美國經(jīng)濟陷入危機的過程顯然是一條線急轉(zhuǎn)直下。但經(jīng)濟可能會以何種形態(tài)復蘇,就另當別論了。

經(jīng)濟學家試圖弄清楚經(jīng)濟復蘇的趨勢,但他們能夠真正確定的因素只有不可預測的病毒、令人沮喪的經(jīng)濟數(shù)據(jù)以及短期內(nèi)失業(yè)人口大增(但目前有所好轉(zhuǎn))。

雖然5月失業(yè)率小幅回落至13.3%,但4月失業(yè)率猛增至14.7%(許多人甚至懷疑失業(yè)率更高),因為自停工以來,已有超過4,260萬美國人申請失業(yè)救濟。第一季度GDP縮水4.8%,但華爾街一致認為的最糟糕的第二季度尚未來臨。因此,經(jīng)濟學家和分析師預測,此次經(jīng)濟復蘇的形態(tài)將比我們在以往經(jīng)濟衰退中所見的更加多樣化。

V字型

但隨著經(jīng)濟重啟(股市已從3月的低點反彈近40%),摩根士丹利(Morgan Stanley)和瑞信(Credit Suisse)等公司最近幾周仍認為,經(jīng)濟或股市可能出現(xiàn)V字型復蘇。例如,摩根士丹利的首席美國股票策略師邁克爾?威爾遜在5月的一份報告中指出:“我們將看到V字型復蘇,原因有兩個:經(jīng)濟活動歷史性的急劇下降以及前所未有的政策反應。”高盛(Goldman Sachs)的經(jīng)濟學家在5月發(fā)布的一份報告中寫道:“隨著經(jīng)濟重啟,我們對大量的經(jīng)濟活動將很快恢復更有信心。”

雖然許多基本經(jīng)濟數(shù)據(jù)算不上令人鼓舞,但安聯(lián)(Allianz)的首席經(jīng)濟顧問穆罕默德?埃里安等人指出,他們的樂觀情緒來自他所說的“極高頻數(shù)據(jù)”,例如谷歌(Google)移動數(shù)據(jù)顯示了人們在經(jīng)濟重啟后的出行和購物方式, Moody's Analytics的首席經(jīng)濟學家馬克?贊迪等人則在關注OpenTable的網(wǎng)上訂餐等早期數(shù)據(jù)和ADP數(shù)據(jù),以尋找經(jīng)濟增長跡象。

例如,德意志銀行(Deutsche Bank)的資深美國經(jīng)濟學家布雷特?瑞安認為,未來三個月,所有數(shù)據(jù)都將有所改善。但他質(zhì)疑:“初始反彈很容易。關鍵是六個月后,經(jīng)濟復蘇速度將如何?雖然現(xiàn)在股市的表現(xiàn)讓所有人歡欣鼓舞,我們也從流動性數(shù)據(jù)中看出:‘哇,經(jīng)濟開始反彈,各州都開始重啟,信心有所恢復。’但我們現(xiàn)在還不到該慶祝勝利的時刻。”

一些經(jīng)濟學家說,盡管投資者最近對美國經(jīng)濟重啟表現(xiàn)出樂觀情緒,但要真正實現(xiàn)V字型復蘇只有一種途徑,那就是出現(xiàn)一種可以廣泛使用且有效的疫苗或治療方法——但這在短期內(nèi)不可能出現(xiàn)。

