只有英偉達這家搖身一變成為不可或缺的市值2萬億美元的人工智能巨頭,才能完美化解高管們獎金化為烏有一事。這家領先的半導體芯片制造商未能在2023財年實現與營收和非美國通用會計準則營業收入相關的財務目標,高管們因此沒有達到兩個關鍵的支付門檻,因為公司披露的信息顯示,2023財年該公司向高管團隊支付的現金獎金為零,某些基于業績的股權獎勵也未能歸屬。不過,該公司的股權計劃結構和出色業績表現在很大程度上使其避免了重大人才流失。

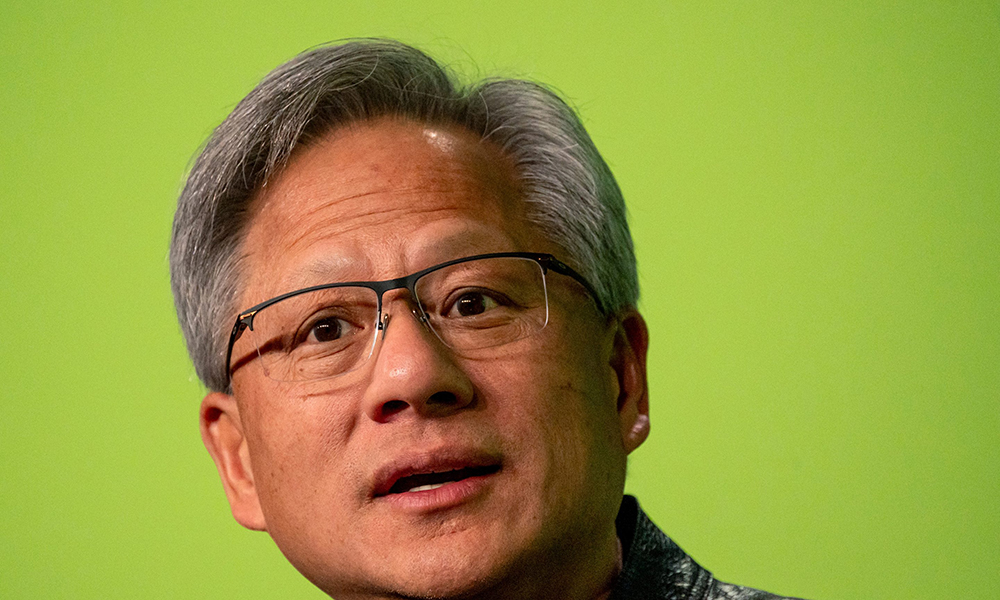

以首席執行官兼創始人黃仁勛本人為例。董事會上一次將黃仁勛2022財年的獎金提高到200萬美元,獎勵機會為200%,即400萬美元,對于這樣一位有影響力的科技公司首席執行官來說,這是一個相對微不足道的數字。在董事會薪酬委員會上個月宣布2025財年的新計劃之前,他的薪酬一直維持在這一水平。(2025財年指的是該公司截至2025年1月26日的財年。)但該股權計劃對黃仁勛來說價值近5億美元。

除了2023財年行使期權獲得的4.428億美元外,黃仁勛還獲得了價值6180萬美元的股票。盡管高管們沒有達到某些目標,只獲得了業績股票單位獎勵,但他們的收入卻十分亮眼。公司披露的信息顯示,高管團隊中薪酬最低的高管在2023財年75510股股票歸屬時,獲得了1480萬美元的收入。

科技人才招聘平臺Betterleap的首席執行官卡勒德·胡賽尼(Khaled Hussein)表示:“現在很多機器學習工程師都在做兩件事中的一件:加入火箭飛船,在這種情況下,英偉達是我能加入的最大的火箭飛船。或者,[一些工程師]打算建造一艘火箭飛船來進行自研。”

“相當有競爭力”的薪酬計劃

黃仁勛的獎勵包括業績股票單位,即SY PSUs,這些股票可在四年內歸屬,前提是達到一定的年度營收目標。他的薪酬計劃還包括第二種業績股票單位獎勵,即MY PSUs,該獎勵基于相對于標準普爾500指數的三年股東總回報率(TSR),可在三年內歸屬。去年,該公司未能實現132億美元的非美國通用會計準則營業收入目標,僅達到90億美元,因此2023年的業績股票單位未能歸屬。然而,該公司2021財年至2023財年的三年股東總回報率為189%,相對于標準普爾500指數處于第99百分位。因此,英偉達的實際業績超過了公司的擴展運營計劃目標,高管們實現了業績股票單位獎勵歸屬最大化。

