企業(yè)負(fù)債屢創(chuàng)新高,信用評級卻不斷下滑

|

雖然美國股市正在創(chuàng)下歷史新高,但還有一個令人擔(dān)憂的數(shù)字也在創(chuàng)下歷史新高:企業(yè)持有的債務(wù)總額,尤其是高風(fēng)險債務(wù)額。 根據(jù)圣路易斯聯(lián)邦儲備銀行(St. Louis Federal Reserve Bank)的數(shù)據(jù),美國企業(yè)債務(wù)(不包括金融公司)自2008年以來飆升了50%以上,達(dá)到約10萬億美元,占國內(nèi)生產(chǎn)總值的47%,創(chuàng)下歷史新高。寬松的資金流動意味著高管們的夢想可能會成真:管理層把借來的低息資金用于新產(chǎn)品發(fā)布、收購、股票回購、增加股息——而這些都是當(dāng)前經(jīng)濟(jì)擴(kuò)張的標(biāo)志。 對于美國企業(yè)來說,近年來大筆舉債似乎是理性的,畢竟,真的很便宜!在2008年至2009年可怕的全球金融危機(jī)之后,美聯(lián)儲和其他央行放任自流,急不可耐地將利率降至極低水平,以期重振資本主義被擊潰的活力。“債務(wù)這么便宜,為什么不借呢?”荷蘭全球人壽資產(chǎn)管理公司(Aegon Asset Management)的副首席投資官吉姆·謝弗表示。 不過,在此過程中,債務(wù)不斷增加,信用質(zhì)量卻出現(xiàn)下滑。咨詢公司德勤(Deloitte)表示,在從大衰退中復(fù)蘇的過程里,投資級債券的市場份額降至78.6%,而在前兩次復(fù)蘇中這一比例約為90%。更糟糕的是,銀行向高杠桿公司發(fā)放的貸款正在增加,而對高風(fēng)險債券發(fā)行人行為的限制(稱為契約)如今要寬松得多。 紐約大學(xué)斯特恩商學(xué)院的榮譽退休教授、紐約大學(xué)所羅門中心信貸與固定收益研究項目的主任愛德華·阿爾特曼表示:“若拖欠債務(wù)率再次達(dá)到峰值,無論發(fā)生在什么時候,程度都將十分嚴(yán)重。”他認(rèn)為,屆時產(chǎn)生的痛苦將比正常情況下持續(xù)得更久,違約造成的損失將比正常情況下更多。 隨著垃圾債務(wù)的增加,歐洲太平洋資本公司(Euro Pacific Capital)的首席執(zhí)行官彼得·希夫在最近的一篇博客文章中寫道:“就像一個巨大的紙牌屋,只等著有什么東西碰一碰桌子,把整間屋子全部推倒。” 目前,美國未償付的高收益?zhèn)傤~為1.5萬億美元,而2007年為7,000億美元(經(jīng)通脹調(diào)整后為8,690億美元)。如果經(jīng)濟(jì)衰退來襲,收入和收益就會枯竭,垃圾債券的違約率會飆升到兩位數(shù)。據(jù)阿爾特曼估計,在上一次經(jīng)濟(jì)衰退中,高收益?zhèn)倪`約率飆升至10.7%。在此之前的兩次經(jīng)濟(jì)衰退中,違約率最高值分別為2002年的12.8%和1991年的10.3%。本次經(jīng)濟(jì)復(fù)蘇期間,在油價暴跌導(dǎo)致收益下降和美國經(jīng)濟(jì)增長放緩之后,違約率在2016年一度升至4.1%。 感到疼痛 若危機(jī)來襲,問題將主要集中在投資級以下的公司。知名債券研究機(jī)構(gòu)Gimme Credit列出了10家高收益?zhèn)l(fā)行人,它們的債券表現(xiàn)最有可能表現(xiàn)低于投資者預(yù)期,其中包括汽車租賃公司Hertz,到服裝品牌Limited Brands(陷入困境的維多利亞的秘密的母公司),再到賭場Mohegan Gaming & Entertainment。 藥店連鎖來德愛(Rite Aid)也在Gimme Credit的名單上,說明這家公司搖搖欲墜、負(fù)債累累。它的杠桿率很高,是安全水平的三倍多:來德愛的長期債務(wù)是該公司息稅折舊及攤銷前利潤(EBITDA)的6.8倍。在激烈的競爭中,該連鎖店上一個財年和今年前兩個季度都出現(xiàn)了虧損。 然而藥店不屬于周期性行業(yè),因為人們總是需要處方藥、牙膏和創(chuàng)可貼,所以來德愛現(xiàn)在的財務(wù)狀況足以讓投資者擔(dān)心它的未來。它的同店銷售增長徘徊在負(fù)增長和弱增長之間。過去三年,公司的股價下跌了92%。 當(dāng)然,沒有人能夠預(yù)測,當(dāng)經(jīng)濟(jì)衰退到來時,一家如今壓力重重的公司是否會進(jìn)入破產(chǎn)保護(hù)狀態(tài)。但是,經(jīng)濟(jì)困難的重?fù)艨赡軙屒闆r變得更糟,因為它增加了公司在債務(wù)到期時無法支付利息或返還本金的可能性。 暴風(fēng)雨前的平靜? |