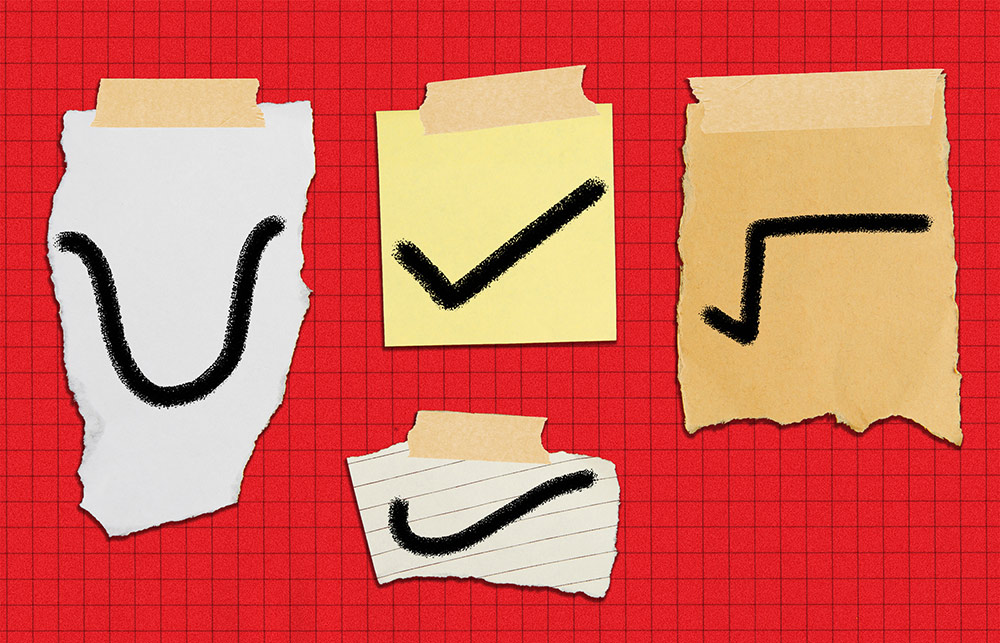

平方根型、U字型、對勾型和鐘擺型

經(jīng)濟學家稱,衡量經(jīng)濟復蘇速度的關鍵在于就業(yè)反彈的速度,以及是否會爆發(fā)第二輪疫情。

瑞銀全球財富管理(UBS Global Wealth Management)的資深經(jīng)濟學家布賴恩?羅斯表示,該公司預計經(jīng)濟復蘇將呈現(xiàn)U字型而不是V字型。羅斯在接受《財富》雜志采訪時說:“好消息是經(jīng)濟正在開始恢復增長。但壞消息是增長起點極低。”復蘇需要經(jīng)過漫長的時間。他認為,經(jīng)濟復蘇可能表現(xiàn)出一段時間以來最強勁的增長勢頭,但“由于起點極低,這樣的增長勢頭也不可能讓經(jīng)濟很快恢復到之前的水平。”

羅斯認為,快速復工是關鍵,但人們可能需要很長時間才能返回工作崗位,尤其是在疫情期間一些企業(yè)可能徹底倒閉。與此同時,即使限制解除,在疫苗上市之前,人們?nèi)詴母腥静《尽A_斯稱:“這將會制約經(jīng)濟增長”。

此外,德意志銀行的瑞安則認為經(jīng)濟會以一種不同尋常的形態(tài)復蘇:平方根型復蘇。他說:“倒平方根符號的尾端在起點以下,并逐漸向上傾斜。”他認為,我們似乎終于迎來了拐點,但一季度和二季度GDP將會大幅縮水,需要幾年才能恢復。瑞安指出,事實上,德意志銀行估計失業(yè)率可能要到2023年才會降至疫情之前的水平(約4%)。

政府的大規(guī)模(快速)財政和貨幣響應措施是一大亮點。但瑞安表示,盡管“政府為應對疫情迅速采取了強有力的措施,會讓我們在擺脫危機的同時迎來更強勁的經(jīng)濟反彈,但這仍需要時間。”他指出,如果最大威脅(疫情再度爆發(fā)導致第二輪停工)到來,就需要更多刺激措施來彌合第二次流動性缺口,隨著選舉臨近,快速通過這些刺激措施可能更具挑戰(zhàn)性。

瑞安在接受《財富》雜志采訪時指出,無論經(jīng)濟是否會出現(xiàn)平方根型反彈,“但歸根結(jié)底,這需要創(chuàng)造就業(yè)并讓人們盡快復工。這將決定經(jīng)濟復蘇的速度”。

Moody's Analytics的首席經(jīng)濟學家馬克?贊迪等人則更加直言不諱,他指出:“V字型復蘇是不可能發(fā)生的,可以直接排除。”他表示,因為疫情正在“對經(jīng)濟造成嚴重的結(jié)構(gòu)性損害。”相反,他認為經(jīng)濟將呈現(xiàn)耐克(Nike)標志的勾型或?qū)葱蛷吞K。他認為,隨著未來幾個月業(yè)務迅速增長,人們可能會感覺像是V字型復蘇,“但在出現(xiàn)可以廣泛使用的疫苗或療法之前,重啟會呈現(xiàn)出另一種態(tài)勢,經(jīng)濟將會橫向發(fā)展。”

