購物中心里的大多數顧客都沒有意識到,美國這家無處不在的大型珠寶連鎖店擁有各自不同的目標群體。例如,Zales主打時尚和潮流以及個人禮物,也就是那些人們可能在辦公室或者參加鄰居普通聚會時穿戴的飾品。如果人們想購買一些不同尋常的首飾,比如給紀念日或者訂婚這類重大慶祝活動的主角送禮,那么他們就更有可能去光顧Kay。如果人們大幅提升其購物預算,而且將目光瞄向了準奢華珠寶,愿意花費3,000美元或者更多的資金,他們可能就會離開商場,并前往附近出售高端珠寶的Jared。

還有一個情況大多數購物者同樣不怎么了解,那就是所有這三家連鎖店(每一個品牌在美國境內都有數百家店面)都歸屬于同一家公司Signet Jewelers。這家珠寶零售巨頭的總部位于美國俄亥俄州,成立于百慕大。這家公司之所以能夠東山再起,Signet的長期董事、消費品業務資深人士吉娜·德羅索斯可謂是功不可沒,她于2017年開始擔任該公司的首席執行官。

需要強調的是,德羅索斯在Zoom的記者電話會議上佩戴的始終都是Zales的首飾。德羅索斯用略帶南方拖腔的口音說:“我非常欣賞將首飾作為時尚物品的理念,以及人們搭配和疊戴不同的首飾的方式。”她撫摸著自己脖子上三條組合金項鏈解釋說,Zales的咨詢師為其提供了穿搭建議,因為她希望自己佩戴的首飾可以兼顧潮流與職業。

Signet帝國或許并非一直走在時尚前沿,然而,自從德羅索斯這位公司的首位女性首席執行官執掌之后,Signet如今的發展態勢比過去強勁了不少。不久之前,Signet旗下三大連鎖品牌甚至連自己的目標群體都不是很清楚。確實,自Signet在21世紀10年代陷入低谷之后,其最大的三個品牌開始內卷,而且各自的差異化特征幾乎消失殆盡。德羅索斯回憶道,當時,Zales的任何促銷活動都會導致Kay業務量下滑。由于這些品牌的連鎖店通常互為競爭關系,而且在同一層級的商場中距離很近,上述問題也就變得更加嚴重。德羅索斯說:“公司旗下的幾個品牌基本都在中端市場相互掐架。”

Signet的三大頂級品牌貢獻了該公司77%的銷售額,其各自定位的明確劃分只不過是這位首席執行官長篇工作清單中的一項任務罷了。雖然說Signet是美國最大的專業珠寶商,但在德羅索斯接手時,這家公司卻面臨著一系列嚴峻問題。Signet在2014年收購的品牌Zales其實是一個陷阱,這家零售商負債累累,而且業績不佳的店面比比皆是,客戶和供應商對其都沒有什么好感。Signet的資產負債表則受累于其店面信用卡業務,而且電商業務基本就是一個擺設。更為嚴重的是,公司爆出了大量的性別歧視和性騷擾案件,其影響最終導致了德羅索斯前任的離職。

到目前為止,德羅索斯重構Signet的計劃已經獲得不小的成功,而這一策略源于她在寶潔(Procter & Gamble)數十年的經驗,以及她在一家基因測試初創企業擔任首席執行官的履歷。Signet關閉了Kay和Zales旗下數百家經營不善的店面,并減少了其對折扣的依賴,同時出售了信用卡業務。得益于在2022年收購的零售網站Blue Nile以及租賃服務Rocksbox,它終于跟上了電商時代的步伐。德羅索斯已經開始著手改變Signet的文化。為實現這一點,她確保那些如驚弓之鳥的雇員,尤其是女性,能夠獲得傾聽和參與感,并且愿意相信管理層的愿景,此外,她還對董事會進行了大刀闊斧的改革。

Signet的銷售額在2021年達到了78億美元,比德羅索斯上任第一年增長了22%,較其在新冠疫情期間的低谷增長了50%,并創下了新高。2022年12月中旬,Signet的第三季度銷售額和利潤均高于預期,有力地支撐了德羅索斯的成功宣言。

與此同時,Signet的挑戰可謂是接踵而至。銷售額受到了通脹的沖擊,因為客戶削減了對珠寶的開支,這項自主性的支出就像是人間蒸發了一樣。Kay、Zales,甚至是Jared的消費群體與蒂芙尼(Tiffany)不一樣,跟卡地亞(Cartier)就更無法比了。畢竟,這類群體不大可能在不景氣的時期花費大量資金來購買首飾。WSL Strategic Retail的首席執行官溫迪·利布曼表示:“美國中低端珠寶市場遭遇了巨大的壓力。我們走出了新冠疫情的陰影,卻陷入了通脹,這時人們會說:‘我真的需要珠寶嗎?’”

假日季已經早早地回答了這個問題:Signet的30%的年度銷售額通常來自于11月和12月。然而,不管珠寶購買人群是感到不安,還是信心十足,或者介于兩者之間,Signet依然有很多工作需要做,更何況華爾街預計Signet的銷售業績在未來兩年之內不大可能會出現增長,Signet也就更加任重道遠了。

德羅索斯的計劃將不得不側重于:通過超越其競爭對手贏得更多的市場份額;進一步實現業務的多元化;繼續專注于電商業務,以防止其再次停滯不前。德羅索斯說:“我們過去奉行的老辦法在上一個十年發揮了其作用。我們當時更加關注商品,與供應商合作,而不是傾聽消費者的心聲。”問題在于,新的戰略和新的文化是否可以讓Signet在波濤洶涌的市場中站穩腳跟。

這家規模最大的珠寶商仍然具有增長空間

Signet所處的戰場是一個高度細分化的市場,占據主導地位的多是小型區域連鎖店和獨立經銷商。盡管該公司是美國最大的珠寶商,但其份額僅占到這個價值760億美元市場的9.3%。這家公司的規模源于自身160年以來的珠寶行業并購交易。

Signet公司的資產組合起源于1862年成立的英國珠寶商H. Samuel。20世紀80年代,H. Samuel被英國巨頭和美國區域連鎖店Ratner Jewelers吞并,后者在那一時期又收購了Sterling Jewelers。1993年,Ratner更名為Signet。如今,Kay(此前是Sterling帝國的支柱品牌)、Zales和Jared三大品牌的銷售額分別占Signet總銷售額的38%、22%和17%。Signet還收購了Banter by Piercing Pagoda,后者是商場里的固定攤位,也是無數美國人第一次打耳眼的地方。Signet的6%的銷售額來自于英國和愛爾蘭,3%來自于加拿大,剩下的則來自美國。

