這四只美股注定會大漲

|

在《財富》雜志6月刊付梓一周前,眾議院議長宣布美國陷入了憲法危機;特朗普的一條推文讓道瓊斯指數暴跌500點;而在政治上,美國依舊有著嚴重的分歧。不過令人震驚的是,至少從某種方式上看,美國是象征著穩定的閃耀燈塔,是全球主要市場中前景最為樂觀的一個。美國經濟繼續以驚人的速度增長,企業盈利表現強勁,而在緩慢增長甚至近乎衰退的全球經濟中,美國的收益堪稱楷模。 確實,根據美國投資公司協會(Investment Company Institute)的數據,僅在今年2月和3月,投資者就從國際重點基金中撤出了近70億美元。與此同時,他們向美國股票基金注入了共計47億美元。 愛德華·瓊斯公司(Edward Jones)的負責人和投資戰略師凱特·沃恩表示:“人們對世界其他地區的前景極度悲觀,對美國的前景相當樂觀。” Glenmede的投資戰略官邁克爾·雷諾茲對此表示贊同,他指出“與全球相比,美國的增長韌性很強,美國公司則從中受益”。 只有一個問題:現在投資美國公司的成本超乎尋常。隨著標準普爾500指數在今年第一季度交出1998年以來的最佳成績,投資者在尋找良好投資機會上更需要睜大眼睛。 所以,從美國商業的黃金標準,也就是今年的《財富》美國500強企業中,我們首先篩選了那些大部分收入來自于美國市場的企業。(這樣就排除了那些盡管位于美國,但卻可能受到國外蕭條影響的企業。例如在2019年《財富》美國500強排名第95位的3M就因為在中國的業績令人失望,未能實現第一季度的業績預期。) 從這些業務集中于美國的企業中,我們進一步挖掘,試圖找到那些在更廣闊的市場具有價值的公司。最后誕生的就是四只建議立刻入手的美國股票。 |

In the week before the June issue of Fortune went to press, the Speaker of the House announced the U.S. was in the midst of a constitutional crisis; a Trump tweet sent the Dow plunging 500 points; and politically, America remained as bitterly divided as ever. So here’s a shock: The U.S., by at least one measure, is a shining beacon of stability, with one of the more upbeat outlooks among major markets around the world. The economy continues to expand at a prodigious rate, corporate earnings are strong, and the U.S. stands as a model of yield within a global economy that has ranged from slow to nearly recessionary. Indeed, in February and March alone, investors pulled almost $7 billion out of internationally focused funds, according to data from the Investment Company Institute. Meanwhile, they poured a combined $4.7 billion into U.S. equity funds. “People are extraordinarily pessimistic about the outlook for the rest of the world, and they’re quite optimistic about the outlook for the U.S.,” according to Kate Warne, a principal and investment strategist at Edward Jones. That’s echoed by Michael Reynolds, investment strategy officer at Glenmede, who notes that “the growth story in the U.S. has been really resilient compared to globally—and U.S. companies tend to benefit from that.” There’s just one problem: Buying American is now unusually expensive. With the S&P 500 having posted its best first quarter since 1998, investors need to look carefully to spot good values. So starting with the gold standard of U.S. business, this year’s Fortune 500, we first screened for companies that derive an outsize percentage of their revenues from the U.S. market. (This to avoid companies that, while based here, might be hampered by overseas headwinds. Case in point:3M, No. 95 on the 2019 Fortune 500, which missed its first-?quarter earnings guidance on the back of disappointing numbers out of China.) From that group of U.S.-focused companies, we dived deeper to screen for value relative to the broader market. The result? Four Born in the U.S.A. stocks to buy now. |

