“沒人知道該怎么辦”:脫歐問題三年遲遲未決對英國商業有何影響?

|

在三年半前,艾瑪·希斯科特-詹姆斯曾經打算把業務拓展到英國以外。 當時,她旗下成立11年的Little Soap公司在英國各地的大型超市和藥房銷售沐浴用品。下一步很明顯,從旁邊的愛爾蘭開始,進入歐洲的其他地區。 隨著2016年6月英國舉行公投決定退出歐盟,擴張計劃戛然而止。由于公投后英鎊貶值,精油等進口產品變得更加昂貴,第一個星期就推高了5%的成本。 Little Soap公司想辦法抵消了額外支出造成的影響,但海外擴張的計劃泡湯了。 “之前跟我們談的人全都靜下來了。”她說。 然而,希斯科特·詹姆斯認為跟其他公司相比,Little Soap的運氣已經不錯。該公司的總部位于田園風格的科茨沃爾德地區,過去幾年已經擴張到國內的新商店,客戶和制造業都在英國,從而避免了英國與歐盟未達成貿易協議便脫歐,產品便無法跨越邊境送給用戶的巨大風險。 但政府缺乏清晰的準備和溝通,沒有為脫歐后的英國做好準備,著實令人沮喪。 “小企業需要確定性,我們卻陷入了困境。”希斯科特-詹姆斯說。 在全世界排名第五大經濟體的英國,退出歐盟導致的政治癱瘓已有三年,而且還在持續。英國仍然在考慮10月31日要不要退出歐盟,以及達成協議再退還是達不成協議也堅決退。 這只是最近一次期限;3月29日的第一個期限被延長,因為議會一直未能就脫歐計劃達成一致。經歷種種挫折后,前首相特雷莎·梅辭職,新上臺的是鮑里斯·約翰遜,他發誓10月底之前帶領英國脫離歐盟,即使此舉意味著英國可能因為“無協議”脫歐出現崩潰,重新啟用世界貿易組織的貿易規則。 |

Three and a half years ago, Emma Heathcote-James was looking to expand her business beyond Britain. Her 11-year-old Little Soap Company was selling bath products through major supermarkets and pharmacies across the U.K. The next step was obvious. Using neighboring Ireland as a starting point, the company would enter the rest of Europe. The vote for Britain to leave the European Union in June 2016 brought those plans to a screeching halt. As the value of the pound plummeted after the referendum, imported products—including essential oils—became more expensive, pushing up costs by 5% in the first week. The Little Soap Company managed to absorb the added expense, but its export expansion plans evaporated. “Everyone we’d been chatting to went quite quiet,” she says. Heathcote-James considers Little Soap lucky compared to others, however. In the years since, the business, headquartered in the idyllic Cotswolds region, has expanded into new stores domestically; and its customers and manufacturing are both based in the U.K., which insulates it from the bigger risk that products won’t be able to cross borders to reach end users if there's no U.K.-EU trade deal after Brexit. But the lack of clarity and communication from the government on how to prepare for a post-Brexit Britain is frustrating. “Small businesses need certainty, and we’ve just been hanging in limbo,” Heathcote-James says. Political paralysis over an exit from the EU has gripped the world’s fifth-largest economy for three years and counting; the U.K. is still figuring out whether it will leave the EU on October 31, and if it will do so with or without a deal. That is only the most recent deadline; the first of March 29 was extended, as Parliament repeatedly failed to agree on a plan for the country’s departure. After those setbacks, former Prime Minister Theresa May resigned and was replaced by Boris Johnson, who has vowed to take Britain out of the EU by the end of October—even if that means the country crashes out with ‘no deal’, reverting to World Trade Organization trade rules. |