得益于其規模,Signet數十年來一直在市場上處于主導地位,但與眾多行業領袖一樣,該公司出現了僵化現象。事后來看,公司2014年對其競爭對手Zale Corp.的收購似乎成為了一個經典案例,即公司通過花錢來購買自身無法實現的有機增長。該交易為Signet帶來了更多的債務,而且該連鎖店存在大量需要翻修的實體店面,同時其地域分布和款式與Kay高度重合。這個戰略性的問題很快便波及了銷售額:Signet的總銷售額在截至2016年年初的財年達到了65.5億美元的峰值,然而在接下來的五年中不斷下滑,經營利潤也因此江河日下。

德羅索斯正是在這一時刻挺身而出。她自2012年便擔任Signet董事,曾經在寶潔工作了25年的時間,并升任其美妝業務負責人。她隨后進軍生物科技初創領域,擔任基因測試公司Assurex Health的首席執行官,并執掌該公司四年時間,直到其被收購。德羅索斯表示,這段經歷讓她更加深刻地意識到數據對決策的作用。事實證明,這一認知對于她的新崗位至關重要。

擺在她眼前的其中一個顯而易見的首要解決辦法就是削減Kay和Zales連鎖店的數量。德羅索斯最終關閉了1,250家店面,同時在更好的地段新開了400家店面,主要涉及Kay和Zales這兩個最大的品牌。總的來說,她關閉了Signet的20%的實體店面,如今其美國店面數量為2,500家。

德羅索斯還通過加大對客戶的研究力度來為其改革提供指引。盡管消費者一直在告訴Signet自己已經做好了在線購物的準備,但沒有得到管理層的真正重視。珠寶購買是零售行業抗拒電商最后的堡壘之一,而Signet在此前卻并不怎么重視這個機會。[蒂芙尼在電商方面也是行動遲緩;自兩年前收購蒂芙尼之后,路威酩軒(LVMH)的首要任務便是把這家奢華珠寶商發展成為電商業務的巨頭。]

這位新首席執行官意識到,電商不僅僅是創建一個促進交易的網站,同時還要讓人們能夠在進店前對其產品進行甄選。她在擔任首席執行官之后首先采取的一個舉措便是于2017年收購了JamesAllen.com,不僅僅是因為該網站有著龐大的業務,同時還因為它擁有有望顛覆鉆石行業的技術,這項技術可以生成網站上所有販賣寶石的360度高分辨率影像,同時還能夠創建一個虛擬展示廳,為買家提供數萬枚鉆石進行挑選。如今,這一技術也可以被用于Jared和Kay的網站。德羅索斯稱:“如今,人們能夠在網站上更好地觀賞鉆石,而且比在店面更清楚,因為我們可以將其放大,并以高分辨率圖像展示。”

科技還能夠通過新奇的方式發揮作用,尤其是庫存管理方面。如果勞德代爾堡的店面的一枚戒指無人問津,那么明尼那波利斯的銷售人員便可以將其銷售給客戶。所有這一切意味著商品的周轉會變得更快,也就會給店面帶來更多的新商品,而“新款”則會吸引客戶,并維持業務的利潤率。

有鑒于新冠疫情帶來的巨大威脅,將電商作為業務重點最終為公司帶來了好運。2020年年中,Signet一直都在應對春末關閉店面數周所帶來的影響,畢竟,Zales、Kay和Jared都不是必需品零售商。Signet不顧一切的想要確保營收不會大幅下滑,并加速采用虛擬銷售和路邊取貨等方式來迎合不愿意與其他人密切接觸的消費者。公司2020年的總銷售額下滑了15%,但這段經歷為Signet提供了一些寶貴的新力量。2017年,Signet的線上銷售額占比約為5%,如今這一比例達到了23%。

收購線上珠寶零售商James Allen的交易也反映了Signet并購策略的轉變。公司長期以來一直專注于收購實體競爭對手;如今,它更關注于構建其電商業務的交易,或至少能夠獲得新客戶的交易。這一舉措的核心人物便是瓊·希爾森,此前供職于維多利亞的秘密(Victoria’s Secret),自20世紀80年代開始為Signet效力,德羅索斯于2018年聘請她擔任公司的策略與財務主管。

德羅索斯和希爾森的一個宏大目標就是解決Signet資產負債表存在的高杠桿問題,并通過削減Signet經營構架的成本來提振盈利能力。自2017年以來,Signet將其長期債務削減了80%,降至1.47億美元,公司2021年的經營利潤率為11.6%,是三年前的兩倍多。這一更加強勁的現金流讓Signet能夠放心大膽地開展收購業務。希爾森說:“此舉為公司帶來了拓展市場的流動性,并讓公司發展壯大。”

公司收購了德羅索斯關注了數年的Blue Nile。作為首個大型專業線上珠寶零售商,Blue Nile在10年前便引發了業界的轟動。然而,該品牌始終未能一飛沖天,其最高的年營收為5億美元。Signet在2022年9月以3.6億美元的現金收購了該公司,拿下了這個有著出眾虛擬展示廳以及不俗年輕客戶群的電商網站。Signet在2022年還完成了對租賃公司Rocksbox、小型專營連鎖店Diamonds Direct,以及幫助Signet提供保養和估值服務的多家公司的收購。

這一系列收購交易讓Signet這個巨頭越發龐大。該公司旗下的零售品牌從2017年的8個增至如今的11個。這一現象也引發了一個新問題:Signet是否可以保持這些品牌不斷增長,而且不會讓顧客感到困惑或者引發品牌之間的內卷。零售分析師利布曼表示:“這些品牌的數量著實不少。如果不小心的話,就很有可能會導致自身業務的碎片化和相互吞噬。”不過到目前為止,公司的三大連鎖品牌Kay、Jared和Zales都再次恢復增長,主要原因在于德羅索斯的團隊能夠下決心去關閉那些應該關閉的店面。

應對有害的公司文化

如果沒有改變Signet的文化,德羅索斯也就無法實現Signet的翻身。與眾多零售商一樣,Signet一直都是一家以女性員工和女性客戶為主的公司,但領導層大多數都是男性。在德羅索斯擔任首席執行官時,這種格局變得難以為繼。

