新冠疫情將引發經濟衰退,這個趨勢變得越來越明顯。全球供應鏈中斷,旅游業遭遇重創,會議和其他大型活動紛紛取消,甚至職業體育賽事和高校體育活動也被推遲或取消。

股市暴跌,現在較史上高點下跌了25%,而且雖然以往的經濟數據喜人,但很快這些數據就會跳崖式下降。所以現在是時候著手為經濟衰退做準備了。

我們如何把個人事務安排妥當,迎接令人痛苦的經濟衰退呢?本文提供了以下建議:

控制生活方式通脹

當經濟和市場運轉良好的時候,我們往往會放任生活方式通脹發生。但在經濟衰退時期,應該評估自己的消費方式,了解可以削減哪些不必要的消費預算。在經濟衰退期間最好的生存方式之一是合理精簡消費習慣。

信用卡債務絕不是好主意,因為信用卡利息極高,而且在經濟衰退期間信用卡債務可能會急速增加直至失控。如果你無力償還欠款,現在是一次很好的機會,你可以給信用卡公司打電話,協商更低的利息,或者確定更合理的還款計劃。只要你提出要求,許多信用卡公司都會愿意讓步。

另外,你還可以給有線電視公司、電話公司和保險公司打電話,為自己爭取最合適的費率。許多公司會跟你協商一個更優惠的方案。你這樣做最糟糕的結果也不過是被拒絕而已。

保證充足的流動性

全球股市普遍下跌。許多投資者多年來一直在等待股價下跌,如今他們的愿望終于實現了。面對這種局面,只有兩種方式可以加以利用:

(1)資產配置。配置足夠多的流動資產,可以讓你調整好狀態,迎接經濟衰退。最簡單的做法是選擇優質債券或現金。

(2)足夠高的儲蓄率。高儲蓄率有許多好處。當金融資產價格暴跌時,你可以利用儲蓄的資金以更低的價格買進,而且足夠多的存款還能緩解個人財務受到的沖擊。

對于有些人而言,流動性能夠保證無論是自己的投資組合還是個人財務,都能承受經濟衰退的洗禮。個人理財專家經常鼓吹在安全應急儲蓄工具中存入6-12個月支出的好處。如果沒有應急資金,也應該有替代方案以防萬一,比如房屋凈值信貸額度、零利率信用卡、經紀賬戶或Roth IRA繳費等。

雖然我們希望你的個人應急計劃永遠沒有用武之地,但它確實可以讓你在需要的時候避免恐慌。

按揭貸款再融資

假如一年前你申請了一筆35萬美元固定利率住房抵押貸款,貸款期限30年,你的貸款利率約為4.5%左右,相當于月供約1775美元(不考慮稅費和保險費)。

今天30年固定利率住房抵押貸款的利率接近3.3%。同樣35萬美元的貸款,月供只有約1530美元,每個月可以節省240美元。在經濟衰退時期,這筆額外的資金可以作為緩沖。股市崩潰的一個好處是,利率下降降低了借款成本。

經濟衰退與每個人息息相關

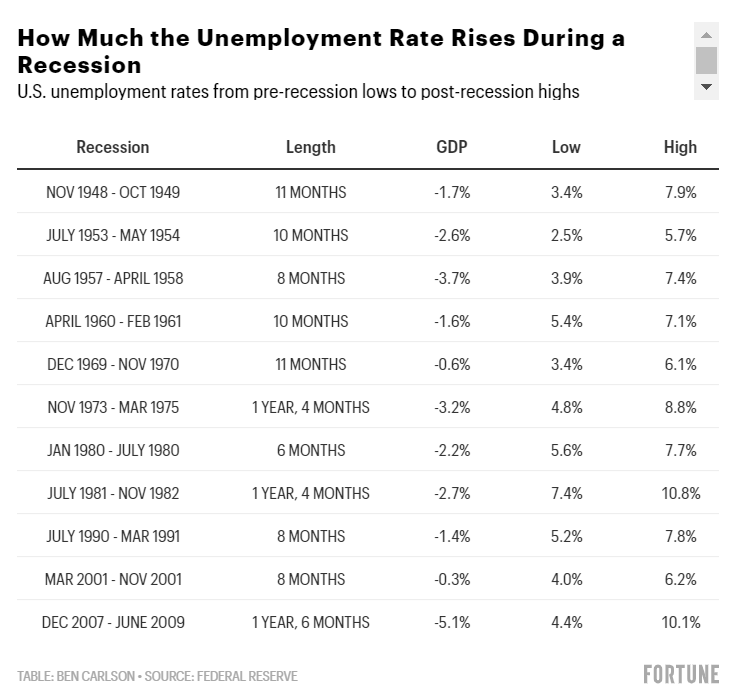

下表顯示了自二戰以來每次經濟衰退期間美國的失業率上升趨勢:

從衰退前的低點到衰退后的高點,平均失業增長率為3.2%。這意味著當前的失業率將從3.6%上升到6.8%。目前美國的勞動人口約為1.6億人,相當于會有500多萬人失業。

顯而易見,每次經濟衰退都是不同的,而這一次經濟衰退必定會帶來獨一無二的風險和挑戰。但重要的是要記住,經濟衰退不能只看經濟數據。有些人會比別人受到更大的傷害。

有句名言說得好:“當你的鄰居失業時就是經濟衰退,當你自己失業時就是經濟蕭條。”

無論你是否會失業,現在都應該為下一次經濟下行做好財務上的準備。(財富中文網)

本文作者本·卡爾森是一位注冊金融分析師,現任里薩茲財富管理公司(Ritholtz Wealth Management)機構資產管理部門總監。卡爾森可能持有本文中所討論的證券或資產。

譯者:Biz

新冠疫情將引發經濟衰退,這個趨勢變得越來越明顯。全球供應鏈中斷,旅游業遭遇重創,會議和其他大型活動紛紛取消,甚至職業體育賽事和高校體育活動也被推遲或取消。

股市暴跌,現在較史上高點下跌了25%,而且雖然以往的經濟數據喜人,但很快這些數據就會跳崖式下降。所以現在是時候著手為經濟衰退做準備了。

我們如何把個人事務安排妥當,迎接令人痛苦的經濟衰退呢?本文提供了以下建議:

控制生活方式通脹

當經濟和市場運轉良好的時候,我們往往會放任生活方式通脹發生。但在經濟衰退時期,應該評估自己的消費方式,了解可以削減哪些不必要的消費預算。在經濟衰退期間最好的生存方式之一是合理精簡消費習慣。

信用卡債務絕不是好主意,因為信用卡利息極高,而且在經濟衰退期間信用卡債務可能會急速增加直至失控。如果你無力償還欠款,現在是一次很好的機會,你可以給信用卡公司打電話,協商更低的利息,或者確定更合理的還款計劃。只要你提出要求,許多信用卡公司都會愿意讓步。

另外,你還可以給有線電視公司、電話公司和保險公司打電話,為自己爭取最合適的費率。許多公司會跟你協商一個更優惠的方案。你這樣做最糟糕的結果也不過是被拒絕而已。

保證充足的流動性

全球股市普遍下跌。許多投資者多年來一直在等待股價下跌,如今他們的愿望終于實現了。面對這種局面,只有兩種方式可以加以利用:

(1)資產配置。配置足夠多的流動資產,可以讓你調整好狀態,迎接經濟衰退。最簡單的做法是選擇優質債券或現金。

(2)足夠高的儲蓄率。高儲蓄率有許多好處。當金融資產價格暴跌時,你可以利用儲蓄的資金以更低的價格買進,而且足夠多的存款還能緩解個人財務受到的沖擊。

對于有些人而言,流動性能夠保證無論是自己的投資組合還是個人財務,都能承受經濟衰退的洗禮。個人理財專家經常鼓吹在安全應急儲蓄工具中存入6-12個月支出的好處。如果沒有應急資金,也應該有替代方案以防萬一,比如房屋凈值信貸額度、零利率信用卡、經紀賬戶或Roth IRA繳費等。

雖然我們希望你的個人應急計劃永遠沒有用武之地,但它確實可以讓你在需要的時候避免恐慌。

按揭貸款再融資

假如一年前你申請了一筆35萬美元固定利率住房抵押貸款,貸款期限30年,你的貸款利率約為4.5%左右,相當于月供約1775美元(不考慮稅費和保險費)。

今天30年固定利率住房抵押貸款的利率接近3.3%。同樣35萬美元的貸款,月供只有約1530美元,每個月可以節省240美元。在經濟衰退時期,這筆額外的資金可以作為緩沖。股市崩潰的一個好處是,利率下降降低了借款成本。

經濟衰退與每個人息息相關

下表顯示了自二戰以來每次經濟衰退期間美國的失業率上升趨勢:

從衰退前的低點到衰退后的高點,平均失業增長率為3.2%。這意味著當前的失業率將從3.6%上升到6.8%。目前美國的勞動人口約為1.6億人,相當于會有500多萬人失業。

顯而易見,每次經濟衰退都是不同的,而這一次經濟衰退必定會帶來獨一無二的風險和挑戰。但重要的是要記住,經濟衰退不能只看經濟數據。有些人會比別人受到更大的傷害。

有句名言說得好:“當你的鄰居失業時就是經濟衰退,當你自己失業時就是經濟蕭條。”

無論你是否會失業,現在都應該為下一次經濟下行做好財務上的準備。(財富中文網)

本文作者本·卡爾森是一位注冊金融分析師,現任里薩茲財富管理公司(Ritholtz Wealth Management)機構資產管理部門總監。卡爾森可能持有本文中所討論的證券或資產。

譯者:Biz

It's increasingly becoming apparent that the outbreak of the coronavirus is going to cause an economic slowdown. Global supply chains are being disrupted. The travel industry is taking a nosedive. Conferences and other large events are being canceled left and right. Even pro and college sporting events are being postponed or called off.

The stock market is getting pummeled, now down 25% from all-time highs and while past economic data looks great, those numbers are quickly going to fall off a cliff. It's time to start preparing for a recession.

Here are some ways to get your affairs in order as we approach what is likely to be a painful economic slowdown:

Get your lifestyle inflation in check

When the economy and markets are humming along it becomes tempting to let lifestyle inflation get away from you. Now is the time to review your spending to understand which non-essential areas of your budget can be cut in case of a slowdown. One of the best ways to survive an economic downturn is by right-sizing your spending habits.

Credit card debt is never a good idea because the rates are so astronomically high but it can spiral out of control during an economic contraction. If you hold a balance and have trouble paying it off, now is a good time to call your credit card company to negotiate lower rates or figure out a more reasonable pay-off plan. Many of these companies will work with you if you ask.

It's also worth putting in a phone call to your cable, phone and insurance providers to ensure you're getting the best rates. Many of the companies will negotiate with you for better rates. And the worst they can do is say no if you ask.

Make sure you have enough liquidity

Stock markets around the globe are down across the board. Many investors have been waiting years for lower prices. Well, they're finally here. There are only two ways of taking advantage of this situation:

(1) Asset allocation. Have an asset allocation in place with enough liquid assets to allow you to rebalance into the pain. The simplest options here are high-quality bonds or cash.

(2) A high enough savings rate. A high savings rate is beneficial in a number of different ways. It not only gives you the option to buy financial assets at lower prices as they are in freefall but also offers a cushion when it comes to your finances.

And for some, liquidity is not just about ensuring their investment portfolio can withstand a storm, but their personal finances. Personal finance experts often preach the benefits of holding 6-12 months of expenses in a safe emergency savings vehicle. Those who don't have an emergency fund in place need to shore up alternatives just in case. This could be a home equity line of credit, zero interest rate credit cards, brokerage accounts or even Roth IRA contributions.

Hopefully your own personal emergency plan never gets triggered but it makes sense to have one in place to avoid panicking if it does.

Refinance your mortgage

If you took out a $350,000 mortgage a year ago from today you likely locked in a 30 year fixed rate mortgage at around 4.5%. That equates to a monthly payment of roughly $1,775 (ignoring taxes and insurance).

Today 30 year fixed-rate mortgages are closer to 3.3%. On that same $350,000 mortgage, that works out to a monthly payment of around $1,530, a savings of $240 a month. That extra money can provide a cushion during a potential economic slowdown. The one bright spot from the crashing stock market is interest rates have made borrowing more affordable.

Recessions are personal

The following table shows the increase in the U.S. unemployment rate during each recession since WWII:

The average rise from the pre-recession low to the post-recession high is 3.2%. That would take us from the current rate of 3.6% up to 6.8%. In a labor force of roughly 160 million people, that would be more than 5 million people out of a job.

Obviously every recession is different and this one will surely pose its own unique sets of risks and challenges. But it's important to remember that recessions go beyond economic data. Some people are hurt much worse than others.

There's an old saying that "It's a recession when your neighbor loses their job but a depression when you lose your own."

Whether you lose your job or not, now is the time to prepare financially for the next downturn.

Ben Carlson, CFA is the Director of Institutional Asset Management at Ritholtz Wealth Management. He may own securities or assets discussed in this piece.