律師事務所Barnes & Thornburg的合伙人布列塔尼·麥坎茨(Brittany McCants)說:“這是一個競爭相當激烈的項目。”

麥坎茨說,薪酬計劃的一大長期重要層面是與股東總回報率掛鉤。她說:“市場對該公司的濃厚興趣實際上是通過其股價急劇上漲凸顯出來的。作為薪酬方案的重要組成部分,這告訴我,高管們可能最看重這部分薪酬。”

英偉達發言人拒絕置評。

盡管英偉達去年在未能實現營收目標后沒有向高管支付任何獎金,但招聘人員表示,鑒于黃仁勛習慣于向員工發放與股價掛鉤的股權獎勵,人才挖角的威脅不大。今年以來,英偉達的股價已經上漲了81%。今年2月,英偉達在發布井噴式盈利后,市值突破了2萬億美元,成為繼微軟(Microsoft)和蘋果(Apple)之后第三家加入數萬億美元估值俱樂部的公司。

該公司強勁的盈利包括全年創紀錄的609億美元收入,同比增長126%。與此同時,對人工智能人才的狂熱興趣引發了一場爭奪戰,例如,埃隆·馬斯克(Elon Musk)面臨特斯拉(Tesla)工程師被挖走的風險,因此,提高了工程師的工資。馬斯克本月早些時候表示,這是他見過的“最瘋狂的人才爭奪戰”,甚至超過了2015年他從谷歌(Google)聯合創始人拉里·佩奇(Larry Page)那里挖走OpenAI崛起背后的關鍵人物伊爾亞·蘇茨克維(Ilya Sutskever)的情形。

盡管英偉達知名度不斷上升,人工智能也已成為主流,但黃仁勛的團隊仍致力于他的愿景、公司,以及如果他們持有英偉達股權,可能解鎖價值數百萬的股票。

胡賽尼說:“英偉達是上市公司,所以這些股票和現金一樣值錢,人們都緊抓不放。沒人拋售。”

去年,該公司未能實現2023財年296億美元的營收目標,僅達到270億美元,高管們的年度獎金也因此為零。一年后的2024年3月,英偉達董事會宣布,將在2025財年提高黃仁勛的年度現金獎金計劃。就在幾周前,該公司宣布季度營收達到創紀錄的221億美元,比上一季度增長22%,比去年同期增長265%。

值得注意的是,黃仁勛發現他的獎金機會從2024財年可能獲得的400萬美元增加到2025財年的600萬美元。這是英偉達董事會在過去五年中第三次上調黃仁勛的年度現金獎金。英偉達的獎金是根據營收目標而定的,黃仁勛的獎金是按基本工資的百分比計算的。

股權決定著英偉達的一切

與大多數科技公司一樣,英偉達高管的大部分薪酬是以股權的形式發放的。眾所周知,英偉達并不像金融服務公司那樣支付高薪或天價獎金,但黃仁勛向員工發放股權獎勵,因為他一直堅信公司將持續增長,員工也將從持股中獲益。獵頭專家表示,外部公司想從英偉達挖走機器學習工程師、總經理和高管的愿望非常強烈,但由于員工擁有大量未解除限制的股權,招聘人員在勸說人才離開公司方面成功希望不大。

Vell Executive Search的首席執行官多拉·維爾(Dora Vell)表示,對于一些科技公司來說,有時可能會根據股權歸屬時間而試圖挖走一些人,但根據英偉達的計劃,高管們總能看到短期、中期和長期的上升空間。她說:“對一些人來說,離職將是非常困難的,除非他們不適合那里。”

根據3月份的報告,包括首席財務官科萊特·克雷斯(Colette Kress)和全球現場運營執行副總裁阿賈伊·普里(Ajay Puri)在內的其他高管在2025財年的獎金目標將保持不變。然而,雖然黃仁勛總薪酬的96%與公司業績目標掛鉤,但其他高管的薪酬只有約56%與實現業績目標掛鉤。在2023財年,英偉達董事會將克雷斯、普里、運營執行副總裁黛博拉·肖奎斯特(Debora Shoquist)和執行副總裁兼法律總顧問蒂莫西·泰特(Timothy Teter)的潛在薪酬提高了200萬美元,每位高管的薪酬漲幅約為22%。

