美國(guó)人說(shuō)“現(xiàn)金為王”是有道理的。

自從古代社會(huì),人們的交換方式從以鹽和牲畜進(jìn)行物物交換變成使用商品貨幣以來(lái),這種有價(jià)值的硬幣和紙幣便一直被沿用至今。美國(guó)在1776年尚未宣布獨(dú)立之前,就開(kāi)始發(fā)行貨幣,后來(lái)演變成了今天眾所周知的美鈔。

如今,現(xiàn)金僅次于借記卡,是美國(guó)第二種最常用的支付方式。但許多“無(wú)現(xiàn)金化”的支持者認(rèn)為,美鈔的時(shí)代即將結(jié)束。

隨著公共衛(wèi)生事件的爆發(fā),使用現(xiàn)金引起了人們對(duì)于衛(wèi)生和病毒傳播問(wèn)題的擔(dān)憂,盡管事實(shí)證明紙鈔的原料棉攜帶病毒顆粒的時(shí)間,與塑料信用卡和借記卡差不多,甚至更短。而且隨著全球數(shù)字化的日益普及,各種各樣的新技術(shù)不斷涌現(xiàn),讓商品和服務(wù)支付變得更簡(jiǎn)單、更流暢。

近幾年來(lái)現(xiàn)金的使用確實(shí)有所減少,但它不可能像無(wú)現(xiàn)金運(yùn)動(dòng)的支持者們所希望的那樣徹底消失。費(fèi)城、舊金山和紐約等多個(gè)城市最近都出臺(tái)了法律,禁止商戶僅接受銀行卡支付和無(wú)接觸支付。新澤西州在2019年通過(guò)了類似的法案,而馬薩諸塞州從1978年就已經(jīng)禁止商戶只接受無(wú)現(xiàn)金支付。

專家們列出了許多理由,來(lái)證明將現(xiàn)金作為一種可行的支付方案的必要性。比如,無(wú)現(xiàn)金社會(huì)將把成百上千萬(wàn)無(wú)銀行賬戶和缺少銀行服務(wù)的美國(guó)人排除在外,其中大部分是有色人種;現(xiàn)金是最好的支付方式,能夠保留一點(diǎn)點(diǎn)隱私;現(xiàn)金是許多文化習(xí)俗中不可分割的一部分,比如付小費(fèi)和贈(zèng)送禮物等;現(xiàn)金比數(shù)字支付更有彈性;最后,消費(fèi)者的選擇權(quán)是自由市場(chǎng)最重要的原則之一,而淘汰現(xiàn)金等于讓消費(fèi)者少了一種重要的支付方式。

美國(guó)消費(fèi)者法律中心的副主管勞倫?桑德斯說(shuō):“無(wú)現(xiàn)金運(yùn)動(dòng)是危險(xiǎn)的。”

無(wú)現(xiàn)金化不利于無(wú)銀行賬戶的人群和有色人種社區(qū)

聯(lián)邦存款保險(xiǎn)公司的“2017年無(wú)銀行賬戶與缺少銀行服務(wù)家庭普查”顯示,美國(guó)約6.5%的家庭(相當(dāng)于1,410萬(wàn)成年人加上640萬(wàn)兒童)沒(méi)有銀行賬戶,這意味著這些家庭沒(méi)有正規(guī)參保金融機(jī)構(gòu)的賬戶。還有18.7%的美國(guó)家庭缺少銀行服務(wù),這意味著這些家庭雖然至少有一個(gè)參保金融機(jī)構(gòu)的賬戶,但他們也在使用銀行系統(tǒng)以外的金融產(chǎn)品或服務(wù),例如工資日貸款或支票兌現(xiàn)服務(wù)等。

《消費(fèi)者調(diào)查報(bào)告》的高級(jí)政策顧問(wèn)克里斯蒂娜?泰特勞特表示:“顧名思義,任何無(wú)現(xiàn)金化的措施都會(huì)把這些群體排除在外。”

如果你有銀行賬戶,支票兌現(xiàn)和免費(fèi)轉(zhuǎn)賬都很方便。但沒(méi)有銀行賬戶的人通常必須使用支票兌現(xiàn)服務(wù)或者匯票,才能得到現(xiàn)金和進(jìn)行轉(zhuǎn)賬,這些服務(wù)的收費(fèi)很高。

彼得森國(guó)際經(jīng)濟(jì)研究所的研究員馬丁?喬真帕說(shuō):“貧窮是昂貴的,而沒(méi)有銀行賬戶更是要承擔(dān)極其高昂的代價(jià)。”

喬真帕稱,美國(guó)銀行業(yè)毫無(wú)必要地設(shè)置了較高的進(jìn)入門檻。這導(dǎo)致低收入者(往往是有色人種,特別是黑人)只能游離在正規(guī)經(jīng)濟(jì)之外。一直以來(lái),美國(guó)社會(huì)的各個(gè)方面都有排斥非白人的種族歧視歷史,這種傳統(tǒng)在銀行業(yè)中也展現(xiàn)出丑陋的一面。

簡(jiǎn)而言之,美國(guó)銀行系統(tǒng)絕不是為沒(méi)有可支配收入的人服務(wù)的。所以,中低收入者使用銀行系統(tǒng)的時(shí)候,受到的傷害要多過(guò)得到的幫助。例如,多數(shù)大銀行規(guī)定支票賬戶和儲(chǔ)蓄賬戶必須達(dá)到最低余額標(biāo)準(zhǔn),才能避免產(chǎn)生手續(xù)費(fèi)。泰特勞特說(shuō),這些手續(xù)費(fèi)和透支費(fèi)就是“沒(méi)錢要交的費(fèi)用。”

對(duì)窮人不利的銀行收費(fèi)還有ATM取款手續(xù)費(fèi)、電匯轉(zhuǎn)賬費(fèi)和借記卡刷卡費(fèi)等,而且肯定不止這些。這些費(fèi)用加起來(lái)是很大一筆支出。

《伯克利經(jīng)濟(jì)評(píng)論》的工作人員在一篇文章中寫道:“多數(shù)透支費(fèi)需要在三天內(nèi)繳清,2014年透支費(fèi)的中位數(shù)是34美元。但工資日貸款的年度百分利率在300%至600%之間;如果把透支手續(xù)費(fèi)視為三天內(nèi)償還的工資日貸款,則年度百分利率高達(dá)1,700%。”