在《華盛頓郵報》(Washington Post)2017年2月一則令人極為震驚的報道發布之后,轉折點出現了。當時,這則報道稱性騷擾在Signet已經成為一種猖獗的系統性現象,而且從上到下的男性主管皆是如此。該報道明確提到了2014年擔任Signet首席執行官的Signet終身員工馬克·萊特。除了其他的指控之外,報道稱有人看到萊特在企業活動中與“全裸和半裸的女性雇員”待在泳池里。萊特和Signet一再否認這項指控。然而,萊特以未詳細說明的健康問題為由,于2017年夏季離開了公司。與此同時,其他有牽連的經理也相繼離職。2022年,Signet和解了有關起訴公司在招聘和薪酬制度中存在性別歧視的集體訴訟案,并向6.8萬名現任和前雇員賠償了1.75億美元。

這種有害的文化并非只涉及猖獗的品行不端行為,它還滋生了業務方面的獨斷專行,以男性為主導的管理者們并不會傾聽現場員工所反映的問題,也就是Signet以女性為主導的員工。德羅索斯稱,自2012年成為公司董事以來,她一直在推動Signet員工和文化的多元化舉措。她表示,在她擔任首席執行官之后,董事會讓其加速這一舉措。

修復充滿恐懼和厭惡風險的文化是一件異常困難的事情。德羅索斯說:“這也是在接受這份工作時令我感到最緊張的事情之一。”她最先采取的其中一個舉措就是,將多元化和包容性目標融入每一位管理者的評估指標,并制定了性騷擾零容忍政策。她回憶道:“我打算從零開始。我不會重蹈覆轍。”如今,42%的副總裁級別以上雇員都是女性,在店面層面,76%的副經理以上職員都是女性。她指出:“這個水平的占比讓所有雇員對未來的可能性充滿了憧憬。”

另一個重要的拯救措施是,將更多的自主權和管理權限下放至店面。當德羅索斯開始擔任首席執行官時,她讓各個店面召開團隊會議,甚至傾聽客戶服務電話,從而了解都有哪些需要真正改進的問題。德羅索斯表示:“我很快意識到,公司的文化基本上是自上而下的命令與控制。公司內部并不缺乏人才,我們需要做的就是釋放其才干。”店面經理如今對于Signet連鎖店的銷售商品擁有更大的話語權。這一舉措,結合重疊店面的關閉,幫助大幅提升了單店銷售額:Signet店面平均年銷售額較新冠疫情前提升了50%。

這一成功的策略反映了德羅索斯自身的歷史:她稱,自己在寶潔工作的25年期間,有求必應的高層給予的支持讓其獲益匪淺。她提到了其導師雷富禮(A.G. Lafley),這位傳奇般的首席執行官曾經在21世紀初領導這家消費巨頭東山再起。正是在寶潔的經歷讓德羅索斯懂得了對一線信息進行快速響應的重要性。她將這些洞見轉化為行動,并因為領導知名護膚品牌玉蘭油(Olay)重振雄風而聲名鵲起。

由于深入掌握了令寶潔得以成名的市場數據,德羅索斯看到了存在于奢華高價百貨店品牌與低價藥店品牌之間的護膚市場。玉蘭油在沃爾瑪(Walmart)或者CVS的單品售價均不超過10美元。她回憶道:“這中間存在著巨大的空白。”因此,她打造了25美元的保濕霜,并稱其品質可以與在尼曼百貨(Neiman Marcus)售價數百美元的奢華美容品牌海藍之謎(La Mer)媲美。這一豪賭得到了回報:在其卸任時,玉蘭油的年銷售額從其執掌伊始的2.5億美元增至25億美元。德羅索斯說:“這一切完全在于理解消費者的需求,并打造能夠為自身帶來競爭優勢的顛覆性產品。”

起伏不定的未來經濟走向

盡管Signet最近大獲成功,但宏觀經濟一直在提醒德羅索斯及其團隊他們所取得的成就有多脆弱。在最近的一個季度中,Signet同比銷售或業務,不計新開設或關閉店面和業務單元的影響,下滑了7.6%。這個成績基本上是必然的,因為在一年前,新冠疫情緩解之后,銷售業績曾經出現了大幅回彈。不管怎么樣,華爾街預計未來三年該公司的銷售增速將非常有限。分析師預計其年銷售額屆時將在80億美元附近徘徊。

為了挺過日趨疲軟的經濟環境,公司將不得不繼續遵循德羅索斯密切關注客戶需求的策略。公司在2022年進一步提升了Jared的檔次,并調高了售價,同時,Kay將更密切地關注婚禮珠寶,Zales則主打時尚。分析師稱,類似舉動將有助于保護其市場份額和利潤率。GlobalData的董事總經理尼爾·桑德斯表示:“在調整其產品種類、服務和營銷來更好地迎合消費者方面,Signet還是可圈可點的。”

德羅索斯在2022年嘗試了Signet的婚禮戒指服務,她與James Allen的員工一道在2021年自己的婚禮之前設計了其訂婚戒指。這枚戒指采用了20世紀30年代的意大利裝飾藝術設計。她回憶道:“一開始,他們并沒有找到可以讓其感到足夠自豪的鑲嵌鉆石,因此他們讓我等了一段時間。”等待是值得的,她說:“我自己也算是一個前衛高調的人。”(財富中文網)

譯者:馮豐

審校:夏林

購物中心里的大多數顧客都沒有意識到,美國這家無處不在的大型珠寶連鎖店擁有各自不同的目標群體。例如,Zales主打時尚和潮流以及個人禮物,也就是那些人們可能在辦公室或者參加鄰居普通聚會時穿戴的飾品。如果人們想購買一些不同尋常的首飾,比如給紀念日或者訂婚這類重大慶祝活動的主角送禮,那么他們就更有可能去光顧Kay。如果人們大幅提升其購物預算,而且將目光瞄向了準奢華珠寶,愿意花費3,000美元或者更多的資金,他們可能就會離開商場,并前往附近出售高端珠寶的Jared。

還有一個情況大多數購物者同樣不怎么了解,那就是所有這三家連鎖店(每一個品牌在美國境內都有數百家店面)都歸屬于同一家公司Signet Jewelers。這家珠寶零售巨頭的總部位于美國俄亥俄州,成立于百慕大。這家公司之所以能夠東山再起,Signet的長期董事、消費品業務資深人士吉娜·德羅索斯可謂是功不可沒,她于2017年開始擔任該公司的首席執行官。

需要強調的是,德羅索斯在Zoom的記者電話會議上佩戴的始終都是Zales的首飾。德羅索斯用略帶南方拖腔的口音說:“我非常欣賞將首飾作為時尚物品的理念,以及人們搭配和疊戴不同的首飾的方式。”她撫摸著自己脖子上三條組合金項鏈解釋說,Zales的咨詢師為其提供了穿搭建議,因為她希望自己佩戴的首飾可以兼顧潮流與職業。

