福特汽車(Ford Motor Co.)向來(lái)自詡思路開闊。公司歷史長(zhǎng)達(dá)117年,長(zhǎng)期以來(lái)把戰(zhàn)略重點(diǎn)放在保持遍布全球主要市場(chǎng)的品牌地位,車型從超小型車覆蓋到豪華SUV,不久的將來(lái)還將全面進(jìn)軍電動(dòng)汽車。

但公司經(jīng)營(yíng)每況愈下,在2015年福特實(shí)現(xiàn)74億美元利潤(rùn)后,去年勉強(qiáng)維持盈虧平衡,而當(dāng)時(shí)新冠疫情還沒(méi)有爆發(fā),也尚未經(jīng)受經(jīng)濟(jì)封鎖對(duì)北美地區(qū)盈利造成的重創(chuàng)。今年第二季度,福特在北美虧損近10億美元,不久之后公司免去了韓愷特(Jim Hackett)的首席執(zhí)行官一職,并宣布新一輪收購(gòu)計(jì)劃。

新任首席執(zhí)行官詹姆斯·法利之前擔(dān)任首席運(yùn)營(yíng)官,面臨的挑戰(zhàn)巨大。但如果他愿意圍繞產(chǎn)品和戰(zhàn)略做一些艱難的選擇,仍然有機(jī)會(huì)帶領(lǐng)福特走向成功。

2021年以及2021年之后,福特會(huì)變成什么樣?《財(cái)富》雜志采訪了分析師和業(yè)內(nèi)專家,還研究了福特的公開文件,為其復(fù)興勾勒出似乎可信的藍(lán)圖。

法利確實(shí)面臨難得的機(jī)遇窗口。在疫情沖擊下,投資者對(duì)短期痛苦但最終可以賺錢、擱置失敗計(jì)劃且拋棄宏大目標(biāo)的艱難決策的容忍度高得多。當(dāng)前危機(jī)是福特不能浪費(fèi)的機(jī)會(huì)。