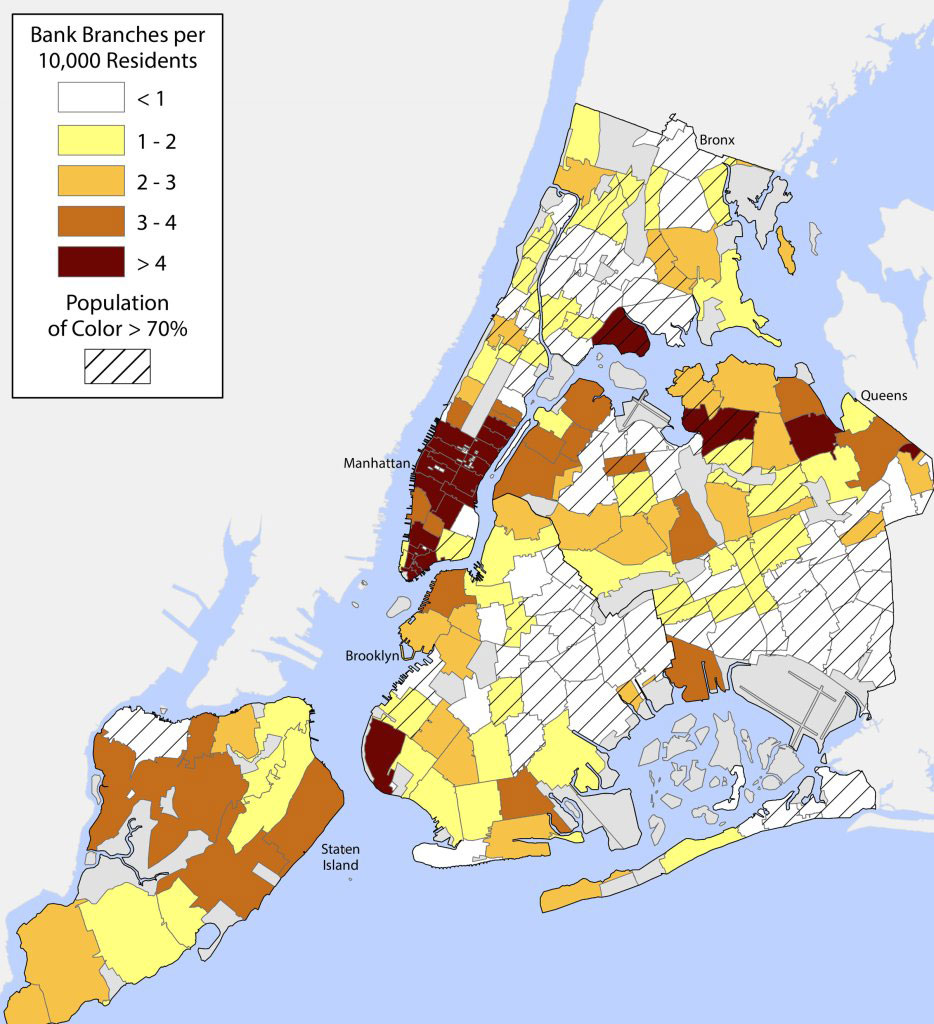

新經(jīng)濟(jì)項(xiàng)目的聯(lián)合執(zhí)行主任得伊阿尼拉?戴黎奧在今年1月前往美國(guó)眾議院金融服務(wù)委員會(huì)金融科技工作組作證時(shí)表示,正規(guī)經(jīng)濟(jì)不利于低收入人群和有色人種的另外一種表現(xiàn)是銀行網(wǎng)點(diǎn)的分布,在有色人種社區(qū)內(nèi),通常銀行網(wǎng)點(diǎn)很少甚至根本沒(méi)有銀行。

例如,根據(jù)聯(lián)邦存款保險(xiǎn)公司以及2015年美國(guó)社區(qū)調(diào)查的數(shù)據(jù)編制的新經(jīng)濟(jì)地圖顯示,在紐約市的有色人種社區(qū)中,平均每1萬(wàn)名居民有一家銀行。而在以白人為主的社區(qū)中,每1萬(wàn)名居民有3.5家銀行。

泰特勞特說(shuō),高手續(xù)費(fèi)、銀行網(wǎng)點(diǎn)不足,以及其他令人煩惱的現(xiàn)象,比如當(dāng)人們想要或者需要更小面額的時(shí)候,ATM機(jī)竟然只能取款20美元的鈔票,這些因素導(dǎo)致許多人的經(jīng)濟(jì)狀況不斷惡化。這迫使人們放棄了銀行賬戶和正規(guī)經(jīng)濟(jì),選擇了工資日貸款和支票兌現(xiàn)等非正規(guī)服務(wù),因?yàn)檫@類服務(wù)的收費(fèi)更低,更容易預(yù)測(cè)。她說(shuō),無(wú)銀行賬戶的人大部分都有過(guò)賬戶,只是他們出于上述原因棄用了自己的賬戶。

美國(guó)公民自由聯(lián)盟的高級(jí)政策分析師杰伊?斯坦利解釋了數(shù)十年來(lái)對(duì)有色人種社區(qū)不利的“數(shù)字紅線”現(xiàn)象。“數(shù)字紅線”這種說(shuō)法源自房地產(chǎn)市場(chǎng)拒絕向有色人種社區(qū)發(fā)放住房抵押貸款的“紅線政策”。數(shù)字紅線是指金融系統(tǒng)描繪有色人種客戶(尤其是黑人)的許多做法。金融系統(tǒng)通過(guò)這種做法來(lái)排斥有色人種,或者給予他們不公平的待遇。

有錢人的錢能生錢,比如在銀行賬戶中產(chǎn)生利息、在股票市場(chǎng)獲得股息,以及累積信用卡獎(jiǎng)勵(lì)積分等。但隨著通脹水平上升,無(wú)銀行賬戶的人如果存款不增加,實(shí)際上就是在賠錢。這種負(fù)回報(bào)率最終會(huì)讓沒(méi)有銀行賬戶的人的錢越來(lái)越少,經(jīng)濟(jì)狀況日益惡化,更無(wú)法參與到正規(guī)的數(shù)字化經(jīng)濟(jì)當(dāng)中。

泰特勞特指出:“人們之所以沒(méi)有方便進(jìn)行電子交易的銀行賬戶,基本上是出于結(jié)構(gòu)性的原因。”

諾桑比亞大學(xué)教授、金融技術(shù)與商業(yè)歷史專家伯納多?巴蒂茲-拉佐說(shuō),無(wú)現(xiàn)金運(yùn)動(dòng)要取得成功,并且避免過(guò)度損害無(wú)銀行賬戶和缺少銀行服務(wù)的人群的利益,就必須重新思考一直以來(lái)將這些人排除在外的銀行系統(tǒng)。

戴黎奧在作證時(shí)表示:“關(guān)于金融準(zhǔn)入差異的討論往往集中在個(gè)人的選擇和行為上,或者設(shè)計(jì)‘替代產(chǎn)品’的必要性上,它從未觸及到阻礙窮人、移民和有色人種享受主流金融機(jī)構(gòu)的服務(wù)和獲取自由的結(jié)構(gòu)性障礙。”

喬真帕表示,如果現(xiàn)金消失,無(wú)法使用最新金融技術(shù)付款的人將淪為二等公民。

支付系統(tǒng)歷史專家和《電子價(jià)值交換:VISA電子支付系統(tǒng)的起源》(Electronic Value Exchange: Origins of the VISA Electronic Payment System)一書(shū)的作者戴維?L?斯特恩斯說(shuō):“我想未來(lái)會(huì)出現(xiàn)嚴(yán)重的社會(huì)正義問(wèn)題,它將成為全面實(shí)現(xiàn)‘無(wú)現(xiàn)金化’的障礙。”

紐約市在1月下旬通過(guò)了對(duì)商戶的無(wú)現(xiàn)金禁令,市議會(huì)議員里奇?托里斯是該禁令的主要發(fā)起者。他說(shuō)商戶只接受無(wú)現(xiàn)金支付“雖然本意不是歧視,但實(shí)際上就是一種歧視行為。”但他補(bǔ)充說(shuō),店主知道哪些人傾向于現(xiàn)金支付,哪些人選擇無(wú)現(xiàn)金支付,就可以控制其店鋪的購(gòu)物者,歧視行為就會(huì)變得更明顯。

無(wú)現(xiàn)金社會(huì)侵犯隱私

在數(shù)字化的現(xiàn)代世界,人們每天都在失去越來(lái)越多的隱私——假如我們還有任何隱私的話。現(xiàn)金是目前最好的匿名支付方式,它對(duì)隱私的保護(hù)連加密貨幣也無(wú)法比擬。

斯特恩斯表示,人們想要匿名有許多原因,并非全都是出于不法目的。在金融領(lǐng)域,無(wú)論是秘密交易、免稅付款,還是用夫妻共有的銀行賬戶為配偶買禮物,保密都很重要。

斯坦利說(shuō),數(shù)據(jù)販賣行業(yè)已經(jīng)成了一個(gè)完整的產(chǎn)業(yè)鏈,他們對(duì)消費(fèi)者財(cái)務(wù)記錄中的數(shù)據(jù)垂涎不已。他認(rèn)為,國(guó)會(huì)對(duì)于薄弱的隱私法律不聞不問(wèn),不進(jìn)行修改,對(duì)數(shù)據(jù)庫(kù)和金融服務(wù)公司能夠與誰(shuí)分享哪些信息,幾乎沒(méi)有任何限制。

斯坦利在為美國(guó)公民自由聯(lián)盟發(fā)布的一篇博文中詳細(xì)解釋了公司如何從極少的信息中獲取大量資料。消費(fèi)者把信用卡交給賣家付款,賣家至少能獲得消費(fèi)者的全名。將客戶的姓名與詢問(wèn)或猜測(cè)出(多數(shù)交易中都會(huì)有信用卡的注冊(cè)郵編)的郵政編碼相結(jié)合,所得出的信息之多讓人震驚。賣家使用“數(shù)據(jù)附加”服務(wù),可以通過(guò)客戶的姓名和郵政編碼獲得客戶的通信地址、電子郵件和手機(jī)號(hào)。賣家通過(guò)這些資料可以進(jìn)入龐大的數(shù)據(jù)庫(kù),查詢到更多信息。

根據(jù)1999年《金融服務(wù)現(xiàn)代化法案》,公司可以向任何人出售客戶的財(cái)務(wù)數(shù)據(jù)。但在聯(lián)邦法規(guī)下,消費(fèi)者沒(méi)有任何隱私可言,除非他們采取措施選擇退出與可能掌握其信息的每一家公司的數(shù)據(jù)共享。

現(xiàn)金是消費(fèi)者保持匿名的最后一種手段,使消費(fèi)者可以真正保密其購(gòu)買信息,避免大量數(shù)據(jù)落入公司手中讓他們從中牟利,或者避免出現(xiàn)更糟糕的后果,被黑客盜取數(shù)據(jù)。

另外,盡管加密貨幣聲稱可以對(duì)用戶的信息保密,但有許多種方法都能追溯到比特幣的前主人。

現(xiàn)金扎根于我們的文化當(dāng)中

當(dāng)一位友善的女士把你的所有行李送到酒店房間的時(shí)候,如果你無(wú)法遞給她五美元小費(fèi),你怎么辦?假如在春節(jié)的時(shí)候,你無(wú)法用紅包裝著嶄新的鈔票送給孩子做禮物呢?

