疫情伊始,機構投資者便將目光投向了比特幣。而現在,那些曾經讓加密貨幣充滿吸引力的論調似乎也不再有說服力。

經紀公司富達投資(Fidelity)近期開展的一項調查顯示,80%的機構投資者表示自己樂意持有比特幣等數字資產。其中36%的受訪者稱,持這一態度的最主要原因是他們相信數字貨幣不受股票等“其他資產波動影響”。

但近期新冠疫情對經濟造成的破壞似乎顛覆了這一投資理念。疫情沖擊之下,加密貨幣與股市之間的關系暴露無遺,從而導致投資者意識到自己鐘愛加密貨幣的理由其實并不充分。

隱秘的浪漫

3月中旬,市場崩潰。標普500指數在3月10日至12日之間暴跌了14%,而比特幣跌勢更是兇猛,僅3月12日一天就跌去了38%的市值。

股市和幣市同時出現拋售的情況表明,兩者之間至少存在著一定聯系,而并非互不相關,彼此獨立。今年4月,全球最大的加密貨幣交易所幣安進行的一項研究發現,第一季度,比特幣價格與標普500指數表現的相關性“相對較高”,為57%。而比特幣與小盤股指數羅素2000的相關性更是高達64%。

對于兩者之間的“意外”聯系,比特幣的支持者們或許會將其視為一種偶然,比如幣安報告的作者就認為這種情況在未來幾個月中不太可能持續,不過看看近期比特幣與股市的市場走勢就知道情況并非如此。

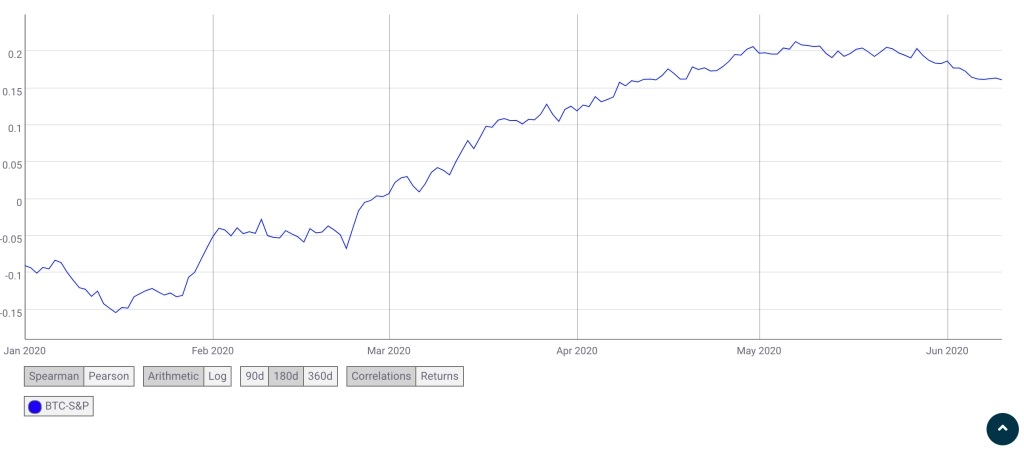

自4月以來,比特幣與股票市場的出現了如影隨形的苗頭。來自加密貨幣數據公司Coin Metrics的圖表信息顯示,兩者之間的相關性已經從3月(富達投資的研究結束之時)的“零”上升至上個月的0.2以上。(縱軸上“ 0”表示不相關,“ 1”表示完全相關。)

而且,兩者之間的相關性或將進一步提升。6月11日,在美聯儲主席鮑威爾對全球經濟前景做出悲觀展望之后,投資者反應消極,導致股市出現3月以來的最大跌幅。標普500指數下跌了5.7%,比特幣則下跌了6.4%至9,100美元(雖然3月比特幣經歷了一波震蕩行情,但今年以來其價格還是上漲了30%)。

