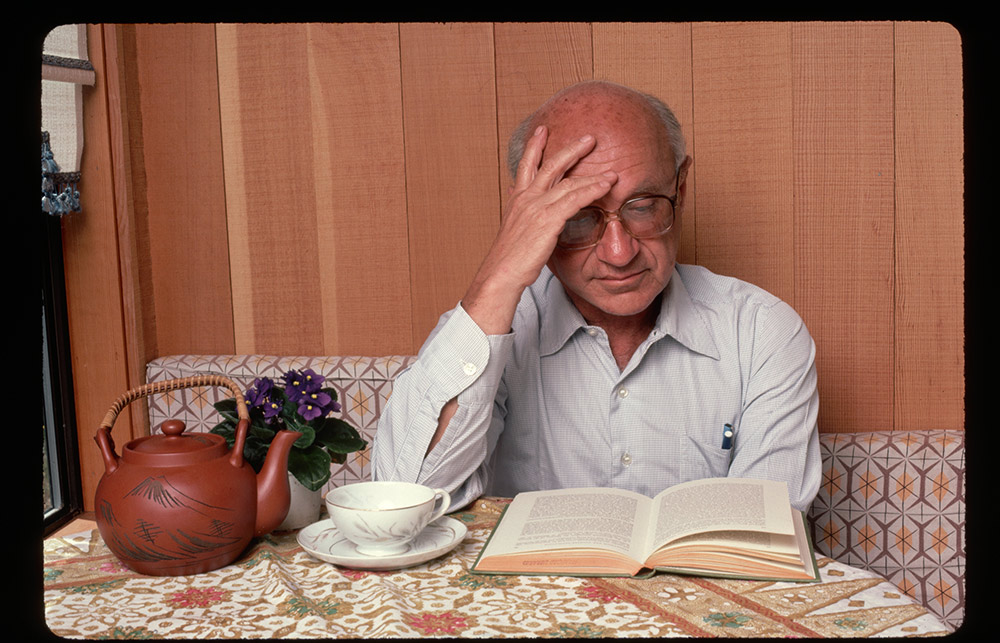

50年前,米爾頓?弗里德曼在《紐約時報》雜志上宣稱,企業的社會責任就是實現利潤增長。董事的責任是維護主人即股東的利益,賺取盡可能多的利潤。弗里德曼反對羅斯福新政和歐洲的社會民主模式,并敦促企業界盡量降低工會的效率,減少應對環境和消費者保護措施的努力,削弱反壟斷法。他希望公司董事會降低對人的關注,削弱法律上制定的企業公平對待工人、消費者和社會的要求。

過去50年里,弗里德曼的觀點在美國影響力越來越大。結果是,股票市場和富裕精英的權力飆升,對工人、環境和消費者利益的關注減少,導致經濟上出現嚴重的不穩定和不平等,對氣候變化應對遲緩,公共機構也受到破壞。公司利用財富和實力追求利潤,率先放松了能夠防止工人和其他利益相關者受過度行為影響的外部約束。

在弗里德曼范式的主導下,公司不斷受到股東決議、收購和對沖基金激進主義等機制的困擾,過于狹隘地關注股東回報。在機構投資者的推動下,高管薪酬體系日漸注重股票總回報率。企業變成股票市場的玩物,越發難以按照開明的方式運作,很難反映人類投資者在可持續增長、公平對待工人和保護環境方面的實際利益。

半個世紀后,很明顯,如此狹隘、以股東為中心的企業觀對社會造成了嚴重影響。早在新冠肺炎疫情爆發之前,有人就曾經批評企業過分關注利潤,導致自然和生物多樣性退化,縱容全球變暖、工資停滯不前,也使得經濟不平等加劇。最明顯的例子就是員工與企業精英利益分配嚴重不均,股東和高管層攫取了蛋糕的大部分。

如今,美國企業界意識到了此類思維方式對社會契約的威脅。作為回應,2019年商業圓桌會議(Business Roundtable)發布企業使命聲明,強調對利益相關者和股東的責任。然而在疫情期間,多家簽署企業并未遵照承諾保護利益相關者,于是人們對簽署該文件的初衷以及后續行動持懷疑態度。

