特朗普下令,字節(jié)跳動(dòng)必須在9月中旬前為其TikTok美國(guó)業(yè)務(wù)找到一個(gè)買家,并稱這家社交媒體平臺(tái)存在安全隱患。

TikTok本月22日宣布,公司將起訴特朗普政府,以阻止這次強(qiáng)制出售。然而與此同時(shí),像甲骨文和Twitter這類合適的候選公司已就購買TikTok與字節(jié)跳動(dòng)進(jìn)行了談判。然而正在就收購進(jìn)行協(xié)商的微軟才是最有可能的買家。

與其他科技巨頭不同的是,這家位于華盛頓州雷蒙德的軟件公司以其B2B銷售業(yè)務(wù)為主打,而不是消費(fèi)業(yè)務(wù)。那為什么微軟想將TikTok攬入懷中呢?為了尋找答案,《財(cái)富》翻閱了大量的分析師報(bào)告,并攜手SurveyMonkey于8月17-18日*對(duì)2478名美國(guó)成年人進(jìn)行了調(diào)查,以了解他們對(duì)社交媒體的態(tài)度以及使用規(guī)律。

TikTok + 領(lǐng)英將讓微軟成為社交媒體巨頭

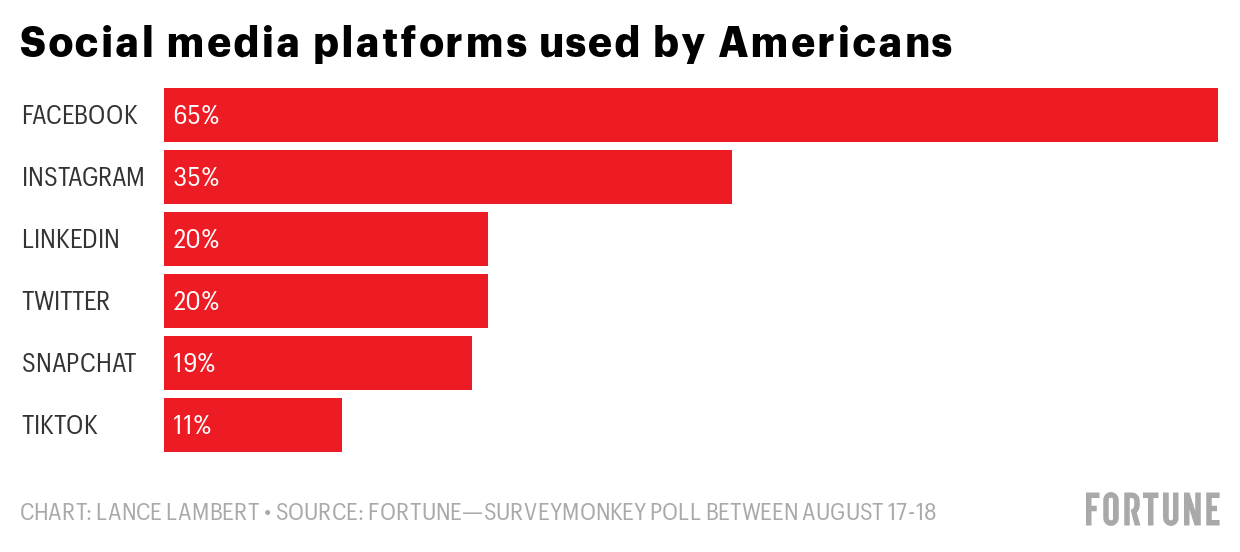

TikTok的新用戶增速遠(yuǎn)超大部分社交媒體。然而《財(cái)富》的調(diào)查顯示,僅有11%的美國(guó)成年人使用這一應(yīng)用,依然遠(yuǎn)低于其競(jìng)爭(zhēng)對(duì)手。用戶數(shù)量最多的平臺(tái)是Facebook(65%)和Facebook旗下Instagram(35%)。然而,TikTok的內(nèi)部數(shù)據(jù)給出的用戶占比則要高得多,而且這其中的差距可能源于一個(gè)事實(shí):TikTok很大一部分用戶群都在18歲以下,因此并不在《財(cái)富》的調(diào)查之列。