雖然經(jīng)濟已經(jīng)“迎來轉(zhuǎn)機”,但贊迪預測,就業(yè)率將需要五年的時間才能完全恢復。贊迪認為,如果第二波疫情大規(guī)模爆發(fā),對于目前脆弱的經(jīng)濟來說,這可能會“引發(fā)經(jīng)濟蕭條”。但他表示,即使沒有第二波疫情,新的財政救援刺激措施對避免第二次衰退也很重要。贊迪認為,出現(xiàn)破產(chǎn)、違約和止贖時,這些趨勢的規(guī)模將“在很大程度上決定經(jīng)濟復蘇的形態(tài)”。但他認為,除非出現(xiàn)第二波疫情,而且政策制定者未能再出臺一套財政方案,否則我們將會“避免再次陷入衰退”。與此同時,他指出,未來幾個月,就業(yè)將會增長,經(jīng)濟復蘇將“時斷時續(xù)”。

這種觀點更符合安聯(lián)的首席經(jīng)濟顧問穆罕默德?埃里安的看法。埃里安認為,經(jīng)濟復蘇過程將呈現(xiàn)出對勾型和鐘擺型:復蘇從正常狀態(tài)開始,然后“猛烈擺動”到封鎖期間的狀態(tài)。他說:“我們會努力尋找一條中間道路,但不可能一蹴而就。我們將在兩者之間搖擺。”埃里安說,好消息是,到目前為止,經(jīng)濟重啟并沒有導致大規(guī)模感染。但他也指出,挑戰(zhàn)在于,我們還發(fā)現(xiàn)“在消費者參與和商業(yè)運營方面,重啟存在困難”,因為對健康的擔憂將是影響消費者參與意愿的核心所在。他說,盡管重啟迄今取得了令人鼓舞的進展,但“仍處于初期”。

但不管是否玩文字游戲,贊迪和其他經(jīng)濟學家勸告人們要謹慎:“就像遇到颶風一樣:你被卷入颶風,進入了風眼,[而且]如果你沒有雷達,你會想:‘哦,我沒事,最糟糕的已經(jīng)過去了。我活下來了。雖然損失很大,但我可以重建。’但如果你有雷達,你知道颶風的另一半即將來臨。它也許不像最初那么猛烈,但也可能一樣猛烈。我們無法預測。”(財富中文網(wǎng))

翻譯:劉進龍

審校:汪皓

美國經(jīng)濟陷入危機的過程顯然是一條線急轉(zhuǎn)直下。但經(jīng)濟可能會以何種形態(tài)復蘇,就另當別論了。

經(jīng)濟學家試圖弄清楚經(jīng)濟復蘇的趨勢,但他們能夠真正確定的因素只有不可預測的病毒、令人沮喪的經(jīng)濟數(shù)據(jù)以及短期內(nèi)失業(yè)人口大增(但目前有所好轉(zhuǎn))。

雖然5月失業(yè)率小幅回落至13.3%,但4月失業(yè)率猛增至14.7%(許多人甚至懷疑失業(yè)率更高),因為自停工以來,已有超過4,260萬美國人申請失業(yè)救濟。第一季度GDP縮水4.8%,但華爾街一致認為的最糟糕的第二季度尚未來臨。因此,經(jīng)濟學家和分析師預測,此次經(jīng)濟復蘇的形態(tài)將比我們在以往經(jīng)濟衰退中所見的更加多樣化。

V字型

但隨著經(jīng)濟重啟(股市已從3月的低點反彈近40%),摩根士丹利(Morgan Stanley)和瑞信(Credit Suisse)等公司最近幾周仍認為,經(jīng)濟或股市可能出現(xiàn)V字型復蘇。例如,摩根士丹利的首席美國股票策略師邁克爾?威爾遜在5月的一份報告中指出:“我們將看到V字型復蘇,原因有兩個:經(jīng)濟活動歷史性的急劇下降以及前所未有的政策反應。”高盛(Goldman Sachs)的經(jīng)濟學家在5月發(fā)布的一份報告中寫道:“隨著經(jīng)濟重啟,我們對大量的經(jīng)濟活動將很快恢復更有信心。”

雖然許多基本經(jīng)濟數(shù)據(jù)算不上令人鼓舞,但安聯(lián)(Allianz)的首席經(jīng)濟顧問穆罕默德?埃里安等人指出,他們的樂觀情緒來自他所說的“極高頻數(shù)據(jù)”,例如谷歌(Google)移動數(shù)據(jù)顯示了人們在經(jīng)濟重啟后的出行和購物方式, Moody's Analytics的首席經(jīng)濟學家馬克?贊迪等人則在關注OpenTable的網(wǎng)上訂餐等早期數(shù)據(jù)和ADP數(shù)據(jù),以尋找經(jīng)濟增長跡象。

