美國股市持續(xù)創(chuàng)出新高,新手何時(shí)能入手?

|

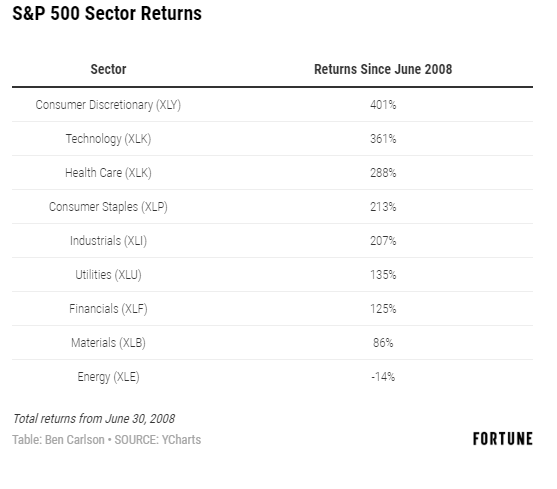

目前情況對投資者來說相當(dāng)好。2019年的標(biāo)普500指數(shù)屢創(chuàng)新高,而且今年其漲幅已經(jīng)超過了去年底近20%的跌幅。雖然相對而言美股在這個(gè)周期中輕松領(lǐng)跑,但其他國家的股市也已經(jīng)正式加入這場派對——MSCI全球所有國家指數(shù)(MSCI All-Country World Index)今年同樣刷新了歷史最高點(diǎn)。 股市屢創(chuàng)新高對于持股者來說好極了,但股市一味上漲也帶來了下行壓力。有些人持幣等待好的買點(diǎn),有些人剛有了一筆可以入市的新資金,如果股價(jià)持續(xù)上漲,他們不得不繼續(xù)觀望。股市不斷上漲就像第二十二條軍規(guī)那樣矛盾,對當(dāng)前回報(bào)率來說這是好跡象,但它幾乎一定會(huì)壓低預(yù)期回報(bào)率,原因是在股市上漲時(shí),股息收益率和估值往往也會(huì)上升。 對于在市場出現(xiàn)慘案后可以較放心地買入股票的投資者來說,好消息是總會(huì)在某個(gè)地方出現(xiàn)熊市,甚至是在整個(gè)股票市場都在扼殺熊市之際。在本輪牛市中,以下三個(gè)領(lǐng)域在一定程度上一直處于落后位置。 能源股票 2008年6月,石油價(jià)格突破每桶150美元。從那時(shí)至今,油價(jià)下跌了三分之二,標(biāo)普500指數(shù)的能源板塊(代碼:XLE)也滑落了13%以上,和該指數(shù)逾200%的上漲形成了鮮明對比。在此期間,能源股一直表現(xiàn)最差,遠(yuǎn)遠(yuǎn)落后于其他板塊,而且這種情況甚至還沒有結(jié)束。就連在金融危機(jī)中暴跌的金融股(代碼:XLF)從2008年夏天到現(xiàn)在也領(lǐng)先能源板塊135%以上。 |

Things are pretty good for investors at the moment. The S&P 500 continues to hit new high after new high in 2019. The gains this year have more than made up for the nearly 20% loss near the end of last year. While U.S. markets have outperformed handily on a relative basis during this cycle, foreign stocks have officially joined the party, with the MSCI All-Country World Index breaking out to new highs this year as well. New highs are great for those holding stocks in their portfolio but there is a downside when stocks seemingly do nothing but rise. Anyone who’s been holding cash waiting for lower prices and a better entry point or those with new savings to deploy into the markets have had to do so at higher and higher prices. Rising prices are a catch-22 in that they’re a welcome sign for current returns but almost certainly detract from expected returns, given that dividend yields and valuations tend to rise when markets move higher. The good thing for investors who are more comfortable buying when there’s blood in the streets is there will always be a bear market somewhere, even when the broad stock market is killing it. Here are three areas of the market that have been left behind to some extent during this bull market: Energy Stocks Oil prices hit more than $150/barrel in June 2008. Since then, oil prices are down two-thirds while the energy sector (ticker: XLE) of the S&P 500 has fallen more than 13% versus a gain of more than 200% for the overall index. Energy has been by far the worst sector during this period and it’s not even close. Even financials (ticker: XLF), which were crushed in the crisis, have outperformed energy since the summer of 2008 by more than 135%. |