北美市場(chǎng)放棄更多不賺錢的車型

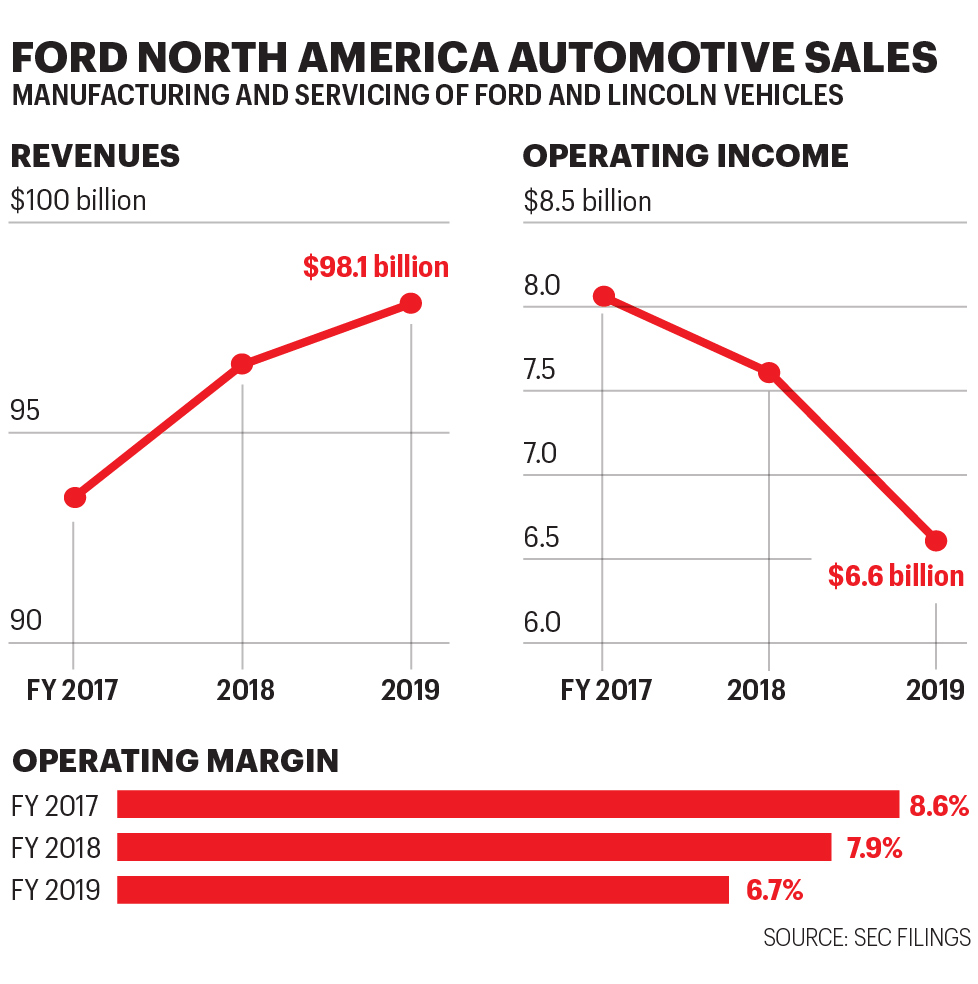

多年來(lái),北美是福特唯一持續(xù)盈利的市場(chǎng)。“但利潤(rùn)率一直在下降,遠(yuǎn)遠(yuǎn)低于合理水平。”惠譽(yù)評(píng)級(jí)(Fitch Ratings)的分析師斯蒂芬·布朗表示。最大的問(wèn)題是,從2016年到去年年底,成本基礎(chǔ)猛增83億美元,而同期銷售額增幅為55億美元。因此利潤(rùn)率從超過(guò)10%降至6.7%。2018年年中,福特宣布了110億美元的全球重組計(jì)劃,希望與供應(yīng)商達(dá)成規(guī)模更大也更優(yōu)惠的協(xié)議,增加機(jī)器人生產(chǎn)線推進(jìn)自動(dòng)化,調(diào)整勞動(dòng)力規(guī)模,在北美地區(qū)逐步淘汰幾乎所有傳統(tǒng)乘用車。

不過(guò),公司集中投資三塊高利潤(rùn)業(yè)務(wù)將可以獲得更大的成功,其中兩塊業(yè)務(wù)都增長(zhǎng)迅速。

第一塊,也是目前最大的一塊是F系列皮卡。去年,福特令人震驚地賣出89.7萬(wàn)輛F系列卡車,其中F-150最暢銷。炒得火熱的F系列電動(dòng)汽車最快明年面世,占福特在美國(guó)市場(chǎng)總銷量40%的產(chǎn)品線成敗在此一舉。

第二塊主要包括“商用車”或簡(jiǎn)稱CV,Transit品牌繼承了老款Econoline車型,客戶包括從快遞員到木匠等,也有箱型載客版本。華爾街的分析師稱,這塊業(yè)務(wù)F系列一樣,利潤(rùn)率也達(dá)到兩位數(shù)。

第三塊是SUV,選擇更加艱難。去年,福特銳際(Escape)和探險(xiǎn)者(Explorer)等車型在美國(guó)銷售了83.1萬(wàn)輛,但銷量和市場(chǎng)份額正在下降,其中探險(xiǎn)者的市場(chǎng)份額從2015年的12%下降到2019年的略低于10%。

不過(guò),SUV在美國(guó)仍然有希望。SUV一般價(jià)格較高,利潤(rùn)也比較豐厚,即便增幅不明顯,也可以基本保持。原因在于主打車型共享“車身框架”架構(gòu),與福特旗下大批量生產(chǎn)的卡車在同一平臺(tái)上生產(chǎn),從而降低了單位成本。新款Bronco SUV與福特的第二代皮卡品牌Ranger采用相同底盤和許多其他部件,且都在密歇根州韋恩市制造。尺寸最大的SUV“征服者”和高端林肯領(lǐng)航員(Lincoln Navigator)跟F-150卡車使用同款底盤。相比之下,EcoSport和銳際兩款尺寸較小的車型采用了不同的系統(tǒng),叫“單體式底盤”,經(jīng)濟(jì)效益方面差一點(diǎn)。“福特應(yīng)該逐步淘汰EcoSport和銳際,這兩款利潤(rùn)率都很低。”行業(yè)顧問(wèn)喬恩·加布里埃森說(shuō)。簡(jiǎn)單來(lái)說(shuō),如果福特能夠剝離邊緣SUV并降低成本,沿原有業(yè)務(wù)軌跡加速前進(jìn),仍然有機(jī)會(huì)蓬勃發(fā)展。

歐洲市場(chǎng)放棄轎車,主攻貨車

福特最大的問(wèn)題在海外。如果福特可以不計(jì)收益爽快地將海外業(yè)務(wù)出售給競(jìng)爭(zhēng)對(duì)手,成功之路將容易得多也更直接。福特應(yīng)該盡快撤出南美。目前其南美業(yè)務(wù)主要在巴西和阿根廷,然而數(shù)十年來(lái)一直未能填上成本。