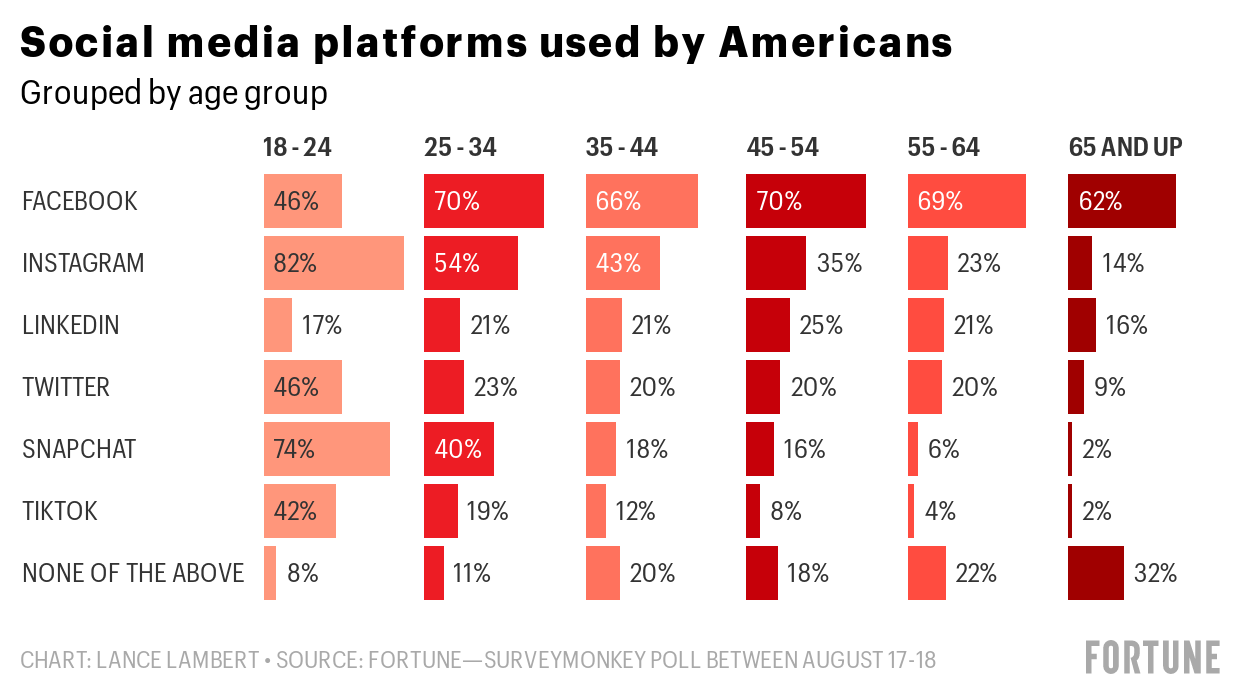

然而對(duì)于微軟來說,如果TikTok再配上美國(guó)成人使用占比達(dá)到20%的領(lǐng)英,那么微軟將有資格在社交媒體領(lǐng)域與頂級(jí)選手Facebook一決高下。微軟在2016年以262億美元的價(jià)格收購了領(lǐng)英。

將TikTok納入麾下能夠讓微軟成為數(shù)字廣告業(yè)務(wù)的佼佼者。eMarketer的數(shù)據(jù)顯示,這一領(lǐng)域70%的市場(chǎng)份額歸屬于谷歌、Facebook和亞馬遜。

Wedbush Securities股票研究業(yè)務(wù)董事總經(jīng)理丹·艾維斯在8月的微軟評(píng)估中寫道:“微軟購買TikTok以及其美國(guó)業(yè)務(wù)可以解決該應(yīng)用的安全問題,而且能夠讓雷蒙德獲得消費(fèi)社交媒體領(lǐng)域的一個(gè)香餑餑,而此時(shí),其他FAANG同行(Facebook、Alphabet)都在經(jīng)歷大規(guī)模的反壟斷監(jiān)管審查,因此無法觸碰TikTok資產(chǎn)。”有意思的是,當(dāng)被問及擬議出售時(shí),50%的公眾稱他們并不同意強(qiáng)制出售TikTok。

TikTok將讓微軟俘獲Z一代

在18-24歲的年齡段中,僅有17%的人使用微軟旗下領(lǐng)英。就TikTok而言,這個(gè)數(shù)字則超過了兩倍,達(dá)到了42%。在這些青年成年人中,僅有Instagram (82%), Twitter (46%)和Facebook (46%)有著更高的用戶占比。

將TikTok收入囊中不僅會(huì)提升微軟社交媒體中的Z一代受眾數(shù)量,同時(shí)也會(huì)幫助公司在今后成為消費(fèi)業(yè)務(wù)領(lǐng)域更大的參與者。