股東權益倡導者聲稱企業使命聲明收效甚微,確實沒錯。要求企業高管只對強大的群體,即以高度強勢的機構投資者形式存在的股東負責,而對其他利益相關者不承擔法律責任,還要以公平方式管理公司,對利益相關者來說不僅無效,而且很幼稚,邏輯也不清晰。

我們需要的是,確保企業承諾履行與其影響力相配的社會責任。實際上,這點一直存在缺位。美國的公司法規定,董事和經理應該受制于強大的股東權力,以權衡其他利益相關者的利益。原則上說,公司可以追求超出利潤和利益相關者的使命,但前提是獲得強大投資者的批準。歸根結底,由于法律要求相當寬泛,企業在公平對待所有利益相關者方面受到了嚴格限制,因為控制權都已經移交給投資者和金融市場。

由于缺乏有效鼓勵遵守圓桌會議聲明的機制,系統對實際遵守的企業并不利。公司不需要照顧利益相關者,多數情況下也確實沒有,因為這么做會讓股東憤怒。去年,機構投資者委員會(Council of Institutional Investors)對圓桌會議宣言的下意識反應就說明了這點。委員會表示反對,稱圓桌會議并未承認股東既是資本所有者,也是資本提供者,而“對所有人負責意味著對任何人都不負責”。

如果圓桌會議真要從股東至上轉向追求使命,需要做兩件事。一是羅斯福新政中的承諾要更新,對美國工人、環境和消費者保護更接近德國及斯堪的納維亞諸國制定的標準。

但要想實現第一件事,第二件事必不可少。公司法本身必須調整,以便企業更好地恢復相關框架,內部管理更加尊重工人和社會。改變公司法的權力結構,要求企業公平考慮利益相關者,克制利潤高于其他價值的欲望,也可以防止公司弱化保護工人、消費者和社會的相關規定。

為了實現這一轉變,公司使命要確立為公司法的核心,以表現出公司更廣泛的社會責任以及董事保障施行的職責。根據美國多個州的法律,企業可通過授權公益法人(PBC)來實現。公益法人有責任聲明企業除利潤以外的公共使命,將實現使命作為董事的職責,還要承擔履行的責任。該模式與一些州的利益相關者規定明顯存在區別,因為有些州希望強化利益相關者的利益,但利益相關者主張將其無效。公益法人變成優秀企業公民的明確義務,要尊重所有利益相關者。類似要求具有強制性,而利益相關者規定則比較模糊。

公益法人的重要性日漸提升,很多年輕的創業者也已經接受,他們認為所有人都能夠公平賺錢才是負責任的前進之路。不過該模式最終成功與否取決于長期應用模式的企業。

即使在圓桌會議高調發表聲明之后,大規模轉變并未發生,而且理由很充分。雖然企業可以選擇成為公益法人,但并無義務,而且需要股東支持。對于創始人掌控的公司或股東人數相對較少的公司來說,如果各方均強烈傾向公益法人形式就相對容易。而要獲得分散的機構投資者批準則困難得多,機構投資者要對更分散的個人投資者群體負責。當前企業若想實現改革,協調是個大問題。

所以法律需要調整。公益法人不應該成為股東至上之外的選擇,而應該成為社會重要公司的普遍標準。至于社會重要公司的標準,參議員伊麗莎白?沃倫提出的建議是收入超過10億美元。在美國,企業根據各州法律轉為公益法人效率最高。美國制度的魔力在很大程度上取決于聯邦政府與各州之間的合作,實現國家標準和靈活執行的最佳結合。該方法也正是基于此。

按照美國法律,公司股東和董事享有實質性的優勢和保護,但并不能夠延伸到經營者。在提供各項權利后,社會可以合理地期望從公司行為中獲益,而非遭受損失。在公司法中要將社會責任定為義務,可以恢復公司的合法性。

