美股去年大漲,說明今年也漲?

|

對美國股票市場而言,剛剛過去的2019年皆大歡喜。算上股息,標普指數大漲近32%。投資者的心情卻是喜憂參半。 喜的是,人們賺得盆滿缽滿自然心情愉快,比不賺錢好太多。憂的是,大漲之后難免讓人擔心會出現大跌。 而事實則是,股票的年收益率對于判斷后一年的走勢并沒有太大參考價值。去年的股票走勢與今年股市的表現關系不大。從股票市場的歷史來看,無論前一年表現如何,后一年上漲的概率比較接近。 |

The stock market just finished a rollicking 2019. The S&P was up nearly 32% including dividends. These types of gains present something of a double-edged sword for the investor psyche though. On the one hand, huge gains are always a pleasant surprise and better than the alternative. On the other hand, investors become nervous following big gains because the assumption is a crash will be soon to follow. The truth is there is little signal in the noise of year-to-year stock market returns. What happened last year has no bearing on what happens this year. Historically, the percentage of gains in the stock market following a variety of scenarios is fairly similar. |

|

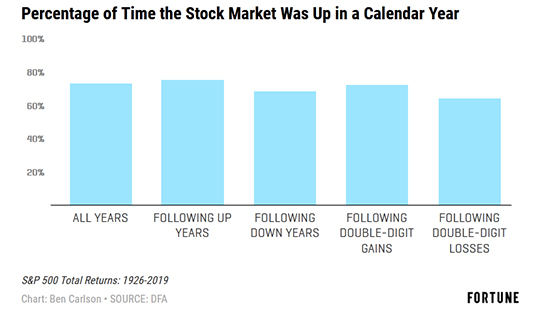

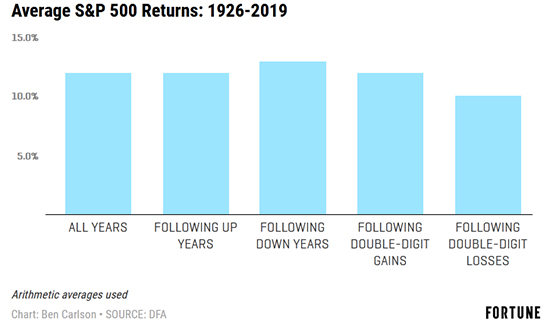

1926年以來,標普500指數基本上每四年有三年上漲。認真研究數據可以發現,不管前一年是上漲、下跌、漲幅達兩位數還是跌幅達兩位數,之后一年股票出現上漲的概率基本上是一樣的。 |

Since 1926, the S&P 500 has been up roughly three out of every four years. But we can also break these numbers down by the percentage of time stocks are up in a calendar year following an up year, down year, double-digit gain or double-digit loss. On average, the percentage of time stocks are up the following year is relatively similar. |

|

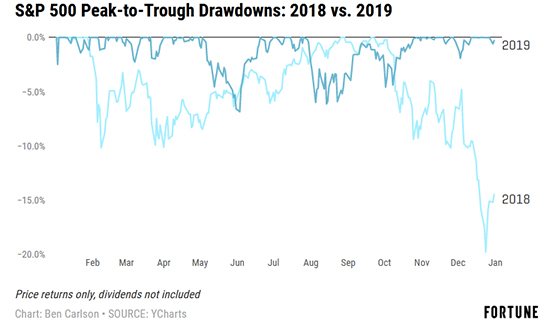

平均而言,股票大多數時間都在上漲。當然,這里說的只是股票的平均回報,實際上每年股票的漲跌幅很大。比較2018年和2019年的標普500指數的表現,投資者可以對股票的漲跌區間更深入理解。 2018年是2010年代標普500指數首次出現下跌,跌幅超過4%。 2019年則是1928年以來第18個標普500指數上漲超過30%的年份,意味著約每五年股市會出現一次年收益超過30% 。 2018年,標普500指數創下18個歷史新高。 而在2019年,標普500指數創下35個歷史新高。 |