在談?wù)撎蕴F(xiàn)金的好處時(shí),我們忘掉了許多文化習(xí)俗。斯特恩斯說(shuō),從給小費(fèi)到送禮物再到收藏,現(xiàn)金深深植根于我們的習(xí)俗當(dāng)中。

在美國(guó),人們用現(xiàn)金向提供服務(wù)的人支付小費(fèi),比如機(jī)場(chǎng)巴士的司機(jī)等,這并不是一種強(qiáng)制性交易。美國(guó)人還會(huì)教孩子金錢的知識(shí)和如何用現(xiàn)金做預(yù)算,每周用現(xiàn)金給孩子零花錢,對(duì)因?yàn)槟挲g太小而沒(méi)有銀行賬戶的孩子用現(xiàn)金作為對(duì)他們做家務(wù)等活動(dòng)的獎(jiǎng)勵(lì)。

在印度南部的文化中,人們會(huì)舉行kuri kalyanam派對(duì),主人會(huì)在派對(duì)上籌款,而客人則會(huì)帶來(lái)現(xiàn)金捐款。當(dāng)主人獲邀參加其他人的kuri kalyanam派對(duì)時(shí),他們會(huì)捐出自己所收到的錢的兩倍。

在希臘、墨西哥和波蘭等國(guó)家的婚禮上,賓客會(huì)在新婚夫婦跳舞的時(shí)候,把鈔票別在新人的衣服上。

斯特恩斯說(shuō),這些風(fēng)俗的關(guān)鍵是有像現(xiàn)金這樣的有價(jià)值的實(shí)物。如果現(xiàn)金消失,這些傳統(tǒng)習(xí)俗也將不復(fù)存在。

當(dāng)技術(shù)失靈的時(shí)候……

在最糟糕的情境下,假如互聯(lián)網(wǎng)無(wú)法使用,我們?cè)撊绾问褂米约旱腻X?這種假設(shè)似乎有些牽強(qiáng),但這是在制定法律和創(chuàng)建基礎(chǔ)架構(gòu)的時(shí)候必須考慮的一個(gè)重要問(wèn)題。當(dāng)技術(shù)失靈的時(shí)候,現(xiàn)金依舊存在。

巴蒂茲-拉佐說(shuō):“我們需要現(xiàn)金,因?yàn)槲覀儽仨氂袀溆孟到y(tǒng)。”

他說(shuō),如今美國(guó)的經(jīng)濟(jì)活動(dòng)都圍繞著現(xiàn)金展開(kāi),現(xiàn)在確實(shí)需要重新思考消費(fèi)者花錢的方式。但他認(rèn)為現(xiàn)金的存在依舊重要,當(dāng)技術(shù)無(wú)法正常運(yùn)行時(shí),現(xiàn)金就是“定海神針”。

斯坦利寫道,電子支付系統(tǒng)的彈性無(wú)法與現(xiàn)金相比,它可能導(dǎo)致消費(fèi)者面臨集中故障點(diǎn)的影響。他在為美國(guó)公民自由聯(lián)盟撰寫的博文中寫道:“如果因?yàn)楹诳汀⒐倭胖髁x錯(cuò)誤或自然災(zāi)害而導(dǎo)致消費(fèi)者無(wú)法使用自己的賬戶,沒(méi)有了現(xiàn)金就讓他們沒(méi)有選擇。”

消費(fèi)者選擇權(quán)是關(guān)鍵

泰特勞特說(shuō):“消費(fèi)者的支付選擇權(quán)是關(guān)鍵。”

專家們認(rèn)為未來(lái)不會(huì)進(jìn)入無(wú)現(xiàn)金社會(huì)的一個(gè)關(guān)鍵原因是,無(wú)現(xiàn)金即使有再多的價(jià)值,也比不過(guò)被奪走的自由的價(jià)值。

提到現(xiàn)金使用,桑德斯說(shuō):“減少使用是一回事。淘汰現(xiàn)金是另一回事。”

她還提到了消費(fèi)者選擇支付聯(lián)盟等團(tuán)體。該聯(lián)盟由消費(fèi)者代表和企業(yè)組成,致力于維護(hù)消費(fèi)者選擇現(xiàn)金支付的權(quán)利。

舊金山聯(lián)邦儲(chǔ)備銀行在2019年的“消費(fèi)者支付選擇日記”中明確表明,消費(fèi)者重視現(xiàn)金這種支付方式的價(jià)值,雖然他們只是將現(xiàn)金作為數(shù)字支付的一種備用方式。該日記還顯示,現(xiàn)金是小額交易的首選支付類型,10美元以下的交易接近一半是使用現(xiàn)金支付,25美元以下的交易使用現(xiàn)金支付的比例為42%。

雖然現(xiàn)金使用量每年都在逐步減少,但它依舊是美國(guó)人財(cái)務(wù)生活中的一種重要選擇。

無(wú)現(xiàn)金化合法嗎?

《美國(guó)法典》有關(guān)美國(guó)貨幣制度的一個(gè)章節(jié)中規(guī)定,“美國(guó)的硬幣和紙幣是所有債務(wù)、公共收費(fèi)、稅費(fèi)和應(yīng)付稅款的法定貨幣。”這聽(tīng)起來(lái)是似乎任何地方都必須接受現(xiàn)金,對(duì)嗎?事實(shí)上并非如此。

所有美國(guó)鑄造的貨幣都是向債權(quán)人償還債務(wù)的有效方式,但沒(méi)有任何聯(lián)邦法規(guī)規(guī)定私人企業(yè)、個(gè)人或機(jī)構(gòu)必須接受用現(xiàn)金支付商品和服務(wù)的費(fèi)用。

由于聯(lián)邦政府和州政府負(fù)責(zé)管理政府服務(wù),而且沒(méi)有聯(lián)邦法律強(qiáng)制接受現(xiàn)金,因此禁止無(wú)現(xiàn)金化的責(zé)任就落在了市立法者的身上。地方政府必須行動(dòng)起來(lái)填補(bǔ)空缺,保護(hù)無(wú)銀行賬戶人群和少數(shù)群體,因?yàn)樗麄冇绕鋾?huì)被商戶只接受無(wú)現(xiàn)金付款的行為影響。

紐約市禁止無(wú)現(xiàn)金化法案的主要發(fā)起者托里斯說(shuō):“我別無(wú)選擇,只能推動(dòng)針對(duì)這些邊緣領(lǐng)域進(jìn)行立法。”

紐約市的法案在2018年11月頒布以后,遭到了一些已經(jīng)施行無(wú)現(xiàn)金化的商戶、技術(shù)公司和信用卡公司(主要是萬(wàn)事達(dá)卡公司)的反對(duì)。他說(shuō),許多科技行業(yè)的從業(yè)者感覺(jué)抓住現(xiàn)金不放,對(duì)于真正的系統(tǒng)性問(wèn)題來(lái)說(shuō)只是權(quán)宜之計(jì),是一種反科技的做法。

托里斯說(shuō)禁止商戶只接受無(wú)現(xiàn)金支付,并不會(huì)阻止技術(shù)的應(yīng)用或進(jìn)步,只是給人們提供了更多選擇。他說(shuō)他認(rèn)為應(yīng)該用法律解決導(dǎo)致許多人沒(méi)有銀行賬戶的諸多問(wèn)題,但眼下必須通過(guò)禁止無(wú)現(xiàn)金化來(lái)保護(hù)無(wú)銀行賬戶群體。

他預(yù)計(jì):“人們會(huì)減少抗拒心理。”但他認(rèn)為,在此之前,我們不能把金融技術(shù)強(qiáng)制應(yīng)用到無(wú)銀行賬戶和缺少銀行服務(wù)的人群或者擔(dān)心隱私問(wèn)題的人身上。

進(jìn)入無(wú)現(xiàn)金社會(huì)?早著呢!