Signet帝國或許并非一直走在時尚前沿,然而,自從德羅索斯這位公司的首位女性首席執行官執掌之后,Signet如今的發展態勢比過去強勁了不少。不久之前,Signet旗下三大連鎖品牌甚至連自己的目標群體都不是很清楚。確實,自Signet在21世紀10年代陷入低谷之后,其最大的三個品牌開始內卷,而且各自的差異化特征幾乎消失殆盡。德羅索斯回憶道,當時,Zales的任何促銷活動都會導致Kay業務量下滑。由于這些品牌的連鎖店通常互為競爭關系,而且在同一層級的商場中距離很近,上述問題也就變得更加嚴重。德羅索斯說:“公司旗下的幾個品牌基本都在中端市場相互掐架。”

Signet的三大頂級品牌貢獻了該公司77%的銷售額,其各自定位的明確劃分只不過是這位首席執行官長篇工作清單中的一項任務罷了。雖然說Signet是美國最大的專業珠寶商,但在德羅索斯接手時,這家公司卻面臨著一系列嚴峻問題。Signet在2014年收購的品牌Zales其實是一個陷阱,這家零售商負債累累,而且業績不佳的店面比比皆是,客戶和供應商對其都沒有什么好感。Signet的資產負債表則受累于其店面信用卡業務,而且電商業務基本就是一個擺設。更為嚴重的是,公司爆出了大量的性別歧視和性騷擾案件,其影響最終導致了德羅索斯前任的離職。

到目前為止,德羅索斯重構Signet的計劃已經獲得不小的成功,而這一策略源于她在寶潔(Procter & Gamble)數十年的經驗,以及她在一家基因測試初創企業擔任首席執行官的履歷。Signet關閉了Kay和Zales旗下數百家經營不善的店面,并減少了其對折扣的依賴,同時出售了信用卡業務。得益于在2022年收購的零售網站Blue Nile以及租賃服務Rocksbox,它終于跟上了電商時代的步伐。德羅索斯已經開始著手改變Signet的文化。為實現這一點,她確保那些如驚弓之鳥的雇員,尤其是女性,能夠獲得傾聽和參與感,并且愿意相信管理層的愿景,此外,她還對董事會進行了大刀闊斧的改革。

Signet的銷售額在2021年達到了78億美元,比德羅索斯上任第一年增長了22%,較其在新冠疫情期間的低谷增長了50%,并創下了新高。2022年12月中旬,Signet的第三季度銷售額和利潤均高于預期,有力地支撐了德羅索斯的成功宣言。

與此同時,Signet的挑戰可謂是接踵而至。銷售額受到了通脹的沖擊,因為客戶削減了對珠寶的開支,這項自主性的支出就像是人間蒸發了一樣。Kay、Zales,甚至是Jared的消費群體與蒂芙尼(Tiffany)不一樣,跟卡地亞(Cartier)就更無法比了。畢竟,這類群體不大可能在不景氣的時期花費大量資金來購買首飾。WSL Strategic Retail的首席執行官溫迪·利布曼表示:“美國中低端珠寶市場遭遇了巨大的壓力。我們走出了新冠疫情的陰影,卻陷入了通脹,這時人們會說:‘我真的需要珠寶嗎?’”

假日季已經早早地回答了這個問題:Signet的30%的年度銷售額通常來自于11月和12月。然而,不管珠寶購買人群是感到不安,還是信心十足,或者介于兩者之間,Signet依然有很多工作需要做,更何況華爾街預計Signet的銷售業績在未來兩年之內不大可能會出現增長,Signet也就更加任重道遠了。

德羅索斯的計劃將不得不側重于:通過超越其競爭對手贏得更多的市場份額;進一步實現業務的多元化;繼續專注于電商業務,以防止其再次停滯不前。德羅索斯說:“我們過去奉行的老辦法在上一個十年發揮了其作用。我們當時更加關注商品,與供應商合作,而不是傾聽消費者的心聲。”問題在于,新的戰略和新的文化是否可以讓Signet在波濤洶涌的市場中站穩腳跟。

這家規模最大的珠寶商仍然具有增長空間

Signet所處的戰場是一個高度細分化的市場,占據主導地位的多是小型區域連鎖店和獨立經銷商。盡管該公司是美國最大的珠寶商,但其份額僅占到這個價值760億美元市場的9.3%。這家公司的規模源于自身160年以來的珠寶行業并購交易。

Signet公司的資產組合起源于1862年成立的英國珠寶商H. Samuel。20世紀80年代,H. Samuel被英國巨頭和美國區域連鎖店Ratner Jewelers吞并,后者在那一時期又收購了Sterling Jewelers。1993年,Ratner更名為Signet。如今,Kay(此前是Sterling帝國的支柱品牌)、Zales和Jared三大品牌的銷售額分別占Signet總銷售額的38%、22%和17%。Signet還收購了Banter by Piercing Pagoda,后者是商場里的固定攤位,也是無數美國人第一次打耳眼的地方。Signet的6%的銷售額來自于英國和愛爾蘭,3%來自于加拿大,剩下的則來自美國。

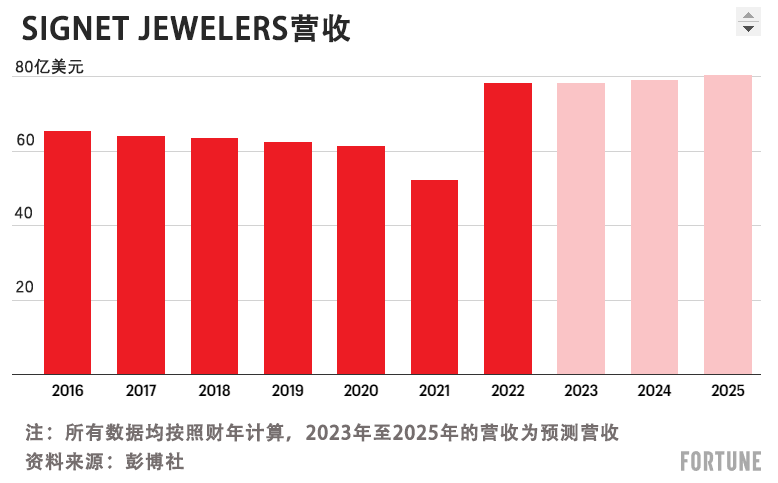

得益于其規模,Signet數十年來一直在市場上處于主導地位,但與眾多行業領袖一樣,該公司出現了僵化現象。事后來看,公司2014年對其競爭對手Zale Corp.的收購似乎成為了一個經典案例,即公司通過花錢來購買自身無法實現的有機增長。該交易為Signet帶來了更多的債務,而且該連鎖店存在大量需要翻修的實體店面,同時其地域分布和款式與Kay高度重合。這個戰略性的問題很快便波及了銷售額:Signet的總銷售額在截至2016年年初的財年達到了65.5億美元的峰值,然而在接下來的五年中不斷下滑,經營利潤也因此江河日下。

