SEC找上了馬斯克,原因是他在推特上屏蔽了人

|

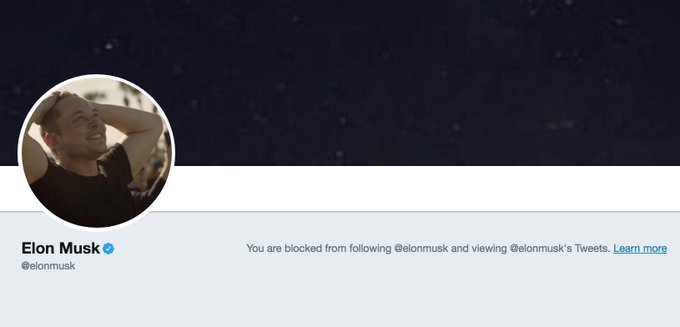

埃隆·馬斯克上周二在推特上宣布他“正在考慮將特斯拉私有化”,這樣做或許違法,但自有他自己的理由。 在推特上披露這種能左右市場的重大信息似乎顯得有違常理。但2013年美國證券交易委員會(SEC)已將社交媒體定為有效披露方式。從那時起推特就一直是和投資者進行溝通的真正渠道,前提是公司要就這樣的披露提醒投資者。 幾個月后,也就是2013年11月,特斯拉就遵循這項要求,在業績發布會上請投資者“關注埃隆·馬斯克和特斯拉的推特賬號”,以獲取更多信息。 從那以后,馬斯克養有了經常在推特上屏蔽別人的習慣。據一位參與制定社交媒體政策的前SEC官員透露,這樣的習慣有可能給特斯拉的良好守法記錄帶來不利影響。 畢竟,SEC看待社交媒體公告的角度是公平披露,這項要求源于該機構的《公平披露規則》,即Regulation FD。該規則要求,公司的信息披露方式必須“設計合理,以便用非排他方式向廣大公眾發布信息。” SEC前辦公室副主任邁克爾·利夫提克曾于2013年參與實施了對社交媒體的考察,如今他在律師事務所Quinn Emanuel Urquhart & Sullivan擔任合伙人。利夫提克說:“關鍵在于一定要確保所有人都知道。但如果屏蔽了某些人,情況就會發生改變,因為如果不讓想關注你的人看你的推特,那就會變成有選擇的披露。這確實是個問題。” 《財富》雜志發現至少有三十多人表示馬斯克在推特上屏蔽了他們,其中有投資者、新聞記者以及做空人士馬克·斯皮格,這位對沖基金經理一直在公開批評特斯拉(我應該明白這種感覺:2016年年中前后,馬斯克在推特上屏蔽了我。后來特斯拉和SolarCity公布了合并計劃,我隨即寫了篇文章指出兩家公司的董事會成員有非常大的重疊。很快我就發現自己被馬斯克屏蔽了。他還在差不多同一時間屏蔽了我的幾位同事,原因看來是在抗議卡羅爾·盧米斯在《財富》上發表的文章,內容涉及到特斯拉拖了太長時間才披露其自動駕駛汽車發生致命事故的消息——實際情況表明這對特斯拉的股價有重大影響)。 |

Elon Musk’s tweet Tuesday announcing that he was “considering taking Tesla private” may have been illegal—but not for the reasons many people think. Using Twitter to disclose such crucial market-moving information may seem unorthodox. But the platform has been a bonafide channel for investor communication since 2013, when the Securities and Exchange Commission blessed social media as a valid disclosure method—as long as companies gave investors a heads-up they would post it there. Tesla complied with this requirement a few months later, directing investors, in a November 2013 earnings press release, to “please follow Elon Musk’s and Tesla’s Twitter accounts” for additional information. Since then, though, Tesla’s CEO has developed a habit that could undermine the company’s good standing with the law, according to a former SEC regulator who helped establish the agency’s social media policy: Elon Musk routinely blocks people from following him on Twitter. After all, the SEC looks at social media announcements through the lens of fair disclosure requirements, as defined in a rule known as Regulation FD. Companies’ communication methods must be “reasonably designed to provide broad, non-exclusionary distribution of the information to the public,” according to the rules. “The point is to just make sure everyone knows,” says Michael Liftik, former deputy chief of staff of the SEC, who helped conduct the 2013 social media inquiry and is now a partner at the law firm Quinn Emanuel Urquhart & Sullivan. “But when you start blocking, that kind of does change the equation, because that kind of becomes a selective disclosure if you’re not letting anyone who wants to follow you, follow you. I do think that creates problems.” Fortune identified at least three dozen people who say Musk has blocked them on Twitter, including investors, journalists, and short-seller Mark Spiegel, a hedge fund manager who has been an outspoken critic of Tesla. (I should know what it feels like: Musk blocked me from following him on Twitter sometime in mid-2016, something I first noticed shortly after I wrote an article pointing out the significant overlap in the boards of Tesla and SolarCity as the companies announced their plan to merge. Musk also blocked several of my colleagues around the same time, in apparent protest of a Fortune article by Carol Loomis suggesting Tesla had waited too long to disclose a fatal crash of one of its cars running on autopilot—which turned out to be material to Tesla’s stock price.) |

?