|

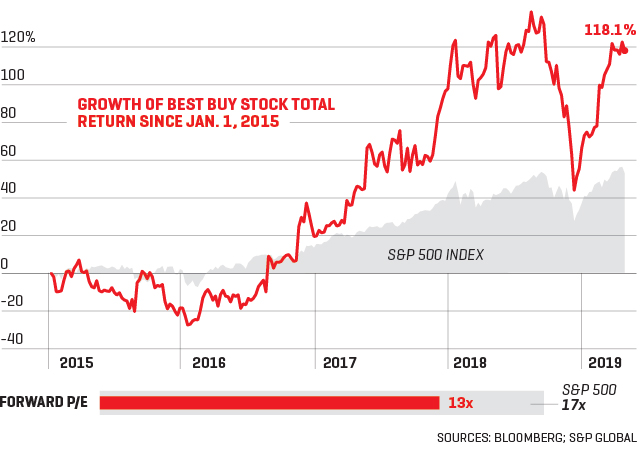

百思買(《財富》美國500強排名第74位) 在上一財年,百思買有近92%的收入來自于美國市場,并且在其他電子產品和家庭娛樂零售商失敗的領域里成功地做出了特色。公司股票的遠期市盈率為13(大大低于標普500指數的遠期市盈率平均值17),股價比52周內最高點下滑了13%,這意味著投資者有零散買入的價值。 在許多分析師的眼中,所謂的非必需消費品領域是個贏家。他們一直青睞這類指標,后者能夠表明在良好的經濟環境下,美國消費者的消費力仍然強勁。投資管理公司Conning的股票策略主管唐·唐斯維克表示:“非必需消費品還有一些上漲空間。”他補充道,該行業的許多股票“還沒有達到預期水平。你可以從中發現一些價值點”。 通過注重極客小分隊(Geek Squad)等服務,百思買將繼續給消費者帶來價值,而不是單單按照某位分析師的形容,成為“亞馬遜(Amazon)的樣品間”。差異化的產品線,以及RadioShack等公司破產導致的競爭降低,會幫助百思買遠離電子商務競爭的影響。 |

Best Buy (No. 74) Best Buy derived nearly 92% of its revenues in its latest fiscal year from the U.S. market, and it has differentiated itself where other electronics and home entertainment retailers have failed. The company’s stock is trading at a forward price-to-earnings ratio of 13 (well below the S&P 500 average of around 17 times forward P/E) and is down 13% from its 52-week high—indicating that there’s value for investors looking for retail plays. The so-called consumer discretionary sector at large is a winner in the eyes of many analysts, who have welcomed metrics indicating that U.S. consumer spending remains strong amid favorable economic conditions. “The consumer discretionaries have been left behind a bit,” according to Don Townswick, director of equity strategies at investment management firm Conning, who adds that many of the stocks in the sector “are not at the levels you’d expect them to be. You really do see some good value.” By focusing on services like its Geek Squad, Best Buy will continue to add value to consumers beyond just serving as “Amazon’s showroom,” as one analyst put it. A diverse product offering, as well as reduced competition from the likes of bankrupt RadioShack, should help insulate the company from ?e-commerce competition. |