德羅索斯正是在這一時刻挺身而出。她自2012年便擔任Signet董事,曾經在寶潔工作了25年的時間,并升任其美妝業務負責人。她隨后進軍生物科技初創領域,擔任基因測試公司Assurex Health的首席執行官,并執掌該公司四年時間,直到其被收購。德羅索斯表示,這段經歷讓她更加深刻地意識到數據對決策的作用。事實證明,這一認知對于她的新崗位至關重要。

擺在她眼前的其中一個顯而易見的首要解決辦法就是削減Kay和Zales連鎖店的數量。德羅索斯最終關閉了1,250家店面,同時在更好的地段新開了400家店面,主要涉及Kay和Zales這兩個最大的品牌。總的來說,她關閉了Signet的20%的實體店面,如今其美國店面數量為2,500家。

德羅索斯還通過加大對客戶的研究力度來為其改革提供指引。盡管消費者一直在告訴Signet自己已經做好了在線購物的準備,但沒有得到管理層的真正重視。珠寶購買是零售行業抗拒電商最后的堡壘之一,而Signet在此前卻并不怎么重視這個機會。[蒂芙尼在電商方面也是行動遲緩;自兩年前收購蒂芙尼之后,路威酩軒(LVMH)的首要任務便是把這家奢華珠寶商發展成為電商業務的巨頭。]

這位新首席執行官意識到,電商不僅僅是創建一個促進交易的網站,同時還要讓人們能夠在進店前對其產品進行甄選。她在擔任首席執行官之后首先采取的一個舉措便是于2017年收購了JamesAllen.com,不僅僅是因為該網站有著龐大的業務,同時還因為它擁有有望顛覆鉆石行業的技術,這項技術可以生成網站上所有販賣寶石的360度高分辨率影像,同時還能夠創建一個虛擬展示廳,為買家提供數萬枚鉆石進行挑選。如今,這一技術也可以被用于Jared和Kay的網站。德羅索斯稱:“如今,人們能夠在網站上更好地觀賞鉆石,而且比在店面更清楚,因為我們可以將其放大,并以高分辨率圖像展示。”

科技還能夠通過新奇的方式發揮作用,尤其是庫存管理方面。如果勞德代爾堡的店面的一枚戒指無人問津,那么明尼那波利斯的銷售人員便可以將其銷售給客戶。所有這一切意味著商品的周轉會變得更快,也就會給店面帶來更多的新商品,而“新款”則會吸引客戶,并維持業務的利潤率。

有鑒于新冠疫情帶來的巨大威脅,將電商作為業務重點最終為公司帶來了好運。2020年年中,Signet一直都在應對春末關閉店面數周所帶來的影響,畢竟,Zales、Kay和Jared都不是必需品零售商。Signet不顧一切的想要確保營收不會大幅下滑,并加速采用虛擬銷售和路邊取貨等方式來迎合不愿意與其他人密切接觸的消費者。公司2020年的總銷售額下滑了15%,但這段經歷為Signet提供了一些寶貴的新力量。2017年,Signet的線上銷售額占比約為5%,如今這一比例達到了23%。

收購線上珠寶零售商James Allen的交易也反映了Signet并購策略的轉變。公司長期以來一直專注于收購實體競爭對手;如今,它更關注于構建其電商業務的交易,或至少能夠獲得新客戶的交易。這一舉措的核心人物便是瓊·希爾森,此前供職于維多利亞的秘密(Victoria’s Secret),自20世紀80年代開始為Signet效力,德羅索斯于2018年聘請她擔任公司的策略與財務主管。

德羅索斯和希爾森的一個宏大目標就是解決Signet資產負債表存在的高杠桿問題,并通過削減Signet經營構架的成本來提振盈利能力。自2017年以來,Signet將其長期債務削減了80%,降至1.47億美元,公司2021年的經營利潤率為11.6%,是三年前的兩倍多。這一更加強勁的現金流讓Signet能夠放心大膽地開展收購業務。希爾森說:“此舉為公司帶來了拓展市場的流動性,并讓公司發展壯大。”

公司收購了德羅索斯關注了數年的Blue Nile。作為首個大型專業線上珠寶零售商,Blue Nile在10年前便引發了業界的轟動。然而,該品牌始終未能一飛沖天,其最高的年營收為5億美元。Signet在2022年9月以3.6億美元的現金收購了該公司,拿下了這個有著出眾虛擬展示廳以及不俗年輕客戶群的電商網站。Signet在2022年還完成了對租賃公司Rocksbox、小型專營連鎖店Diamonds Direct,以及幫助Signet提供保養和估值服務的多家公司的收購。

這一系列收購交易讓Signet這個巨頭越發龐大。該公司旗下的零售品牌從2017年的8個增至如今的11個。這一現象也引發了一個新問題:Signet是否可以保持這些品牌不斷增長,而且不會讓顧客感到困惑或者引發品牌之間的內卷。零售分析師利布曼表示:“這些品牌的數量著實不少。如果不小心的話,就很有可能會導致自身業務的碎片化和相互吞噬。”不過到目前為止,公司的三大連鎖品牌Kay、Jared和Zales都再次恢復增長,主要原因在于德羅索斯的團隊能夠下決心去關閉那些應該關閉的店面。

應對有害的公司文化

如果沒有改變Signet的文化,德羅索斯也就無法實現Signet的翻身。與眾多零售商一樣,Signet一直都是一家以女性員工和女性客戶為主的公司,但領導層大多數都是男性。在德羅索斯擔任首席執行官時,這種格局變得難以為繼。

在《華盛頓郵報》(Washington Post)2017年2月一則令人極為震驚的報道發布之后,轉折點出現了。當時,這則報道稱性騷擾在Signet已經成為一種猖獗的系統性現象,而且從上到下的男性主管皆是如此。該報道明確提到了2014年擔任Signet首席執行官的Signet終身員工馬克·萊特。除了其他的指控之外,報道稱有人看到萊特在企業活動中與“全裸和半裸的女性雇員”待在泳池里。萊特和Signet一再否認這項指控。然而,萊特以未詳細說明的健康問題為由,于2017年夏季離開了公司。與此同時,其他有牽連的經理也相繼離職。2022年,Signet和解了有關起訴公司在招聘和薪酬制度中存在性別歧視的集體訴訟案,并向6.8萬名現任和前雇員賠償了1.75億美元。

