股市走勢能影響特朗普連任嗎?

|

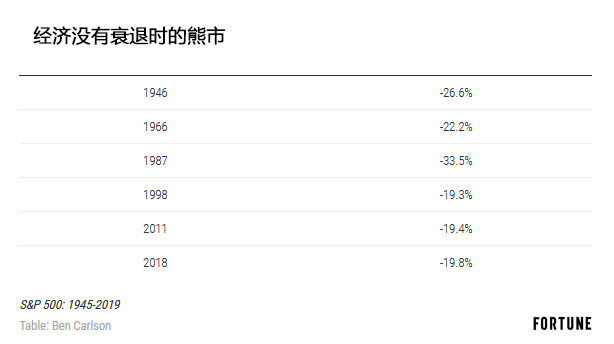

在7月26日創(chuàng)歷史新高后,標(biāo)普500指數(shù)連跌六天,下滑6%。許多人都把股市迅速回落歸咎于特朗普總統(tǒng)的對華貿(mào)易戰(zhàn)以及人民幣匯率大幅下降造成緊張局勢不斷升級。 這不是美國股市第一次如此迅速地下挫,也不會是最后一次。但在大選年還有幾個月就要到來的情況下,值得考慮一下不利行情延續(xù)到2020年對特朗普總統(tǒng)的連任可能性會有什么樣的影響。 1928年至今,美國已經(jīng)進(jìn)行了23次總統(tǒng)選舉,其中標(biāo)普500指數(shù)在大選年下跌的只有四次(最近的一次是2008年,跌幅為37%)。另外,現(xiàn)任總統(tǒng)謀求連任的有13次。 在上述13次現(xiàn)任總統(tǒng)謀求連任的選舉中,標(biāo)普500指數(shù)收益率為負(fù)的只有兩次,分別是1932年和1940年,該指數(shù)分別下跌了8.6%和10.7%。1932年,富蘭克林·羅斯福擊敗了意圖連任的赫伯特·胡佛;1940年羅斯福則實現(xiàn)連任,戰(zhàn)勝了對手文多爾·威爾吉。因此,就現(xiàn)任總統(tǒng)謀求連任時股市是否下跌而言,并無太多先例可循。 經(jīng)濟,愚蠢 1992年比爾·克林頓向當(dāng)時的總統(tǒng)老布什發(fā)起挑戰(zhàn)時,其競選助手詹姆斯·卡維爾在克林頓的選舉總部掛起了一面牌子,上面寫著需重視的三大要點: 1. 改變還是更多地保持原樣 2. 經(jīng)濟,愚蠢 3. 別忘了醫(yī)療 在決定總統(tǒng)的連任可能性方面,這塊牌子上的第二條可能遠(yuǎn)比股市重要。1928年至今,在現(xiàn)任總統(tǒng)謀求連任的13次嘗試中,失敗的只有三次,而且都出現(xiàn)在衰退剛剛過去的時候。 富蘭克林·羅斯福在1932年輕松擊敗了當(dāng)時的總統(tǒng)赫伯特·胡佛,而1929年胡佛上任時美國正要出現(xiàn)大蕭條,許多人都覺得胡佛的政策實際上讓大蕭條期間的情況變得更加糟糕。 1980年,羅納德·里根戰(zhàn)勝了總統(tǒng)吉米·卡特,而當(dāng)年的經(jīng)濟衰退一直延續(xù)到了夏天,失業(yè)率一度接近8%。利率快速上升,通脹率也失去了控制。里根以壓倒性優(yōu)勢當(dāng)選。 現(xiàn)任總統(tǒng)最后一次謀求連任失敗是在1992年,當(dāng)時克林頓的重點是“經(jīng)濟,愚蠢”。這句口號起作用的原因是1990年夏天出現(xiàn)的美國經(jīng)濟衰退一直延續(xù)到了1991年大選期間。失業(yè)率最高幾乎達(dá)到8%。20世紀(jì)90年代初,美國許多地區(qū)的房價都出現(xiàn)了幾十年來的最大跌幅。 其他謀求連任并且成功的總統(tǒng)(羅斯福、艾森豪威爾、尼克松、里根、克林頓、小布什和奧巴馬)在第二次參選前都沒有遭遇到經(jīng)濟衰退。 熊市,無衰退 股市明年暴跌,從而在經(jīng)濟未衰退時陷入熊市的可能性一直存在。以前出現(xiàn)過這種情況,今后也仍然有可能發(fā)生,原因是投資者不是非常善于通過股價來預(yù)測經(jīng)濟走勢。 1945年以來,標(biāo)普500指數(shù)在經(jīng)濟沒有衰退時下跌10%或更多的情況出現(xiàn)過18次,其中的6次形成了熊市。 |