雖然科技界有些人在大聲疾呼,但現(xiàn)金肯定不會(huì)消失。

巴蒂茲-拉佐等專家認(rèn)為,特殊時(shí)期將推動(dòng)支付領(lǐng)域發(fā)生變化,但并不足以淘汰現(xiàn)金。他認(rèn)為,這種變化會(huì)促使政府出臺(tái)更強(qiáng)有力的法律,保護(hù)消費(fèi)者的財(cái)務(wù)數(shù)據(jù),重新評(píng)估萬(wàn)事達(dá)卡和Visa等大型金融技術(shù)公司所扮演的角色,甚至可能會(huì)拆分這些公司。

巴蒂茲-拉佐說(shuō):“希望有開(kāi)明的人能記住,他們必須照顧到弱勢(shì)消費(fèi)者。”這樣美國(guó)的金融系統(tǒng)將變得越來(lái)越好。

貨幣歷史學(xué)家斯特恩斯說(shuō),無(wú)現(xiàn)金運(yùn)動(dòng)早在上世紀(jì)60年代末和70年代初就已經(jīng)開(kāi)始,經(jīng)過(guò)了這么多年依舊沒(méi)有成為主流。

泰特勞特說(shuō):“現(xiàn)金使用量的減少被夸大了。多年來(lái)一直有現(xiàn)金消失的說(shuō)法,現(xiàn)在確實(shí)有許多人更多地使用電子支付,但我依舊認(rèn)可現(xiàn)金為王的觀點(diǎn)。”

有些專家認(rèn)為當(dāng)今美國(guó)經(jīng)濟(jì)的運(yùn)行方式是“輕現(xiàn)金化”,即消費(fèi)者有許多支付方式可供選擇,并且多數(shù)人選擇數(shù)字支付。但現(xiàn)金依舊是一種重要的支付方式,并將繼續(xù)存在下去。

即使有令人興奮的新技術(shù)誕生,人們依舊會(huì)回歸現(xiàn)金支付。在公共事件爆發(fā)之初,有人擔(dān)心使用現(xiàn)金可能會(huì)增加感染病毒的風(fēng)險(xiǎn),但實(shí)際上人們對(duì)紙幣的使用率與2019年秋季相同。

斯特恩斯說(shuō):“在付款方式這方面,我們是非常固執(zhí)的。”

所以,盡管有人說(shuō)無(wú)現(xiàn)金化代表了未來(lái),但專家們認(rèn)為這個(gè)未來(lái)不會(huì)太早來(lái)臨。

正如斯坦利所說(shuō):“有時(shí)候,最古老、最簡(jiǎn)單的東西有其自身的價(jià)值,并且有理由繼續(xù)存在下去。”(財(cái)富中文網(wǎng))

譯者:Biz

美國(guó)人說(shuō)“現(xiàn)金為王”是有道理的。

自從古代社會(huì),人們的交換方式從以鹽和牲畜進(jìn)行物物交換變成使用商品貨幣以來(lái),這種有價(jià)值的硬幣和紙幣便一直被沿用至今。美國(guó)在1776年尚未宣布獨(dú)立之前,就開(kāi)始發(fā)行貨幣,后來(lái)演變成了今天眾所周知的美鈔。

如今,現(xiàn)金僅次于借記卡,是美國(guó)第二種最常用的支付方式。但許多“無(wú)現(xiàn)金化”的支持者認(rèn)為,美鈔的時(shí)代即將結(jié)束。

隨著公共衛(wèi)生事件的爆發(fā),使用現(xiàn)金引起了人們對(duì)于衛(wèi)生和病毒傳播問(wèn)題的擔(dān)憂,盡管事實(shí)證明紙鈔的原料棉攜帶病毒顆粒的時(shí)間,與塑料信用卡和借記卡差不多,甚至更短。而且隨著全球數(shù)字化的日益普及,各種各樣的新技術(shù)不斷涌現(xiàn),讓商品和服務(wù)支付變得更簡(jiǎn)單、更流暢。

如今,現(xiàn)金僅次于借記卡,是美國(guó)第二種最常用的支付方式。但許多“無(wú)現(xiàn)金化”的支持者認(rèn)為,美鈔的時(shí)代即將結(jié)束。

近幾年來(lái)現(xiàn)金的使用確實(shí)有所減少,但它不可能像無(wú)現(xiàn)金運(yùn)動(dòng)的支持者們所希望的那樣徹底消失。費(fèi)城、舊金山和紐約等多個(gè)城市最近都出臺(tái)了法律,禁止商戶僅接受銀行卡支付和無(wú)接觸支付。新澤西州在2019年通過(guò)了類似的法案,而馬薩諸塞州從1978年就已經(jīng)禁止商戶只接受無(wú)現(xiàn)金支付。

專家們列出了許多理由,來(lái)證明將現(xiàn)金作為一種可行的支付方案的必要性。比如,無(wú)現(xiàn)金社會(huì)將把成百上千萬(wàn)無(wú)銀行賬戶和缺少銀行服務(wù)的美國(guó)人排除在外,其中大部分是有色人種;現(xiàn)金是最好的支付方式,能夠保留一點(diǎn)點(diǎn)隱私;現(xiàn)金是許多文化習(xí)俗中不可分割的一部分,比如付小費(fèi)和贈(zèng)送禮物等;現(xiàn)金比數(shù)字支付更有彈性;最后,消費(fèi)者的選擇權(quán)是自由市場(chǎng)最重要的原則之一,而淘汰現(xiàn)金等于讓消費(fèi)者少了一種重要的支付方式。

美國(guó)消費(fèi)者法律中心的副主管勞倫?桑德斯說(shuō):“無(wú)現(xiàn)金運(yùn)動(dòng)是危險(xiǎn)的。”

無(wú)現(xiàn)金化不利于無(wú)銀行賬戶的人群和有色人種社區(qū)

聯(lián)邦存款保險(xiǎn)公司的“2017年無(wú)銀行賬戶與缺少銀行服務(wù)家庭普查”顯示,美國(guó)約6.5%的家庭(相當(dāng)于1,410萬(wàn)成年人加上640萬(wàn)兒童)沒(méi)有銀行賬戶,這意味著這些家庭沒(méi)有正規(guī)參保金融機(jī)構(gòu)的賬戶。還有18.7%的美國(guó)家庭缺少銀行服務(wù),這意味著這些家庭雖然至少有一個(gè)參保金融機(jī)構(gòu)的賬戶,但他們也在使用銀行系統(tǒng)以外的金融產(chǎn)品或服務(wù),例如工資日貸款或支票兌現(xiàn)服務(wù)等。

《消費(fèi)者調(diào)查報(bào)告》的高級(jí)政策顧問(wèn)克里斯蒂娜?泰特勞特表示:“顧名思義,任何無(wú)現(xiàn)金化的措施都會(huì)把這些群體排除在外。”

如果你有銀行賬戶,支票兌現(xiàn)和免費(fèi)轉(zhuǎn)賬都很方便。但沒(méi)有銀行賬戶的人通常必須使用支票兌現(xiàn)服務(wù)或者匯票,才能得到現(xiàn)金和進(jìn)行轉(zhuǎn)賬,這些服務(wù)的收費(fèi)很高。

彼得森國(guó)際經(jīng)濟(jì)研究所的研究員馬丁?喬真帕說(shuō):“貧窮是昂貴的,而沒(méi)有銀行賬戶更是要承擔(dān)極其高昂的代價(jià)。”

喬真帕稱,美國(guó)銀行業(yè)毫無(wú)必要地設(shè)置了較高的進(jìn)入門檻。這導(dǎo)致低收入者(往往是有色人種,特別是黑人)只能游離在正規(guī)經(jīng)濟(jì)之外。一直以來(lái),美國(guó)社會(huì)的各個(gè)方面都有排斥非白人的種族歧視歷史,這種傳統(tǒng)在銀行業(yè)中也展現(xiàn)出丑陋的一面。

