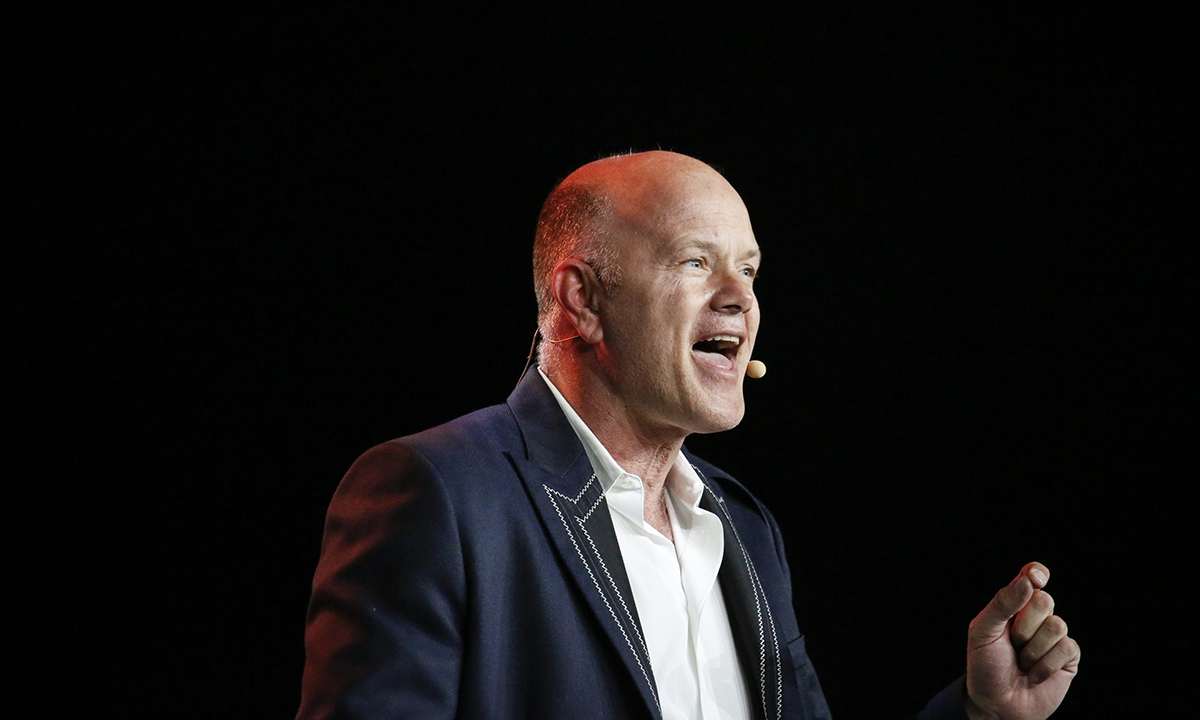

資產管理公司Galaxy Digital的CEO邁克·諾沃格拉茨周四下午在接受彭博電視臺采訪時表示,投資者很快就會更偏好數字黃金交易,而不是現實交易。

他表示,雖然比特幣當前的市值(1.21萬億美元)不足黃金市值(13.79萬億美元)的十分之一,但作為市值最高的加密貨幣,比特幣將很快超過黃金這種全球知名的保值資產。

諾沃格拉茨表示:“這一定會發(fā)生,而且不會太久。它的市值將會超過黃金。”

他表示,在嬰兒潮一代的約85萬億財富中,大部分由注冊投資者管理,其中約一半注冊投資者可以投資最近獲批的10個現貨比特幣交易所交易基金。如果主要由嬰兒潮的財富支撐的貝萊德(BlackRock)和富達基金(Fidelity)等平臺鼓勵客戶將1%至3%的財富,用于加密貨幣投資,這意味著有數萬億美元新流動資金進入加密貨幣市場。

他表示:“這可能是在比特幣歷史上首次出現真正的市場定價,”因為以前從未有過機構投資者和散戶都能投資比特幣的情況。

諾沃格拉茨還預測,隨著嬰兒潮一代的海量財富被傳給下一代,對數字資產的投資只會提速。

他說道:“隨著每一位像查理·芒格這樣的嬰兒潮一代離開人世——愿他得到安息,他們的財富將被傳給Z世代和千禧一代,這些年輕人更愿意投資數字黃金,而不是傳統的實物黃金。”