這一豪賭將實(shí)現(xiàn)微軟業(yè)務(wù)的多元化

Wedbush稱,在微軟1.6萬億的市值中,約90%來自于企業(yè)云策略,包括Azure和Office 365。收購TikTok將幫助微軟實(shí)現(xiàn)其業(yè)務(wù)的多元化,并找到新的業(yè)務(wù)增長(zhǎng)點(diǎn)。

艾維斯在其8月對(duì)微軟的評(píng)估中寫道:“公司的消費(fèi)策略依然處于飄忽不定的狀態(tài),而對(duì)TikTok的果斷收購(或策略投資)則意味著微軟已經(jīng)下定了決心,并嘗試與包括Facebook在內(nèi)的其他科技巨頭進(jìn)行競(jìng)爭(zhēng)。從公司管理層和董事會(huì)角度來看,我們認(rèn)為這是這10年難得一見的機(jī)遇,而且還可以輕易地拿到異常劃算的收購價(jià)格。”

簡(jiǎn)而言之:將TikTok收入麾下,再加上Xbox和領(lǐng)英,意味著微軟將押注重金,拉近這家B2B公司與消費(fèi)者的距離。

艾維斯寫道:“微軟在過去5年所做的任何賭注都是無可爭(zhēng)辯的,不過,公司一直在用欲蓋彌彰的消費(fèi)策略來掩蓋其缺失的一環(huán),如今,這個(gè)空缺可以通過TikTok以及價(jià)值重估/分類加總估值來彌補(bǔ)。”

反壟斷調(diào)查讓Facebook無緣TikTok資產(chǎn)

《財(cái)富》與SurveyMonkey在6月25-26日對(duì)1276名美國(guó)成年人所做的調(diào)查顯示,在美國(guó)成年人中,呼吁對(duì)Facebook (48%)與亞馬遜 (31%)進(jìn)行反壟斷調(diào)查的比例最高。在美國(guó)最大的五家科技公司中,要求對(duì)微軟進(jìn)行反壟斷調(diào)查(20%)或拆分(12%)的比例最低。

上個(gè)月,亞馬遜、蘋果、Facebook、谷歌均前往國(guó)會(huì)參加眾議院反壟斷委員會(huì)舉行的聽證會(huì)。然而,微軟首席執(zhí)行官薩特亞·納德拉收到的則是無需參會(huì)的通知。

這一切都意味著,微軟并不像其他大型科技公司那樣面臨著同樣的反壟斷問題,因此可以繼續(xù)開展這一交易。與此同時(shí),原本可作為TikTok天然著陸點(diǎn)的社交媒體巨頭Facebook,則只能將這一機(jī)會(huì)拱手讓人。(財(cái)富中文網(wǎng))

譯者:Feb

特朗普下令,字節(jié)跳動(dòng)必須在9月中旬前為其TikTok美國(guó)業(yè)務(wù)找到一個(gè)買家,并稱這家社交媒體平臺(tái)存在安全隱患。

TikTok本月22日宣布,公司將起訴特朗普政府,以阻止這次強(qiáng)制出售。然而與此同時(shí),像甲骨文和Twitter這類合適的候選公司已就購買TikTok與字節(jié)跳動(dòng)進(jìn)行了談判。然而正在就收購進(jìn)行協(xié)商的微軟才是最有可能的買家。

與其他科技巨頭不同的是,這家位于華盛頓州雷蒙德的軟件公司以其B2B銷售業(yè)務(wù)為主打,而不是消費(fèi)業(yè)務(wù)。那為什么微軟想將TikTok攬入懷中呢?為了尋找答案,《財(cái)富》翻閱了大量的分析師報(bào)告,并攜手SurveyMonkey于8月17-18日*對(duì)2478名美國(guó)成年人進(jìn)行了調(diào)查,以了解他們對(duì)社交媒體的態(tài)度以及使用規(guī)律。

TikTok + 領(lǐng)英將讓微軟成為社交媒體巨頭

TikTok的新用戶增速遠(yuǎn)超大部分社交媒體。然而《財(cái)富》的調(diào)查顯示,僅有11%的美國(guó)成年人使用這一應(yīng)用,依然遠(yuǎn)低于其競(jìng)爭(zhēng)對(duì)手。用戶數(shù)量最多的平臺(tái)是Facebook(65%)和Facebook旗下Instagram(35%)。然而,TikTok的內(nèi)部數(shù)據(jù)給出的用戶占比則要高得多,而且這其中的差距可能源于一個(gè)事實(shí):TikTok很大一部分用戶群都在18歲以下,因此并不在《財(cái)富》的調(diào)查之列。

