今年7月,美國雇主發布的職位空缺數量少于上個月,這意味著招聘突然降溫,而且職位空缺未來幾個月可能進一步減少。

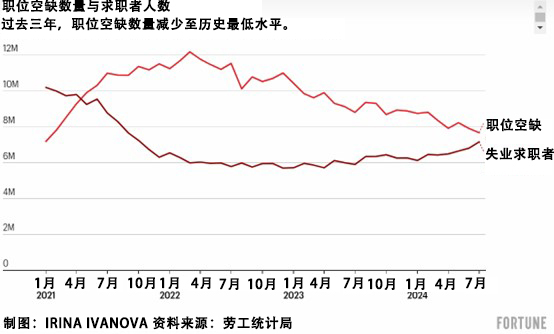

美國勞工部周三公布的報告顯示,7月份的職位空缺為770萬個,少于6月份的790萬個,為2021年1月以來的最低水平。今年,美國的職位空缺從1月份的近880萬個持續減少。

裁員人數從156萬增加到176萬,達到自2023年3月以來的最高水平,但這與疫情之前的裁員水平一致,當時美國的失業率處于歷史低位。在經歷過疫情期間的衰退后,美國經濟快速復蘇,因此裁員人數不同尋常地處于較低水平,許多雇主希望留住現有員工。

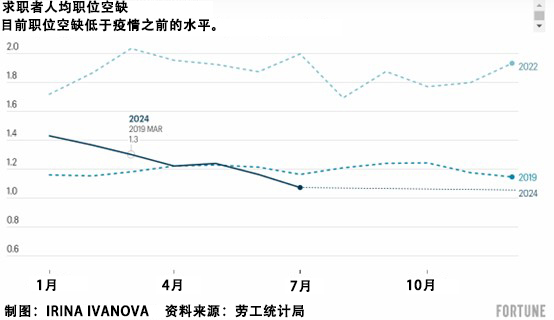

英迪德招聘實驗室(Indeed Hiring Lab)的研究總監尼克·邦克表示:“勞動力市場不僅僅是逐步降溫,達到疫情之前的水平,而是會比疫情之前更加低迷。在這個重要關頭,包括美聯儲的政策制定者在內,沒有人想看到勞動力市場進一步降溫。”邦克指出,目前職位空缺與失業的求職者的比例,低于2019年的水平,就業市場持續降溫可能意味著更多人將被裁員。

總體而言,周三發布的報告呈現出來的就業市場狀況令人喜憂參半。一方面,總聘用人數在6月份降至四年最低的520萬人之后,7月增長至550萬人。辭職人數小幅增長至約330萬人。辭職人數被視為衡量就業市場健康狀況的一個指標:工作者通常會在已經找到新工作或者有信心找到新工作時才選擇辭職。

辭職人數依舊遠低于2022年450萬人的最高點。當時,在經歷過疫情導致的經濟衰退之后,美國經濟正在加快復蘇,因此許多上班族選擇了換工作。當時辭職人數激增,幫助刺激了工資上漲,因為許多公司為了找到或留住員工,紛紛加薪。目前辭職人數較少,意味著工資可能維持適度上漲,這將有助于繼續降低通脹。

桑坦德銀行(Santander)的經濟學家史蒂芬·斯坦利指出,7月份的職位空缺依舊比招聘狀況較為健康的2019年高約7%。他說道:“勞動力需求依舊強勁,只是增速有所放緩。”

消費者繼續支出,但企業在減少招聘

周三公布的數據表明,盡管近期數據顯示消費者支出維持增長勢頭,但很少有公司正在尋求增加員工。上周,美國政府估計,4月至6月這一季度,美國經濟維持了健康的3%的年增長率。

7月,醫療保健和州與地方政府的職位空缺大幅減少,倉儲和交通運輸行業的職位空缺同樣有所減少。制造業和專業服務與商務服務行業(包括法律服務和工程與會計等領域)的職位空缺增多。

盡管過去兩年職位空缺有所減少,但目前每個失業者依舊有約1.1個職位空缺,這與疫情之前的情況相反,當時失業人數幾乎始終多于提供的工作崗位。

7月份的職位空缺報告是本周最早發布的衡量勞動力市場健康狀況的指標,美聯儲將密切關注這些指標。如果有確切證據表明招聘低迷,美聯儲可能在9月17日至18日的下一次會議上決定下調基準利率,降幅將是相對激進的50個基點。但如果招聘情況依舊穩健,美聯儲更有可能像往常一樣將利率下調25個基點。

周四,美國政府將公布上周有多少被裁員的上班族申請失業補助。迄今為止,大多數雇主主要是在努力留住員工,而不是進行裁員,只是與今年早些時候相比,他們放慢了增加工作崗位的速度。

周五,本周最受關注的經濟報告“月度就業數據”即將發布。經濟學家們一致估計,8月雇主新增163,000個就業崗位,失業率從4.3%小幅下降到4.2%。

上個月,美國政府公布的報告顯示,7月份就業崗位增長速度放緩,僅新增了114,000個就業崗位(遠不及預期,而且這是三年半以來新增就業崗位數量第二低的一個月份),而且失業率連續四個月上升。