While the stock market is hitting new all-time highs, so is another more alarming statistic: the amount of debt held by corporations, especially the riskiest kind. U.S. corporate debt (excluding financial firms) surged more than 50% since 2008 to around $10 trillion, a record 47% of gross domestic product, according to the St. Louis Federal Reserve Bank. The flow of easy money meant C-suite dreams could come true: Managements used the cut-rate borrowed money for new product launches, acquisitions, stock buybacks, dividend boosts—all the hallmarks of the economy’s current expansion. For Corporate America, heaping on all this corporate debt in recent years seemed rational, after all, it's a bargain! Following the terrifying 2008-09 global financial crisis, an indulgent Federal Reserve and other central banks eagerly pushed interest rates very low, bidding to revive capitalism’s crushed animal spirits. “Debt’s been cheap, so why not do it?” said Jim Schaeffer, deputy chief investment officer of Aegon Asset Management. Along the way, though, the credit quality of that growing debt pile has slipped. During the recovery from the Great Recession, the portion of the market made up of investment grade bonds fell to 78.6%, from around 90% in the previous two recoveries, says consulting firm Deloitte. Making matters worse, bank loans to highly leveraged companies are growing, and restrictions on risky debt issuer behavior, called covenants, are much weaker nowadays. “The magnitude of the next spike in default rates, whenever it occurs, will be severe,” said Edward Altman, professor emeritus at New York University’s Stern School of Business and director of the Credit and Fixed Income Research Program at the NYU Salomon Center. The pain will last longer than is typical, he believes, and more money will be lost than normal through defaults. With more junk debt around, Peter Schiff, CEO of Euro Pacific Capital, wrote in a recent blog post: “This is a giant house of cards just waiting for something to nudge the table and send the whole thing toppling down.” Today, outstanding high-yield bonds in the U.S. total $1.5 trillion, up from $700 billion in 2007 (or $869 billion if inflation-adjusted). When a recession hits, revenues and earnings dry up, and junk default rates tend to surge into double digits. In the last recession, high-yield default levels soared to 10.7%, by Altman’s estimate. For the two downturns before that, they peaked at 12.8% in 2002 and 10.3% in 1991. During the current recovery, defaults temporarily blipped up to 4.1% in 2016, after the oil-price bust lowered earnings and U.S. economic growth. Feeling the pain The trouble, when it hits, will mostly be concentrated in companies with below investment grade designations. Gimme Credit, a well-regarded bond research house, lists 10 high-yield issuers whose bonds are most likely to under-perform for investors. They range from auto renter Hertz to apparel purveyor Limited Brands (parent of struggling Victoria’s Secret) to casino company Mohegan Gaming & Entertainment. Drugstore chain Rite Aid, also on the Gimme Credit's list, is emblematic of a precarious, debt-laden corporation. Its leverage ratio is high, more than three times what’s considered safe: Rite Aid’s long-term debt is 6.8 times the money the company generates in earnings before interest, taxes, depreciation and amortization, or EBITDA. Amid bruising competition, the chain has been in the red for its last fiscal year and the first two quarters in this year. While drugstores aren’t a cyclical industry—people always need prescriptions, toothpaste and Band-Aids—Rite Aid’s financial picture is wobbly enough to make investors worry about its future. Its same-store sales growth shuttles between negative and anemic. Over the last three years, the stock has tumbled 92%. Certainly, no one can predict whether a stressed company today will be in Chapter 11 when the recession arrives. But the hammer blows of a bad economy will probably make things a lot worse, as it increases the likelihood that a company can’t pay interest or return principal when it’s due. Calm before the storm? |