歐洲市場(chǎng)上,2017年通用汽車(GM)就明智地將業(yè)務(wù)出售給標(biāo)致(Peugeot)從而退出,福特還在承諾縮小利潤(rùn)低大排量乘用車生產(chǎn)線,大力投資發(fā)展明星車型、商用車和乘用車。但種種舉措并不夠。

福特應(yīng)該全力掌控貨車市場(chǎng)。目前福特在歐洲商用車市場(chǎng)份額領(lǐng)先,占15.1%。銷量也不斷增長(zhǎng),去年達(dá)到26.4萬(wàn)輛,業(yè)內(nèi)專家稱其Transit貨車?yán)麧?rùn)率為兩位數(shù)。

福特要保持貨車領(lǐng)域領(lǐng)先地位,實(shí)現(xiàn)大規(guī)模生產(chǎn)至關(guān)重要。與大眾公司(Volkswagen)新成立合資企業(yè)應(yīng)該大有幫助。大眾已經(jīng)承諾在歐洲采購(gòu)商用貨車,還有以福特為所有市場(chǎng)設(shè)計(jì)制造的Ranger為原型的皮卡。

不過(guò)在縮減乘用車陣容的過(guò)程中,福特不再能夠享受工程和采購(gòu)規(guī)模的優(yōu)勢(shì),也無(wú)法保持成本的競(jìng)爭(zhēng)力。福特要徹底退出該領(lǐng)域。

SUV的前景則更加黯淡。去年福特在英國(guó)和歐洲大陸銷售了30萬(wàn)輛SUV,大部分為本地制造。與轎車領(lǐng)域不同,福特在美國(guó)設(shè)計(jì)制造大量同款SUV,其中一些型號(hào)與F-150共享平臺(tái),因此福特可以通過(guò)繼續(xù)生產(chǎn)銷售歐洲最受歡迎的車型來(lái)提升經(jīng)濟(jì)效益。

降低在中國(guó)市場(chǎng)的野心,盡量發(fā)揮優(yōu)勢(shì)

就在五年前,福特在中國(guó)市場(chǎng)的占有率近5%,107億美元的銷售額中有7.65億美元稅前利潤(rùn)來(lái)自中國(guó)。(早些時(shí)候的數(shù)據(jù)統(tǒng)計(jì)亞太地區(qū),其中以中國(guó)為主。)然而隨后出現(xiàn)驚人的斷崖式下跌,到2019年已無(wú)收益,導(dǎo)致收入暴跌35%至70億美元。隨著福特推出銳際和新款林肯冒險(xiǎn)家(Lincoln Corsair)SUV,2020年上半年財(cái)務(wù)狀況有所改善。但福特在中國(guó)市場(chǎng)份額仍然僅為2.5%,面臨的障礙也與歐洲市場(chǎng)類似,即嚴(yán)重依賴低利潤(rùn)乘用車,也很難提升銷量,在轎車和SUV領(lǐng)域展開競(jìng)爭(zhēng)。

盡管福特沒(méi)有透露具體細(xì)分?jǐn)?shù)據(jù),但據(jù)《財(cái)富》雜志估計(jì),第二季度福特在華銷售的15.9萬(wàn)輛汽車中約一半是轎車,以中型福克斯(Focus)、緊湊型福睿斯(Escort)還有SUV為主。跟歐洲一樣,中國(guó)正在迅速轉(zhuǎn)向電動(dòng)汽車。福特并沒(méi)有畏縮,承諾未來(lái)三年內(nèi)推出30款新車型,其中10款為全電動(dòng)。但中國(guó)有400多家國(guó)內(nèi)生產(chǎn)商在爭(zhēng)奪電動(dòng)汽車市場(chǎng)。目前,電動(dòng)汽車的利潤(rùn)遠(yuǎn)遠(yuǎn)低于傳統(tǒng)汽車,因?yàn)殡姵爻杀境掷m(xù)上升,而產(chǎn)量仍然太少。

這并不代表福特應(yīng)該放棄中國(guó)。福特應(yīng)該再次發(fā)揮自身優(yōu)勢(shì)。跟在歐洲一樣,福特輕型商用車在中國(guó)很受歡迎。福特應(yīng)該轉(zhuǎn)型主推貨車和小型皮卡。隨著福特在美國(guó)和歐洲產(chǎn)量,包括新款電動(dòng)汽車產(chǎn)量不斷增長(zhǎng),有助于擴(kuò)大規(guī)模在全世界最大的汽車市場(chǎng)中國(guó)獲得成功。而且福特貨車和皮卡業(yè)務(wù)利潤(rùn)豐厚,應(yīng)該能夠順利推動(dòng)向電動(dòng)汽車的轉(zhuǎn)型。