|

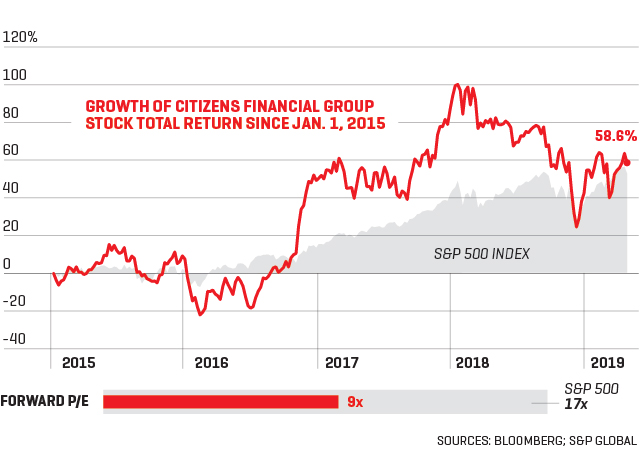

公民金融集團(《財富》美國500強排名第415位) 像公民金融集團(Citizens Financial Group)這樣遠期市盈率只有9的區域性美國銀行,被認為是尤其明智的價值投資目標。盡管按照合并資產計算,這家位于普羅維登斯的金融機構在在2018年年底僅僅是美國排名第22位的商業銀行,但它統治了自己的目標區域美國西北,在那里的11個州設有1,100家分行和2,900臺ATM機。 類似于公民金融集團這種區域性機構,不僅因為受到國際蕭條的影響有限甚至沒有而獲利,而且它們作為根深蒂固的本地公司,通過回頭生意得到了回報,在科技初創公司“新型銀行”試圖顛覆消費金融業務的當下,這一點價值非凡。 分析師表示,整體經濟局勢也推動了該領域的發展。Conning的唐斯維克指出:“區域性銀行作為產業集群,幾乎完全暴露于美國收入的影響之下,在經濟增長率保持穩定或提升的環境中,它們確實能夠獲益。”他補充道,盡管他不認為將來會出現“增長率大幅提升”,但“上行的可能性大于下行”。比起規模更大、受到更多監管的競爭對手,區域性銀行也可以從“更高的(消費者)忠誠度”上獲益。 |

Citizens Financial Group (No. 415) Regional U.S. banks like Citizens Financial Group—which is trading at a forward P/E ratio of only 9—are considered a particularly canny value play. While the Providence-based financial institution was only the 22nd-?largest commercial bank in the U.S. by consolidated assets at the end of 2018, it dominates its targeted region in the Northeast—with 1,100 bank branches and 2,900 ATMs in 11 states. Not only do regional institutions like Citizens benefit from limited to no exposure to international headwinds, but as established local players, they’re also rewarded with the kind of repeat business that’s valuable at a time when tech-oriented startup “neo-banks” are looking to disrupt the consumer banking space. Analysts say the overall economic picture should also boost this sector. “The regional banks, as an industry group, tend to be almost entirely exposed to U.S. revenues, and they do benefit in an environment where rates tend to be stable or increasing,” Conning’s Townswick notes. He adds that while he doesn’t expect a “massive increase in rates” moving forward, the movement is likely to be “more upward than downward”—with regional banking players also benefiting from “more [customer] loyalty” than some of their larger, more scrutinized counterparts. |

|

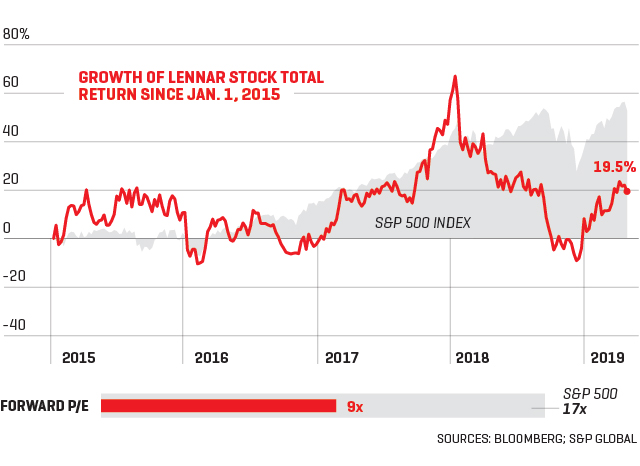

萊納房屋公司(《財富》美國500強排名第154位) 盡管房地產建設是出了名的不穩定,而且房地產建筑商的股票在2018年表現慘淡,但美聯儲(Federal Reserve)在利率上較為中立的新立場對萊納(Lennar)這樣的公司而言會是個利好。完全著眼于美國市場的萊納是今年《財富》美國500強榜單上進步最大的公司之一,提升了76位。公司的遠期市盈率為9,股價也低于去年夏天達到的52周內最高值。 摩根士丹利投資管理公司(Morgan Stanley Investment Management)的常務董事安德魯·斯利蒙表示:“我認為房地產建筑商現在的吸引力很大。它們去年完全潰不成軍。但如果你看看房地產建筑商的歷史,當它們的股票擺脫困境之后,漲幅不會是20%或30%,而是會比這還多得多。” 不過斯利蒙補充道,這個行業尤其需要投資者抗拒天性,他們還要有等待賭注獲得回報的耐心。房地產建設行業“周期性很強”,投資者需要提前做出反應。 按照斯利蒙的看法,“你不能等到行業的基本面出現轉機才行動。你得愿意在轉機尚不明朗時買入,也要在局勢似乎不錯時懂得脫手。” |