這種所謂“巧合”或許正揭示了事實的真相,盡管這個真相可能不那么容易令人接受。

反米達斯之觸

隨著傳統資產市場上擁有巨大影響力的投資者逐步將其勢力擴張到數字貨幣領域,加密貨幣市場也將受到其影響力的輻射。

成熟機構投資者更傾向于在股市持有更大的頭寸。在市場波動加劇時,券商有時也會向其發出追加保證金通知,要求其存入更多現金,以填補可能出現的虧損。

實際上,這意味著機構投資者可能會被迫迅速平倉,從而可能導致比特幣或其他資產被拋棄。

這些情況就使得原本迥異的兩個領域更加同步,造成了一個“自相矛盾”的循環。專業投資者之所以喜歡比特幣,就是因為他們覺得比特幣與其他資產的相關性低,投資比特幣可以增加投資組合的多樣性,而這又恰好降低了比特幣相對于其它資產的獨立性。

可以說是“南轅北轍”。這就像收藏家通過光澤來評估藏品價值,但恰恰是因為頻繁碰觸,使得藏品表面因為不斷磨損而失去了光澤。

利亞·布托利亞是富達數字資產的研究主管,所供職的部門成立已經有兩年時間,負責處理數字資產相關業務。她認為,數字資產與股市的這種相關性可能只是一種暫時現象,“在市場動蕩和不確定時,兩者會存在短暫的相關性”。但她補充道,根據過去的經驗,從長遠來看,有理由相信這種相關性“可能會隨著時間的推移而逐漸回落。”

只有時間知道在經濟環境惡化時投資者會如何處理比特幣。布托利亞表示,富達團隊正在密切關注市場在“長期避險期”可能發生的變化。所謂的“長期避險期”是投資者為規避風險,拋售高風險資產,如高收益“垃圾”債券等,轉而買入公認的更安全的資產,如美國國債。

也就是說,投資者究竟是會將比特幣當作救生衣、資產保值的避難所,還是一文不值的垃圾?

發光的未必都是金子

機構投資者喜歡數字資產的另外兩個主要原因純粹是投機性的。

去年11月至3月,共有800家美國和歐洲的機構投資者參與了富達的調查訪問,其中約三分之一的受訪者表示,他們喜歡比特幣等數字資產的原因在于“比特幣是一種創新的技術手段”。另有三分之一(33%)的受訪者表示,他們喜歡數字資產是因為其具有“較高的升值潛力”。

而這兩種特性,無論是所謂的“新奇的技術”,還是“一夜暴富”的機會,都與全球知名價值投資者的投資哲學相反。作為價值投資者的代表人物沃倫·巴菲特便將比特幣比作“老鼠藥的平方”。

比特幣或許更適合那些偏好高風險的風險投資者,但隨著全球各大央行紛紛將利率調低至接近零利率甚至負利率的水平,許多投資者也不得不將獲利的目光投向其它地方,其中不乏那些風險更高的領域,如加密貨幣。

有投資者擔心,美聯儲一心想通過加印鈔票來避免金融危機,最終可能導致惡性的通貨膨脹。所以一部分投資者認為,比特幣可以作為“數字黃金”,成為一種潛在的通脹對沖工具。

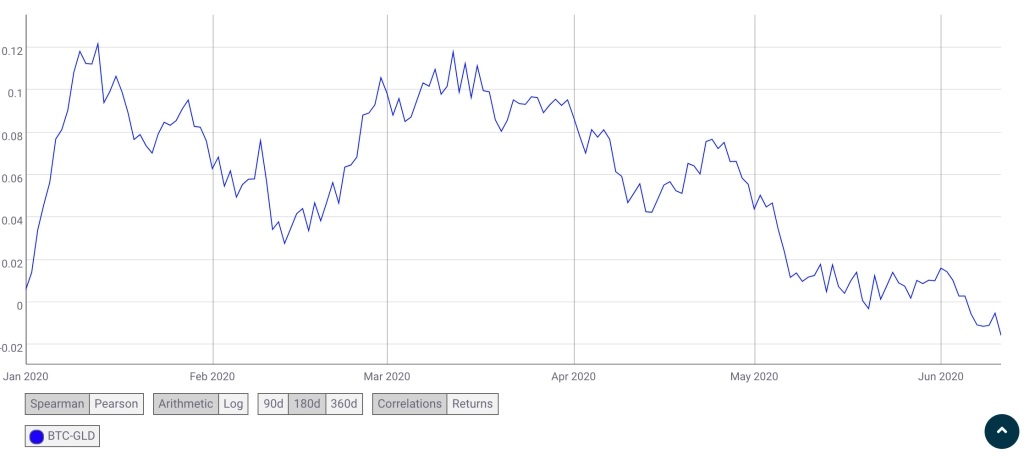

然而,具有諷刺意味的是,從第一季度來看,與所謂“數字黃金”走勢最不相關的資產恰恰正是黃金。Coin Metrics提供的另一張圖表顯示,近幾個月來,比特幣走勢與黃金之間的相關性越來越小。