On average, stocks go up most of the time. Of course, within those average returns is a wide range of outcomes, both to the upside and the downside. Investors can get a better sense of this range of outcomes by comparing what happened in the S&P 500 in 2018 and 2019. 2018 was the first down year of the decade in the 2010s for the S&P 500, falling more than 4%. 2019 was the eighteenth calendar year since 1928 which saw the S&P 500 rise 30% or more. This means gains of 30% or more have happened in roughly one out of every five calendar years. In 2018 there were 18 new all-time highs in the S&P 500. In 2019 there were 35 new all-time highs in the S&P 500. |

|

2018年,標普500指數的最大跌幅達19.8%。 而在2019年,標普500指數的最大跌幅僅為6.8%。 2018年,標普500指數有四個月下跌,且跌幅都較深(-3.6%,-2.8%,-6.8%和-9.0%)。 而在2019年,標普500指數僅有兩個月下跌,在5月和8月分別下跌了6.3%和1.6%。 |

In 2018 the maximum peak-to-trough drawdown in the S&P 500 was 19.8%. In 2019 the maximum peak-to-trough drawdown in the S&P 500 was just 6.8%. In 2018 the S&P 500 experienced four down months and all of them were relatively large declines (-3.6%, -2.8%, -6.8% and -9.0%). In 2019 the S&P 500 experienced just two down months over the course of the year, falling 6.3% and 1.6%, respectively in May and August. |

|

2018年,標普500指數有32個交易日跌幅至少為1%。其中15天的跌幅超過2%。上漲方面,有35天漲幅至少1%,其中有5個交易日上漲超過2%。 2019年,標普500指數有15個交易日跌幅至少1%,其中5個交易日跌幅超過2%。有23天漲幅達到1%,僅有兩天超過2%。 相關數據看起來有點反常,但市場表現最好的年份通常不會出現連日大漲。反而是在股市動蕩行情低迷時(如2018年),更容易出現大漲大跌的行情,牛市往往振幅很小,多是小幅上漲。 2018年,彭博巴克萊綜合債券指數的表現比標普500指數高近4.5%。 2019年,標普500指數的業績則比彭博巴克萊綜合債券指數高出超過22%。 觀察股票市場的平均表現確實有助于投資者培養長期眼光。但有一點務必記住,就是去年股票市場的表現對今年并無影響。(財富中文網) 本文作者是注冊金融分析師本·卡爾森(Ben Carlson),他是里薩茲財富管理公司(Ritholtz Wealth Management)機構資產管理部門的主任。作者可能持有文中提及的證券或資產。 譯者:梁宇 審校:夏林 |

In 2018 there were 32 trading days in which the S&P 500 was down 1% or worse. Fifteen of those days saw losses extend to 2% or worse. On the flipside, the S&P was up at least 1% or more 35 days while 5 of those trading sessions saw gains of 2% or more. In 2019 there were just 15 trading days where the S&P 500 fell 1% or worse, of which 5 of those were 2% or worse. There were 23 up 1% days in 2019 and just two 2% or better daily gains. It's counterintuitive but the best years in the stock market don't typically feature huge gains day in and day out. In fact, large gains and large losses tend to cluster during volatile, down markets like we saw in 2018. The best years tend to have little volatility and many small gains. In 2018 the Bloomberg Barclays Aggregate Bond Index outperformed the S&P 500 by nearly 4.5%. In 2019 the S&P 500 outperformed the Bloomberg Barclays Aggregate Bond Index by more than 22%. Looking at the averages in the stock market can help provide investors a much-needed long-term perspective. But it's important to remember that last year's results in the stock market have no bearing on what will happen this year. Ben Carlson, CFA is the Director of Institutional Asset Management at Ritholtz Wealth Management. He may own securities or assets discussed in this piece. |