銷售萎縮之際,成本控制要跟上

在新福特汽車調(diào)整規(guī)模并實(shí)現(xiàn)盈利后,可能只有目前業(yè)務(wù)的三分之二,意味著銷量將從去年的1560億美元縮水至1000億美元左右。不過(guò)只有福特同步縮減管理費(fèi)用才能實(shí)現(xiàn)。隨著福特轉(zhuǎn)向利潤(rùn)率更高的產(chǎn)品組合,不必與銷售同步迅速降低成本以爭(zhēng)取更高利潤(rùn)。但轉(zhuǎn)變?nèi)匀粫?huì)很殘酷。整個(gè)工程和銷售團(tuán)隊(duì)都要集體行動(dòng)。

福特?fù)碛幸槐姾诵牡膬?yōu)秀產(chǎn)品,然而攤子鋪太大導(dǎo)致優(yōu)勢(shì)不夠明顯。大膽實(shí)施瘦身計(jì)劃意味著終結(jié)原有的全球帝國(guó),但可以確保福特充分發(fā)揮長(zhǎng)處。

新款Bronco是福特正確決策的案例

共享平臺(tái)

Bronco的工程平臺(tái)、底盤和部分零件都與福特新款Ranger皮卡共享,而Ranger一直很暢銷。

適度懷舊

福特不怕回顧過(guò)去,福特GT和整個(gè)野馬(Mustang)系列都是明證。但Bronco結(jié)合了懷舊與實(shí)用性,可以吸引年輕司機(jī)。

真實(shí)表現(xiàn)

Bronco在市場(chǎng)上的競(jìng)爭(zhēng)對(duì)手是越野頂級(jí)品牌吉普牧馬人(Jeep Wrangler),只有擊敗牧馬人才能夠在市場(chǎng)上取勝。從已經(jīng)發(fā)布的技術(shù)規(guī)格來(lái)看,福特顯然對(duì)這場(chǎng)大戰(zhàn)非常重視。(財(cái)富中文網(wǎng))

本文另一版本登載于《財(cái)富》雜志2020年10月刊。

譯者:馮豐

審校:夏林

福特汽車(Ford Motor Co.)向來(lái)自詡思路開闊。公司歷史長(zhǎng)達(dá)117年,長(zhǎng)期以來(lái)把戰(zhàn)略重點(diǎn)放在保持遍布全球主要市場(chǎng)的品牌地位,車型從超小型車覆蓋到豪華SUV,不久的將來(lái)還將全面進(jìn)軍電動(dòng)汽車。

但公司經(jīng)營(yíng)每況愈下,在2015年福特實(shí)現(xiàn)74億美元利潤(rùn)后,去年勉強(qiáng)維持盈虧平衡,而當(dāng)時(shí)新冠疫情還沒(méi)有爆發(fā),也尚未經(jīng)受經(jīng)濟(jì)封鎖對(duì)北美地區(qū)盈利造成的重創(chuàng)。今年第二季度,福特在北美虧損近10億美元,不久之后公司免去了韓愷特(Jim Hackett)的首席執(zhí)行官一職,并宣布新一輪收購(gòu)計(jì)劃。

新任首席執(zhí)行官詹姆斯·法利之前擔(dān)任首席運(yùn)營(yíng)官,面臨的挑戰(zhàn)巨大。但如果他愿意圍繞產(chǎn)品和戰(zhàn)略做一些艱難的選擇,仍然有機(jī)會(huì)帶領(lǐng)福特走向成功。

2021年以及2021年之后,福特會(huì)變成什么樣?《財(cái)富》雜志采訪了分析師和業(yè)內(nèi)專家,還研究了福特的公開文件,為其復(fù)興勾勒出似乎可信的藍(lán)圖。

法利確實(shí)面臨難得的機(jī)遇窗口。在疫情沖擊下,投資者對(duì)短期痛苦但最終可以賺錢、擱置失敗計(jì)劃且拋棄宏大目標(biāo)的艱難決策的容忍度高得多。當(dāng)前危機(jī)是福特不能浪費(fèi)的機(jī)會(huì)。