|

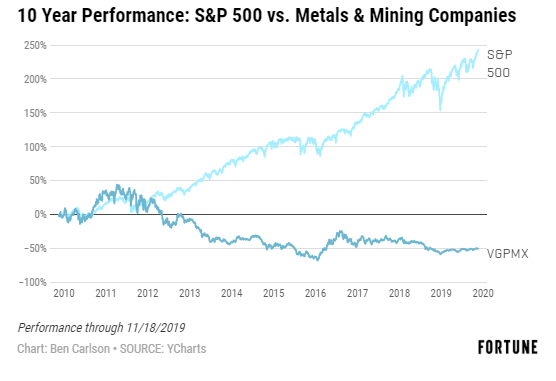

如果正在考慮抄底,目前收益率3.8%的能源板塊ETF(代碼:XLE)可供一試。 貴金屬和礦業(yè)股 如果希望找到和大盤幾乎沒有關(guān)聯(lián)的股票,那就非貴金屬和采礦板塊莫屬。這些大宗商品生產(chǎn)商的股票經(jīng)常有碾壓波動(dòng)性的表現(xiàn),無論是向上還是向下。Vanguard Global Capital Cycles Fund(代碼:VGPMX)不光在這個(gè)周期中一直落后于大盤,它還在不斷地大幅下挫。過去10年VGPMX的跌幅接近50%,標(biāo)普500指數(shù)則上漲逾240%。 |

The energy sector ETF (XLE) currently yields 3.8% for your troubles if you’re thinking about trying to catch a falling knife here. Precious Metals & Mining Stocks If you want to find stocks that have little correlation to the overall stock market, look no further than precious metals & mining stocks. These commodity producer stocks often exhibit pulverizing volatility, both to the upside and the downside. The Vanguard Global Capital Cycles Fund (ticker: VGPMX) has not only trailed the overall stock market during this cycle, but it’s also in the midst of a crash. Over the past 10 years, VGPMX is down nearly 50% while the S&P 500 is up more than 240%. |

|

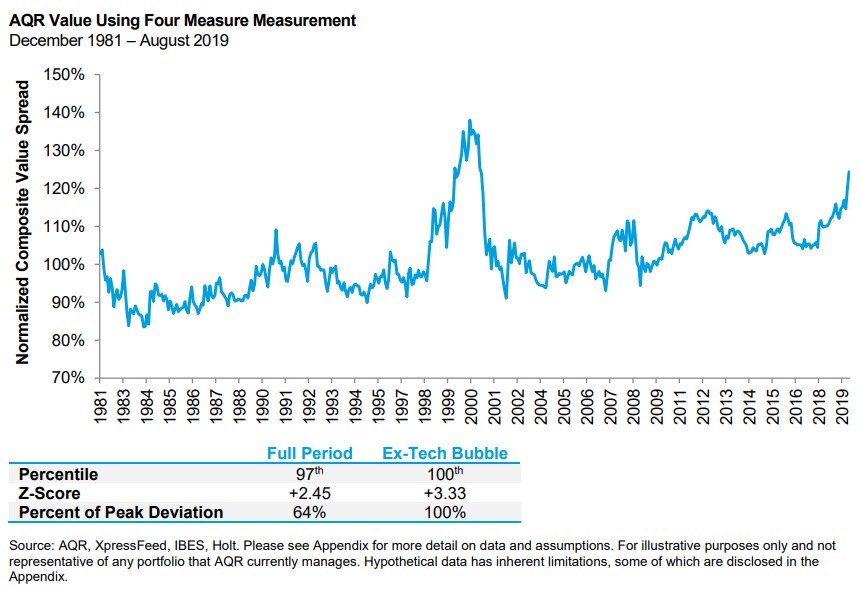

盡管這次下跌了50%,但2016年一年就VGPMX曾經(jīng)上漲50%。從2011年至2015年,這只基金下滑了近75%。投資者經(jīng)常會(huì)搜尋和大盤關(guān)聯(lián)度低的資產(chǎn),以便增加持倉多元性帶來的好處。貴金屬和礦業(yè)公司看來就屬于這一類,但追逐無關(guān)資產(chǎn)有時(shí)意味著在市場其他領(lǐng)域都高歌猛進(jìn)之際承擔(dān)巨大的虧損。 價(jià)值股 當(dāng)20世紀(jì)90年代末出現(xiàn)互聯(lián)網(wǎng)泡沫的時(shí)候,成長股全面超越價(jià)值股,原因是投資者爭相追捧“新經(jīng)濟(jì)”中的科技公司。在泡沫最大的時(shí)候,成長股和價(jià)值股的相對估值差距達(dá)到了歷史最高點(diǎn),用人們認(rèn)可的幾乎所有“價(jià)值”定義來衡量都是如此。而當(dāng)泡沫消退時(shí),價(jià)值股在隨后幾年里把成長股遠(yuǎn)遠(yuǎn)地甩在后面。 許多傾向于基本面的投資者都希望這種情況再次出現(xiàn),原因是本輪周期中成長股又徹底擊敗了價(jià)值股。亞馬遜、蘋果、Netflix、谷歌和Facebook等高成長公司占據(jù)了投資者的心,乏味的老式價(jià)值股則被遺棄在了塵土中。 經(jīng)過一段時(shí)間后,價(jià)值股的估值看起來終于夠低了,至少對資本管理公司AQR的克里夫·阿斯尼斯來說是這樣。他在近期發(fā)表的一篇研究報(bào)告中用多種價(jià)值指標(biāo)說明成長股目前的估值已經(jīng)非常高,僅次于互聯(lián)網(wǎng)泡沫時(shí)期。阿斯尼斯寫道:“除了科技泡沫階段,價(jià)值股的價(jià)值已經(jīng)降至歷史最低點(diǎn),差距相當(dāng)大。” |