簡(jiǎn)而言之,美國(guó)銀行系統(tǒng)絕不是為沒(méi)有可支配收入的人服務(wù)的。所以,中低收入者使用銀行系統(tǒng)的時(shí)候,受到的傷害要多過(guò)得到的幫助。例如,多數(shù)大銀行規(guī)定支票賬戶和儲(chǔ)蓄賬戶必須達(dá)到最低余額標(biāo)準(zhǔn),才能避免產(chǎn)生手續(xù)費(fèi)。泰特勞特說(shuō),這些手續(xù)費(fèi)和透支費(fèi)就是“沒(méi)錢要交的費(fèi)用。”

對(duì)窮人不利的銀行收費(fèi)還有ATM取款手續(xù)費(fèi)、電匯轉(zhuǎn)賬費(fèi)和借記卡刷卡費(fèi)等,而且肯定不止這些。這些費(fèi)用加起來(lái)是很大一筆支出。

《伯克利經(jīng)濟(jì)評(píng)論》的工作人員在一篇文章中寫道:“多數(shù)透支費(fèi)需要在三天內(nèi)繳清,2014年透支費(fèi)的中位數(shù)是34美元。但工資日貸款的年度百分利率在300%至600%之間;如果把透支手續(xù)費(fèi)視為三天內(nèi)償還的工資日貸款,則年度百分利率高達(dá)1,700%。”

新經(jīng)濟(jì)項(xiàng)目的聯(lián)合執(zhí)行主任得伊阿尼拉?戴黎奧在今年1月前往美國(guó)眾議院金融服務(wù)委員會(huì)金融科技工作組作證時(shí)表示,正規(guī)經(jīng)濟(jì)不利于低收入人群和有色人種的另外一種表現(xiàn)是銀行網(wǎng)點(diǎn)的分布,在有色人種社區(qū)內(nèi),通常銀行網(wǎng)點(diǎn)很少甚至根本沒(méi)有銀行。

例如,根據(jù)聯(lián)邦存款保險(xiǎn)公司以及2015年美國(guó)社區(qū)調(diào)查的數(shù)據(jù)編制的新經(jīng)濟(jì)地圖顯示,在紐約市的有色人種社區(qū)中,平均每1萬(wàn)名居民有一家銀行。而在以白人為主的社區(qū)中,每1萬(wàn)名居民有3.5家銀行。

泰特勞特說(shuō),高手續(xù)費(fèi)、銀行網(wǎng)點(diǎn)不足,以及其他令人煩惱的現(xiàn)象,比如當(dāng)人們想要或者需要更小面額的時(shí)候,ATM機(jī)竟然只能取款20美元的鈔票,這些因素導(dǎo)致許多人的經(jīng)濟(jì)狀況不斷惡化。這迫使人們放棄了銀行賬戶和正規(guī)經(jīng)濟(jì),選擇了工資日貸款和支票兌現(xiàn)等非正規(guī)服務(wù),因?yàn)檫@類服務(wù)的收費(fèi)更低,更容易預(yù)測(cè)。她說(shuō),無(wú)銀行賬戶的人大部分都有過(guò)賬戶,只是他們出于上述原因棄用了自己的賬戶。

美國(guó)公民自由聯(lián)盟的高級(jí)政策分析師杰伊?斯坦利解釋了數(shù)十年來(lái)對(duì)有色人種社區(qū)不利的“數(shù)字紅線”現(xiàn)象。“數(shù)字紅線”這種說(shuō)法源自房地產(chǎn)市場(chǎng)拒絕向有色人種社區(qū)發(fā)放住房抵押貸款的“紅線政策”。數(shù)字紅線是指金融系統(tǒng)描繪有色人種客戶(尤其是黑人)的許多做法。金融系統(tǒng)通過(guò)這種做法來(lái)排斥有色人種,或者給予他們不公平的待遇。

有錢人的錢能生錢,比如在銀行賬戶中產(chǎn)生利息、在股票市場(chǎng)獲得股息,以及累積信用卡獎(jiǎng)勵(lì)積分等。但隨著通脹水平上升,無(wú)銀行賬戶的人如果存款不增加,實(shí)際上就是在賠錢。這種負(fù)回報(bào)率最終會(huì)讓沒(méi)有銀行賬戶的人的錢越來(lái)越少,經(jīng)濟(jì)狀況日益惡化,更無(wú)法參與到正規(guī)的數(shù)字化經(jīng)濟(jì)當(dāng)中。

泰特勞特指出:“人們之所以沒(méi)有方便進(jìn)行電子交易的銀行賬戶,基本上是出于結(jié)構(gòu)性的原因。”

諾桑比亞大學(xué)教授、金融技術(shù)與商業(yè)歷史專家伯納多?巴蒂茲-拉佐說(shuō),無(wú)現(xiàn)金運(yùn)動(dòng)要取得成功,并且避免過(guò)度損害無(wú)銀行賬戶和缺少銀行服務(wù)的人群的利益,就必須重新思考一直以來(lái)將這些人排除在外的銀行系統(tǒng)。

戴黎奧在作證時(shí)表示:“關(guān)于金融準(zhǔn)入差異的討論往往集中在個(gè)人的選擇和行為上,或者設(shè)計(jì)‘替代產(chǎn)品’的必要性上,它從未觸及到阻礙窮人、移民和有色人種享受主流金融機(jī)構(gòu)的服務(wù)和獲取自由的結(jié)構(gòu)性障礙。”

喬真帕表示,如果現(xiàn)金消失,無(wú)法使用最新金融技術(shù)付款的人將淪為二等公民。

支付系統(tǒng)歷史專家和《電子價(jià)值交換:VISA電子支付系統(tǒng)的起源》(Electronic Value Exchange: Origins of the VISA Electronic Payment System)一書(shū)的作者戴維?L?斯特恩斯說(shuō):“我想未來(lái)會(huì)出現(xiàn)嚴(yán)重的社會(huì)正義問(wèn)題,它將成為全面實(shí)現(xiàn)‘無(wú)現(xiàn)金化’的障礙。”

紐約市在1月下旬通過(guò)了對(duì)商戶的無(wú)現(xiàn)金禁令,市議會(huì)議員里奇?托里斯是該禁令的主要發(fā)起者。他說(shuō)商戶只接受無(wú)現(xiàn)金支付“雖然本意不是歧視,但實(shí)際上就是一種歧視行為。”但他補(bǔ)充說(shuō),店主知道哪些人傾向于現(xiàn)金支付,哪些人選擇無(wú)現(xiàn)金支付,就可以控制其店鋪的購(gòu)物者,歧視行為就會(huì)變得更明顯。

無(wú)現(xiàn)金社會(huì)侵犯隱私

在數(shù)字化的現(xiàn)代世界,人們每天都在失去越來(lái)越多的隱私——假如我們還有任何隱私的話。現(xiàn)金是目前最好的匿名支付方式,它對(duì)隱私的保護(hù)連加密貨幣也無(wú)法比擬。

斯特恩斯表示,人們想要匿名有許多原因,并非全都是出于不法目的。在金融領(lǐng)域,無(wú)論是秘密交易、免稅付款,還是用夫妻共有的銀行賬戶為配偶買禮物,保密都很重要。

斯坦利說(shuō),數(shù)據(jù)販賣行業(yè)已經(jīng)成了一個(gè)完整的產(chǎn)業(yè)鏈,他們對(duì)消費(fèi)者財(cái)務(wù)記錄中的數(shù)據(jù)垂涎不已。他認(rèn)為,國(guó)會(huì)對(duì)于薄弱的隱私法律不聞不問(wèn),不進(jìn)行修改,對(duì)數(shù)據(jù)庫(kù)和金融服務(wù)公司能夠與誰(shuí)分享哪些信息,幾乎沒(méi)有任何限制。

斯坦利在為美國(guó)公民自由聯(lián)盟發(fā)布的一篇博文中詳細(xì)解釋了公司如何從極少的信息中獲取大量資料。消費(fèi)者把信用卡交給賣家付款,賣家至少能獲得消費(fèi)者的全名。將客戶的姓名與詢問(wèn)或猜測(cè)出(多數(shù)交易中都會(huì)有信用卡的注冊(cè)郵編)的郵政編碼相結(jié)合,所得出的信息之多讓人震驚。賣家使用“數(shù)據(jù)附加”服務(wù),可以通過(guò)客戶的姓名和郵政編碼獲得客戶的通信地址、電子郵件和手機(jī)號(hào)。賣家通過(guò)這些資料可以進(jìn)入龐大的數(shù)據(jù)庫(kù),查詢到更多信息。