這種有害的文化并非只涉及猖獗的品行不端行為,它還滋生了業務方面的獨斷專行,以男性為主導的管理者們并不會傾聽現場員工所反映的問題,也就是Signet以女性為主導的員工。德羅索斯稱,自2012年成為公司董事以來,她一直在推動Signet員工和文化的多元化舉措。她表示,在她擔任首席執行官之后,董事會讓其加速這一舉措。

修復充滿恐懼和厭惡風險的文化是一件異常困難的事情。德羅索斯說:“這也是在接受這份工作時令我感到最緊張的事情之一。”她最先采取的其中一個舉措就是,將多元化和包容性目標融入每一位管理者的評估指標,并制定了性騷擾零容忍政策。她回憶道:“我打算從零開始。我不會重蹈覆轍。”如今,42%的副總裁級別以上雇員都是女性,在店面層面,76%的副經理以上職員都是女性。她指出:“這個水平的占比讓所有雇員對未來的可能性充滿了憧憬。”

另一個重要的拯救措施是,將更多的自主權和管理權限下放至店面。當德羅索斯開始擔任首席執行官時,她讓各個店面召開團隊會議,甚至傾聽客戶服務電話,從而了解都有哪些需要真正改進的問題。德羅索斯表示:“我很快意識到,公司的文化基本上是自上而下的命令與控制。公司內部并不缺乏人才,我們需要做的就是釋放其才干。”店面經理如今對于Signet連鎖店的銷售商品擁有更大的話語權。這一舉措,結合重疊店面的關閉,幫助大幅提升了單店銷售額:Signet店面平均年銷售額較新冠疫情前提升了50%。

這一成功的策略反映了德羅索斯自身的歷史:她稱,自己在寶潔工作的25年期間,有求必應的高層給予的支持讓其獲益匪淺。她提到了其導師雷富禮(A.G. Lafley),這位傳奇般的首席執行官曾經在21世紀初領導這家消費巨頭東山再起。正是在寶潔的經歷讓德羅索斯懂得了對一線信息進行快速響應的重要性。她將這些洞見轉化為行動,并因為領導知名護膚品牌玉蘭油(Olay)重振雄風而聲名鵲起。

由于深入掌握了令寶潔得以成名的市場數據,德羅索斯看到了存在于奢華高價百貨店品牌與低價藥店品牌之間的護膚市場。玉蘭油在沃爾瑪(Walmart)或者CVS的單品售價均不超過10美元。她回憶道:“這中間存在著巨大的空白。”因此,她打造了25美元的保濕霜,并稱其品質可以與在尼曼百貨(Neiman Marcus)售價數百美元的奢華美容品牌海藍之謎(La Mer)媲美。這一豪賭得到了回報:在其卸任時,玉蘭油的年銷售額從其執掌伊始的2.5億美元增至25億美元。德羅索斯說:“這一切完全在于理解消費者的需求,并打造能夠為自身帶來競爭優勢的顛覆性產品。”

起伏不定的未來經濟走向

盡管Signet最近大獲成功,但宏觀經濟一直在提醒德羅索斯及其團隊他們所取得的成就有多脆弱。在最近的一個季度中,Signet同比銷售或業務,不計新開設或關閉店面和業務單元的影響,下滑了7.6%。這個成績基本上是必然的,因為在一年前,新冠疫情緩解之后,銷售業績曾經出現了大幅回彈。不管怎么樣,華爾街預計未來三年該公司的銷售增速將非常有限。分析師預計其年銷售額屆時將在80億美元附近徘徊。

為了挺過日趨疲軟的經濟環境,公司將不得不繼續遵循德羅索斯密切關注客戶需求的策略。公司在2022年進一步提升了Jared的檔次,并調高了售價,同時,Kay將更密切地關注婚禮珠寶,Zales則主打時尚。分析師稱,類似舉動將有助于保護其市場份額和利潤率。GlobalData的董事總經理尼爾·桑德斯表示:“在調整其產品種類、服務和營銷來更好地迎合消費者方面,Signet還是可圈可點的。”

德羅索斯在2022年嘗試了Signet的婚禮戒指服務,她與James Allen的員工一道在2021年自己的婚禮之前設計了其訂婚戒指。這枚戒指采用了20世紀30年代的意大利裝飾藝術設計。她回憶道:“一開始,他們并沒有找到可以讓其感到足夠自豪的鑲嵌鉆石,因此他們讓我等了一段時間。”等待是值得的,她說:“我自己也算是一個前衛高調的人。”(財富中文網)

譯者:馮豐

審校:夏林

Most passersby at the mall don’t realize it, but America’s big, ubiquitous jewelry store chains are designed to serve different needs. Zales, for example, is more focused on fashion and trends and gifts for oneself—the kind of jewelry you might wear to the office, or to a casual party in your neighborhood. If you were looking for something more out of the ordinary, a gift for someone to celebrate a big life event like an anniversary or an engagement, you’d probably be more likely to go to Kay. And if you were going shopping with a substantially bigger budget and dip into quasi-luxury, willing to spend, say, $3,000 or more, you might leave the mall and go to a nearby Jared, which tracks higher-end.

Another thing most shoppers don’t realize is that all three of those chains—each a national brand with hundreds of stores—are owned by the same company: Signet Jewelers, a jewelry-retail behemoth headquartered in Ohio and incorporated in Bermuda. It’s a company celebrating a resurgence, thanks in no small part to Gina Drosos, a longtime Signet board member and consumer-goods veteran who became CEO in 2017.

And for the record, the jewelry Drosos is wearing—on a Zoom call with a reporter—is Zales all the way. “I really enjoy the idea of jewelry as a fashion item, and how you stack and layer different pieces,” Drosos says, her voice revealing a slight Southern drawl. She runs her fingers across her set of three gold necklaces and explains that a Zales consultant gave her pointers on how to get the look she wanted—trendy, but still professional.

The Signet empire may not always be trendy, but it has considerably 1more momentum these days than it did when Drosos, the company’s first female CEO, took the helm. Not so long ago, it was not nearly as clear-cut what purpose each of Signet’s three biggest chains were most suitable for. Indeed, as Signet fell into a rut during the 2010s, its biggest banners cannibalized each other and started to become almost indistinguishable. Drosos recalls a time when any sales event at Zales would mean a corresponding drop in business at Kay, a problem made all the worse given that the chains often operated rival stores within yards of each other at the same tired malls. “We had all of our banners pretty much on top of each other in the middle tier,” says Drosos.