例如,德意志銀行(Deutsche Bank)的資深美國經(jīng)濟學家布雷特?瑞安認為,未來三個月,所有數(shù)據(jù)都將有所改善。但他質(zhì)疑:“初始反彈很容易。關鍵是六個月后,經(jīng)濟復蘇速度將如何?雖然現(xiàn)在股市的表現(xiàn)讓所有人歡欣鼓舞,我們也從流動性數(shù)據(jù)中看出:‘哇,經(jīng)濟開始反彈,各州都開始重啟,信心有所恢復。’但我們現(xiàn)在還不到該慶祝勝利的時刻。”

一些經(jīng)濟學家說,盡管投資者最近對美國經(jīng)濟重啟表現(xiàn)出樂觀情緒,但要真正實現(xiàn)V字型復蘇只有一種途徑,那就是出現(xiàn)一種可以廣泛使用且有效的疫苗或治療方法——但這在短期內(nèi)不可能出現(xiàn)。

平方根型、U字型、對勾型和鐘擺型

經(jīng)濟學家稱,衡量經(jīng)濟復蘇速度的關鍵在于就業(yè)反彈的速度,以及是否會爆發(fā)第二輪疫情。

瑞銀全球財富管理(UBS Global Wealth Management)的資深經(jīng)濟學家布賴恩?羅斯表示,該公司預計經(jīng)濟復蘇將呈現(xiàn)U字型而不是V字型。羅斯在接受《財富》雜志采訪時說:“好消息是經(jīng)濟正在開始恢復增長。但壞消息是增長起點極低。”復蘇需要經(jīng)過漫長的時間。他認為,經(jīng)濟復蘇可能表現(xiàn)出一段時間以來最強勁的增長勢頭,但“由于起點極低,這樣的增長勢頭也不可能讓經(jīng)濟很快恢復到之前的水平。”

羅斯認為,快速復工是關鍵,但人們可能需要很長時間才能返回工作崗位,尤其是在疫情期間一些企業(yè)可能徹底倒閉。與此同時,即使限制解除,在疫苗上市之前,人們?nèi)詴母腥静《尽A_斯稱:“這將會制約經(jīng)濟增長”。

此外,德意志銀行的瑞安則認為經(jīng)濟會以一種不同尋常的形態(tài)復蘇:平方根型復蘇。他說:“倒平方根符號的尾端在起點以下,并逐漸向上傾斜。”他認為,我們似乎終于迎來了拐點,但一季度和二季度GDP將會大幅縮水,需要幾年才能恢復。瑞安指出,事實上,德意志銀行估計失業(yè)率可能要到2023年才會降至疫情之前的水平(約4%)。

政府的大規(guī)模(快速)財政和貨幣響應措施是一大亮點。但瑞安表示,盡管“政府為應對疫情迅速采取了強有力的措施,會讓我們在擺脫危機的同時迎來更強勁的經(jīng)濟反彈,但這仍需要時間。”他指出,如果最大威脅(疫情再度爆發(fā)導致第二輪停工)到來,就需要更多刺激措施來彌合第二次流動性缺口,隨著選舉臨近,快速通過這些刺激措施可能更具挑戰(zhàn)性。

瑞安在接受《財富》雜志采訪時指出,無論經(jīng)濟是否會出現(xiàn)平方根型反彈,“但歸根結(jié)底,這需要創(chuàng)造就業(yè)并讓人們盡快復工。這將決定經(jīng)濟復蘇的速度”。

Moody's Analytics的首席經(jīng)濟學家馬克?贊迪等人則更加直言不諱,他指出:“V字型復蘇是不可能發(fā)生的,可以直接排除。”他表示,因為疫情正在“對經(jīng)濟造成嚴重的結(jié)構(gòu)性損害。”相反,他認為經(jīng)濟將呈現(xiàn)耐克(Nike)標志的勾型或?qū)葱蛷吞K。他認為,隨著未來幾個月業(yè)務迅速增長,人們可能會感覺像是V字型復蘇,“但在出現(xiàn)可以廣泛使用的疫苗或療法之前,重啟會呈現(xiàn)出另一種態(tài)勢,經(jīng)濟將會橫向發(fā)展。”