該制度有三項核心。首先,企業必須是負責任的企業公民,公平對待員工和其他利益相關者,避免出現碳排放等可能對他人造成不合理或不相稱傷害的外部因素。第二,企業應該通過造福他人來謀取利潤。第三,要測定和報告業績證明達到了兩項標準。

公益法人模式包含了三項要素,而且背后有法律力量和市場力量。公司經理和大多數人一樣要認真對待義務。如果做不到,在公益法人模式下,允許法院發布禁止令等指示,要求公司履行對利益相關者和社會的義務。此外,公益法人模式要求在企業生命周期的各個階段公平對待所有利益相關者,即使要出售也應如此。該模式將權力轉交給對社會負責的投資和指數基金,相關基金專注于長期發展,無法從危害社會的不可持續增長方式中獲益。

我們建議修改公司法以確保負責任的企業公民身份,很可能將引發既得利益者和傳統學術界人士的強烈抗議。他們會聲稱這條路行不通,對創業和創新將造成毀滅性打擊,破壞推動增長和繁榮的資本主義制度,對全球各地就業、養老金和投資造成威脅。如果把企業使命作為公司法核心有如此大的破壞力,人們可能會懷疑當初為何要發明公司。

很顯然,結果與某些威脅是相反的。將使命納入法律,遵照法律要求實現創建企業的初心,只會簡化企業經營而不是將其復雜化。該模式將成為企業家精神、創新和靈感的源泉,為個人、社會和自然面臨的問題找到解決方案。通過鼓勵對福利和繁榮作出積極貢獻,而不是以犧牲他人為代價轉移財富,市場和資本主義制度可以更好地發揮作用。此外,該模式還能夠創造有意義且令人滿意的工作,支持員工就業并保障退休,鼓勵可以為全民創造財富的投資。

我們呼吁大企業普遍采用公益法人模式。這樣才能夠避免資本主義制度和企業面臨當前做法的破壞性后果,而這也是為了下一代,為了社會和大自然。(財富中文網)

科林?邁耶是牛津大學薩伊德商學院的彼得?摩爾管理學教授,也是英國社會科學院未來企業項目的學術帶頭人。

小利奧?E?斯特林是賓夕法尼亞大學凱里法學院的邁克爾?L?瓦赫特法律和政策杰出研究員、哥倫比亞大學法學院艾拉?M?米爾斯坦全球市場和企業所有權中心的杰出高級研究員、特拉華州前首席大法官和校長,也在Wachtell, Lipton, Rosen, & Katz律師事務所擔任法律顧問。

雅普?溫特是Phyleon Leadership and Governance的合伙人,在阿姆斯特丹自由大學擔任公司法、治理和行為學教授。

譯者:馮豐

審校:夏林

50年前,米爾頓?弗里德曼在《紐約時報》雜志上宣稱,企業的社會責任就是實現利潤增長。董事的責任是維護主人即股東的利益,賺取盡可能多的利潤。弗里德曼反對羅斯福新政和歐洲的社會民主模式,并敦促企業界盡量降低工會的效率,減少應對環境和消費者保護措施的努力,削弱反壟斷法。他希望公司董事會降低對人的關注,削弱法律上制定的企業公平對待工人、消費者和社會的要求。

過去50年里,弗里德曼的觀點在美國影響力越來越大。結果是,股票市場和富裕精英的權力飆升,對工人、環境和消費者利益的關注減少,導致經濟上出現嚴重的不穩定和不平等,對氣候變化應對遲緩,公共機構也受到破壞。公司利用財富和實力追求利潤,率先放松了能夠防止工人和其他利益相關者受過度行為影響的外部約束。

在弗里德曼范式的主導下,公司不斷受到股東決議、收購和對沖基金激進主義等機制的困擾,過于狹隘地關注股東回報。在機構投資者的推動下,高管薪酬體系日漸注重股票總回報率。企業變成股票市場的玩物,越發難以按照開明的方式運作,很難反映人類投資者在可持續增長、公平對待工人和保護環境方面的實際利益。