|

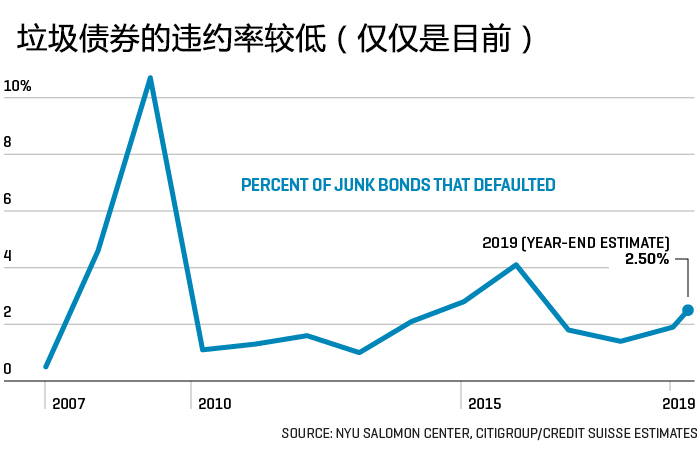

垃圾債券市場目前表現(xiàn)平靜,因此阿爾特曼和希夫的警告似乎是危言聳聽。今年迄今為止,美國垃圾債券的違約率僅為1.9%,遠(yuǎn)低于3.3%的歷史平均水平。對投機(jī)性票據(jù)的需求是健康的,因為在一個低利率的世界里,它的利率是誘人的。Diamond Hill Capital Management公司固定收益部門的首席投資官比爾·佐克斯表示:“投資者如今不記風(fēng)險地追逐過高的收益率。” 隨著買家哄抬價格,大多數(shù)垃圾債券的平均收益率在2019年出現(xiàn)了下降:例如,B級垃圾債券的收益率從1月初的略高于8.45%降至6.0%。(價格和收益率走向相反。)美國銀行(Bank of America)的高收益指數(shù)今年已經(jīng)攀升11.6%。 然而,令人不安的是,投資者的信心并沒有擴(kuò)大至垃圾級的最低水平——CCC。投資者正在更糟的情況出現(xiàn)之前拋售這些CCC級債券,其中很多來自境況不佳的能源發(fā)行者。這一事態(tài)鮮有人注意,但引發(fā)了人們的擔(dān)憂,因為CCC級債券的拋售可能是經(jīng)濟(jì)出現(xiàn)某些問題的先兆,而這種問題將會蔓延至其它垃圾債券。 未來不完美 一旦現(xiàn)金流在經(jīng)濟(jì)衰退中枯竭,大額利息支付迫在眉睫,就要當(dāng)心了。那時,一切都可以很快完蛋。小裂縫變成大斷裂。許多公司已經(jīng)意識到自己的債務(wù)風(fēng)險——不管是否屬于垃圾債券——都在盡其所能降低杠桿,為金融氣候的變化做準(zhǔn)備。 評級為垃圾級的來德愛為擺脫沉重的債務(wù)負(fù)擔(dān)做出了堅定努力,不過它還有很長的路要走,資源也很緊張。在美國連鎖藥店中,來德愛不幸屈居第三,僅排在沃博聯(lián)(Walgreens Boots Alliance)和CVS Health之后。該公司曾經(jīng)試圖與沃爾格林(Walgreens)合并,后來又試圖與食品和藥品零售商艾伯森(Albertsons)合并,但都以失敗告終。為了籌集資金償還債務(wù),來德愛最終將其近一半的門店出售給了沃爾格林,這進(jìn)一步影響了未來的收入。 標(biāo)準(zhǔn)普爾(Standard & Poor’s)于今年 4月將來德愛的評級從B降至B-,原因是該公司運營中存在缺陷,在剛剛結(jié)束的財年業(yè)績不佳。最近,管理層以39%的折扣回購了價值8,400萬美元的債券,并提出以同樣的價格再買進(jìn)1億美元。來德愛通過循環(huán)貸款融通進(jìn)行支付,這種工具收取的利息明顯低于債券支付的利息,為7.7%和6.875%。 這家連鎖企業(yè)因此遇上了麻煩,這種回購被標(biāo)普稱為“廉價交易”,因為這種操作導(dǎo)致投資者獲得的收益減少了。標(biāo)準(zhǔn)普爾因此將來德愛從B-級信用評級下調(diào)至SD級(選擇性違約)。 來德愛通過一名發(fā)言人回應(yīng)稱,這種認(rèn)定是“臨時的,在這類交易中很常見”。標(biāo)準(zhǔn)普爾補(bǔ)充稱,一旦該公司的要約完成,它將重新評估該問題。 該公司指出,其債券短期內(nèi)不會到期,第一批債券的到期時間是2023年。該藥店連鎖企業(yè)在9月下旬舉行的第二季度財報電話會議上,新任首席執(zhí)行官海沃德·多尼根表示:“來德愛需要一個清晰的新戰(zhàn)略愿景,以及一條能夠推動未來實現(xiàn)有機(jī)增長和盈利的執(zhí)行路徑。” 沒人知道當(dāng)經(jīng)濟(jì)衰退的寒風(fēng)吹來時,來德愛和其他類似公司會怎么樣。但有一件事情是肯定的:欠的錢總是要還的。(財富中文網(wǎng)) 譯者:Agatha |