根據(jù)1999年《金融服務(wù)現(xiàn)代化法案》,公司可以向任何人出售客戶的財(cái)務(wù)數(shù)據(jù)。但在聯(lián)邦法規(guī)下,消費(fèi)者沒(méi)有任何隱私可言,除非他們采取措施選擇退出與可能掌握其信息的每一家公司的數(shù)據(jù)共享。

現(xiàn)金是消費(fèi)者保持匿名的最后一種手段,使消費(fèi)者可以真正保密其購(gòu)買信息,避免大量數(shù)據(jù)落入公司手中讓他們從中牟利,或者避免出現(xiàn)更糟糕的后果,被黑客盜取數(shù)據(jù)。

另外,盡管加密貨幣聲稱可以對(duì)用戶的信息保密,但有許多種方法都能追溯到比特幣的前主人。

現(xiàn)金扎根于我們的文化當(dāng)中

當(dāng)一位友善的女士把你的所有行李送到酒店房間的時(shí)候,如果你無(wú)法遞給她五美元小費(fèi),你怎么辦?假如在春節(jié)的時(shí)候,你無(wú)法用紅包裝著嶄新的鈔票送給孩子做禮物呢?

在談?wù)撎蕴F(xiàn)金的好處時(shí),我們忘掉了許多文化習(xí)俗。斯特恩斯說(shuō),從給小費(fèi)到送禮物再到收藏,現(xiàn)金深深植根于我們的習(xí)俗當(dāng)中。

在美國(guó),人們用現(xiàn)金向提供服務(wù)的人支付小費(fèi),比如機(jī)場(chǎng)巴士的司機(jī)等,這并不是一種強(qiáng)制性交易。美國(guó)人還會(huì)教孩子金錢的知識(shí)和如何用現(xiàn)金做預(yù)算,每周用現(xiàn)金給孩子零花錢,對(duì)因?yàn)槟挲g太小而沒(méi)有銀行賬戶的孩子用現(xiàn)金作為對(duì)他們做家務(wù)等活動(dòng)的獎(jiǎng)勵(lì)。

在印度南部的文化中,人們會(huì)舉行kuri kalyanam派對(duì),主人會(huì)在派對(duì)上籌款,而客人則會(huì)帶來(lái)現(xiàn)金捐款。當(dāng)主人獲邀參加其他人的kuri kalyanam派對(duì)時(shí),他們會(huì)捐出自己所收到的錢的兩倍。

在希臘、墨西哥和波蘭等國(guó)家的婚禮上,賓客會(huì)在新婚夫婦跳舞的時(shí)候,把鈔票別在新人的衣服上。

斯特恩斯說(shuō),這些風(fēng)俗的關(guān)鍵是有像現(xiàn)金這樣的有價(jià)值的實(shí)物。如果現(xiàn)金消失,這些傳統(tǒng)習(xí)俗也將不復(fù)存在。

當(dāng)技術(shù)失靈的時(shí)候……

在最糟糕的情境下,假如互聯(lián)網(wǎng)無(wú)法使用,我們?cè)撊绾问褂米约旱腻X?這種假設(shè)似乎有些牽強(qiáng),但這是在制定法律和創(chuàng)建基礎(chǔ)架構(gòu)的時(shí)候必須考慮的一個(gè)重要問(wèn)題。當(dāng)技術(shù)失靈的時(shí)候,現(xiàn)金依舊存在。

巴蒂茲-拉佐說(shuō):“我們需要現(xiàn)金,因?yàn)槲覀儽仨氂袀溆孟到y(tǒng)。”

他說(shuō),如今美國(guó)的經(jīng)濟(jì)活動(dòng)都圍繞著現(xiàn)金展開(kāi),現(xiàn)在確實(shí)需要重新思考消費(fèi)者花錢的方式。但他認(rèn)為現(xiàn)金的存在依舊重要,當(dāng)技術(shù)無(wú)法正常運(yùn)行時(shí),現(xiàn)金就是“定海神針”。

斯坦利寫道,電子支付系統(tǒng)的彈性無(wú)法與現(xiàn)金相比,它可能導(dǎo)致消費(fèi)者面臨集中故障點(diǎn)的影響。他在為美國(guó)公民自由聯(lián)盟撰寫的博文中寫道:“如果因?yàn)楹诳汀⒐倭胖髁x錯(cuò)誤或自然災(zāi)害而導(dǎo)致消費(fèi)者無(wú)法使用自己的賬戶,沒(méi)有了現(xiàn)金就讓他們沒(méi)有選擇。”

消費(fèi)者選擇權(quán)是關(guān)鍵

泰特勞特說(shuō):“消費(fèi)者的支付選擇權(quán)是關(guān)鍵。”

專家們認(rèn)為未來(lái)不會(huì)進(jìn)入無(wú)現(xiàn)金社會(huì)的一個(gè)關(guān)鍵原因是,無(wú)現(xiàn)金即使有再多的價(jià)值,也比不過(guò)被奪走的自由的價(jià)值。

提到現(xiàn)金使用,桑德斯說(shuō):“減少使用是一回事。淘汰現(xiàn)金是另一回事。”

她還提到了消費(fèi)者選擇支付聯(lián)盟等團(tuán)體。該聯(lián)盟由消費(fèi)者代表和企業(yè)組成,致力于維護(hù)消費(fèi)者選擇現(xiàn)金支付的權(quán)利。

舊金山聯(lián)邦儲(chǔ)備銀行在2019年的“消費(fèi)者支付選擇日記”中明確表明,消費(fèi)者重視現(xiàn)金這種支付方式的價(jià)值,雖然他們只是將現(xiàn)金作為數(shù)字支付的一種備用方式。該日記還顯示,現(xiàn)金是小額交易的首選支付類型,10美元以下的交易接近一半是使用現(xiàn)金支付,25美元以下的交易使用現(xiàn)金支付的比例為42%。

雖然現(xiàn)金使用量每年都在逐步減少,但它依舊是美國(guó)人財(cái)務(wù)生活中的一種重要選擇。

無(wú)現(xiàn)金化合法嗎?

《美國(guó)法典》有關(guān)美國(guó)貨幣制度的一個(gè)章節(jié)中規(guī)定,“美國(guó)的硬幣和紙幣是所有債務(wù)、公共收費(fèi)、稅費(fèi)和應(yīng)付稅款的法定貨幣。”這聽(tīng)起來(lái)是似乎任何地方都必須接受現(xiàn)金,對(duì)嗎?事實(shí)上并非如此。

所有美國(guó)鑄造的貨幣都是向債權(quán)人償還債務(wù)的有效方式,但沒(méi)有任何聯(lián)邦法規(guī)規(guī)定私人企業(yè)、個(gè)人或機(jī)構(gòu)必須接受用現(xiàn)金支付商品和服務(wù)的費(fèi)用。

由于聯(lián)邦政府和州政府負(fù)責(zé)管理政府服務(wù),而且沒(méi)有聯(lián)邦法律強(qiáng)制接受現(xiàn)金,因此禁止無(wú)現(xiàn)金化的責(zé)任就落在了市立法者的身上。地方政府必須行動(dòng)起來(lái)填補(bǔ)空缺,保護(hù)無(wú)銀行賬戶人群和少數(shù)群體,因?yàn)樗麄冇绕鋾?huì)被商戶只接受無(wú)現(xiàn)金付款的行為影響。

紐約市禁止無(wú)現(xiàn)金化法案的主要發(fā)起者托里斯說(shuō):“我別無(wú)選擇,只能推動(dòng)針對(duì)這些邊緣領(lǐng)域進(jìn)行立法。”

紐約市的法案在2018年11月頒布以后,遭到了一些已經(jīng)施行無(wú)現(xiàn)金化的商戶、技術(shù)公司和信用卡公司(主要是萬(wàn)事達(dá)卡公司)的反對(duì)。他說(shuō),許多科技行業(yè)的從業(yè)者感覺(jué)抓住現(xiàn)金不放,對(duì)于真正的系統(tǒng)性問(wèn)題來(lái)說(shuō)只是權(quán)宜之計(jì),是一種反科技的做法。

托里斯說(shuō)禁止商戶只接受無(wú)現(xiàn)金支付,并不會(huì)阻止技術(shù)的應(yīng)用或進(jìn)步,只是給人們提供了更多選擇。他說(shuō)他認(rèn)為應(yīng)該用法律解決導(dǎo)致許多人沒(méi)有銀行賬戶的諸多問(wèn)題,但眼下必須通過(guò)禁止無(wú)現(xiàn)金化來(lái)保護(hù)無(wú)銀行賬戶群體。

他預(yù)計(jì):“人們會(huì)減少抗拒心理。”但他認(rèn)為,在此之前,我們不能把金融技術(shù)強(qiáng)制應(yīng)用到無(wú)銀行賬戶和缺少銀行服務(wù)的人群或者擔(dān)心隱私問(wèn)題的人身上。

進(jìn)入無(wú)現(xiàn)金社會(huì)?早著呢!