雖然經(jīng)濟已經(jīng)“迎來轉(zhuǎn)機”,但贊迪預測,就業(yè)率將需要五年的時間才能完全恢復。贊迪認為,如果第二波疫情大規(guī)模爆發(fā),對于目前脆弱的經(jīng)濟來說,這可能會“引發(fā)經(jīng)濟蕭條”。但他表示,即使沒有第二波疫情,新的財政救援刺激措施對避免第二次衰退也很重要。贊迪認為,出現(xiàn)破產(chǎn)、違約和止贖時,這些趨勢的規(guī)模將“在很大程度上決定經(jīng)濟復蘇的形態(tài)”。但他認為,除非出現(xiàn)第二波疫情,而且政策制定者未能再出臺一套財政方案,否則我們將會“避免再次陷入衰退”。與此同時,他指出,未來幾個月,就業(yè)將會增長,經(jīng)濟復蘇將“時斷時續(xù)”。

這種觀點更符合安聯(lián)的首席經(jīng)濟顧問穆罕默德?埃里安的看法。埃里安認為,經(jīng)濟復蘇過程將呈現(xiàn)出對勾型和鐘擺型:復蘇從正常狀態(tài)開始,然后“猛烈擺動”到封鎖期間的狀態(tài)。他說:“我們會努力尋找一條中間道路,但不可能一蹴而就。我們將在兩者之間搖擺。”埃里安說,好消息是,到目前為止,經(jīng)濟重啟并沒有導致大規(guī)模感染。但他也指出,挑戰(zhàn)在于,我們還發(fā)現(xiàn)“在消費者參與和商業(yè)運營方面,重啟存在困難”,因為對健康的擔憂將是影響消費者參與意愿的核心所在。他說,盡管重啟迄今取得了令人鼓舞的進展,但“仍處于初期”。

但不管是否玩文字游戲,贊迪和其他經(jīng)濟學家勸告人們要謹慎:“就像遇到颶風一樣:你被卷入颶風,進入了風眼,[而且]如果你沒有雷達,你會想:‘哦,我沒事,最糟糕的已經(jīng)過去了。我活下來了。雖然損失很大,但我可以重建。’但如果你有雷達,你知道颶風的另一半即將來臨。它也許不像最初那么猛烈,但也可能一樣猛烈。我們無法預測。”(財富中文網(wǎng))

翻譯:劉進龍

審校:汪皓

The U.S. economy's descent into a crisis certainly looks like a straight line down. What shape the recovery might take on the way up is an entirely different story.

As economists try to make sense of what a recovery might look like, the only real certainties have been an unpredictable virus, dismaying data, and massive (yet improving) unemployment numbers in the near term.

While unemployment modestly ticked down to 13.3% in May, it skyrocketed in April, hitting 14.7% (and many suspect it was even higher), as over 42.6 million Americans have filed for unemployment since shutdowns began. GDP for the first quarter shrank by 4.8%, with what Wall Street uniformly touts will likely be the worst quarter—the second—still to come. That has led to economists and analysts predicting a much wider variety of lettered and shaped recoveries than we have typically seen in past recessions.

The V crowd

But as the economy begins to reopen (and equity markets have bounced nearly 40% off their March lows), some firms like Morgan Stanley and Credit Suisse in recent weeks still see a V-shaped recovery in the economy or market as a possibility. For one, Michael Wilson, chief U.S. equity strategist at Morgan Stanley, wrote in May, "We will see a V-shaped recovery for two reasons—the historic steepness of the decline in activity, and the unprecedented policy response." And Goldman Sachs economists wrote in a May note that "we have more confidence that a large amount of activity will return fairly quickly" as the economy reopens.

While much of the fundamental economic data isn't too encouraging yet, those like Mohamed El-Erian, chief economic adviser at Allianz, point to what he calls "high high frequency data" for optimism, like Google mobility data to show how people are getting out and shopping as reopenings take place, while other economists like Moody's Analytics chief economist Mark Zandi are watching early data like OpenTable reservations for restaurants and ADP data for signs of growth in the economy.

For one, Brett Ryan, senior U.S. economist at Deutsche Bank, is betting all the data in the next three months will improve. "That initial bounce is the easy part. It’s when you get six months out, what does the pace of recovery look like then?" he asks. "While everybody is cheering the stock market right now, and we’re watching the mobility data and saying, 'Wow, things are starting to bounce back, states are starting to open up and confidence is coming back a little bit,' let’s not take a victory lap just yet."