A clearer delineation between Signet’s top three brands, which together generate 77% of company sales, was just one item on the CEO’s long to-do list. Despite being the single largest jeweler in the country, Signet was dealing with a litany of major problems when Drosos took over. Zales, which Signet had acquired in 2014, turned out to be booby-trapped—a debt-laden retailer with too many terrible stores, losing favor with both customers and suppliers. Signet’s balance sheet was being dragged down by its store credit-card business; and it had all but ignored e-commerce. Overlaid on all that was the fallout from massive sexual discrimination and sexual harassment cases that culminated with the departure of Drosos’s predecessor.

So far, Drosos’s plan to reinvent Signet—a strategy shaped by her decades of experience at Procter & Gamble, as well as by a stint as CEO of a genetic-testing startup—has registered some big successes. Signet has shed hundreds of weak stores in the Kay and Zales chains and reduced its reliance on discounting. It sold off that credit-card business. And it has finally adapted to the e-commerce era, thanks to deals such as its recent acquisitions of retail site Blue Nile and the rental service Rocksbox. Drosos has also begun to change Signet’s culture—by making sure shell-shocked employees, primarily women, feel heard and included and are willing to buy into management’s vision, and by dramatically overhauling the board.

Signet sales hit $7.8 billion in 2021—up 22% from Drosos’s first year in the corner office, and up 50% from their pandemic lows—to reach a new record. In mid-December 2022, Signet reported better than expected sales and profits results for its third quarter, bolstering Drosos’s claims of success.

At the same time, there has been no shortage of reminders of Signet’s challenges. Sales have been hit by inflation as customers have pared back on jewelry, a discretionary category if ever there was one. Kay, Zales, and even Jared shoppers are not Tiffany shoppers, let alone Cartier, after all—they’re not the kinds of people likely to spend big on jewelry when times get tight. The mid- and lower tiers of the U.S. jewelry market are under enormous pressure, says Wendy Liebmann, CEO of WSL Strategic Retail: “We have come out of the pandemic and into inflation, where people are saying, ‘Do I really need it?’”

This holiday season could provide an early answer to that question: Signet typically gets 30% of annual sales in November and December. But whether jewelry shoppers show themselves to be skittish, bullish, or somewhere in between, there’s much work left to be done, all the more given that Wall Street is expecting hardly any sales growth in the next two years for Signet.

Drosos’s game plan will have to be about winning more market share by outdoing its rivals; further diversifying its businesses; and staying committed to e-commerce, lest it fall back into stagnation. “We were running an old playbook that had worked for the previous decade,” says Drosos. “We were much more about the merchandise, and working with vendors, than we were about listening to consumers.” The question is whether a new playbook and a new culture will keep Signet on an even keel in choppier waters.

The biggest jeweler, but with room to grow

Signet competes in a highly fragmented industry, where small regional chains and independent stores dominate. While it’s America’s biggest jeweler, it controls only 9.3% of a $76 billion market. It owes its size to 160 years of jewelry M&A.

The company’s portfolio dates back to the founding in 1862 of British jeweler H. Samuel. H. Samuel was absorbed in the 1980s by Ratner Jewelers, a conglomerate of U.K. and U.S. regional chains, that around the same time also absorbed Sterling Jewelers. Ratner changed its name to Signet in 1993. Today, Kay, a former anchor of the Sterling empire, generates 38% of Signet sales, while Zales accounts for 22%, and Jared 17%. Signet also owns Banter by Piercing Pagoda, the mall kiosk fixture where countless Americans had their earlobes punctured for the first time. Signet gets about 6% of sales in Britain and Ireland, 3% in Canada, and the rest in the States.

Signet’s size made it dominant for decades—but like many industry leaders, it became sclerotic. The 2014 acquisition of Zale Corp., at the time Signet’s main rival, looks in hindsight like a classic example of a company buying the growth that it couldn’t capture organically. The deal saddled Signet with more debt, along with a chain of stores that needed a big physical fix-up job, and had massive geographic and stylistic overlap with Kay. The strategic problem soon showed in the top line: Signet’s total sales peaked at $6.55 billion in the fiscal year ended in early 2016, then declined for the next five years, taking operating profitability down in the process.

That was the point at which Drosos stepped up. Drosos, a Signet director since 2012, had spent 25 years at P&G, rising to head of its beauty business. She had then detoured into biotech startup territory, becoming CEO at Assurex Health, a genetic testing company, and guiding it for four years until it got acquired. There, she says, she deepened her understanding of the power of data in decision-making—a knowledge that would prove pivotal in her new role.

Among the first obvious fixes on her plate was the need to cut stores in the Kay and Zales chains. Drosos ended up closing 1,250 stores across the company while opening 400 in better locations, with much of that change in the two biggest banners. All told, she closed 20% of Signet’s physical locations, which now number 2,500 stores in the U.S.

Drosos also turned to deeper customer research to guide her reforms. One of the things consumers were telling Signet but that management hadn’t really heard was that they were ready to shop online. Jewelry shopping was one of the last ramparts in retail to resist e-commerce, and it was an opportunity Signet had previously seemed to yawn at. (Tiffany was also late to e-commerce; LVMH, which bought Tiffany two years ago, has made turning the luxury jeweler into an e-commerce powerhouse a top priority.)

The new CEO realized that e-commerce wasn’t just about having a site that facilitates transactions, but about enabling people to conduct research before setting foot in stores. In one of her first moves as CEO, Drosos in 2017 bought JamesAllen.com—not because the site was a big business, but because it had tech that would upend the diamond industry. Its technology generates a 360-degree, high-definition image of every stone sold on the site, creating a virtual showroom in which buyers can choose from tens of thousands of diamonds. And that tech can now be used by the websites of Jared and Kay, too. “People can now see a diamond on our website better than they can see it in person, because we can blow it up and show it to them in HD,” boasts Drosos.

Tech has also been helpful in nerdy ways, specifically inventory management. If a ring is sitting unsold in a store in Fort Lauderdale, a salesperson in Minneapolis can access it for a customer. All this has meant a faster turnover of goods, meaning more fresh inventory in stores, and “newness” to draw in customers and protect profit margins.

Making e-commerce a priority turned out to be fortuitous, given the massive threat that would come from the COVID-19 pandemic. By mid-2020, Signet was dealing with the fallout of having stores closed for weeks on end in the spring—after all, Zales, Kay, and Jared were anything but essential retailers. Desperate to make sure revenue didn’t crater, the company sped the adoption of options like virtual selling and curbside pickup to accommodate shoppers wary of being in close quarters with others. Overall sales fell 15% in 2020, but the experience gave Signet some valuable new muscles. In 2017, some 5% of Signet’s sales were online; that rate now stands at 23%.