Those 50% losses are despite a 50% gain in 2016 alone. From 2011-2015 this fund was down close to 75%. Investors are often in search of asset classes with low correlation to the broad market to add portfolio diversification benefits. Precious metals & mining companies seem to fit that bill but the catch with uncorrelated assets is sometimes that means eating big losses while the rest of the market screams higher. Value Stocks During the dot-com bubble in the late-1990s, growth stocks stomped all over value stocks as investors rushed into technology companies in the “new economy.” By almost every accepted definition of “value”, growth stocks were more expensive than their value counterparts at the peak of that bubble on a relative basis than at any time in history. When the bubble deflated, value went on a huge run of outperformance over growth for years to come. Many fundamentally-inclined investors are hoping for a repeat of this situation as growth has once again decidedly beat the pants off value stocks during this cycle. High growth companies such as Amazon, Apple, Netflix, Google, and Facebook have attracted investor mindshare while boring old value stocks have been left in the dust. It’s taken some time but it looks like value stocks are finally getting cheap enough, at least according to AQR’s Cliff Asness. Using a number of different value metrics, Asness showed in a recent research piece that growth is more expensive now than at any time other than the dot-com bubble. Asness writes, “Excluding the tech bubble the value of value is the cheapest it’s ever been by a fairly decent margin.” |

|

當(dāng)然,時(shí)機(jī)的選擇總是上述問題中的難點(diǎn)。某只股票正在下跌絕不意味著它不會(huì)繼續(xù)滑落一段距離。某只股票很便宜絕不意味著它不會(huì)變的更便宜。金融危機(jī)以來,能源股以及金屬和礦業(yè)股持續(xù)遭受如此沉重的打擊是有原因的——大宗商品價(jià)格本身大幅下跌,而通脹一直得到控制。價(jià)值型公司持續(xù)跑輸成長型公司可能是因?yàn)檐浖凇巴淌伞边@個(gè)世界,無形資產(chǎn)實(shí)現(xiàn)增長以及投資者在資本充足的環(huán)境下愿意為成長投入資金。 發(fā)生慘案時(shí)通常都會(huì)有絕佳的解釋。每一類股票的暴跌都有原因。這就是當(dāng)前局勢讓投資者如此困惑的原因。大家面臨的選擇是要么投資于基本面良好但價(jià)格高的資產(chǎn),要么投資于基本面正在變差但價(jià)格低的資產(chǎn)。 對投資者來說,最困難的一點(diǎn)是決定自己是要自律,還是要發(fā)揮想象力,繼續(xù)持有表現(xiàn)落后的投資。我猜那些一直手握能源股、金屬和采礦公司以及價(jià)值股的人現(xiàn)在會(huì)覺得自己的想法有點(diǎn)兒虛幻了。時(shí)間會(huì)告訴我們,他們所堅(jiān)持的想象能否帶來回報(bào)。(財(cái)富中文網(wǎng)) 本文作者是注冊金融分析師本·卡爾森(Ben Carlson),他是里薩茲財(cái)富管理公司(Ritholtz Wealth Management)機(jī)構(gòu)資產(chǎn)管理部門的主任。 譯者:Charlie 審校:夏林 |

Of course, the hard part with these things is always the timing. Just because something is down, doesn’t mean it can’t go down some more. And just because something is cheap, doesn’t mean it can’t get cheaper. There’s a reason energy stocks and metals & mining shares have been hit so hard since the financial crisis—commodities prices themselves have been battered while inflation has been kept under control. And value companies have likely underperformed growth companies because software is eating the world, the growth in intangible assets, and the willingness of investors to pay up for growth in a world awash in capital. When there’s blood in the streets, there’s usually a perfectly good explanation for it. Each of these categories has a black eye for a reason. That’s what makes the current situation for investors so confusing. Your choices are (a) invest in assets with good fundamentals but high prices or (b) invest in assets with deteriorating fundamentals but low prices. One of the hardest things to do as an investor is determining whether you’re being disciplined or delusional by sticking with an underperforming investment. I’m guessing those who have stuck with energy stocks, metals & mining companies, and value stocks feel a bit delusional at the moment. Time will tell if their disciplined delusion will pay off. Ben Carlson, CFA is the Director of Institutional Asset Management at Ritholtz Wealth Management. |