這些數字引發了人們對經濟嚴重疲軟的擔憂,并導致股價暴跌。

ZipRecruiter首席經濟學家茱莉亞·波拉克表示:“就業報告數據下滑,職位空缺與勞動力流動調查報告中的指標下滑,這表明勞動力市場不再是通脹壓力的來源,而且降息的時機在7月份就已經到來或者說早已成熟。”

上個月晚些時候,美聯儲主席杰羅姆·鮑威爾強調,隨著通脹逐步降溫,美國央行日益重視就業市場的狀況。

在懷俄明州杰克遜霍爾召開的年度經濟研討會上,鮑威爾在發言中表示,招聘“大幅降溫”,美聯儲不會“尋求或者歡迎”就業市場“進一步降溫”。經濟學家們認為這些言論表明,如果美聯儲確定需要抵消招聘下滑的影響,它可能會加快降息。(財富中文網)

譯者:劉進龍

審校:汪皓

今年7月,美國雇主發布的職位空缺數量少于上個月,這意味著招聘突然降溫,而且職位空缺未來幾個月可能進一步減少。

美國勞工部周三公布的報告顯示,7月份的職位空缺為770萬個,少于6月份的790萬個,為2021年1月以來的最低水平。今年,美國的職位空缺從1月份的近880萬個持續減少。

裁員人數從156萬增加到176萬,達到自2023年3月以來的最高水平,但這與疫情之前的裁員水平一致,當時美國的失業率處于歷史低位。在經歷過疫情期間的衰退后,美國經濟快速復蘇,因此裁員人數不同尋常地處于較低水平,許多雇主希望留住現有員工。

英迪德招聘實驗室(Indeed Hiring Lab)的研究總監尼克·邦克表示:“勞動力市場不僅僅是逐步降溫,達到疫情之前的水平,而是會比疫情之前更加低迷。在這個重要關頭,包括美聯儲的政策制定者在內,沒有人想看到勞動力市場進一步降溫。”邦克指出,目前職位空缺與失業的求職者的比例,低于2019年的水平,就業市場持續降溫可能意味著更多人將被裁員。

總體而言,周三發布的報告呈現出來的就業市場狀況令人喜憂參半。一方面,總聘用人數在6月份降至四年最低的520萬人之后,7月增長至550萬人。辭職人數小幅增長至約330萬人。辭職人數被視為衡量就業市場健康狀況的一個指標:工作者通常會在已經找到新工作或者有信心找到新工作時才選擇辭職。

辭職人數依舊遠低于2022年450萬人的最高點。當時,在經歷過疫情導致的經濟衰退之后,美國經濟正在加快復蘇,因此許多上班族選擇了換工作。當時辭職人數激增,幫助刺激了工資上漲,因為許多公司為了找到或留住員工,紛紛加薪。目前辭職人數較少,意味著工資可能維持適度上漲,這將有助于繼續降低通脹。

桑坦德銀行(Santander)的經濟學家史蒂芬·斯坦利指出,7月份的職位空缺依舊比招聘狀況較為健康的2019年高約7%。他說道:“勞動力需求依舊強勁,只是增速有所放緩。”

消費者繼續支出,但企業在減少招聘

周三公布的數據表明,盡管近期數據顯示消費者支出維持增長勢頭,但很少有公司正在尋求增加員工。上周,美國政府估計,4月至6月這一季度,美國經濟維持了健康的3%的年增長率。

7月,醫療保健和州與地方政府的職位空缺大幅減少,倉儲和交通運輸行業的職位空缺同樣有所減少。制造業和專業服務與商務服務行業(包括法律服務和工程與會計等領域)的職位空缺增多。

盡管過去兩年職位空缺有所減少,但目前每個失業者依舊有約1.1個職位空缺,這與疫情之前的情況相反,當時失業人數幾乎始終多于提供的工作崗位。

7月份的職位空缺報告是本周最早發布的衡量勞動力市場健康狀況的指標,美聯儲將密切關注這些指標。如果有確切證據表明招聘低迷,美聯儲可能在9月17日至18日的下一次會議上決定下調基準利率,降幅將是相對激進的50個基點。但如果招聘情況依舊穩健,美聯儲更有可能像往常一樣將利率下調25個基點。

周四,美國政府將公布上周有多少被裁員的上班族申請失業補助。迄今為止,大多數雇主主要是在努力留住員工,而不是進行裁員,只是與今年早些時候相比,他們放慢了增加工作崗位的速度。

周五,本周最受關注的經濟報告“月度就業數據”即將發布。經濟學家們一致估計,8月雇主新增163,000個就業崗位,失業率從4.3%小幅下降到4.2%。

上個月,美國政府公布的報告顯示,7月份就業崗位增長速度放緩,僅新增了114,000個就業崗位(遠不及預期,而且這是三年半以來新增就業崗位數量第二低的一個月份),而且失業率連續四個月上升。