The James Allen deal also reflected a shift in Signet’s M&A strategy. The company had long been focused on buying out brick-and-mortar rivals; now, it’s more focused on deals that build up its e-commerce firepower, or at least win new customers. Central to this effort is Joan Hilson, a Victoria’s Secret alum who worked for Signet in the 1980s and whom Drosos hired in 2018 to be her strategy and finance chief.

One of Drosos and Hilson’s big goals was to fix Signet’s balance sheet, which was highly leveraged, and to bolster profitability by taking costs out of Signet’s operating structure. Since 2017, Signet has lowered its long-term debt by 80% to $147 million; and its operating profit margin was 11.6% in 2021, more than twice what it was just three years earlier. That stronger cash flow frees Signet to make bets through acquisitions. “It has generated liquidity for us to go out and grow our company,” says Hilson.

Take Blue Nile, which Drosos had been eyeing for years. Blue Nile created a sensation a decade ago as the first big online-only jewelry retailer. But the brand never truly took off, plateauing at $500 million a year in revenue. Signet bought it in September 2022 for $360 million, all cash, grabbing an e-commerce site with impressive virtual showrooms and an appealing young customer base. Other buys in 2022 include Rocksbox, a rental company; a small, specialized store chain called Diamonds Direct; and companies that help Signet offer services like maintenance and valuations.

The buying spree has made the Signet conglomerate even more sprawling: The company now has 11 retail banners under its umbrella, up from eight in 2017. That raises anew the question of whether Signet can keep the brands growing without confusing shoppers and competing against itself. “That’s an extraordinary accumulation of brands,” says Liebmann, the retail analyst. “There’s a lot of potential for fragmentation and cannibalizing your own business if you’re not careful.” But for now, the three big chains—Kay, Jared, and Zales—are growing simultaneously again, not least because Drosos’s team had the discipline to close the stores that needed to be closed.

Tackling a toxic culture

Drosos would not have been able to effect this turnaround without changing Signet’s culture. Like many retailers, Signet had long been a company with a mostly female workforce, a mostly female clientele, and mostly male leadership. By the time Drosos became CEO, that lineup had created an untenable situation.

The breaking point came after a devastating Washington Post story in February of 2017 that alleged years of systemic, rampant sexual harassment by male supervisors all the way up the chain of command. The story specifically implicated Mark Light, a Signet lifer who became CEO in 2014. Among other allegations, Light reportedly was seen in a pool with “nude and partially undressed female employees” at a corporate retreat. Light and Signet repeatedly denied the allegations. But Light left in the summer of 2017, citing unspecified health issues, and other implicated managers also departed. And in 2022, Signet settled a class action suit alleging gender bias in its hiring and compensation practices, shelling out $175 million to 68,000 current and former employees.

The toxic culture went beyond rampant misbehavior: It also took the form of a quasi-autocratic approach to business in which the bosses, disproportionately men, didn’t listen to what people in the field, the predominantly female frontline Signet workers, were seeing. Drosos, says that as a board member from 2012, she had always pushed for Signet to diversify its workforce and culture. When she became CEO, she says, the board told her to accelerate that effort.

Fixing a culture of fear and risk aversion is a tall order. “It was one of the things that made me the most nervous about taking this job,” Drosos says. Among her first moves: Making diversity and inclusion goals part of every leaders’ evaluation and creating a zero-tolerance policy for sexual harassment. “I’m going to create a clean slate. I’m not going to let history be our future,” she recalls thinking. Today, 42% of Signet employees at the vice-president level or higher are women; at the store level, 76% of assistant managers or higher are female. “Representation at that level sets a vision for all employees of what’s possible,” she said.

Another key fix: giving more autonomy and authority to store-level management. When she started as CEO, Drosos made the rounds of stores, sitting in on team meetings and even listening in on customer service calls to get a sense of what truly needed fixing. “What I realized very quickly was that it was quite a top-down culture of command and control,” she says. “We had brilliance in the organization that we just needed to unleash.” Store managers have a lot more say now in what Signet’s chains will carry. That move, combined with the closures of overlapping stores, has helped make individual stores far more productive: The average Signet store now generates 50% more in annual sales than it did pre-pandemic.

That coup reflects Drosos’s own history: She says she benefited from support from responsive higher-ups in her 25 years at Procter & Gamble. She counts among her mentors A.G. Lafley, the iconic CEO credited with leading a turnaround at the consumer giant in the early 2000s. It was at P&G that Drosos understood the importance of responding quickly to information from the front lines. She put those insights into action, and made her reputation, with her turnaround of famed skin-care brand Olay.

Armed with the in-depth market data for which P&G is famed, Drosos saw a big white space in the skin-care market between fancy, pricey department store brands, and low-price drugstore brands. Olay wasn’t selling a single product over $10 at Walmart or CVS. “There was a big gap,” she recalls. So she created a $25 moisturizer that she argued was on par with Crème de la Mer, a luxury beauty product sold at Neiman Marcus for hundreds of dollars a jar. The gambit took off: A brand that had seen $250 million in annual sales when she took it over had reached $2.5 billion a year by the time she was done with it. “It was really all about consumer understanding, and creating disruptions that would form a competitive advantage for us,” says Drosos.

A choppy economy ahead

For all of Signet’s recent success, the economy keeps reminding Drosos and her team how fragile that progress can be. In its most recent quarter, Signet’s comparable sales, or business excluding newly added or removed stores and business units, fell by 7.6%. Much of that drop was just the law of arithmetic after the dramatic sales bounce-back a year ago as the pandemic eased. Nonetheless, Wall Street is expecting very limited sales growth over the next three years, with analysts predicting that annual sales will hover at about $8 billion during that time.

To power through a softening economy, the company will have to keep following Drosos’s playbook of listening closely to what customers want. It has recently taken Jared further upscale with higher price points, and focused Kay more tightly on bridal jewelry and Zales on fashion, and analysts say moves like that could help protect its market share and margins. “Signet deserves credit for pivoting its assortment, services, and marketing to better cater to consumers,” says Neil Saunders, managing director of GlobalData.

Drosos recently got to try out Signet’s bridal-ring services, working with staff at James Allen to design her own engagement ring ahead of her marriage in 2021. The ring had an Italian Art Deco design from the 1930s. “They couldn’t find a diamond that they were proud enough of to put in the ring at first, and so they made me wait,” she recalls. The wait was well worth it, she says: “I’m a bit more of a bold statement maker myself.”