Amid the junk market’s present calm, admonitions like Altman’s and Schiff’s seem alarmist. Thus far this year, the U.S. junk default rate is a low 1.9%, well beneath the 3.3% historical average. Demand is healthy for speculative paper, since its interest rates are enticing in a low-rate world. “Investors will reach for yield these days,” said Bill Zox, chief investment officer for fixed income at Diamond Hill Capital Management. As buyers bid up prices, most junk bonds have seen their average yields drop in 2019: B-rated junk, for instance, has fallen to 6.0%, from just over 8.45% in early January. (Prices and yields move in opposite directions.) Bank of America’s high-yield index has climbed 11.6% year-to-date. What’s troubling, however, is that investor confidence doesn’t extend to the lowest level of junk, CCC. Investors are dumping the CCCs, much of them from woebegone energy issuers, before something bad happens. This little-noticed development has prompted worry that the CCC selloff might be the harbinger of a malaise that will spread to other junk issues. Future imperfect Once cash flows dry up in a recession and big interest payments loom, look out. Then, everything can go to hell very quickly. Small cracks become major fractures. Aware of their debt exposure, many companies—whether in the junk yard or not?—are preparing for a change in the financial weather by de-levering as best they can. Junk-rated Rite Aid has made valiant efforts to shed its big debt load, although it has a long way to go and tight resources to get there. Rite Aid has the misfortune of being the distant third in the U.S. drugstore chain realm, behind Walgreens Boots Alliance and CVS Health. Attempts to merge fizzled with Walgreens and later with food and drug retailer Albertsons. To raise cash to retire debt, Rite Aid ended up selling almost half its stores to Walgreens, which had the added effect of crimping revenue going forward. Citing operational shortcomings, Standard & Poor’s in April downgraded Rite Aid to B- from B, following weak results in its just-concluded fiscal year. Recently, management repurchased $84 million worth of bonds at a 39% discount and offered to buy in another $100 million at a similar level. Rite Aid is paying for this via a revolving loan facility that apparently charges less interest than the bonds pay out, 7.7% and 6.875%. That tactic landed the chain in trouble with S&P, which branded the repurchase a “distressed exchange” because the maneuver offered investors less than what they had. The agency lowered Rite Aid’s junk B- rating to a category called SD, for selective default. Rite Aid responded, through a spokesman, that this designation is “temporary and common in these types of transactions.” S&P added that it will reevaluate the issue once the company’s offer is complete. The company notes that its next bonds aren’t slated to mature for a while, with the first due in 2023. In remarks at the drug chain’s second quarter earnings call in late September, new CEO Heyward Donigan said, “Rite Aid needs a clear new strategic vision and a pathway to execution that drives future organic growth and profitability.” No one can tell how Rite Aid and others like it will fare when the chill recession winds blow. But one thing’s for sure: there’s always payback time. |