半個世紀后,很明顯,如此狹隘、以股東為中心的企業觀對社會造成了嚴重影響。早在新冠肺炎疫情爆發之前,有人就曾經批評企業過分關注利潤,導致自然和生物多樣性退化,縱容全球變暖、工資停滯不前,也使得經濟不平等加劇。最明顯的例子就是員工與企業精英利益分配嚴重不均,股東和高管層攫取了蛋糕的大部分。

如今,美國企業界意識到了此類思維方式對社會契約的威脅。作為回應,2019年商業圓桌會議(Business Roundtable)發布企業使命聲明,強調對利益相關者和股東的責任。然而在疫情期間,多家簽署企業并未遵照承諾保護利益相關者,于是人們對簽署該文件的初衷以及后續行動持懷疑態度。

股東權益倡導者聲稱企業使命聲明收效甚微,確實沒錯。要求企業高管只對強大的群體,即以高度強勢的機構投資者形式存在的股東負責,而對其他利益相關者不承擔法律責任,還要以公平方式管理公司,對利益相關者來說不僅無效,而且很幼稚,邏輯也不清晰。

我們需要的是,確保企業承諾履行與其影響力相配的社會責任。實際上,這點一直存在缺位。美國的公司法規定,董事和經理應該受制于強大的股東權力,以權衡其他利益相關者的利益。原則上說,公司可以追求超出利潤和利益相關者的使命,但前提是獲得強大投資者的批準。歸根結底,由于法律要求相當寬泛,企業在公平對待所有利益相關者方面受到了嚴格限制,因為控制權都已經移交給投資者和金融市場。

由于缺乏有效鼓勵遵守圓桌會議聲明的機制,系統對實際遵守的企業并不利。公司不需要照顧利益相關者,多數情況下也確實沒有,因為這么做會讓股東憤怒。去年,機構投資者委員會(Council of Institutional Investors)對圓桌會議宣言的下意識反應就說明了這點。委員會表示反對,稱圓桌會議并未承認股東既是資本所有者,也是資本提供者,而“對所有人負責意味著對任何人都不負責”。

如果圓桌會議真要從股東至上轉向追求使命,需要做兩件事。一是羅斯福新政中的承諾要更新,對美國工人、環境和消費者保護更接近德國及斯堪的納維亞諸國制定的標準。

但要想實現第一件事,第二件事必不可少。公司法本身必須調整,以便企業更好地恢復相關框架,內部管理更加尊重工人和社會。改變公司法的權力結構,要求企業公平考慮利益相關者,克制利潤高于其他價值的欲望,也可以防止公司弱化保護工人、消費者和社會的相關規定。

為了實現這一轉變,公司使命要確立為公司法的核心,以表現出公司更廣泛的社會責任以及董事保障施行的職責。根據美國多個州的法律,企業可通過授權公益法人(PBC)來實現。公益法人有責任聲明企業除利潤以外的公共使命,將實現使命作為董事的職責,還要承擔履行的責任。該模式與一些州的利益相關者規定明顯存在區別,因為有些州希望強化利益相關者的利益,但利益相關者主張將其無效。公益法人變成優秀企業公民的明確義務,要尊重所有利益相關者。類似要求具有強制性,而利益相關者規定則比較模糊。

公益法人的重要性日漸提升,很多年輕的創業者也已經接受,他們認為所有人都能夠公平賺錢才是負責任的前進之路。不過該模式最終成功與否取決于長期應用模式的企業。

即使在圓桌會議高調發表聲明之后,大規模轉變并未發生,而且理由很充分。雖然企業可以選擇成為公益法人,但并無義務,而且需要股東支持。對于創始人掌控的公司或股東人數相對較少的公司來說,如果各方均強烈傾向公益法人形式就相對容易。而要獲得分散的機構投資者批準則困難得多,機構投資者要對更分散的個人投資者群體負責。當前企業若想實現改革,協調是個大問題。

