巴菲特談蒂姆·庫克推出的服務:蘋果應該做一些行不通的事

|

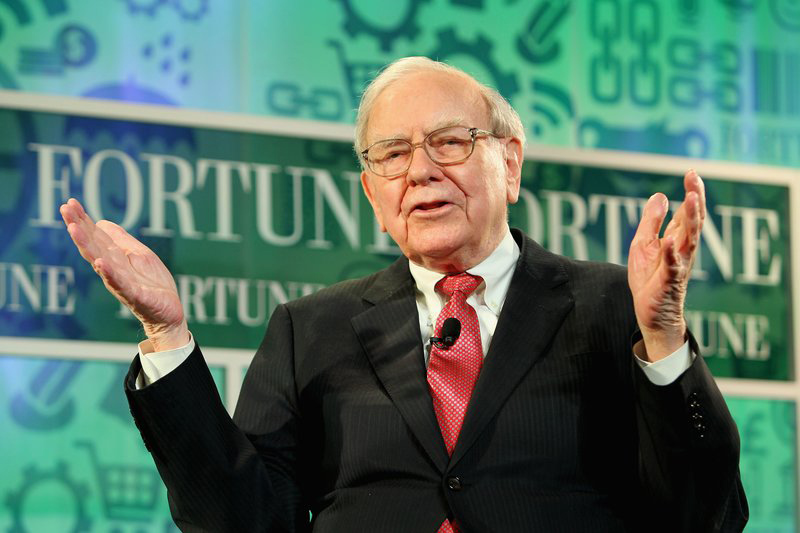

蘋果公司新品發布會披露流媒體電視和新聞訂閱服務幾天后,沃倫·巴菲特對這家硬件廠商借此創收的計劃給予了不那么令人激動的肯定。

巴菲特說,蘋果即將在流媒體訂閱市場和迪士尼、Netflix這樣的娛樂巨頭硬碰硬,“這場游戲不那么容易預測,因為他們有非常聰明的人以及大量資源,其目的是想辦法再抓住你半個小時。我可不會參加這樣的游戲。”

當采訪者,CNBC記者貝基·奎克指出伯克希爾-哈撒韋目前對蘋果的投資價值約470億美元,也就是說伯克希爾實際上已經參與了這個市場的時候,巴菲特對蘋果進入一個最終或許不會成功的市場表露出了耐心。

巴菲特說:“蘋果——我愿意看到他們取得成功。這家公司承受得起一、兩次失誤。不能買那些必須把所有事情都做對的公司的股票。你會犯錯誤,但不要讓它在你的資本中占太大比例……蘋果應該做一些行不通的事。”

截至2018年年底,巴菲特的伯克希爾-哈撒韋手握2.5億股蘋果公司股票,持股比例約為5.7%。上個季度,隨著蘋果和其他重磅科技股下跌,伯克希爾賣掉了約300萬股蘋果股票。據《福布斯》估算,巴菲特的凈身家約為830億美元。

巴菲特還表示他不愿在Lyft、Uber和Pinterest等大型科技公司準備上市時進入IPO市場。雖然承認自己在亞馬遜等科技巨頭上市時錯過了買入機會,但巴菲特認為風險太大,不光是伯克希爾,對普通投資者來說也是如此。伯克希爾上次買進首發新股還是在1955年。

巴菲特說:“在市場火爆時買新股根本不是普通人應該考慮的事。你可以兜一圈,做些笨投資,而且依然可以賺錢。但你不能把它作為終身模式。你得確保自己在下注時跟莊家站在一邊,而不是跟莊家對著干。”

在采訪過程中,巴菲特自始至終都帶著謙虛而直率的幽默來回答問題。當奎克問他是否打算在iPad上看蘋果的節目時,巴菲特掏出了一部功能手機,跟十幾年前流行的那種手機一樣。

88歲的巴菲特開玩笑說:“亞歷山大·格拉漢姆·貝爾(被譽為“電話之父”)把這個借給我,我忘了還給他了。”(財富中文網) 譯者:Charlie 審校:夏林 |

A few days after Apple staged an elaborate event to unveil its plans for streaming-TV and news subscription services, Warren Buffett offered less than a rousing endorsement for the device manufacturer’s plans to build out its revenue stream through such offerings.

Buffett said the market for streaming-video subscriptions, in which Apple is going up against entertainment giants like Disney and Netflix, is “not an easy game to predict, because you have very smart people with lots of resources trying to figure out how to grab another half hour of your time. I wouldn’t want to play in that game myself.”

When the interviewer, CNBC’s Becky Quick, pointed out that Berkshire Hathaway’s investment in Apple, currently worth about $47 billion, means Berkshire is in fact playing in that market, Buffett indicated a patience toward Apple’s move into a market that ultimately may not pan out.

“Apple—I’d love to see them succeed. That’s a company that can afford a mistake or two. You don’t want to buy stock in a company that has to do everything right,” Buffett said. “You’re going to make mistakes but you don’t want to make them with too big a portion of your capital… Apple should do some things that don’t work.”

Buffett’s Berkshire Hathaway owned 250 million shares of Apple at the end of 2018, or about 5.7% stake in the Silicon Valley giant. The company sold off about 3 million shares of Apple last quarter, as it and other big name tech stocks tumbled. Buffett’s net worth is estimated at around $83 billion, according to Forbes.

Buffett also expressed a reluctance to jump into the IPO market at a time when big-name tech companies like Lyft, Uber and Pinterest are preparing to go public. While acknowledging he missed out on buying tech giants like Amazon when they went public, Buffett thinks the risks are too great, not just for Berkshire but for the average investor as well. The last time his firm bought shares in an IPO was in 1955.

“Buying new offerings during hot periods in the market isn’t anything the average person should think about at all,” Buffett said. “You can go around and make dumb bets and still win. It’s not something you want to take as a lifetime model. You just want to make sure you’re on the side of the house when you bet, rather than bet against the house.”

Throughout the interview, Buffett answered questions with a humble, plainspoken sense of humor. When Quick asked if he planned to watch Apple programs on his iPad, Buffett pulled out a flip phone, the likes of which were popular more than a decade ago.

“Alexander Graham Bell lent it to me and I forgot to return it,” joked the 88-year-old Buffett. |