胡賽尼審視了英偉達及其在人工智能領域的競爭對手,然后表示,如今,他們的高管“大受歡迎”。(財富中文網)

譯者:中慧言-王芳

只有英偉達這家搖身一變成為不可或缺的市值2萬億美元的人工智能巨頭,才能完美化解高管們獎金化為烏有一事。這家領先的半導體芯片制造商未能在2023財年實現與營收和非美國通用會計準則營業收入相關的財務目標,高管們因此沒有達到兩個關鍵的支付門檻,因為公司披露的信息顯示,2023財年該公司向高管團隊支付的現金獎金為零,某些基于業績的股權獎勵也未能歸屬。不過,該公司的股權計劃結構和出色業績表現在很大程度上使其避免了重大人才流失。

以首席執行官兼創始人黃仁勛本人為例。董事會上一次將黃仁勛2022財年的獎金提高到200萬美元,獎勵機會為200%,即400萬美元,對于這樣一位有影響力的科技公司首席執行官來說,這是一個相對微不足道的數字。在董事會薪酬委員會上個月宣布2025財年的新計劃之前,他的薪酬一直維持在這一水平。(2025財年指的是該公司截至2025年1月26日的財年。)但該股權計劃對黃仁勛來說價值近5億美元。

除了2023財年行使期權獲得的4.428億美元外,黃仁勛還獲得了價值6180萬美元的股票。盡管高管們沒有達到某些目標,只獲得了業績股票單位獎勵,但他們的收入卻十分亮眼。公司披露的信息顯示,高管團隊中薪酬最低的高管在2023財年75510股股票歸屬時,獲得了1480萬美元的收入。

科技人才招聘平臺Betterleap的首席執行官卡勒德·胡賽尼(Khaled Hussein)表示:“現在很多機器學習工程師都在做兩件事中的一件:加入火箭飛船,在這種情況下,英偉達是我能加入的最大的火箭飛船。或者,[一些工程師]打算建造一艘火箭飛船來進行自研。”

“相當有競爭力”的薪酬計劃

黃仁勛的獎勵包括業績股票單位,即SY PSUs,這些股票可在四年內歸屬,前提是達到一定的年度營收目標。他的薪酬計劃還包括第二種業績股票單位獎勵,即MY PSUs,該獎勵基于相對于標準普爾500指數的三年股東總回報率(TSR),可在三年內歸屬。去年,該公司未能實現132億美元的非美國通用會計準則營業收入目標,僅達到90億美元,因此2023年的業績股票單位未能歸屬。然而,該公司2021財年至2023財年的三年股東總回報率為189%,相對于標準普爾500指數處于第99百分位。因此,英偉達的實際業績超過了公司的擴展運營計劃目標,高管們實現了業績股票單位獎勵歸屬最大化。

律師事務所Barnes & Thornburg的合伙人布列塔尼·麥坎茨(Brittany McCants)說:“這是一個競爭相當激烈的項目。”

麥坎茨說,薪酬計劃的一大長期重要層面是與股東總回報率掛鉤。她說:“市場對該公司的濃厚興趣實際上是通過其股價急劇上漲凸顯出來的。作為薪酬方案的重要組成部分,這告訴我,高管們可能最看重這部分薪酬。”

英偉達發言人拒絕置評。

盡管英偉達去年在未能實現營收目標后沒有向高管支付任何獎金,但招聘人員表示,鑒于黃仁勛習慣于向員工發放與股價掛鉤的股權獎勵,人才挖角的威脅不大。今年以來,英偉達的股價已經上漲了81%。今年2月,英偉達在發布井噴式盈利后,市值突破了2萬億美元,成為繼微軟(Microsoft)和蘋果(Apple)之后第三家加入數萬億美元估值俱樂部的公司。

該公司強勁的盈利包括全年創紀錄的609億美元收入,同比增長126%。與此同時,對人工智能人才的狂熱興趣引發了一場爭奪戰,例如,埃隆·馬斯克(Elon Musk)面臨特斯拉(Tesla)工程師被挖走的風險,因此,提高了工程師的工資。馬斯克本月早些時候表示,這是他見過的“最瘋狂的人才爭奪戰”,甚至超過了2015年他從谷歌(Google)聯合創始人拉里·佩奇(Larry Page)那里挖走OpenAI崛起背后的關鍵人物伊爾亞·蘇茨克維(Ilya Sutskever)的情形。