所以法律需要調整。公益法人不應該成為股東至上之外的選擇,而應該成為社會重要公司的普遍標準。至于社會重要公司的標準,參議員伊麗莎白?沃倫提出的建議是收入超過10億美元。在美國,企業根據各州法律轉為公益法人效率最高。美國制度的魔力在很大程度上取決于聯邦政府與各州之間的合作,實現國家標準和靈活執行的最佳結合。該方法也正是基于此。

按照美國法律,公司股東和董事享有實質性的優勢和保護,但并不能夠延伸到經營者。在提供各項權利后,社會可以合理地期望從公司行為中獲益,而非遭受損失。在公司法中要將社會責任定為義務,可以恢復公司的合法性。

該制度有三項核心。首先,企業必須是負責任的企業公民,公平對待員工和其他利益相關者,避免出現碳排放等可能對他人造成不合理或不相稱傷害的外部因素。第二,企業應該通過造福他人來謀取利潤。第三,要測定和報告業績證明達到了兩項標準。

公益法人模式包含了三項要素,而且背后有法律力量和市場力量。公司經理和大多數人一樣要認真對待義務。如果做不到,在公益法人模式下,允許法院發布禁止令等指示,要求公司履行對利益相關者和社會的義務。此外,公益法人模式要求在企業生命周期的各個階段公平對待所有利益相關者,即使要出售也應如此。該模式將權力轉交給對社會負責的投資和指數基金,相關基金專注于長期發展,無法從危害社會的不可持續增長方式中獲益。

我們建議修改公司法以確保負責任的企業公民身份,很可能將引發既得利益者和傳統學術界人士的強烈抗議。他們會聲稱這條路行不通,對創業和創新將造成毀滅性打擊,破壞推動增長和繁榮的資本主義制度,對全球各地就業、養老金和投資造成威脅。如果把企業使命作為公司法核心有如此大的破壞力,人們可能會懷疑當初為何要發明公司。

很顯然,結果與某些威脅是相反的。將使命納入法律,遵照法律要求實現創建企業的初心,只會簡化企業經營而不是將其復雜化。該模式將成為企業家精神、創新和靈感的源泉,為個人、社會和自然面臨的問題找到解決方案。通過鼓勵對福利和繁榮作出積極貢獻,而不是以犧牲他人為代價轉移財富,市場和資本主義制度可以更好地發揮作用。此外,該模式還能夠創造有意義且令人滿意的工作,支持員工就業并保障退休,鼓勵可以為全民創造財富的投資。

我們呼吁大企業普遍采用公益法人模式。這樣才能夠避免資本主義制度和企業面臨當前做法的破壞性后果,而這也是為了下一代,為了社會和大自然。(財富中文網)

科林?邁耶是牛津大學薩伊德商學院的彼得?摩爾管理學教授,也是英國社會科學院未來企業項目的學術帶頭人。

小利奧?E?斯特林是賓夕法尼亞大學凱里法學院的邁克爾?L?瓦赫特法律和政策杰出研究員、哥倫比亞大學法學院艾拉?M?米爾斯坦全球市場和企業所有權中心的杰出高級研究員、特拉華州前首席大法官和校長,也在Wachtell, Lipton, Rosen, & Katz律師事務所擔任法律顧問。

雅普?溫特是Phyleon Leadership and Governance的合伙人,在阿姆斯特丹自由大學擔任公司法、治理和行為學教授。

譯者:馮豐

審校:夏林

Fifty years ago, Milton Friedman in the New York Times magazine proclaimed that the social responsibility of business is to increase its profits. Directors have the duty to do what is in the interests of their masters, the shareholders, to make as much profit as possible. Friedman was hostile to the New Deal and European models of social democracy and urged business to use its muscle to reduce the effectiveness of unions, blunt environmental and consumer protection measures, and defang antitrust law. He sought to reduce consideration of human concerns within the corporate boardroom and legal requirements on business to treat workers, consumers, and society fairly.

Over the last 50 years, Friedman’s views became increasingly influential in the U.S. As a result, the power of the stock market and wealthy elites soared and consideration of the interests of workers, the environment, and consumers declined. Profound economic insecurity and inequality, a slow response to climate change, and undermined public institutions resulted. Using their wealth and power in the pursuit of profits, corporations led the way in loosening the external constraints that protected workers and other stakeholders against overreaching.