|

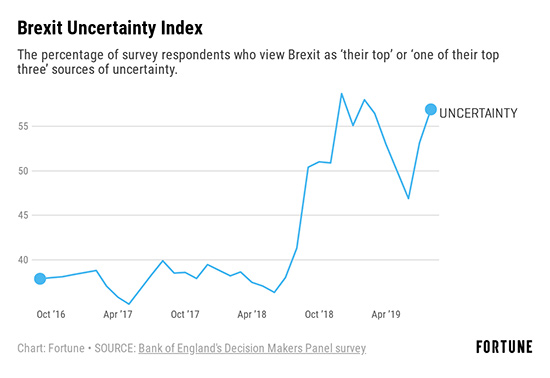

但在約翰遜的領導下,議會只是進一步陷入混亂,隨著國會議員排除了“無協議”脫歐的可能,約翰遜暫停了議會,后來英國最高法院宣布非法。 一直以來,脫歐的陰影阻礙了英國企業的運轉,因為許多未知數抑制了投資增長,拖累了生產率,也拖延了寶貴的執行時間,原因都是脫歐后英國的前景與公投結果剛出來時一樣不明朗。 “沒人在做事,因為大家都不知道該做什么。”希斯科特-詹姆斯說。 “脫歐也沒有幫助” 說起駭人聽聞的經濟事件,“脫歐”公投堪稱歷史性一幕。 不僅脫歐公投出人意料,畢竟民意調查顯示三分之二的人預計英國會留在歐盟,由此帶來的不確定性持續時間也比預期長,諾丁漢大學的教授保羅·米茲恩表示,他也是2019年8月一項關于脫歐對英國企業影響的研究論文的作者。 “如果想找類似的沖擊,唯一真正(可比的)沖擊是1929年。”米茲恩說,他在研究中使用了英格蘭銀行從2016年8月以來收集的企業數據。他表示,1929年的金融危機恰好趕上1930年代大蕭條之前的關稅和保護主義措施,導致情況加劇。 研究表明,在脫歐公投以來的三年里,投資增長率比起公投結果留在歐盟要低11%。與此同時,生產率下降了多達5%,主要原因是管理者每周都要花幾個小時為脫歐做準備。 脫歐并不是罪魁禍首。英國龐大的汽車市場轉向柴油車,以及電子商務對傳統零售商造成的壓力從2016就已經開始加速,導致兩個行業的公司收入下降。不過,“脫歐也沒有幫助。”米茲恩說。 |

But under Johnson, Parliament has only fallen further into chaos, as Members of Parliament ruled out a ‘no deal’ scenario, and Johnson suspended Parliament—a move the U.K. Supreme Court later declared illegal. All the while, the prospect of Brexit has jammed the gears of British businesses—large and small—as its many unknowns have smothered investment growth, hampered productivity, and sidetracked valuable executive time, all for a vision of post-bloc Britain that's nearly as unclear as it was immediately following the vote. “Nobody’s doing anything, because nobody knows what to do,” Heathcote-James says. “Brexit hasn’t helped” As far as shocking economic events go, the Brexit vote stands out as historic. Not only was the vote to leave the EU largely unexpected—two-thirds of polls predicted Britain would vote to remain—but the uncertainty has lasted longer than anticipated, says Paul Mizen, a University of Nottingham professor and an author of an August 2019 study on the impact of Brexit on British businesses. “If you look at a shock that’s parallel, the only real [comparable] shock is 1929,” says Mizen, whose study used Bank of England data collected from businesses starting in August 2016. The 1929 financial crash was quickly compounded by tariffs and protective measures ahead of the depression of the 1930s, he says. In the three years since the Brexit vote, investment growth was 11% lower than it would have been had voters opted to remain, the study says. Meanwhile, productivity declined as much as 5%, largely due to executives diverting several hours a week to Brexit planning. Brexit isn’t wholly to blame. The shift away from diesel cars in the U.K.’s sizable auto market, as well as pressure from e-commerce on traditional retailers have accelerated since 2016, resulting in falling revenue for companies in both sectors. But “Brexit hasn’t helped,” says Mizen. |

|

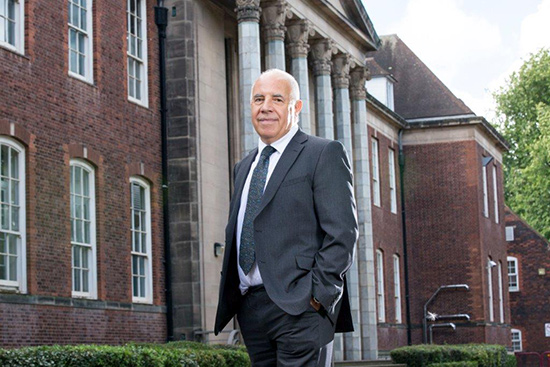

英國與歐盟的分離尚未完成,已然造成了巨額成本,比如在其他國家開設辦事處以在歐洲站穩腳跟,還有在3月脫歐截止日期之前囤積庫存,即將到來的10月31日截止日期之前還得再囤積。此外,脫歐也影響了投資、工作崗位招聘、擴張計劃等,打擊了英國企業。 “在某種程度上,還影響了公司與海外競爭對手競爭的能力。”米茲恩說。 “脫歐病” 兩年前,收入達2400萬英鎊的英國材料咨詢公司Lucideon開始與其位于特倫特河畔斯托克總部附近的地方政府合作,開設先進的工業陶瓷研究中心。工業陶瓷與裝飾陶瓷不同,廣泛用于從手機到飛機引擎的各種零部件。 原本該研究中心將涉及4000萬英鎊的投資,Lucideon打算自己投資1000萬英鎊。但由于英國沒有按計劃3月退出歐盟,雙方的會議開始很難推進。 “就是無法談了。”Lucideon的首席執行官托尼·金塞拉表示。“因為幾乎每次開會都會出現變化。”脫歐影響了政府的關注點和時間,他說。 |