Despite the recent reopening optimism, the only way we'll actually see a true V-shaped recovery, some economists say, is if there is a widely distributed and effective vaccine or treatment available—a scenario that's unlikely to happen anytime soon.

Square root symbols, U-shapes, check marks, and pendulums

Key to gauging how quickly the economy might recover is the pace at which employment bounces back, and whether a second wave of the virus hits, economists say.

UBS Global Wealth Management senior economist Brian Rose says the firm is anticipating a U-shaped recovery, not a V. "The good news [is] that we are starting to grow again. The bad news is that we’re starting from an awfully deep hole" that will take a long time to recover from, Rose tells Fortune. That growth may look like some of the strongest growth we've had in a while, he argues, but "when you're starting from this deep down, even that doesn't get you all the way back to where you were."

A rapid return to work is key, Rose suggests, but it's likely going to take a long time for people to get their jobs back, especially as some businesses may disappear during the crisis. Meanwhile, even as restrictions lift, people will still worry about catching the virus until there's a vaccine. "That’s going to put a limit on the economy," Rose says.

Deutsche's Ryan, on the other hand, prefers a more unusual shape: the square root symbol recovery. "A reversed square root symbol whereby the tail is below the start and gradually upward sloping," he describes. It seems we've hit an inflection point at last, but the GDP contraction in the first and second quarters is going to be massive, and it will take several years for output to recover, he suggests. In fact, Deutsche Bank is estimating the unemployment rate likely won't drop to pre-pandemic levels of around 4% until 2023, says Ryan.

One bright spot? The massive (and quick) fiscal and monetary response from the government. But while that "forceful response right off the bat in this crisis sets you up to have a more robust rebound as we come out the other side of this, it’s still going to take time," Ryan suggests. And if the biggest threat of all (the reemergence of the virus causing a second shutdown) hits, there’s going to need to be more stimulus to bridge a second liquidity gap—something that might be more challenging to pass quickly as the election approaches, he says.

Whether that recovery looks more like a sharp square root symbol or not, "at the end of the day, it’s about job creation and bringing people back to work as quickly as possible. That is really going to determine the pace of this recovery," Ryan tells Fortune.

Others like Moody's Zandi are more blunt: "A V-shaped recovery is out of the question. That’s not happening," he says, as the virus is doing "meaningful structural damage to the economy." Instead, he's seeing a Nike swoosh shape, or a check mark. As businesses ramp up in the coming months, it might feel like a V-shaped recovery, he says, "but on the other side of the reopenings, the economy is going to go sideways until we get a vaccine or therapy that’s widely distributed and adopted."

While the economy has "turned the corner," Zandi predicts employment won't fully recover until mid-decade. If a significant second wave of the virus hits, Zandi believes that could be "fodder for a depression" in the economy's current fragile state. But even without a second wave, new fiscal rescue stimulus will be important to staving off a second recession, he says. And as we start to see bankruptcies, defaults, and foreclosures, how big that wave is will "determine a lot about the shape of the recovery," Zandi argues. But barring a second wave and the failure of policymakers to put another fiscal package together, Zandi thinks we'll "avoid going back into a recession." In the meantime, we'll see job growth in the next few months, and there will be "fits and starts" of recovery, he says.

That's more along the lines of how Allianz's El-Erian sees recovery. He thinks of it more as a check mark or a pendulum: Things started out in a normal state, then "violently swung" to the lockdown stage. "We are trying to find a middle way, and we’re not going to get there immediately. We’re going to oscillate around some midway of these two things," he suggests. The good news is that the reopening thus far hasn't resulted in massive spikes in infection, he says. But the challenge is we're also seeing "there are difficulties in reopening when it comes to consumer engagement and operational issues on the business side," El-Erian notes, as concerns around health will be central in people's willingness to engage. While the progress of the reopening thus far is encouraging, "it's early days," he says.

But playing the letters game or not, economists like Zandi encourage caution: "The metaphor is a hurricane: You get nailed by the hurricane. You go into the eye, [and] if you don't have radar, you think, 'Oh, I’m okay, the worst is over. I survived. A lot of damage, but I can rebuild.' But if you have radar, you know there’s the other side of the hurricane coming. Maybe not as powerful as the original, but maybe it is," he says. "We don’t know."