?

|

哇,我才知道自己有幸被特斯拉CEO埃隆·馬斯克親自屏蔽了。真有意思,真的——2018年8月8日上午4:23 利夫提克說:“如果他屏蔽所有對特斯拉發表不利言論的人,比如,你說‘我不喜歡你們造的車’,結果就被屏蔽了,那么就可以說他存在一種屏蔽他人的行為模式,我覺得這確實會帶來一個問題:即他是否已把這個開放渠道重新變為了選擇性渠道。” 特斯拉和SEC均拒絕就此發表評論。 誰在什么時候了解到了什么? 問題在于是否有一部分投資者先于別人從特斯拉那里了解到了重大信息,從而能在被排除在消息圈之外的投資者采取行動前通過買賣特斯拉的股票牟利。就上周的特斯拉私有化消息而言,該公司股價最高漲幅曾達到7%(隨后一度停牌)。做空者(獲利方式為借入并賣出股票,然后以較低價格將其買回,再歸還給股票出借人)因此受損。特斯拉股價快速上漲迫使一些做空者以高價買入該公司股票,這讓后來才聽到這個消息的人處于更不利的位置。 斯皮格就是其中之一,這位對沖基金經理告訴《財富》雜志,他“看到特斯拉股價飆升,然后聽了新聞報道”才知道馬斯克的私有化計劃。“他已經屏蔽我好幾年了。我不得不用瀏覽器和另一個用戶名來關注他。” 和這個問題相呼應的是另一場全國性爭論,那就是特朗普總統在推特上屏蔽他人是否合法。今年5月,一位聯邦法官裁定特朗普此舉違反美國憲法第一修正案,但司法部已就此項裁決提起上訴。 斯皮格還說:“就跟特朗普的案例一樣,應該強制性‘禁言’[馬斯克]而且不允許他‘屏蔽’別人。” 據報道,SEC正在調查特斯拉向投資者發布的公告,包括馬斯克關于私有化的推特,只是還不清楚此項調查是否涉及這位CEO在推特上屏蔽別人的行為。但在判斷是否違規時,選擇性問題是SEC考慮的主要問題之一。 2013年,時任SEC執行部門代理主管的喬治·卡內洛斯在該機構頒布社交媒體指導意見時發表的聲明中表示:“絕不能因為公司選擇性地披露重要信息而使一部分股東先于其他股東采取行動。大多數社交媒體都是和投資者交流的最合適工具,但如果訪問受到限制,或者如果投資者不知道社交媒體是他們獲得最新消息的地方,那就得另當別論了。”(財富中文網) 譯者:Charlie 審校:夏林 |

Wow, I didn't know I had the honor(?) of being personally blocked by $TSLA's Elon Musk. Fascinated by this, really. “If he blocks anyone who says anything negative about Tesla—you say ‘I don’t like your cars,’ you’re blocked—and he really has a pattern of blocking a lot of people, I do think that raises particular questions about whether he has turned that open channel back into a selective channel,” Liftik says. Tesla and the SEC each declined to comment. Who learns what, when? The problem lies in whether some investors learn material information from Tesla sooner than others, allowing them to make money by buying or selling the stock before investors who were out of the loop can take action. In the case of Musk’s taking-private tweet this week, Tesla stock instantly shot up as much as 7% (before trading was temporarily halted). That hurt short-sellers, who make money by borrowing stock, selling it, then buying it back at a cheaper price (to return it to the lender). The rapid surge in Tesla’s stock price forced some short-sellers to buy shares at elevated levels—putting those who heard the news later in an even worse position. Spiegel, for one, found out about Musk’s going-private plan when he saw “the jump in the stock and then the headlines,” the hedge fund manager tells Fortune. “He’s blocked me for years. I have to use a separate web browser and ID to follow him.” The debate echoes a similar controversy playing out on the national stage as to whether it is illegal for President Trump to block people on Twitter. A federal judge ruled in May that Trump’s actions violated the First Amendment, although the Department of Justice is appealing the decision. “As in the Trump ruling, [Musk] should be forced to ‘mute’ and not ‘block,'” Spiegel adds. The SEC is reportedly probing Tesla’s public statements to investors, including Musk’s tweet about going private, though it’s unclear if the CEO’s Twitter blocking practice is part of the review. But the issue of selectivity is a key consideration in how the SEC determines whether there has been a violation. “One set of shareholders should not be able to get a jump on other shareholders just because the company is selectively disclosing important information,” George Canellos, then acting director of the SEC’s division of enforcement, said in the 2013 statement announcing the agency’s social media guidance. “Most social media are perfectly suitable methods for communicating with investors, but not if the access is restricted or if investors don’t know that’s where they need to turn to get the latest news.” |