The U.K.’s split from the EU has yet to be consummated, but it’s already spawned myriad costs for companies, like opening offices in other countries to keep a foothold in Europe, and stockpiling inventory ahead of Brexit’s initial March deadline—and again ahead of the upcoming October 31 cutoff. Plus, it’s hit businesses by way of investments not made, open jobs not filled, and expansions pared back. “To some extent, this is something that’s affecting the firm’s ability to compete with its rivals overseas,” Mizen says. “The Brexit disease” Two years ago, Lucideon—a U.K. materials consultancy with 24 million pounds in revenue—started working with the regional government near its Stoke-on-Trent headquarters to open a research center for advanced technical ceramics. The material, unlike decorative ceramics, is used to make components in everything from mobile phones to airplane engines. The research center was to be a 40 million pound investment, and Lucideon was looking to invest up to 10 million pounds of its own money. But when the U.K. didn’t exit the EU in March 2019 as planned, the meetings started going nowhere. It has “just not happened,” says Lucideon CEO Tony Kinsella. “That’s because almost every meeting gets changed," as Brexit diverts the government’s attention and time, he says. |

|

與此同時,10年前Lucideon有40%的收入來自于歐盟,如今也要調整。自從脫歐公投以來,業務雖然也有所擴張,但主要是在美國和亞洲。現在公司約20%的收入來自于歐洲,遠遠落后于來自美國的35%。 “脫歐病并沒有阻止商業投資,”金塞拉說。“只是在改變資金投向的選擇。” 即便如此,目前 Lucideon為脫歐做準備已經花費10萬英鎊。舉例來說,公司在都柏林開設了辦事處,作為通往歐盟其他市場的門戶。如果出現無協議脫歐的局面,公司將失去歐洲認證機構的證書,進一步打擊收入,因為只有獲得認證的公司才能夠宣布產品符合歐盟規則。 金塞拉樂觀地認為,脫歐后的業務發展仍然會保持良好。但持續三年的等候,還有最后期限一再拖延已經讓人精疲力竭。 “感覺就像凌遲。”他說。“鑒于議會各種政治鬧劇不斷,我認為英國希望繼續延長(歐盟成員國資格)三、四個月,簡直太愚蠢。” 保持沉默 許多大公司向客戶和股東保證已經為脫歐做好了準備,但很少有人愿意討論已經造成的影響。 一家著名的行業協會告訴《財富》雜志,在圍繞脫歐高度兩極分化的辯論中,許多成員不想因為討論脫歐潛在的消極影響得罪客戶。(協會要求不透露姓名,以便坦率地私下發表觀點。) 在《財富》世界500強的17家英國公司中,除一家外,其他公司均拒絕置評,也沒有回應《財富》雜志的問詢。多家公司表示已經決定不談論脫歐。(發表評論的只有礦業巨頭力拓集團,力拓表示其業務都在英國以外,預計不會受到影響。) 然而,脫歐導致的業務癱瘓跡象比較明顯。8月,世界500強排名第90位的匯豐推出10億美元回購時,首席財務官邵偉信表示,“考慮到脫歐造成的不確定性,回購10億美元是相當保守之舉”,也就是說如果大環境沒有那么動蕩,回購金額可能更高。2月,世界500強排名第336位的巴克萊表示,已經劃撥1.95億美元應對“硬”脫歐帶來的潛在問題,一旦硬脫歐,英國將無法輕易進入歐盟單一市場。 脫歐不確定性的涓流效應之一就是可能影響各種規模的公司,也導致消費者情緒轉變。盡管在2016年剛公投之后,英國對產品和服務的需求驚人地強勁,但隨后幾個月里英國對產品和服務的需求有所下降。 9月,市場研究公司YouGov表示,英國的消費者信心處于六年來的最低點;市場研究機構IHS Markit的報告稱,家庭對個人財務的關注度達到了六年來的最高水平;英國工業聯合會也表示,8月的零售額下降速度達2008以來最快,此后一直疲軟。 “真的值得嗎?” 2016年6月,當英國投票決定脫歐時,位于倫敦的湯姆·布朗批發花店的財務總監約翰·戴維森就已經知道,花卉生意將遭逢巨大威脅。 湯姆·布朗花店的收入為1500萬英鎊,在全國有四家分店,幾乎所有花卉都是通過歐盟進口,主要是通過歐洲花卉中心荷蘭,進口來源包括南美和非洲。 公投后,隨著英鎊走軟,成本立即飆升。按業內人士的說法,截至今年年底,按枝計算花卉價格上漲了20%。2016年上半年底前,即脫歐公投之前,湯姆·布朗的客戶購買的數量較2015年同期增長了6.5%。下半年脫歐公投之后勢頭急轉直下,銷售額跌了7.3%。 接下來幾年里,花卉銷售與英國政治基本保持同步。2017年年底隨著脫歐臨近銷售上漲,2018年繼續走強,2019年則變慢。 戴維森表示,倫敦的主店里已經暫時停止招聘。他說最近幾個月感覺變得安靜,送貨速度也有所放緩。 |