然而對(duì)于微軟來說,如果TikTok再配上美國(guó)成人使用占比達(dá)到20%的領(lǐng)英,那么微軟將有資格在社交媒體領(lǐng)域與頂級(jí)選手Facebook一決高下。微軟在2016年以262億美元的價(jià)格收購了領(lǐng)英。

將TikTok納入麾下能夠讓微軟成為數(shù)字廣告業(yè)務(wù)的佼佼者。eMarketer的數(shù)據(jù)顯示,這一領(lǐng)域70%的市場(chǎng)份額歸屬于谷歌、Facebook和亞馬遜。

Wedbush Securities股票研究業(yè)務(wù)董事總經(jīng)理丹·艾維斯在8月的微軟評(píng)估中寫道:“微軟購買TikTok以及其美國(guó)業(yè)務(wù)可以解決該應(yīng)用的安全問題,而且能夠讓雷蒙德獲得消費(fèi)社交媒體領(lǐng)域的一個(gè)香餑餑,而此時(shí),其他FAANG同行(Facebook、Alphabet)都在經(jīng)歷大規(guī)模的反壟斷監(jiān)管審查,因此無法觸碰TikTok資產(chǎn)。”有意思的是,當(dāng)被問及擬議出售時(shí),50%的公眾稱他們并不同意強(qiáng)制出售TikTok。

TikTok將讓微軟俘獲Z一代

在18-24歲的年齡段中,僅有17%的人使用微軟旗下領(lǐng)英。就TikTok而言,這個(gè)數(shù)字則超過了兩倍,達(dá)到了42%。在這些青年成年人中,僅有Instagram (82%), Twitter (46%)和Facebook (46%)有著更高的用戶占比。

將TikTok收入囊中不僅會(huì)提升微軟社交媒體中的Z一代受眾數(shù)量,同時(shí)也會(huì)幫助公司在今后成為消費(fèi)業(yè)務(wù)領(lǐng)域更大的參與者。

這一豪賭將實(shí)現(xiàn)微軟業(yè)務(wù)的多元化

Wedbush稱,在微軟1.6萬億的市值中,約90%來自于企業(yè)云策略,包括Azure和Office 365。收購TikTok將幫助微軟實(shí)現(xiàn)其業(yè)務(wù)的多元化,并找到新的業(yè)務(wù)增長(zhǎng)點(diǎn)。

艾維斯在其8月對(duì)微軟的評(píng)估中寫道:“公司的消費(fèi)策略依然處于飄忽不定的狀態(tài),而對(duì)TikTok的果斷收購(或策略投資)則意味著微軟已經(jīng)下定了決心,并嘗試與包括Facebook在內(nèi)的其他科技巨頭進(jìn)行競(jìng)爭(zhēng)。從公司管理層和董事會(huì)角度來看,我們認(rèn)為這是這10年難得一見的機(jī)遇,而且還可以輕易地拿到異常劃算的收購價(jià)格。”

簡(jiǎn)而言之:將TikTok收入麾下,再加上Xbox和領(lǐng)英,意味著微軟將押注重金,拉近這家B2B公司與消費(fèi)者的距離。

艾維斯寫道:“微軟在過去5年所做的任何賭注都是無可爭(zhēng)辯的,不過,公司一直在用欲蓋彌彰的消費(fèi)策略來掩蓋其缺失的一環(huán),如今,這個(gè)空缺可以通過TikTok以及價(jià)值重估/分類加總估值來彌補(bǔ)。”

反壟斷調(diào)查讓Facebook無緣TikTok資產(chǎn)

《財(cái)富》與SurveyMonkey在6月25-26日對(duì)1276名美國(guó)成年人所做的調(diào)查顯示,在美國(guó)成年人中,呼吁對(duì)Facebook (48%)與亞馬遜 (31%)進(jìn)行反壟斷調(diào)查的比例最高。在美國(guó)最大的五家科技公司中,要求對(duì)微軟進(jìn)行反壟斷調(diào)查(20%)或拆分(12%)的比例最低。

上個(gè)月,亞馬遜、蘋果、Facebook、谷歌均前往國(guó)會(huì)參加眾議院反壟斷委員會(huì)舉行的聽證會(huì)。然而,微軟首席執(zhí)行官薩特亞·納德拉收到的則是無需參會(huì)的通知。

這一切都意味著,微軟并不像其他大型科技公司那樣面臨著同樣的反壟斷問題,因此可以繼續(xù)開展這一交易。與此同時(shí),原本可作為TikTok天然著陸點(diǎn)的社交媒體巨頭Facebook,則只能將這一機(jī)會(huì)拱手讓人。(財(cái)富中文網(wǎng))

譯者:Feb

President Donald Trump has given ByteDance until mid-September to find a buyer for its U.S. TikTok business, calling the social media platform a security threat.