雖然科技界有些人在大聲疾呼,但現(xiàn)金肯定不會(huì)消失。

巴蒂茲-拉佐等專家認(rèn)為,特殊時(shí)期將推動(dòng)支付領(lǐng)域發(fā)生變化,但并不足以淘汰現(xiàn)金。他認(rèn)為,這種變化會(huì)促使政府出臺(tái)更強(qiáng)有力的法律,保護(hù)消費(fèi)者的財(cái)務(wù)數(shù)據(jù),重新評(píng)估萬(wàn)事達(dá)卡和Visa等大型金融技術(shù)公司所扮演的角色,甚至可能會(huì)拆分這些公司。

巴蒂茲-拉佐說(shuō):“希望有開(kāi)明的人能記住,他們必須照顧到弱勢(shì)消費(fèi)者。”這樣美國(guó)的金融系統(tǒng)將變得越來(lái)越好。

貨幣歷史學(xué)家斯特恩斯說(shuō),無(wú)現(xiàn)金運(yùn)動(dòng)早在上世紀(jì)60年代末和70年代初就已經(jīng)開(kāi)始,經(jīng)過(guò)了這么多年依舊沒(méi)有成為主流。

泰特勞特說(shuō):“現(xiàn)金使用量的減少被夸大了。多年來(lái)一直有現(xiàn)金消失的說(shuō)法,現(xiàn)在確實(shí)有許多人更多地使用電子支付,但我依舊認(rèn)可現(xiàn)金為王的觀點(diǎn)。”

有些專家認(rèn)為當(dāng)今美國(guó)經(jīng)濟(jì)的運(yùn)行方式是“輕現(xiàn)金化”,即消費(fèi)者有許多支付方式可供選擇,并且多數(shù)人選擇數(shù)字支付。但現(xiàn)金依舊是一種重要的支付方式,并將繼續(xù)存在下去。

即使有令人興奮的新技術(shù)誕生,人們依舊會(huì)回歸現(xiàn)金支付。在公共事件爆發(fā)之初,有人擔(dān)心使用現(xiàn)金可能會(huì)增加感染病毒的風(fēng)險(xiǎn),但實(shí)際上人們對(duì)紙幣的使用率與2019年秋季相同。

斯特恩斯說(shuō):“在付款方式這方面,我們是非常固執(zhí)的。”

所以,盡管有人說(shuō)無(wú)現(xiàn)金化代表了未來(lái),但專家們認(rèn)為這個(gè)未來(lái)不會(huì)太早來(lái)臨。

正如斯坦利所說(shuō):“有時(shí)候,最古老、最簡(jiǎn)單的東西有其自身的價(jià)值,并且有理由繼續(xù)存在下去。”(財(cái)富中文網(wǎng))

譯者:Biz

There’s a reason they say cash is king.

Commodity money—physical objects like coins and paper bills that hold value—has been used since ancient societies made the switch from bartering goods like salt and cattle. America started issuing its own currency, which evolved into the dollar we know today, in 1776, just before the country declared its independence.

Cash is still the second-most-used form of payment in America today after debit cards. But many advocates for “going cashless” believe that the paper dollar’s time is nearly up.

As the coronavirus pandemic ravages communities around the globe, the use of cash is raising concerns around cleanliness and viral transmission, even though the cotton that paper money is made of has been proved to carry virus particles for around the same time or less than plastic credit and debit cards do. And as digitization tightens its grip on the world, new technologies are popping up left and right to make paying for goods and services easier and more frictionless.

While its use has certainly declined in recent years, cash will likely never disappear as those in the cashless movement would hope. Many cities like Philadelphia, San Francisco, and New York have recently passed legislation banning merchants from accepting only card and contactless payments. New Jersey passed a similar bill in 2019 on the state level, and cashless merchants have been banned in Massachusetts since 1978.

There are many reasons experts list in arguing that cash must remain a viable payment option: Going cashless excludes the millions of unbanked and underbanked people in America, most of whom are people of color; cash is the best way to pay while maintaining a modicum of privacy; cash is integral to many cultural practices like tipping and gift giving; cash is resilient in a way that digital payments are not; and finally, consumer choice is one of the most important tenets of the free market, and eliminating cash removes one of the key payment options available to consumers.

“The cashless movement is a dangerous movement,” assistant director of the National Consumer Law Center Lauren Saunders says.

Going cashless disadvantages the unbanked and communities of color

Approximately 6.5% of U.S. households—14.1 million adults and 6.4 million children—are unbanked, according to the FDIC’s 2017 National Survey of Unbanked and Underbanked Households, meaning they live in a household holding no accounts with formal, insured financial institutions. Another 18.7% of households are underbanked, which means they have at least one account at an insured institution, but they also use financial products or services outside of the banking system, like payday loans or cash-checking services.

“Any move to cashlessness is, by definition, exclusionary to those groups,” Christina Tetreault, senior policy counsel at Consumer Reports, says.

If you have a bank account, it’s easy to get checks cashed and transfer money for free. But the unbanked typically have to use check-cashing services or money orders to get cash and transfer money, methods that cost quite a bit in fees.

“It’s expensive to be poor, and it’s very expensive to be unbanked,” says Martin Chorzempa, research fellow at the Peterson Institute for International Economics.

Banking in the United States has unnecessarily high barriers to entry, says Chorzempa. That leaves lower-income people—often people of color, particularly black people—from participating in the formal economy. America’s long and racist history of excluding nonwhite people in all corners of society rears its ugly head here too.

Simply put, the American banking system was not built for people without disposable income. So, when low- and middle-income people use these systems, they are often hurt more than helped. For instance, most major banks require checking and savings accounts to carry a minimum balance to avoid incurring fees. These and overdraft fees are simply “fees for not having money,” Tetreault says.

Other fees that disadvantage poorer people include but certainly aren’t limited to ATM withdrawal fees, wire transfer charges, and debit card swipe fees. Those add up.

“Most overdraft fees are repaid within three days, and the median fee in 2014 was $34,” reads an article by the Berkeley Economic Review staff. “However, the annual percentage rates for payday loans are between 300% and 600%; if overdraft fees were treated as a payday loan that is repaid within three days, the APR would be 1,700%.”

Another way lower-income people and people of color are disadvantaged in the formal economy is the physical placement of banks, which are often few and far between or entirely absent in communities of color, Deyanira Del Río, codirector of the New Economy project, said in her January testimony before the U.S. House Committee on Financial Services Task Force on Financial Technology.

For instance, in New York City neighborhoods of color, there is one bank on average per 10,000 residents, according to a New Economy map made by compiling data from the FDIC and the 2015 American Community Survey. In majority-white neighborhoods, there are 3.5 banks per 10,000 residents.

Mounting fees along with the banking deserts and irritations like ATMs dispensing only $20 bills when people may want or need to withdraw smaller amounts add up to a crippling financial situation for many, Tetreault says. That forces people to abandon their bank accounts and the formal economy in favor of the cheaper and easier-to-predict fees associated with informal services like payday loans and check-cashing. She says that most unbanked people used to have bank accounts, but chose to forgo them for these reasons.

Jay Stanley, a senior policy analyst at the ACLU, explains that “digital redlining”—named after the redlining in the housing market that denied mortgages in neighborhoods of color—has worked against communities of colors for decades now. Digital redlining refers to a number of practices that profile customers of color (again, particularly black people) and excludes them from and disadvantages them in financial systems.

And while wealthier people’s money works for them—accruing interest in bank accounts, earning dividends in the stock market, and racking up rewards points with credit cards—the unbanked essentially lose money as inflation increases while their stockpile stays stagnant. This negative return rate ends up digging a deeper hole, leaving the unbanked with even less money, further from being able to participate in the formal, digitized economy if they want to.