盡管英偉達知名度不斷上升,人工智能也已成為主流,但黃仁勛的團隊仍致力于他的愿景、公司,以及如果他們持有英偉達股權,可能解鎖價值數百萬的股票。

胡賽尼說:“英偉達是上市公司,所以這些股票和現金一樣值錢,人們都緊抓不放。沒人拋售。”

去年,該公司未能實現2023財年296億美元的營收目標,僅達到270億美元,高管們的年度獎金也因此為零。一年后的2024年3月,英偉達董事會宣布,將在2025財年提高黃仁勛的年度現金獎金計劃。就在幾周前,該公司宣布季度營收達到創紀錄的221億美元,比上一季度增長22%,比去年同期增長265%。

值得注意的是,黃仁勛發現他的獎金機會從2024財年可能獲得的400萬美元增加到2025財年的600萬美元。這是英偉達董事會在過去五年中第三次上調黃仁勛的年度現金獎金。英偉達的獎金是根據營收目標而定的,黃仁勛的獎金是按基本工資的百分比計算的。

股權決定著英偉達的一切

與大多數科技公司一樣,英偉達高管的大部分薪酬是以股權的形式發放的。眾所周知,英偉達并不像金融服務公司那樣支付高薪或天價獎金,但黃仁勛向員工發放股權獎勵,因為他一直堅信公司將持續增長,員工也將從持股中獲益。獵頭專家表示,外部公司想從英偉達挖走機器學習工程師、總經理和高管的愿望非常強烈,但由于員工擁有大量未解除限制的股權,招聘人員在勸說人才離開公司方面成功希望不大。

Vell Executive Search的首席執行官多拉·維爾(Dora Vell)表示,對于一些科技公司來說,有時可能會根據股權歸屬時間而試圖挖走一些人,但根據英偉達的計劃,高管們總能看到短期、中期和長期的上升空間。她說:“對一些人來說,離職將是非常困難的,除非他們不適合那里。”

根據3月份的報告,包括首席財務官科萊特·克雷斯(Colette Kress)和全球現場運營執行副總裁阿賈伊·普里(Ajay Puri)在內的其他高管在2025財年的獎金目標將保持不變。然而,雖然黃仁勛總薪酬的96%與公司業績目標掛鉤,但其他高管的薪酬只有約56%與實現業績目標掛鉤。在2023財年,英偉達董事會將克雷斯、普里、運營執行副總裁黛博拉·肖奎斯特(Debora Shoquist)和執行副總裁兼法律總顧問蒂莫西·泰特(Timothy Teter)的潛在薪酬提高了200萬美元,每位高管的薪酬漲幅約為22%。

胡賽尼審視了英偉達及其在人工智能領域的競爭對手,然后表示,如今,他們的高管“大受歡迎”。(財富中文網)

譯者:中慧言-王芳

Only Nvidia, the suddenly indispensable $2 trillion AI giant, could turn a missing C-suite bonus into a total nonissue. The dominant maker of semiconductor chips missed hitting financial goals in fiscal 2023 related to revenue and non-GAAP operating income, and executives didn’t make two key payout thresholds as a result, as corporate disclosures show the company paid zero cash bonuses in fiscal 2023 to its top team and certain performance-based equity awards failed to vest. However, the structure of the company’s equity program and its blockbuster performance have largely inoculated it from major talent defection.

Take CEO and founder Jensen Huang himself. The board last raised Huang’s bonus pay opportunity in fiscal 2022 to $2 million with an award opportunity of 200% or $4 million, a relatively paltry sum for such an influential tech CEO. His pay stayed at that level until the board’s compensation committee announced a new plan last month for fiscal 2025. (Fiscal year 2025 refers to the company’s fiscal year that ends Jan. 26, 2025.) But the equity program has been worth nearly half a billion dollars for Huang.

Huang received stock worth $61.8 million in value, in addition to $442.8 million in value he derived from exercising options in fiscal 2023. And even though his top executives missed certain goals and only earned a type of performance share unit award, they hit the lights out. The lowest-paid executive on the top team realized $14.8 million when their 75,510 shares vested in fiscal 2023, company disclosures show.

“The calculus that a lot of machine learning engineers are doing right now is between one of two things—join a rocket ship, in which case, Nvidia is about as big of a rocket ship as I can get,” said Khaled Hussein, CEO of tech talent acquisition platform Betterleap. “Or [some engineers] are going to build a rocket ship to do their own thing.”