盡管現在的市場狀況可能只是暫時的,未必會成為常態,但還是會讓諸多專業投資者及加密貨幣擁躉所持的信念受到質疑。至少從現在來看,人們最普遍的假設與現實情況并不相符。

待到疫情塵埃落定之后,投資者或許要重新考慮比特幣的投資價值到底在哪里。(財富中文網)

譯者:Feb

疫情伊始,機構投資者便將目光投向了比特幣。而現在,那些曾經讓加密貨幣充滿吸引力的論調似乎也不再有說服力。

經紀公司富達投資(Fidelity)近期開展的一項調查顯示,80%的機構投資者表示自己樂意持有比特幣等數字資產。其中36%的受訪者稱,持這一態度的最主要原因是他們相信數字貨幣不受股票等“其他資產波動影響”。

但近期新冠疫情對經濟造成的破壞似乎顛覆了這一投資理念。疫情沖擊之下,加密貨幣與股市之間的關系暴露無遺,從而導致投資者意識到自己鐘愛加密貨幣的理由其實并不充分。

隱秘的浪漫

3月中旬,市場崩潰。標普500指數在3月10日至12日之間暴跌了14%,而比特幣跌勢更是兇猛,僅3月12日一天就跌去了38%的市值。

股市和幣市同時出現拋售的情況表明,兩者之間至少存在著一定聯系,而并非互不相關,彼此獨立。今年4月,全球最大的加密貨幣交易所幣安進行的一項研究發現,第一季度,比特幣價格與標普500指數表現的相關性“相對較高”,為57%。而比特幣與小盤股指數羅素2000的相關性更是高達64%。

對于兩者之間的“意外”聯系,比特幣的支持者們或許會將其視為一種偶然,比如幣安報告的作者就認為這種情況在未來幾個月中不太可能持續,不過看看近期比特幣與股市的市場走勢就知道情況并非如此。

自4月以來,比特幣與股票市場的出現了如影隨形的苗頭。來自加密貨幣數據公司Coin Metrics的圖表信息顯示,兩者之間的相關性已經從3月(富達投資的研究結束之時)的“零”上升至上個月的0.2以上。(縱軸上“ 0”表示不相關,“ 1”表示完全相關。)

而且,兩者之間的相關性或將進一步提升。6月11日,在美聯儲主席鮑威爾對全球經濟前景做出悲觀展望之后,投資者反應消極,導致股市出現3月以來的最大跌幅。標普500指數下跌了5.7%,比特幣則下跌了6.4%至9,100美元(雖然3月比特幣經歷了一波震蕩行情,但今年以來其價格還是上漲了30%)。

這種所謂“巧合”或許正揭示了事實的真相,盡管這個真相可能不那么容易令人接受。

反米達斯之觸

隨著傳統資產市場上擁有巨大影響力的投資者逐步將其勢力擴張到數字貨幣領域,加密貨幣市場也將受到其影響力的輻射。

成熟機構投資者更傾向于在股市持有更大的頭寸。在市場波動加劇時,券商有時也會向其發出追加保證金通知,要求其存入更多現金,以填補可能出現的虧損。

實際上,這意味著機構投資者可能會被迫迅速平倉,從而可能導致比特幣或其他資產被拋棄。

這些情況就使得原本迥異的兩個領域更加同步,造成了一個“自相矛盾”的循環。專業投資者之所以喜歡比特幣,就是因為他們覺得比特幣與其他資產的相關性低,投資比特幣可以增加投資組合的多樣性,而這又恰好降低了比特幣相對于其它資產的獨立性。