Meanwhile, Lucideon—which got 40% of its revenue from the EU ten years ago—was undergoing a shift. Since the Brexit vote, it has expanded, but mostly in the U.S. and Asia. Now, about 20% of its revenue comes from Europe, far behind the U.S.’s 35% share. “The Brexit disease has not stopped the business investing,” Kinsella says. “It’s just shifting where we’ve chosen to put that money.” Even so, preparing for Brexit has cost Lucideon a hundred thousand pounds so far. For instance, it’s opened a Dublin office as a gateway to the rest of the EU market. And in the case of a no-deal Brexit, it would lose its certification as a European Notified Body—a standing that allows it to declare products to be in conformity with EU rules—which would deal another blow to its revenue. Kinsella is optimistic that the business will be fine post-Brexit. But three years of anticipation and deadline delays has been draining. “It’s death by a thousand cuts,” he says. “For all the Westminster political shenanigans, I think the nation wants another three-, four-month extension [to EU membership] like it wants a hole in its head.” Staying mum While many large companies have reassured clients and shareholders that they have prepared for Brexit, few appear willing to discuss the impact it has already had. One prominent trade association told Fortune that, in the highly polarized debate around Brexit, many of its members don't want to run the risk of losing customers by speaking out about potential downsides. (The association asked not to be named in order to candidly express such views, which were spoken in private.) Of the 17 U.K.-based companies on Fortune’s Global 500 list, all but one either declined to comment or did not respond to Fortune's inquiries. Several companies said they had decided not to speak about Brexit at all. (The one company that did comment—mining giant Rio Tinto Group—said its operations are all outside the U.K. and so didn’t expect to be affected.) However, some hints of Brexit paralysis are evident. When HSBC—No. 90 on the Global 500—launched a billion-dollar buyback in August, Chief Financial Officer Ewen Stevenson said the move was “appropriately conservative given Brexit uncertainties”—meaning it might have been bigger if the environment wasn’t so shaky. And in February, Barclays—No. 336—said it had set aside $195 million to cover potential problems arising from a “hard” Brexit, in which the U.K. would lose easy access to the EU’s single market. One trickle-down effect of Brexit uncertainty that’s likely to hit firms of all sizes is the shift in consumer sentiment. Though surprisingly robust immediately after the 2016 vote, British demand for products and services has waned in subsequent months. In September, market researcher YouGov said consumer sentiment in the U.K. was at a six-year low; IHS Markit reported a six-year high in household concern over personal finances; and the Confederation of British Industry said retail sales remained weak, after dropping in August at the fastest pace since 2008. “Is it really worth it?” When Britain voted for Brexit in June 2016, John Davidson, the finance director of London-based Tom Brown Wholesale Florists, knew it would be a major threat to the flower business. With about 15 million pounds in revenue and four locations countrywide, Tom Brown imports almost all of its flowers through the EU—mostly through the Netherlands, Europe’s flower hub, including flowers originally imported from South America and Africa. After the vote, costs immediately jumped as the pound weakened, pushing up the price of flowers—measured in industry parlance by the stem—by as much as 20% by the end of the year. In the first half of 2016—before the Brexit vote—Tom Brown had seen customers buy 6.5% more stems compared to the same period in 2015. Sales in the second half, after the Brexit vote, went in the opposite direction, falling 7.3%. In the following years, flower sales fluctuated alongside British politics: picking up in late 2017 as a Brexit deal seemed imminent, getting stronger in 2018, and then flattening out in 2019. In his key London store location, Davidson says he’s paused hiring for now: in recent months, he says the warehouse feels quieter and deliveries have slowed down. |

