司50%左右是能源公司。自新冠疫情爆發(fā)以來,全球能源類資產(chǎn)一直是表現(xiàn)最差的股票之一。

與此同時(shí),“英國(guó)卻有全球規(guī)模最大、流動(dòng)性最好的交易所。英國(guó)市場(chǎng)資產(chǎn)種類豐富,并且法治基礎(chǔ)牢固。英國(guó)對(duì)投資者提供全球最高水平的保護(hù)。俄羅斯在這方面無(wú)法與英國(guó)相提并論。”

莫斯科股市以能源股為主,倫敦則主要是金融股和醫(yī)療股。今年,金融股表現(xiàn)低迷,但醫(yī)療股在3月跌入低谷之后已經(jīng)反彈。

兩個(gè)交易所有一個(gè)驚人的相似之處:高增長(zhǎng)的科技股較少。

史上最低

投資新興市場(chǎng),比如金磚國(guó)家,如果選擇的時(shí)機(jī)恰當(dāng),就能帶來巨額回報(bào)。當(dāng)然,投資金磚國(guó)家的風(fēng)險(xiǎn)更高,但這也意味著潛在回報(bào)更高。

市場(chǎng)專家很少看到英國(guó)股市像新興市場(chǎng)一樣,高風(fēng)險(xiǎn)與高回報(bào)并存。事實(shí)恰恰相反。

從今年的表現(xiàn)來看,富時(shí)指數(shù)一直存在一種“避險(xiǎn)”的情緒。本月早些時(shí)候,根據(jù)MSCI全球指數(shù),富時(shí)指數(shù)跌至歷史新低,對(duì)于一個(gè)不久前還被認(rèn)為是歐洲經(jīng)濟(jì)發(fā)動(dòng)機(jī)的國(guó)家來說,如此糟糕的表現(xiàn)令其蒙羞。如今,歐洲經(jīng)濟(jì)的發(fā)動(dòng)機(jī)變成了德國(guó)。事實(shí)上,上個(gè)月,藍(lán)籌指數(shù)Dax的表現(xiàn)勝過了三大美股指數(shù)。

而倒霉的英國(guó)股票沒有吸引到太多外部投資者。據(jù)高盛(Goldman Sachs)統(tǒng)計(jì),截至9月16日,過去四周內(nèi),投資者從英國(guó)股市總共撤走資金6.45億美元。這些資金被投資到哪些領(lǐng)域?首先是歐洲大陸國(guó)家和美國(guó)的股票。

信安環(huán)球投資基金(Principal Global Investors)的首席投資策略師西瑪?沙告訴彭博社:“我們認(rèn)為英國(guó)是一個(gè)價(jià)值陷阱。股票的估值或許很有吸引力,但基本面很糟糕。”

與其他有投資價(jià)值的股票相比,英國(guó)股票顯然并不占優(yōu)勢(shì)。投資者認(rèn)為英國(guó)股票面臨三重風(fēng)險(xiǎn):疫情帶來的不確定性、經(jīng)濟(jì)二次探底,以及即將到來的脫歐帶來的災(zāi)難。

這些都預(yù)示著英國(guó)經(jīng)濟(jì)和英國(guó)股票面臨著大麻煩。貝倫貝格銀行(Berenberg Bank)的高級(jí)經(jīng)濟(jì)學(xué)家卡魯姆?皮克林在9月26日發(fā)布的一篇投資者報(bào)告中寫道:“與疫情相關(guān)的不確定性,以及英國(guó)與歐盟之間艱難的貿(mào)易談判和在2020年12月31日硬脫歐,直接退出歐盟單一市場(chǎng)帶來的混亂,預(yù)示著英國(guó)今年將面臨嚴(yán)峻的挑戰(zhàn)。在最糟糕的情況下,第二輪全國(guó)封鎖和毫無(wú)秩序地退出單一市場(chǎng),會(huì)使英國(guó)經(jīng)濟(jì)第二次陷入衰退。我們將其視為尾部風(fēng)險(xiǎn),而不是基準(zhǔn)情景。”

經(jīng)濟(jì)學(xué)家和分析師都認(rèn)為英國(guó)在無(wú)貿(mào)易協(xié)定的情況下脫歐的可能性大幅提高,在這種背景下,英國(guó)資產(chǎn)出現(xiàn)了史上最差的行情。隨著新冠疫情愈演愈烈和對(duì)英國(guó)脫歐的擔(dān)憂加劇,本月,英鎊兌美元貶值超過5%。英鎊也代表了投資者的需求。

與此同時(shí),唐寧街的政客們依舊在宣揚(yáng)“不計(jì)后果完成脫歐”的承諾。

但投資者們卻已經(jīng)主動(dòng)開始與英國(guó)脫鉤。

路孚特理柏的約翰說:“英國(guó)政府信心滿滿。但市場(chǎng)似乎并不認(rèn)同他們的觀點(diǎn)。”(財(cái)富中文網(wǎng))

翻譯:劉進(jìn)龍

審校:汪皓

Country A is home to one of the oldest stock exchanges in the world where the rule of law is rock solid, and investors are afforded rigorous protections.