A ‘fairly competitive’ compensation plan

Huang’s awards include performance share units that are eligible to vest over a four-year period based on attaining certain annual operating income goals, known as SY PSUs. His pay plan includes a second type of performance share unit award based on three-year total shareholder return (TSR) relative to the S&P 500 that is eligible to vest over three years, known as MY PSUs. Last year, the company missed its non-GAAP operating income goal of $13.2 billion, only hitting $9 billion, and the 2023 SY PSUs therefore failed to vest. However, the company’s three-year relative TSR between fiscal 2021 and fiscal 2023 was 189%, landing it at the 99th percentile relative to the S&P 500. Thus, Nvidia’s actual performance exceeded the company’s stretch operating plan goal and the executives earned the maximum vesting of MY PSUs.

“This is a fairly competitive program,” said Brittany McCants, a partner at law firm Barnes & Thornburg.

The link with TSR is a key long-term aspect of the comp scheme, said McCants. “The market’s exuberant interest in the company is really highlighted through the story of the precipitous increase in its stock price,” she said. “That being a significant piece of the compensation package tells me that is the piece of their compensation that people at the executive level will probably value the most.”

A spokesperson for Nvidia declined to comment.

Although Nvidia didn’t pay any bonuses to executives last year after they failed to hit the revenue goal, recruiters say the threat of talent poaching is low, given Huang’s habit of showering employees with equity awards tied to the stock price, which has risen 81% year to date. Nvidia’s market capitalization famously surpassed $2 trillion in February after it released blowout earnings, making it just the third company to join the multitrillion-dollar valuation club, after Microsoft and Apple.

The company’s formidable earnings included record full-year revenue of $60.9 billion, up 126%. Meanwhile, red-hot interest in AI talent fueled a bidding war that has, for instance, moved Elon Musk to raise salaries for Tesla engineers at the risk of their being lured away. Musk said earlier this month that it was the “craziest talent race” he’d ever seen—even more than the 2015 occasion when he lured Ilya Sutskever, a key brain behind the rise of OpenAI, away from Google cofounder Larry Page.

But despite Nvidia’s rising popularity and the mainstreaming of AI, Huang’s team is devoted to his vision, the company, and the potential millions in stock they can unlock if they hold their equity.

“Nvidia is public so those shares are as good as cash, and people are hanging on to their shares,” said Hussein. “Nobody is selling.”

Last year, the company missed its revenue goal of $29.6 billion for fiscal 2023, only hitting $27 billion, and execs earned zero annual bonuses as a result. A year later in March 2024, the Nvidia board announced that it was hiking its annual cash bonus plan for Huang in fiscal 2025 just weeks after the company announced record quarterly revenue of $22.1 billion, an increase of 22% from the previous quarter and up 265% from a year ago.

Notably, Huang saw his bonus opportunity rise from a possible $4 million in fiscal year 2024, to $6 million for fiscal 2025. It marked the third time the Nvidia board has bumped up Huang’s annual cash bonus in the past five years. Bonuses at Nvidia are earned based on hitting revenue goals and Huang’s is set as a percentage of his base salary.

Equity rules everything around Nvidia

Like most tech companies, the lion’s share of Nvidia executives’ pay is delivered in the form of equity. Nvidia is known as a company that doesn’t pay the high salaries or sky-high bonuses of, for instance, financial services companies, but Huang doles out equity awards to employees because of his long-held confidence that the company will continue to grow and that employees will be enriched by their stakes. The desire among outside firms to entice machine learning engineers, general managers, and executives from Nvidia is strong, but because of the high levels of unvested equity the employees have, recruiters haven’t seen much success in coaxing talent out of the company, search experts said.

With some tech companies, there’s sometimes a point at which it becomes possible to try to lure someone away depending on when their equity vests, but with Nvidia’s plan, executives are always seeing upside in the short term, midrange, and long term, said Dora Vell, CEO of Vell Executive Search. “It’s going to be very hard for somebody to move, unless they’re just not a fit there,” she said.

Other top executives, including chief financial officer Colette Kress and Ajay Puri, executive vice president of worldwide field operations, saw their bonus targets stay flat for fiscal 2025, based on the March report. However, while 96% of Huang’s total pay is dependent on corporate performance goals, only about 56% of other executives’ pay is dependent on hitting performance goals. And in fiscal 2023, the Nvidia board increased potential payout values for Kress, Puri, EVP of operations Debora Shoquist, and EVP and general counsel Timothy Teter by $2 million, a raise of about 22% for each executive.

Hussein looks at Nvidia and its rivals in the AI space and says, right now, their executives are “having a moment.”