這些數字引發了人們對經濟嚴重疲軟的擔憂,并導致股價暴跌。

ZipRecruiter首席經濟學家茱莉亞·波拉克表示:“就業報告數據下滑,職位空缺與勞動力流動調查報告中的指標下滑,這表明勞動力市場不再是通脹壓力的來源,而且降息的時機在7月份就已經到來或者說早已成熟。”

上個月晚些時候,美聯儲主席杰羅姆·鮑威爾強調,隨著通脹逐步降溫,美國央行日益重視就業市場的狀況。

在懷俄明州杰克遜霍爾召開的年度經濟研討會上,鮑威爾在發言中表示,招聘“大幅降溫”,美聯儲不會“尋求或者歡迎”就業市場“進一步降溫”。經濟學家們認為這些言論表明,如果美聯儲確定需要抵消招聘下滑的影響,它可能會加快降息。(財富中文網)

譯者:劉進龍

審校:汪皓

America’s employers posted fewer job openings in July than they had the previous month, a sign that hiring is cooling sharply and could drop further in coming months.

The Labor Department reported Wednesday that there were 7.7 million open jobs in July, down from 7.9 million in June and the fewest since January 2021. Openings have fallen steadily this year, from nearly 8.8 million in January.

Layoffs rose from 1.56 million to 1.76 million, the most since March 2023, though that level of job cuts is roughly consistent with pre-pandemic levels, when the unemployment rate was historically low. Layoffs have been unusually low since the economy’s rapid recovery from the pandemic recession, with many employers intent on holding onto their workers.

“The labor market is no longer cooling down to its pre-pandemic temperature, it’s dropped past it. Nobody, and certainly not policymakers at the Federal Reserve, should want the labor market to get any cooler at this point,” said Nick Bunker, research director at the Indeed Hiring Lab. Bunker noted that the ratio of open jobs to unemployed job-seekers is now below where it was in 2019, and any further cooling in the job market would likely mean more layoffs.

Overall, Wednesday's report painted a mixed picture of the job market. On the positive side, total hiring rose in July, to 5.5 million, after it had fallen to a four-year low of 5.2 million in June. And the number of people who quit their jobs ticked up slightly, to about 3.3 million. The number of quits is seen as a measure of the job market’s health: Workers typically quit when they already have a new job or when they're confident they can find one.

Still, quits remain far below the peak of 4.5 million reached in 2022, when many workers shifted jobs as the economy accelerated out of the pandemic recession. The spike in quits at that time helped drive up wage gains as companies jacked up pay to try to find or keep employees. The current lower level of quits suggests that wage increases will likely remain modest, which should help further cool inflation.

Stephen Stanley, an economist at Santander, noted that July's job openings are still about 7% above 2019 levels, when hiring was healthy. “Labor demand is still solid, albeit moderating,” he said.

Consumers spend, but businesses halt hiring

Wednesday's figures indicate that fewer companies are seeking to add workers despite recent data showing that consumer spending is still growing. Last week, the government estimated that the economy expanded at a healthy 3% annual rate in the April-June quarter.

In July, job openings fell sharply in health care and state and local government and also dropped in warehousing and transportation. Openings rose in manufacturing and professional and business services, a category that includes legal services and engineering and accounting.

Even as openings have fallen for the past two years, there are still roughly 1.1 job openings for every unemployed person—a reversal from before the pandemic, when there were nearly always more unemployed people than available jobs.

The July report on job openings is the first of several measures this week of the labor market's health that the Federal Reserve will be watching closely. If clear evidence emerges that hiring is faltering, the Fed might decide at its next meeting Sept. 17-18 to start cutting its benchmark interest rate by a relatively aggressive half-percentage point. If hiring remains mostly solid, however, a more typical quarter-point rate cut would be likelier.

On Thursday, the government will report how many laid-off workers sought unemployment benefits last week. So far, most employers are largely holding onto their workers, rather than imposing layoffs, even though they have been slower to add jobs than they were earlier this year.

On Friday, the week’s highest-profile economic report — the monthly jobs data — will be released. The consensus estimate of economists is that employers added 163,000 jobs in August and that the unemployment rate ticked down from 4.3% to 4.2%.

Last month, the government reported that job gains slowed in July to just 114,000 — far fewer than expected and that the second-smallest total in 3 1/2 years — and the unemployment rate rose for a fourth straight month.

Those figures sparked fears that the economy was seriously weakening and contributed to a plunge in stock prices.

"Together with slipping Jobs Report figures, sliding JOLTS Report indicators provide evidence that the labor market is no longer a source of inflationary pressure, and that the time to cut interest rates has arrived—or rather, had already arrived in July," Julia Pollak, chief economist at ZipRecruiter, said.

Late last month, Fed Chair Jerome Powell underscored the central bank’s increasing focus on the job market, with inflation steadily fading.

In a speech at an annual economic symposium in Jackson Hole, Wyoming, Powell said that hiring has “cooled considerably” and that the Fed does not “seek or welcome further cooling” in the job market. Economists saw those comments as evidence that the Fed may accelerate its rate cuts if it decides it is needed to offset a slowdown in hiring.