北美市場(chǎng)放棄更多不賺錢的車型

多年來(lái),北美是福特唯一持續(xù)盈利的市場(chǎng)。“但利潤(rùn)率一直在下降,遠(yuǎn)遠(yuǎn)低于合理水平。”惠譽(yù)評(píng)級(jí)(Fitch Ratings)的分析師斯蒂芬·布朗表示。最大的問(wèn)題是,從2016年到去年年底,成本基礎(chǔ)猛增83億美元,而同期銷售額增幅為55億美元。因此利潤(rùn)率從超過(guò)10%降至6.7%。2018年年中,福特宣布了110億美元的全球重組計(jì)劃,希望與供應(yīng)商達(dá)成規(guī)模更大也更優(yōu)惠的協(xié)議,增加機(jī)器人生產(chǎn)線推進(jìn)自動(dòng)化,調(diào)整勞動(dòng)力規(guī)模,在北美地區(qū)逐步淘汰幾乎所有傳統(tǒng)乘用車。

不過(guò),公司集中投資三塊高利潤(rùn)業(yè)務(wù)將可以獲得更大的成功,其中兩塊業(yè)務(wù)都增長(zhǎng)迅速。

第一塊,也是目前最大的一塊是F系列皮卡。去年,福特令人震驚地賣出89.7萬(wàn)輛F系列卡車,其中F-150最暢銷。炒得火熱的F系列電動(dòng)汽車最快明年面世,占福特在美國(guó)市場(chǎng)總銷量40%的產(chǎn)品線成敗在此一舉。

第二塊主要包括“商用車”或簡(jiǎn)稱CV,Transit品牌繼承了老款Econoline車型,客戶包括從快遞員到木匠等,也有箱型載客版本。華爾街的分析師稱,這塊業(yè)務(wù)F系列一樣,利潤(rùn)率也達(dá)到兩位數(shù)。

第三塊是SUV,選擇更加艱難。去年,福特銳際(Escape)和探險(xiǎn)者(Explorer)等車型在美國(guó)銷售了83.1萬(wàn)輛,但銷量和市場(chǎng)份額正在下降,其中探險(xiǎn)者的市場(chǎng)份額從2015年的12%下降到2019年的略低于10%。

不過(guò),SUV在美國(guó)仍然有希望。SUV一般價(jià)格較高,利潤(rùn)也比較豐厚,即便增幅不明顯,也可以基本保持。原因在于主打車型共享“車身框架”架構(gòu),與福特旗下大批量生產(chǎn)的卡車在同一平臺(tái)上生產(chǎn),從而降低了單位成本。新款Bronco SUV與福特的第二代皮卡品牌Ranger采用相同底盤和許多其他部件,且都在密歇根州韋恩市制造。尺寸最大的SUV“征服者”和高端林肯領(lǐng)航員(Lincoln Navigator)跟F-150卡車使用同款底盤。相比之下,EcoSport和銳際兩款尺寸較小的車型采用了不同的系統(tǒng),叫“單體式底盤”,經(jīng)濟(jì)效益方面差一點(diǎn)。“福特應(yīng)該逐步淘汰EcoSport和銳際,這兩款利潤(rùn)率都很低。”行業(yè)顧問(wèn)喬恩·加布里埃森說(shuō)。簡(jiǎn)單來(lái)說(shuō),如果福特能夠剝離邊緣SUV并降低成本,沿原有業(yè)務(wù)軌跡加速前進(jìn),仍然有機(jī)會(huì)蓬勃發(fā)展。

歐洲市場(chǎng)放棄轎車,主攻貨車

福特最大的問(wèn)題在海外。如果福特可以不計(jì)收益爽快地將海外業(yè)務(wù)出售給競(jìng)爭(zhēng)對(duì)手,成功之路將容易得多也更直接。福特應(yīng)該盡快撤出南美。目前其南美業(yè)務(wù)主要在巴西和阿根廷,然而數(shù)十年來(lái)一直未能填上成本。

歐洲市場(chǎng)上,2017年通用汽車(GM)就明智地將業(yè)務(wù)出售給標(biāo)致(Peugeot)從而退出,福特還在承諾縮小利潤(rùn)低大排量乘用車生產(chǎn)線,大力投資發(fā)展明星車型、商用車和乘用車。但種種舉措并不夠。

福特應(yīng)該全力掌控貨車市場(chǎng)。目前福特在歐洲商用車市場(chǎng)份額領(lǐng)先,占15.1%。銷量也不斷增長(zhǎng),去年達(dá)到26.4萬(wàn)輛,業(yè)內(nèi)專家稱其Transit貨車?yán)麧?rùn)率為兩位數(shù)。

福特要保持貨車領(lǐng)域領(lǐng)先地位,實(shí)現(xiàn)大規(guī)模生產(chǎn)至關(guān)重要。與大眾公司(Volkswagen)新成立合資企業(yè)應(yīng)該大有幫助。大眾已經(jīng)承諾在歐洲采購(gòu)商用貨車,還有以福特為所有市場(chǎng)設(shè)計(jì)制造的Ranger為原型的皮卡。