|

戴維森說,目前湯姆·布朗店可以在上午11點前從荷蘭訂購鮮花,12小時后收到,顧客的預期也是如此。脫歐可能導致延遲和額外費用,主要由于脫歐后進口鮮花需要大量文件,而之前只要簡單下個訂單就行。 “新一代花店越來越少。”他說。“面對種種不確定,老一代花卉商也在想:‘真的值得嗎?’” 克服“脫歐疲勞” 其他跡象表明,在過去三年內,招聘、應聘、建筑和房地產方面都付出了代價。 9月,專業人士獵頭公司SThree 發布報告稱,獵頭公司從英國和愛爾蘭招聘單位賺取的季度凈費用下降了7%,前一季度下降了12%。與此同時,大型合同工機構Staffline發布了盈利警告,稱由于需求減少,客戶逐漸減少歐盟招納合同工。 有些公司,特別是科技公司,在招聘時根本找不到求職者。 科技行業協會techUK負責研究脫歐政策的尼爾·羅斯說,作為協會成員之一的一家數據中心運營商最近告訴他,過去兩年都沒有歐洲大陸的求職者應聘。 “能夠招到人才是企業擴張的基礎。”羅斯說。 同時,今年9月,建筑和基礎設施服務公司Keir Group 警告稱,由于客戶要等脫歐事項確定,推遲項目關鍵決策,導致收入持平。 房地產服務公司世邦魏理仕則估計,由于投資者對英國何時脫離歐盟以及退出具體情況心存疑慮,2019年商業地產價值將下跌3.8%。 不過,世邦魏理仕英國研究團隊的執行董事邁爾斯·吉布森表示,由于脫歐事項久而未決,一些公司已經決定先采取行動。 “毫無疑問,人們對脫歐都有些厭倦了,只想趕緊做出決定,實在不想再等。”他說。 對于Little Soap公司的希斯科特-詹姆斯來說,只能重新將業務重點放在英國市場,曾經雄心勃勃的海外擴張計劃前途未卜。 “先暫停一下吧。”她說。不管怎樣,她還是充滿希望。畢竟,就算英國退出歐盟,“人們還是要用肥皂的。”(財富中文網) 譯者:Charlie 審校:夏林 |

Currently, Tom Brown can order fresh flowers from the Netherlands by 11 a.m. and receive them about 12 hours later—and that’s what customers expect, Davidson says. Brexit could cause delays and additional costs, largely due to reams of paperwork required to import flowers that previously needed only a simple order request. “The newer generation of florists are fewer and far between,” he says. “And some of that uncertainty is making the older generation of florists think, ‘Is it really worth it?’” Fighting off “Brexit fatigue” There are other signs that the last three years have taken a toll, across hiring, recruiting, construction, and real estate. In September, specialist recruiter SThree reported a 7% drop in quarterly net fees—the fees recruiters collect for successful placements—for its U.K. and Ireland unit, after reporting a 12% drop in the previous quarter. Meanwhile Staffline, a major contract-worker agency, issued a profit warning due to reduced demand, noting that its customers were reducing their exposure to temporary labor from the EU. Some companies—especially in tech—simply can’t attract applicants when they want to hire. Neil Ross, the lead on Brexit policy at industry association techUK, said one member of the organization, a data center operator, recently told him it had attracted no job applicants from mainland Europe in the last two years. “Being able to recruit talent is fundamental to companies’ ability to expand,” says Ross. Meanwhile, construction and infrastructure services company Keir Group warned in September of flat revenue due to clients putting off key decisions on projects until they know what’s happening with Brexit. And real estate services company CBRE estimates the value of commercial real estate will fall by 3.8% in 2019 due to investors’ wariness over when Britain will leave the bloc and what the departure will look like. Still, the lengthy duration of the Brexit uncertainty has prompted some companies to move forward regardless, says Miles Gibson, executive director of the U.K. research team at CBRE. “There is no doubt that people are getting a bit of Brexit fatigue, and making decisions anyways, because they can’t wait,” he says. For Heathcote-James of the Little Soap Company, refocusing the business on its existing U.K. market has pushed her once-ambitious export plans into the unknowable future. “That’s on pause for the moment,” she says. Still, she remains hopeful. Even in Brexit Britain, “everyone needs a bar of soap.” |