Under the dominant Friedman paradigm, corporations were constantly harried by all the mechanisms that shareholders had available—shareholder resolutions, takeovers, and hedge fund activism—to keep them narrowly focused on stockholder returns. And pushed by institutional investors, executive remuneration systems were increasingly focused on total stock returns. By making corporations the playthings of the stock market, it became steadily harder for corporations to operate in an enlightened way that reflected the real interests of their human investors in sustainable growth, fair treatment of workers, and protection of the environment.

Half a century later, it is clear that this narrow, stockholder-centered view of corporations has cost society severely. Well before the COVID-19 pandemic, the single-minded focus of business on profits was criticized for causing the degradation of nature and biodiversity, contributing to global warming, stagnating wages, and exacerbating economic inequality. The result is best exemplified by the drastic shift in gain sharing away from workers toward corporate elites, with stockholders and top management eating more of the economic pie.

Corporate America understood the threat that this way of thinking was having on the social compact and reacted through the 2019 corporate purpose statement of the Business Roundtable, emphasizing responsibility to stakeholders as well as shareholders. But the failure of many of the signatories to protect their stakeholders during the coronavirus pandemic has prompted cynicism about the original intentions of those signing the document, as well as their subsequent actions.

Stockholder advocates are right when then they claim that purpose statements on their own achieve little: Calling for corporate executives who answer to only one powerful constituency—stockholders in the form of highly assertive institutional investors—and have no legal duty to other stakeholders to run their corporations in a way that is fair to all stakeholders is not only ineffectual, it is naive and intellectually incoherent.

What is required is to match commitment to broader responsibility of corporations to society with a power structure that backs it up. That is what has been missing. Corporate law in the U.S. leaves it to directors and managers subject to potent stockholder power to give weight to other stakeholders. In principle, corporations can commit to purposes beyond profit and their stakeholders, but only if their powerful investors allow them to do so. Ultimately, because the law is permissive, it is in fact highly restrictive of corporations acting fairly for all their stakeholders because it hands authority to investors and financial markets for corporate control.

Absent any effective mechanism for encouraging adherence to the Roundtable statement, the system is stacked against those who attempt to do so. There is no requirement on corporations to look after their stakeholders and for the most part they do not, because if they did, they would incur the wrath of their shareholders. That was illustrated all too clearly by the immediate knee-jerk response of the Council of Institutional Investors to the Roundtable declaration last year, which expressed its disapproval by stating that the Roundtable had failed to recognize shareholders as owners as well as providers of capital, and that “accountability to everyone means accountability to no one.”

If the Roundtable is serious about shifting from shareholder primacy to purposeful business, two things need to happen. One is that the promise of the New Deal needs to be renewed, and protections for workers, the environment, and consumers in the U.S. need to be brought closer to the standards set in places like Germany and Scandinavia.

But to do that first thing, a second thing is necessary. Changes within company law itself must occur, so that corporations are better positioned to support the restoration of that framework and govern themselves internally in a manner that respects their workers and society. Changing the power structure within corporate law itself—to require companies to give fair consideration to stakeholders and temper their need to put profit above all other values—will also limit the ability and incentives for companies to weaken regulations that protect workers, consumers, and society more generally.

To make this change, corporate purpose has to be enshrined in the heart of corporate law as an expression of the broader responsibility of corporations to society and the duty of directors to ensure this. Laws already on the books of many states in the U.S. do exactly that by authorizing the public benefit corporation (PBC). A PBC has an obligation to state a public purpose beyond profit, to fulfill that purpose as part of the responsibilities of its directors, and to be accountable for so doing. This model is meaningfully distinct from the constituency statutes in some states that seek to strengthen stakeholder interests, but that stakeholder advocates condemn as ineffectual. PBCs have an affirmative duty to be good corporate citizens and to treat all stakeholders with respect. Such requirements are mandatory and meaningful, while constituency statutes are mushy.