不過(guò)在縮減乘用車陣容的過(guò)程中,福特不再能夠享受工程和采購(gòu)規(guī)模的優(yōu)勢(shì),也無(wú)法保持成本的競(jìng)爭(zhēng)力。福特要徹底退出該領(lǐng)域。

SUV的前景則更加黯淡。去年福特在英國(guó)和歐洲大陸銷售了30萬(wàn)輛SUV,大部分為本地制造。與轎車領(lǐng)域不同,福特在美國(guó)設(shè)計(jì)制造大量同款SUV,其中一些型號(hào)與F-150共享平臺(tái),因此福特可以通過(guò)繼續(xù)生產(chǎn)銷售歐洲最受歡迎的車型來(lái)提升經(jīng)濟(jì)效益。

降低在中國(guó)市場(chǎng)的野心,盡量發(fā)揮優(yōu)勢(shì)

就在五年前,福特在中國(guó)市場(chǎng)的占有率近5%,107億美元的銷售額中有7.65億美元稅前利潤(rùn)來(lái)自中國(guó)。(早些時(shí)候的數(shù)據(jù)統(tǒng)計(jì)亞太地區(qū),其中以中國(guó)為主。)然而隨后出現(xiàn)驚人的斷崖式下跌,到2019年已無(wú)收益,導(dǎo)致收入暴跌35%至70億美元。隨著福特推出銳際和新款林肯冒險(xiǎn)家(Lincoln Corsair)SUV,2020年上半年財(cái)務(wù)狀況有所改善。但福特在中國(guó)市場(chǎng)份額仍然僅為2.5%,面臨的障礙也與歐洲市場(chǎng)類似,即嚴(yán)重依賴低利潤(rùn)乘用車,也很難提升銷量,在轎車和SUV領(lǐng)域展開競(jìng)爭(zhēng)。

盡管福特沒(méi)有透露具體細(xì)分?jǐn)?shù)據(jù),但據(jù)《財(cái)富》雜志估計(jì),第二季度福特在華銷售的15.9萬(wàn)輛汽車中約一半是轎車,以中型福克斯(Focus)、緊湊型福睿斯(Escort)還有SUV為主。跟歐洲一樣,中國(guó)正在迅速轉(zhuǎn)向電動(dòng)汽車。福特并沒(méi)有畏縮,承諾未來(lái)三年內(nèi)推出30款新車型,其中10款為全電動(dòng)。但中國(guó)有400多家國(guó)內(nèi)生產(chǎn)商在爭(zhēng)奪電動(dòng)汽車市場(chǎng)。目前,電動(dòng)汽車的利潤(rùn)遠(yuǎn)遠(yuǎn)低于傳統(tǒng)汽車,因?yàn)殡姵爻杀境掷m(xù)上升,而產(chǎn)量仍然太少。

這并不代表福特應(yīng)該放棄中國(guó)。福特應(yīng)該再次發(fā)揮自身優(yōu)勢(shì)。跟在歐洲一樣,福特輕型商用車在中國(guó)很受歡迎。福特應(yīng)該轉(zhuǎn)型主推貨車和小型皮卡。隨著福特在美國(guó)和歐洲產(chǎn)量,包括新款電動(dòng)汽車產(chǎn)量不斷增長(zhǎng),有助于擴(kuò)大規(guī)模在全世界最大的汽車市場(chǎng)中國(guó)獲得成功。而且福特貨車和皮卡業(yè)務(wù)利潤(rùn)豐厚,應(yīng)該能夠順利推動(dòng)向電動(dòng)汽車的轉(zhuǎn)型。

銷售萎縮之際,成本控制要跟上

在新福特汽車調(diào)整規(guī)模并實(shí)現(xiàn)盈利后,可能只有目前業(yè)務(wù)的三分之二,意味著銷量將從去年的1560億美元縮水至1000億美元左右。不過(guò)只有福特同步縮減管理費(fèi)用才能實(shí)現(xiàn)。隨著福特轉(zhuǎn)向利潤(rùn)率更高的產(chǎn)品組合,不必與銷售同步迅速降低成本以爭(zhēng)取更高利潤(rùn)。但轉(zhuǎn)變?nèi)匀粫?huì)很殘酷。整個(gè)工程和銷售團(tuán)隊(duì)都要集體行動(dòng)。

福特?fù)碛幸槐姾诵牡膬?yōu)秀產(chǎn)品,然而攤子鋪太大導(dǎo)致優(yōu)勢(shì)不夠明顯。大膽實(shí)施瘦身計(jì)劃意味著終結(jié)原有的全球帝國(guó),但可以確保福特充分發(fā)揮長(zhǎng)處。