但諾沃格拉茨警告稱,未來幾天或幾周可能出現比特幣價格修正:“我想說我們的泡沫已經非常嚴重。”但他并不認為比特幣會跌破55,000美元的大關,而且之后會再次上漲。

周三,比特幣價格上漲至63,968美元,更接近其史上最高的約69,000美元,這可能令Coinbase等加密貨幣提供商不堪重負,隨著應用和網站上的流量激增,這些平臺均經歷過宕機。

彭博社的數據顯示,交易所交易基金的大量資金凈流入推動了需求,周三交易所交易基金日交易量創(chuàng)下新紀錄,交易額超過76億美元。一天前,貝萊德的iShares比特幣信托(IBIT)交易所交易基金資金流入5.2億美元,創(chuàng)下其最大的單日資金流入量。

此外,4月19日,比特幣將進行所謂的“減半”,即新增比特幣日供應量將減少50%,這是又一個利好消息。歷史上比特幣減半曾導致價格暴漲,在開始減半之前平均漲幅高達14%。

Fineqia International分析師馬特歐·格雷科表示,本輪周期的表現與之前三次減半已經“截然不同”,因為比特幣的價格在減半前約兩個月正在接近史上最高水平。他說道:“這是歷史上從未發(fā)生過的情況。”他還補充道,比特幣通常會在減半后6至12個月達到最高點。

據彭博社的數據顯示,周一和周二,交易所交易基金的平均資金流入為5億美元,這相當于每天有約10,000枚比特幣被買走。10x Research公司的CEO馬庫斯·蒂倫對《財富》雜志表示,比特幣挖礦機構每天只能挖出900個比特幣,而且很快將變成450個。

他說道:“在交易平臺存放的庫存被用于滿足需求,但這些庫存正在快速減少。”(財富中文網)

翻譯:劉進龍

審校:汪皓

資產管理公司Galaxy Digital的CEO邁克·諾沃格拉茨周四下午在接受彭博電視臺采訪時表示,投資者很快就會更偏好數字黃金交易,而不是現實交易。

他表示,雖然比特幣當前的市值(1.21萬億美元)不足黃金市值(13.79萬億美元)的十分之一,但作為市值最高的加密貨幣,比特幣將很快超過黃金這種全球知名的保值資產。

諾沃格拉茨表示:“這一定會發(fā)生,而且不會太久。它的市值將會超過黃金。”

他表示,在嬰兒潮一代的約85萬億財富中,大部分由注冊投資者管理,其中約一半注冊投資者可以投資最近獲批的10個現貨比特幣交易所交易基金。如果主要由嬰兒潮的財富支撐的貝萊德(BlackRock)和富達基金(Fidelity)等平臺鼓勵客戶將1%至3%的財富,用于加密貨幣投資,這意味著有數萬億美元新流動資金進入加密貨幣市場。

他表示:“這可能是在比特幣歷史上首次出現真正的市場定價,”因為以前從未有過機構投資者和散戶都能投資比特幣的情況。

諾沃格拉茨還預測,隨著嬰兒潮一代的海量財富被傳給下一代,對數字資產的投資只會提速。

他說道:“隨著每一位像查理·芒格這樣的嬰兒潮一代離開人世——愿他得到安息,他們的財富將被傳給Z世代和千禧一代,這些年輕人更愿意投資數字黃金,而不是傳統的實物黃金。”

但諾沃格拉茨警告稱,未來幾天或幾周可能出現比特幣價格修正:“我想說我們的泡沫已經非常嚴重。”但他并不認為比特幣會跌破55,000美元的大關,而且之后會再次上漲。

周三,比特幣價格上漲至63,968美元,更接近其史上最高的約69,000美元,這可能令Coinbase等加密貨幣提供商不堪重負,隨著應用和網站上的流量激增,這些平臺均經歷過宕機。