可以說是“南轅北轍”。這就像收藏家通過光澤來評估藏品價值,但恰恰是因為頻繁碰觸,使得藏品表面因為不斷磨損而失去了光澤。

利亞·布托利亞是富達數字資產的研究主管,所供職的部門成立已經有兩年時間,負責處理數字資產相關業務。她認為,數字資產與股市的這種相關性可能只是一種暫時現象,“在市場動蕩和不確定時,兩者會存在短暫的相關性”。但她補充道,根據過去的經驗,從長遠來看,有理由相信這種相關性“可能會隨著時間的推移而逐漸回落。”

只有時間知道在經濟環境惡化時投資者會如何處理比特幣。布托利亞表示,富達團隊正在密切關注市場在“長期避險期”可能發生的變化。所謂的“長期避險期”是投資者為規避風險,拋售高風險資產,如高收益“垃圾”債券等,轉而買入公認的更安全的資產,如美國國債。

也就是說,投資者究竟是會將比特幣當作救生衣、資產保值的避難所,還是一文不值的垃圾?

發光的未必都是金子

機構投資者喜歡數字資產的另外兩個主要原因純粹是投機性的。

去年11月至3月,共有800家美國和歐洲的機構投資者參與了富達的調查訪問,其中約三分之一的受訪者表示,他們喜歡比特幣等數字資產的原因在于“比特幣是一種創新的技術手段”。另有三分之一(33%)的受訪者表示,他們喜歡數字資產是因為其具有“較高的升值潛力”。

而這兩種特性,無論是所謂的“新奇的技術”,還是“一夜暴富”的機會,都與全球知名價值投資者的投資哲學相反。作為價值投資者的代表人物沃倫·巴菲特便將比特幣比作“老鼠藥的平方”。

比特幣或許更適合那些偏好高風險的風險投資者,但隨著全球各大央行紛紛將利率調低至接近零利率甚至負利率的水平,許多投資者也不得不將獲利的目光投向其它地方,其中不乏那些風險更高的領域,如加密貨幣。

有投資者擔心,美聯儲一心想通過加印鈔票來避免金融危機,最終可能導致惡性的通貨膨脹。所以一部分投資者認為,比特幣可以作為“數字黃金”,成為一種潛在的通脹對沖工具。

然而,具有諷刺意味的是,從第一季度來看,與所謂“數字黃金”走勢最不相關的資產恰恰正是黃金。Coin Metrics提供的另一張圖表顯示,近幾個月來,比特幣走勢與黃金之間的相關性越來越小。

盡管現在的市場狀況可能只是暫時的,未必會成為常態,但還是會讓諸多專業投資者及加密貨幣擁躉所持的信念受到質疑。至少從現在來看,人們最普遍的假設與現實情況并不相符。

待到疫情塵埃落定之后,投資者或許要重新考慮比特幣的投資價值到底在哪里。(財富中文網)

譯者:Feb

Institutional investors were warming to Bitcoin just as the pandemic struck. Now the main reason they found cryptocurrencies appealing no longer appears justified.

Nearly four out of five institutional investors said they find something to like about digital assets such as Bitcoin, according to the results of a new survey by brokerage firm Fidelity. The foremost reason, as reported by 36% of respondents, was that they believed cryptocurrencies were “uncorrelated to other assets,” like stocks.

But the economic devastation of the recent coronavirus pandemic has seemingly shattered that investment thesis. The wave of destruction has exposed entanglements between digital currencies and the stock market that undermine the very reason investors said they were most interested.

A secret romance

In mid-March the markets crashed. The S&P 500, a common stock market measure, plummeted 14% between March 10 to 12, as did Bitcoin, which lost about 38% of its market value on March 12 alone.

The selloff revealed that stock and cryptocurrency values are at least partly linked, rather than being independent of one another. In April, a study by Binance, the world’s largest cryptocurrency exchange, found the correlation of Bitcoin's price to the performance of the S&P 500 was “relatively high” at 57% for the first quarter. The correlation was even higher, 64%, when comparing Bitcoin to the Russell 2000, another stock market index that features smaller-cap stocks.