新款Bronco是福特正確決策的案例

共享平臺(tái)

Bronco的工程平臺(tái)、底盤和部分零件都與福特新款Ranger皮卡共享,而Ranger一直很暢銷。

適度懷舊

福特不怕回顧過(guò)去,福特GT和整個(gè)野馬(Mustang)系列都是明證。但Bronco結(jié)合了懷舊與實(shí)用性,可以吸引年輕司機(jī)。

真實(shí)表現(xiàn)

Bronco在市場(chǎng)上的競(jìng)爭(zhēng)對(duì)手是越野頂級(jí)品牌吉普牧馬人(Jeep Wrangler),只有擊敗牧馬人才能夠在市場(chǎng)上取勝。從已經(jīng)發(fā)布的技術(shù)規(guī)格來(lái)看,福特顯然對(duì)這場(chǎng)大戰(zhàn)非常重視。(財(cái)富中文網(wǎng))

本文另一版本登載于《財(cái)富》雜志2020年10月刊。

譯者:馮豐

審校:夏林

Ford Motor Co. prides itself on thinking big. The 117-year-old icon’s long-running strategy centers on preserving its status as a universal nameplate serving all the world’s major geographies and offering a wide array of vehicles from subcompacts to luxury SUVs, in a variety of flavors soon to widely encompass electric.

But it’s a company that’s sliding: After posting $7.4 billion in profit in 2015, Ford’s earnings barely broke even last year, and that was before COVID-19 and its subsequent lockdowns took a sledgehammer to its North American profitability. In the second quarter of this year the company lost nearly $1 billion in the region. Jim Hackett was ousted as CEO shortly after, and a new round of buyouts was announced.

New CEO James Farley, who was promoted from chief of operations, has a monumental challenge on his hands but also has everything he needs to make Ford a success, if he’s willing to make some hard choices around product and strategy.

So what should Ford look like in 2021 and beyond? Fortune spoke to analysts and industry experts and studied Ford’s public filings to assemble a plausible blueprint for its revival.

Farley has a rare opening to seize the moment. The pandemic’s onslaught makes investors a lot more tolerant of tough decisions that cause short-term pain but build on what makes money, shelves losers, and jettisons lofty ambitions. This is a crisis Ford can’t afford to waste.

Junk more unprofitable models in North America

For years, North America has been Ford’s only consistently profitable market. “But margins there have been falling, and are well below where they need to be,” says Stephen Brown, an analyst with Fitch Ratings. The big problem is a cost base that jumped $8.3 billion from 2016 to the end of last year, outpacing sales increases of just $5.5 billion; that combination shrank margins from over 10% to just 6.7%. In mid-2018, Ford announced an $11 billion worldwide restructuring plan aimed at securing bigger, better deals with suppliers, automating production by adding fleets of robots, rightsizing its workforce, and phasing out nearly all traditional passenger cars in North America.

But the company will see greater wins by winnowing the portfolio to three high-margin franchises, two of which are growing fast.

The first, and by far the biggest, is the F-series pickup. Last year, Ford sold an astounding 897,000 F-series trucks, led by the F-150, America’s bestselling vehicle. The much-hyped electric F-series, which could be unveiled as soon as next year, is going to be a make-or-break addition to a line that constitutes 40% of Ford’s total domestic sales.

The second category encompasses “commercial vehicles” or CVs, its Transit-brand vans used by businesses from couriers to carpenters, as well as boxy passenger versions that are the successors to the old Econoline models. Like the F-series, they boast double-digit margins according to Wall Street analysts.

The third category, SUVs, are a tougher call. Last year, Ford sold 831,000 in the category including the Escape and Explorer in the U.S., but its sales and market share are dropping, the latter falling from 12% in 2015 to just under 10% in 2019.

Still, SUVs are a promising business stateside. They’re generally high-priced, lucrative products, and even if they don’t grow much, can remain so. That’s because key models share the “body on frame” architecture and are produced on the same platforms as the trucks that Ford manufactures in gigantic volumes, lowering unit costs. The new Bronco SUV shares the same chassis, and many other parts, with Ford’s second pickup brand, the Ranger, and is being made alongside its cousin in Wayne, Mich. The Expedition, its largest SUV, and the high-end Lincoln Navigator use the same underpinnings as the F-150. By contrast, two of the smaller models, the EcoSport and Escape, employ a different system called “unibody,” and hence don’t offer the same economies. “Ford should phase out the EcoSport and Escape, which are low-margin anyway,” says Jon Gabrielsen, an industry consultant. Put simply, Ford can prosper if it speeds faster on the same route by shedding the marginal SUVs and hitting the brakes on costs.