Lennar (No. 154) While homebuilding is notoriously volatile—and indeed, homebuilder stocks had a brutal 2018—the Federal Reserve’s newly neutral interest rate stance could prove a boon for the likes of Lennar. Wholly focused on the U.S. market, Lennar is one of this year’s biggest “movers” on the Fortune 500, jumping up the list by 76 spots. The company is trading at a forward P/E ratio of 9 and is also below its 52-week high set last summer. “I think the homebuilders are very attractive right now,” says Andrew Slimmon, managing director at Morgan Stanley Investment Management. “They got absolutely crushed last year. And if you look at the history of homebuilders, when these stocks come off the mat, they don’t go up 20% or 30%—they go up a lot more.” But Slimmon adds this industry in particular requires investors to fight their natural instincts—and have the patience to wait for bets to play out. The homebuilding industry is “very cyclical,” and investors need to get ahead of the curve. “You cannot wait for the fundamentals for this industry to turn,” according to Slimmon. “You have to be willing to buy in when it’s not clear that things have turned and be willing to take your chips off the table when they’re looking good.” |

|

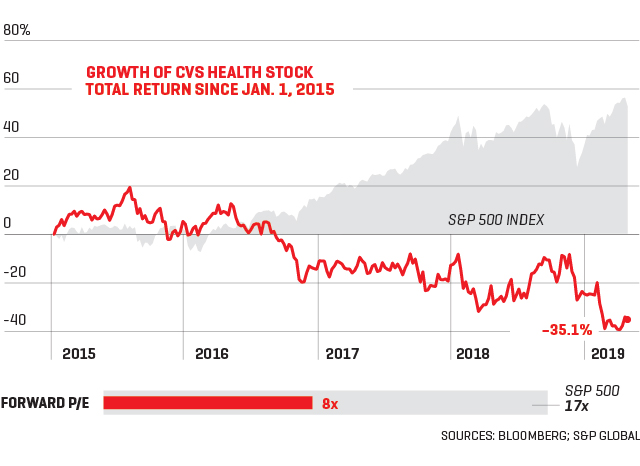

CVS Health(《財富》美國500強排名第8位) CVS Health在以700億美元的巨款收購醫療保險公司安泰(Aetna)之后,于今年早些時候交上了令人失望的第四季度財報。不過這家醫藥連鎖店在2019年第一季度強勢反彈,利潤暴漲42%。放眼整個競爭激烈的零售行業,它的韌性十分突出。憑借這次并購,CVS進入了醫療保健行業,這是一些分析師推薦的增持領域——盡管一些民主黨候選人提出了“全民醫療”(Medicare for All)平臺,這在即將到來的大選年注定會引發業內劇變。 財富管理公司Catalyst Private Wealth的創始人和總經理布蘭登·康諾頓指出:“你不知道下一款引起轟動的藥物是什么,但你知道它會在CVS出售。” CVS股票的遠期市盈率為8,股價比起去年11月達到的52周內最高值有著顯著回落,對投資者來說有著真正的上升空間。 沒錯,沒有人知道美國這次(已經持續了很久的)經濟擴張可以延續多長時間。不過從目前來看,如果投資者做出了明智選擇,或許還能享受一陣子光輝歲月。(財富中文網) 本文最初登載于《財富》雜志2019年6月刊。 譯者:嚴匡正 |

CVS Health (No. 8) CVS Health reported disappointing fourth-quarter earnings earlier this year in the wake of its massive $70 billion acquisition of health insurer Aetna. But the drugstore chain rebounded nicely in the first quarter of 2019, reporting a 42% jump in profits. The company is among the more resilient players in what has been a challenging retail market at large. With the merger, CVS gains exposure to a health care sector that some analysts are overweight on—despite an upcoming election year in which some Democratic candidates are floating a Medicare for All platform that would surely cause disruption within that industry. “You don’t know what drug is going to be the next blockbuster, but you know that it’s going to be sold through CVS,” points out Brendan Connaughton, founder and managing director of wealth management firm Catalyst Private Wealth. With CVS’s stock trading at a forward P/E ratio of 8 and its price down considerably from its 52-week high last reached in November, there could be real upside to be found for investors. True, no one knows how long this (already prolonged) U.S. economic expansion will last. But for now, it looks as if investors who choose wisely may enjoy a few more Glory Days. This article originally appeared in the June 2019 issue of Fortune. |