While Bitcoin boosters may have considered the unexpected ties between Bitcoin and the stock market to be a fluke—the relationship "remains very unlikely to persist” in the months ahead, the Binance report's author wagered—recent market movements suggest otherwise.

Since April, Bitcoin and the stock market have moved closer in lockstep. As the following chart from Coin Metrics, a cryptocurrency data firm, shows, the correlation has trended upward from “zero” in March, when the Fidelity study ended, to more than 0.2 last month. (On the vertical axis: “0” means uncorrelated, "1" means correlated.)

The correlation may be getting stronger. On June 11, after Fed chair Jerome Powell gave his dour assessment of the global economic outlook, investors reacted negatively, causing the stock market’s biggest selloff since March. The S&P 500 dropped 5.7%, and Bitcoin—which had gained 30% for the year, despite its March turmoil—dipped 6.4% to $9,100.

The coincidences between Bitcoin and the stock market's ups and downs reveal a hard truth.

The anti-Midas touch

As investment firms—which hold great sway in traditional asset markets—have extended their influence to digital currencies, their gyrations now reverberate beyond the stock market and into cryptoland.

Established institutional investors tend to hold larger positions in the stock market. Sometimes, when volatility strikes, they're hit with margin calls, requirements by brokerages for more cash deposits to cover possible losses.

In practice, this means institutional investors may be forced quickly to liquidate positions elsewhere. It can lead to Bitcoin, among other holdings, getting jettisoned.

These circumstances are pushing the two formerly disparate realms more in sync. It's a self-defeating cycle. The very reason professional investors have taken a liking to Bitcoin—a supposed lack of correlation to other assets, like stocks—is justifying its addition to more portfolios, thereby reducing its independence from other assets.

The consequence of these strengthened ties is paradoxical. It’s as though collectors, valuing the worth of treasures by their shininess, ruined relics simply through the frequency of their touching them, smudging surfaces and causing the objects to lose their luster.

Ria Bhutoria, director of research at Fidelity Digital Assets, Fidelity’s two-year-old cryptocurrency-oriented business, says this greater correlation between digital assets and the stock market could be temporary. “There are brief periods of correlation during turbulence and uncertainty,” she says. But over the long run, she adds, there’s reason to believe, based on past experience, that the correlation could “end up trending back down over time.”

Only time will tell how investors will treat Bitcoin in the event that economic conditions worsen. The Fidelity team is watching closely what may happen, Bhutoria says, in a "prolonged risk off period," referring to a situation in which investors off-load riskier assets, like high-yield “junk” bonds, and head for assets considered safer, like U.S. Treasuries.

That is, will investors treat Bitcoin as a life jacket, a refuge to preserve people's wealth, or will they treat it as flotsam?

All that glitters is not gold

The two other top reasons institutional investors said they liked digital assets were purely speculative.

About a third of respondents to the Fidelity survey, which included interviews with 800 U.S. and European institutional investors between November and March, said they liked digital assets such as Bitcoin because they “consider it an innovative technology play.” Another third, 33%, said they liked it because it had “high potential upside.”

These traits—a fancy tech angle and the possibility of a get-rich-quick opportunity—represent the antithesis of the philosophy of the world's most famous value investors. Warren Buffett, chief among them, has likened Bitcoin to "rat poison squared."

An affinity for Bitcoin is perhaps more suited to the mentality of high-risk, venture capital investing. But since central banks around the world have adopted near-zero—and in some cases negative—interest rates, many investors find themselves in search of yield elsewhere, including in riskier assets, such as cryptocurrencies.

Some investors worry that a Fed bent on printing money to stave off financial calamity could result in higher inflation down the line. A portion of these investors believe Bitcoin could serve as “digital gold,” like the real-world yellow stuff, a possible hedge against inflation.

Yet, ironically, one asset to which so-called digital gold appeared least correlated in the first quarter was…gold. Another chart provided by Coin Metrics reveals the increasingly untethered relationship between Bitcoin and gold in recent months.

While the circumstances of the market today may be ephemeral and anomalous, they call into question beliefs held by many professional investors and cryptocurrency believers. At least today, people's most common assumptions appear to jar against reality.

As the dust kicked up in the wreckage of the pandemic settles, investors may have to rethink what they find appealing about Bitcoin.