The PBC model is growing in importance and is embraced by many younger entrepreneurs committed to the idea that making money in a way that is fair to everyone is the responsible path forward. But the model’s ultimate success depends on longstanding corporations moving to adopt it.

Even in the wake of the Roundtable’s high-minded statement, that has not yet happened, and for good reason. Although corporations can opt in to become a PBC, there is no obligation on them to do so and they need the support of their shareholders. It is relatively easy for founder-owned companies or companies with a relatively low number of stockholders to adopt PBC forms if their owners are so inclined. It is much tougher to obtain the approval of a dispersed group of institutional investors who are accountable to an even more dispersed group of individual investors. There is a serious coordination problem of achieving reform in existing corporations.

That is why the law needs to change. Instead of being an opt-in alternative to shareholder primacy, the PBC should be the universal standard for societally important corporations, which should be defined as ones with over $1 billion of revenues, as suggested by Sen. Elizabeth Warren. In the U.S., this would be done most effectively by corporations becoming PBCs under state law. The magic of the U.S. system has rested in large part on cooperation between the federal government and states, which provides society with the best blend of national standards and nimble implementation. This approach would build on that.

Corporate shareholders and directors enjoy substantial advantages and protections through U.S. law that are not extended to those who run their own businesses. In return for offering these privileges, society can reasonably expect to benefit, not suffer, from what corporations do. Making responsibility in society a duty in corporate law will reestablish the legitimacy of incorporation.

There are three pillars to this. The first is that corporations must be responsible corporate citizens, treating their workers and other stakeholders fairly, and avoiding externalities, such as carbon emissions, that cause unreasonable or disproportionate harm to others. The second is that corporations should seek to make profit by benefiting others. The third is that they should be able to demonstrate that they fulfill both criteria by measuring and reporting their performances against them.

The PBC model embraces all three elements and puts legal, and thus market, force behind them. Corporate managers, like most of us, take obligatory duties seriously. If they don’t, the PBC model allows for courts to issue orders, such as injunctions, holding corporations to their stakeholder and societal obligations. In addition, the PBC model requires fairness to all stakeholders at all stages of a corporation’s life, even when it is sold. The PBC model shifts power to socially responsible investment and index funds that focus on the long term and cannot gain from unsustainable approaches to growth that harm society.

Our proposal to amend corporate law to ensure responsible corporate citizenship will prompt a predictable outcry from vested interests and traditional academic quarters, claiming that it will be unworkable, devastating for entrepreneurship and innovation, undermine a capitalist system that has been an engine for growth and prosperity, and threaten jobs, pensions, and investment around the world. If putting the purpose of a business at the heart of corporate law does all of that, one might well wonder why we invented the corporation in the first place.

Of course, it will do exactly the opposite. Putting purpose into law will simplify, not complicate, the running of businesses by aligning what the law wants them to do with the reason why they are created. It will be a source of entrepreneurship, innovation, and inspiration to find solutions to problems that individuals, societies, and the natural world face. It will make markets and the capitalist system function better by rewarding positive contributions to well-being and prosperity, not wealth transfers at the expense of others. It will create meaningful, fulfilling jobs, support employees in employment and retirement, and encourage investment in activities that generate wealth for all.

We are calling for the universal adoption of the PBC for large corporations. We do so to save our capitalist system and corporations from the devastating consequences of their current approaches, and for the sake of our children, our societies, and the natural world.

Colin Mayer is the Peter Moores professor of management studies at the University of Oxford’s Said Business School, and academic lead of the Future of the Corporation program at the British Academy.

Leo E. Strine Jr. is the Michael L. Wachter distinguished fellow in law and policy at the University of Pennsylvania Carey Law School, the Ira M. Millstein distinguished senior fellow at the Ira M. Millstein Center for Global Markets and Corporate Ownership at Columbia Law School, former chief justice and chancellor of Delaware, and of counsel at Wachtell, Lipton, Rosen, & Katz.

Jaap Winter is a partner at Phyleon Leadership and Governance and professor of corporate law, governance, and behavior at Vrije Universiteit Amsterdam.