In Europe, get out of sedans and go all-in with vans

Ford’s biggest problems lie overseas. If the automaker could simply sell its foreign operations to a rival at no gain, its road to success would be far shorter and straighter. Ford should leave South America as quickly as possible. Its operation there, serving mainly Brazil and Argentina, hasn’t earned its cost of capital in decades.

In Europe, where GM wisely withdrew via a sale to Peugeot in 2017, Ford is pledging to downsize its line of low-margin, high-volume passenger vehicles and invest heavily in growing its star performers, commercial and passenger vans. This doesn’t go far enough.

Ford should focus on dominating the van market. The company is the market-share leader in commercial vehicles in Europe at 15.1%. Sales are growing, hitting over 264,000 vehicles last year, and according to industry experts, its Transits are generating double-digit margins.

Achieving large-scale production is crucial to keeping its lead in vans. A new joint venture with Volkswagen should help a lot. VW has pledged to source commercial vans in Europe and a pickup based on the Ranger for all markets engineered and manufactured by Ford.

But in shrinking its passenger vehicle lineup, Ford will no longer benefit from scale in engineering and purchasing, and thus won’t be able to keep costs competitive. It needs to get out of this segment entirely.

The picture for SUVs is cloudier. Last year, Ford sold just under 300,000 SUVs in the U.K. and on the Continent, largely manufactured in the region. Unlike the situation in sedans, Ford is designing and making large volumes of the same SUVs in the U.S., some sharing platforms with its F-150s. So Ford would achieve economies by continuing to manufacture and sell the most popular models in Europe.

Scale back China ambitions and play to your strengths

Just five years ago, Ford was on a roll in China, holding an almost 5% market share and generating $765 million in pretax profits on $10.7 billion in sales. (Earlier figures are for the Asia-Pacific region, heavily dominated by China.) A stunning free fall ensued, erasing all earnings by 2019 and sending revenues plunging 35%, to $7.0 billion. Fortunes improved in the first half of 2020 with the introduction of new versions of the Ford Escape and Lincoln Corsair SUVs. But its market share is still just 2.5%, and it faces obstacles similar to those in Europe: A heavy dependence on low-margin passenger cars, and the challenge of achieving volumes big enough to compete on sedans and SUVs.

Though Ford doesn’t disclose the exact breakdown, Fortune estimates that of the 159,000 vehicles that Ford sold in China in Q2, roughly half were sedans, led by the midsize Focus and compact Escort, and SUVs. As in Europe, China is moving rapidly to EVs. Undaunted, Ford is pledging to introduce 30 new models over the next three years, 10 in all-electric versions. But China has over 400 domestic producers vying for that market. And EVs for now are far less profitable than conventional vehicles, because battery costs remain elevated, while volumes remain too low.

That doesn’t mean that Ford should abandon China. Rather, it should once again play to its strengths. Its light commercial vehicles are big hits in China, just as in Europe. Ford should transform itself into a specialty manufacturer concentrating on vans and small pickups. Its growing output in the U.S. and Europe, including in new EVs, will help provide the scale essential to winning in the world’s largest auto market. It’s also starting with fat margins in those vans and pickups, which should ease the transition to EVs.

As sales shrink, costs need to keep pace

A New Ford that’s resized and profitable might be two-thirds as big as the current model, meaning that sales would shrink from $156 billion last year to around $100 billion. But that template can work only if Ford crunches overhead. Since it would be shifting to a mix of much higher-margin products, the automaker wouldn’t need to lower costs quite as fast as sales to become far more profitable. But the transition would still be brutal. Entire engineering and sales teams behind axed models would have to go en masse.

Ford has a core of great products that are being diluted by trying to do too much in too many places. A daring plan for downsizing would mean the end of the global empire of old, but it could ensure that the blue oval survives on what Ford does best.?

*****

The new Bronco is an example of everything Ford is doing right

Shared platform

The engineering platform, chassis, and several parts for the Bronco are shared with Ford’s new Ranger pickup truck, which has already proved to be a hit seller.

Bankable nostalgia

Ford isn’t afraid to look to the past and trade on nostalgia—take the Ford GT and its entire Mustang line for evidence.But with the Bronco that nostalgia is paired with a practicalvehicle, and one that will appeal to younger drivers.

Genuine performance

The Bronco is going right up against the proven off-roadcredentials of the Jeep Wrangler, and only by beating the Wrangler will it succeed in the market. The released specs show Ford is taking this fight very seriously.

A version of this article appears in the October 2020 issue of Fortune.