“The reasons that people are shut out of bank accounts that would allow them to transact electronically are largely structural,” Tetreault says.

Bernardo Batiz-Lazo, a professor at Northumbria University and an expert in financial technology and business history, says for the cashless movement to succeed and not disproportionately disadvantage the unbanked and underbanked, the systems that work overtime to exclude those people must be rethought.

Del Río speaks of this in her testimony: “Too often, discussions about financial access disparities focus on the choices and behaviors of individuals, or on the need to design ‘a(chǎn)lternative products,’ rather than on structural barriers that block poor people, immigrants, and people of color from mainstream financial institutions and freedom.”

Chorzempa says that if cash were to disappear, individuals without the access or means to pay for things with the newest financial technology effectively become second-class citizens.

“I think there’s going to be a big social justice question that would block the complete adoption of [cashlessness],” says David L. Stearns, an expert in the history of payment systems and author of Electronic Value Exchange: Origins of the VISA Electronic Payment System.

New York City Councilman Ritchie Torres, the prime sponsor of the ban on cashless merchants that the city passed in late January, says businesses going cashless is “discrimination not in intent, but in effect.” However, he adds, in knowing who tends to pay with cash and who could go cashless, business owners could control who shops at their stores, making the discrimination more overt.

A cashless society would surrender privacy

In the digital modern world, people lose more and more of their privacy every day—if there is any of it left at this point at all. Cash is the most anonymous form of payment that exists right now, preserving privacy in a way that even cryptocurrency doesn’t.

There are plenty of reasons, not all of them nefarious, to want anonymity in transactions, Stearns says. From under-the-table, taxless payments to buying a gift for a spouse with a joint bank account, privacy is a concern in the financial world.

There is an entire data-brokering industry that wants the data that comes from consumers’ financial records, Stanley says. And Congress, he believes, is allowing weak privacy laws to go unchecked and unchanged, placing few to no limits on what data banks and financial services companies can share and with whom.

In a blog post for the ACLU, Stanley detailed how companies can gain access to a wealth of knowledge from very little information. When given a credit card for payment, a seller can, at the very least, learn the consumer’s full name. That, with the customer’s zip code, either asked for or guessed (most transactions take place in a credit card’s registered zip code), can lead to a shocking amount of information. Using “data appending” services, the name and zip code can get that seller the consumer’s mailing address, email, and phone number. And with that knowledge, sellers can get into the giant databases and learn even more.

Under the Gramm-Leach-Bliley Act of 1999, companies can sell customer financial data to just about anyone they choose. Consumers, then, have no privacy under federal regulations unless they take steps to opt out of that data-sharing with every company that might have their information.

Cash is one of the last strongholds left to maintain anonymity and keep purchasing information truly private without handing heaps of data to the corporations that make a buck off your receipts—or worse, to hackers, in the case of a data breach.

Despite cryptocurrency’s claim that it keeps users’ information private, there are plenty of ways to track the likes of Bitcoin back to their last owners.

Cash is ingrained in our cultures

What would you do if you couldn’t slide the kind woman that brings all your bags to your hotel room a five? If you couldn’t gift the kids in your life crisp new bills in a red envelope on Lunar New Year?

There are a lot of cultural customs we forget about when we discuss the merits of nixing cash. From tipping to gift giving to collecting, cash is deeply ingrained in our practices, Stearns says.

In the U.S., people use cash to tip people who perform services for which there isn’t a mandatory transaction, like an airport shuttle bus driver. Americans also teach their children about money and budgeting with cash, using it to pay weekly allowances and reward children who are too young for bank accounts for chores and the like. And don’t forget about the tooth fairy!

In Southern Indian culture, people throw kuri kalyanam parties, to which guests are expected to bring a cash donation for whatever big cost the host is raising funds for. When that host gets invited to someone else’s kuri kalyanam feast, they are expected to donate twice what they received at their party.

And at weddings in many cultures, including Greek, Mexican, and Polish, guests pin bills onto the happy couple’s clothing as they dance.

Having a physical object of value like cash is key to these practices, Stearns says. If cash dies, so too could these traditions.

Cash will be there when technology fails

In a doomsday scenario where we have no access to the Internet, how would we access our money? This may seem far-fetched, but it’s an important question to ask when creating laws and infrastructures. When technology fails, cash is there.

“We need to have cash because we need to have backup systems,” Batiz-Lazo says.

The economy as it is in America today was built for cash, he says, and it needs to be rethought for the way consumers use their money now. But cash is still important to keep around, he says, if only as an anchor for when technology doesn’t work according to plan.

Stanley writes that electronic payments systems are far less resilient than cash and leave consumers open to centralized points of failure. “If a hacker, bureaucratic error, or natural disaster shuts a consumer out of their account, the lack of a cash option would leave them few alternatives,” he writes for the ACLU.

Consumer choice is key

“Consumer payment choice is critical,” Tetreault says.

One of the key reasons that experts don’t see a cashless future is that the pros don’t outweigh the freedom that would be taken away.

“Minimizing is one thing,” Saunders says of cash use. “Eliminating it is something else.”

She also points to groups like the Consumer Choice Payment Coalition, a mix of consumer representatives and businesses committed to fighting for consumers’ right to choose cash.

The Federal Reserve Bank of San Francisco’s 2019 Diary of Consumer Payment Choice makes clear that consumers value cash as an option, even if it’s mainly considered a backup to digital forms of payment. The diary also shows that cash is the preferred payment type for small transactions, used in nearly half of all transactions under $10, and 42% of those under $25.

While cash use is declining little by little each year, it remains an important option in the financial lives of Americans.

Is going cashless even legal?

A section of U.S. Code on the American monetary system states that “United States coins and currency are legal tender for all debts, public charges, taxes, and dues.” That sure makes it sound like cash must be accepted everywhere, doesn’t it? Not so.

All U.S.-minted money is a valid form of payment for debts when tendered to a creditor, but there is no federal statute mandating that private businesses, individuals, or organizations have to accept cash as payment for goods and services.

Because federal and state governments can regulate government services, and there is no federal law mandating cash acceptance, it falls to city lawmakers to ban cashlessness. Local governments have to act to fill the voids and protect their unbanked and minority constituents that are disproportionately affected by cashless merchants.

“I have no choice but to legislate at the margins,” Torres, the prime sponsor of the bill banning cashlessness in New York City, says.

The New York bill was introduced in November 2018 and had plenty of pushback from already-cashless merchants, technology companies, and credit card companies, primarily Mastercard. Many in the tech industry, he says, feel that clinging to cash is a Band-Aid for real systemic problems and that it is an anti-tech move.

Torres says banning cashless merchants does nothing to prevent technology from being used or advanced—it just allows for more choice. And while he says he believes that there should be legislation to address the many issues causing people to go unbanked, this is what has to be done to protect that population for now.

“Then people would be less resistant,” he predicted. But until then, he says, we can’t force fintech on the unbanked and underbanked or those worried for their privacy.

Don’t expect America to go cashless anytime soon, if at all

Despite what some of the loudest voices in tech want you to think, cash probably isn’t going anywhere.

Some experts, like Batiz-Lazo, believe the pandemic will be a strong force for change in the payments landscape, but not one that eliminates cash. He believes that change will likely be a push for stronger legislation protecting consumer financial data and reassessing the role of—and maybe even breaking up—big fintech companies like Mastercard and Visa.

“If we just have some enlightened people that remember they have to take care of vulnerable consumers,” Batiz-Lazo says, the American financial system will get better for all involved.

The cashless movement, which money historian Stearns says started in the late ’60s and early ’70s, still hasn’t managed to go mainstream after all these years.

“The decline of cash is overstated,” Tetreault says. “There’s been a talk of the death of cash for many years, and it is true that many people make more electronic payments now, but I think cash is still king.”

The way the American economy functions these days is what some experts call “cash lite,” meaning that there are a lot of payment options for consumers to choose from, and most prefer the digital ones. But cash is still an important option to maintain.

Even as new and exciting financial technologies become available, people keep returning to cash. Despite fears at the beginning of the COVID-19 pandemic that cash might increase the risk of contracting the virus, people are using paper money at the same rate as they were in the fall of 2019.

“In the way we pay for things, we’re super stubborn,” Stearns says.

So though some say cashless is the future, the experts don’t see that future arriving anytime soon.

As Stanley says, “Sometimes the oldest, simplest things have their place and continue for a reason.”