Country B is essentially a petrol state that ranks low on various financial freedom indexes. Its relatively recent transition to a market-based economy has been bumpy, and its embrace of democratic processes and norms has been widely criticized by human rights groups. Country B's President, for example, recently changed the constitution to extend his rule by decades and is widely suspected of routinely poisoning his political foes.

And yet to investors, the two countries are widely indistinguishable. They're both seen as a lousy place to sink your spare cash.

You've probably guessed Country B is Russia. And Country A? That's the United Kingdom.

Investors who are long U.K. equities watched incredulously in March as their portfolios sank precipitously and have watched with just as much surprise as it's failed to recover to the levels of its European peers.

Down roughly 23% year to date, the once mighty FTSE 100 is underperforming just about every major European exchange and is miles behind the major U.S. indexes.

In fact, you have to head to emerging markets to find a comparable performance match. The FTSE 100 (negative 23.1%) sits between Brazil (-16%) and Chile's Santiago IPSA (-26%) in YTD performance for 2020.

But Dewi John, head of research, United Kingdom & Ireland, at Refinitiv Lipper, sees troubling parallels with another index—that of the MSCI Russia.

"The FTSE 100 performance's closest match is to MSCI Russia, an .83 correlation, which is tight," he notes.

He shared this stock chart, which shows the London and Moscow shares in near lockstep since the start of the year. Note: The FTSE 100 index is in orange; the MSCI Russia index is in purple.

The matchup astounded John, adding that the two countries, as investment options, couldn't be any more different.

Russian stocks are more volatile, the Moscow exchange "more illiquid, and the breadth of stocks is more shallow," he said. Roughly 50% of Moscow-listed companies are energy companies, which as a global asset class has been one of the worst performers since the start of the COVID-19 outbreak.

Meanwhile, "the U.K. is home to one of the largest, most liquid exchanges. It has incredible breadth and has a really strong rule of law. Investors' protection is regarded as one of the highest in the world. You certainly wouldn’t say the same thing about Russia."

Where Moscow is strong in energy, London is strongly weighted to financials and health care. Financials have been a dud this year, but health care stocks are well off their March lows.

The one area where the two exchanges are woefully similar: They are both light on high-growth tech stocks.

All-time low

Investing in emerging markets, such as the BRIC countries, can bring huge returns if timed correctly. The risk is higher, of course, but so too is the potential return.

Few market pros sees such an EM-style return coming from British stocks. In fact, they see just the opposite.

Judging by this year's performance, the FTSE has a risk-off cloud hanging over it. Earlier this month, the FTSE hit an all-time low against the MSCI World, a humiliating underachievement for an economy that not long ago was seen as an engine of the European economy. That distinction today goes to Germany. In fact, the blue-chip Dax had been outperforming all three major U.S. indexes over the past month.

Down-on-their-luck U.K. equities, meanwhile, are attracting few outside bidders. According to Goldman Sachs, investors pulled a combined $645 million out of U.K. stocks over the past four weeks, ending Sept. 16. Where did they put their money? In continental European and U.S. equities, for starters.

“We see the U.K. as a value trap,” Seema Shah, chief strategist at Principal Global Investors, told Bloomberg. “Valuations might be attractive, but fundamentals are not.”

U.K. stocks are clearly at a disadvantage to other value plays. Investors see in them a triple whammy of risks: the uncertainty of a pandemic, a double-dip recession, and, on the horizon, a calamitous divorce with its European trading partners.

All of it points to trouble ahead for the U.K. economy and for U.K. stocks. "Uncertainties linked to the pandemic, as well as the difficult ongoing U.K.-EU trade talks and the threat of a disorderly hard exit from the EU single market on 31 December 2020, point to a challenging year end for the U.K.," wrote Berenberg Bank senior economist Kallum Pickering in an investor note on September 26. "In the worst-case scenario, a second nationwide lockdown, combined with a messy exit from the single market, could tip the U.K. economy back into recession. We view this as a tail risk, not as our base case."

As economists and analysts up the odds of a Brexit break from Europe sans trade deal, the worse U.K. assets perform. The pound sterling, another proxy for investor demand, has lost more than 5% of its value against the dollar this month as COVID and Brexit fears intensify.

Meanwhile Downing Street politicians continue to dial up the volume on their pledge of “getting Brexit done, and hang the consequences.”

At the same time, investors have already pulled off a Brexit of their own.

"The U.K. government is speaking in a bullish fashion. Markets don’t seem to agree," says John of Refinitiv Lipper.