彭博社的數據顯示,交易所交易基金的大量資金凈流入推動了需求,周三交易所交易基金日交易量創(chuàng)下新紀錄,交易額超過76億美元。一天前,貝萊德的iShares比特幣信托(IBIT)交易所交易基金資金流入5.2億美元,創(chuàng)下其最大的單日資金流入量。

此外,4月19日,比特幣將進行所謂的“減半”,即新增比特幣日供應量將減少50%,這是又一個利好消息。歷史上比特幣減半曾導致價格暴漲,在開始減半之前平均漲幅高達14%。

Fineqia International分析師馬特歐·格雷科表示,本輪周期的表現與之前三次減半已經“截然不同”,因為比特幣的價格在減半前約兩個月正在接近史上最高水平。他說道:“這是歷史上從未發(fā)生過的情況。”他還補充道,比特幣通常會在減半后6至12個月達到最高點。

據彭博社的數據顯示,周一和周二,交易所交易基金的平均資金流入為5億美元,這相當于每天有約10,000枚比特幣被買走。10x Research公司的CEO馬庫斯·蒂倫對《財富》雜志表示,比特幣挖礦機構每天只能挖出900個比特幣,而且很快將變成450個。

他說道:“在交易平臺存放的庫存被用于滿足需求,但這些庫存正在快速減少。”(財富中文網)

翻譯:劉進龍

審校:汪皓

Investors soon will prefer trading digital gold to the real deal, Mike Novogratz, CEO of Galaxy Digital, told Bloomberg TV in a Thursday afternoon interview.

Although Bitcoin’s current market cap isn’t yet one-tenth of gold’s —$1.21 trillion compared with $13.79 trillion—the top cryptocurrency by market cap, he noted, soon could supersede a store of wealth known the world over.

“It will be, and it won’t wait. It will be larger than gold,” Novogratz said.

Of the estimated $85 trillion in baby boomer wealth, the majority is managed by registered investors, approximately half of which have access to the 10 recently approved spot Bitcoin ETFs, he says. If platforms like BlackRock and Fidelity, largely powered by baby boomer wealth, encourage their clients to allocate a minimal 1% to 3% of their assets to the cryptocurrency, that amounts to trillions in new liquidity.

“This is probably the first time in the history of Bitcoin that we have a true price discovery,” he said, as never before have both institutional and retail investors had access to it.

Novogratz also predicts that once the bubble of boomer wealth passes down a generation, allocations to digital assets should only accelerate.

“For every Charlie Munger—God rest his soul—who passes away, that money is finding its way to Gen Z and millennials, and they feel much more comfortable with digital gold than old, clunky gold,” he said.

However, Novogratz did caution that a Bitcoin price correction could unfold in the coming days or weeks: “I would say we’ve gotten to very frothy, frothy levels.” But he doesn’t see Bitcoin dipping below the mid-$50,000s before climbing again.

Bitcoin spiked to $63,968 on Wednesday, edging closer to its all-time high of about $69,000, a move that’s exhausted crypto providers like Coinbase, which suffered outages as app and site traffic surged.

Demand has been bolstered by colossal net inflows into the ETFs, which set a new record for daily trading volumes on Wednesday, with more than $7.6 billion in activity, according to Bloomberg data. The day before, BlackRock saw $520 million flood into its iShares Bitcoin Trust (IBIT) ETF, the largest daily inflow yet.

Moreover, on April 19, Bitcoin is poised to undergo a so-called halving, which cuts the daily supply of newly minted coins by 50%, another tailwind at play. This event has historically caused prices to soar, increasing on average by 14% in the run-up.

But the way the cycle is performing is already “really different” from the previous three halvings, because we’re nearing the all-time high almost two months before the event, said Matteo Greco, an analyst at Fineqia International. “It’s not something that historically has happened before,” he said, adding that Bitcoin typically peaks six to 12 months after a halving.

The ETF inflows averaged $500 million on Monday and Tuesday, according to Bloomberg data, which equates to about 10,000 Bitcoin being bought per day. However, miners are only minting 900 Bitcoins, which will soon be 450, Markus Thielen, CEO of 10x Research, told Fortune.

“The demand has been satisfied by the inventory placed on exchanges, but this inventory is also dwindling rather quickly,” he said.