After hitting new all-time highs on July 26, the S&P 500 was then down six days in a row, falling 6%. Many are blaming this swift correction on President Trump’s trade war with China and the escalating tensions from the massive currency devaluation in the Yuan. This is not the first time the stock market has fallen so quickly nor will it be the last. But as we head into an election year in several months, it’s worth considering what could happen to President Trump’s re-election hopes if the market’s woes spill into 2020. Going back to 1928, there have been 23 presidential elections. Only 4 of those 23 elections experienced a loss in the S&P 500 during the election year itself (the most recent being the 37% loss in 2008). In 13 of those elections, the sitting president was seeking re-election. The S&P 500 saw a negative return in just two of those re-election years, 1932 and 1940. Stocks were down 8.6% and 10.7%, respectively in those years. In 1932, FDR defeated Herbert Hoover, who lost his re-election bid while FDR was re-elected in 1940 over Wendell Willkie. So there’s not much precedent in terms of stocks seeing a down year during a re-election campaign. The economy, stupid When Bill Clinton ran against then-President George H.W. Bush in 1992, James Carville hung a sign in the Clinton campaign headquarters with three phrases on it for what to focus on: 1. Change vs. more of the same 2. The economy, stupid 3. Don’t forget healthcare Number two on the list is likely far more important than the stock market in determining a president’s re-election chances. Out of the 13 times a president has been up for re-election going back to 1928, there were only three times when the incumbent lost the presidency. Each of those instances came just after a recession. Franklin D. Roosevelt handily defeated Herbert Hoover, the incumbent president, in 1932. The country was just about to enter the Great Depression when Hoover took office in 1929, and many felt his policies actually made things worse throughout the economic carnage. Ronald Reagan defeated then-President Jimmy Carter in 1980, a year in which the country experienced a recession that lasted well into the summer and saw the unemployment rate spike to nearly 8%. This was also during a period of rapidly rising interest rates and runaway inflation. Reagan won by a landslide. The last time a sitting president lost their re-election bid was in the 1992 election when Clinton focused on “the economy, stupid.” This slogan worked because the U.S. economy slid into a recession during the summer of 1990 that lasted well into the 1991 campaign trail. The unemployment rate topped out at almost 8%. The early-1990s was also a time where real estate prices fell in many regions the most they had in decades. None of the other incumbent presidents who ran for re-election in that time and were victorious (Roosevelt, Eisenhower, Nixon, Reagan, Clinton, Bush and Obama) were forced to deal with a recession in the run-up to the election. Bear market, no recession It’s always possible the stock market could crash next year and go into a bear market outside of a recession. This has happened in the past and it will likely happen in the future as investors aren’t very good at forecasting the economy through stock prices. Since 1945, there have been 18 instances where the S&P 500 sold off 10% or worse outside of a recession. Six of those sell-offs would constitute bear markets. |

|

不過,就算美股在選舉前確實下跌,總統(tǒng)連任面臨的最大經(jīng)濟風(fēng)險也還是經(jīng)濟放緩。蓋洛普的一項調(diào)查顯示,以各種形式持有股票的人約占美國人口的一半。但股票往往集中在上層,或者說美國10%的富人持有幾乎九成股票。因此,股市已經(jīng)不像以前那樣具有平民特色。 衰退的影響更深遠(yuǎn),因為人們會失業(yè),他們的住房可能貶值,公司也會倒閉。這時人們會對政客感到憤怒。經(jīng)濟滑坡時股市也可能下跌,但就總統(tǒng)連任的可能性而言,經(jīng)濟看來比股市重要。(財富中文網(wǎng)) 譯者:Charlie 審校:夏林 |

But even if the stock market did fall between now and the election, an economic slowdown would still likely be the president’s biggest economic risk for re-election. According to a Gallup poll, roughly half of Americans own stocks in some form. But those holdings tend to be concentrated at the top, with the top 10% in wealth owning almost 90% of the stocks in the U.S. So the stock market doesn’t have a hold over the populace as it once did. Recessions are felt more far and wide because people lose jobs, their housing prices likely fall, and businesses fail. That’s when people become angry at politicians. Stocks would also likely fall in an economic slowdown but it appears the economy is more important than the stock market when it comes to re-election chances for the president. |