TikTok announced Saturday it will sue the Trump administration to prevent the forced sale. But in the meantime suitors like, Oracle and Twitter, have already held preliminary talks to purchase TikTok. But it's Microsoft, which is working on a deal, that is the clear favorite.

Unlike other tech conglomerates, the Redmond, WA-based software company is known more for its B2B sales than consumer businesses. So why would Microsoft want TikTok? To find out Fortune scoured analyst reports and teamed up with SurveyMonkey to poll 2,478 U.S. adults between August 17 and 18* to find out more about their attitudes towards social media and usage patterns.

TikTok + LinkedIn would make Microsoft a social media giant

TikTok is adding users at a clip that far outpaces most social media platforms. However, with only 11% of U.S. adults using the app, according to Fortune's poll, it is still very behind its competition. The platforms with the most users are Facebook (65%) and Facebook-owned Instagram (35%). However, TikTok's internal numbers show a much higher usage rate, and some of that discrepancy could be explained by the fact that much of its user base are under the age of 18 so would not be reached in Fortune's polling.

But for Microsoft, if TikTok were paired with LinkedIn, which has 20% of U.S. adults using the platform, the company would have the footing to compete in the world of social media against top dog Facebook. Microsoft purchased LinkedIn in 2016 for $26.2 billion.

Adding TikTok would make Microsoft a major player in the digital ad business, which currently has 70% of market share going to Google, Facebook, and Amazon, according to eMarketer.

"Microsoft buying TikTok and these US operations would resolve the security issues with this app and also give Redmond a crown jewel on the consumer social media front at a time that other FAANG peers (Facebook, Alphabet) are under massive regulatory scrutiny with anti-trust concerns swirling and cannot go near the TikTok asset," Dan Ives, managing director of equity research at Wedbush Securities, wrote in an August assessment of Microsoft. Interestingly, when asked about a proposed sale, 50% of the public say they disapprove of a forced TikTok sale.

TikTok would give Microsoft an in with Gen Z

Among 18 to 24 year-olds, only 17% use Microsoft-owned LinkedIn. For TikTok, that number is more than double at 42%. Only Instagram (82%), Twitter (46%), and Facebook (46%) have a greater reach with young adults.

Adding TikTok would not only improve Microsoft's social media reach with Gen Zers, but it would help the company make a bigger consumer play in the years to come.

Big bet would diversify Microsoft's business

Around 90% of Microsoft's $1.6 trillion current valuation can be attributed to its enterprise cloud strategy, including Azure and Office 365, according to Wedbush. Acquiring TikTok would help Microsoft diversify its business and find new areas for growth.

"Its consumer strategy remains in flux and an aggressive acquisition (or strategic investment) of TikTok would be Microsoft throwing its hat in the ring and trying to compete with other tech giants such as Facebook in a new avenue of growth for the next decade for its consumer business," Ives wrote in his August assessment of Microsoft. "We believe from a management and Board perspective this is a unique deal of a decade opportunity with a price tag that could easily be consummated."

Simply put: Adding TikTok alongside its Xbox and LinkedIn, would represent an aggressive bet to move the B2B company closer with consumers.

"Its hard to argue with any bet MSFT has made over the last five years, although the missing piece in the puzzle has been a consumer trojan horse strategy which TikTok can fill along with a re-rating/sum-of-the-parts valuation," Ives wrote.

Antitrust pushback locks Facebook out of TikTok race

Facebook (48%) and Amazon (31%) have the highest percentage of U.S. adults calling for them to be investigated for antitrust, according to a Fortune and SurveyMonkey polled 1,276 U.S. adults between June 25 and 26. Among the country's five largest tech firms, Microsoft has the lowest percentage of U.S. adults calling for it be investigated for antitrust (20%) or to be broken-up (12%).

And last month when the CEOs of Amazon, Apple, Facebook, Google all went to Congress to testify before the House Antitrust Subcommittee, Microsoft CEO Satya Nadella was not asked to join.

This all indicates Microsoft doesn't face the same antitrust concerns as other Big Tech firms and can move forward with a bid. Meanwhile social media titan Facebook, which would have been a natural landing spot for TikTok, has to sit on the sidelines.